IRS Form 433-B Instructions

If your business is looking for tax relief through an Offer In Compromise, the Internal Revenue Service will generally ask for you to complete IRS Form 433-B, Collection Information Statement for Businesses.

In this step-by-step guide, we’ll help you with everything you need to know about IRS Form 433-B, including:

- Detailed instructions on how to complete IRS Form 433-B

- Frequently asked questions

- Filing considerations

Let’s begin with step by step instructions on how to complete your collection information statement.

Table of contents

How do I complete IRS Form 433-B?

There are 7 sections to this tax form:

- Section 1: Business Information (Domestic and Foreign)

- Section 2: Business Asset Information

- Section 3: Business Income Information

- Section 4: Business Expense Information

- Section 5: Calculate Your Minimum Offer Amount

- Section 6: Other Information

- Section 7: Signatures

Let’s take a closer look at each section, line by line. But before we start with Section 1, let’s review the guidance at the top of the form.

Form guidance

At the top of IRS Form 433-B, there are some guidelines.

When to complete this form

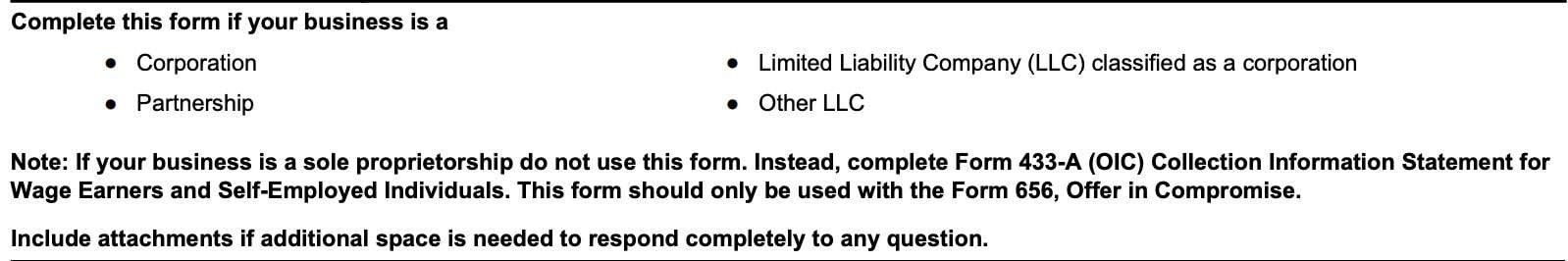

Only complete this form if your business is one of the following type of entity:

- Corporation

- Partnership

- Limited Liability Company (LLC) classified as a corporation

- Other LLC

If you are a sole proprietorship, follow the guidance below.

Sole proprietorships

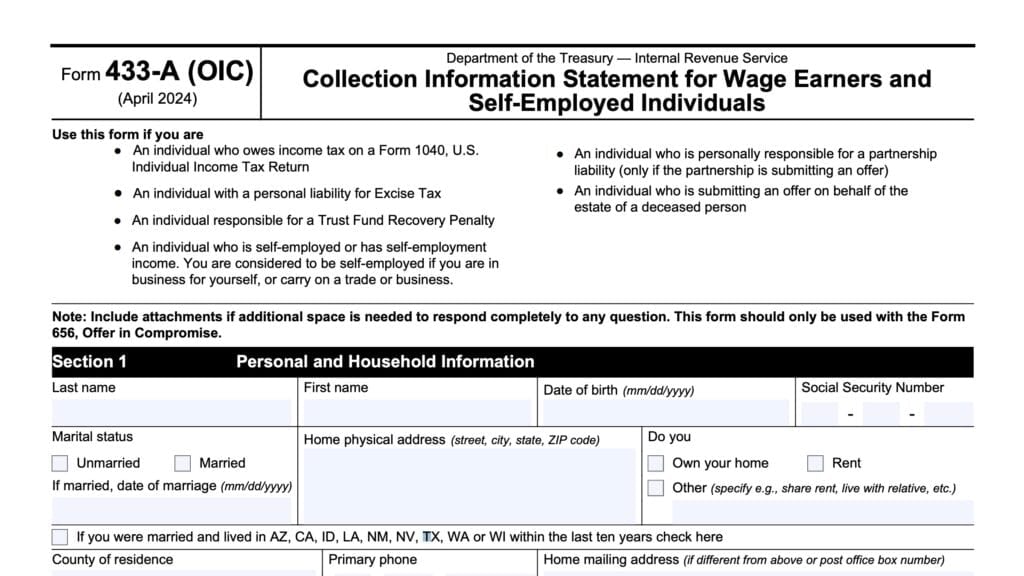

If your business is a sole proprietorship, do not use IRS Form 433-B. Instead, individual taxpayers should complete IRS Form 433-A (OIC), Collection Information Statement for Wage Earners and Self-Employed Individuals.

Attachments

If you need more space for additional information, you may include attachments or additional documentation as required.

With the basics out of the way, let’s proceed to Section 1.

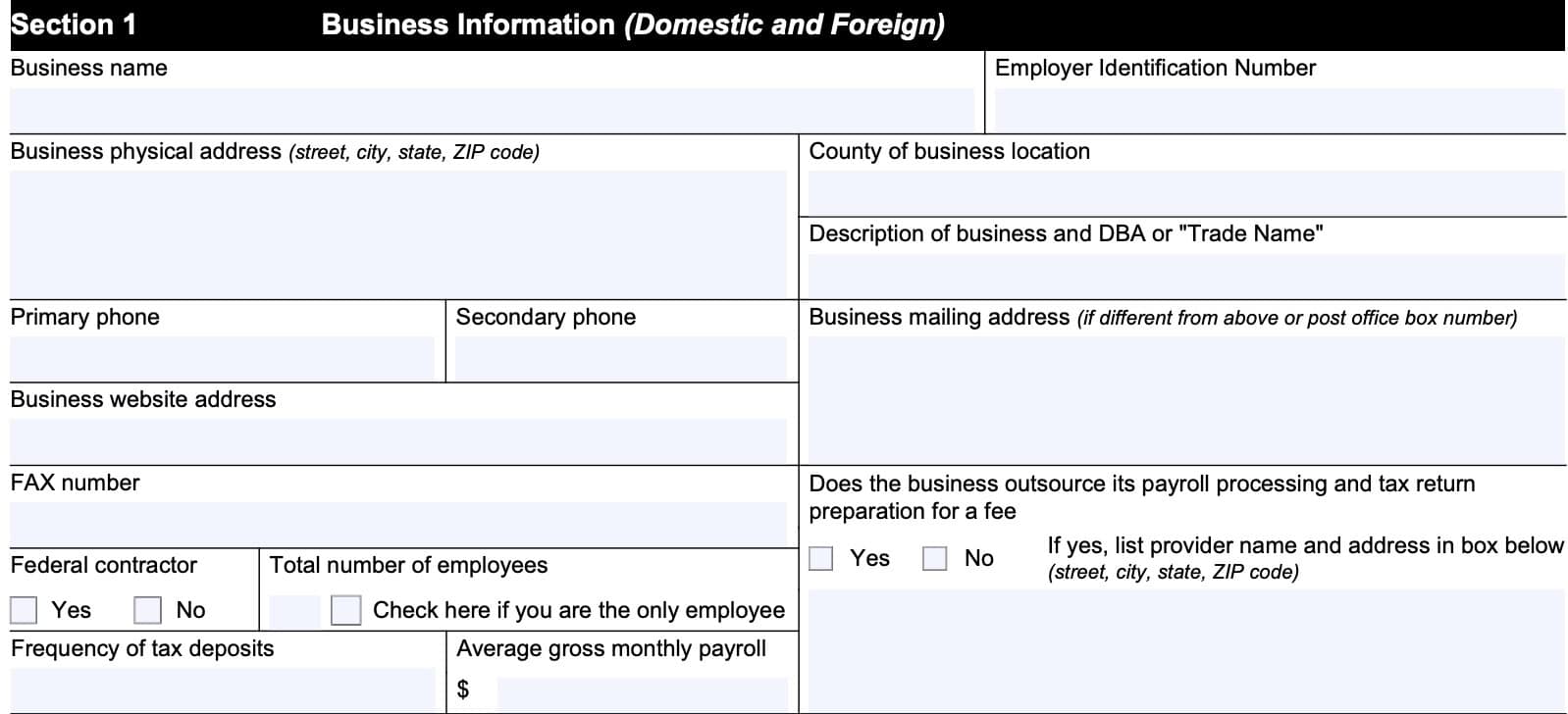

Section 1: Business Information (Domestic and Foreign)

In this section, we’re going to enter information about the business as well as any relevant partners, officers, LLC members, or major shareholders.

