IRS Form 5558 Instructions

If you are a single employer looking for an extension of time to file a tax return regarding your employee benefit plan, you might need to complete IRS Form 5558, Application for Extension of Time

To File Certain Employee Plan Returns.

In this article, we’ll go over everything you need to know about this tax form, including:

- How to complete IRS Form 5558

- Tax return extensions that IRS Form 5558 covers

- Filing considerations

Let’s begin with a step by step overview of this tax form.

Contents

Table of contents

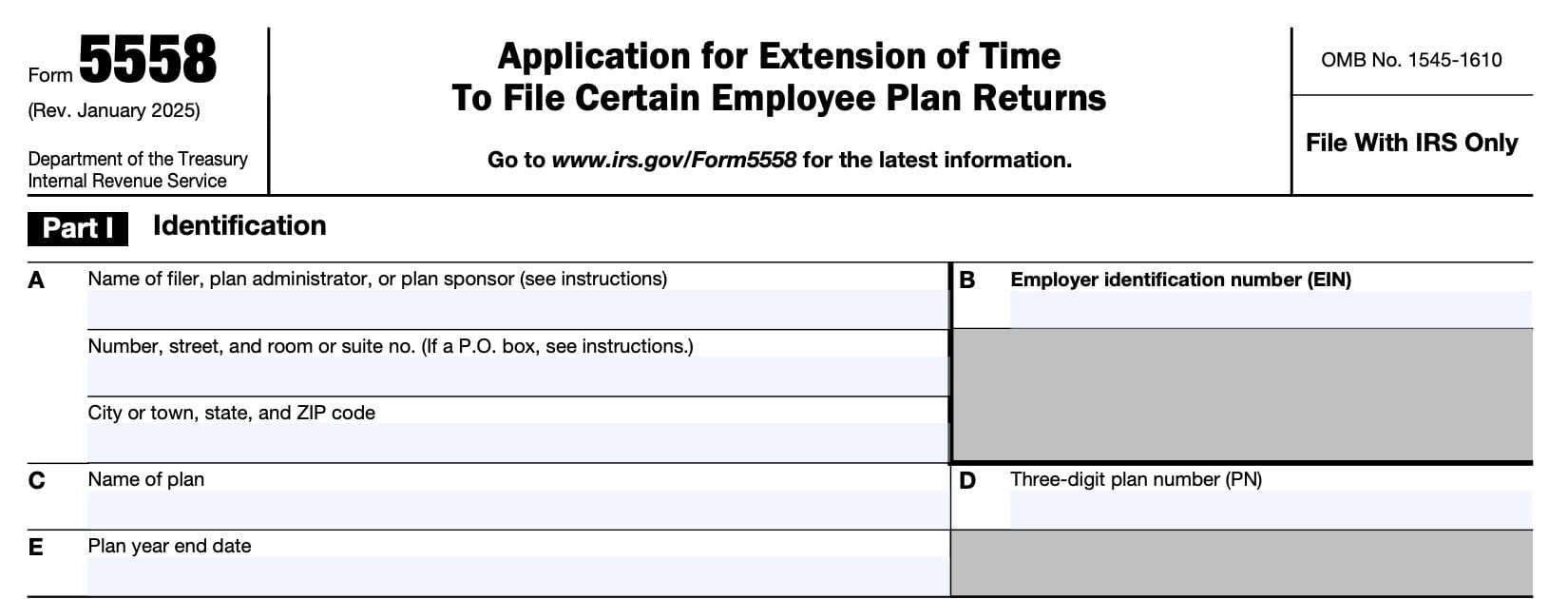

How do I complete IRS Form 5558?

There are two parts to this one-page tax form:

Let’s take a look at each part, beginning with Part I.

Part I: Identification

In Part I, you’ll provide identifying information about the employee plan return that you’re requesting a filing extension for.

