IRS Form 8888 Instructions

Are you expecting a federal income tax refund this year? Most likely, you’ve set up direct deposit to a single account, like your credit union or bank account. But did you know that you can split your tax refund using IRS Form 8888?

In this article, we’ll answer some basic questions about what you can do with your tax refund, including:

- What options you have with the allocation of refund from your income tax return

- How to use IRS Form 8888 to direct where each portion of your tax refund goes

- How to file Form 8888 with the Internal Revenue Service

Let’s start with going through IRS Form 8888 step by step.

Table of contents

How do I complete IRS Form 8888?

This one-page tax form is relatively easy to complete. We’ve broken IRS Form 8888 into three parts:

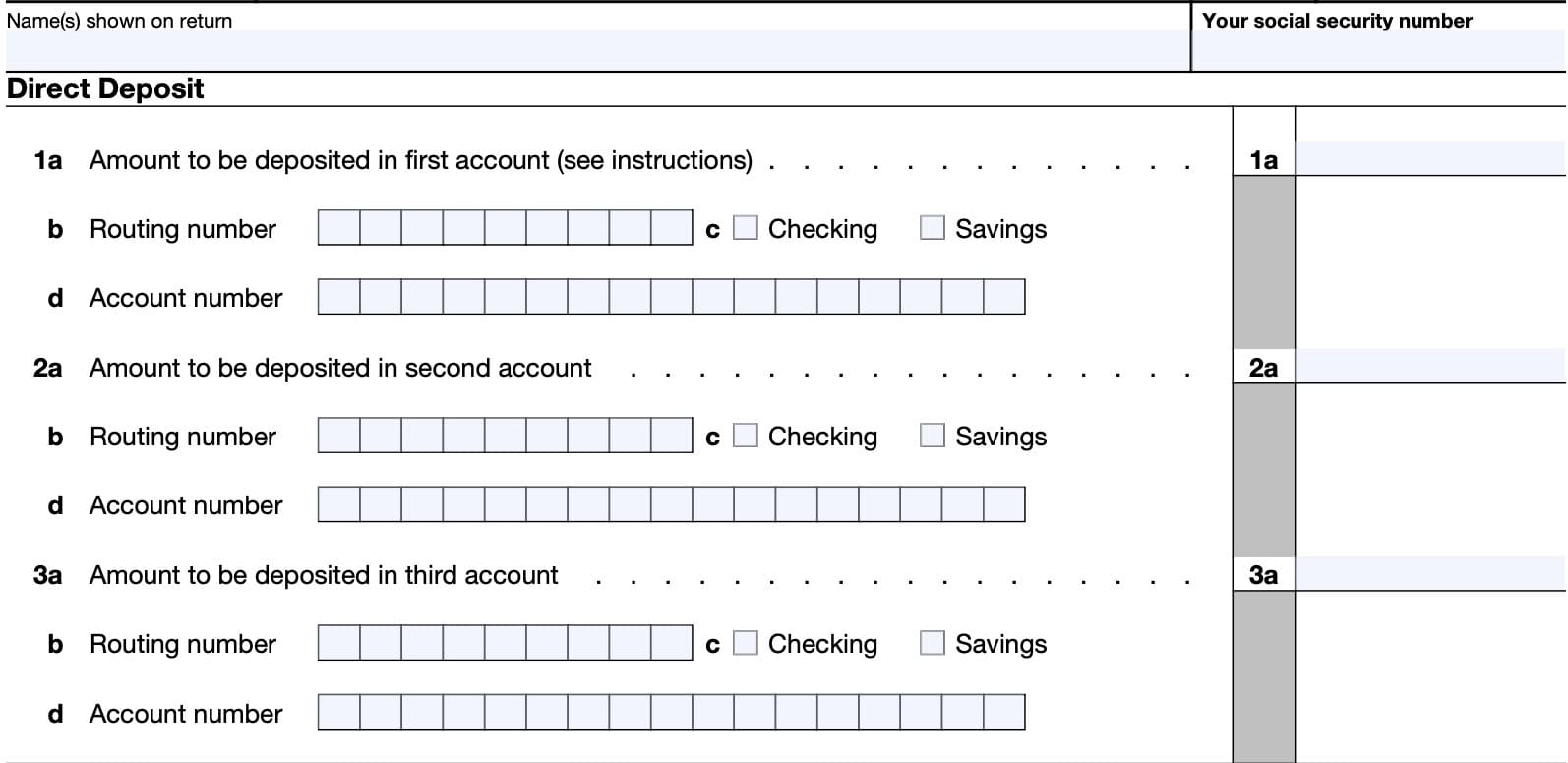

Part I: Direct Deposit

In this section, your tax software will probably automatically complete the following fields based on information in your IRS Form 1040:

- Calendar year of tax return

- Name(s) as shown on tax return

- Taxpayer’s Social Security number

From here, you can select up to three financial accounts to send your refund to. These accounts can be checking or savings accounts at a bank or credit union. They can also be investment accounts or retirement accounts at a brokerage firm.

Setting up financial accounts

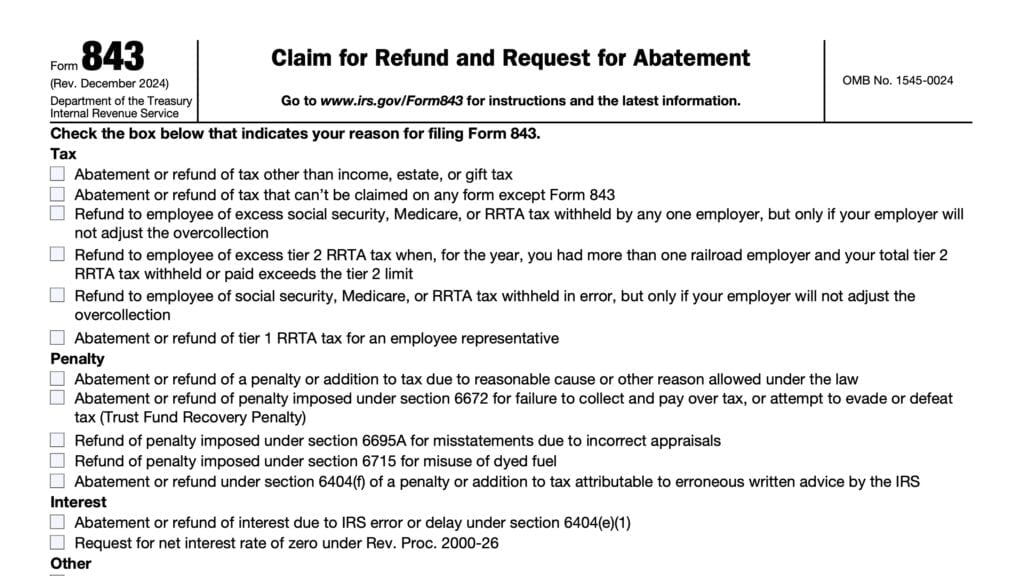

In any case, you will need to complete the following information for each account:

- Amount to be deposited

- Routing number: This nine-digit number is unique to the bank, and identifies the correct financial institution. Should start with the following digits:

- 01 through 12 or

- 21 through 31

- Account number: This is unique to you as the account holder

- Whether it is a checking or savings account (check the appropriate box)

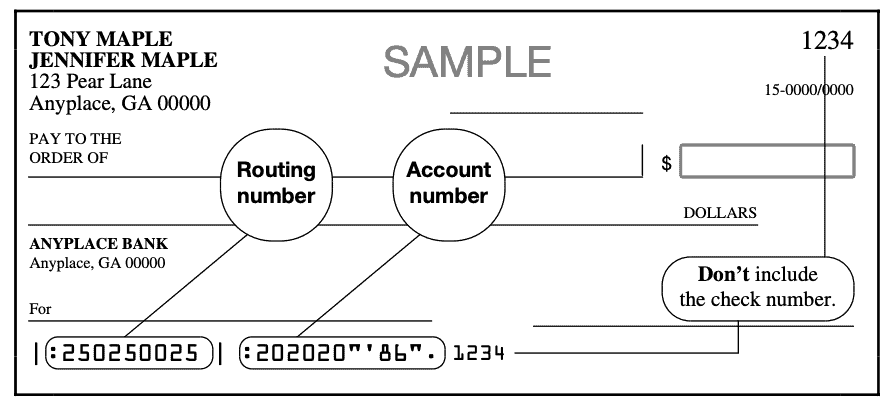

Routing number vs. account number

For checking accounts, you can obtain both the routing number and account number from a check. To help visualize the difference, and to avoid confusion, please refer to the below image.

