IRS Form 2290 Instructions

If you operate a vehicle weighing 55,000 or more on public highways, you may need to file IRS Form 2290, Heavy Highway Vehicle Use Tax Return, to calculate, report, and pay an excise tax.

In this complete guide, we’ll walk through everything you need to know about this form, including:

- How to complete and file the heavy vehicle use tax return on IRS Form 2290

- How to calculate the heavy highway vehicle use tax (also known as HVUT tax)

- Other filing considerations

Let’s get started with step by step instructions on how to complete IRS Form 2290.

Table of contents

How do I complete IRS Form 2290?

We’ve broken down this tax form to the following components:

- Taxpayer Information

- Part I: Figuring the tax

- Part II: Statement in Support of Suspension

- Signatures

- Tax computation

- Schedule 1: Schedule of Heavy Highway Vehicles

- Consent to Disclosure of Tax Information

- Payment Voucher

Taxpayer information

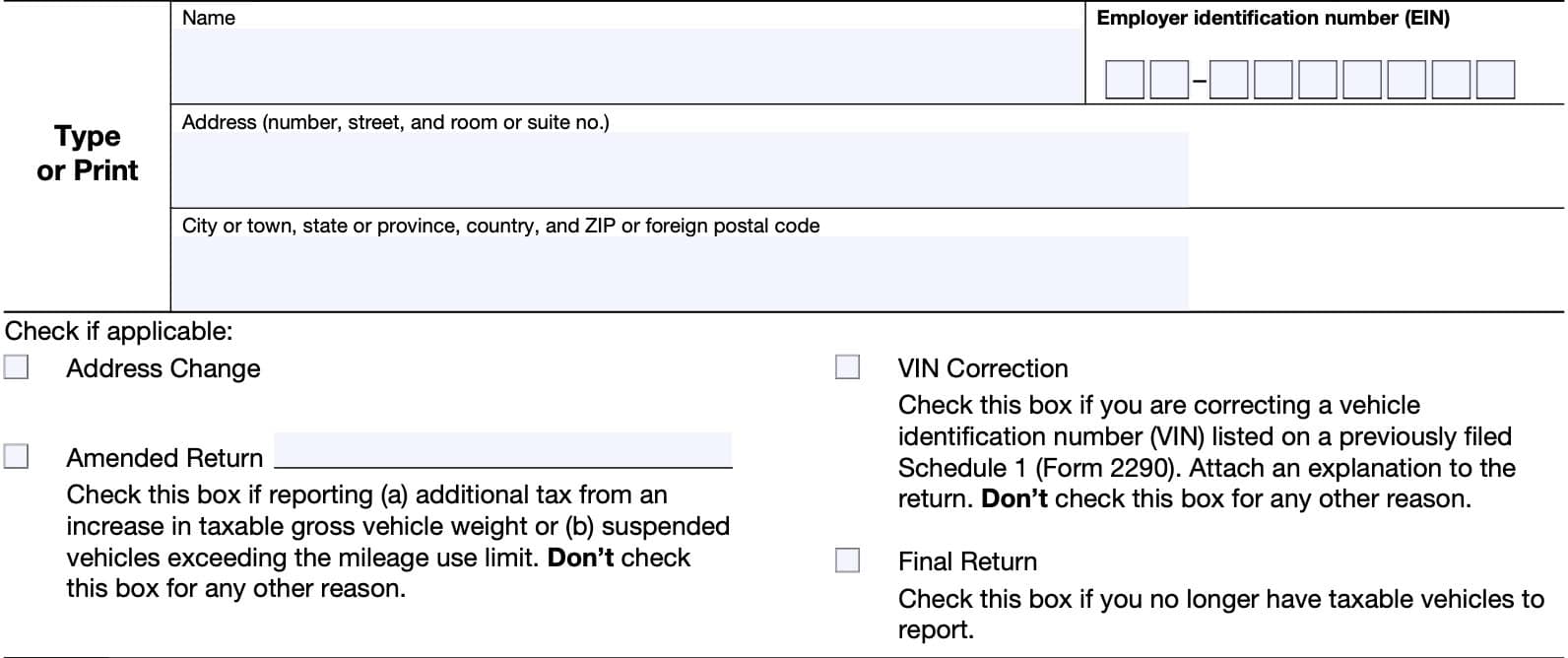

At the top of IRS Form 2290, you’ll complete the taxpayer information fields.

Name

Enter the your name, or the name of your business, in this space.

Address

Enter your address in the spaces provided.

If you have a post office box, and the postal system does not deliver mail to your street address, then enter your P.O. Box information instead of your street address.

If you’re filing IRS Form 2290 from Canada or Mexico, then follow the country’s practice for entering the postal code. Don’t abbreviate the country name.

Employer identification number

Enter your employer identification number (EIN) in the space provided. Do not enter a Social Security number (SSN), even if you are a sole proprietor.

If you do not have an EIN, you can apply for one through the IRS website or by filing Form SS-4,

Application for Employer Identification Number.

Check if applicable

In this area, there are 4 unique boxes. Check each box as applicable. If no boxes apply, then move down to Part I, below.

Address change

Check here if you’ve changed your address since the last time you completed Form 2290. According to Internal Revenue Bulletin 2010-16, if you updated your address on IRS Form 2290, you should not have to file IRS Form 8822-B to report your change of address.

Amended return

Check this box only if you are reporting one of the following:

- Additional tax from an increase in taxable gross weight of the vehicle, or

- Suspended vehicles exceeding the mileage use limit

Do not check this box for any other reason.

VIN Correction

Check the VIN Correction box if you are correcting a VIN listed on a previously filed Schedule 1 (IRS Form

2290). List the corrected VIN or VINs on Schedule 1.

Be sure to use the Form 2290 for the given tax period you are correcting. Attach a statement with an explanation for the VIN correction.

Don’t check this box for any other reason.

Final Return

If you no longer have vehicles to report, file a final return. To do this, check the Final Return box on Form 2290, sign the return, and mail it to the IRS.