For your convenience, we’ve broken Section 1 down into two parts:

- Business information

- Officer information

Let’s begin with information about the business.

Business information

In this section, enter as much detailed information as you can. This includes contact information such as:

- Business name

- Employer identification number (EIN)

- Physical address

- Also add business mailing address if different from the physical address or if you use a post office box

- Primary and secondary phone number

- Website address

- Fax number

- County of business location

- Description of business and DBA or Trade name

Additionally, you’ll answer the following questions:

- Are you a federal contractor? (Yes/No)

- Total number of employees

- Check the box if you are a solo entrepreneur or the only employee

- Does the business outsource payroll processing and tax return preparation? (Yes/No)

- If Yes, list your tax preparer’s name and address in the space provided

- Frequency of tax deposits (such as payroll deposits)

- Average gross monthly payroll

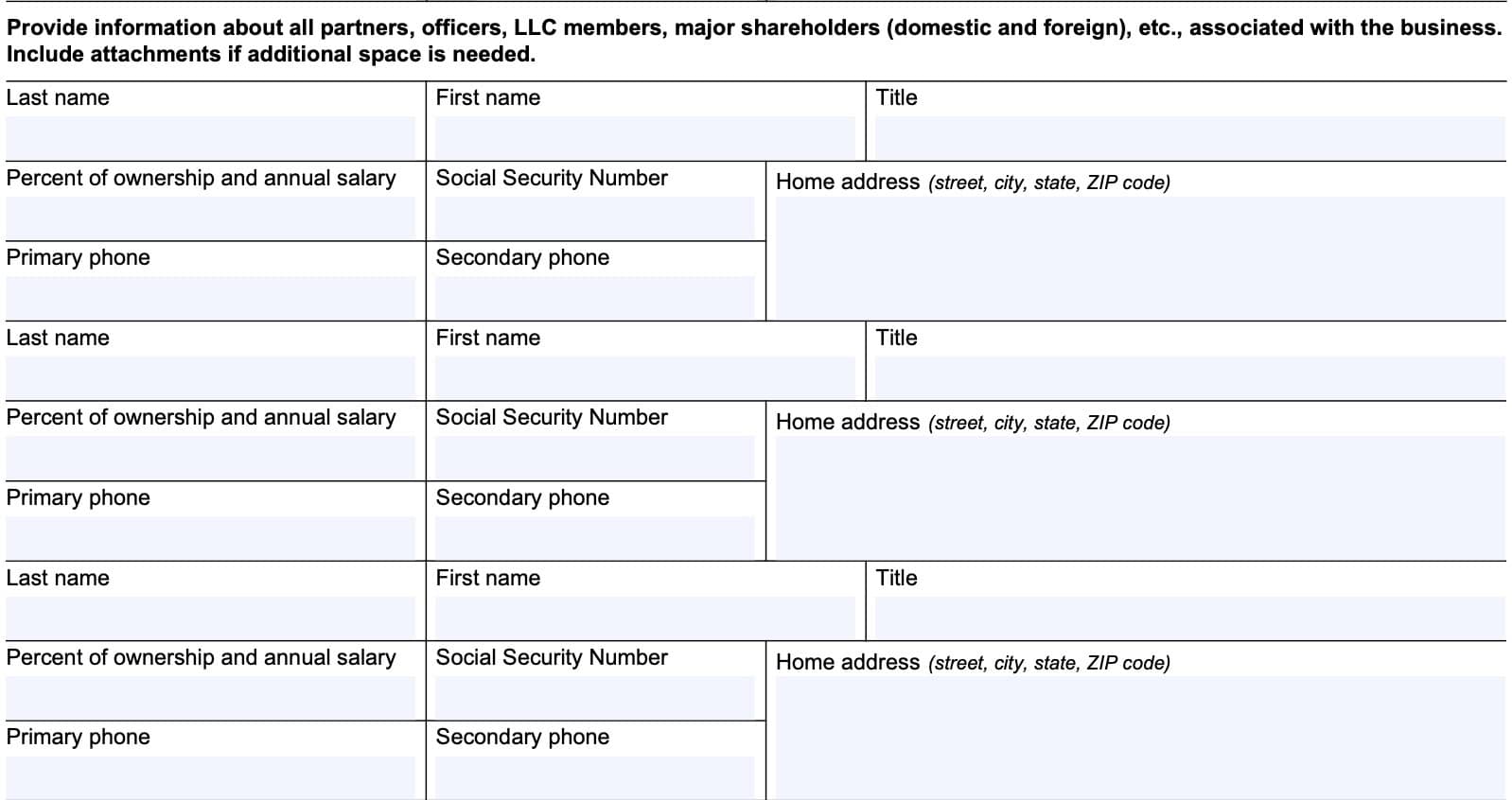

Officer information

For each partner, officer, LLC member, business owner or major shareholder, you will need to provide the following information:

- Complete name (last name, first name)

- Title

- Percentage of ownership and annual salary

- Social Security number

- Or individual taxpayer identification number if person does not have a Social Security number

- Primary phone number and secondary phone number

- Home address

- Include street, city, state, and zip code

There is sufficient space for up to 3 members/officers. If you need more space, you may provide attachments that include the required information.

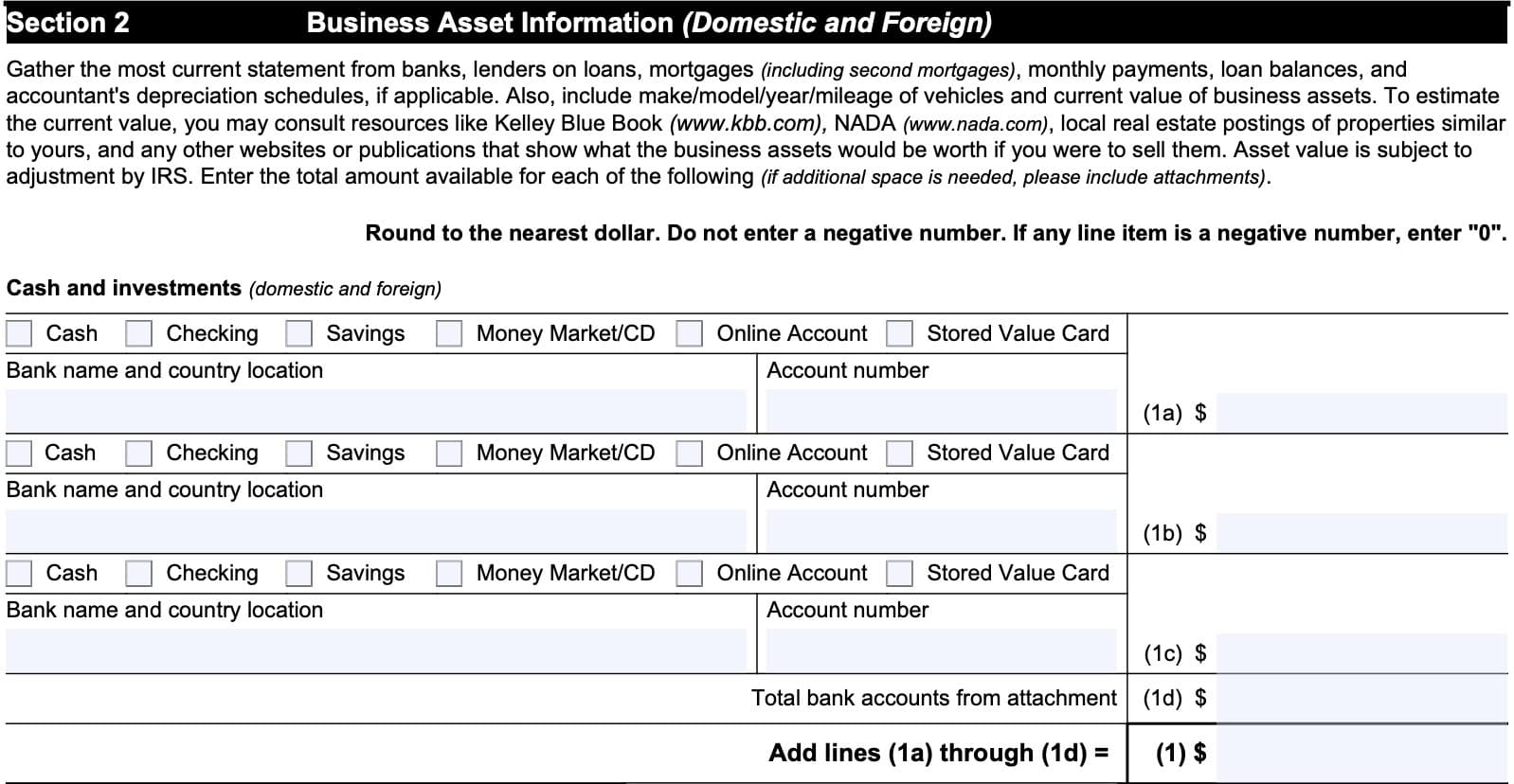

Section 2: Business Asset Information

In Section 2, we’ll go over each category of business assets. At the end of Section 2, you’ll have the financial information needed for Box A, which we’ll use to calculate your minimum offer amount, in Section 5, below.

