IRS Form W-8BEN Instructions

If you are not a U.S. citizen or resident, and are opening an account with a bank or financial institution located in the United States, you may need to file IRS Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), with the payer or withholding agent.

In this article, we’ll walk through what you need to know about IRS Form W-8BEN, including:

- How to complete IRS Form W-8BEN

- Situations when another form is more appropriate

- Frequently asked questions

Let’s begin with step by step instructions on completing IRS Form W-8BEN.

Table of contents

How do I complete IRS Form W-8BEN?

There are three parts to this one-page tax form:

- Part I: Identification of Beneficial Owner

- Part II: Claim of Tax Treaty Benefits

- Part III: Certification

Let’s go over the identifying information fields in Part I.

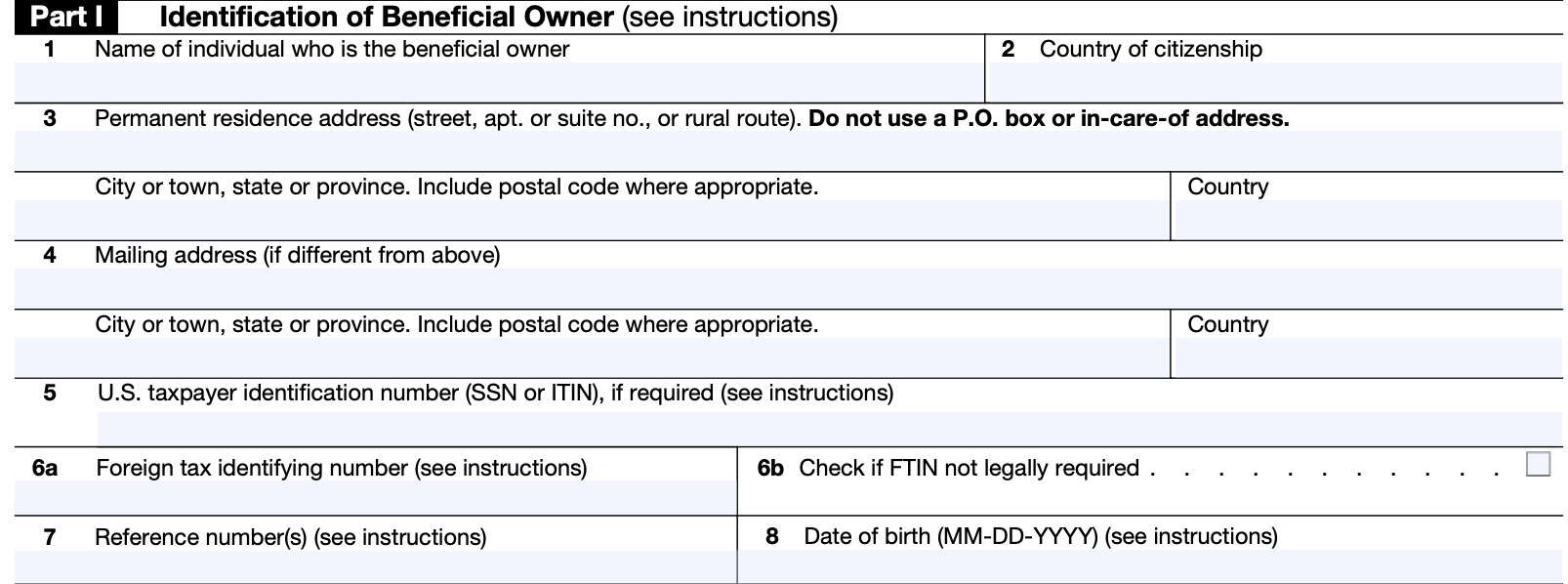

Part I: Identification of Beneficial Owner

In Part I, we will enter the required information for the beneficial owner of the payments for tax withholding purposes.

Line 1: Name of individual who is the beneficial owner

Line 1 contains the name of the individual who is the beneficial owner of the income being reported to the Internal Revenue Service.

Beneficial owner

According to the IRS instructions, for payments other than those for which a reduced rate of, or exemption from, withholding is claimed under an income tax treaty, the beneficial owner of income is generally the person who is required under U.S. tax principles to include the payment in gross income on a tax return.

