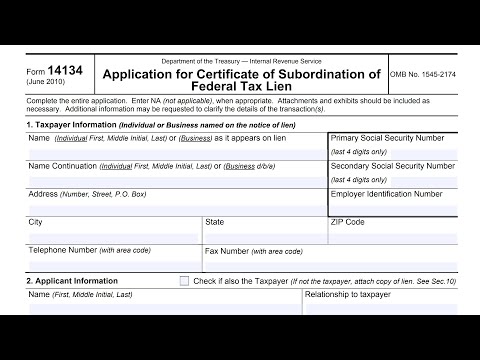

IRS Form 14134 Instructions

Taxpayers who receive a notice of federal tax lien (NFTL) can usually expect a tax lien on their property until they have paid the federal government their full tax liability, plus interest. However, federal law does allow the Internal Revenue Service to subordinate a federal tax lien if it’s in the government’s best interest to do so. This article will walk you through using IRS Form 14134 to do just that.

Additionally, we’ll cover:

- Different ways you might get rid of a tax lien, even if you can’t fully pay your tax bill

- Why you might consider subordinating a tax lien

- How to request a federal lien subordination

Let’s start by going step by step through the form instructions.

Table of contents

How do I complete IRS Form 14134?

This three-page tax form might seem intimidating, but it’s pretty straightforward. Let’s walk through this, step by step.

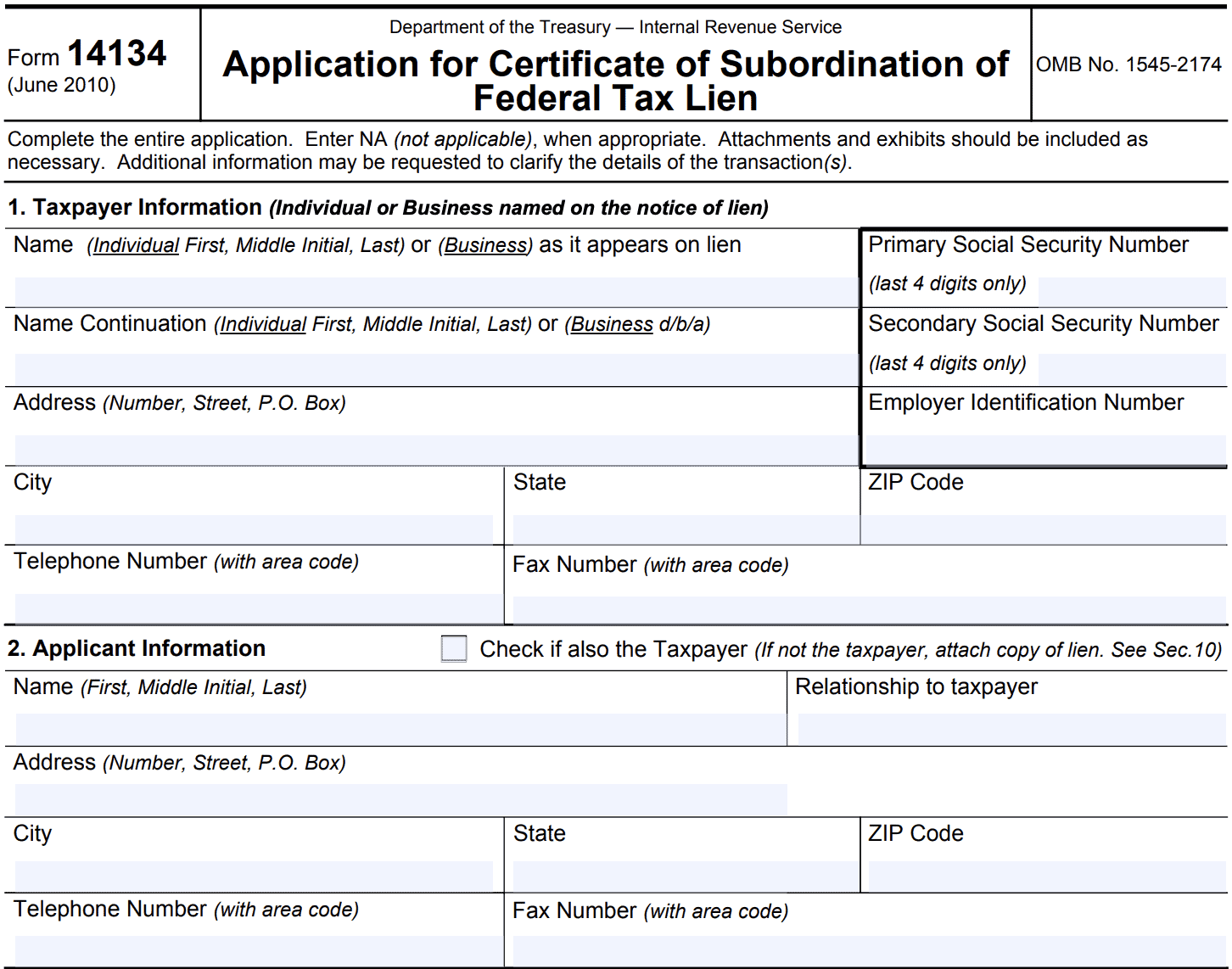

Line 1: Taxpayer information

In Line 1, enter the taxpayer name as it appears on the notice of federal tax lien. If necessary, there is a second line for a spouse or other business name, if applicable.