Before we do, let’s go over some of the IRS guidance so that you can better understand what the IRS revenue officer may be looking for.

Documentation requirements

For financial accounts, gather the most current statement from the following, as applicable:

- Banks

- Loan officers

- Mortgage companies

- Monthly payment obligations

- Loan balances

- Depreciation schedules

For vehicles, also include make/model/year/mileage of vehicles. List the current value of business assets.

To estimate the current value, you may consult resources such as:

- Kelley Blue book

- National Automobile Dealers Association

- Local real estate listings of similar properties

- Relevant websites or publications indicating business asset value

The IRS may adjust asset values. Enter the total amount for each of the following types of assets.

Line 1: Cash

For Line 1, you’ll enter the total amount of cash in your bank or financial accounts.

Lines 1a, 1b, and 1c

IRS Form 433-B contains 3 lines for up to 3 different business bank accounts, marked Line 1a, Line 1b, and Line 1c.

For each account, you’ll need to select from one of the following:

- Cash

- Checking account

- Savings account

- Money market account or certificate of deposit (CD)

- Online banking account

- Stored value card

For each account, list the following information:

- Bank name and country location

- Account number

- Total amount

Line 1d: total bank accounts from attachment

If you have more than three accounts, you may add an attachment that contains the previously mentioned information for each additional account. Enter the total amount of cash in Line 1(d).

Add Lines 1a through 1d and enter the total in Line 1.

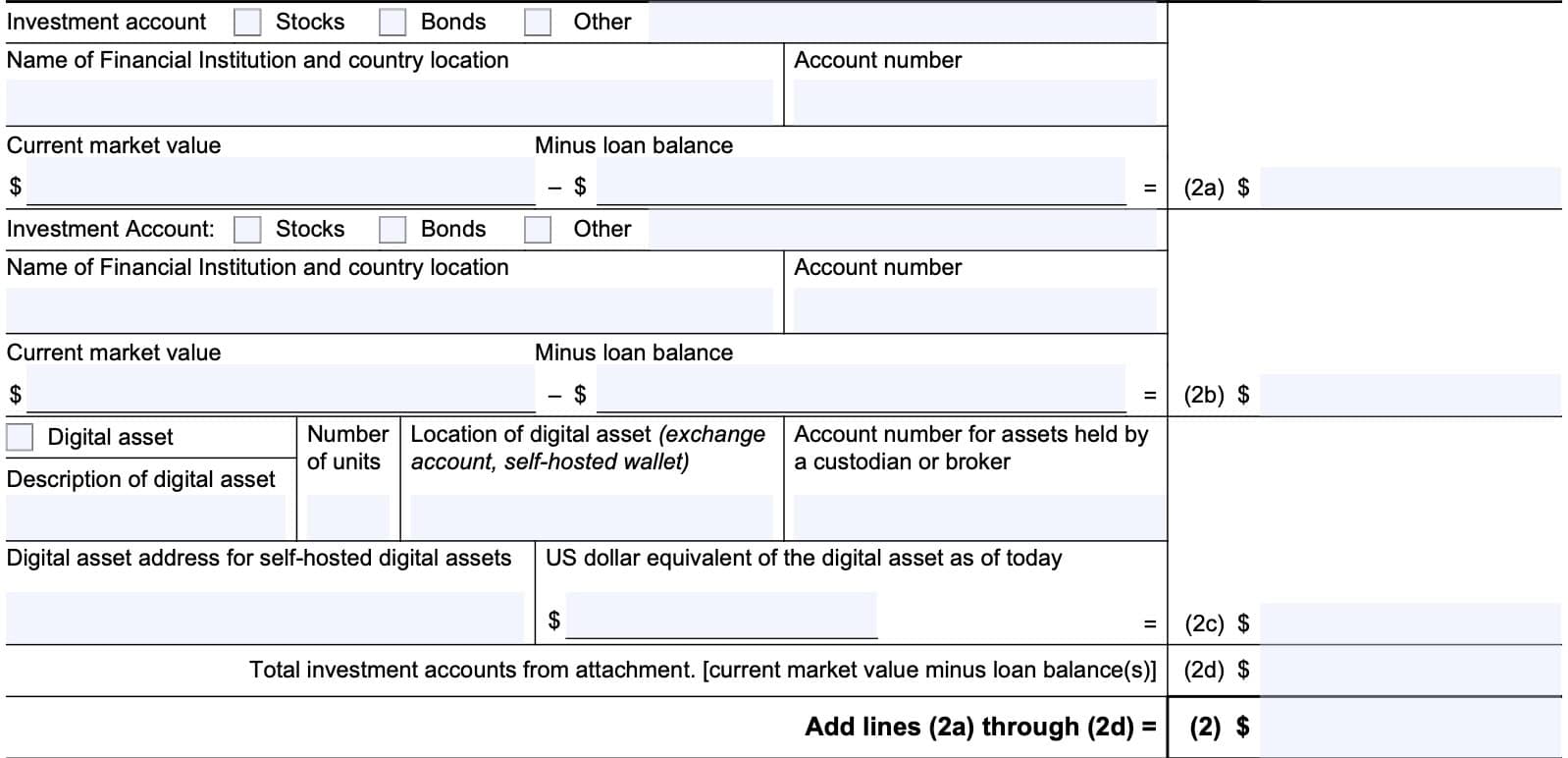

Line 2: Investments

For Line 2, you’ll enter the total amount of investments considered to be part of the business’s assets.

Lines 2a and 2b: Investment accounts

IRS Form 433-B contains 2 lines for up to 2 different investment accounts, marked Line 2a and Line 2b.

For each account, you’ll need to select from one of the following:

- Stocks

- Bonds

- Other investments

For each account, list the following information:

- Financial institution name and country location

- Account number

- Current market value

- Subtract any outstanding loan balances such as margin account balances

- List the market value minus loan balance in Line 2a or Line 2b

Line 2c: Digital assets

If you have digital assets, such as cryptocurrency, then you’ll enter that information in Line 2c. In this case, you’ll check the box marked, Digital asset, then enter the following information:

- Description of digital asset

- Number of units

- Location of digital asset, such as in a self-hosted cryptocurrency wallet

- Account number, if assets are held by a custodian or investment broker

- Digital asset address for self-hosted assets

- US dollar equivalent of the digital asset

The last item will also go in the space marked, (2c).

Line 2d

If you have additional accounts, you may add an attachment that contains the previously mentioned information for each additional account. Enter the total amount of investments in Line 2(d).

Add Lines 2a through 2d and enter the total in Line 2.

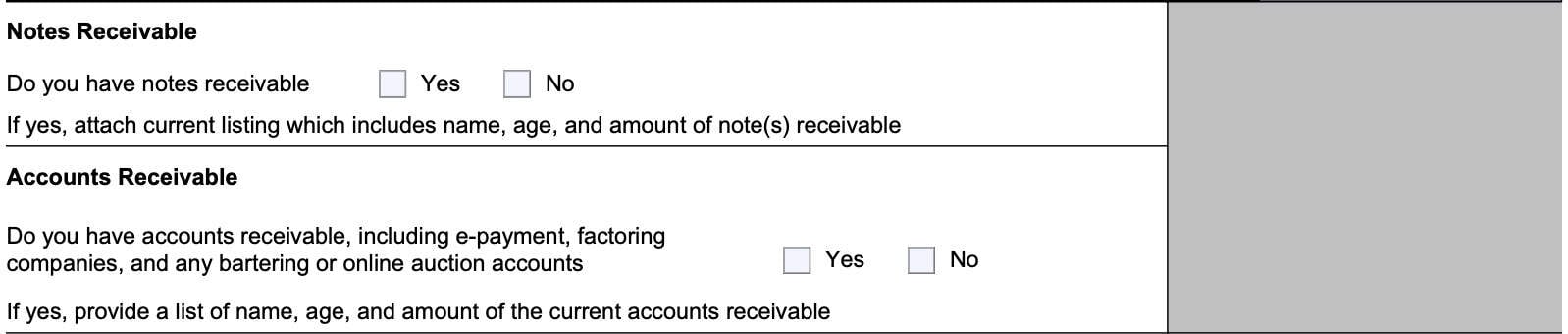

Receivables

There is no line number here. However, if you have either notes receivable or accounts receivable, then check Yes in the applicable box and attach a listing that includes the requested information, outlined below.

