IRS Form 1310 Instructions

Dealing with the death of a loved one is very difficult. In addition to the emotional loss, the family of the deceased person often has to deal with financial difficulties.

Unfortunately, that includes dealing with taxes. A surviving spouse, or the executor of the decedent’s estate, is usually responsible for filing a final tax return on the decedent’s behalf.

But if there was already a tax return filed, and the decedent was owed a refund? That refund now should go to his estate, and eventually to his beneficiaries.

That’s where IRS Form 1310 comes in. This in-depth article will explain, what you need to know if you are claiming a refund on behalf of a deceased taxpayer’s estate.

Table of contents

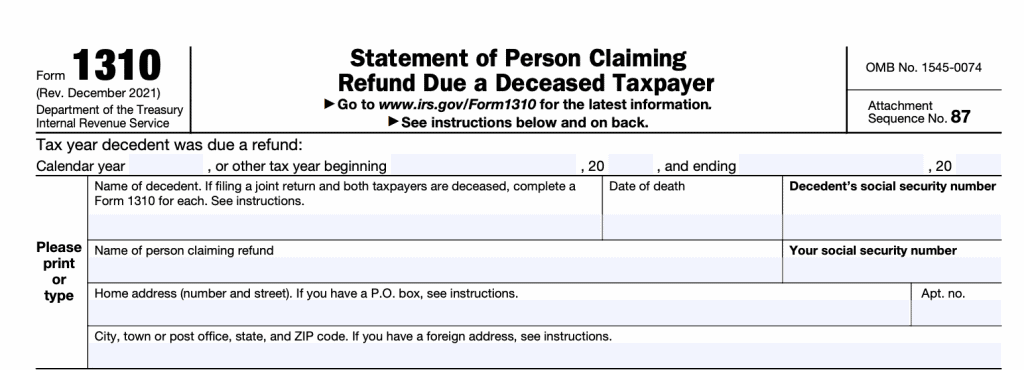

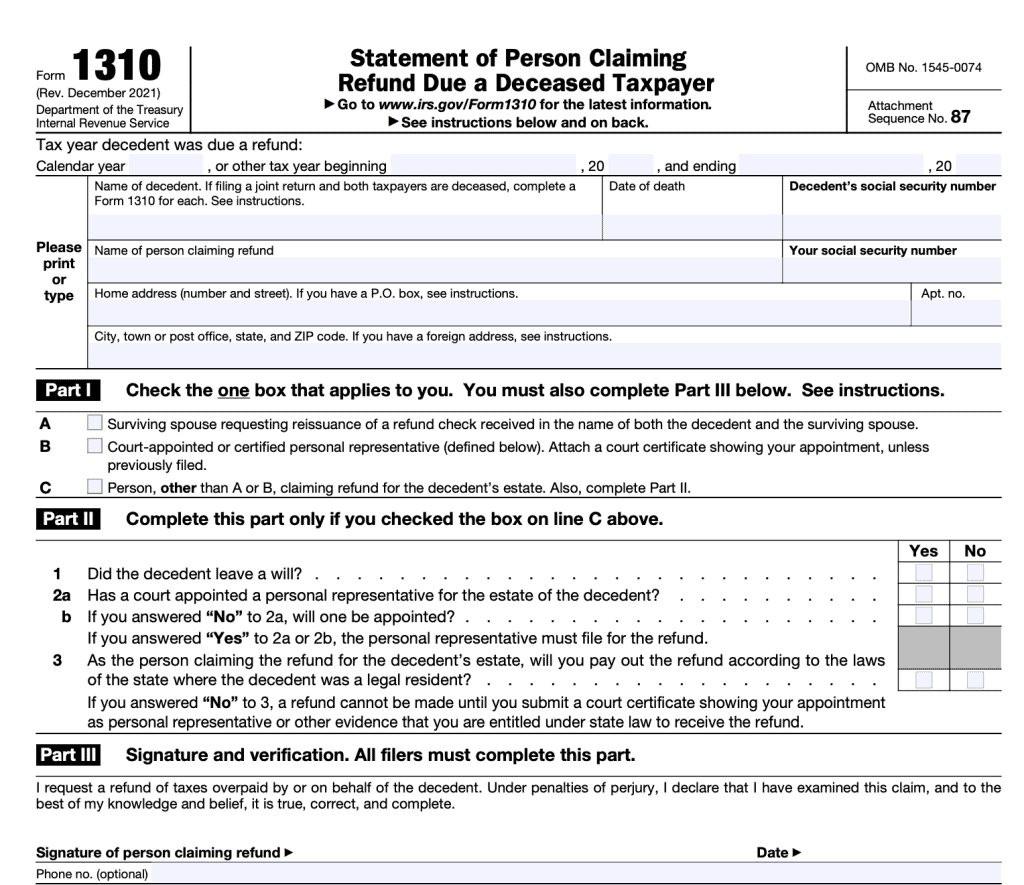

Let’s begin by walking through Form 1310, step by step.

