Form SSA 10 Instructions

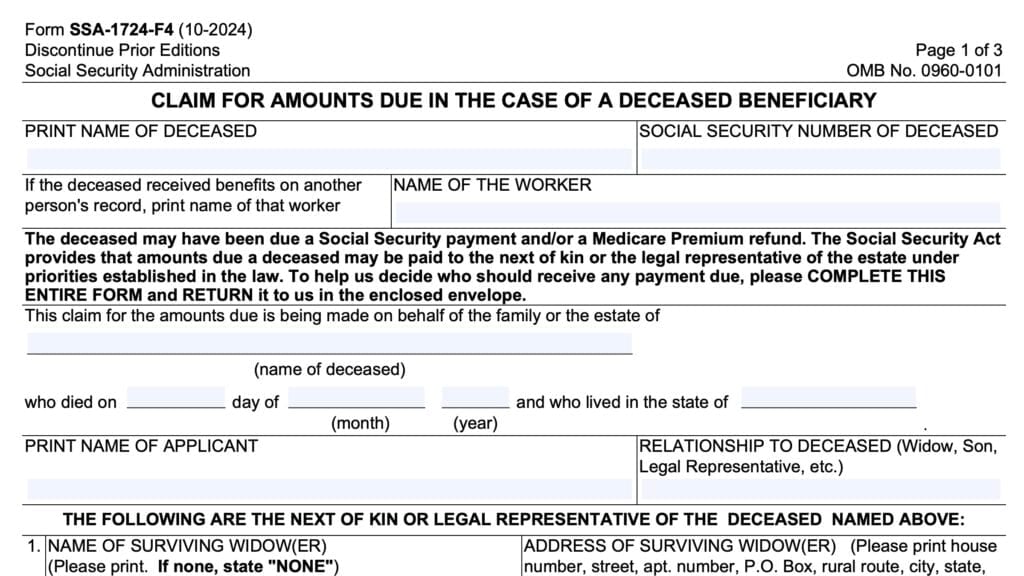

If you are the surviving spouse of a Social Security recipient, you may be eligible for survivor benefits based upon your deceased spouse’s earnings history. To claim spousal benefits, you’ll need to file Form SSA-10, Application for Widow’s or Widower’s Insurance Benefits.

In this article, we’ll walk through each step of this Social Security form and address some frequently asked questions. Let’s start with instructions on completing Form SSA-10.

Table of contents

How do I complete Form SSA 10?

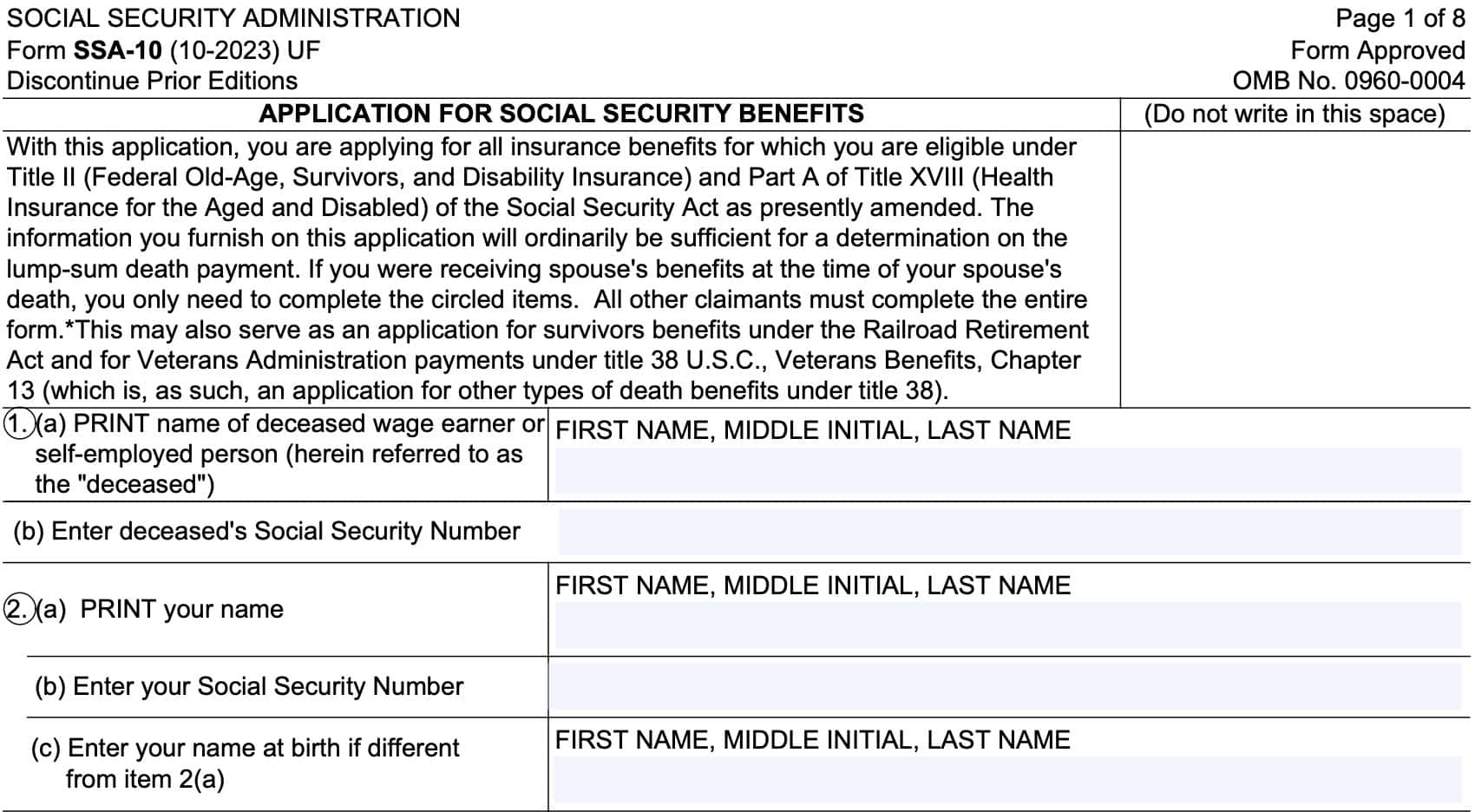

At the top of Form SSA-10, there are a couple of things you should know before going through the application.

First, if you were receiving spousal benefits at the time of your spouse’s passing, then you only need to complete the items that are circled. All other applicants must complete the entire application.

To summarize, the required fields for a surviving spouse receiving benefits includes the following:

- Line 1: Decedent information

- Line 2: Applicant’s information

- Line 4: Date and place of death

- Line 5: State or country where the deceased lived at time of death

- Line 6

- Line 8

- Line 11

- Line 14: Marriage information

- Line 15: Surviving divorced spouse information

- Line 21: Last year’s earnings

- Line 22: This year’s expected earnings

- Line 23: Next year’s expected earnings

- Line 24: Fiscal year

- Line 25: When you want to start receiving benefits

Second, if you have not yet reached full retirement age (FRA) and apply for survivors benefits, you may be subject to an earnings test. Before continuing your application, you may want to read How Work Affects Your Benefits, published by the Social Security Administration.

Finally, the Social Security Administration will calculate the amount of your benefits based upon all insurance benefits for which you are eligible. Although you may be applying for benefits based upon your deceased spouse’s history, you may be entitled to higher benefits if you have your own work history or if you qualify for benefits based upon another marriage.

Let’s get started.

Line 1: Decedent’s information

In Line 1a, print the name of the deceased wage earner. This should be as follows:

- First name

- Middle initial

- Last name

For Line 1b, check the appropriate box regarding whether the decedent is a male or female.

In Line 1c, enter the deceased’s Social Security number (SSN).

Line 2: Applicant’s information

In Line 2a, print your name: first name, middle initial, last name.

For Line 2b, enter your SSN.