Otherwise, check No in both boxes and move down to Line 3, below.

Notes receivable

Notes receivable are formal, written promissory notes representing a debt owed to a lender by a borrower, which includes:

- Principal amount

- Interest rate

- Maturity date

In other words, it’s an official loan, not just an outstanding balance. If you have notes receivable, then attach a current listing that includes:

- Name

- Age

- Amount of note receivable

Accounts receivable

Accounts receivable, in contrast, is money that a customer owes to you based upon goods and services already provided on credit. If you have accounts receivable, then attach a current listing that includes:

- Name

- Age

- Amount of current accounts receivable

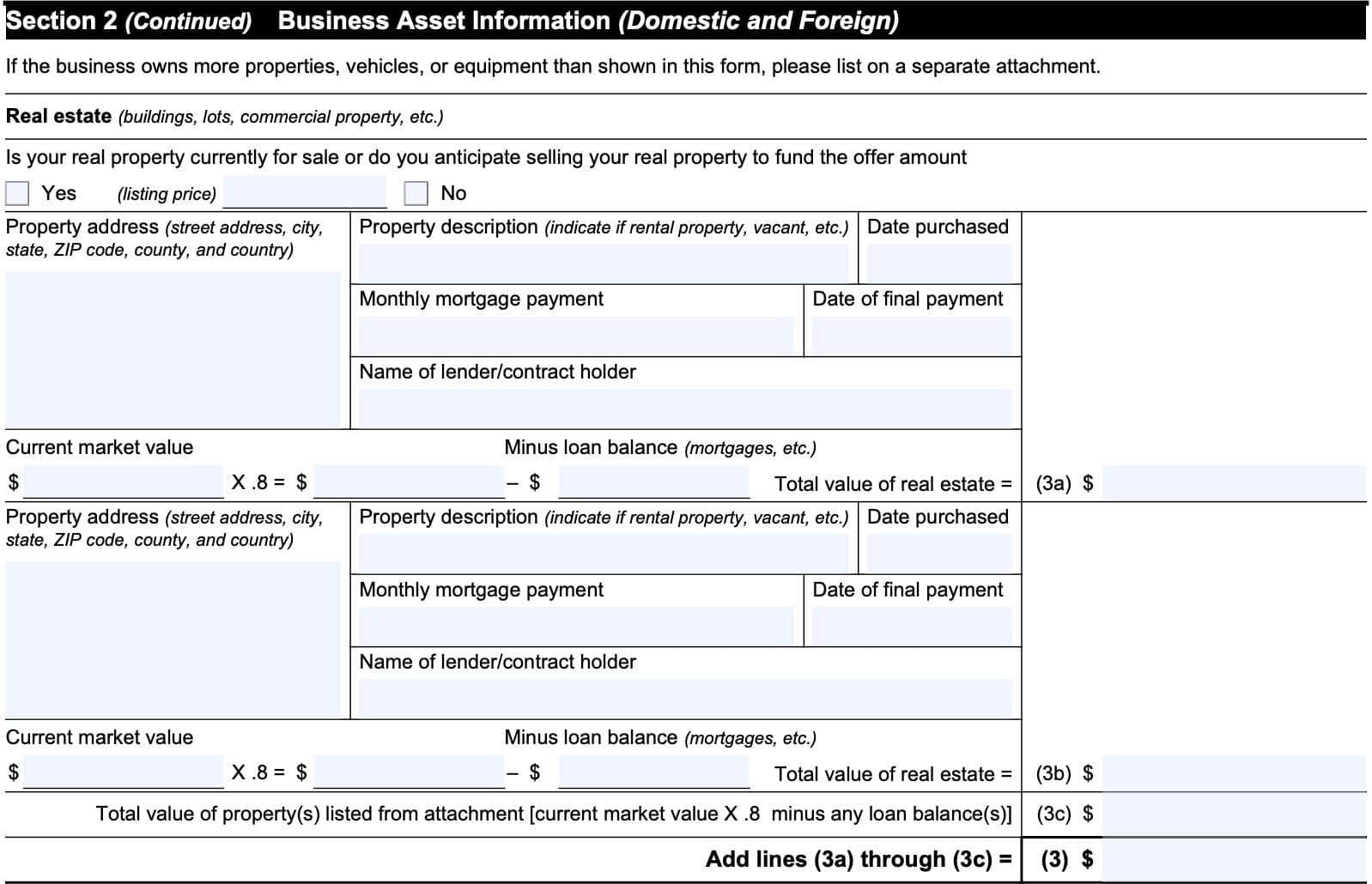

Line 3: Real estate

Line 3 covers real estate. Before we get to Line 3a, you’ll answer Yes or No to the following question:

“Is your real property currently for sale or do you anticipate selling your real property to fund the offer amount?”

If Yes, then enter the listing price or anticipated listing price.

Lines 3a and 3b: Properties

IRS Form 433-B contains 2 lines for up to 2 different real estate properties, marked Line 3a and Line 3b.

For each property, list the following information:

- Property address, including city, state, ZIP code, county, and country (if outside the United States)

- Property description

- Indicate if this is a rental property, vacant property, etc.

- Date property was purchased

- Date of final payment

- Monthly mortgage amount

- Name of lender

- Current market value

- Multiply by 0.8 and enter the result in the space provided

- Loan balance

Subtract loan balance from the the modified market value, then enter the calculated real estate value in either Line 3a or Line 3b, as applicable.

Line 3c: Total value of property from attachment

If you have more than 2 properties, then you’ll need to add an attachment containing the information outlined above. Be sure to modify the property’s market value by multiplying the current value by 0.8.

Enter the total value of the property (or properties) in Line 3c.

Add Lines 3a, 3b, and 3c. Enter the total in the space provided for Line 3.

