IRS Form 14039 Instructions

If your personal information has been compromised or you notice suspicious activity in your financial accounts, you might be a potential victim of identity theft. If you’re the victim of identity theft, then this might impact your tax situation as well. Fortunately, victims of identity theft can report this on IRS Form 14039, Identity Theft Affidavit.

This IRS Form 14039 how-to guide will walk you through:

- How to complete and file IRS Form 14039

- What you need to know about tax identity theft

- How to use IRS Form 14039 to report questionable or unusual activity

- Ways that you can avoid becoming a victim of tax-related identity theft

Let’s start with step by step guidance on completing your identity theft affidavit.

Table of contents

How do I complete IRS Form 14039?

This two-page tax form is fairly straightforward. Form 14039 contains six sections:

- Section A: Type of Situation You are Reporting

- Section B: How I Am Impacted

- Section C: Name and Contact Information of Identity Theft Victim

- Section D: Tax Account Information

- Section E: Penalty of Perjury Statement and Signature

- Section F: Representative, Conservator, Parent or Guardian Information

We’ll cover each section, one at a time, starting with Section A.

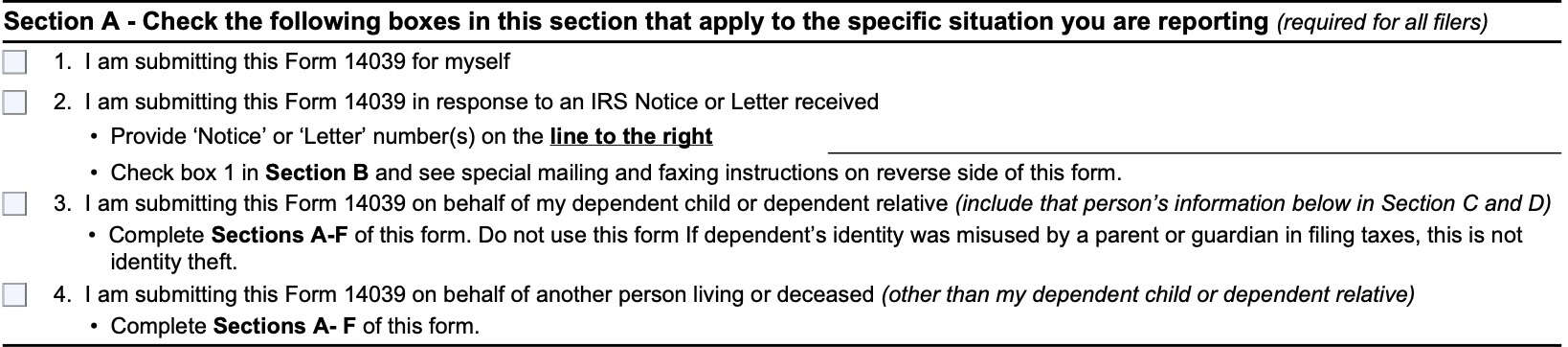

Section A: Type of situation you are reporting

Section A simply informs the IRS why you are submitting the identity theft affidavit. You can choose from the following options:

- You are filing on your own behalf

- You are filing in response to an IRS notice or letter

- If you select this box, you must provide the IRS notice or IRS letter number(s) on the provided line

- You should also check Box 1 in Section B and follow the special mailing or faxing instructions

- You are filing on behalf of a dependent

- Complete the entire form

- Do not use this form if the dependent’s identity was misused by a parent or relative filing an individual income tax return

- You are filing on behalf of another person who is not a dependent

- Can be living or deceased

- Complete the entire form

Check the box that pertains to your situation and move on to Section B.