In Line 2c, enter your name as it appears on your birth certificate, if this name is different from the one listed in Line 2a. This commonly happens to married spouses who may have a different maiden name.

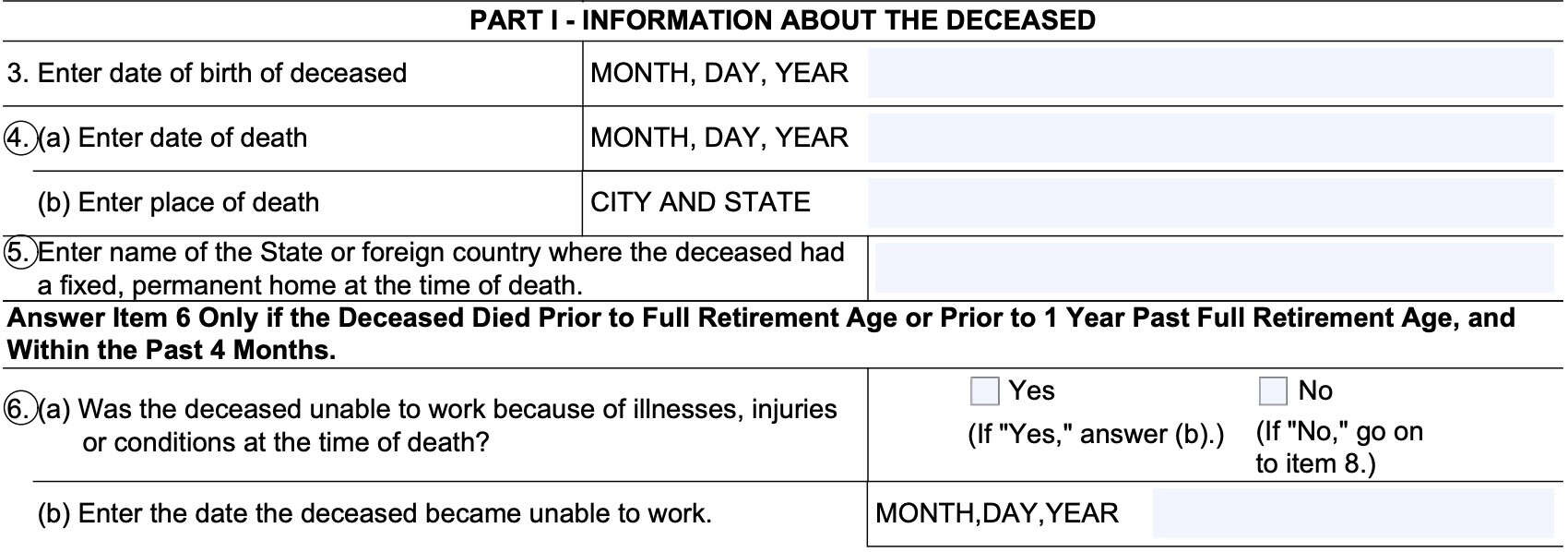

Line 3: Decedent’s date of birth

Enter the deceased person’s date of birth in Line 3.

Line 4: Date and place of death

In Line 4a, enter the date that the decedent passed away. For Line 4b, enter the city and state where he or she died.

Line 5: State of residence

If applicable, enter the name of the state or foreign country where the deceased person had a permanent home at the time of death.

Line 6: Did the decedent have a disability?

Do not answer Line 7 unless:

- The deceased died before reaching full retirement age (FRA), OR

- Prior to 1 year beyond FRA, AND within the past 4 months

In Line 6a, check ‘Yes’ if the decedent was unable to work because of illness, injury, or other health conditions at the time of his or her death. In Line 6b, enter the date that the decedent became unable to work.

Otherwise, check ‘No’ in Line 6a, and go to Line 7.

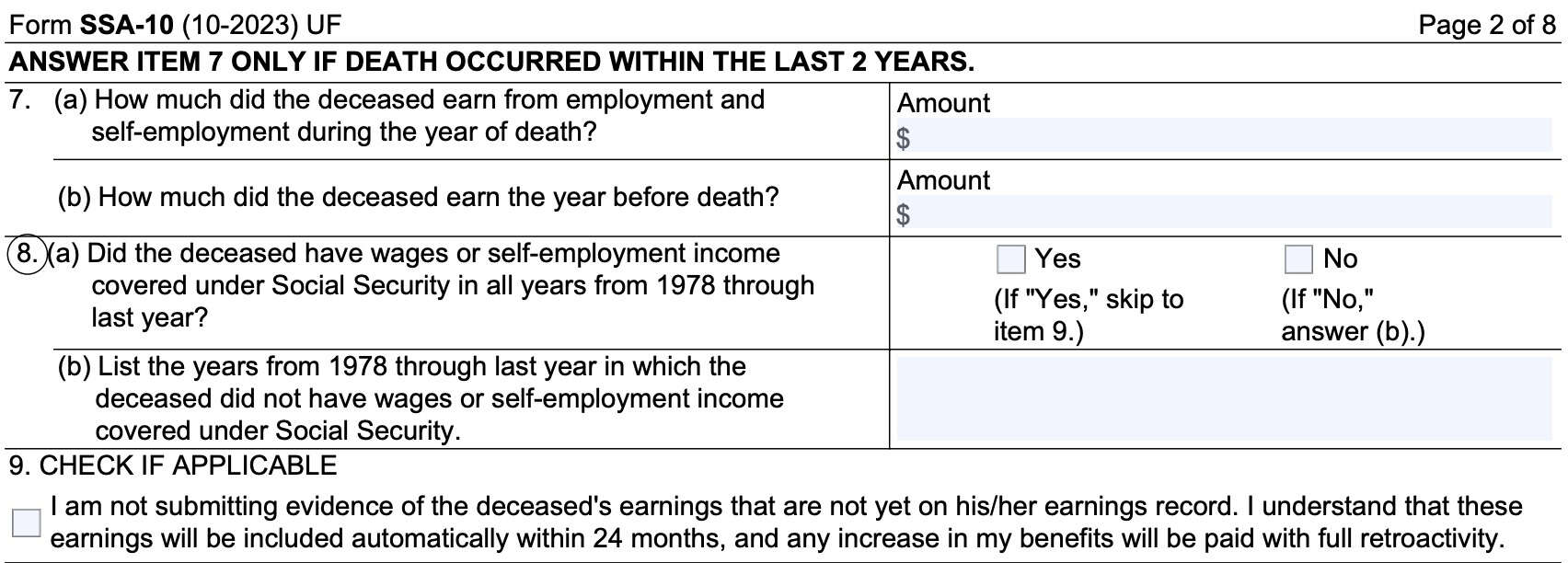

Line 7: Decedent’s earnings

Do not answer Line 7 if the decedent passed away more than 2 years ago.

For Line 7a, enter the approximate amount that the decedent earned in the year of his or her death. This includes both employment earnings and any self-employment income the decedent may have had.

In Line 7b, enter the approximate earnings amount for the year before the decedent’s death.

Line 8: Wages or self-employment income

In Line 8a, check ‘Yes’ if the deceased had wages or self-employment income that were covered under Social Security for all tax years between 1978 and last year. Then skip to Line 9, below.

Otherwise, check ‘No’ and list the years in which the deceased did not have wages or self-employment income in Line 8b.

Line 9

If you do not plan to submit documentation or other evidence regarding the decedent’s earnings for the past 2 years, check the box. If you do plan to include substantiating documentation, skip to Line 10, below.

Whether you submit any documentation, the SSA will evaluate Social Security benefits as the decedent’s earnings record continues to be updated. Normally, this is as a result of federal income tax return information that eventually is reported to the SSA.

As the earnings record is updated, you can expect to receive any benefits increase automatically, without additional paperwork. The SSA will apply any increase in your benefits retroactively.