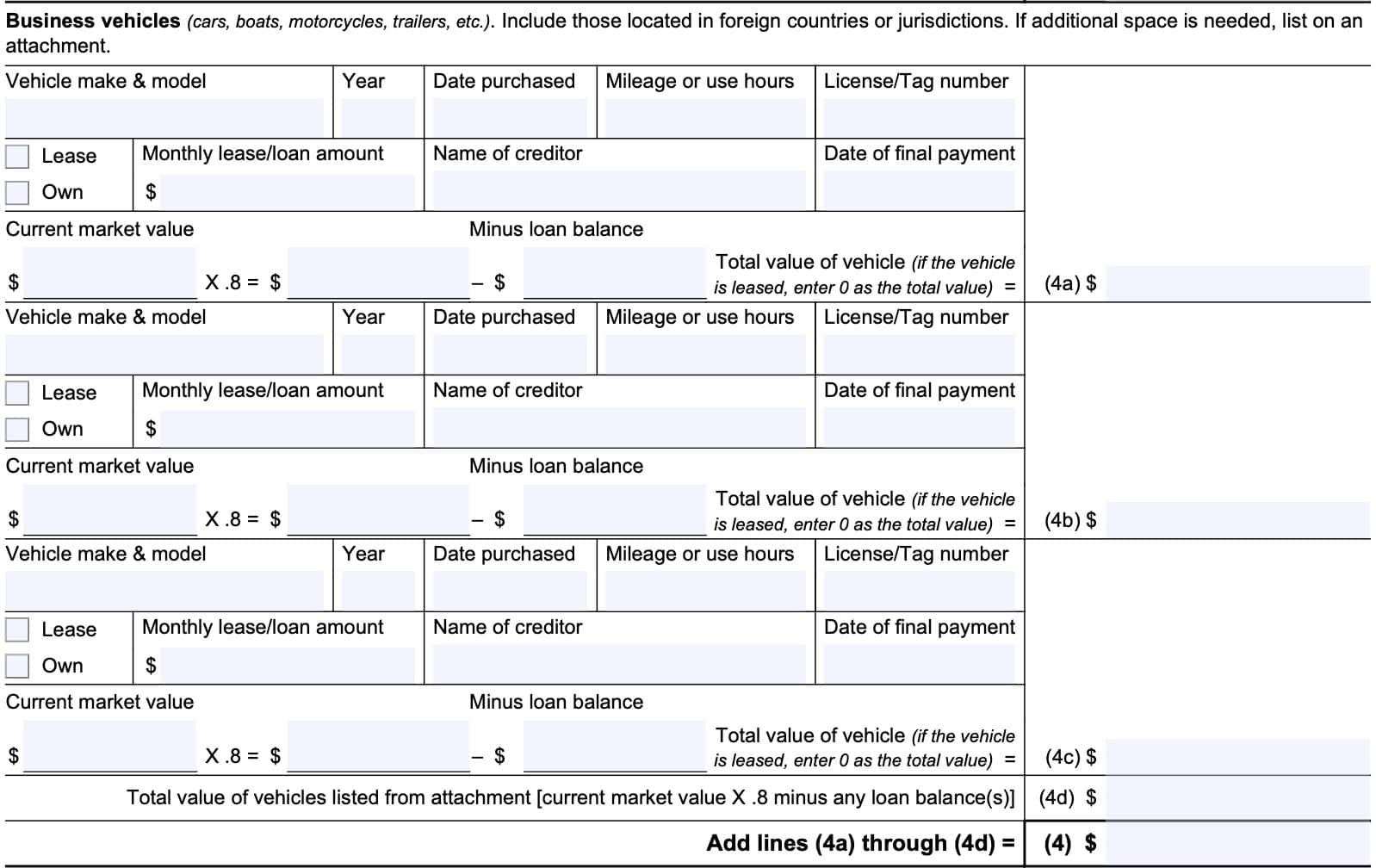

Line 4: Business vehicles

Line 4 calculates the estimated value of business vehicles.

Lines 4a, 4b, and 4c: Vehicles

IRS Form 433-B contains 3 lines for up to 3 different business vehicles, marked Line 4a, Line 4b, and Line 4c.

For each vehicle, list the following information:

- Vehicle make and model

- Year of manufacture

- Date purchased

- Mileage or usage hours

- License plate or tag number

- Lease or own

- Monthly lease or loan amount

- Name of creditor

- Date of final payment

- Current market value

- Multiply by 0.8 and enter the result in the space provided

- Loan balance

Subtract any loan balance from the modified market value, then enter the result in Line 4a, 4b, or 4c as applicable. If the vehicle is a lease, then simply enter $0 in the applicable field.

Line 4d: Total value of property from attachment

If you have more than 3 vehicles, then you’ll need to add an attachment containing the information outlined above. Be sure to modify each vehicle’s market value by multiplying the current value by 0.8.

Enter the total value of the vehicle (or vehicles) in Line 4d.

Add Lines 4a through 4d. Enter the total in the space provided for Line 4.

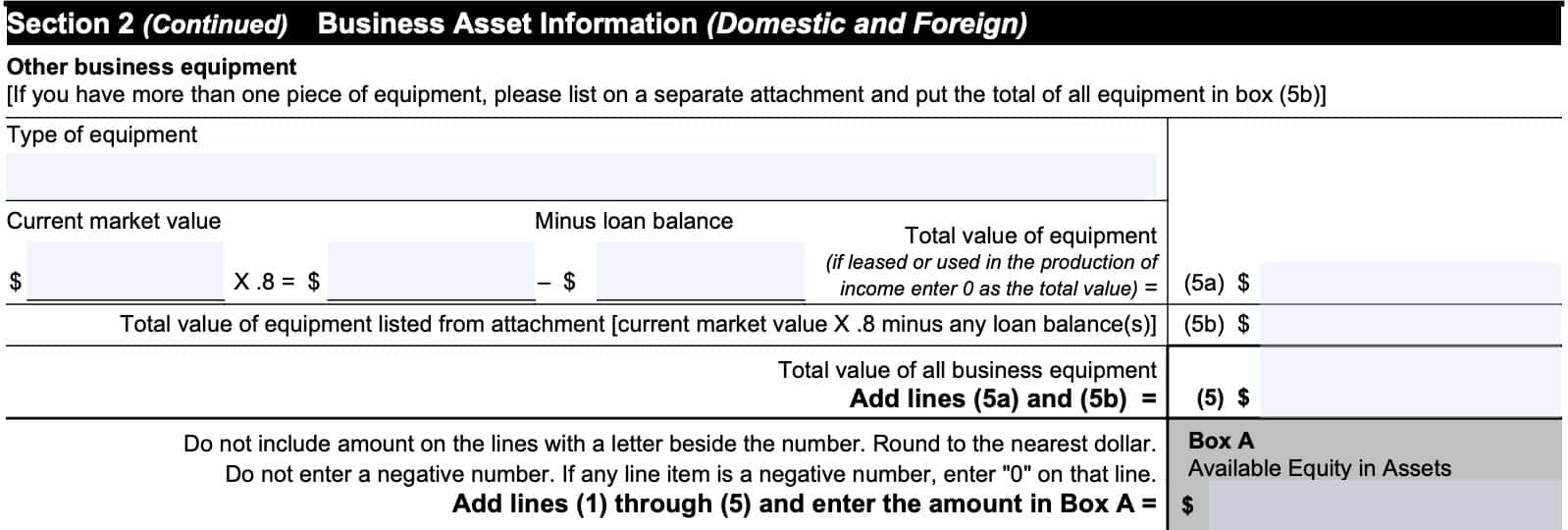

Line 5: Other business equipment

If you have any other equipment or income-producing assets, then you’ll use Line 5 to enter this information.

Line 5a: Business equipment

In Line 5a, enter the type of equipment in the space provided.

Also, enter the current market value, multiply by 0.8, then enter the result in the space provided. If there is a loan, enter the loan amount where indicated. Subtract the loan amount from the modified market value and enter the result in Line 5a.

Line 5b: Total value of equipment from attachment

If you have additional equipment, then you’ll need to add an attachment containing the information outlined above. Be sure to modify each vehicle’s market value by multiplying the current value by 0.8.

Enter the total value of the business equipment in Line 5b.

Add Lines 5a and 5b. Enter the total in the space provided for Line 5.

Calculating Box A

At the bottom of Section 2, you’ll see the space marked Box A. Add Lines 1 through 5, and enter the total here. This is your Available Equity in Assets, which will be used in determining your minimum offer amount in Section 5 below.

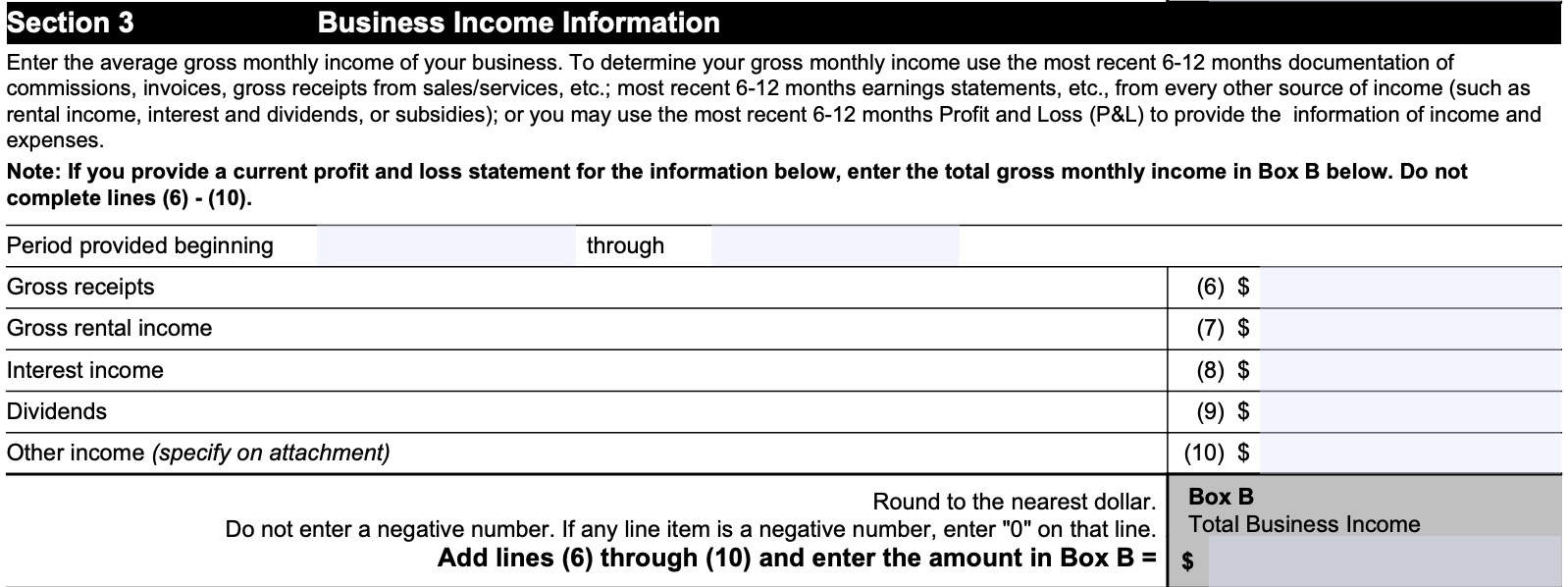

Section 3: Business Income Information

Section 3 will contain income information as it pertains to your business. For Lines 6 through 10, you’ll need to either:

- Provide the most recent profit and loss (P&L) statement, containing information for the past 6-12 months, or

- Enter the average gross monthly income of your business

If you have a P&L statement, you can simply enter the total gross monthly income in Box B, below. Otherwise, we’ll go over how to calculate your gross monthly income before covering each line.