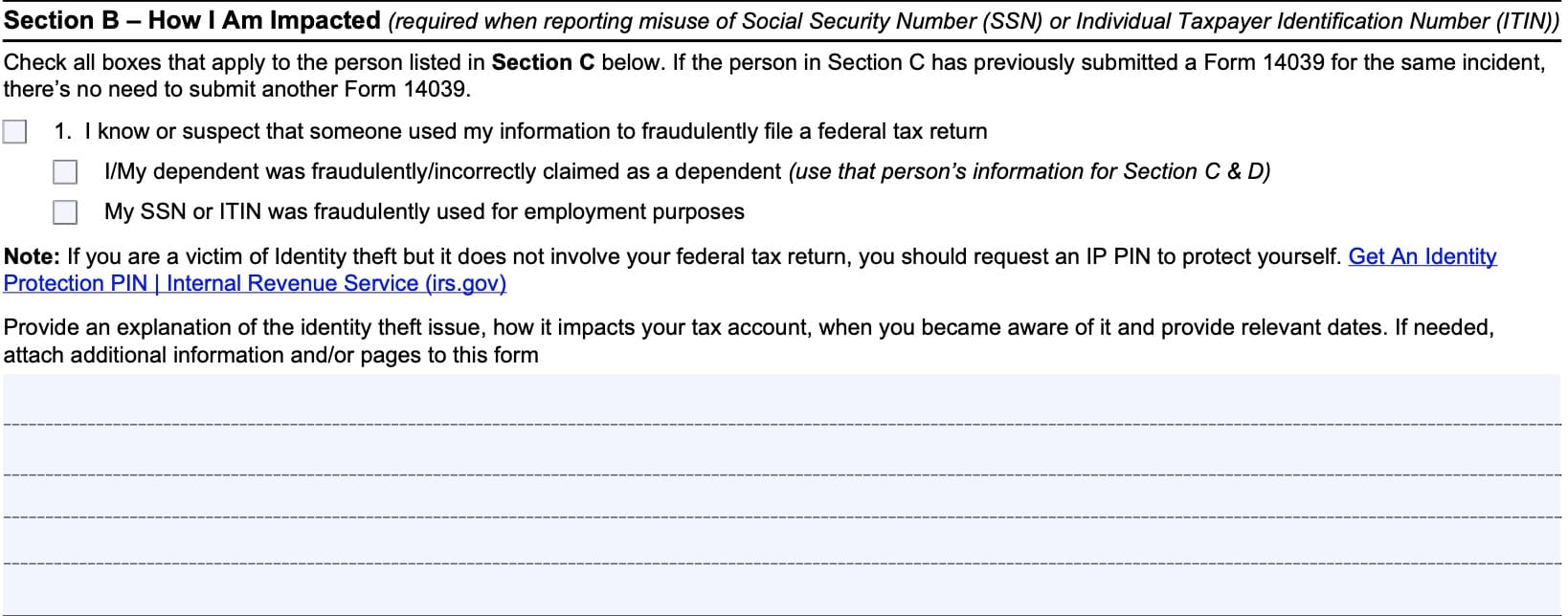

Section B: How you are impacted

Check all boxes that apply to the identity theft victim (see Section C, below).

- I know that someone used my information to fraudulently file a tax return

- Someone fraudulently claimed me or my dependent as their own dependent on a tax return

- Someone fraudulently used my SSN or individual taxpayer identification number (ITIN) for employment purposes

- I have been a victim of identity theft

Additionally, use the available space to provide a written explanation on this issue, to include:

- How this issue has impacted your tax account

- When you became aware of the issue (with relevant dates)

If required, attach additional pages to the form.