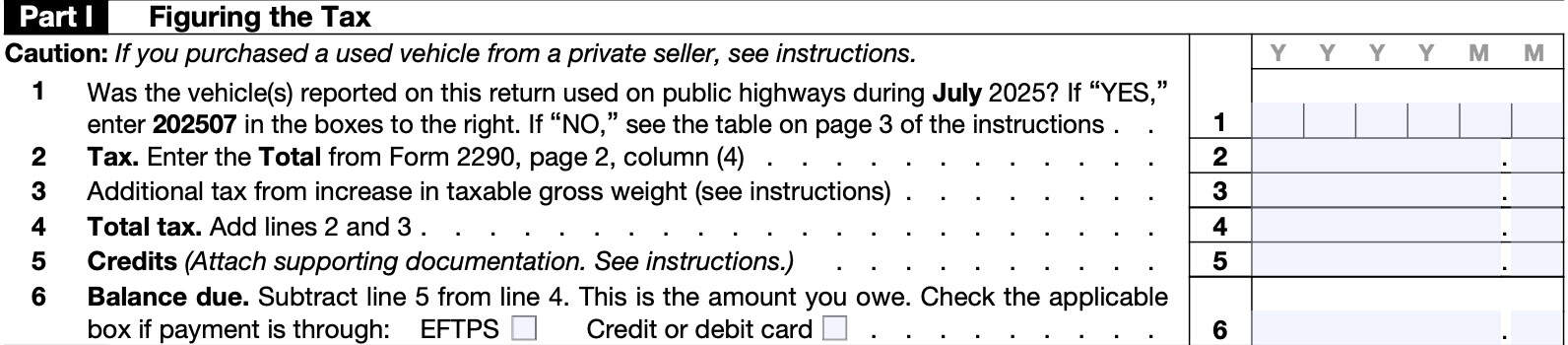

Part I: Figuring the tax

In Part I, we’ll actually calculate the heavy highway use tax owed. If you purchased a used vehicle from a private seller, you should read the following instructions. Otherwise, proceed directly to Line 1, below.

Used vehicles

If you acquire and register or are required to register a used taxable vehicle in your name during the tax

period, you must keep as part of your records proof showing whether:

- Someone used the vehicle during the taxable period

- The tax was suspended during the period before you registered the vehicle in your name

The evidence may be a written statement signed and dated by the person (or dealer) from whom you purchased the vehicle.

Tax computation for privately purchased used vehicles and required claim information for sold used vehicles

If you purchased the vehicle from a private party who completely heavy highway use tax for the tax period, and your first use (which includes driving it from the purchase location to your home or business location) is in the month of sale, then your total tax for the tax period doesn’t include the tax

for the month of sale.

For example, if the tax bill was paid from July 2025 through June 2026, and you purchased the vehicle in October, your first month would be in November. However, this does not change the due date of your tax return.

As a general rule, the seller is entitled to a tax refund for the period in which they no longer own the vehicle, but paid the tax for. Because of this, the buyer must calculate a prorated amount of the tax that they are responsible for.

Below is an example on how this works, directly from the IRS instructions.

Example

On July 2, 2025, Linda paid the full tax period tax of $550 for the use of her 80,000-pound taxable gross

weight vehicle. John purchased the used truck from Linda on September 9, 2025, and drove it on the public highway from Linda’s home to his own home the next day.

Linda, the seller, can claim a credit or refund of the tax she paid for the 9 months after the sale. Because of that, and that John’s first taxable use was to drive the truck to his home in the month of

sale (September), his prorated tax is figured from the first day of the next month (October) through the end of the tax period, June 30, 2026.

The due date of John’s Form 2290 doesn’t change, so he must file by October 31, 2025.

Line 1

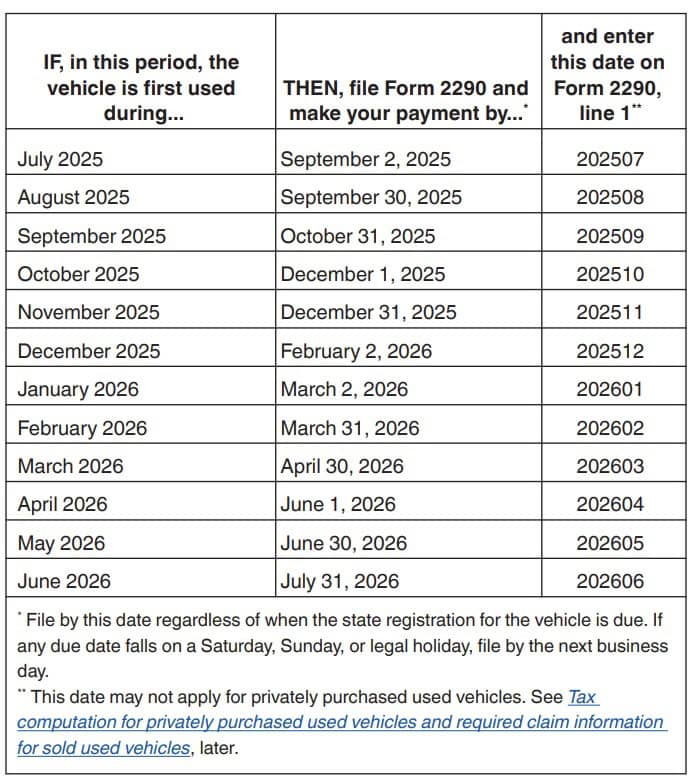

Was the vehicle (or vehicles) reported on this tax return used on public highways during July 2025?

If Yes, then enter 202507 in the boxes on the right. This represents the YYYYMM format indicated at the top of the column.

If No, then for a new vehicle, enter the date for the month of first use during the tax period, according to the chart below.

See the guidance at the top of Part I for used vehicles purchased from a private dealer.

Line 2: Tax

To figure the tax on Line 2, complete the Tax Computation table, outlined below.

Don’t use Line 2 to report additional tax from an increase in taxable gross weight. Instead, report the additional tax on Line 3.

Line 3: Additional tax from increase in taxable gross weight

In Line 3, enter any additional tax from an increase in taxable gross weight.

Complete Line 3 only if the taxable gross weight of a vehicle increases during the period and the vehicle falls in a new category. For instance, an increase in maximum load customarily carried may change the taxable gross weight.

How to calculate additional tax from increase in taxable gross weight

If this occurs, you should follow these steps as outlined in the IRS instructions:

- Enter the month the taxable gross weight increased.

- Enter the month here and in the space next to the Amended Return box on page 1

- From Page 2, determine the new taxable gross weight category.

- Go to the Partial-Period Tax Tables, located in the Column (2) instructions.

- Find the month entered on Line 1 above.