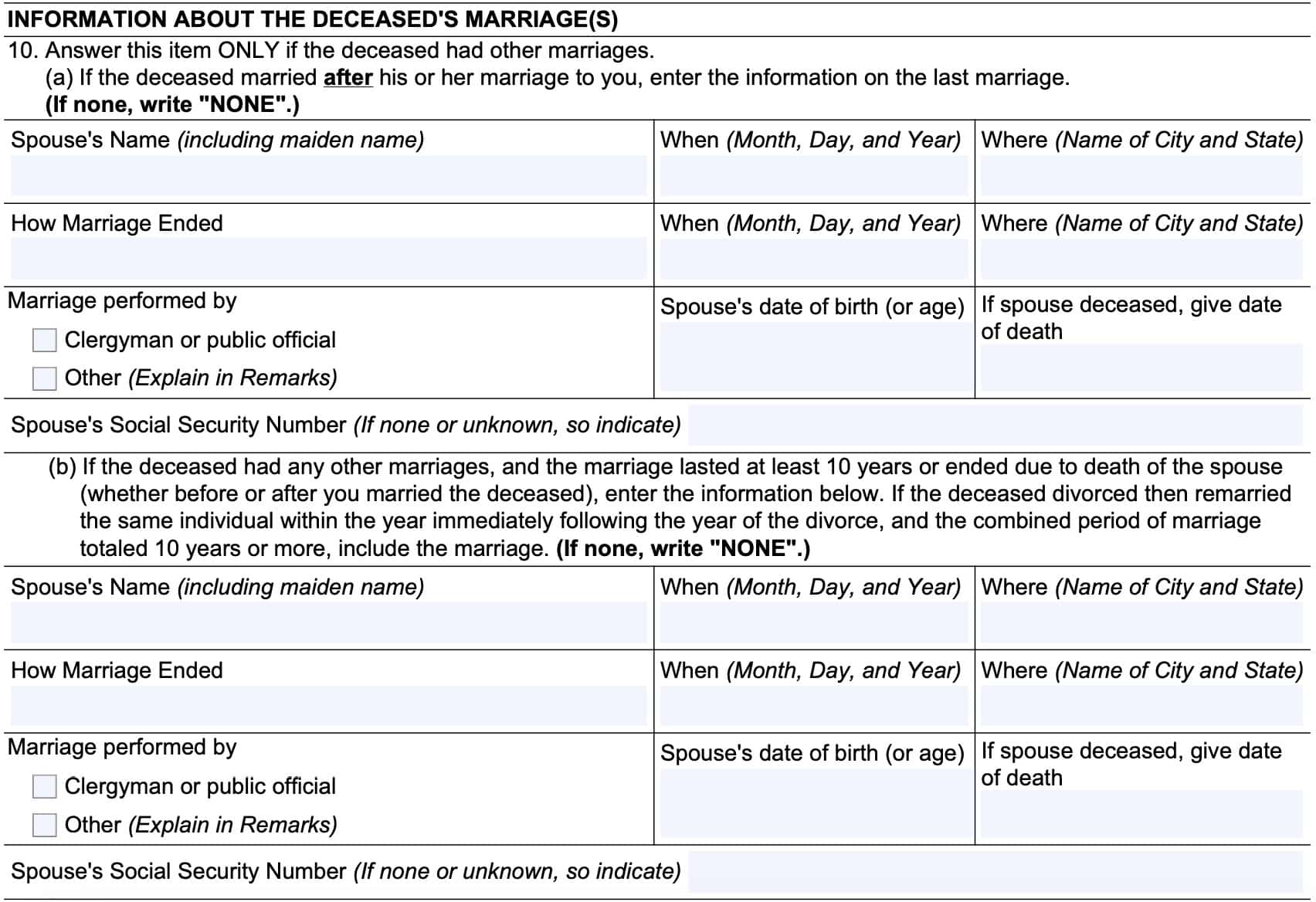

Line 10: Deceased’s Marriage

Only answer Line 10 if the decedent had other marriages, either prior to or after his marriage to you.

If the decedent remarried after the marriage between you ended, enter the information on the most recent marriage here.

If there are no other marriages, proceed to Line 11.

In Line 10a, include:

- Spouse’s name (including spouse’s maiden name)

- Date and location of marriage date

- How, when, and where the marriage ended

- Whether the marriage ceremony was performed by a clergyman, public official, or other person

- If someone other than a clergyman or public official conducted the marriage, provide a written explanation in the remarks section.

- Spouse’s Social Security number, if known

- If not known or there is no SSN, indicate this as well

For Line 10b, enter information about any other marriages that meet the following criteria:

- Marriage lasted 10 years or longer

- Marriage ended in divorce, but the decedent remarried the same person within the year immediately following the year of divorce, and the combined marriage periods exceeded 10 years

- Marriage ended in the death of the spouse, regardless of how long it lasted

For third and subsequent marriages, use the remarks section to provide additional information.

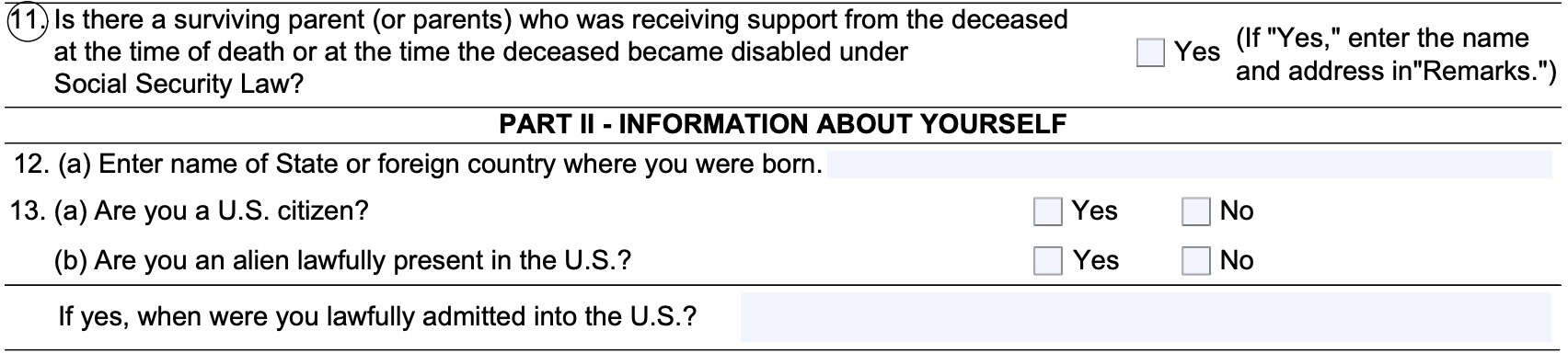

Line 11: Surviving parent information

Check ‘Yes’ if there is one or more surviving parents who were receiving support from the decedent at the time of death or disability as defined by the Social Security Act. Enter the name and address of surviving parents in the remarks section.

Otherwise, proceed to Line 12.

Line 12: Applicant’s information

In Line 12a, enter the name of the state or foreign country where you were born.

Line 13

For Line 13a, check Yes or No, depending on whether you are a United States citizen.

In Line 13b, check Yes or No, depending on whether you are an alien who is lawfully present in the United States. If you are, enter the date of your lawful admission in the space provided.

