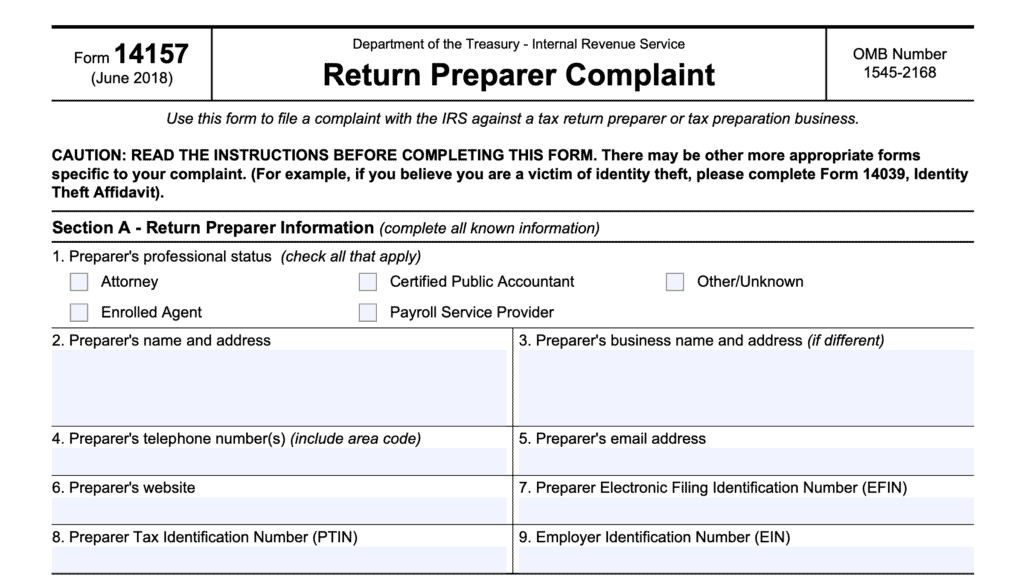

IRS Form 211 Instructions

Did you know the Internal Revenue Service can pay whistleblower claims to those who report cases of tax evasion or tax underpayments? According to its annual report, the IRS Whistleblower Office has paid out over 2,500 awards totaling over $1 billion since 2007. This article will walk you through the IRS Whistleblower program and how to use IRS Form 211 to file a claim.

Let’s start with step by step guidance on completing this tax form.

Table of contents

How do I complete IRS Form 211?

There are three sections to this form:

- Section A: Information about the person or business you are reporting

- Section B: Information about the alleged violation

- Section C: Information about yourself

Let’s take a look at each section in more detail.

Section A: Information about the person or business you are reporting

In Section A, you will include detailed information about the person or business you are reporting.

Line 1: Are you submitting information related to an existing claim?

Check Yes or No.

Line 2: Did you submit this information to the IRS, other agencies, or government personnel?

Check Yes or No.

Line 3

Check the box if you are including one or more attachments with this claim submission.

Line 4: Name of taxpayer and other related taxpayers who committed the suspected violation

Enter the name of the primary person involved. If you suspect multiple tax law violators, like business partners, then check the box in Line 8 and enter their names as well.

Line 5: Taxpayer identification number

Enter the tax ID number for the person or business committing the suspected violation. This can be any of the following:

- Social Security number (SSN)

- Individual Taxpayer Identification number (ITIN)

- Employer identification number (EIN)

Line 6: Taxpayer’s date of birth or approximate age

If known, enter the taxpayer’s birthdate. If not known, enter the approximate age of the taxpayer in Line 6.

Line 7: Taxpayer’s address

Enter the entire address, including city, state, and ZIP code.

Line 8: Additional taxpayers

Check this box to add additional suspected taxpayers to this complaint.

Line 9: What is your relationship to the noncompliant taxpayer?

Check all of the following boxes that apply:

- Current employee

- Former employee

- Attorney

- Certified public accountant (CPA)

- Relative or family member

- Other

- None

If necessary, use additional sheets.

