IRS Form 5498 Instructions

If you have an IRA, you should know about IRS Form 5498, IRA Contribution Information. This tax form, issued by your broker or financial institution, outlines any transaction in which money transferred into an IRA for the previous year.

This article will go over IRS Form 5498 so you can better understand how it can help with your tax planning. Specifically, we’ll go over:

- What is Form 5498

- How to read and understand your IRS Form 5498

- How Form 5498 can help your tax planning

Let’s start with how to read and understand IRS Form 5498.

Table of contents

IRS Form 5498 instructions

In most of our articles, we walk you through how to complete the tax form. However, many readers will probably want to understand the information reported on their IRS Form 5498, instead of how to complete it.

There are generally 3 copies of this form that financial institutions must file. Copy A goes to the Internal Revenue Service, while Copy B goes to the account holder. The financial institution usually will retain Copy C for their records.

Let’s get into the form itself, starting with the payer and recipient information fields on the left side of the form.

Taxpayer information

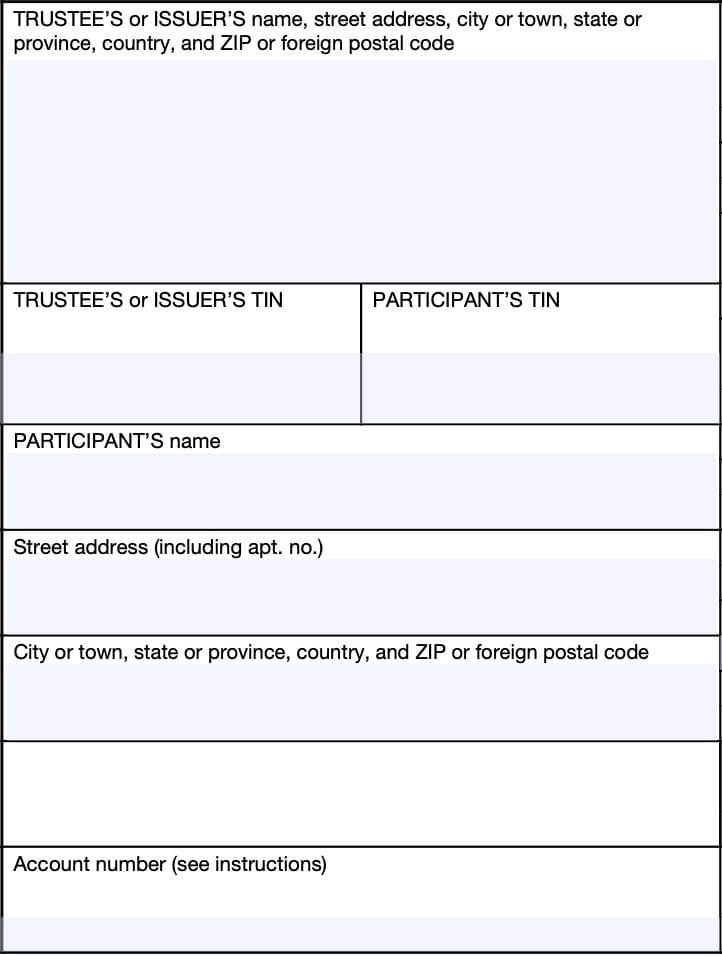

In the boxes on the left side of the form, you should see your personal information, as well as the information for the financial institution.

Review these for accuracy, to make sure that the reported information is correct.

Trustee’s or Issuer’s Information

This field should contain the following information with regards to the reporting institution:

- Trustee’s name or Issuer’s name

- Street address

- City, state, ZIP code

If you have any questions about any of the transactions reported on this form, you should have enough contact information to reach out to the financial institution for resolution.

Trustee’s TIN

Most likely, this will be an employer identification number, or EIN.

Participant’s TIN

This field should contain your Social Security number, or SSN. Quickly review this field for accuracy.

Participant’s Information

This field should contain your name and complete mailing address. Review this for incorrect information.

Account number

If applicable, your account custodian may enter an account number in this field. If you have more than one IRA with the same custodian and the custodian sends you Form 5498 for each account, the custodian must enter account number information in this field.

Right side of Form 5498

On the right side of IRS Form 5498 are boxes 1-15. These contain most of the important information, and we’ll go through them in order.