Enter the last 4 digits of the SSN, as appropriate, or the employer identification number (EIN). Complete the address information as it appears on the tax lien, including:

- Street number and street name

- City

- State

- Zip code

- Phone number

- Fax number (if applicable)

Line 2: Applicant information

If the taxpayer is the same person as the applicant, check the box and proceed to Line 3. Otherwise, attach the applicant’s name, relationship to the taxpayer, and contact information below.

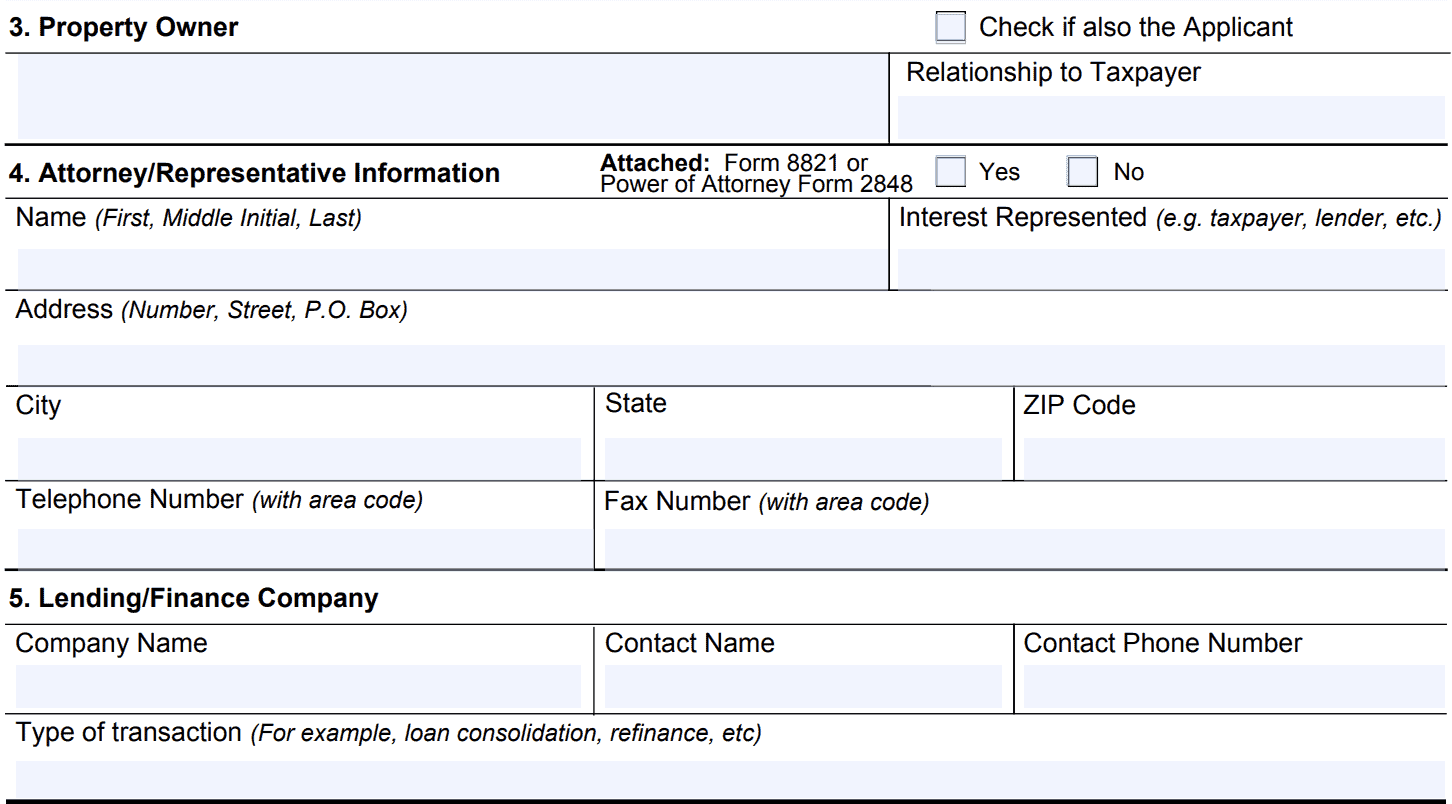

Line 3: Property Owner

Check the box if you are the applicant and property owner.

Otherwise, name the property owner and list their relationship to the taxpayer.

Line 4: Attorney or representative information

If you’ve authorized someone access to your tax information on IRS Form 8821, or designated a power attorney using IRS Form 2848, select “Yes” and attach a copy of that form to this request and complete the rest of the field.

Otherwise, enter “No” and move on to Line 5.

Line 5: Lending/Finance company

List the name of the lending institution involved in this lien subordination. Enter the contact information and phone number as well as the type of transaction involved (consolidation loan, cash-out refinance, etc).