Section B: Information the alleged violation

In this section, provide as much information about the actual violation that you witnessed.

Line 10: Alleged violation

Check one or more of the following that apply:

- Unreported or under reported income

- Income characterization

- International/foreign transaction

- Undisclosed foreign bank and financial accounts

- Specific allegations of tax fraud

- Employee vs. subcontractor

- Money laundering and Bank Secrecy Act

- Tax Shelter/Abusive Transaction

- Overstated/False deductions

- Crytocurrency/Digital Assets

- Failure to withhold tax

- Failure to file tax return

- Failure to pay

- Tax-exempt/Government entity tax

- Promoter of tax avoidance schemes

- Terrorism

- Other (write in details)

You can find additional information about suspected tax violations on the IRS Whistleblower page.

Line 11: Describe the alleged violation and provide details

Attach a detailed explanation here. Include records and supporting information that you have access to. Describe the availability and information of supporting documentation that you do not currently possess.

Line 12: Is the information in this claim based upon public information?

Answer Yes or No.

Line 13: Describe amount of tax owed by the taxpayer

Provide records and a summary of the information that you have which supports your claim. This could include books, ledgers, records, receipts, or tax returns.

Attach additional documentation as required.

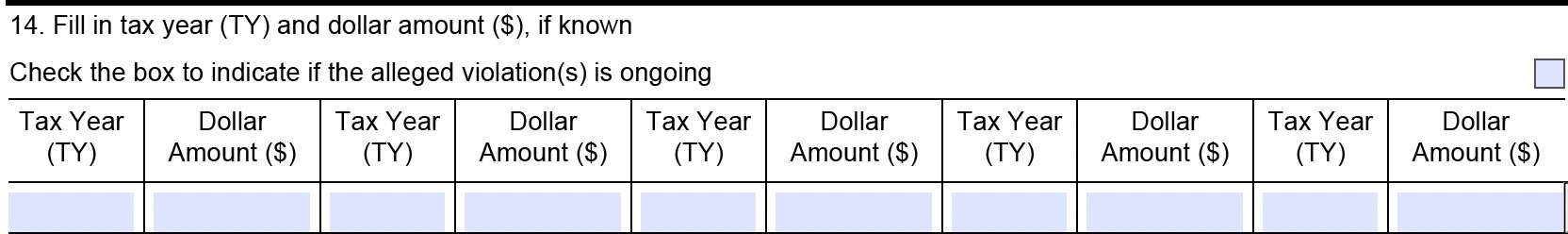

Line 14: Tax year and dollar amount, if known

To the extent known, enter the tax year and approximate dollar amount of taxes owed for each tax year. There is sufficient space for up to 5 tax years’ information.

Check the associated box if the tax violation is ongoing.

Section C: Information about yourself

If multiple claimants are manually completing the form, then multiple prints for Section C are required in order to complete the questions for each claimant.

Line 15: Check the box to indicate if multiple claimants are jointly filing this claim

Check the box as needed.

Line 16: Name of claimant

Enter your name in Line 16.

Line 17: Claimant’s date of birth

Enter your date of birth here.

Line 18: Claimant’s SSN or ITIN

Enter your SSN or ITIN.

Line 19: Claimant’s address

Enter your complete address in Line 19. Check the box below if you agree to have the IRS send correspondence to the address in the IRS record for you.

Line 20: Telephone number

Enter your telephone number, including area code, in Line 20.

Line 21: Email address

Enter your email address here.

Line 22

If you have completed a copy of IRS Form 2848, Power of Attorney and Declaration of Representative, check the box and attach the completed form to this report.

Line 23: Are you the spouse or dependent of an IRS employee?

Check Yes or No.

Line 24: Are you currently, or formerly, an employee of the department of Treasury?

Check Yes or No.

Line 25: Are you currently, or formerly, a federal government employee?

Check Yes or No.

Line 26: are there any federal laws or regulations that require you to disclose this information?

Check Yes or No.

Line 27: are there any federal laws or regulations that prohibit you from disclosing this information?