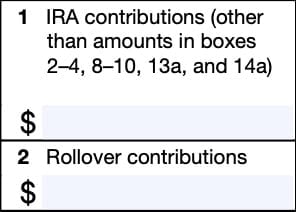

Box 1: IRA contributions

Shows total IRA contributions for the tax year. This includes IRA contributions made in the current year, including those made in the following year before the tax filing deadline.

Box 1 does not include:

- Box 2: Rollover contributions

- Box 3: Roth conversion amounts

- Box 4: Recharacterized contributions

- Box 8: SEP IRA contributions

- Box 9: SIMPLE IRA contributions

- Box 10: Roth IRA contributions

- Box 13a: Postponed or late contributions

- Box 14a: Repayments

Box 1 may also show excess contributions to your IRA account, even if those excess contributions are later withdrawn.

This box does not indicate whether or not you can take a tax deduction for these IRA contributions.

Box 2: Rollover contributions

Shows the rollover amounts from another tax-advantaged account, including a direct rollover to a traditional or Roth IRA, or a qualified rollover contribution to a Roth IRA you made during the tax year.

This could include:

- 60 day IRA rollovers

- Direct transfer or indirect rollovers from qualified plans, like a 401k or 403b

- Qualified rollovers into a Roth IRA (but not Roth IRA conversions, which are reported in Box 3)

- Military death gratuity

- Servicemember’s Group Life Insurance (SGLI) proceeds

Box 2 does not include:

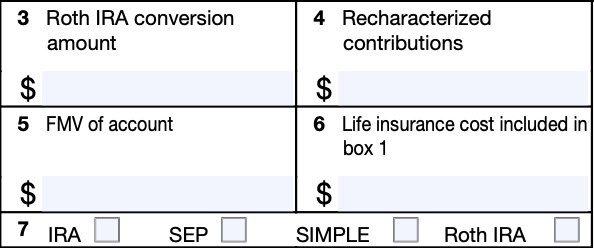

Box 3: Roth IRA conversion amount

Shows the amount converted to a Roth IRA. This conversion amount could be from a traditional IRA, SEP IRA, or SIMPLE IRA.

Box 4: Recharacterized contributions

The amount of contributions (plus accumulated earnings) that were recharacterized from a different account.

Box 5: FMV (fair market value) of account

This is the account balance as of December 31 of the tax year reported.

This information is required to calculate RMDs.

Accounts belonging to a decedent

If a decedent’s name is shown on the Form 5498, the amount reported may be the FMV on the date of death. The executor or estate administrator may request a date of death value from the reporting institution.

Box 6: Life insurance cost

Used to report the cost of life insurance in the case of endowment contracts. Taxpayers may need to subtract this amount from their allowable IRA contribution, reported in Box 1, to compute their IRA deduction.

Box 7: IRA Type

The checked box will indicate the type of IRA:

- Traditional IRA

- SEP IRA

- SIMPLE IRA

- Roth IRA

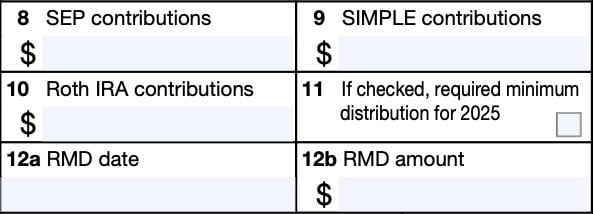

Box 8: SEP contributions

Includes employer contributions to a SEP IRA for the tax year reported.

- Does not include employee contributions, which are reported in Box 1

- Does include contributions by a self-employed individual

- Includes contributions in the reported tax year for the previous tax year.

For example, a 2024 Form 5498 would include 2023 contributions that were made in calendar year 2024. But it would not include 2024 contributions made in 2025. These contributions would be reported in 2025 because they are for the prior tax year.

Box 9: SIMPLE contributions

Includes employer contributions to the plan. Also includes contributions in the reported tax year that were made for the previous tax year.

Box 10: Roth IRA contributions

Includes total Roth IRA contributions made for the tax year, through the tax filing deadline, including rollovers from a qualified tuition program, or 529 plan. Box 10 does not include Roth conversions.

Taxpayers may not deduct Box 10 amounts from taxable income on their individual tax return.

Box 11: If checked, must take RMD for the subsequent tax year

For example, if Box 11 is checked on the 2024 Form 5498, this indicates the taxpayer must take a required minimum distribution (RMD) for 2025.

An RMD may be required even if the box is not checked. If you do not take the RMD for 2025, you are subject to an excise tax on the amount not distributed.