How to file IRS Form 1310

In this section, we’ll go through each part of the form, step by step. That way, you’ll have a better understanding of how to complete the form.

There are 3 parts to this form (4, if you count the personal information field above Part I). Let’s start with that field first.

Taxpayer information

This section is fairly straightforward. Most blocks are self-explanatory.

But if there are blocks with additional instructions, they are outlined for your benefit.

Tax year decedent was due a refund

Most individual taxpayers file tax returns in which the tax year and calendar year are identical. In the case that they might not be identical, you would need to know how the decedent filed for previous tax years.

Decedent’s name

Usually, there is one decedent’s name. In the case that the refund is for a joint return, and both taxpayers are deceased, then you would:

- Complete a Form 1310 for each taxpayer

- Attach both forms to the joint tax return as you file it.

Decedent’s date of death

Enter the decedent’s death as shown on his or her death certificate.

Decedent’s Social Security number

Enter the SSN of the deceased.

Name of person claiming refund

Enter the name of the person who is claiming the deceased taxpayer’s tax refund.

Social Security number

Enter the claimant’s SSN.

Home Address

Enter the home address for the claimant.

City, state, and zip code

Enter the claimant’s city, state, and zip code.

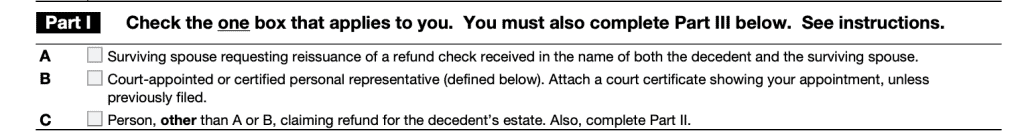

Part I

Part I is pretty straight forward as well. You will only check one box in Part I.

Line A

Check the box in Line A if you are a surviving spouse and you are requesting a refund check to be reissued in your name only. This might be necessary if you filed a tax return together, received a refund check in both your names, but you cannot deposit the check.

If you check this box, you can return the joint-name check by writing “VOID” across the front. You’ll send this check along with the completed form to your local IRS office or the Internal Revenue Service Center where you filed your return. You’ll also have to send a written request for reissuance of the refund check.

Once the IRS receives this, they will issue a new check in your name and mail it to your address.

If you check the box in Line A, you can skip Part II and sign Part III below.

Line B

Check the box in Line B if you are a court-appointed or certified personal representative claiming a refund on Form 1040X (Amended U.S. Individual Income Tax Return), or IRS Form 843, Claim for Refund and Request for Abatement.

If you check Line B, you will need to attach a court certificate showing your appointment. If you’ve previously filed paperwork with this certificate attached, you do not need to do this again. Instead, you’ll complete Form 1310 and write “Certificate Previously Filed” at the bottom of the form.

If you check the box in Line B, you can skip Part II and sign Part III below.

What is a personal representative?

According to the instructions, the IRS considers a personal representative to be the executor or administrator of the estate for the deceased individual, as recognized or appointed by the court. The IRS specifically disallows a copy of the decedent’s will as proof that someone is a personal representative.

Line C

Check the box in Line C if you have to fill out the form, but neither of these apply to you. If you select Line C, you must accompany the Form 1310 with proof of death. Proof of death can be either:

- Copy of the death certificate

- Formal notification from the appropriate government office informing the next of kin of the decedent’s death. For example, the surviving spouse of a deceased service member would send a copy of the Department of Defense notification letter.

If you select option C, you’ll need to complete Part II before signing Part III below.

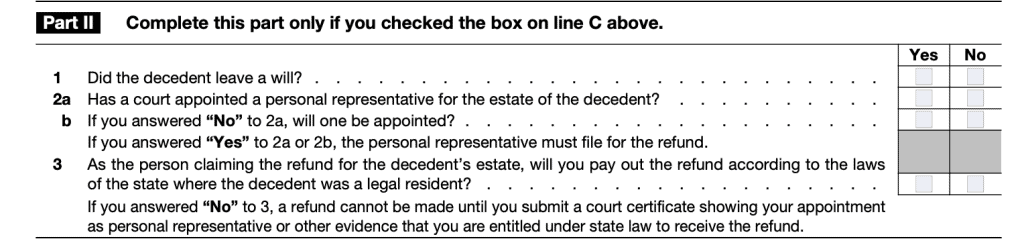

Part II

This section is required only if you are not a surviving spouse requesting a reissued refund check, and you are not a court-appointed personal representative of the decedent’s estate.

Each of these blocks is self-explanatory. Question 3 asks you to affirm that you will pay the tax refund to the decedent’s estate according to the laws of the state where the decedent was a legal resident.

If you do not do this, the IRS will not issue the refund to you. And if you affirm this, but later renege on this commitment, the federal government can hold you accountable (see Part III below).