Disregarded entities

If you are a foreign individual who is the single owner of a disregarded entity that is not claiming treaty benefits as a hybrid entity, with respect to a payment, you should complete this form with your name and information.

However, if the disregarded entity is claiming treaty benefits as a hybrid entity, it should complete IRS Form W-8BEN-E instead of this W-8 form.

Line 2: country of citizenship

Enter the country where you claim citizenship.

If you are not a resident in any country in which you have citizenship, enter the country where you were most recently a resident.

Dual citizenship

If you are a dual citizen, enter the country where you are both a citizen and a resident at the time you complete this form.

U.S. citizens

If you are a U. S. citizen, you should not complete this form even if you hold citizenship in another jurisdiction. Instead, provide a completed Form W-9.

Line 3: Permanent residence address

In Line 3, enter the permanent residence address.

Do not show the address of a financial institution, a post office box, or an address used solely for mailing purposes.

Permanent residence address

Your permanent residence address is the address in the country where you claim to be a resident for purposes of that country’s income tax. If you do not have a tax residence, then your permanent residence is where you normally reside.

Income tax treaties

If you are completing IRS Form W-8 BEN to claim a reduced rate of withholding under an income tax treaty, you must determine your residency in the manner required by the treaty.

Line 4: Mailing address

Enter a mailing address only if it is different from the address listed in Line 3.

Line 5: U.S. taxpayer identification number, if required

If you have a Social Security number (SSN), then enter it in Line 5. If you do not have an SSN but are eligible for one, then you can file Form SS-5 with the Social Security Administration to obtain one.

If you do not have an SSN and are not eligible for one, you can get an individual taxpayer identification

number by filing IRS Form W-7 with the Internal Revenue Service. It usually takes 4–6 weeks to get an ITIN.

To claim certain treaty benefits, you must complete Line 5 by submitting an SSN or ITIN, or Line 6 by providing a foreign tax identification number (foreign TIN).

When you must submit an SSN or ITIN

You must submit a Social Security number or ITIN if you are:

- Claiming an exemption from withholding under Internal Revenue Code Section 871(f) for certain annuities received under qualified plans, or

- Submitting the form to a partnership that conducts a trade or business in the United States

If you are claiming treaty benefits, you are generally required to provide an ITIN if you do not provide a tax identifying number issued to you by your jurisdiction of tax residence on Line 6. However, an ITIN is not required to claim treaty benefits relating to:

- Dividends and interest from actively traded stocks and debt obligations;

- Dividends from any mutual funds as defined under the Investment Company Act of 1940

- Dividends, interest, or royalties from units of beneficial interest in a unit investment trust that are (or were upon issuance) publicly offered and are registered with the SEC under the Securities Act of 1933; and

- Income related to loans of any of the above securities

Line 6a: Foreign tax identifying number

You must provide on Line 6a the foreign tax identifying number (FTIN) issued to you by your jurisdiction of tax residence identified on Line 3 unless:

- You are a resident of a U.S. territory, or

- Your jurisdiction of residence is on the IRS’s List of Jurisdictions That Do Not Issue Foreign TINs

This list includes the following countries:

- Australia

- Bermuda

- British Virgin Islands

- Cayman Islands

- Japan

Line 6b

You may check the box in this Line 6b if

- You are an account holder as described for purposes of Line 6a and

- You are not legally required to obtain an FTIN from your jurisdiction of residence (including if the jurisdiction does not issue TINs).

By checking this box, you will be treated as having provided an explanation for not providing an FTIN on Line 6a.

Line 7: Reference number

This is an optional field.

This line may be used by the filer of Form W-8BEN or by the withholding agent to whom it is provided to include any referencing information that is useful to the withholding agent in carrying out its obligations.

Line 8: Date of birth

If you are providing this Form W-8BEN to document yourself as an account holder with respect to a financial account as described above in Line 6 that you hold with a U.S. office of a financial institution (including a U.S. branch of an FFI), provide your date of birth.

Use the following format to input your information: MM-DD-YYYY. For example, if you were born on April 15, 1956, you would enter 04-15-1956.