- Read down the column to the new category; this is the new tax.

- Enter the amount here: _______________________

- On the Partial-Period Tax Tables, find the tax under that month for the previous category reported.

- Enter the amount here: _______________________

- Additional tax. Subtract Line 3 from Line 2. This is the amount of additional tax you should enter in Line 3 for this vehicle.

Please note: you’ll have to perform a separate calculation for each vehicle. If you have multiple highway motor vehicles, add the total of these calculations, then enter that total amount in Line 3.

If the increase in taxable gross weight occurs in July after you have filed your return, use the amounts from the Tax Computation section for the new category instead of the Partial-Period Tax Tables.

Line 4: Total Tax

Add Line 2 and Line 3. Enter the totals here in Line 4.

Line 5: Credits

Complete Line 5 to claim a tax credit only if you are claiming a credit for tax paid on a heavy highway motor vehicle that was:

- Sold before June 1 and not used during the remainder of the period,

- Destroyed (so damaged by accident or other casualty it isn’t economical to rebuild it)

- Stolen before June 1 and not used during the remainder of the period, or

- Used during the prior period 5,000 miles or less (7,500 miles or less for agricultural vehicles)

A credit, lower tax, exemption, or refund isn’t allowed for an occasional light or decreased load or a discontinued or changed use of the vehicle.

The amount claimed on Line 5 can’t exceed the tax reported on Line 4. You must claim any excess credit as a refund using IRS Form 8849, Claim for Refund of Excise Taxes.

Figuring the credit

Figure the number of months of use and find the taxable gross weight category of the vehicle before you complete the calculations below.

Once you’ve determined the number of months to use (see Number of Months, below), you can look to determine the partial-period tax, using the Partial-Period tax tables. You can find these in the instructions for Column 2, below.

Follow these steps:

- For the vehicle that was destroyed, stolen, or sold, enter the tax previously reported: ________

- Enter the partial-period tax from the tax tables: ___________

- Subtract Line 2 from Line 1. Enter the difference on Line 5

For the vehicle that was destroyed, stolen, or sold, enter the tax previously reported on Form 2290,

Multiple vehicles

If you have multiple vehicles, perform this calculation separately for each vehicle. Add the total, and enter this amount in Line 5.

Number of months

To figure the number of months of use, start counting from the first day of the month in the period in which the vehicle was first used to the last day of the month in which it was destroyed, stolen, or sold.

Documentation requirements

On a separate attachment, provide an explanation detailing the facts for each credit. For vehicles destroyed, stolen, or sold, include:

- The VIN;

- The taxable gross weight category;

- The date of destruction, theft, or sale;

- A copy of the worksheet under Figuring the Credit; and

- If the vehicle was sold on or after July 1, 2015, the name and address of the purchaser of the vehicle.

Line 6: Balance due

Subtract Line 5 from Line 4. The result is the amount that you owe. For more details on how to pay, see the How to Pay section, later in this article.

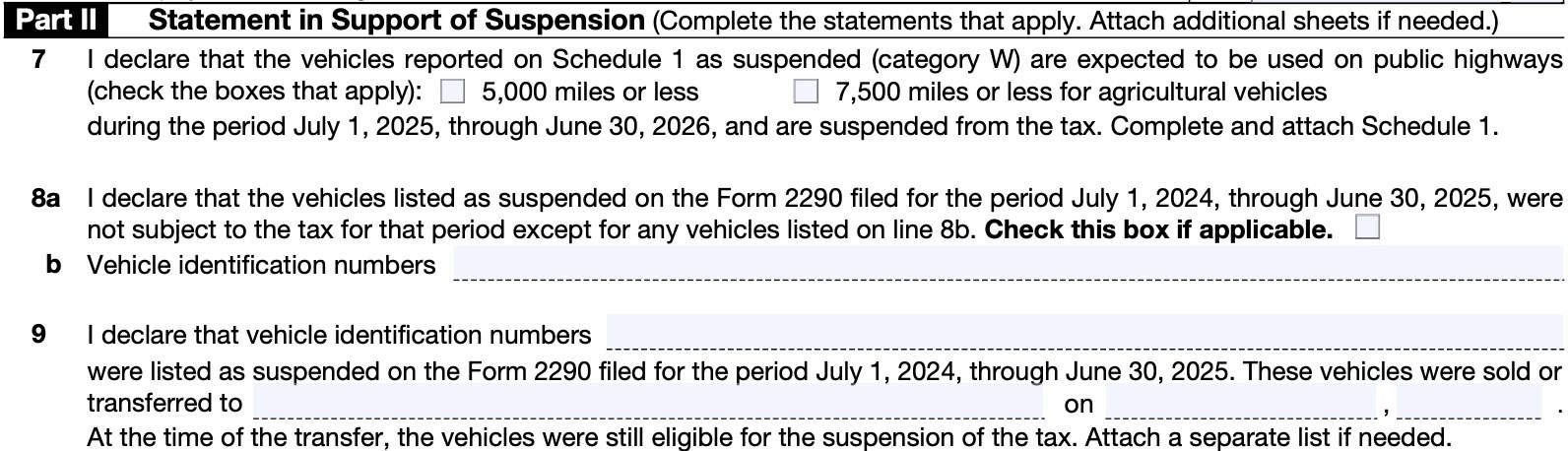

Part II: Statement in Support of Suspension

Complete Part II only if you have vehicles that are considered to be tax-suspended, either due to not exceeding the mileage limit, or because you sold or transferred the vehicle(s) while the vehicles were eligible for suspension of the tax.

Line 7

Complete Line 7 to suspend the tax on vehicles expected to be used less than the mileage use limit during a period. The mileage limit is as follows:

- 5,000 miles or less for all non-agricultural vehicles

- 7,500 miles or less for agricultural vehicles

Agricultural vehicles

According to the federal government, an agricultural vehicle is any taxable highway motor vehicle that is:

- Used (or expected to be used) primarily for farming purposes, and

- Registered (under state laws) as a highway motor vehicle used for farming purposes for the entire period.

- You do not need a special tag or license plate identifying the vehicle as used for

farming

- You do not need a special tag or license plate identifying the vehicle as used for

A vehicle is used primarily for farming purposes if more than half of the vehicle’s use (based on mileage) during the period is for farming purposes. Farming purposes includes:

- Transportation of any farm commodity to or from a farm, or

- Use directly in agricultural production

Don’t take into account the number of miles the vehicle is used on the farm when determining if the 7,500-mile limit on the public highways has been exceeded. Keep accurate records of the miles that a vehicle is used on a farm.