Line 6: Monetary information

Enter the following information:

- Amount of current loan (if you are refinancing debt)

- Amount of your new loan

- Amount to be paid to the U.S. government (Section 6325(d)(1) applications only)

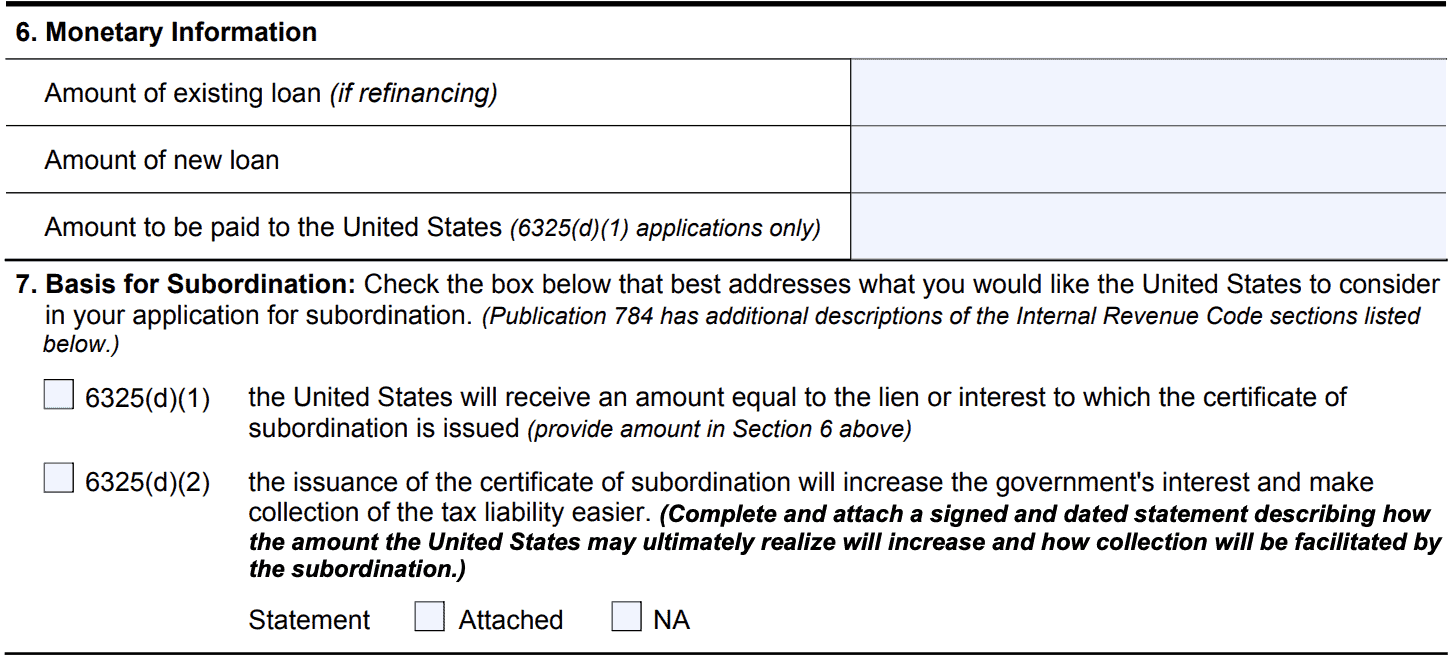

Line 7: Basis for subordination

Choose the appropriate box, based upon the situation you feel is best represented by your request:

- 6325(d)(1): The U.S. Government receives a certain amount of money based upon the lien

- 6325(d)(2): The subordination will make it easier for the taxpayer to pay the U.S. government.

If you select the latter, you must complete and attach a signed statement describing how this will improve.

