IRS Form 712 Instructions

If you’re the executor of a decedent’s estate, you may be required to include the value of any life insurance proceeds in the gross estate for federal estate tax purposes. In that case, you may need to become familiar with IRS Form 712, Life Insurance Statement. This article will help you understand what you need to know about this tax form, to include:

- What is IRS Form 712?

- Who uses IRS Form 712 in a tax return?

- What information does IRS Form 712 contain?

- What to look for when handling the life insurance portion of the estate tax return

Let’s start with learning more about what this tax form is.

Before we proceed, please recognize that this is not tax or legal advice. This article exists for educational purposes only. For detailed advice about your specific situation, you should talk with your life insurance company, financial advisor, or tax professional.

Table of contents

What is IRS Form 712?

IRS Form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably IRS Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return.

In other words, unless you are filing an estate tax return (or less commonly, a gift tax return), you probably will not use IRS Form 712.

Who uses IRS Form 712 in a tax return?

There are a couple of parties to this.

Executor of the estate

After the death of the decedent, it is the executor’s responsibility to handle the financial affairs of the deceased, to include:

- Helping the surviving spouse or other beneficiaries make life insurance claims

- Filing an estate tax return and paying estate taxes on the taxable estate

However, the executor cannot create the information that the IRS requires. Because only the life insurance company has this information, it also has an important role in this process.

Trustee

If a trust is the beneficiary of the life insurance policy, then the trustee (or successor trustee) usually has the responsibility of filing the trust’s tax return. Depending on the type of life insurance policy and the type of trust, the trustee’s role might be nominal, or it might be significant.

Life insurance company

The life insurance company, upon request, should provide a copy of this tax form to the executor. This will allow the executor to complete the estate tax return.

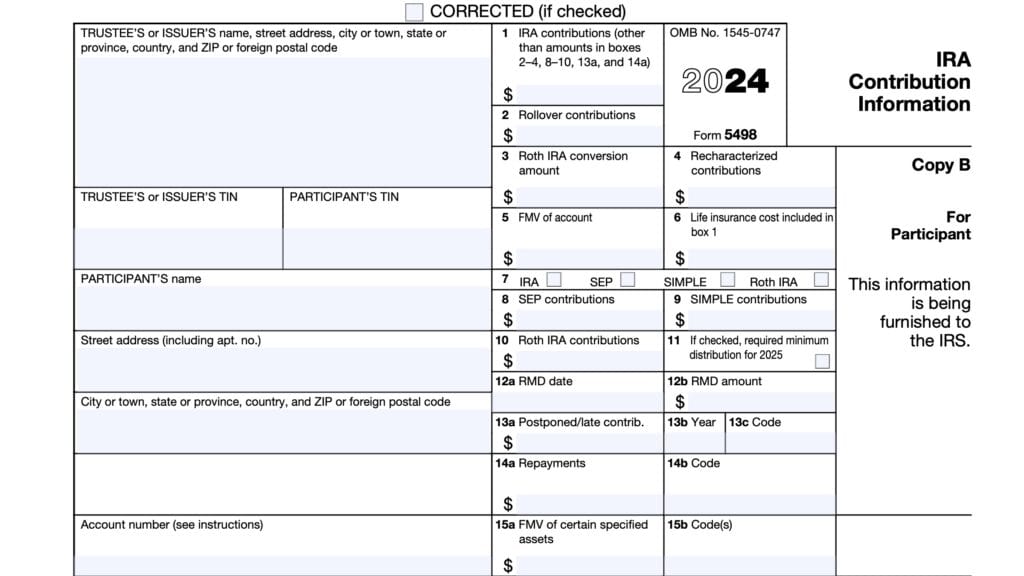

What information does IRS Form 712 contain?

There are 2 parts to this tax form:

- Part I: Decedent-Insured

- Part II: Living Insured

Let’s look at each part of the form to see what type of information it contains.

