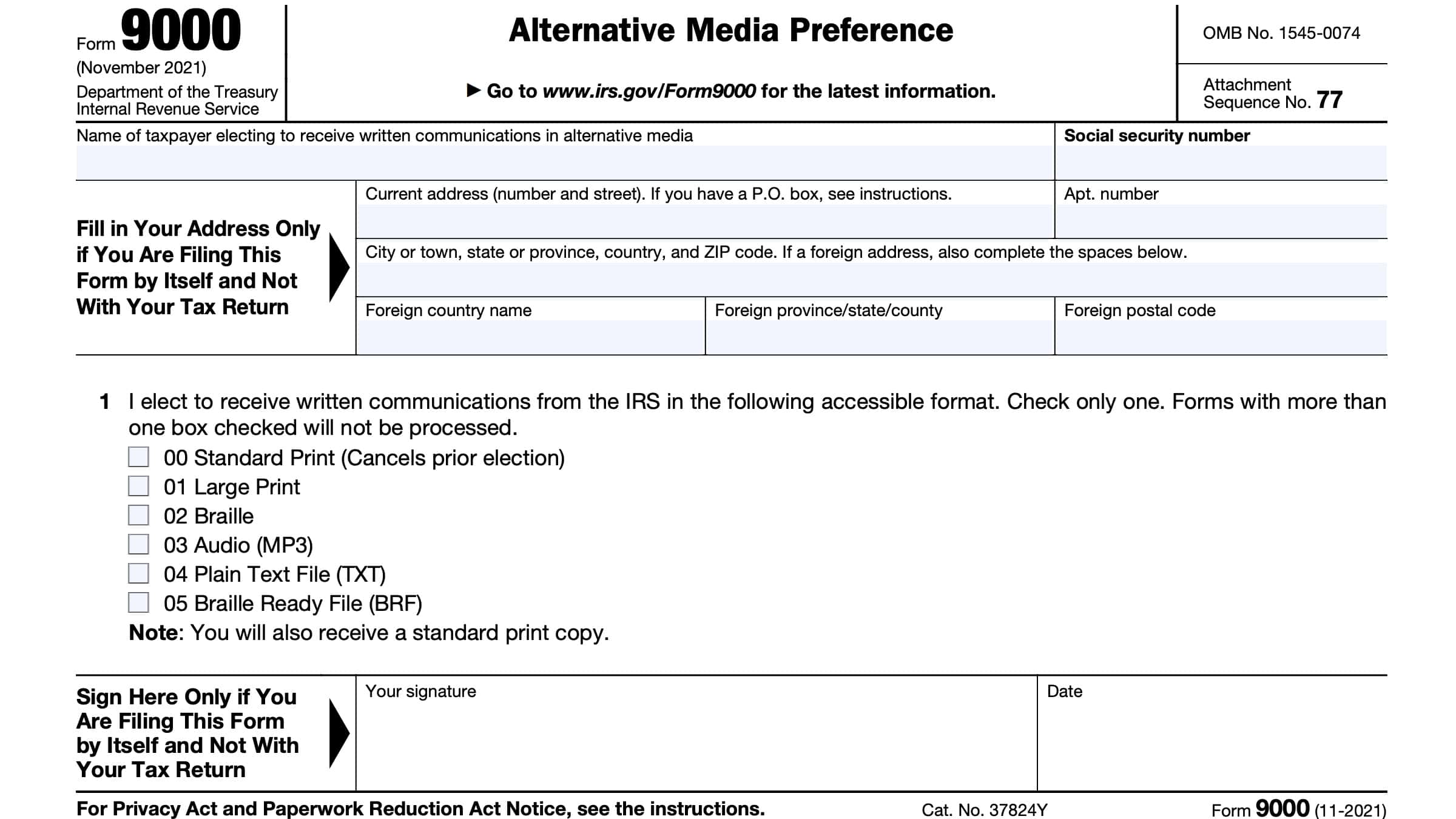

IRS Form 9000 Instructions

Beginning in tax year 2022, the Internal Revenue Service introduced IRS Form 9000, Alternative Media Preference, to allow taxpayers to receive correspondence, such as IRS tax notices, in one of several preferred formats.

In this article, we’ll walk you through everything you need to know about IRS Form 9000, including:

- How to complete and file IRS Form 9000

- Types of accessible formats you can request with this tax form

- Other resources, such as accessible forms, that taxpayers may have access to.