When to clarify routing information

You may need to clarify your routing information if:

- You’re looking to directly deposit money into a savings account and you don’t have checks for that account

- The routing information on a deposit slip looks different from the routing information on one of your checks

- If depositing into an HSA, Archer MSA, or investment account, clarify whether your financial institution wants you to check either ‘Checking’ or ‘Savings’ in the account type.

Line 1a: Amount to be deposited in first account

Enter the refund amount that you would like to be deposited into the first amount. You may select your entire refund amount, or any lesser amount. However, each deposit must be at least $1.00.

Line 1b: Routing number

Enter your financial institution’s nine-digit routing number here.

Line 1c: Type of account

Check the appropriate box, based on the type of account your deposit will go to.

Line 1d: Account number

Enter the appropriate account number here.

Complete Lines 2a through 2d and 3a through 3d in a similar manner.

Account deposit points to consider

You must deposit at least $1 into each account that you specify.

If there are delays in the processing of your tax return, your entire refund might be deposited in the first specified account. For this reason, most people use the first account as their ‘primary’ deposit account, with a second or third account set aside for savings, investments, etc.

If you’re looking to invest your money in an IRA or other trading account, you must first establish the account before setting up the deposit. Also, you may want to check with your financial institution to ensure that you understand the deposit rules to avoid future tax issues.

Part II: Reserved for future use

Line 4 used to allow taxpayers to direct a portion of their refund to purchase Treasury Bonds. However, this is no longer an option as of January 1, 2025.

Complete Part II if you want the Internal Revenue Service to issue you a Treasury check for part or all of your tax refund. Part II is no longer available for taxpayers to purchase Treasury Bonds.

However, you may still create a Treasury Direct account to purchase Series I savings bonds.

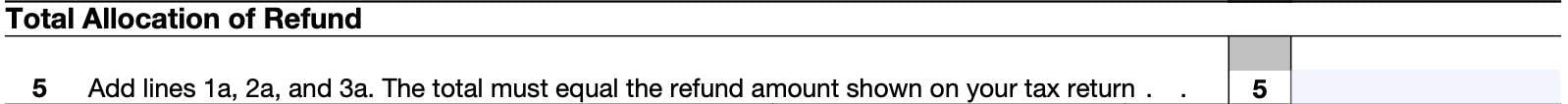

Part III: Total Allocation of Refund

Add the totals of the following lines:

- Line 1a

- Line 2a

- Line 3a

Your tax software will automatically do this for you. However, these numbers must equal the total amount of your tax refund as indicated on your Form 1040.

Does the IRS split tax refunds?

Yes, the Internal Revenue Service can split a tax refund from a taxpayer’s federal income tax return, based upon the taxpayer’s written instruction. To do this, the taxpayer must complete IRS Form 8888, Allocation of Refund.

When submitted with the taxpayer’s income tax return, Form 8888 directs the IRS where to allocate the taxpayer’s refund.

What payment options do I have with my federal tax refund?

A taxpayer may choose a variety of options.

- Direct deposit for up to three accounts

- Issuance of a paper check

Let’s take a close look at each of these options a little more closely.

Direct deposit

Using this tax form, you can select up to three different accounts for the deposit of your refund. These accounts do not have to be at the same financial institution.

Furthermore, you can select between deposits to one of the following different accounts:

- Checking account

- Savings account

- Money market account

- Individual retirement account (IRA)

- Can be traditional IRA, Roth IRA, SEP-IRA

- Cannot be a SIMPLE IRA

- Must otherwise be eligible for IRA contribution

- Medical savings account, also known as an Archer MSA

- Health savings account

- Coverdell education savings account (ESA)

Of course, you don’t have to set up direct deposit for your entire refund. You can also use Form 8888 to have the IRS issue a portion of your refund in the form of a check or U.S. Series I savings bonds.

Savings bonds

As of January 1, 2025, the savings bond purchases option has been discontinued. However, you may still create a TreasuryDirect account to purchase Treasury bonds directly from the federal government without commissions or fees.

Paper check

If any portion of your refund remains after you allocate your direct deposit to your financial accounts, you can request this portion be sent to you in the form of a check. Simply follow the steps in Part II, below and verify that everything adds up to the correct amount in Part III.