Check Yes or No.

Line 28: Are you currently, or formerly, a federal government contractor?

Check Yes or No.

Line 29: Are you filing this form based on information obtained from an ineligible person?

Check Yes or No.

Line 30: Declaration signature

This signature declares, under penalty of perjury, that the following information, accompanying statements, and supporting documents, are true and correct to the whistleblower’s knowledge.

Let’s move on to some background on the federal law which allows for the IRS whistleblower program to exist in the first place. That is Internal Revenue Code (IRC) Section 7623.

IRS Whistleblower law: What is IRC Section 7623?

According to the United States code, the Secretary of the Treasury has the authority to pay a whistleblower award to individuals

- Detecting underpayments of tax, or

- Detecting and bringing to trial and punishment persons guilty of violating internal revenue laws to trying to do the same

In other words, IRC Section 7623 simply allows the Treasury Department to establish a whistleblower’s office to catch tax cheats. The IRS Whistleblowers Office is the operating division of the IRS who administers this program on behalf of the federal government.

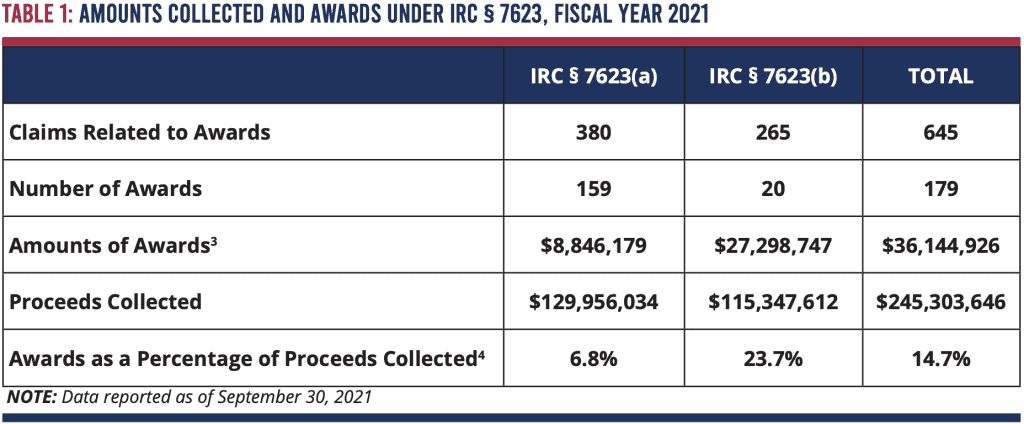

There are two sections of the Internal Revenue Code that allow for payouts in an IRS whistleblower case.

IRC Section 7623(a)

Under IRC Section 7623(a), the Secretary has discretion to establish award criteria in cases not otherwise authorized by U.S. law. The IRS pays out the majority of claims that do not qualify for an award under IRC Section 7623(b) under this provision.

IRC Section 7623(b)

Section 7623(b) provides more specific payout criteria. If the federal government proceeds with any administrative or judicial proceeding based upon credible information, then the whistleblower may receive between 15% and 30% of the collected proceeds from the case.

In cases of specific allegations that came from public information (such as a news report, audit, governmental report, etc.), the Whistleblower Office may still grant an award payment of up to 10% of the collection.

In fiscal year 2021, the IRS issued 179 awards for $36.1 million. This represents about 14.7% of the collected proceeds.

Who is eligible to file a whistleblower claim?

According to the IRS website, a whistleblower must meet certain criteria to file a claim under IRC 7623(b). The reported information must be:

- Signed and submitted under penalties of perjury;

- Related to an action in which the proceeds in dispute exceed $2,000,000; and

- Related to a taxpayer, and for individual taxpayers only, one whose annual gross income exceeds $200,000 for at least one of the tax years in question.

If a submission does not meet the criteria for IRC § 7623(b), the Whistleblower Office may consider it for an award pursuant to its discretionary authority under IRC § 7623(a).

The IRS also provides examples of they will not consider under both IRC § 7623(a) and IRC § 7623(b).