Check each box as applicable. Also, you must do the following:

- List the vehicles on which the tax is suspended on Schedule 1

- Count the number of tax-suspended vehicles (designated by category W) listed on Schedule 1, Part I, then enter the number on Schedule 1, Part II, Line b.

Line 8a

You must verify that vehicles listed as suspended on the Form 2290 for the prior tax period and used 5,000 miles or less (7,500 miles or less for agricultural vehicles) were not subject to the tax for that period.

To verify that vehicles listed as suspended in the prior period did not exceed the mileage use limit, except for any vehicles listed on Line 8b, check Box 8a.

Line 8b

If you checked Box 8a and vehicles that you previously listed as suspended on the prior tax period’s Form 2290 exceeded the mileage use limit, you must list on line 8b the VINs of the vehicles listed as suspended in the prior period and then used for 5,000 miles or more during the period (7,500 miles or more for agricultural vehicles).

You must report the tax for these vehicles on a separate Form 2290 for the prior tax period and pay the tax. Attach a separate sheet if needed to list the VINs for Line 8b

Line 9

Complete Line 9 if you:

- Previously completed Line 7 for the prior period’s Form 2290, and

- Sold or transferred the tax-suspended vehicles

Attach a separate sheet, if necessary.

Signatures

This section contains signatures and authorization information. Let’s begin with the third-party designee field at the top.

Third party designee

If you wish to allow another person to discuss this tax return with the IRS, then check Yes and enter the following:

- Designee’s name and telephone number

- Five-digit personal identification number (PIN)

This PIN should be a five-digit combination that your designee chooses, and will only apply to this tax return.

By checking the Yes box, you are authorizing the IRS to speak with the designee to answer any questions relating to the information reported on Form 2290. You are also authorizing the designee to:

- Exchange information concerning Form 2290 with the IRS, and

- Request and receive written tax return information relating to Form 2290, including copies of notices, correspondence, and account transcripts.

This authorization automatically expires one year after the due date. However, you or your designee can revoke this authorization at any time by sending a written statement of revocation to:

Internal Revenue Service

7940 Kentucky Drive

Florence, KY 41042-2915

If you do not wish to elect a designee, then select No and proceed to the signature block below.

Sign here

In the signature block, sign and date where indicated. Below these lines, type or print your complete name and telephone number.

By signing this form, you are making a declaration that the information in this tax return is true, correct, and complete, under penalties of perjury.

Paid preparer use only

If you hired a tax professional to complete your return, he or she will complete the following information:

- Preparer’s name and signature

- Date

- Firm information, including name, address, EIN, and phone number

- Self-employment status

- Preparer tax identification number (PTIN)

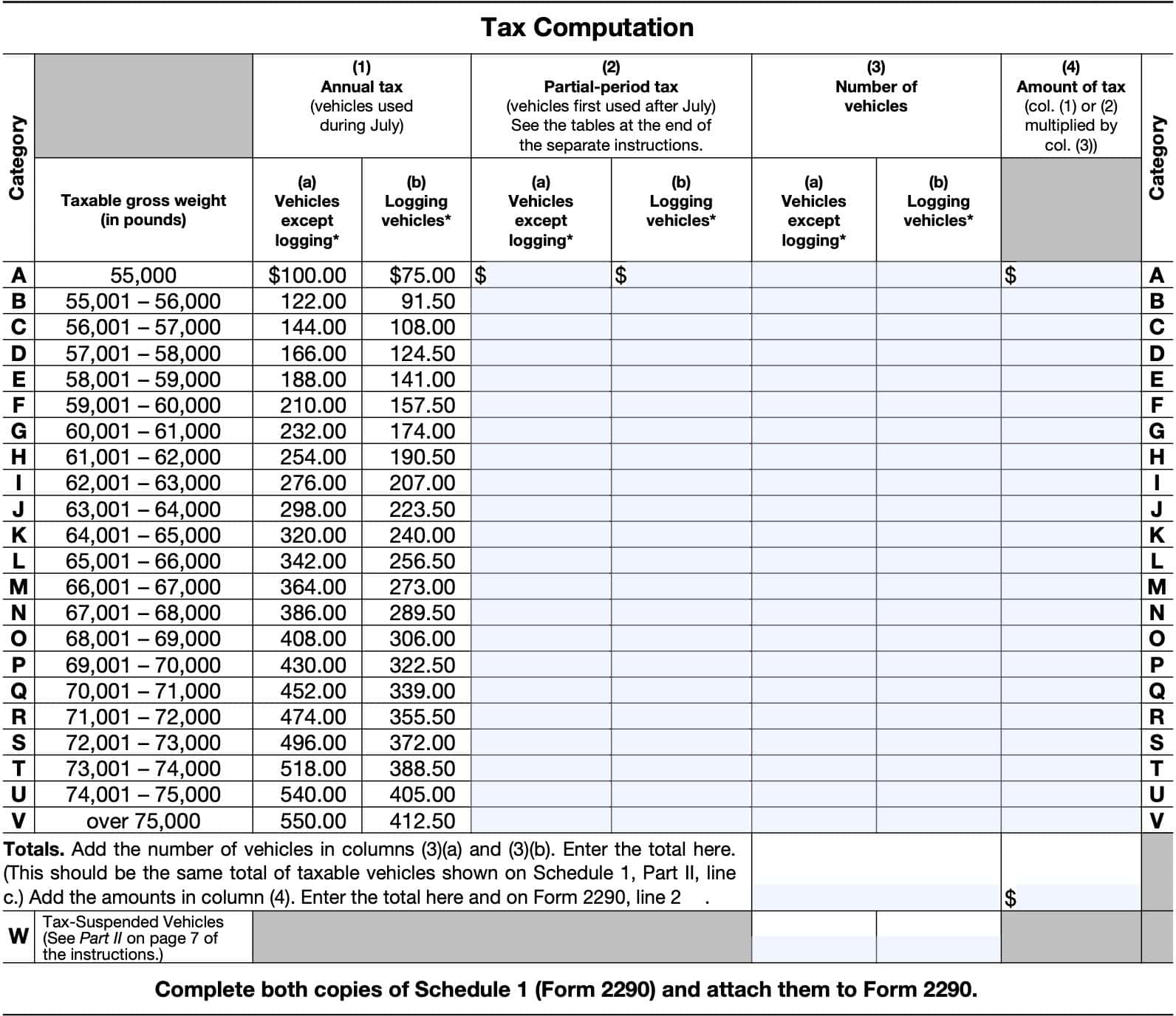

Tax computation

We’ll cover how to complete the tax computation table in this section, column by column. The total amount will go into Line 2 in Part I, above.