This could be any of the following tax forms:

- IRS Form 5500, Annual Return/Report of Employee Benefit Plan

- IRS Form 5500-SF, Short Form Annual Return/Report of Employee Benefit Plan

- IRS Form 5500-EZ, Annual Return of a One-Participant (Owners/Partners and their Spouses) Retirement Plan or a Foreign Plan

- Form 8955-SSA, Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

Let’s go through this, line by line.

Line A

In this section, enter the following information if you’re requesting an extension of time to file:

- Name of filer, plan administrator, or plan sponsor

- Filer’s address, including:

- Street name and number

- City, state, zip code

Plan sponsor information

The plan sponsor (generally, the employer for a single-employer plan) or plan administrator listed on the application should be the same as the plan sponsor or plan administrator listed on the annual return/report filed for the plan.

P.O. Box or foreign address

If the post office does not deliver mail to the street address and you have a P.O. box, show the box number instead of the street address.

If the entity’s address is outside the United States or its territories, enter in the space for city or town, state, and ZIP code, the information in the following order:

- City

- Province or state

- Country

Follow the country’s practice for entering the postal code. Do not abbreviate the country name.

Change of address

If your mailing address has changed since you filed your last return, use Form 8822-B, Change of Address or Responsible Party — Business, to notify the IRS of the change. A new address shown on

Form 5558 will not update your records.

Line B: Employer identification number

Enter the nine-digit employer identification number, or EIN, associated with the employer. Do not use a

social Security number in lieu of an EIN.

If you do not have an EIN

An entity that does not have an EIN must apply for one as soon as possible. You may apply online through the IRS website or by filing IRS Form SS-4, Application for Employer Identification Number with the IRS. The EIN is issued immediately once the application information is validated.

If the principal business was created or organized outside of the United States or its territories, you may apply for an EIN by calling 267-941-1099 (not a toll-free number).

Line C: Name of plan

Enter the formal plan name in Line C.

Line D: Three-digit plan number (PN)

Enter the three-digit plan number that the employer assigned to the plan.

Plans must be numbered consecutively starting with 001. Once a PN is used for a plan, it must be used as the PN for all future filings of tax returns for the plan, and this number may not be used for any other plan even after the plan is terminated.

Line E: Plan year end date

Enter the end of the plan year (MM/DD/YYYY). The term Plan year refers to the calendar year or fiscal year for which the records of the plan are kept.

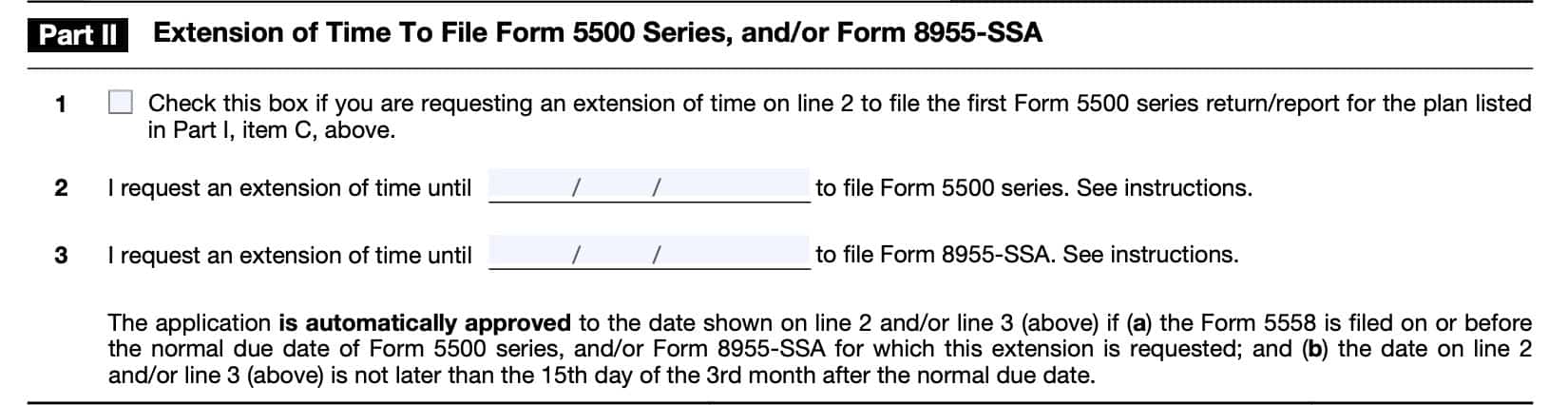

Part II: Extension of Time to File Form 5500 Series, and/or Form 8955-SSA

In Part II, you can indicate how long you need a filing extension, and specify the extended due date needed.

