IRS Form 1099-LS Instructions

If you’ve recently sold your life insurance policy, you might receive a copy of IRS Form 1099-LS, Reportable Life Insurance Sale, after the end of the calendar year. In this article, we’ll go over IRS Form 1099-LS, including:

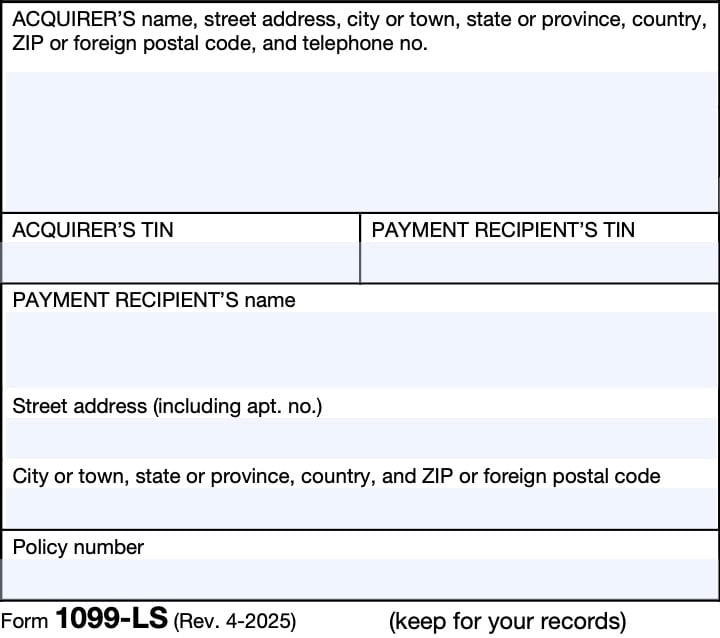

- What information you can expect to see on IRS Form 1099-LS

- Tax implications of reportable life insurance policy sales

- Frequently asked questions

Let’s begin by going over this tax form, step by step.

Contents

Table of contents

IRS Form 1099-LS Instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-LS form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 copies of Forms 1099-LS. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For the payment recipient

- Copy C: For the issuer

Taxpayer information

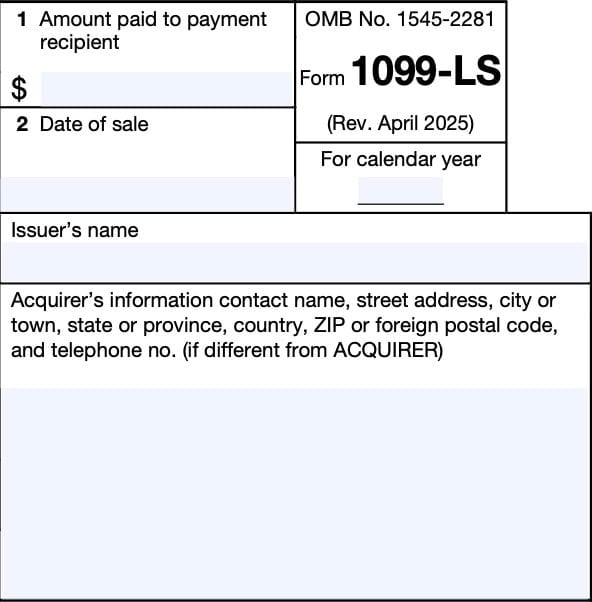

Let’s get into the form itself, starting with the information fields on the left side of the form.

Acquirer’s Name, Address, And Telephone Number

You should see the acquirer’s contact information, with complete business name, address, zip code, and telephone number in this field. The acquirer is the company that purchased or obtained the reportable life insurance contract.

Acquirer’s TIN

This is the acquirer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The acquirer’s TIN should never be truncated.

Payment Recipient’s TIN

As the recipient of IRS Form 1099-LS, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

Payment recipient’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the lender and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Policy Number

This should reflect the policy number of the life insurance policy involved. Now, let’s take a closer look at the right side of this tax form.

Right side of the Form 1099-LS

There are two reportable lines here.

Line 1: Amount paid to payment recipient

Line 1 should contain the amount of the reportable policy sale payment that was made to the payment recipient by the acquirer of a life insurance contract.

Line 2: Date of sale

Line 2 contains the date that the reportable life insurance sale occurred.

Issuer’s name

This line contains the name of the life insurance carrier that issued the insurance contract.

Acquirer’s information

In this section, you should see the following information about the acquirer of a life insurance contract:

- Contact name

- Street address

- City or town

- State or province

- Country

- ZIP code or foreign postal code

- Phone number

Filing considerations

While most taxpayers will not need to report their life insurance proceeds as taxable income on their federal income tax return, there are a few things worth exploring. However, you may need to include part of the sale of the life insurance policy as a capital gain on your tax return.

Let’s take a closer look.

Taxability of a reportable sale

IRS Form 1099-LS is not used to determine whether the sale of an insurance contract is includible in gross income. However, when a life insurance carrier receives a copy of IRS Form 1099-LS from the acquirer of one or more life insurance policies, then that carrier must issue IRS Form 1099-SB, Seller’s Investment in Life Insurance Contract to report the proceeds of a life settlement transaction.

IRS Form 1099-SB is what helps a taxpayer determine whether the life settlement transaction is a reportable sale for income tax purposes.

When is a life insurance sale considered taxable?

In 2018, the Tax Cuts and Jobs Act changed the taxation on the sale of life insurance settlements. As a general rule, life settlement proceeds above the cost basis are taxable in two tiers:

- Proceeds over and above the policy’s cash surrender value are taxed as long-term capital gains.

- Proceeds over the cost basis and up to the policy’s cash surrender value are taxed as ordinary income.

Example

Let’s imagine John Doe recently sold his whole life insurance policy for $90,000. His policy had the following values:

- $500,000 death benefit

- $30,000 premiums paid (cost basis)

- $50,000 cash value

Since his cost basis is $50,000, John is wondering how to report the profits ($60,000). In this hypothetical example, John would report the following:

- Long-term capital gains: $40,000

- Ordinary income: $20,000

Video walkthrough

Frequently asked questions

IRS Form 1099-LS, Reportable Life Insurance Sale, is the tax form that you might receive if you sold a life insurance policy in a life settlement transaction. Issuers should expect to receive IRS Form 1099-LS no later than January 15 after the tax year of the transaction. Policy holders should expect their Form 1099-LS by February 15, or the next business day.

Not necessarily. However, the issuer of a life insurance contract that you sold may be required to file IRS Form 1099-SB, Seller’s Investment in Life Insurance Contract. IRS Form 1099-SB will contain the required information to help you determine whether to report the proceeds as part of net income.

Where can I find IRS Form 1040-LS?

You can find the latest versions of IRS forms such as IRS Form 1099-LS on the Internal Revenue Service website. For your convenience, we’ve included the most recent version of this IRS form here as a PDF file.