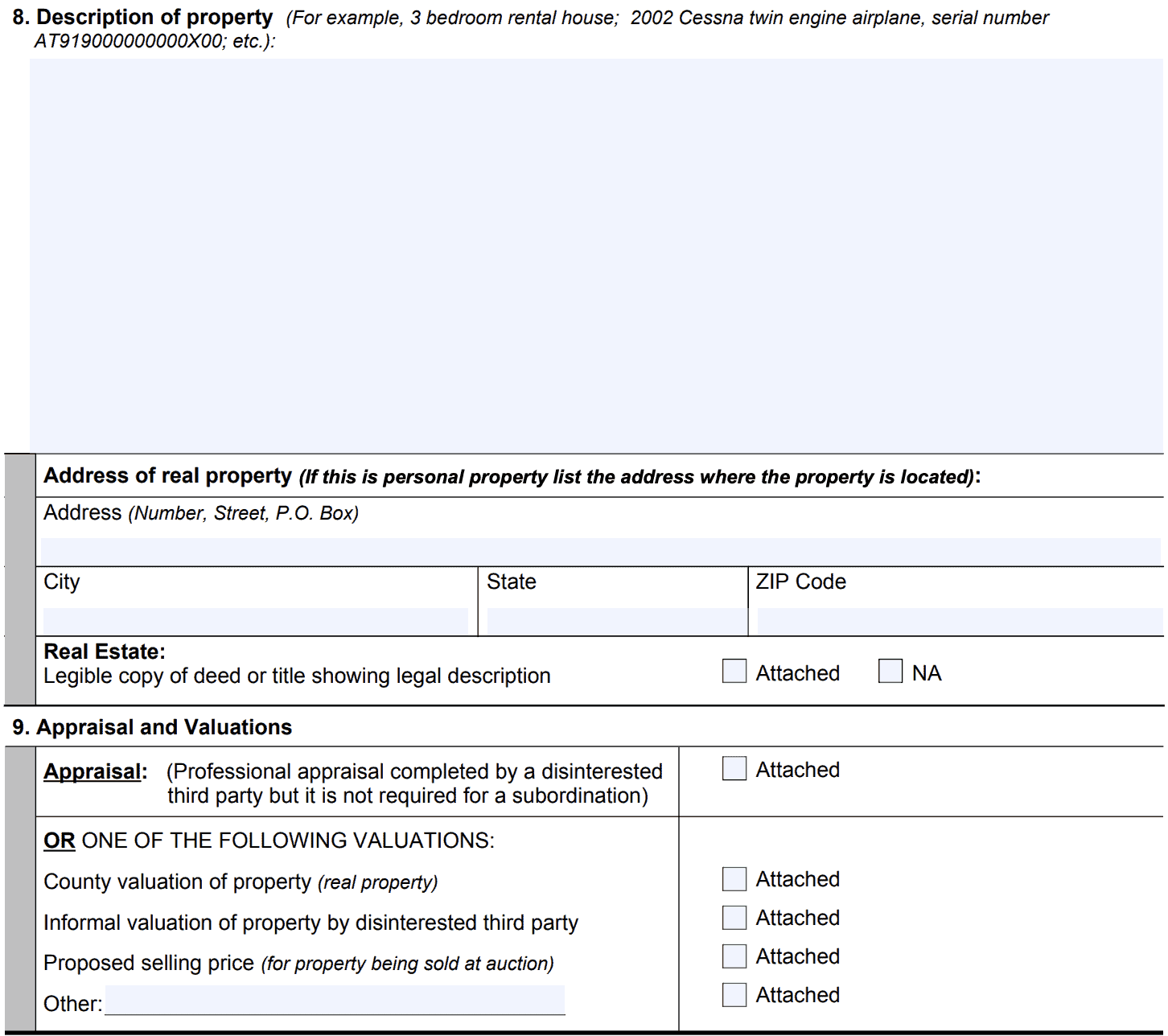

Line 8: Description of property

Give an accurate description of the property at hand.

When the property is real estate, include the type of property.

For example, 3-bedroom house; etc. Also list the property address. Attach a copy of the deed, if you have one, and select the appropriate box.

When the property is personal property, include serial or vehicle numbers, as appropriate.

For example, 2002 Cessna twin engine airplane, serial number AT919000000000X00; etc.

Line 9: Appraisal and Valuations

Check the block if you’ve attached a professional appraisal completed by a disinterested third party.

If not applicable, attach one of the following types of valuations:

- County valuation (real property)