Line 1

Check this box if the extension of the time to file being requested on Line 2 is for the first Form 5500 series return/report filed for the plan.

Do not check this box if the plan previously filed a Form 5500 series return/ report at any time for any year.

Line 2

On Line 2, enter the due date for which you are requesting to file either Form 5500, Form 5500-SF, or Form 5500-EZ.

This date should not be later than the 15th day of the 3rd month after the normal due date of the

return/report.

If Form 5558 is timely filed and complete, you will be granted an extension to not later than the 15th day of the 3rd month after the return/report’s normal due date to file Form 5500, Form 5500-SF, or Form 5500-EZ.

Line 3

Enter on Line 3 the due date for which you are requesting to file Form 8955-SSA. This date should not be later than the 15th day of the 3rd month after the normal due date of the return.

If you timely complete and file Form 5558, the IRS will grant an extension to not later than the 15th day of the 3rd month after the return’s normal due date to file Form 8955-SSA.

Filing considerations

Below are some things to consider when filing IRS Form 5558.

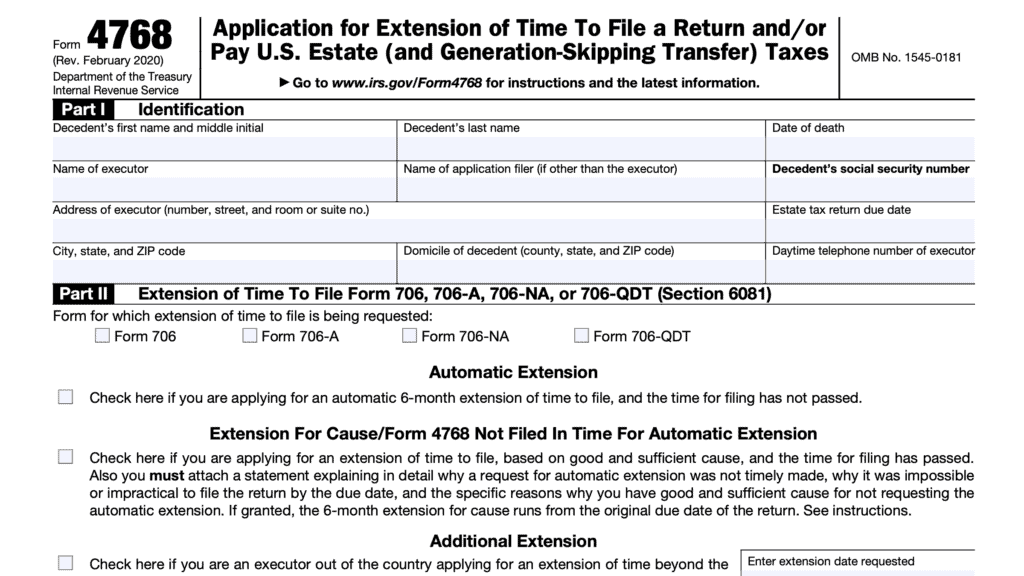

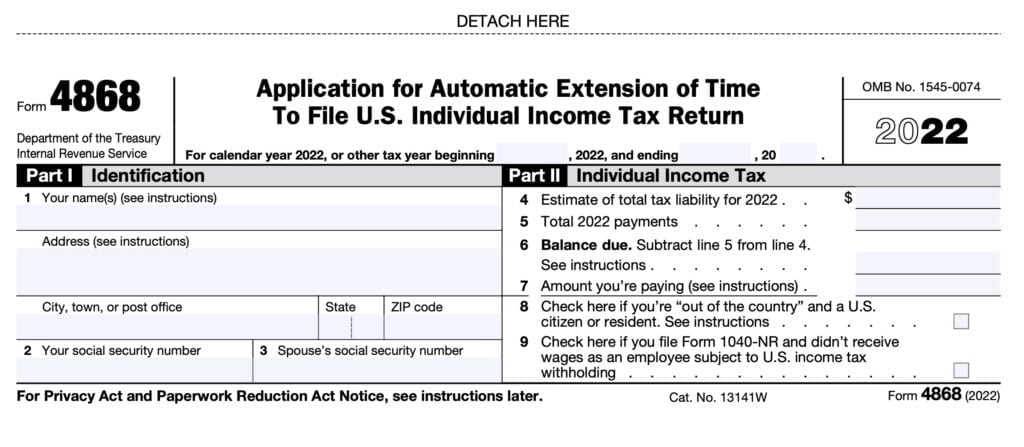

You may not need to file IRS Form 5558

An exception to the Form 5558 filing requirement exists when certain conditions exist.

According to the IRS instructions, Form 5500, Form 5500-SF, Form 5500-EZ, and Form 8955-SSA filers are automatically granted extensions of time to file until the extended due date of the federal income tax return of the employer if both of the following conditions are met:

- The plan year and the employer’s tax year are the same

- The employer has been granted an extension of time to file its federal income tax return to a date later than the normal due date for a Form 5500-series return or Form 8955-SSA

Filing IRS Form 5558 after the normal due date will not further any extension granted under this exception.

A filing extension does not operate as an extension of time to file the PBGC (Pension Benefit Guaranty Corporation) Form 1, Annual Premium Payment.

How to file IRS Form 5558

From the form instructions, below are a couple of notes for filing this extension request.

A separate Form 5558 must be used for each plan for which an extension is requested.