Let’s start with an overview of this brief tax form.

Table of contents

How do I complete IRS Form 9000?

This one-page tax form is relatively straightforward. Let’s start at the top of the form.

Taxpayer information

For taxpayers filing this form with their federal income tax return, you should review the taxpayer information at the top of the form for accuracy.

If you are filing this tax form by itself, then be sure to enter the following information:

- Taxpayer name

- Social Security number or individual taxpayer identification number (ITIN)

- Current address, to include:

- Street number and street name

- Apartment number, if applicable

- City, state, zip code

If you live in a foreign country, be sure to enter:

- Name of the foreign country

- Do not abbreviate

- Province or state

- Foreign postal code

Once you’ve completed the taxpayer information field, go to Line 1 to select your preferred format for receiving IRS communications.

Line 1

In Line 1, you may select one of the IRS’ available alternative media formats that you wish to receive.

However, you can check exactly one box. The Internal Revenue Service will not process your Form 9000 if you check more than one option.

Let’s look at each option in more detail.

00 Standard Print

In this format, you’ll see your tax information as the IRS conveys it visually and produces it on paper in the ordinary course of business. Taxpayers may select this option to reverse a previous election to receive an accessible format.

01 Large Print

In this format, your correspondence will contain an enlarged font, generally with a typeface of 18 points or larger.

For certain nonessential text, large print will consist of enlarged font with a typeface no smaller than 16 points.

By comparison, the plain font that you see in this article is 18 point font. Conversely, some IRS forms can contain font sizes as small as 10 points.

02 Braille

This format consists of a system of touch reading and writing in which raised dots represent the letters of the alphabet.

Documents are created in Grade 2 Interpoint Braille.

03 Audio

In an audio file, the IRS creates an MP3 file generated using text-to-speech technology. Taxpayers who request an audio file should expect their tax information to be delivered on a USB flash drive.

04 Plain Text File (TXT)

This is an unformatted text that the IRS saves to a TXT file. You can expect to receive files in a plain text file format on a USB flash drive.

05 Braille Ready File (BRF)

A specialized digital text format used by refreshable braille displays or a refreshable braille device. Files in this accessible format are delivered on a USB flash drive.

Taxpayer signature

You only need to sign and date the bottom of IRS Form 9000 if you are filing it as a standalone form. If you file your completed form with your income tax return, you do not need to sign the form.

Do I need to file IRS Form 9000 to obtain accessible tax forms?

No. The IRS official website contains an Accessible Forms and Publications page, specifically for different accessibility resources.

This page contains a list of tax forms and IRS publications in a variety of print and electronic formats, including the formats discussed below.

Section 508-compliant PDF format

Section 508 of the Rehabilitation Act requires federal agencies to provide individuals with disabilities equal access to electronic information and data comparable to those who do not have disabilities, unless an undue burden would be imposed on the agency.

Braille and text formats

The Braille and text format pages contains IRS tax forms and instructions in text (.txt) and Braille ready file (.brf) formats. Both formats are bundled together in a ZIP (.zip) file.

Text files can be opened or read by any program that reads text. This includes Microsoft Word and Notepad. This format also works well with:

- Screen enlargers

- Refreshable Braille displays, and

- Screen reading software

The Braille Ready File format is a widely recognized form of contracted Braille that can be read with a refreshable Braille display or embossed to produce high quality hard-copy Braille.

Some mobile devices can read .brf files using eBook reading software. However, these files are for reference only and cannot be submitted to the IRS in this format.

IRS Tax Forms and Instructions in Braille and text format

IRS Tax Publications in Braille and text format

HTML format

You may request any IRS publication or form instruction in HTML format, as well as PDF format.

IRS Tax Forms and Instructions in HTML Format

IRS Publications in HTML Format

Large print format

The IRS large print format pages contain large print versions of IRS tax instructions and publications.

Each document is a compressed ZIP (.zip) file, which contains a Portable Document Format (PDF) file or set of files.

Large print files are produced in 20-point Arial font. These files can be printed on standard letter-size (8 ½ in x 11 in) paper copy. For comparison, the smallest font in this tax article is 16-point font.

Some files include inserts that are printed on tabloid (11 in x 17 in) paper. These pages will appear in a smaller font on paper copies unless you print them on tabloid paper.

However, the files on this page are for print purposes only and are not Section 508 compliant. If you need a Section 508 compliant version, you can visit the Browser-Friendly Instructions page for instructions in HTML format.