Column (1)

For any heavy vehicle (except for logging vehicles) used during the month of July, use the tax amounts listed in Column (1)(a).

Logging vehicles

Use the tax amounts listed in Column (1)(b) for logging vehicles used in July.

The Internal Revenue Service considers a vehicle to be a logging vehicle if:

- The vehicle exclusively transports products harvested from the forested site, or exclusively transports products harvested from the forested site to/from locations on a forested site, AND

- The vehicle’s registration indicates that the owner uses this vehicle exclusively to transport forest products

- No special tag or license plate is required

Products harvested from the forested site may include timber that has been processed for commercial use by sawing into lumber, chipping, or other milling operations if the processing occurs before transportation from the forested site.

Column (2)

For used vehicles purchased from a private seller during the period, see Used Vehicles, above.

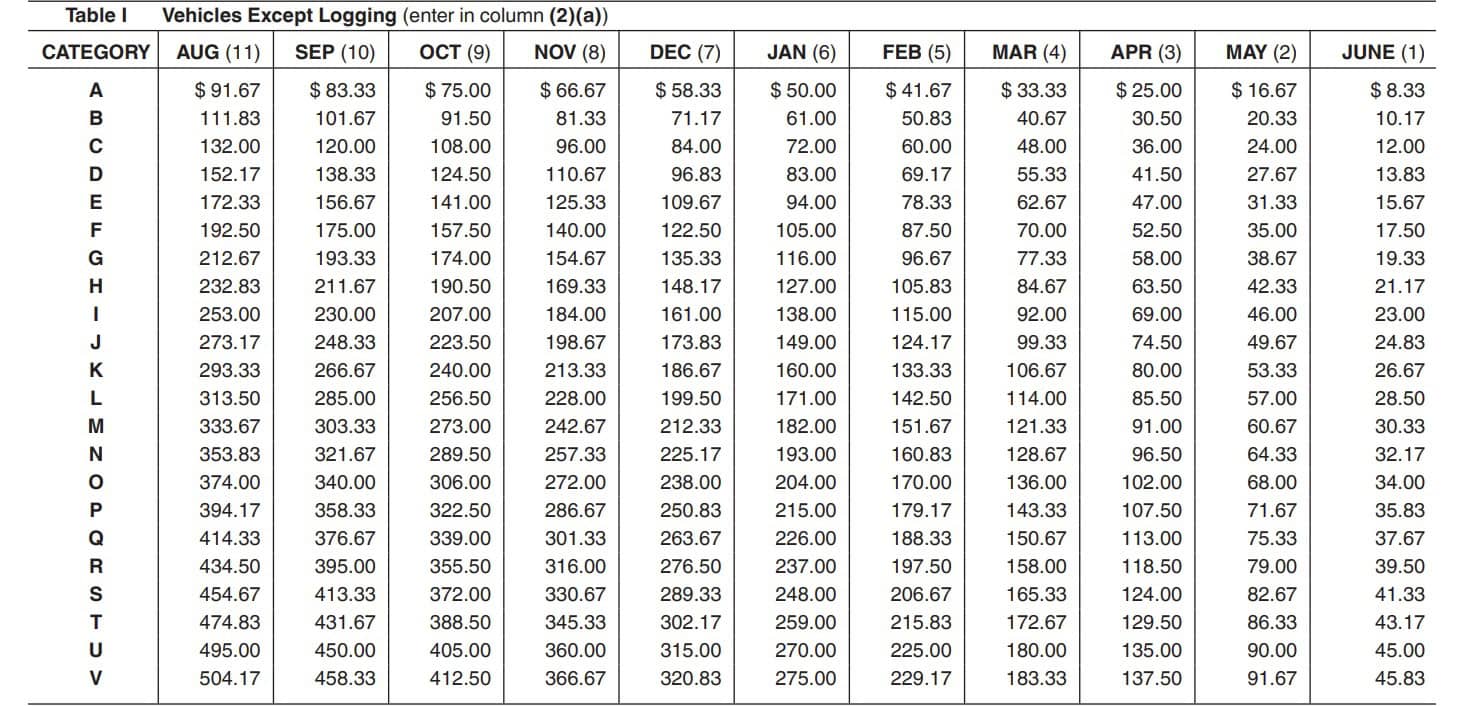

For all other vehicles, if the vehicle is first used after July, the tax is based on the number of months remaining in the period. The IRS has two tables that you can use to determine the proper tax, depending on the vehicle weight and when you placed the vehicle into service:

To enter the proper amount in Column (2), follow these steps:

- Find the category line for the vehicle in Table I or Table II, below. The categories are listed in the Tax Computation table, above.

- Find the month the vehicle was first used on public highways.

- Read down the column. The amount where the category line and the month column meet is the tax due.

- Enter the amount on the appropriate line in the Tax Computation table

Table I: Vehicles Except Logging

Here is the table that you would use for all non-logging vehicles.

Let’s imagine that you placed a non-logging vehicle weighing 65,600 lbs into service in November 2025. According to the form, this would be a Category L vehicle. Placing the vehicle into service in November would result in a partial-year bill of $228.00 for that vehicle.

Since it was placed into service mid-year, this particular vehicle’s tax return would be due on December 31, 2025, as indicated in the When to File chart for Line 1.