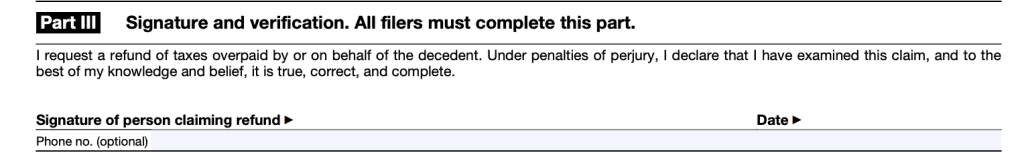

Part III

This section is simply the signature field that affirms the accuracy of this filing. Please note, this signature is under the penalty of perjury.

So if you filled out Part II above, and you selected “Yes” to Question 3, then you are binding yourself to a legal obligation.

What is IRS Form 1310?

According to the IRS website, Form 1310 is known as a Statement of Person Claiming Refund Due a Deceased Taxpayer. In other words, if the Internal Revenue Service owes a taxpayer money that hasn’t already been accounted for, then a personal representative of the taxpayer’s estate would file Form 1310 on the decedent’s behalf.

The purpose of this form is to notify the IRS that the taxpayer has died. This form gives the Internal Revenue Service instructions on where to forward the tax refund check.

Who must file IRS Form 1310?

According to the tax form, you must file Form 1310 both of the following conditions apply:

- You are NOT a surviving spouse who is filing a joint return with the decedent. This could be an original or amended joint return.

- You are NOT a personal representative of the decedent, filing an original tax return on the decedent’s behalf. This could be IRS Form 1040, 1040-SR, 1040A, 1040EZ, 1040NR, or 1040NR that has a copy of the court certificate showing your appointment attached.

In other words, if the decedent’s refund hasn’t already been accounted for in a tax return filing after the decedent died, then an IRS Form 1310 must be filed.

Case study examples

To help better understand the use of Form 1310, we’ve included a couple of case studies. The first involves a situation where the taxpayer should file Form 1310, while the second walks through an example where the beneficiary does not need to file in order to claim the decedent’s unpaid tax refund.

Taxpayer filing IRS Form 1310

Jane Smith is the personal representative and sole heir to her father’s estate. Her father’s accountant noticed an error in a previously filed tax return and is filing an amended tax return on behalf of Jane’s father’s estate.

As the sole heir, Jane will eventually receive the refund. However, to properly receive the money, she would follow the tax code:

- As the personal representative, Jane would sign the amended tax return AND the Form 1310.

- Jane would accompany the tax forms with a copy of the court certification.

- Jane would receive the funds on behalf of her father’s estate, into a banking account in the name of the estate.

- Jane, at her discretion as personal representative, would issue a check to her self as the beneficiary.

Taxpayer doesn’t have to file IRS Form 1310

Using the above example, let’s imagine that Jane’s father died before he was able to file an income tax return for the previous tax year. As his estate’s personal representative, Jane would file an income tax return on behalf of the estate.

If the income tax return shows that Jane’s father was due a refund, Jane would not need to file IRS Form 1310. Jane would simply attach a copy of the court certificate to the tax return showing that she was appointed personal representative.

Video walkthrough

Frequently asked questions

Anyone who expects to receive an income tax refund on behalf of a decedent should file IRS Form 1310 if he or she is:

-A surviving spouse who is requesting that the IRS reissue a refund check in the surviving spouse’s name only, OR

-A court-appointed personal representative who is requesting a refund from an amended tax return or filing IRS Form 843-Claim for Refund and Request for Abatement, OR

-A beneficiary or personal representative requesting a refund to be disbursed to the decedent’s estate.

For a surviving spouse requesting a reissued refund check, you can return the joint-name check with Form 1310 to your local IRS office or the IRS Center where you filed your return.

If you checked the box on Line B or Line C, then you can either send the completed form to the IRS center where you filed the original tax return, or follow the instructions for the form to which you are attaching Form 1310.

If the original federal return was filed electronically, mail Form 1310 to the IRS Center designated for the address on the form. See the instructions for the original return to obtain the address.

If filing with an amended tax return, you may attach IRS Form 1310 to the amended return. However, you do not need to attach IRS Form 1310 to a previously filed tax return or a future tax return.

There are certain tax preparation software programs that may be able to electronically file IRS Form 1310. However, you should discuss this with a qualified tax professional to avoid filing errors.

Generally speaking, a surviving spouse or personal representative (usually the executor of the decedent’s estate) will claim the refund on behalf of the taxpayer. But there are certain circumstances where this form might not be required.

If you are a beneficiary who is not the surviving spouse, filing this form does not forward the refund to you directly. It simply instructs the IRS to send the check to the decedent’s estate.

From there, it is the personal representative’s responsibility to ensure the money is properly distributed according to the decedent’s wishes and the laws of the state.

Where can I get a copy of IRS Form 1310?

You may download a copy of the IRS Form 1310 from the IRS website or by selecting the file below.

Related forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!