IRS Tax Forms and Instructions in Large Print Format

IRS Publications in Large Print Format

ePub format

IRS eBooks for mobile devices are provided in the ePub format and have the following features:

- Searching within the publication

- Resizing type

- Adding your own comments and bookmarks

- Text automatically reflows to the screen size of your device

- Accessibility using VoiceOver

IRS eBooks have been tested using Apple’s iBooks for iPad. However, IRS eBooks have not been tested on other dedicated eBook readers and eBook functionality may not operate as intended.

Also, the IRS provides detailed information on how to download and view IRS eBooks on its website:

Additional IRS resources

The IRS has additional resources to improve accessibility.

Accessibility helpline

In addition, IRS established an Accessibility Helpline to answer questions related to current and future products in alternative media formats (i.e. Braille, large print, audio, etc.) and accessibility services available to taxpayers with print disabilities.

Taxpayers who need accessibility assistance can call 833-690-0598. Assistance for multilingual taxpayers is also available on the helpline via the Over-the-Phone Interpreter service.

However, the new helpline does not have access to taxpayers’ IRS accounts. Those needing help with tax law, refunds or other account-related issues, should visit the Let Us Help You page.

Helpful links

Below are links to different IRS pages with additional resources for taxpayer situations.

American Sign Language (ASL) Videos

This link connects deaf and hard-of-hearing taxpayers to a variety of instructional videos, recorded in American Sign Language (ASL).

These videos cover a variety of different topics, ranging from education tax credits to setting up direct deposit so you can receive your tax refund directly into your bank account.

American Sign Language (ASL) Videos

Free Tax Preparation by IRS Volunteers

The IRS’s Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs offer free basic tax return preparation to qualified individuals.

The VITA program has operated for over 50 years. VITA sites offer free tax help to people who need assistance in preparing their own tax returns, including:

- People who generally make $60,000 or less

- Persons with disabilities; and

- Limited English-speaking taxpayers

In addition to VITA, the TCE program offers free tax help, particularly for those who are 60 years of age and older, specializing in questions about pensions and retirement-related issues unique to seniors.

IRS Publication 3676-B also contains additional information about how the VITA service can help taxpayers.

Free Tax Preparation by IRS Volunteers

Information for Veterans with Disabilities

Information for Veterans With Disabilities

IRS Social Media Page

All taxpayers can keep up to date with the latest IRS updates and changes by following the Internal Revenue Service on social media.

More information for persons with disabilities

This page contains additional tax information, such as disability tax benefits for taxpayers with disabilities.

More Information for Persons With Disabilities

Understanding your IRS notice or letter

If you’ve received an IRS notice or IRS letter, you can request additional assistance, such as requesting correspondence in an alternative format.

Understanding Your IRS Notice or Letter

Penalty abatement

Taxpayers who believe that the IRS has inappropriately assessed a tax penalty due to their disability or inability to understand the tax form may file IRS Form 843, Claim for Refund and Request for Abatement.

According to the IRS Form 843 instructions:

If you were unable to read and timely respond to a standard print notice from the IRS, you may be able to request a refund or abatement of assessed penalties, interest, or additional taxes.

The following list illustrates the types of items you may want to include in your explanation on Line 7 when completing Form 843 for this purpose.

- The nature of the disability that prevents you from reading and timely responding to notices in a standard print format.

- The date you received the standard print notice from the IRS and a description of the notice.

- The date you learned of the issue described in the standard print notice.

- Whether you requested that the IRS provide the notice (or previous notices) in an alternative format and, if so, the date of the request and the format requested.

Video walkthrough

Watch this instructional video to learn more about this IRS document.

Frequently asked questions

No. The IRS Alternative Media Center contains a list of tax forms and publications in a variety of formats. If you have questions but cannot find the answer on the IRS website, you can call the IRS Accessibility Helpline at (833)-690-0598. Also, the IRS’ Let Us Help You page contains additional information about the tax law, or about account-related issues.

Any taxpayer with print disabilities or who uses accessibility assistance may file IRS Form 9000 to obtain written correspondence in a preferred format.

You can file Form 9000 with your tax return, or you may send your completed form directly to: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0002.

Where can I find IRS Form 9000?

As with other tax forms, you may find IRS Form 9000 on the IRS.gov website. For your convenience, we’ve enclosed the most recent version in our article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!