- Informal valuation by disinterested third party

- Proposed listing or selling price

- Other

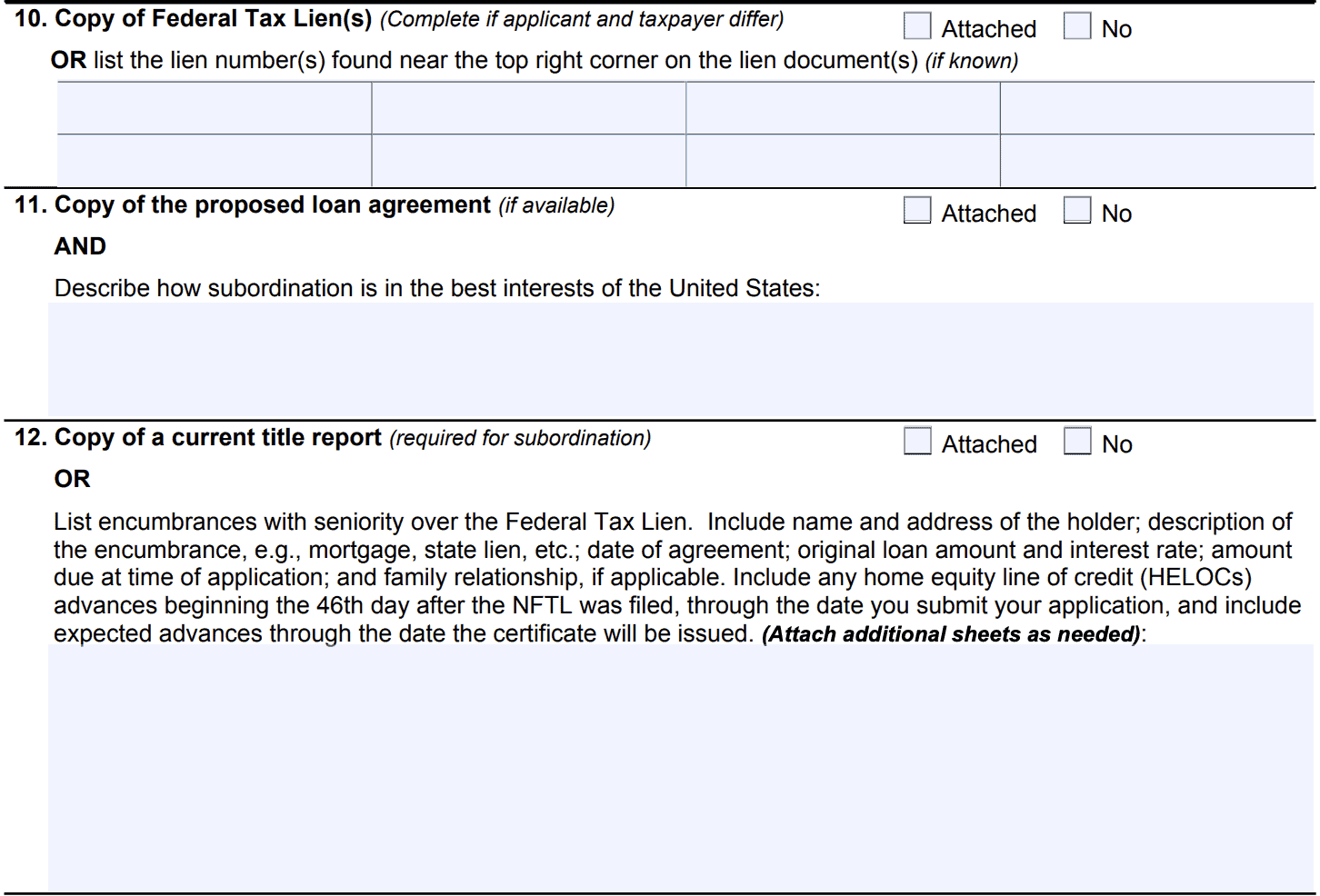

Line 10: Copy of federal tax lien(s)

List the lien number(s) of any applicable federal tax lien or liens. Check the ‘Attached’ box if you’ve attached a copy. If you do not know the lien number, state, “Unknown.”

Line 11: Copy of proposed loan agreement (if available)

Attach a copy of the loan agreement. Also describe how lien subordination is in the United States’ best interest.

Line 12: Copy of current title report

Attach a copy of the title report. If you cannot, check ‘No” and use the provided space to list any liens or claims against the property and whether those claims are senior to the United States’ lien interest.

Include:

- Name and address of the lien holder

- Description of the claim

- Date of agreement

- Original loan and interest rate

- Amount due at application

- Whether there was a family relationship

Home equity loans: The NFTL takes priority over advances made via a home equity line of credit (HELOC) on the 46th day after the NFTL is filed.

Line 13: Copy of proposed closing statement

Select the ‘attached’ box if you plan to send a draft copy of the closing statement.

Otherwise, use the space provided to itemize all proposed costs, commissions, and expenses to refinance the property