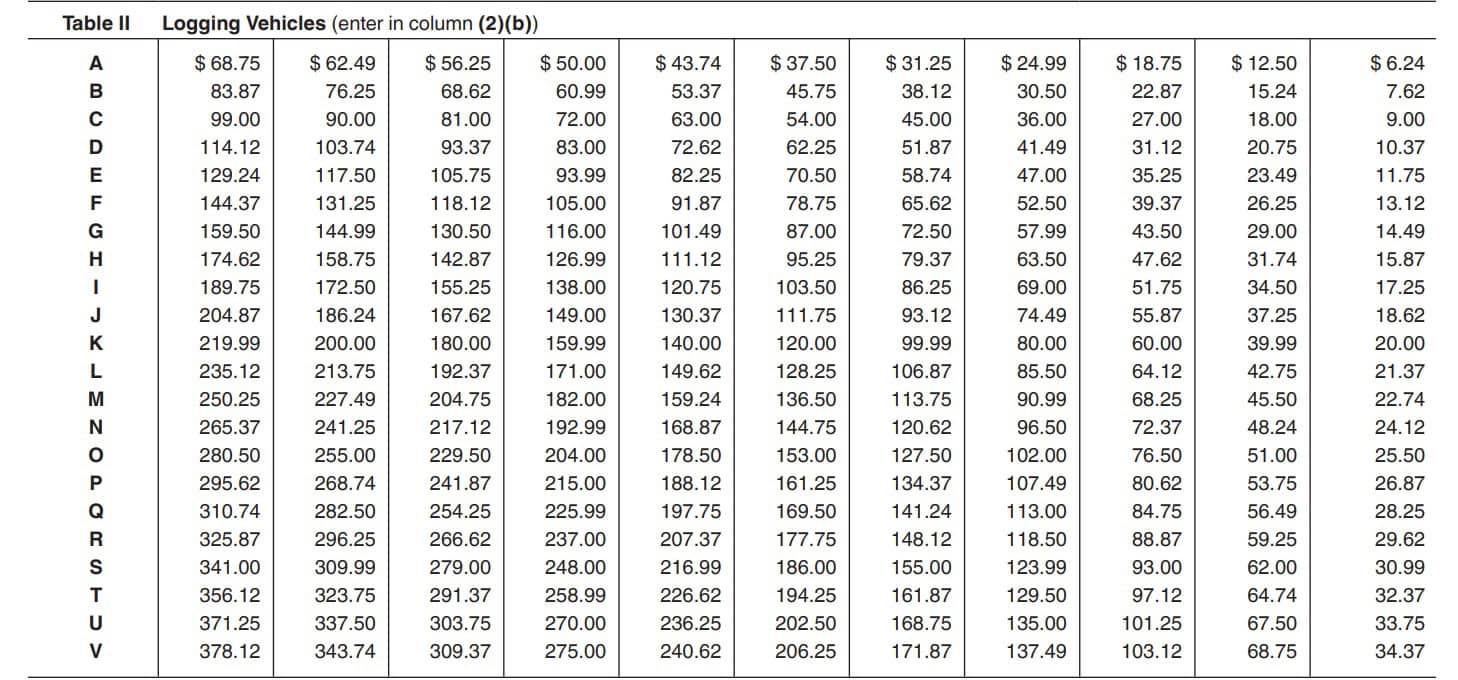

Table II: Logging Vehicles

Using the above example, let’s imagine that you placed a logging vehicle weighing 65,600 lbs into service in November. According to the form, this would be a Category L vehicle. Placing the vehicle into service in November (indicated in the fourth column from the left) would result in a partial-year bill of $171.00 for that vehicle.

Since it was placed into service in the middle of the tax year, this particular vehicle’s tax return would be due on December 31, 2025, as indicated in the When to File chart for Line 1.

Column (3)

In Column (3)(a), enter the number of non-logging vehicles for each category for this tax return only.

Enter the number of logging vehicles in Column (3)(b) for each category, enter the number of non-logging vehicles for each category.

Column (4)

For Column (4), multiply the Column (1) or Column (2) amount by the number of vehicles indicated in Column (3).

Once you’ve completed each row, do the following:

- Add the total vehicles in both Column (3)(a) and Column (3)(b).

- Enter the total number of vehicles at the bottom. This should reflect the total number of taxable vehicles on Schedule 1, Part II, Line c.

- Add the total amount of tax in Column (4). Enter this amount here and on Line 2, above.

Tax-suspended vehicles

Tax-suspended vehicles fall under category W. Enter the number of tax-suspended vehicles (both logging and non logging vehicles) in the spaces provided.