Examples of claims that will not be processed under IRC § 7623(a)

- The individual is an employee of the Department of Treasury, or is acting within the scope of his or her duties as an employee of any Federal, State, or local Government.

- The individual is required by federal law or regulation to disclose the information, or the individual is precluded by federal law or regulation from making the disclosure.

- The individual obtained or was furnished the information while acting in his or her official capacity as a member of a State body or commission having access to such materials as Federal returns, copies or abstracts.

- The individual had access to taxpayer information arising out of contract with the federal government that forms the basis of the claim.

- The claim is found to have no merit or the claim lacked sufficient specific and credible information.

- The claim was submitted anonymously or under an alias.

- The claim was filed by a person other than an individual (e.g., corporation or partnership)

Examples of claims that will not be processed under IRC § 7623(b)

- The informant is an employee of the Department of Treasury, or is acting within the scope of his or her duties as an employee of any Federal, State, or local Government.

- The individual is required by federal law or regulation to disclose the information, or the individual is precluded by federal law or regulation from making the disclosure.

- The individual obtained or was furnished the information while acting in his or her official capacity as a member of a State body or commission having access to such materials as Federal returns, copies or abstracts.

- The individual had access to taxpayer information arising out of contract with the federal government that forms the basis of the claim.

- The claim does not have merit or the claim lacked sufficient specific and credible information.

- The claim was submitted anonymously or under an alias.

- The claim was filed by a person other than an individual (e.g., corporation or partnership)

- The alleged noncompliant taxpayer is an individual whose gross income is below $200,000.

Ineligible individuals

There is also a list of people who, by definition, are ineligible for a whistleblower award:

- An individual who is an employee of the Department of Treasury or was an employee of the Department of Treasury when the individual obtained the information on which the claim is based;

- An individual who obtained the information through the individual’s official duties as an employee of the Federal Government, or who is acting within the scope of those official duties as an employee of the Federal Government;

- An individual who is or was required by Federal law or regulation to disclose the information or who is or was precluded by Federal law or regulation from disclosing the information;

- An individual who obtained or had access to the information based on a contract with the federal government; or

- An individual who filed a claim for award based on information obtained from an ineligible whistleblower for the purpose of avoiding the rejection of the claim that would have resulted if the claim was filed by the ineligible whistleblower.

What is IRS Form 211?

IRS Form 211-Application for Award for Original Information, is the IRS form that a whistleblower must use to report suspected underpayment of taxes or violation of the tax laws.

The IRS Whistleblower’s Office stresses that a completed form must contain:

- A description of the alleged tax noncompliance, including a written narrative explaining the issue(s).

- Whistleblower’s information to support the narrative. This could include:

- Copies of books and records

- Ledger sheets

- Receipts

- Bank records

- Contracts

- Emails

- Location of assets

- A description of documents or supporting evidence not in the whistleblower’s possession or control, and their location.

- An explanation of how and when the whistleblower became aware of the information that forms the basis of the claim.

- A complete description of the whistleblower’s present or former relationship (if any) to the subject of the claim.

- The whistleblower’s original signature on the declaration under penalty of perjury and the date of signature.

- NOTE: A legal representative cannot sign IRS Form 211 for the whistleblower.

Video walkthrough

Frequently asked questions

Whistleblowers must mail the completed Form 211, with supporting documentation to the IRS’ Ogden office:

Internal Revenue Service

Whistleblower Office – ICE

1973 N Rulon White Blvd.

M/S 4110

Ogden, UT 84404

There are several factors that determine the amount of the whistleblower’s monetary award. These factors include: size of tax revenue collected, whether the information provided was publicly available, and how pertinent the whistleblower’s information was to the IRS collection efforts.

Under federal law, the maximum whistleblower award is 30% of the proceeds collected and attributable to information provided by the whistleblower. However, the IRS reports indicate that the average award is somewhere between 15% and 30% of collections.

Where can I find a copy of IRS Form 211?

You can find a copy of this tax form on the IRS website or by downloading the free version below.