Box 12a: RMD Date

If required, Box 12a will show the date by which the RMD amount in Box 12b must be distributed to avoid the excise tax on the undistributed amount for the following year..

Box 12b: RMD Amount

Shows the amount of the RMD for the following year.

If Box 11 is checked and there is no amount in this box, then the trustee or issuer must provide you the amount or offer to calculate the amount in a separate statement by January 31 of the following tax year.

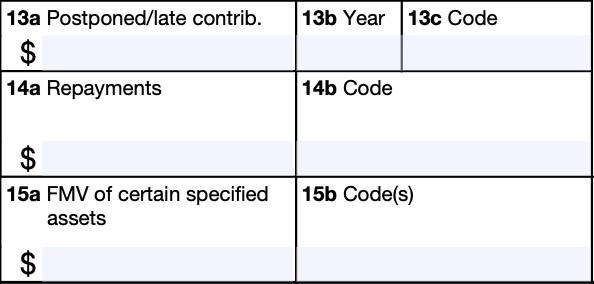

Box 13a: Postponed or late contribution

Usually blank. If required, the IRA trustee will report the amount of either:

- A late contribution made during the tax year and certified by the participant, or

- A postponed contribution made in the tax year for a prior tax year

This amount is not reported in Box 1 or Box 2.

Box 13b: Year

Box 13b shows the year to which the postponed contribution was credited. If a late rollover contribution is shown in Box 13a, this box will be blank.

Box 13c: Reason code

Box 13c contains the reason code for why a participant made a postponed contribution. Below is a partial list of reason codes you might see in Box 13c:

- FD: Postponed contribution due to an extension of the due date because of a federally designated disaster

- PO: Rollover of a qualified plan loan offset

- SC: For a participant who used the self-certification procedure for a late rollover contribution

Additionally, there are unique reason codes for participants who served in designated combat zones, qualified hazardous duty areas, or direct support areas. Below is a partial list of acceptable combat zone codes:

- EO12744: Arabian Peninsula

- EO13239: Afghanistan

- EO13119 (or PL 106-21): Yugoslavia operations areas

Box 14a: Repayments

This box shows the amount of any repayment of any of the following:

- Qualified reservist distribution

- Qualified disaster distribution

- Qualified birth or adoption distribution

Box 14b: Reason code

This box contains the applicable reason code based on the type of repayment:

- QR: Repayment of qualified reservist distribution

- DD: Repayment of qualified disaster distribution

- BA: Repayment of qualified birth or adoption distribution

Box 15a: Fair market value of certain assets

If required, the IRA trustee will report the fair market value (FMV) amount in Box 15a.

Box 15b: Reason code

If the IRA trustee reports the FMV amount in Box 15a, the reason code should appear here, based on the type of investment in the IRA. No more than two reason codes should appear here.

Below is the complete list of reason codes from the IRS instructions:

- A: Stock or other ownership interest in a corporation that is not readily tradable on an established securities market

- B: Short-term or long-term debt obligation that is not traded on an established securities market

- C: Ownership interest in a limited liability company or similar entity (unless the interest is traded on an established securities market)

- D—Real estate

- E—Ownership interest in a partnership, trust, or similar entity (unless the interest is traded on an established securities market)

- F—Option contract or similar product that is not offered for trade on an established option exchange

- G—Other asset that does not have a readily available FMV

- H—More than two types of assets (listed in codes A through G) in this IRA

Filing IRS Form 5498

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Watch this instructional video so you can better understand each field in your Form 5498.

Variations of Form 5498

IRS Form 5498 is used to report IRA transactions. However, other versions of this tax form are used to report similar transactions in other tax-advantaged accounts. These include:

- Form 5498-QA: IRS Form 5498-QA is used to report contributions to a qualified ABLE (Achieving a Better Life Experience) account. ABLE accounts are tax-advantaged savings programs for qualified people with disabilities.

- Form 5498-ESA: IRS Form 5498-ESA is used to report contributions to a Coverdell Education Savings Account (ESA)

- Form 5498-SA: IRS Form 5498-SA reports contributions to one of the following:

- Health Savings Accounts (HSA)

- Archer Medical Savings Accounts (MSA)

- Medicare Advantage MSA

Form 5498 is issued by the financial institution responsible for the IRA for informational purposes. There is a hidden tax planning opportunity that many people are unaware of.

Let’s discuss what the hidden tax opportunity is.