For example, if an employer maintains a defined benefit plan and a profit-sharing plan, a separate Form 5558 must be filed for each plan. A single Form 5558 may, however, be used to extend the time to file a plan’s Form 5500 series return/report and its Form 8955-SSA.

Do not attach lists of other plans to Form 5558.

The IRS will only process the plan listed on Form 5558. Lists attached to the Form 5558 will not be processed.

A DCG reporting arrangement can file a single Form 5558 for an extension of time to file a Form 5500. The reporting arrangement does not have to attach a list of participating plans in the DCG to the Form 5558.

You can file electronically or by mail

Effective January 1, 2025, you can file IRS Form 5558 electronically through EFAST2 or you can file paper Form 5558 by mailing your completed form to the following address:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0045

When to file Form 5558

To request an extension of time to file Form 5500, Form 5500-SF, Form 5500-EZ, and/or Form 8955-SSA, file Form 5558 on or before the return/report’s normal due date. The normal due date is the date the Form 5500, Form 5500-SF, Form 5500-EZ, and/or Form 8955-SSA would otherwise be due, without extension.

The IRS will automatically approve applications for an extension of time to file Form 5500, Form 5500-SF, Form 5500-EZ, and/or Form 8955-SSA filed on or before the return/report’s normal due date on a properly completed Form 5558. The approved date will be no later than the 15th day of the 3rd month after the return/report’s normal due date.

Video walkthrough

Frequently asked questions

In general, tax returns for employee benefit plans are due on the last day of the seventh month after the plan year ends. You can file IRS Form 5558, Application for Extension of Time to File Certain Employee Plan Returns to request a one-time extension of time of up to 2 1/2 months.

IRS Form 5558, Application for Extension of Time To File Certain Employee Plan Returns, is the tax form that employers may apply to request a filing extension for certain employee benefit returns.

Where can I find IRS Form 5558?

You can find tax forms such as IRS Form 5558 on the IRS’ official website. For your convenience, we’ve enclosed the latest version of this tax form here, in our article.