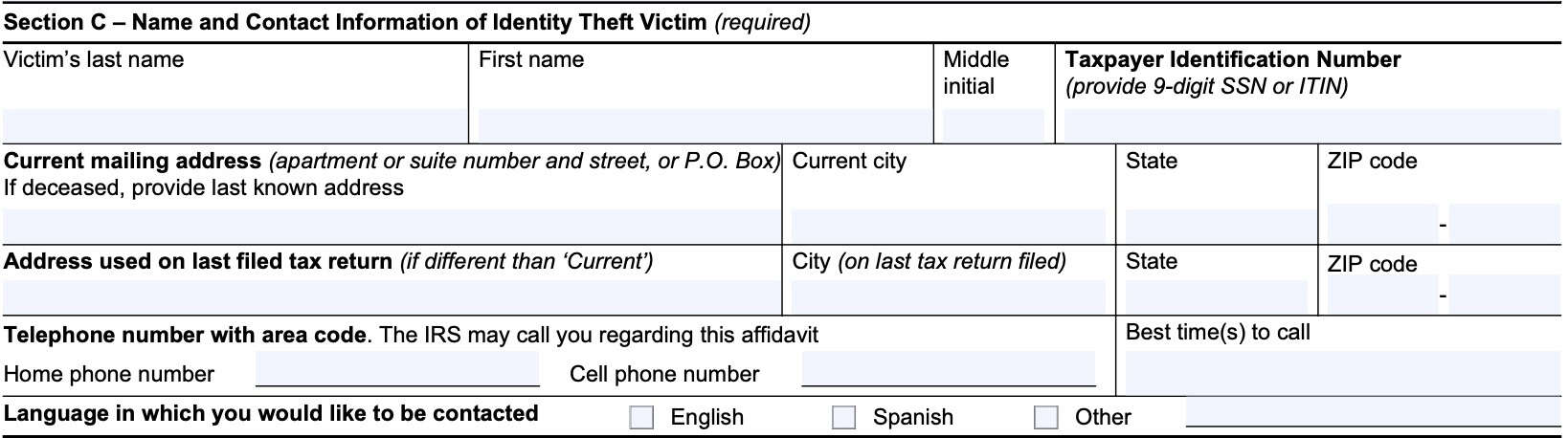

Section C: Contact information of the identity theft victim

In Section C, provide the victim’s full name and contact information. This should include:

- Victim’s name

- Social Security number or ITIN

- Mailing address, to include city, state, and zip code

- Address used on last tax return (if different from current mailing address)

- Telephone number and best time to call

- Preferred language

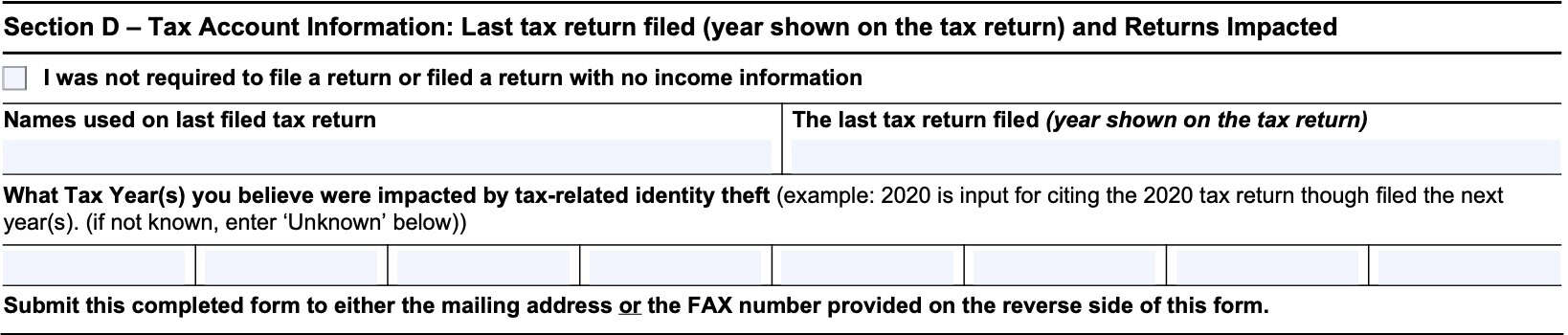

Section D: Tax account information

In Section D, check the box if you were not required to file an income tax return, or if you filed a non-filer return.

If you’ve previously filed a tax return, list the following:

- Name(s) used on the last tax return

- The year that you last filed a tax return

- The tax year(s) that you believe were impacted

- If you do not know, enter ‘Unknown’

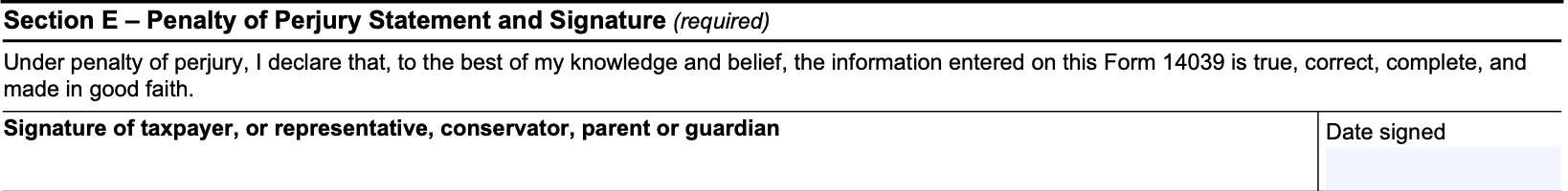

Section E: Penalty of perjury statement and signature

Section E contains the sworn signature of the filer, under penalty of perjury. Only sign this Form 14039 if you believe this identity theft information is true, correct, complete, and made in good faith.