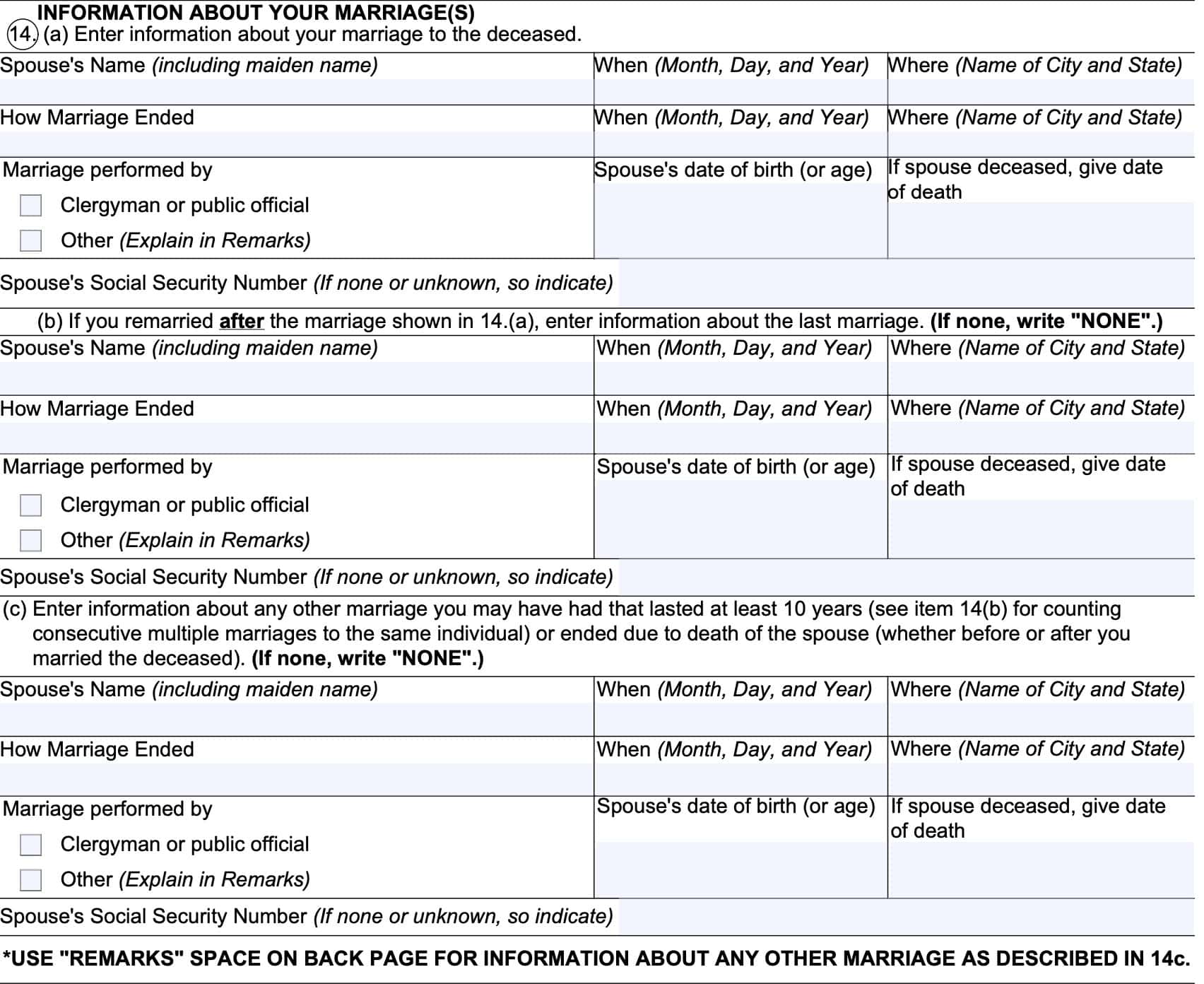

Line 14: Information about your marriage

In Line 14a, enter information about your marriage to the decedent. Similar to Line 12, this should include:

- Spouse’s name (including spouse’s maiden name)

- Date and location of marriage date

- How, when, and where the marriage ended

- Whether the marriage ceremony was performed by a clergyman, public official, or other person

- If someone other than a clergyman or public official conducted the marriage, provide a written explanation in the remarks section.

- Spouse’s Social Security number, if known

- If not known or there is no SSN, indicate this as well

If you remarried after your marriage to the decedent, complete Line 14b to include information about the last marriage. If not applicable, simply write ‘None.’

In Line 14c, enter any information about other marriages (before or after your marriage to the decedent) that meets the following guidelines:

- Marriage lasted 10 years or longer

- Marriage ended in divorce, but the decedent remarried the same person within the year immediately following the year of divorce, and the combined marriage periods exceeded 10 years

- Marriage ended in the death of the spouse, regardless of how long it lasted

If you need more space for additional marriage information, go to the remarks section.

Line 15

If you’re applying for survivor benefits based upon a divorced spouse’s work history, skip Line 15 and proceed directly to Line 16, below.

In Line 15a, if you and the deceased were living together at the time of the decedent’s death, select Yes and go onto Line 16. If No, then go to Line 15b.

In Line 15b, check the appropriate box if either you or the deceased were away from home at the time of death. If one of you was away from home (either temporarily or not), then complete the following information:

- Date last at home

- Reason absence began

- Reason you were apart at time of death

- If separated because of illness, enter the nature of the illness or disabling condition

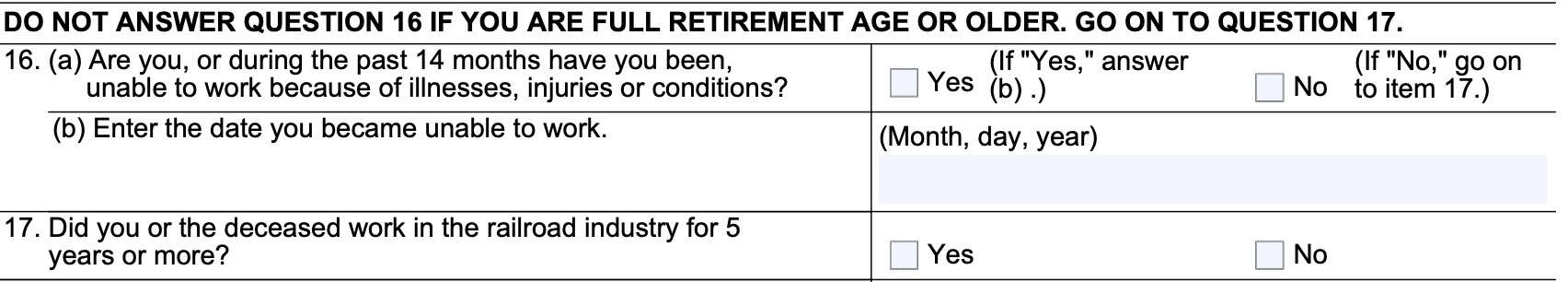

If you are full retirement age or older, you can skip Line 16 and proceed to Line 17. Otherwise, go to Line 16.

Line 16: Disability history

Do not answer Line 16 if you have already reached full retirement age (FRA). Simply go to Line 17, below.

If you have not reached FRA, and you’ve been unable to work within the past 14 months due to an illness, injury, or other medical condition, check ‘Yes.’ Otherwise, check ‘No’ and proceed to Line 17.

In Line 16b, enter the date that you became unable to work.

Line 17: Railroad industry history

If either you or the decedent worked in the railroad industry for at least 5 years, check ‘Yes.’ Otherwise, check ‘No.’