Calculating gross monthly income

To determine your gross monthly income use the most recent 6-12 months documentation of the following:

- Commissions, invoices, gross receipts from sales or services, etc.

- Earnings statements from all sources of income, including

- Rental income

- Interest and dividend income

- Subsidies

For Lines 6 through 10, enter the beginning date and ending date for each of the following:

- Line 6: Gross receipts

- Line 7: Gross rental income

- Line 8: Interest income

- Line 9: Dividends

- Line 10: Other income

Calculating Box B

Add Lines 6 through 10, then enter the amount in the space provided in Box B. This represents Total Business Income, and will be used in Section 4, below.

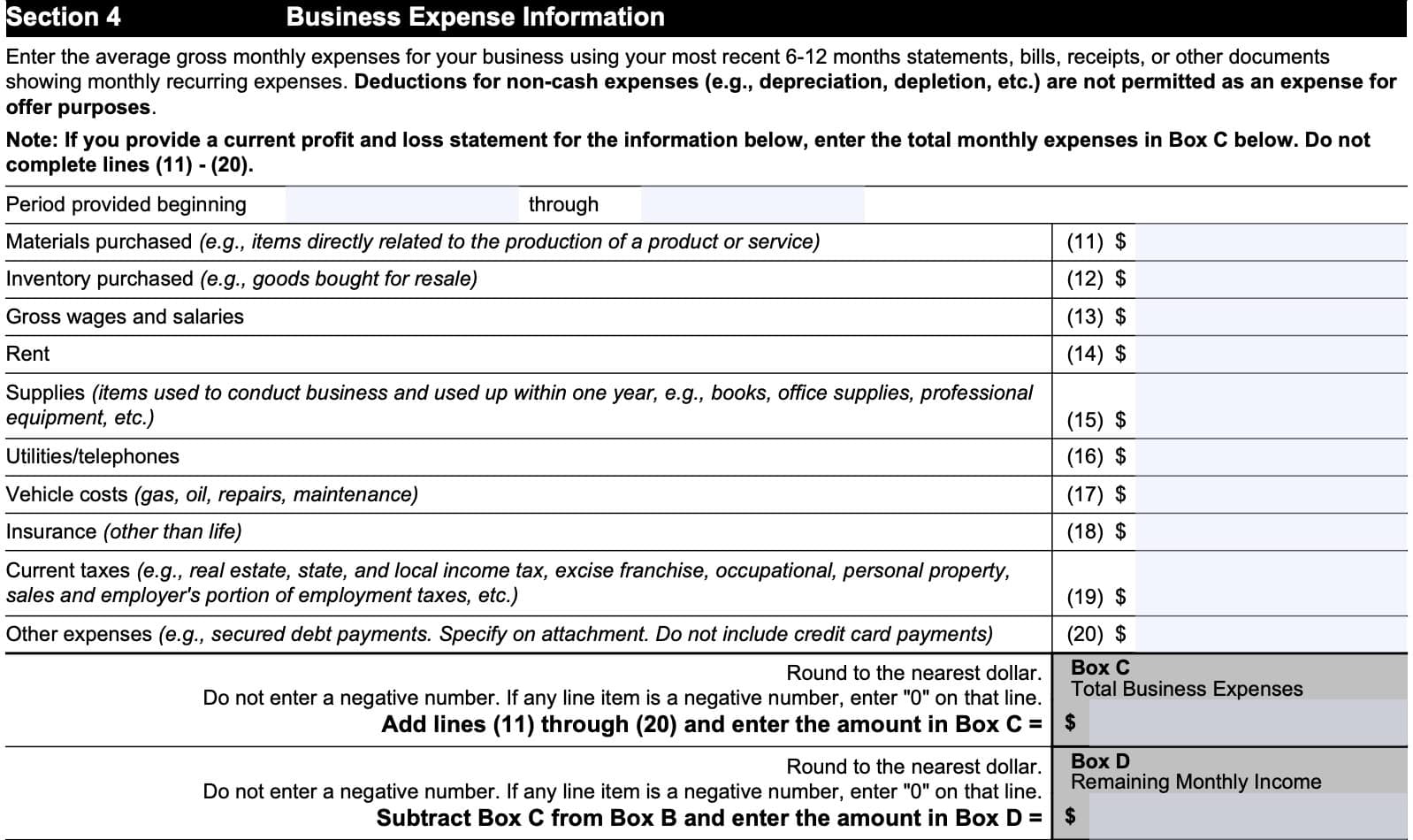

Section 4: Business Expense Information and Liability Information

Section 4 will contain business expense and liability information as it pertains to your business. For Lines 11 through 20, you’ll need to either:

- Provide the most recent profit and loss (P&L) statement, containing information for the past 6-12 months, or

- Enter the average gross monthly expenses for your business

If you have a P&L statement, you can simply enter the total gross monthly expenses in Box C, below. Otherwise, we’ll go over how to calculate your gross monthly expenses before covering each line.

Calculating gross monthly Expenses

To determine your gross monthly expenses, use the most recent 6-12 months documentation of statements, bills, receipts, or other documents showing monthly recurring expenses. Tax deductions for non-cash expenses, such as depreciation, amortization, or depletion, are not permitted as an expense.

For Lines 11 through 20, enter the beginning date and ending date for each of the following:

Line 11: Materials purchased

- Line 12: Inventory purchased

- Line 13: Gross wages and salaries

- Line 14: Rent

- Line 15: Supplies

- Line 16: Utilities/telephones

- Line 17: Vehicle costs

- Line 18: Insurance

- Line 19: Current taxes

- Line 20: Other expenses

Calculating Box C

Add Lines 11 through 20, then enter the amount in the space provided in Box C. This represents Total Business Expenses, and will be used to calculate the Remaining Monthly Income, in Box D, below.

Calculating Box D

Subtract the Total Business Expenses (Box C) from the Total Business Income (Box B), and enter the result in Box D. This is called Remaining Monthly Income, and will be used in calculating your minimum offer amount, in Section 5, below.