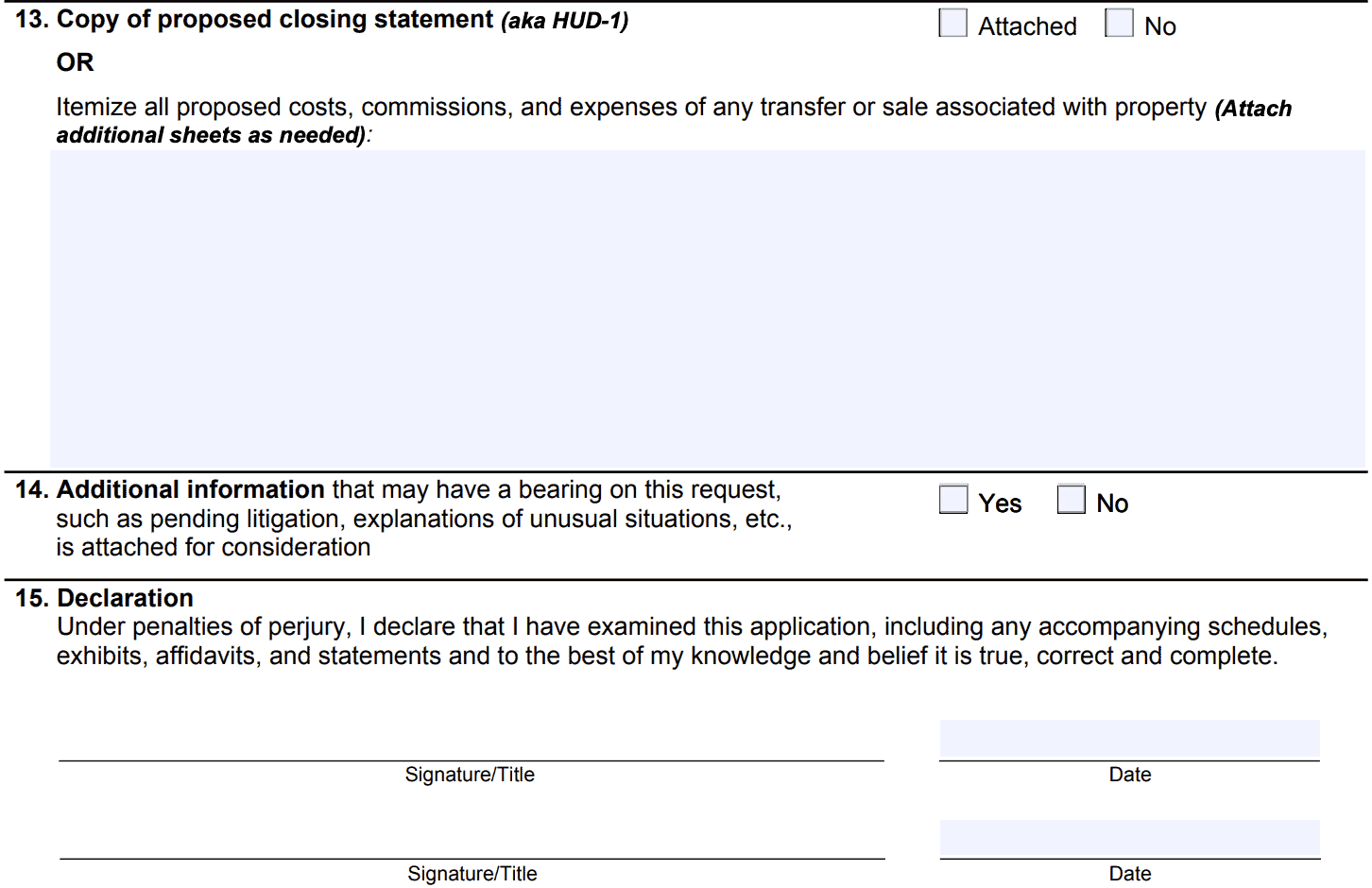

Line 14: Additional information

If there is additional information, select “Yes” and attach to this form. Additional information could include:

- Pending litigation

- Written explanation of extenuating circumstances

- Affidavits

- Court documents

Line 15: Declaration

In Line 15, you (and your spouse, if applicable) will sign and date the form. Please note that this attestation is made under the penalty of perjury.

How can I get rid of a tax lien if I cannot pay my full tax bill?

According to the Internal Revenue Service, the best way to completely rid yourself of a federal tax lien is to completely pay off your outstanding tax debt. The IRS website states that an IRS lien release occurs within 30 days of full payment of all federal taxes, plus any tax penalties and interest.

However, the IRS recognizes certain instances where it might be in the best interest of the taxpayer and the IRS to reduce the impact of a tax lien if a federal lien release is not feasible. There are three alternative options that the IRS offers, provided that they serve the best interests of both the government and the taxpayer.