Roth conversions: The hidden tax planning opportunity

As previously mentioned, Form 5498 is issued by the financial institution responsible for your IRA. It is issued for any year in which money or securities were transferred into that account. This could include (but is not limited to):

- IRA contributions (including SEP, SIMPLE, or Roth IRA contributions)

- Rollovers

- Roth conversions

- Recharacterizations

An account holder will receive a Form 5498 for each account. If you make a non-deductible contribution to your traditional IRA, then do a backdoor Roth conversion, you would receive a Form 5498 for both your traditional IRA as well as your Roth IRA.

In addition, you would receive a Form 1099-R for the traditional IRA since money left your traditional IRA.

What does this mean?

For IRA owners who are eligible to directly contribute to a Roth IRA, or to fully deduct traditional IRA contributions on their tax return, this form won’t mean much. This simply is an acknowledgement of the money you contributed to your IRA in a given year.

However, there is a situation where this will come in handy. That is when your traditional IRA ends up having a combination of deductible (pre-tax) & non-deductible (after-tax) contributions.

Here are two common scenarios, where this might occur:

Scenario 1

At the beginning of your career, you start off in a lower tax bracket. You contribute directly to a traditional IRA while contributing to your workplace retirement plan. That way, you maximize your retirement savings.

Over time, you creep into the income phase out limits for being able to deduct your IRA contributions on your tax return. Your IRA now has a combination of pre-tax and after-tax contributions.

Scenario 2

You’ve been making non-deductible IRA contributions for a while. But you never converted them to a Roth IRA. You change jobs.

As part of this change, you change your 401k participation. To simplify your finances, you rollover your previous 401k into your traditional IRA. You now have a combination of pre-tax contributions & after-tax contributions.

How do I figure out the difference between pre-tax contributions were pre-tax and after-tax ones?

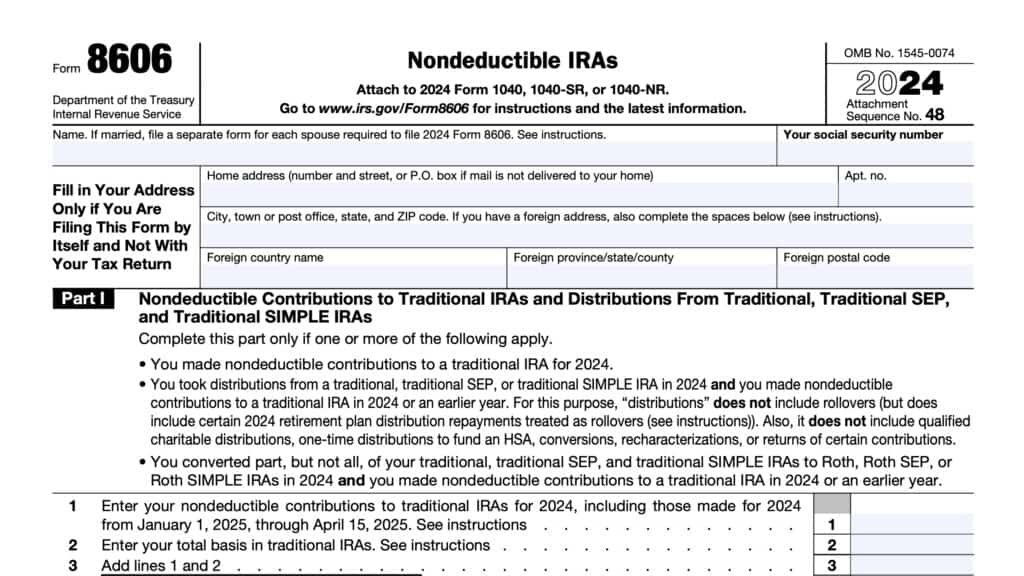

Ideally, you would use IRS Form 8606, Nondeductible IRAs, to help keep track of your after tax contributions. But many people don’t file Form 8606 each year. Or at all.

This happens for many reasons:

- They don’t know they’re supposed to file Form 8606.

- They don’t tell their accountant about the IRA contribution.

- Their tax preparation software doesn’t properly prompt them to do so.

Fortunately, you can use IRS Form 5498, in conjunction with each year’s tax returns to figure this out.

To do this, you compare Box 1 (IRA contributions other than amounts in boxes 2-4, 8-10, 13a, and 14a) to the ‘IRA deduction’ line on your tax return.