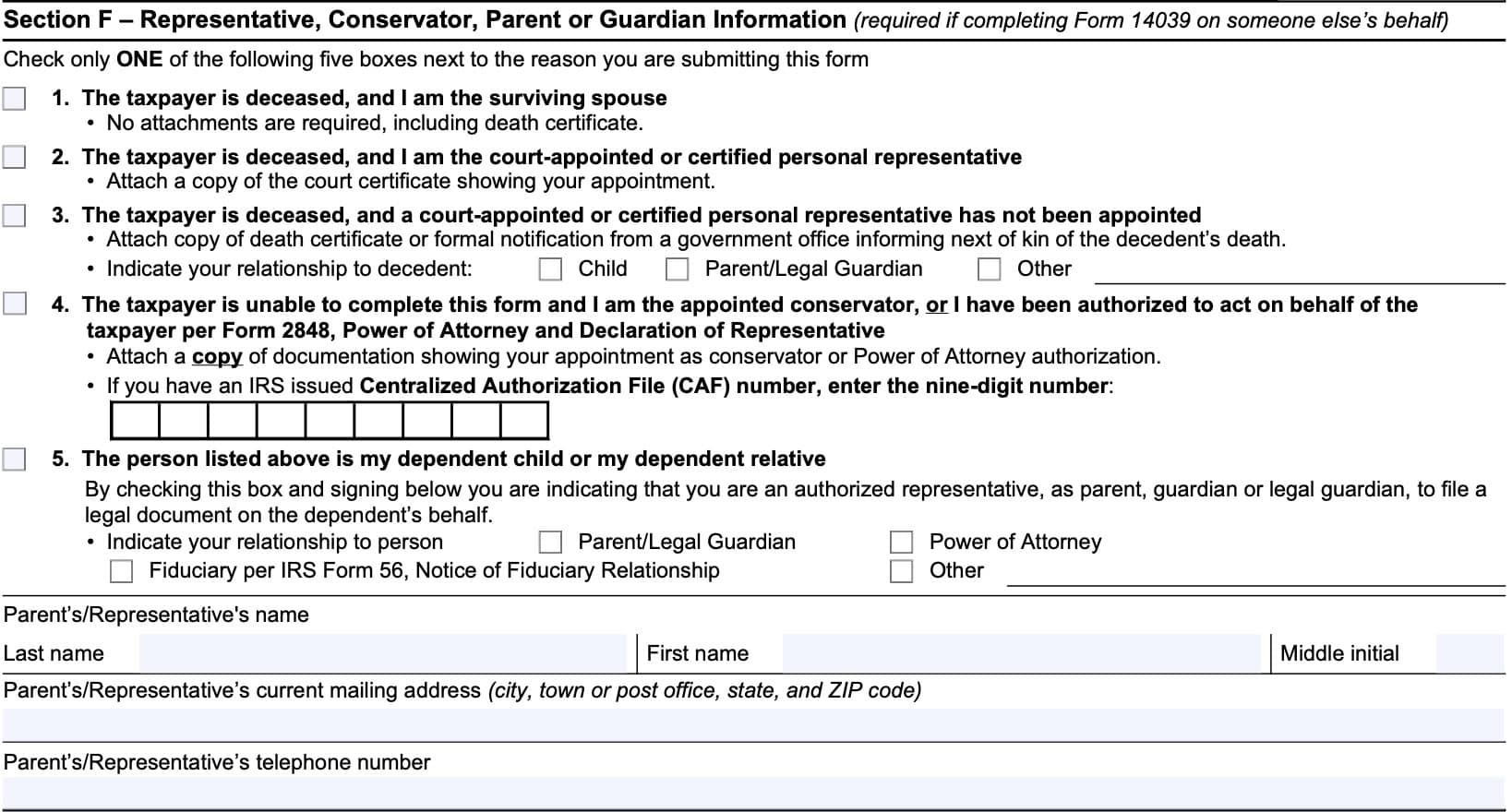

Section F: Representative, conservator, parent, or guardian information

Only complete Section F if you are submitting Form 14039 on someone’s behalf.