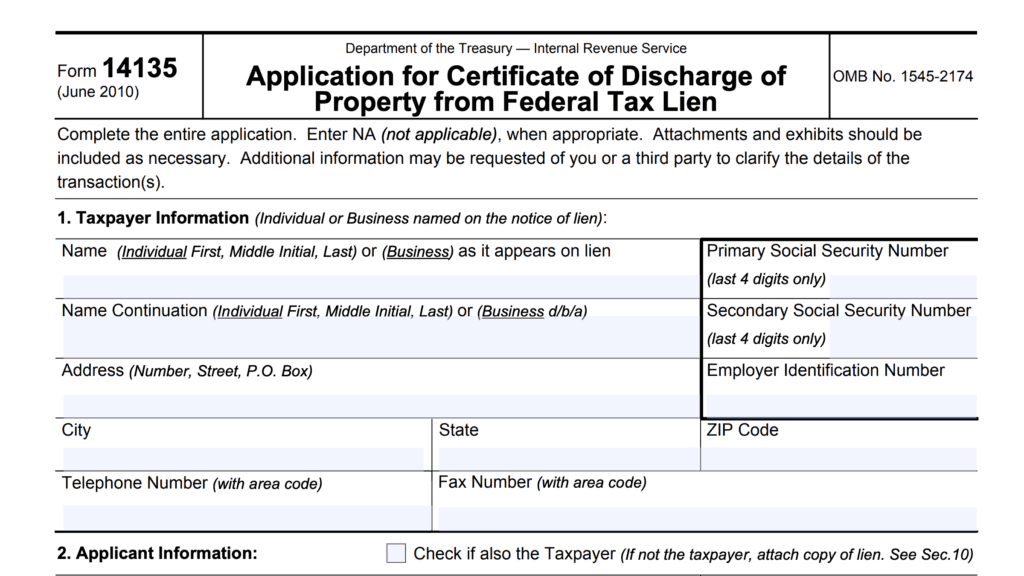

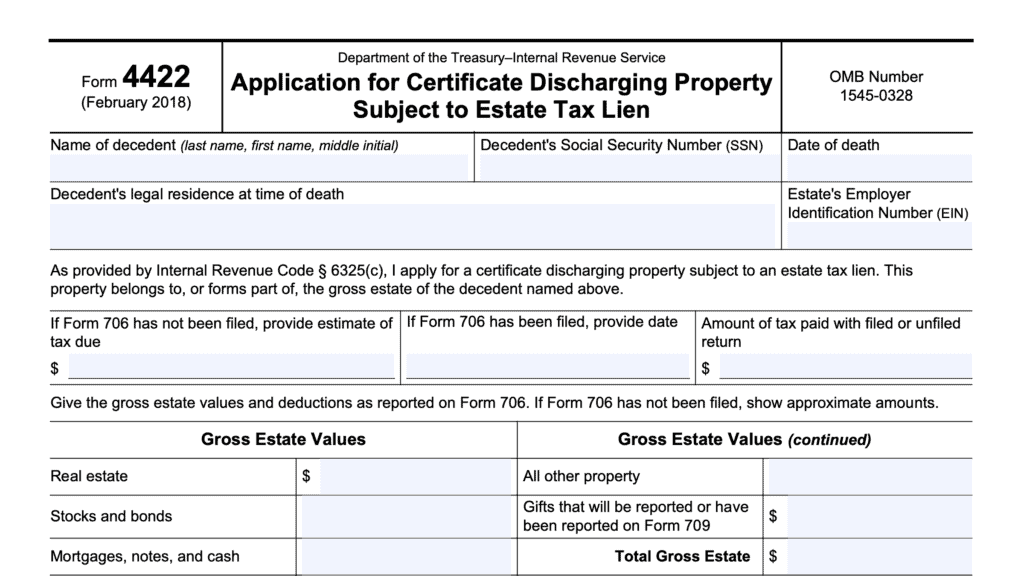

Discharge of property

A lien discharge does not absolve the taxpayer of the unpaid taxes they still owe. However, it removes the government’s legal claim to the property from the property itself.

When might I be able to obtain a discharge of property from a tax lien?

Internal Revenue Code Section 6325(b) authorizes the discharge of property secured by a federal tax lien under one of the following circumstances:

- Fair market value of the property secured by the lien is at least twice the amount of the lien and all other debts associated with the property

- Most applicable to real property in a rising real estate market

- Lien has been partially satisfied, and/or the federal government determines that their interest in the property has no value

- The property is sold and the available funds are held in a separate account that the U.S. government has the same priority over the funds as with the property

- Taxpayer either:

- Makes a payment equivalent to the amount secured by the lien

- Furnishes a bond acceptable to the federal government for the amount secured by the lien

A lien discharge might be a good idea for taxpayers with a lien on real estate that they are trying to sell or refinance. IRS Publication 783 contains more information on how to obtain a certificate of discharge from federal tax lien.

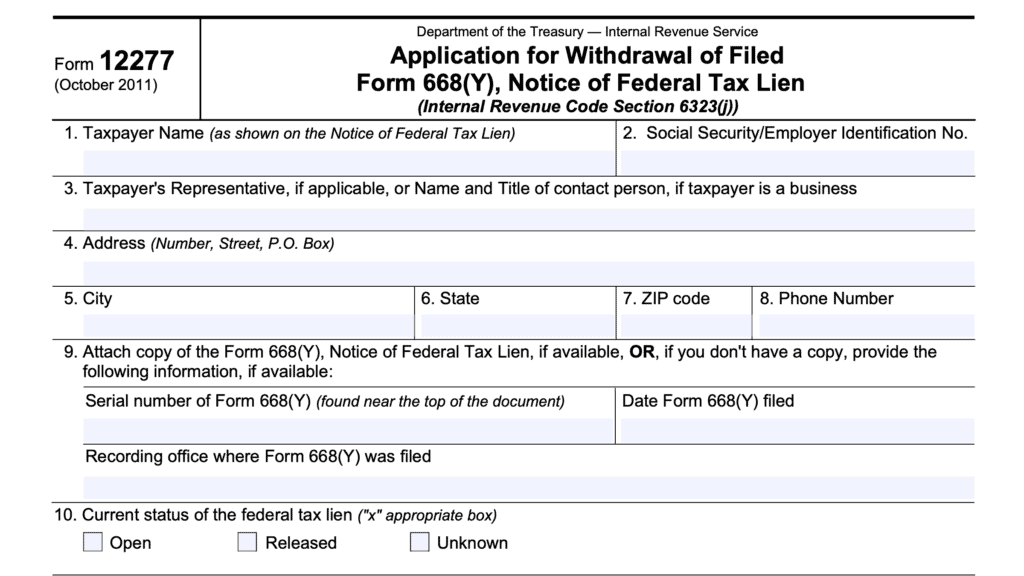

Withdrawal of a tax lien

IRC Section 6323(j) states that the federal government may withdraw notice of a federal tax lien under one or more of the following circumstances:

- The IRS or the Treasury Secretary determines that the lien notice was premature or otherwise not filed according to established procedures

- The taxpayer has entered into a direct debit installment agreement with the IRS

- Withdrawal of the lien notice will actually facilitate collection of the tax, or

- With the consent of the Taxpayer Advocate or at the Taxpayer Advocate’s recommendation that a tax lien withdrawal would be in the federal government’s best interest

We’ve written extensively on how to obtain a tax lien withdrawal by filing IRS Form 12277.

Subordination of a tax lien

Federal law also allows the IRS to subordinate their tax lien so that another creditor may move ahead of the IRS in position. This may be particularly helpful for taxpayers who are looking to refinance their mortgage, but have been consistently paying their taxes.