Based upon tax year, you’ll find this line item on Schedule 1 of your tax return for years 2018 and later. For 2017 and prior tax years, this contribution should appear on Line 32 of your Form 1040.

One of three things will happen:

1. The number in Block 1 equals the respective number on your tax return.

This means that your IRA contribution was fully deducted for that year, and is considered a pre-tax contribution.

2. There is no number for IRA deduction on your tax return, but there is a number in Block 1 of your 5498.

This means that your IRA contribution was not deducted at all that year, and is considered an after-tax contribution.

3. There are numbers in both forms, but they’re different.

This means that your IRA contribution was partially deducted in that year. The difference between the two numbers is the amount of your after-tax contributions.

This usually happens when you’re in the phase-out of your IRA contribution deduction eligibility.

For example, in 2024, a single tax filer, participating in an employer-sponsored retirement plan, could:

- Fully deduct their IRA contribution if their modified adjusted gross income (AGI) is $73,000 or less,

- Not deduct their IRA contribution at all if their modified AGI was $83,000 or more, or

- Partially deduct their IRA contribution if their modified AGI was between $73,000 and $83,000. This is known as a phase-out.

You’ll need to calculate this amount for each year that you contributed to an IRA. The total number is the total of your after-tax contributions.

What you must do before starting your Roth conversions

The most important thing that you do is to discuss the strategy with your accountant before you start doing conversions. You want to achieve 3 things:

- Your accountant knows of your strategy and agrees with it. By preparing your tax return, they’re going to be telling the story after the fact. So it’s worth making sure they’re onboard with the big picture before moving forward.

And if not, then it’s worth taking the time to learn what adjustments you need to make so they’re onboard.

- You’ve reviewed that year’s plan as part of your tax planning. This is a little different.

- You’re comfortable with the actual mechanics. This means that if you need to open a Roth IRA, then you actually open the Roth IRA. Likely, your accountant will be in a situation to advise on what you should be doing, but might not be in control of the actual transactions. That falls to you or your investment advisor (if you have one).

If you’re working with an investment advisor, then your accountant and investment advisor should be on the same page in terms of what needs to be done and when.

What if I can’t find my Form 5498?

Contact your financial institution or your financial advisor. You should be able to have them send you copies for each year that you deposited funds into an IRA they manage. This is the preferred approach.

If you have changed custodians over the years, or have many years of IRA contributions, this might be difficult. However, if you keep paper (or electronic copies) of your statements, you should be able to document when deposited funds reached your IRA.

In either case, you should discuss what documentation you do have with your accountant or tax advisor, so they can decide how to proceed.

More important are the tax returns for each year. They contain the information telling you how much of your contributions were deducted (pre-tax), and how much were never deducted (after-tax).

Frequently asked questions

IRS Form 5498 is used to report contributions into any IRA. This includes traditional IRAs, Roth IRAs, SEP (Simplified Employee Pension) IRAs, SIMPLE (Savings Incentive Match PLan for Employees) IRAs and Inherited IRAs.

IRS Form 5498 is used to report any money or assets transferred into an IRA. This includes contributions, catch up contributions, rollovers from another retirement account, Roth conversions into the IRA, and recharacterizations of Roth contributions.

The deadline for taxpayers to receive their Form 5498 from their IRA custodian is May 31 of the following tax year. If the due date falls on a weekend or federal holiday, then Form 5498 is due the following business day.

There are three copies of each Form 5498 issued. They contain identical information and they each go to different parties:

Copy A: Copy A goes to the Internal Revenue Service.

Copy B: Copy B goes to the taxpayer. This is the copy you should expect to receive from your IRA trustee or IRA custodian.

Copy C: Copy C is retained by the IRA custodian.

Most likely, not. Form 5498 is an informational form and not required to file a tax return. If you do Roth conversions, you may need your Form 5498s, as well as your old tax returns, so your tax preparer properly calculate your tax liability, or in case of an IRS audit.

Where can I find a copy of IRS Form 5498?

Your IRA custodian should give you a copy of IRS Form 5498 after the end of the tax year. However, we’ve enclosed a copy of the latest version for your convenience.

Thanks for sharing this info.

I do have a question. Does FMV mean the sum of all deductible and non-deductible contributions to this plan?

FMV means the fair market value of all investments in the plan at year end. If a decedent’s name is shown, then it may be the FMV on the date of death. But either way, it includes all contributions and investment growth in the plan.