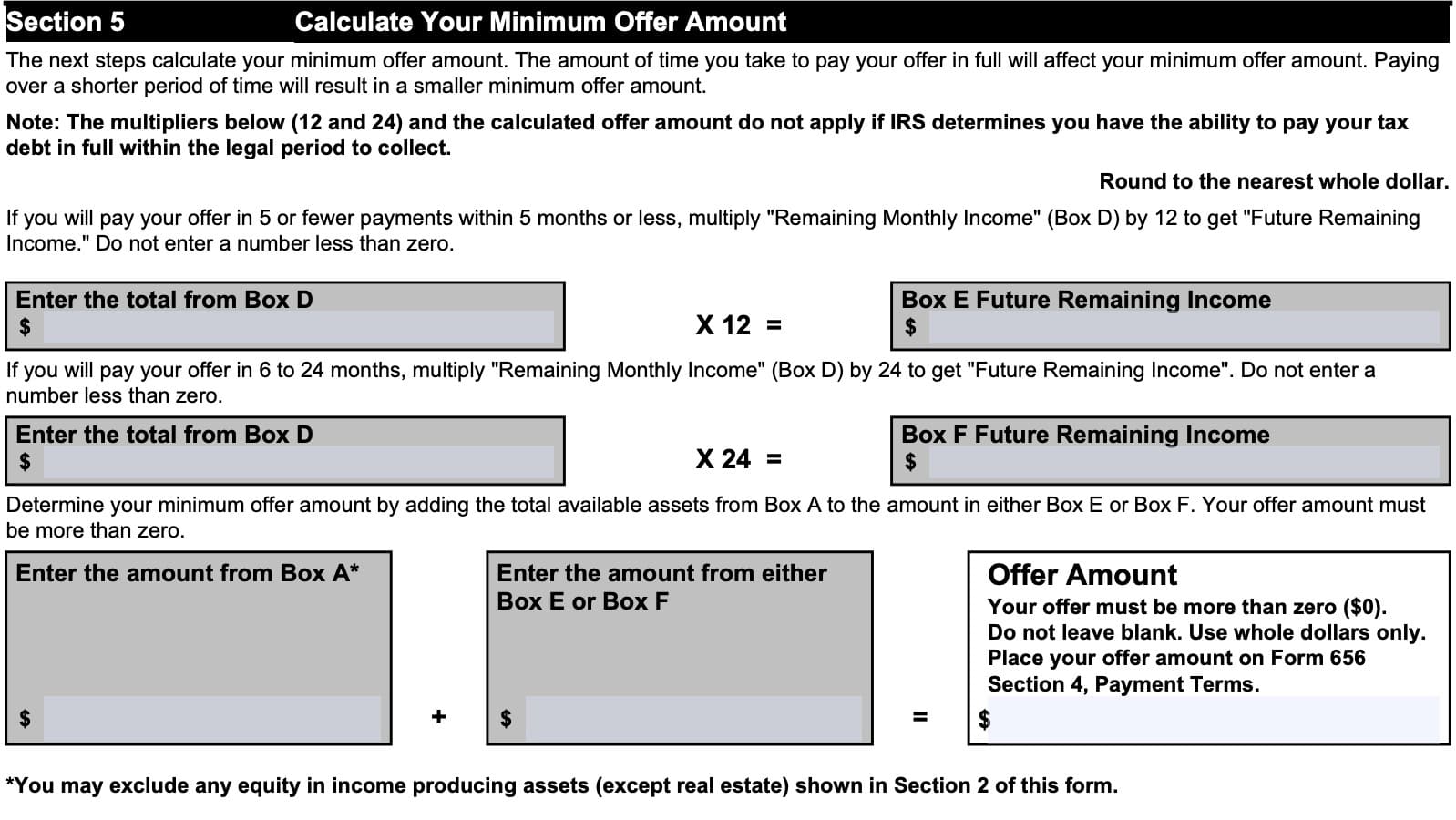

Section 5: Calculate Your Minimum Offer Amount

In this section, we’ll calculate the minimum offer amount. There are two ways to calculate your minimum offer amount, and they are based upon the amount of time that you take to pay your business taxes in full.

Please note a couple of things:

- Paying over a shorter period of time will result in a smaller minimum offer amount

- If the IRS determines that you have the ability to pay off the full amount of your tax bill within the collection period

Box E: Paying off your tax debt in 5 months or less

If you are able to pay your offer in 5 or fewer monthly payments, within 5 months or less, then you will multiply the Remaining Monthly Income from Box D by 12 in order to get the Future Remaining Income amount in Box E.

Box F: Paying off your Back Taxes in 6 to 24 months

If you are able to pay your offer in within 6 to 24 months, then you will multiply the Remaining Monthly Income from Box D by 24 in order to get the Future Remaining Income amount.

Calculating your offer amount

To calculate your offer amount, you’ll need the amount from Box A, calculated in Section 2, as well as the Future Remaining Income amount from either Box E or Box F. Simply take the Box A amount, then add it to the Box E or Box F amount.

The result is your Offer Amount. There are a couple of guidelines:

- This amount must be greater than zero

- You cannot leave this field blank

- Enter this amount on IRS Form 656, Section 4: Payment Terms

Let’s go on to Section 6.

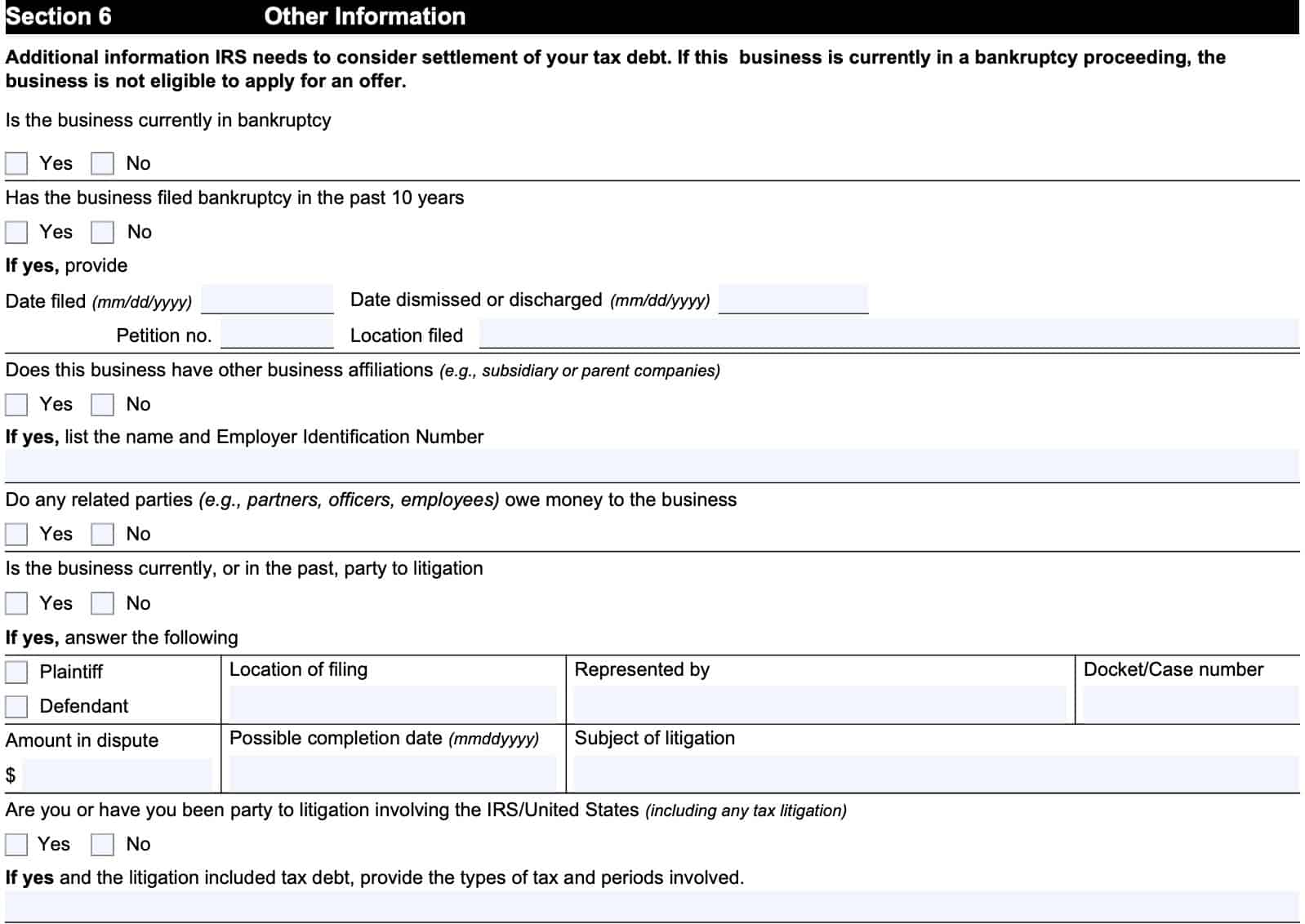

Section 6: Other Information

In this section, we’ll go through additional questions that the Internal Revenue Service needs to ask in order to consider settling your tax debt. Most of these are Yes/No questions, but we’ll go over each of them here.

Is the business currently in bankruptcy?

Answer Yes or No.

Has the business filed bankruptcy in the past 10 years?

Answer Yes or No.

If Yes, then provide the following information:

- Location bankruptcy was filed

- Date the business filed bankruptcy

- Date the bankruptcy was dismissed or discharged

- Petition number

Does this business have any other business affiliations?

Answer Yes or No.

If Yes, then enter the name and Employer Identification Number (EIN) of the affiliated businesses. These could be subsidiaries or parent companies.

Do any related parties owe money to the business?

Answer Yes or No.

Is the business currently, or in the past, party to litigation?

Answer Yes or No.

If Yes, then indicate whether the business was the plaintiff or the defendant in the litigation. Also, provide the following information:

- Location of filing

- Who represented the business

- Docket or case number

- Amount in dispute

- Completion date

- Subject of litigation

Are you or have you been party to litigation involving the IRS/United States?

Answer Yes or No.

If Yes, and the litigation included tax debt, then indicate the types of tax and the tax period (or periods) involved.