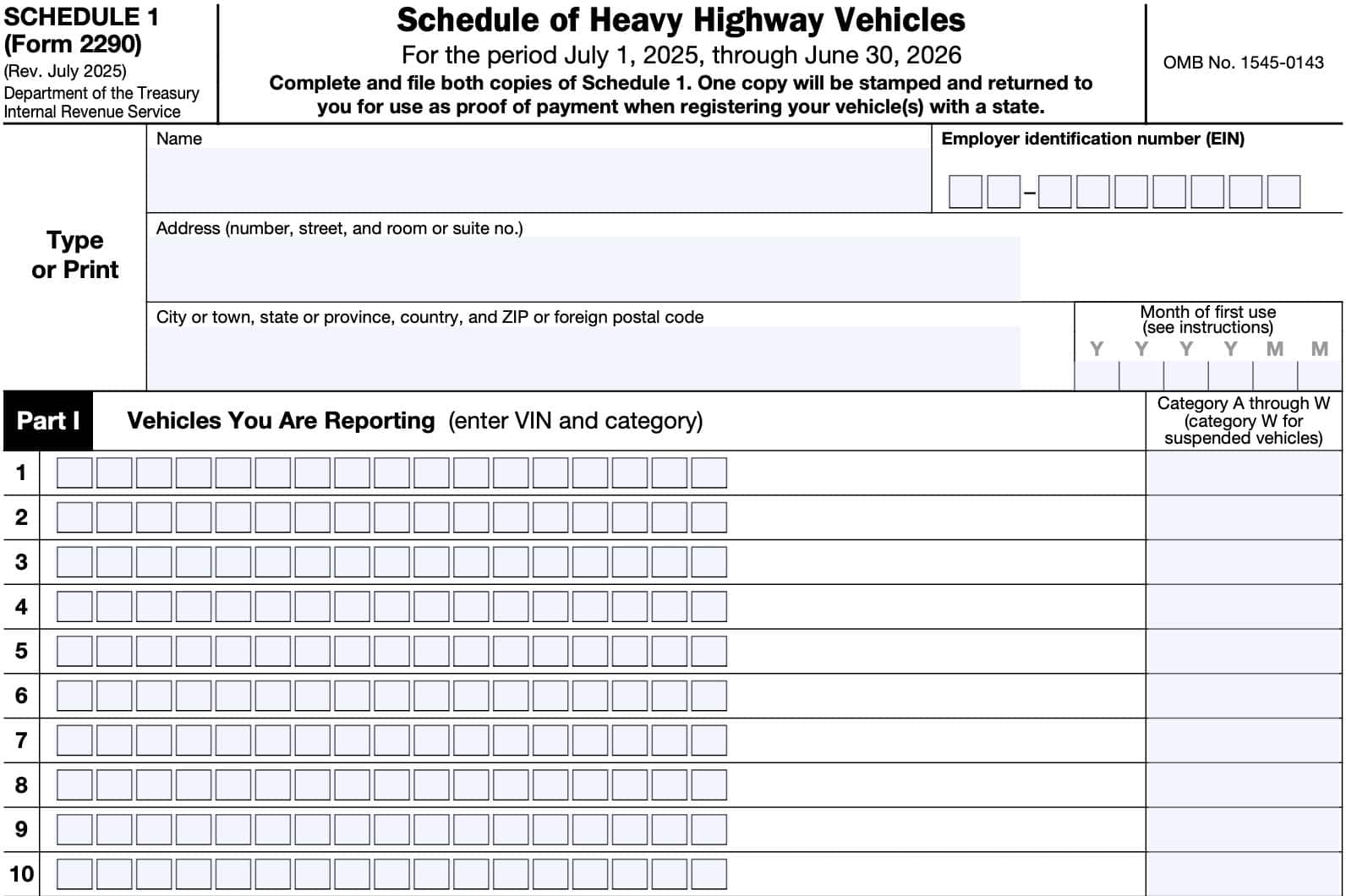

Schedule 1: Schedule of Heavy Highway Vehicles

Schedule 1 is used to list all registered and exempt vehicles, by category.

You should have two copies of Schedule 1. Complete and file both copies of Schedule 1. After filing, you should receive an IRS-stamped Schedule 1 as proof of your payment.

The IRS may reject your return if Schedule 1 isn’t attached to Form 2290.

Taxpayer information

In this field, you’ll enter the following information:

- Business name

- Business address, including city, state, and zip code

- Employer identification number

- Month of first use

Month of first use

Enter the same date as that entered in Part I, Line 1.

Part I: Vehicles you are reporting

In Part I, you’ll enter up to 25 vehicles (add additional sheets as required).

For each vehicle, enter the complete vehicle identification number (VIN) and the category to which that vehicle belongs. The total number of vehicles that you report in Schedule 1 should match the number of vehicles listed in the Tax Computation Worksheet.

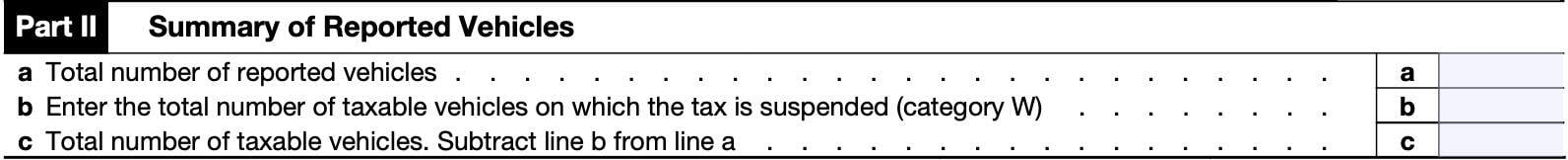

Part II: Summary of reported vehicles

In Part II, you will enter the total of vehicles, both taxable and nontaxable.

Line a: Total number of reported vehicles

Enter the total number of vehicles in your report.

Line b: Total number of taxable vehicles on which the tax is suspended (Category W)

In Line b, enter the total number of vehicles for which the tax is suspended. These vehicles should appear in Part I under Category W.

Line c: Total number of taxable vehicles

Subtract Line b from Line a. The result is the total number of taxable vehicles.