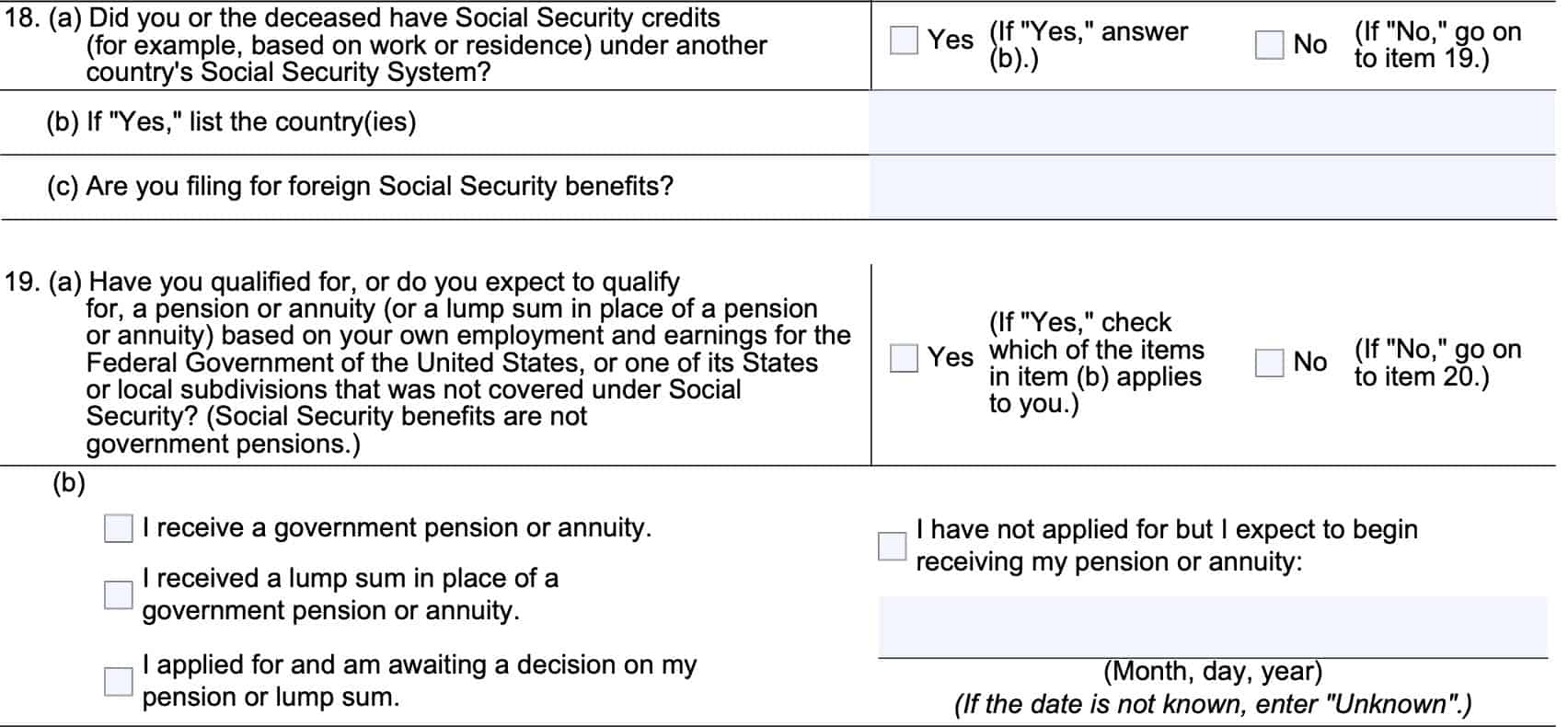

Line 18: Other country social security system

In Line 18a, if you or the deceased have Social Security credits under another country’s Social Security system, check Yes. Otherwise, select No and go to Line 19.

If Yes, then list the country or countries in Line 18b.

In Line 18c, indicate whether you are filing for foreign Social Security benefits.

Line 19: Pension information

Do any of the following apply to your situation:

- You have qualified for, or expect to qualify for a pension or annuity

- Based on your own employment and earnings

- For the federal government or a state or local government

- Not covered under Social Security

If the answer is yes, then select Yes and go to Line 19b. Otherwise, select No and go to Line 20.

In Line 19b, check the appropriate box regarding your pension or annuity:

- I receive a government pension or annuity

- I received a lump sum in place of a government pension or annuity

- I applied for and am awaiting a decision on my pension or lump-sum benefit

- I have not applied for but expect to begin receiving my pension or annuity

If you have not yet applied for your pension benefits, enter the approximate date that you expect to start receiving benefits. If that date is unknown, enter ‘Unknown.’

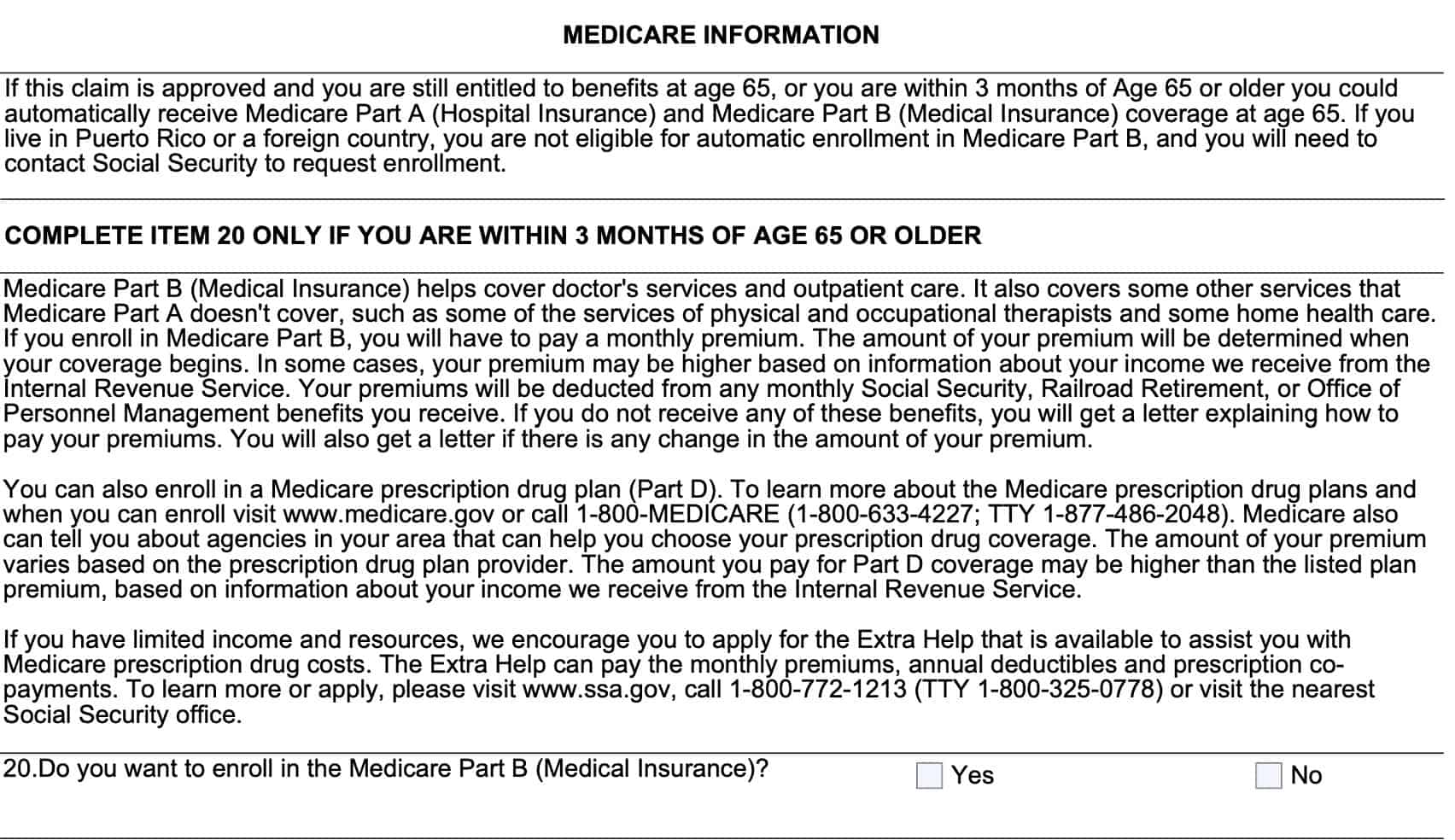

Line 20: Medicare information

In Line 20, check the appropriate box, depending on whether you want to use this application form to apply for Medicare insurance.

However, skip this box if you are younger than age 65, and you do not expect to turn 65 within the next three months.

About Medicare

If you are eligible for Medicare and have not already applied for Medicare benefits, you may want to discuss this further with your local SSA office. Generally, additional fees may apply to your Medicare premium as a late enrollment penalty for Medicare recipients who do not apply when eligible.