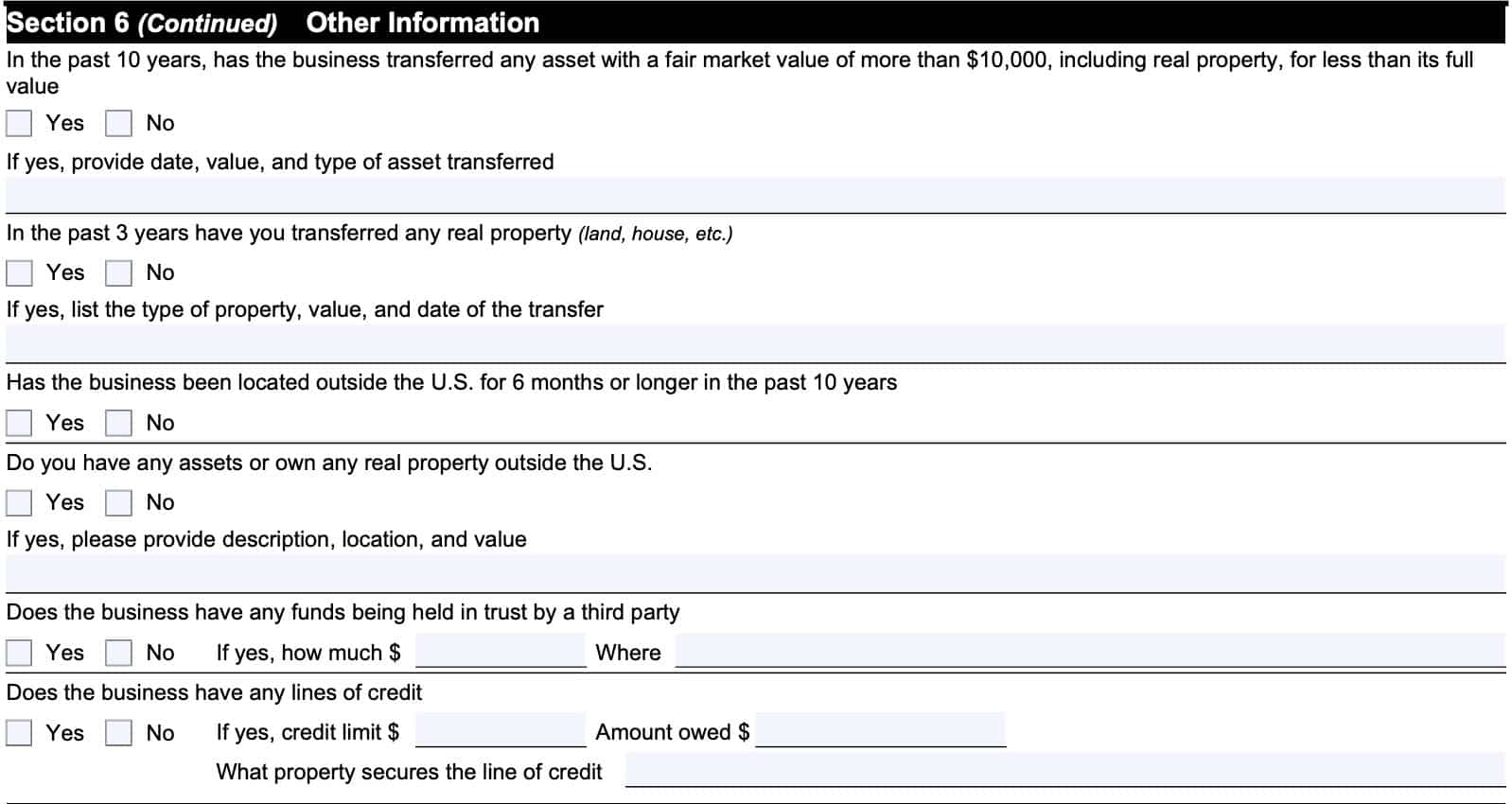

In the past 10 years, has the business transferred any asset with a fair market value of more than $10,000, including real property, for less than its full value?

Answer Yes or No.

If Yes, then provide date, value, and type of asset transferred.

In the past 3 years, have you transferred any real property?

Answer Yes or No.

If Yes, then list the type of property, value, and date of the transfer.

Has the business been located outside the United States for 6 months or longer within the past 10 years?

Answer Yes or No.

Do you have any assets or own any real property outside the United States?

Answer Yes or No.

If Yes, then the provide description, location, and value.

Does the business have any funds being held in trust by a third party?

Answer Yes or No.

If Yes, then indicate how much, and where the funds are being held.

Does the business have any lines of credit?

Answer Yes or No.

If Yes, then indicate the following:

- Available credit limit (in dollars)

- Amount owed

- Property securing the line of credit

Section 7: Signatures

In Section 7, sign and date the form, indicating that the information you’re providing is true, complete, and correct to the best of your knowledge. Also, enter your title as an officer representing the company.

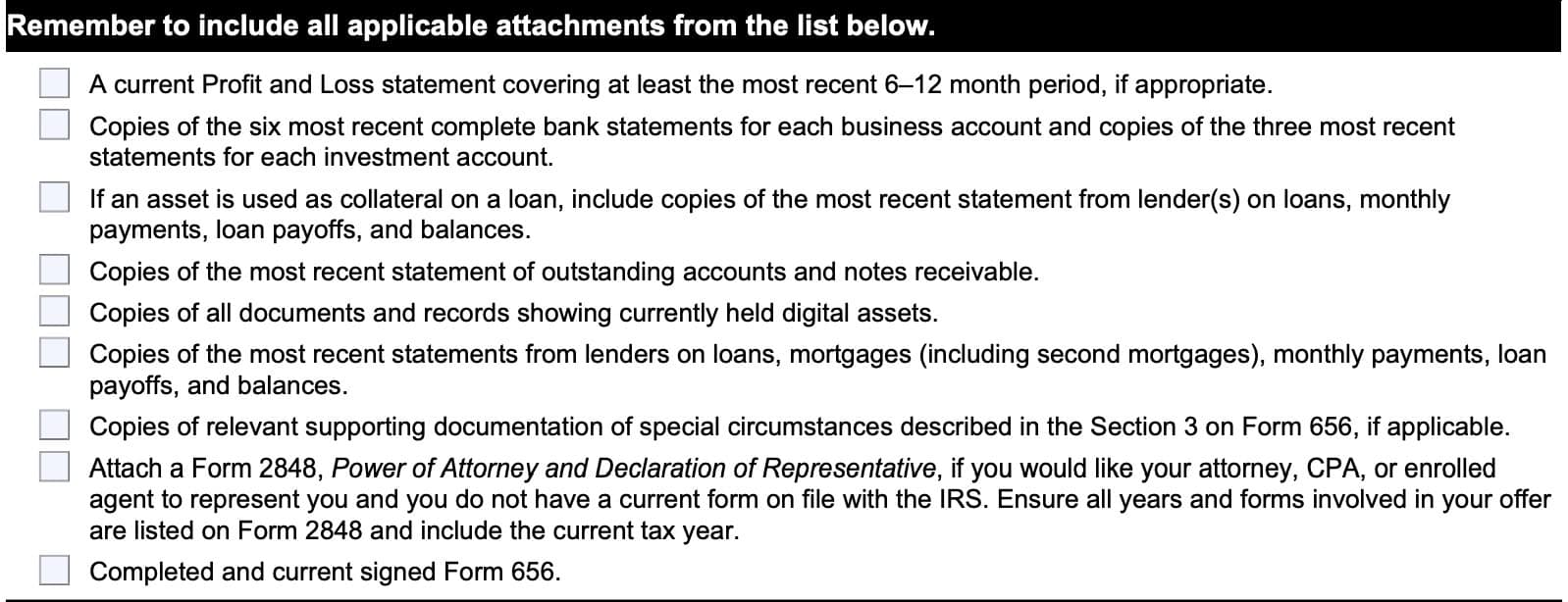

Filing considerations

At the end of the form, there is a checklist of pertinent documents and additional information. This checklist exists to help you ensure that you have everything for your offer-in-compromise submission.

Video walkthrough

Watch this instructional video for step by step guidance on completing your business’s collection information statement.

Frequently asked questions

No. Sole proprietorships are considered individual taxpayers. Individual taxpayers should instead complete IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals.

No. The IRS will not consider an offer in compromise without an attached collection information statement. Also, the IRS will likely want to see attachments containing supporting documentation that gives an accurate description of the taxpayer’s financial situation to make a determination.

Where can I find IRS Form 433-B?

You can find the latest versions of IRS forms such as Form 433-B on the IRS website. For your convenience, we’ve enclosed the latest version of IRS Form 433-B here as a PDF file.