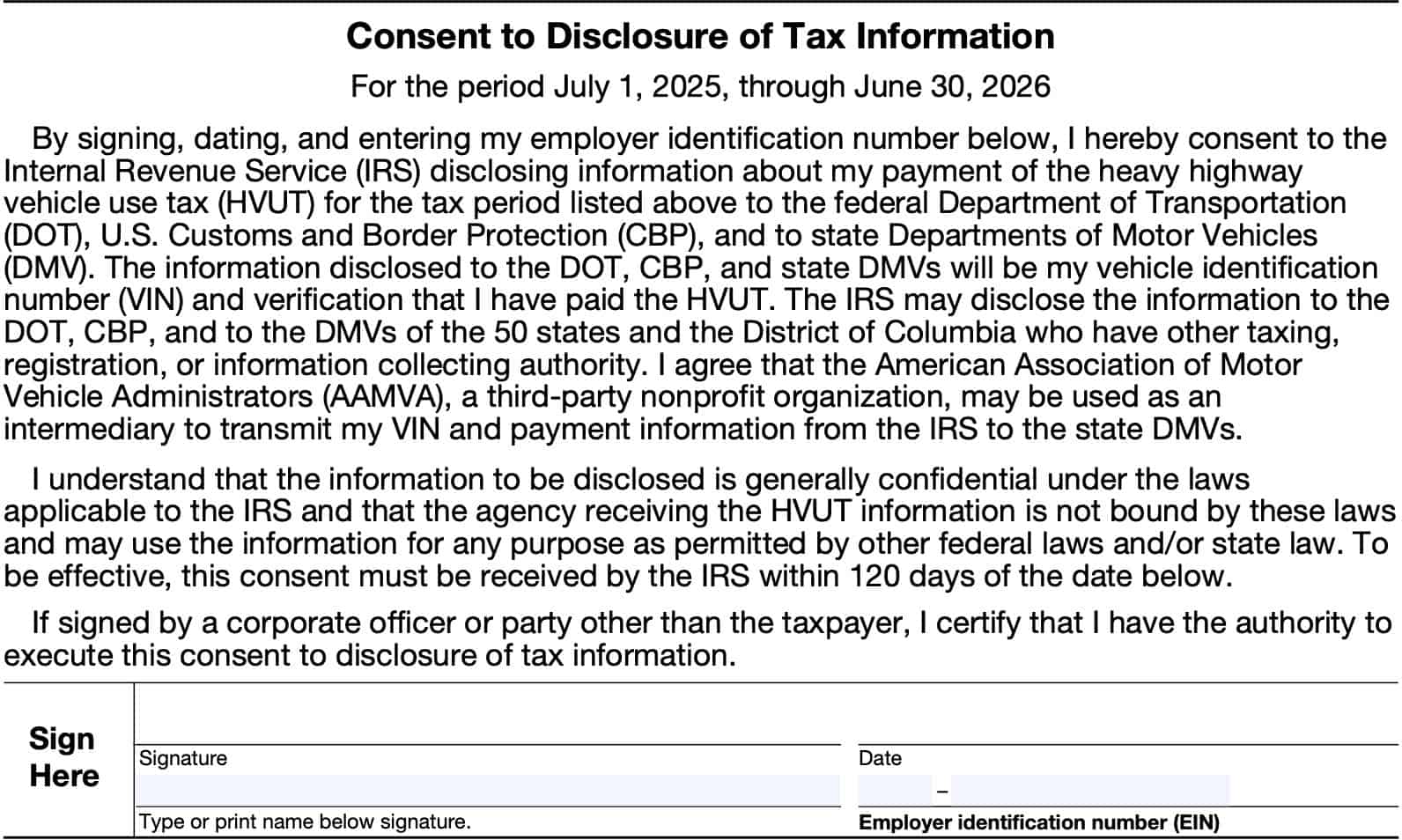

Consent to Disclosure of Tax Information

This section contains consent information. To summarize, here is what you are agreeing to when you complete this section:

- The IRS can disclose information about your heavy highway vehicle use tax payment to the following:

- United States Department of Transportation (DOT)

- U.S. Customs and Border Protection (CBP)

- State Departments of Motor Vehicles (DMV)

- This information includes:

- VIN numbers

- Verification that you have paid the heavy vehicle use tax

- The American Association of Motor Vehicle Administrators, which is a third-party nonprofit, may be an intermediary to transmit this information to DMVs as required

If you agree to the above, then enter the following information where provided:

- Signature

- Printed name (just below signature)

- Signature date

- EIN

The IRS must receive this consent within 120 days of the signature date indicated.

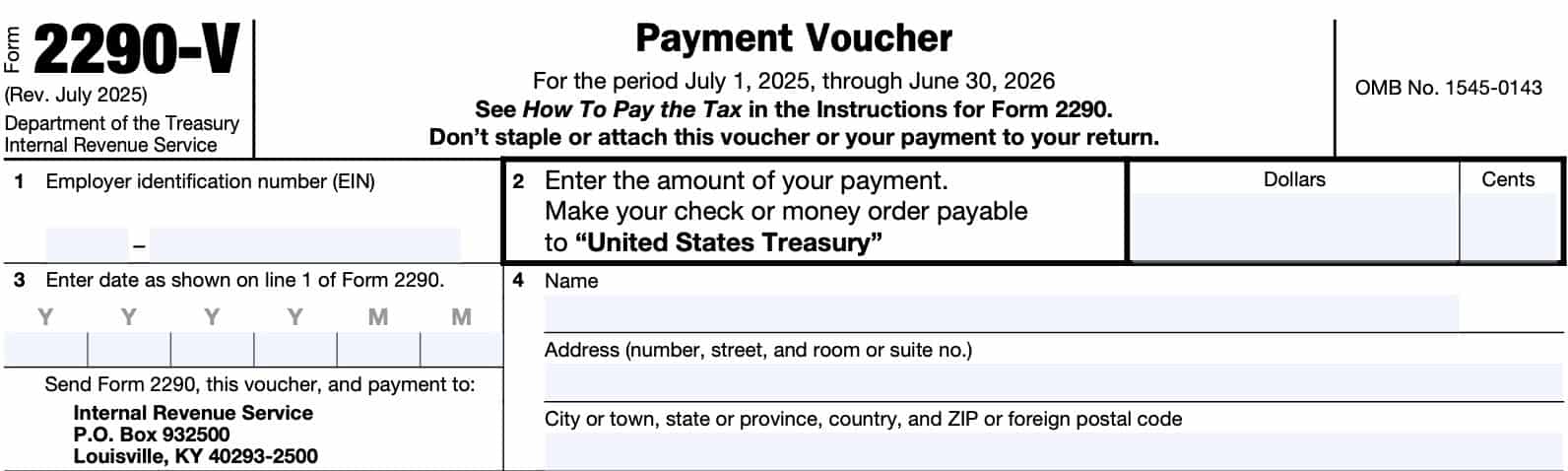

Payment Voucher

You may pay online through the IRS website, through the Electronic Federal Tax Payment System (EFTPS) or by sending a check or money order with a payment voucher, IRS Form 2290-V.

If you choose to send a voucher, you’ll want to complete the voucher in its entirety as indicated below:

- Line 1: Employer identification number

- Line 2: Amount of payment

- Line 3: Date as shown on Line 1

- Line 4: Name & address, including city, state, and zip code

Once complete, send your payment voucher and a check or money order made payable to United States Treasury to the following address:

Internal Revenue Service

P.O. Box 932500

Louisville, KY 40293-2500

Filing considerations

Filing IRS Form 2290 electronically

The IRS requires electronic filing for each heavy highway tax return reporting and paying tax on 25 or more vehicles during the filing. This does not include tax-suspended vehicles, designated by category W.

However, the IRS highly encourages electronic filing for all taxpayers, even if the number of vehicles falls below the filing requirement. You may file Form 2290 electronically through a provider that participates in the IRS e-file program for excise taxes.

Once the IRS has accepted your Form 2290, your stamped Schedule 1 can be available within minutes.

How to pay the heavy highway use tax

You can pay this amount by using the Electronic Federal Tax Payment System or by using a credit or debit card.

If you use a credit card or debit card, keep in mind that the IRS does not accept these payments directly. Instead, you would need to use one of several government authorized payment processors, who are allowed to charge fees for processing your highway tax payment.

Video walkthrough

Frequently asked questions

If you own or register a highway motor vehicle that has a taxable gross weight of 55,000 pounds or more and you use it on public highways, you must file IRS Form 2290.

The form reports and pays the federal tax for heavy vehicles (55,000 + lbs) used on public roads, covers weight‐increases, and handles exemptions/suspensions for very low mileage use.

You must file by the last day of the month after the month you first use the taxable vehicle on a public highway during the July-through-June tax period.