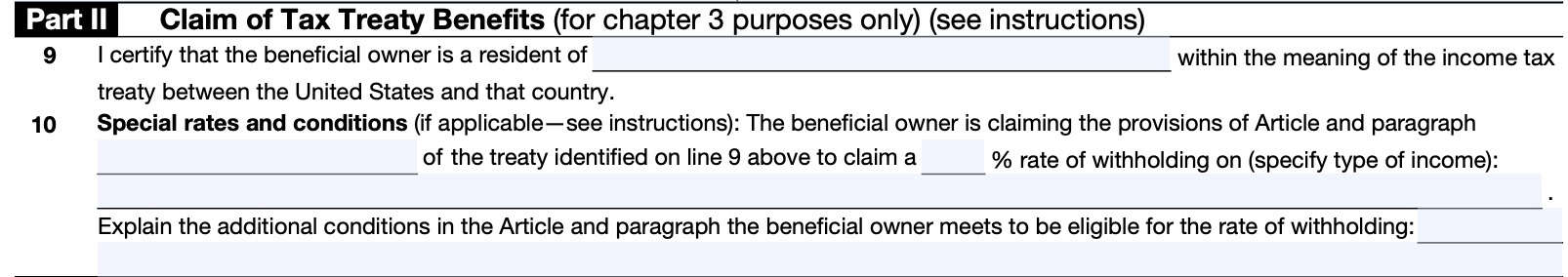

Part II: Claim of Tax Treaty Benefits

In Part II, you will certify your claim of tax treaty benefits, as applicable.

Line 9

In Line 9, identify the foreign country where you are a resident for income tax treaty purposes.

Line 10: Special rates and conditions

Only use Line 10 if you are claiming treaty benefits that require that you meet conditions not covered by the representations you make on Line 9 and Part III. This line is generally not applicable to treaty

benefits under an interest or dividends (other than dividends subject to a preferential rate based on ownership) article of a treaty.

Examples of special rates and conditions

Examples of when you must complete Line 10 include:

- Persons claiming treaty benefits on royalties must complete this line if the treaty contains different withholding rates for different types of royalties,

- Foreign students and researchers claiming treaty benefits must complete this line.

- Persons claiming treaty benefits on business profits or gains that are not attributable to a permanent establishment must complete this line.

- Persons claiming treaty benefits pursuant to a remittance provision under a treaty must complete this line.