Part I: Decedent-Insured

This is the section of the form that the executor should file with Schedule D of IRS Form 706. This form can also be used to file IRS Form 706-NA, which is used for the estate of a nonresident who is not a citizen of the United States

Part I contains personal information about the decedent, specifically:

- Name

- Decedent’s Social Security number

- Name of designated beneficiaries

- Date of death

Part I also contains information about the life insurance policy itself, to include:

- Name and address of insurance company

- Type of policy

- Value of the policy

- Policy number

- Amount of premium

- Death benefit amount

- Whether there were incidents of ownership or transfers of the policy prior to the death of the insured

In addition to the basics, there is a lot of other financial information about the insurance policy. This might not apply to a group life insurance policy or a term life policy. However, this information may be appropriate for more complicated situations, like an irrevocable life insurance trust:

- Face value of the life insurance policy

- Amount of accumulated dividends

- Amount of returned premium

- Amount of proceeds if payable in one sum

- Principal of any indebtedness to the company deductible in determining net proceeds

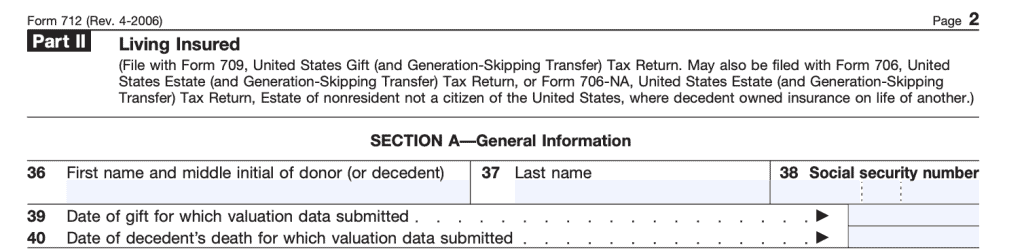

Part II: Living Insured

This is the part of the form that one may file when required to complete IRS Form 709-United States Gift (and Generation-Skipping Transfer) Tax Return for gift tax purposes. This might occur in a situation where there was a transfer of ownership of the policy to another person.

It may also be used along with IRS Form 706 for situations in which the decedent owned a life insurance policy on another person.

There are two sections to Part II:

- Section A: General Information

Section B: Policy Information

Section A: General Information

This section contains:

- Complete name of the donor or decedent

- Social Security number

- Date of gift

- Date of decedent’s death

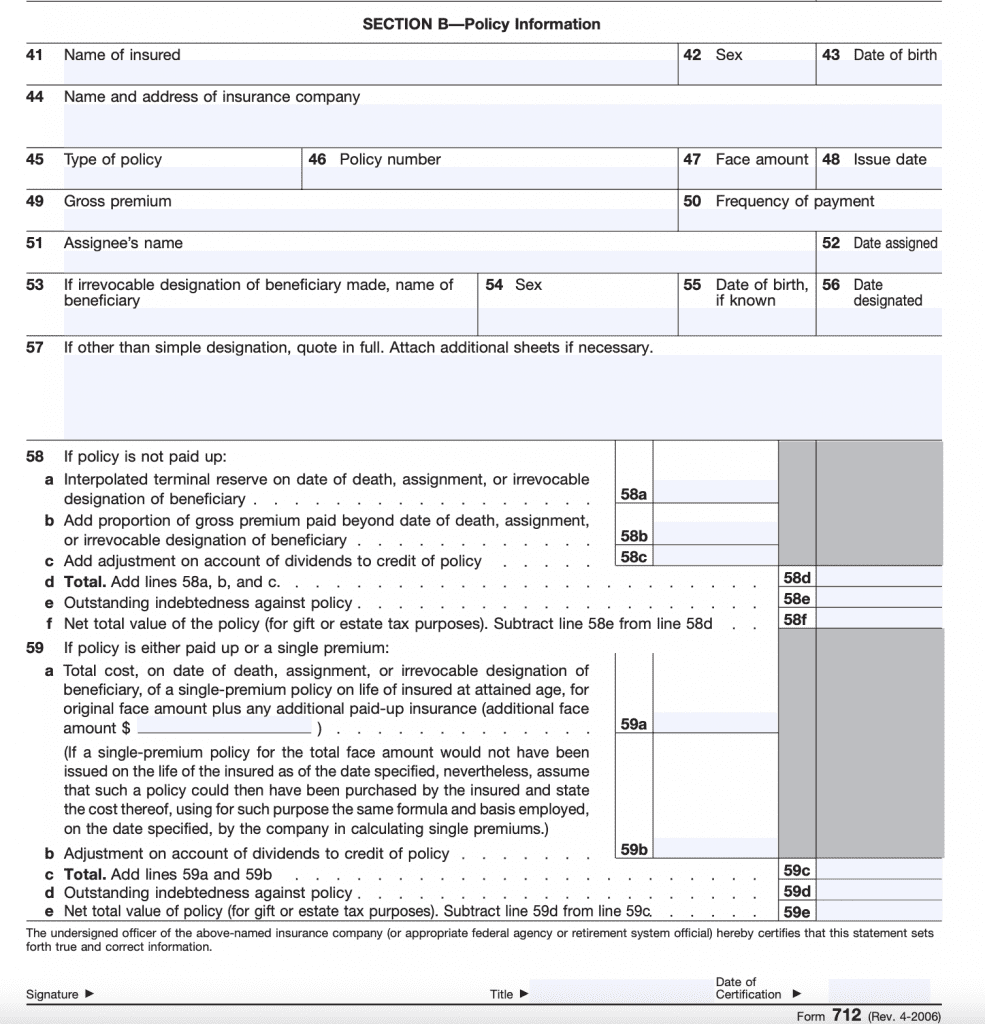

Section B: Policy Information

Section B contains more detail about the life insurance policy. In addition to the basic policy information contained in Part I, Section B contains more detail, to include:

- Date of birth

- Gross premium amount and frequency of payment

- Date of assignment

- Terminal reserve amounts

- Net total value of the policy

The net total value of the policy, specifically for gift or estate tax purposes, is the value of a life insurance policy adjusted for dividends, indebtedness, or additional paid premiums.

If the policy is a single premium policy or paid up policy, Form 712 will contain additional information on that as well.

In short, the executor does not have to worry about filing IRS Form 712. However, they may use none, some, or most of the information contained in this form when they file the estate’s tax return.

This also goes for any successor trustee, or any other person responsible for reporting life insurance information for gift or estate tax purposes. You’re not responsible for producing this tax form, but you do need to report this information to the Internal Revenue Service.

Video walkthrough

Watch this instructional video to learn more about your life insurance statement as documented on IRS Form 712.

Frequently asked questions

Below are some frequently asked questions about this tax form.

You may need this form if you are required to file Form 706 and there was any insurance on the decedent’s life. If this is the case, you must complete Schedule D and file it with the return. In this situation, you are required to provide a copy of IRS form 712 for each life insurance policy, regardless of whether it was included in the decedent’s gross estate.

Generally speaking, life insurance proceeds are not subject to income taxes in most situations. If an estate is subject to estate taxes, either on the federal or state level, the proceeds may be taxable, regardless of whether you use Form 712.

Generally, if the employee pays their own insurance premiums, then the life insurance proceeds are generally not subject to income tax. Conversely, if the premium amounts are paid by the employer, then the proceeds are generally taxable.

Most life insurance companies should provide this form when you provide a certified death certificate, or upon the owner’s request. In the case the insurance carrier does not provide a copy, you should file IRS Form 706, Schedule D. Include as much information, including copies of the insurance contract, riders, proceeds check, or other relevant material.

Yes. Each life insurance policy owned by a decedent must be accompanies by a separate Form 712.

Where can I find a copy of IRS Form 712?

For informational purposes, you may download a copy of this form from the IRS website or by clicking the file below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!