In that case, check only one of the following boxes:

Taxpayer is deceased, and I am the surviving spouse

You do not need to attach any documents. This includes the taxpayer’s death certificate.

Taxpayer is deceased and I’m the personal representative or court-appointed representative

Attach a copy of the court certificate documenting your appointment as the taxpayer’s personal representative.

Taxpayer is deceased, and a personal representative has not yet been appointed

Attach a copy of the death certificate or a formal notification letter from a government office regarding the taxpayer’s death.

Also, indicate your relationship to the deceased taxpayer:

- Child

- Parent or legal guardian

- Other

Taxpayer is unable to complete this form

This can be for one of two reasons:

- You are the appointed conservator, or

- You have been authorized to act on the taxpayer’s behalf on IRS Form 2848

Attach one of the following:

- Copy of the appointment letter designating you as conservator

- Copy of the IRS Form 2848, Power of Attorney authorization

If you have an IRS-issued centralized authorization file (CAF) number, enter it here.

The person is my dependent

Checking this box indicates that you are an authorized representative to file a legal document on behalf of the dependent. If this is true, check the appropriate box to indicate your relationship:

- Parent or legal guardian

- Power of attorney

- Fiduciary per IRS Form 56, Notice of Fiduciary Relationship

- Other (complete the line)

After checking the appropriate box, enter the personal representative’s information, to include:

- Name

- Current mailing address

- Including city, state, and zip code

- Contact telephone number

What is tax identity theft?

According to the identity theft information page on the IRS website, tax identity theft occurs when an identity thief “steals your personal information to commit tax fraud.” The Government Accountability Office states that there are two basic types of tax identity theft:

- Employment fraud

- Tax refund fraud

Employment fraud occurs when someone stales a taxpayer’s identity to secure employment under that person’s identity.

Tax refund fraud occurs when someone steals taxpayer information to file a fraudulent return to claim a false tax refund. In some of the more complex cases, the IRS sends the fraudulent refunds to the scammer’s bank account while the identity theft victims face potential audits for the suspicious return.

How does tax identity theft occur?

Tax identity theft may occur through a variety of means:

- Data breach: If you’re the victim of a data breach, you should keep in touch with the company who is responsible for your personal information to see what identity theft services they might be providing

- Identity theft scams: Identity theft scams usually target a specific individual by convincing that person to give the scammer certain personal information like the taxpayer’s Social Security number, bank account numbers, financial institution information, or access to certain cash applications like Venmo. Examples of identity theft scams might include:

- Email phishing scams

- Text message scams

- Phone scams

In identity theft cases, victims might be less willing to report the incident if they’ve unwittingly given the tax scammers enough information to claim a fraudulent refund.

While victims of tax-related identity theft cannot prevent data breaches, they can be on the look out for identity theft scams and avoid falling for them. Here are some warning signs that you might be a victim of tax identity theft.

What are the warning signs of tax identity theft?

Below are some of the more common warning signs that someone is using your tax information to file fraudulent tax returns:

- You get a letter from the IRS inquiring about a suspicious tax return that you did not file

- You can’t file an electronic tax return because of a duplicate Social Security number

- You get a tax transcript in the mail that you did not request

- You get an IRS notice that an online account has been created in your name when you know that you did not create an online account

- You get an IRS notice that your existing online account has been accessed or disabled when you took no action

- You get an IRS notice for one of the following:

- You owe additional taxes

- There is a tax refund offset against you

- You have had collection actions taken against you for a year during which you did not file a tax return

- IRS records indicate you received wages or other income from an employer you didn’t work for

- You’ve been assigned an Employer Identification Number but you did not request an EIN

How long does the IRS take to investigate tax identity theft?

The IRS website contains a lot of useful information for victims of tax-related identity theft. This includes ways that taxpayers may remain informed once they inform the IRS of a fraudulent tax return or send an IRS identity theft affidavit.