This higher premium is a permanent increase to your Medicare costs.

Additionally, there is an initial enrollment period for people turning age 65. This window includes the following

- Three month period prior to turning age 65

- The month the applicant turns age 65

- Three month period after turning 65

Late applicants who miss the deadline may have to wait until the next Medicare enrollment period. This is usually between January 1 and March 31 of each calendar year.

There may be certain exceptions for people who are still working and participating in a group health plan. This exception extends to health benefits for a spouse covered under the health care plan. After those individuals stop working, there is a special enrollment period window for application. The special enrollment period is 7 months.

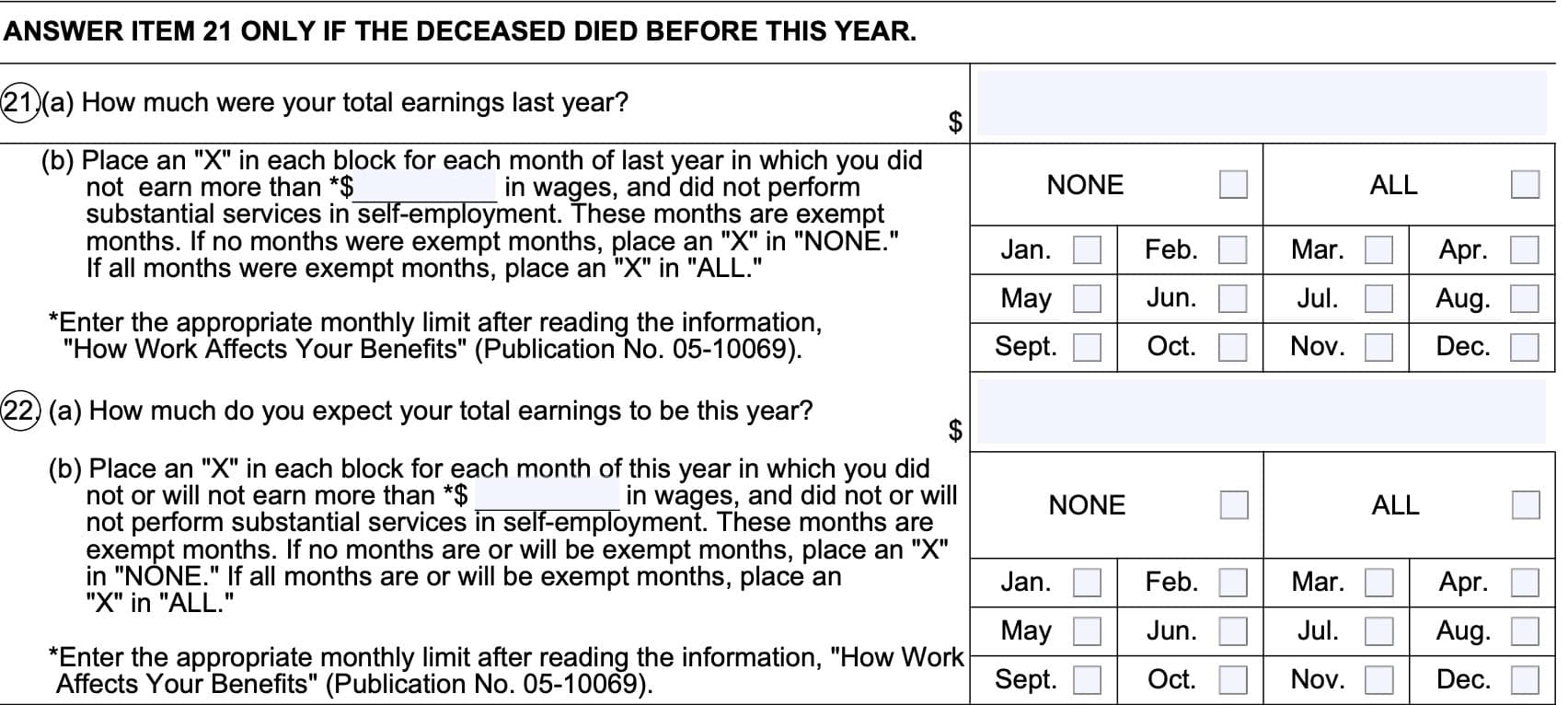

Line 21: prior year earnings information

Lines 21 through 23 mostly impact recipients who may be younger than full retirement age, and could be subject to an earnings test.

Only answer Line 21 if the decedent passed away before the beginning of this year.

In Line 21a, enter how much your total earnings were from last year. This should not be the number from your income tax return. This should be the total of your employment earnings, either as an employee or as a self-employed individual. You should be able to find evidence of your earnings from wage statements, tax records, or paystubs.

In Line 21b, you’ll need to determine the monthly exemption for earnings. This is based upon whether you’ve reached full retirement age (or will reach full retirement age this year).

If you are younger than FRA

In 2025, the annual earnings limit for people younger than FRA is $23,400. This translates to a monthly limit of $1,950.

If there were any months in which you earned less than $1,950, then check the appropriate box(es). If there were no months where you earned less than $1,950, check the ‘None’ box. If you earned less than $1,770 in all months during the tax year, then check the ‘All’ box.

If you have reached FRA or will reach FRA this year

In 2025, the annual earnings limit for people who have reached FRA is $62,160. This translates to a monthly limit of $5,180.

If there were any months in which you earned less than $5,180, then check the appropriate box(es). If there were no months where you earned less than $5,180, check the ‘None’ box. If you earned less than $5,180 in all months during the tax year, then check the ‘All’ box.

Line 22: Current year earnings information

In Line 22a, enter your expected earnings for the current tax year.

For Line 22b, follow the same steps that you did in Line 21b.

Line 23: Next year’s earnings

Do not answer Line 23 if you are completing this application between January and August of any calendar year.

If you’re completing this application in September, October, November, or December, then enter your projected earnings for next year in Line 23a. Then follow the steps in Line 23b as you did for Lines 21b and 22b.

Line 24: Fiscal year

If your fiscal year is the same as your calendar year, leave this field blank and go to Line 25. Otherwise, enter the month in which your fiscal year ends.

If you are not sure, but your income tax return is normally on or around April 15, then you can leave this field blank.