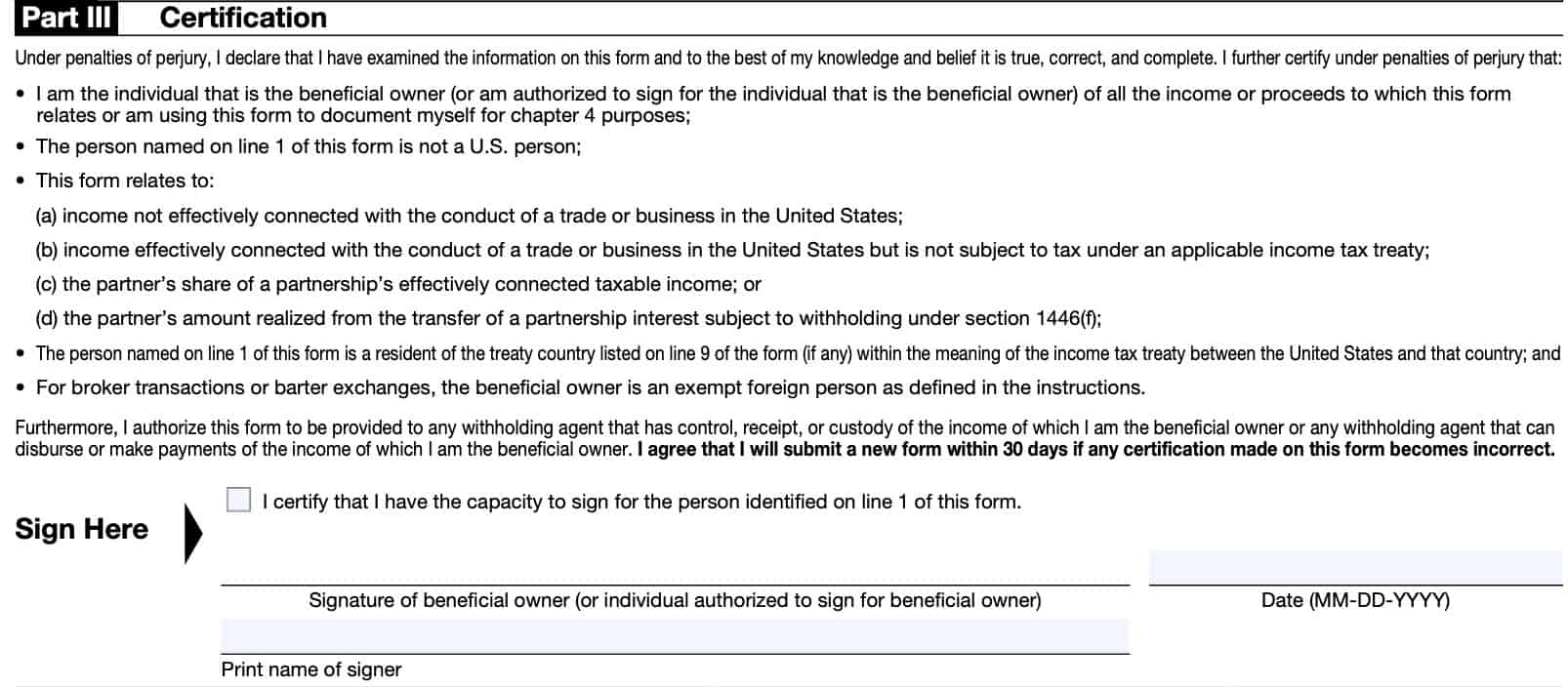

Part III: Certification

In Part III, you will certify, under penalty of perjury, that the information submitted on this IRS form is complete, true, and correct to the best of your knowledge.

This includes the following declarations:

- You are the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form relates or am using this form to document myself for chapter 4 purposes;

- The person named on Line 1 of this form is not a U.S. person;

- This form relates to:

- Income not effectively connected with the conduct of a trade or business in the United States;

- Income effectively connected with the conduct of a trade or business in the United States but is not subject to tax under an applicable income tax treaty;

- The partner’s share of a partnership’s effectively connected taxable income; or

- The partner’s amount realized from the transfer of a partnership interest subject to withholding under section 1446(f);

- The person named on Line 1 of this form is a resident of the treaty country listed on Line 9 of the form (if any) within the meaning of the income tax treaty between the United States and that country; and

- For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions

Additional certifications

Also, you are authorizing this form to be provided to any withholding agent that has control, receipt, or custody of the income of which you are the beneficial owner or any withholding agent that can disburse or make payments of the income of which you are the beneficial owner.

You agree that you will submit a new form within 30 days if any certification made on this form becomes incorrect.

Filing considerations

There are some things to consider before filing IRS Form W-8BEN.

When NOT to file IRS Form W-8BEN

There may be circumstances when another tax form is more appropriate. Here is a partial list, which you can find on Page 1.

| Situation | Use this form instead |

| You are not an individual | IRS Form W-8BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities) |

| You are a U.S. citizen or other US person (including a resident alien) | IRS Form W-9, Request for Taxpayer Identification Number and Certification |

| You are a beneficial owner claiming that income is effectively connected with the conduct of trade or business within the United States (other than personal services) | IRS Form W-8ECI |

| You are a beneficial owner who is receiving compensation for personal services performed in the United States | IRS Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, or IRS Form W-4, Employee’s Withholding Certificate |

| You are a person acting as an intermediary | IRS Form W-8IMY, Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting |

Video walkthrough

Frequently asked questions

IRS Form W-8BEN is the tax withholding form that you would provide to a withholding agent or payer to establish yourself as a foreign individual for tax withholding and reporting purposes.

You do not need to provide IRS Form W-8BEN to the Internal Revenue Service. When requested, provide a copy of this certificate to the withholding agent or payer.