Direct deposit vs. paper check

As many as 80% of taxpayers use direct deposit to receive their tax refund. The IRS highly recommends using direct deposit instead of requesting paper checks for the following reasons:

- Less prone to error: As long as the taxpayer enters the correct bank information, refund transactions are easier to process, with fewer math errors or other mistakes

- Faster: Taxpayers can expect their electronic refunds to take days while paper checks can take weeks or months

- Saves taxpayer money: Because electronic transactions are faster and more efficient, it costs the U.S. government less money to perform them. Which saves taxpayers money.

- Convenience and ease of use: You don’t have to make an extra trip to the bank to deposit your refund or worry about your check getting lost in the mail

What is IRS Form 8888?

IRS Form 8888 is the tax form that you can use to direct deposits of tax refunds to multiple deposit accounts.

When should I file IRS Form 8888?

You should file this form with your federal income tax return when:

- You want the IRS to issue your direct deposit refund to more than one financial account.

- This can be traditional banking accounts or retirement accounts, such as an IRA or Roth IRA

- You would like to receive a paper check for part of your refund, but would like the remaining funds to be sent to one or more accounts electronically

However, there are some situations where you cannot use this tax form.

When should I not file Form 8888?

The IRS recommends that you not use this form if you would like your tax refund to go only to one bank account and you’re not interested in receiving a paper check or buying savings bonds. If this is the case, you can simply enter your direct deposit information on your tax return without having to use this extra form.

The IRS websites states that if you file IRS Form 8379, Injured Spouse Allocation, you cannot do either of the following:

- Request a direct deposit refund to more than one account number

- Buy paper Series I savings bonds from the U.S. Treasury

In this situation, you can only deposit to one account, either in your name, your spouse’s name, or a joint account in both your names.

Video walkthrough

Watch this informative video to learn how to split your tax refund by filing IRS Form 8888 with your federal income tax return.

Are you tired of dreading tax season?

If you’re like most people, you push through the stress of filing, only to be hit with a bigger bill than expected—then put it all behind you until the same cycle repeats next year.

But what if you could change the game?

Tax planning puts you in control. It’s about being proactive, not reactive—taking small, smart steps throughout the year to reduce your tax burden, increase your savings, and keep more of your hard-earned money working for you.

Here’s what effective tax planning helps you do:

✅ Avoid the surprise of a high tax bill

✅ Understand how your income and decisions affect your taxes

✅ Strategically lower your tax liability over time

Ready to make smarter tax moves?

👉 Join my free weekly tax planning newsletter and get one actionable tip every week to help you reduce your taxes legally and effectively.

Start taking control—your future self will thank you.

Frequently asked questions

You should file Form 8888 with your federal income tax return.

There may be one of several things happening here. Most likely, a rejection of one or more accounts by your financial institution simply means that you entered the wrong account information. As a result, your financial institution cannot find an account to accept the deposit and rejects it. If you entered the wrong account information, but it is accepted by your financial institution, then your tax refund might go to the wrong account. In this situation, you’ll likely have to sort it out with your financial institution, as the IRS will not help you correct this mistake.

If a math error results in a refund increase, the additional amount will be deposited into the last account indicated on your allocation form.

If the math error results in a refund decrease, then the decrease will be allocated to your accounts in the following order:

Third account: If applicable any decrease will be taken from this account first

Second account: If the refund decrease is greater than the amount allocated to the third account, or if there are only two accounts, then the decrease will be taken from this account

First account: Any remaining decrease after the second and third account allocations are depleted will be taken from the primary account

f your tax refund offset is for federal back taxes, then your offsets will be similar to that of a math error resulting in a refund decrease: Third account, then second account, then first account.

If your refund offset is to pay down other types of debt, such as state taxes or past due child support, then the offset will reduce the payment to the account with the lowest routing number first. Then, the second lowest routing number, and finally, the last remaining account.

If a tax offset or math error decreases your IRA contribution, and you’ve already claimed a deduction on your tax return, then you’ll need to do one of the following:

Complete the contribution for the intended amount with outside money by the due date of the tax return, or file an amended return without the contribution. You can file an amended return with the contribution amount in the case of a partial deposit.

Keep in mind, an increase to your deposit might impact accounts with contribution limits. Be sure to compare the intended deposit amounts from your tax return with actual deposit amounts when you receive your tax refund.

Where can I find IRS Form 8888?

Like most tax forms, you can find IRS Form 8888 on the IRS website. For your convenience, we’ve included the most recent version of this tax form at the bottom of this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!