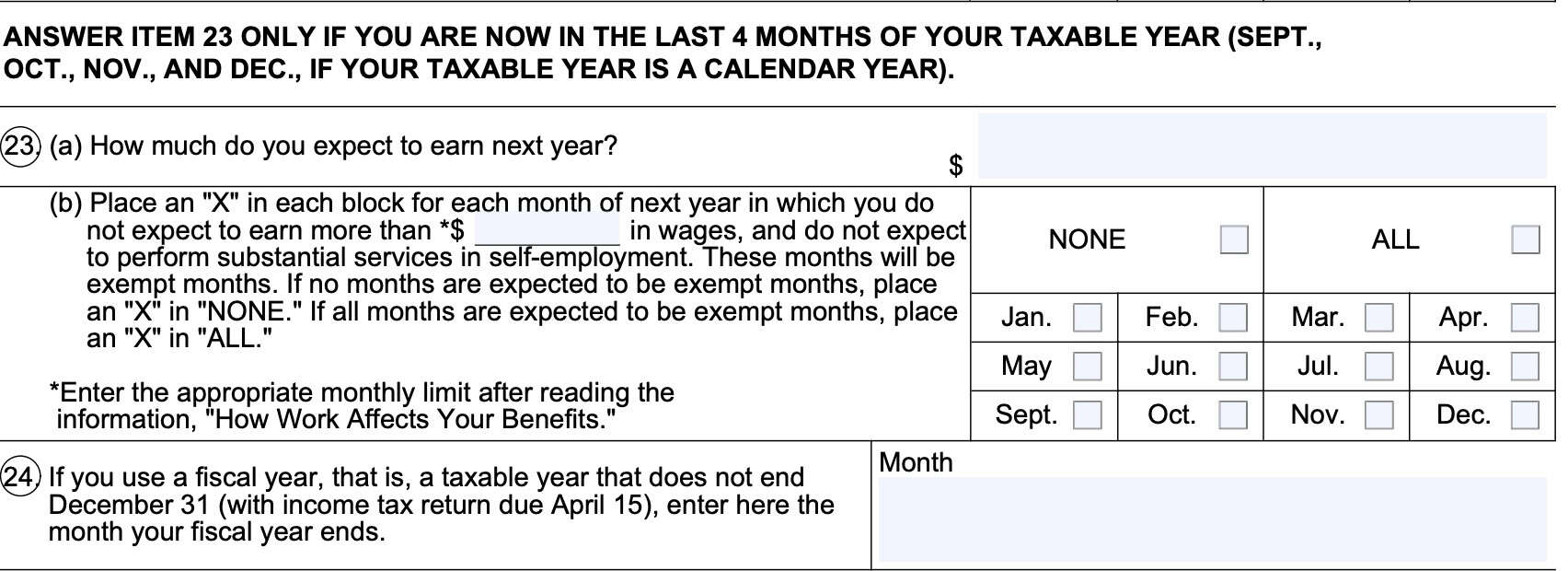

Line 25

If you have already reached FRA, you can skip to Line 26, below. Otherwise, check the box that indicated your preference:

- You’d like to receive your survivor benefits as soon as possible

- You want to maximize your benefits, even if you need to wait an extra month or two

- You have a specific date in mind

If you do not wait until reaching FRA for your benefits, your monthly benefits may be lower than expected. Please consider this carefully before making your decision.

Line 26

Do not answer Line 26 if you are younger than age 62 and do not expect to turn 62 within the next 4 months.

If you wish to apply for retirement benefits based upon your earnings record, check Yes. Otherwise, select No.

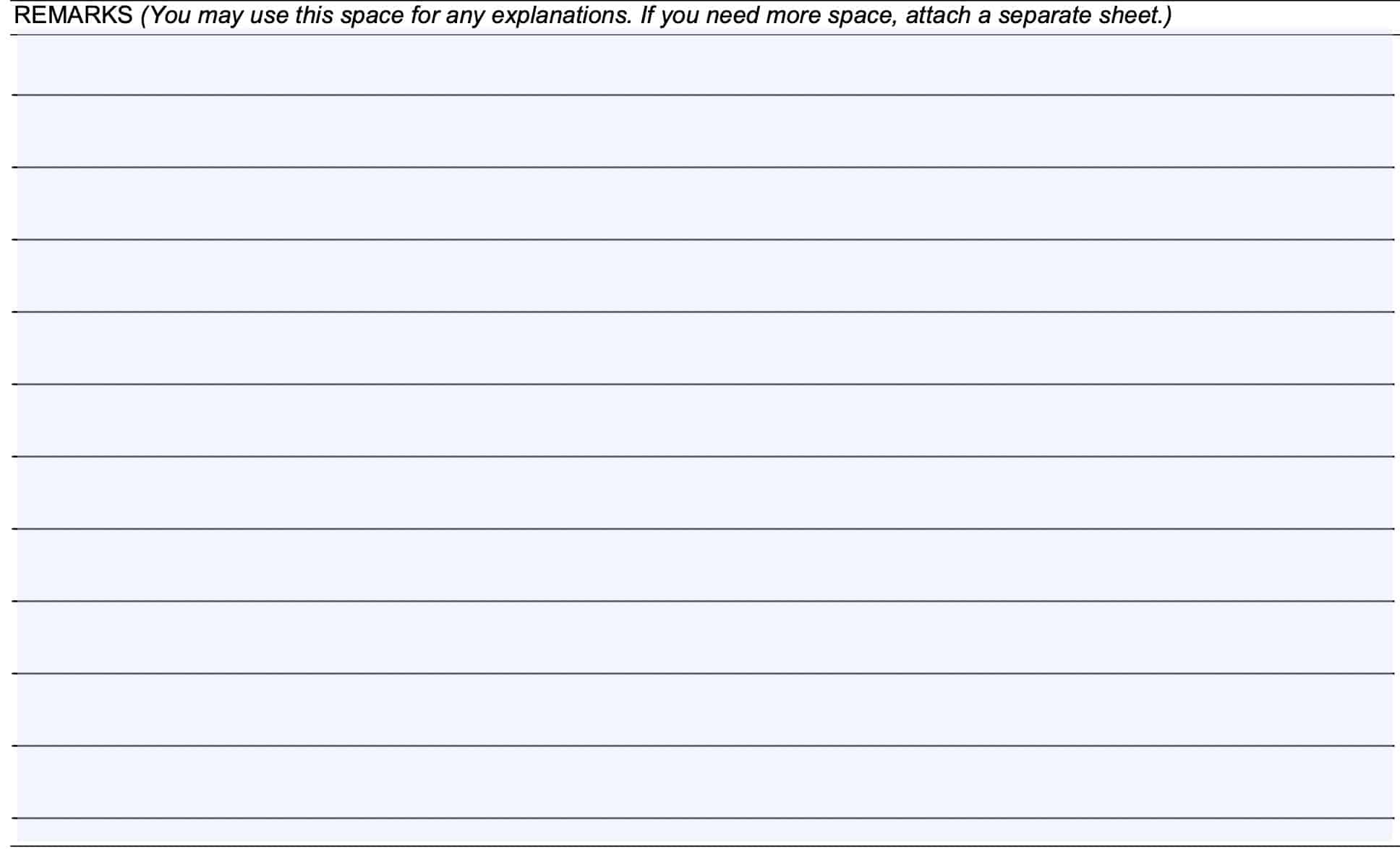

Remarks

The remarks section may. be used to provide a written explanation or additional information for any field where you did not have enough room in the space provided.

As a suggestion, for each explanation, write the line number next to the verbiage. Attach additional sheets as needed.

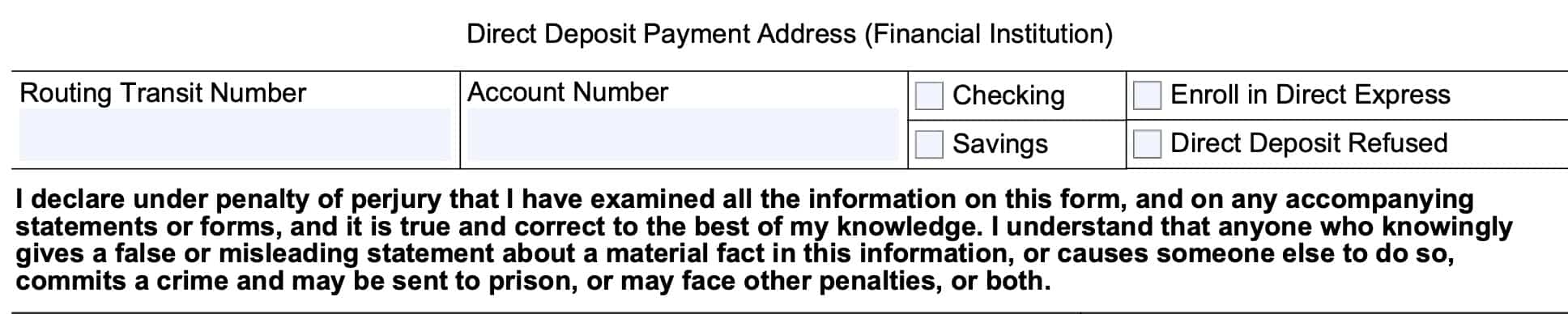

Direct deposit information

In this section, you’ll enter the account information for the financial institution where you would like to receive your Social Security benefits. Include the following information:

- Routing Transit Number

- This is the 9-digit number on the bottom, left hand side of any checks you may have