According to the IRS identity theft victim assistance page, the IRS reports that tax identity cases are usually resolved within 120 days.

However, you may experience additional lead time on if inquiring about the status of your identity theft claim. Due to the pandemic, IRS records indicate a rise in identity theft cases which have increased the lead time to about 360 days, on average.

How do I avoid having my tax information used in a fraudulent tax return?

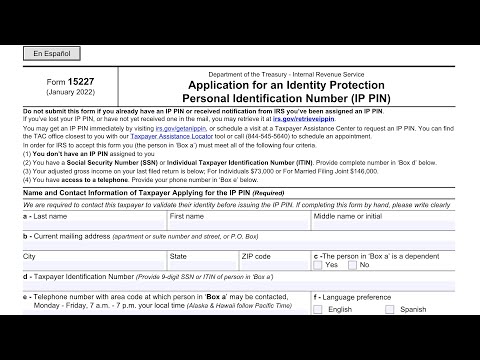

The best way to avoid having your tax information used in future returns is to apply for an identity protection PIN, or IP PIN. You can apply for an IP PIN using the IRS website or by filing IRS Form 15227, Application for an Identity Protection Personal Identification Number (IP PIN).

Having this level of identity protection allows you to file federal income tax returns safely with the use of a six-digit number that the IRS issues each year.

Individual taxpayers must meet the following criteria to obtain an IP PIN:

- Have a valid Social Security number or individual taxpayer identification number.

- Adjusted gross income on your last filed return is below

- $84,000 for individuals, or

- $168,000 for married filing jointly

- Have access to a telephone

Watch this video to learn more about obtaining an IP PIN.

How do I file IRS Form 14039?

You can file this form with the IRS at any time, via mail or fax.

Filing by mail

When filing Form 14039 by mail, your mailing instructions may differ based upon your situation.

If responding to an IRS notice or letter, mail your completed form to the address indicated in the IRS correspondence.

For taxpayers who are unable to electronically file your tax return, attach the IRS Form 14039 to the back of your paper tax return and file the return to the address you would normally file.

If neither of these situations apply, mail your completed form to the following address:

Department of the Treasury

Internal Revenue Service

Fresno, CA 93888-0025

Filing by fax

If responding to an IRS notice or letter, fax your completed form to the fax number indicated in the IRS correspondence. If no fax number is included in your mailed notice or letter, mail the form to the address indicated.

Otherwise, fax your completed form to the following toll-free number: (855) 807-5720.

In all cases, be sure to use a fax cover sheet marked, ‘Confidential.’

Video walkthrough

Watch this instructional video to learn step by step details about filing your identity theft affidavit on Form 14039.

Are you tired of dreading tax season?

If you’re like most people, you push through the stress of filing, only to be hit with a bigger bill than expected—then put it all behind you until the same cycle repeats next year.

But what if you could change the game?

Tax planning puts you in control. It’s about being proactive, not reactive—taking small, smart steps throughout the year to reduce your tax burden, increase your savings, and keep more of your hard-earned money working for you.

Here’s what effective tax planning helps you do:

✅ Avoid the surprise of a high tax bill

✅ Understand how your income and decisions affect your taxes

✅ Strategically lower your tax liability over time

Ready to make smarter tax moves?

👉 Join my free weekly tax planning newsletter and get one actionable tip every week to help you reduce your taxes legally and effectively.

Start taking control—your future self will thank you.

Frequently asked questions

Taxpayers use IRS Form 14039 in the case of tax-related identity theft so that the IRS may:

-Document cases of tax-related identity theft for public awareness

-Determine the taxpayer’s proper tax liability if suspicious returns are filed by identity thieves

-Relieve the taxpayer’s burden in such identity theft cases

The IRS website goes on to inform taxpayers that filing Form 14039 is not mandatory. However, if you do not complete Form 14039, the IRS will be less able to help you. For example, the IRS will have less flexibility in granting tax relief based on a fraudulent federal tax return.

Where can I find IRS Form 14039?

You may download a copy of this form and other tax forms from the IRS website. For your convenience, the most recent version of IRS Form 14039 is included below.