IRC Section 6325(d) states that the federal government may subordinate a federal tax lien under one of the following circumstances:

- The taxpayer has made an additional payment equal to the amount of the lien or interest to which the certificate subordinates the lien of the United States

- The federal government believes that subordinating the tax lien will help the taxpayer continue to pay down their tax liability

IRS Publication 784 contains additional information on how a taxpayer may request a subordination of their tax lien.

Let’s move on to some background information on IRS Form 14134 and what it does.

What is IRS Form 14134?

IRS Form 14134, Application for Certificate of Subordination of Federal Tax Lien, is the tax form a taxpayer may file to request the federal government subordinate their tax lien to other lienholders on a certain property.

Let’s take a moment to fully discuss lien subordination and why IRS tax lien subordination is even a possibility.

What is lien subordination?

Lien subordination involves multiple lienholders who may hold a legal claim to the same property.

When this occurs, there exists a hierarchy. This means that if the property owner defaults on their debt, and the property is liquidated, the most senior debt gets paid first. After the entire debt is resolved, the remaining proceeds go to pay next senior debt, and so on. The most junior debt is the last to be paid, if at all.

Specifically, lien subordination refers to one lender willingly allowing another lender’s debt to take a higher priority than their own. In the case of tax debt, the federal government usually is the most senior debt. But when in federal tax lien subordination, the IRS willingly allows another lender to take a higher priority.

Why would the IRS subordinate a lien?

The IRS will issue a certificate of subordination of federal tax lien for one reason only: when it determines that it is in the government’s interest to do so.

But why would subordinating federal tax debt be in the government’s best interest?

Subordinating IRS tax debt to a primary lender, such as a mortgage lender, might make sense when:

- There is enough equity in the property (i.e. real estate) to allow debt restructuring

- Restructuring the debt allows more affordable payment options

- The lender will not restructure the debt unless they’re the senior lender

For instance, let’s imagine a taxpayer looking to refinance their house. If they can refinance at a lower interest rate than their current rate, that might help them lower their monthly payment or take out equity to pay their tax debt.

So if a lender requires IRS lien subordination, the IRS might consider this option. As long as it’s in the government’s best interest. There are two ways the government can determine this.

Two ways the government can grant subordination

There are two references of the federal law under which the federal government can grant lien subordination:

- IRC 6325(d)(1): a subordination may be issued under this section if you pay an amount equal to the lien or interest to which the certificate subordinates the lien of the United States

- IRC 6325(d)(2): a subordination may be issued under this section if the IRS determines that the issuance of the certificate will increase the amount the government realizes and make collection of the tax liability easier.

Since this is part of the request, we’ll go into each in a little more detail.

IRC 6325(d)(1)

Under this authority, the U.S. government is willing to subordinate its loan if it receives a sufficient down payment. IRS Publication 784, How to Apply for a Certificate of Subordination of a Federal Tax Lien, gives the following example:

Mortgage refinance example

Let’s imagine that you’re refinancing a mortgage so you can withdraw money. The IRS will allow you to pull money out, as long as you use some of that money to pay down your back taxes.

| New mortgage | Old mortgage | |

| Fair market value | $200,000 | N/A |

| Refinance | $160,000 | $145,000 |

| Closing costs | $4,800 | N/A |

| United States’ interest | $10,200 | N/A |

In this example. the United States’ interest is the equity you obtain from your refinanced loan after paying off the existing loan of $145,000 and paying the closing costs to obtain the loan.

($200,000 property value x 80% loan to value ratio = $160,000 refinance loan amount. $160,000 –

$145,000 loan payoff = $15,000 potential equity. $160,000 x 3% = $4800 closing costs to obtain the loan. $15,000 potential equity – $4,800 closing costs = $10,200)

The IRS would ask for $10,200 in return for the United States subordinating its interest to the refinanced loan. The lien remains on the property but the refinanced loan has priority over the lien.

IRC 6325(d)(2)

Here, the IRS may allow lien subordination if it frees up cash flow and allows the taxpayer to make larger monthly payments on their IRS debt.

The example that the IRS provides is that of a car dealership.

Car dealership example

AAA Auto Sales currently pays the IRS $2000 per month on a $120,000 tax debt.

Their inventory needs replenishing but their wholesaler is reluctant to provide added inventory because of the federal tax lien.

AAA requests subordination and provides the IRS with documentation that an inventory replenishment of 500 cars could allow them to increase their monthly payment to $3000 as well as increase their pay back rate to biweekly.

In this example the United States’ interest would be second on the new inventory, if the subordination is granted.

Let’s walk through the tax form itself.

Video walkthrough

Watch this instructional video for detailed guidance on completing Form 14134.

Frequently asked questions

You may consider filing Form 14134 to subordinate your tax lien if you are looking to consolidate or refinance existing debt. By subordinating your federal lien, you may be more likely to have your refinance approved by the lender.

The federal government will consider subordinating your tax lien to other creditors if it is believed to help improve your ability to pay your existing tax debt, or if the federal government receives a significant payment as a result of the lien subordination and subsequent refinance.

If the IRS denies your request for lien subordination, you should receive a notification letter from the IRS with a written explanation. You may consider appealing this determination on IRS Form 9423, Collection Appeal Request.

Where can I find a copy of IRS Form 14134?

You can find this tax form on the IRS website. However, the simplest way is to download the file below.