- Each financial institution has a unique routing transit number

- Account Number

- This is unique to your checking or savings account

- Check whether your account is a checking or savings account

- Check whether you’re enrolling in Direct Express or if your direct deposit request has previously been refused

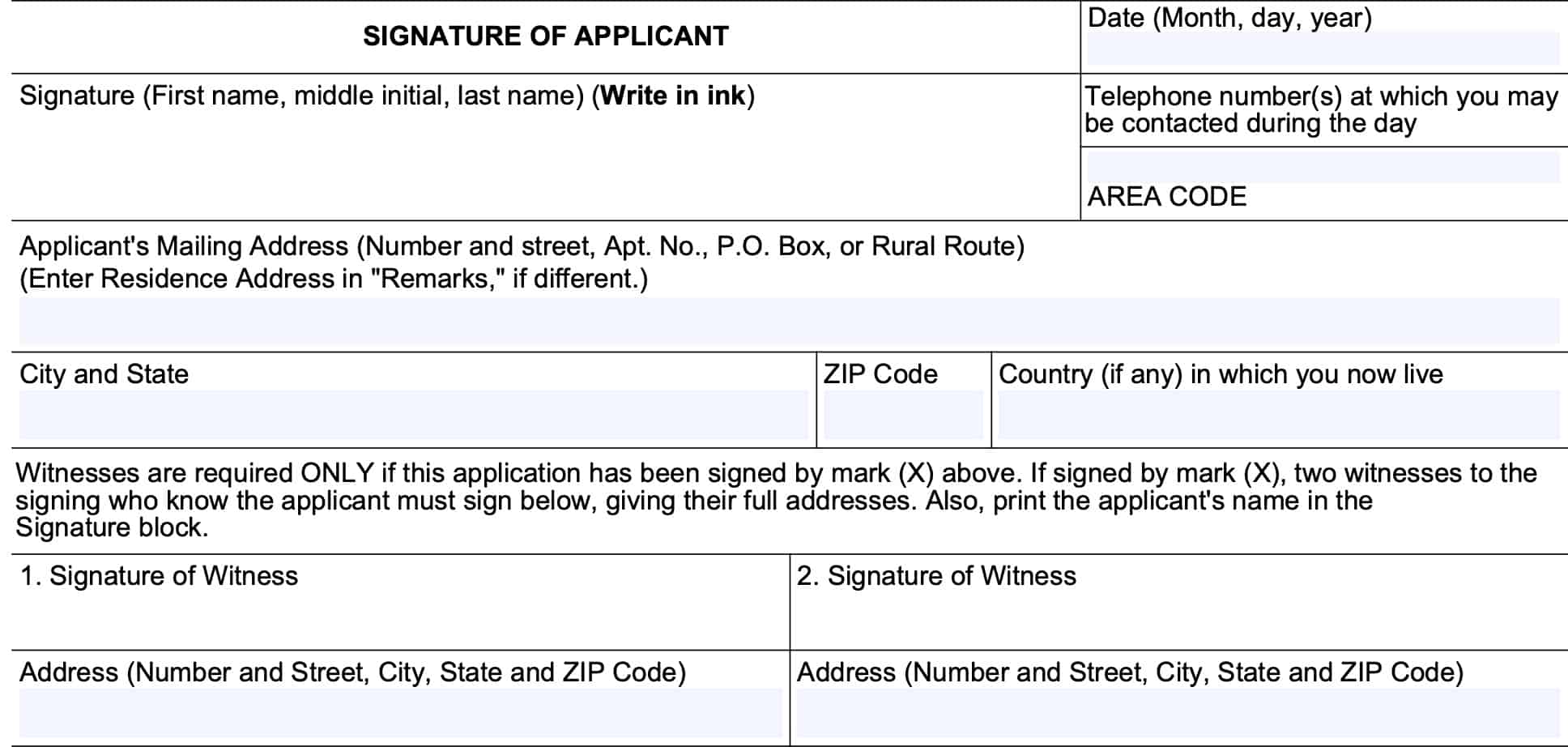

Applicant signature

In this field, you’ll sign your name in ink, then enter the application date and a contact telephone number. This number should be where an SSA employee can call you during the day to answer any questions.

Below this, enter your mailing address, to include:

- Street address or P.O. Box number

- City & state

- Zip code

- Country (if residing outside the United States)

You do not need to have witnesses unless you sign ‘X’ as the applicant. In that case, you will need two witness signatures and addresses from people who personally know you and can verify your identity.

Claim receipt

When you file your Form SSA-10, you should receive a receipt from the SSA office. This claim receipt will contain the following information:

- Contact information to call before you receive a notice of award

- Contact information to call after you receive a notice of award

- SSA office handling your claim

- Date of receipt

- Approximate number of days the SSA should take before giving you a response

Video walkthrough

Watch this instructional video to learn more about using Form SSA 10 to apply for widow’s or widower’s benefits.

Frequently asked questions

You may file for spousal benefits over the phone by calling the SSA’s toll-free number: 800-772-1213. To protect sensitive information, you may need to file Form SSA 10 in person at your local Social Security office.

Survivor benefits will continue to be paid until the recipient dies or becomes eligible for a larger benefit based upon either their own earnings record, or the earnings record of another spouse.

Eligible spouses may be eligible to receive survivor benefits as early as age 60. However if you delay filing Form SSA 10, you may be eligible for larger monthly benefits when you do file. Delayed benefits increase until full retirement age. Spouses who wait until FRA to claim survivor benefits will receive a larger monthly payment than if they filed at their first opportunity.

Direct Express is a program that enables Social Security recipients to receive benefits without having a bank account. Social Security payments are loaded onto a Direct Express MasterCard instead of deposited into an account. Recipients may use their card to make purchases, pay bills, or withdraw cash from an ATM.

Where can I find Form SSA-10?

As with many other SSA forms, you may find a copy of this form on the SSA website. For your convenience, we’ve attached the latest version to this article.

Very helpful video. Question: You stated ‘Survivor benefits will continue to be paid until the recipient dies or becomes eligible for a larger benefit based upon either their own earnings record’.

What if I want to wait until 70 to take my retirement? Can’t I stay with my Survivor benefit until then? How can I make sure SSA doesn’t switch me over to my own retirement before 70?

If you’ve applied for survivor benefits and you have not already started receiving retirement benefits based upon your own record, then you will remain on survivor benefits until you file to receive benefits on your own earnings record. You absolutely can do this, and you’ll likely be better off in the long run, since you’re allowing your own retirement benefits to continue growing.

The SSA will not automatically give you retirement benefits (even after you’ve turned age 70 and happen to forget to file for them), so you’ll need to apply at age 70 (or shortly beforehand, to make sure the paperwork is processed in time).

extremely helpful video. Queston: Does SSA provide the Direct Express MasterCard to me or do I need to obtain this card on my own? What information do I need to provide to obtain this card?

Thank you for your video and written information too!

According to the SSA, you can call the Treasury Electronic Payment Solution Contact Center at 1-877-874-6347 to obtain a Direct Express MasterCard. There is more background about this program in this SSA web page: https://www.ssa.gov/pubs/EN-05-10073.pdf

I’ve filled out my SSA-10, what is the next step? Do I mail it to Social Security or call someone to make an appointment to take it in? Or is there another option? This is very confusing for an old, non-computer person. I thank you for your wonderful video for assistance in filling out the form.

If I were in your position, I would schedule an appointment and bring your completed form with you. You may need to bring additional documents (see the link below with documentation requirements). During your appointment, you should get a receipt (see page 7 of the Form SSA 10), and you should get all of your documentation back (the SSA will make copies and give the originals to you). You also have the opportunity to ask any questions about your benefits that might come up.

I strongly suggest making an appointment to take care of this.

SSA-10 (10-2023) UF

WHERE CAN I FIND / DOWNLOAD THE FOEM SSA-10 (10-2023) UF

THANKS

Here’s the link to the most recent version on the SSA website: https://www.ssa.gov/forms/ssa-10.pdf