IRS Form 8879 Instructions

If you’re having your individual income tax returns prepared by a tax professional, odds are likely that your tax preparer will ask you to sign IRS Form 8879. This in-depth guide will walk you through:

- What IRS Form 8879 is

- Why it is required with your tax return

- Step by step instructions so you know what to expect

Let’s start with step by step instructions for completing Form 8879.

Table of contents

IRS Form 8879 Instructions

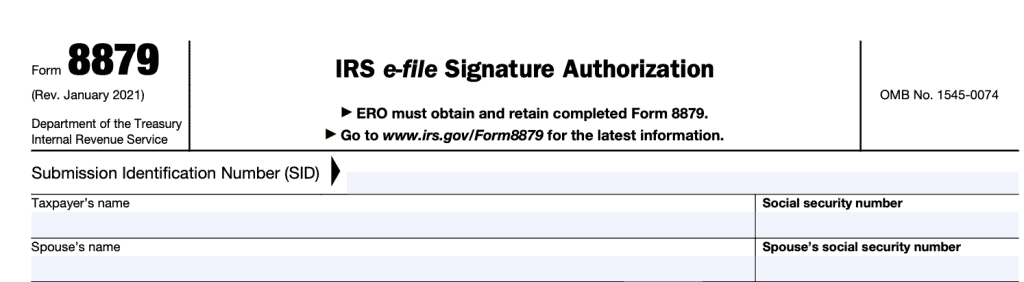

The instructions contain 3 numbered parts, as well as a taxpayer information field at the top. Before we get into the numbered parts, let’s look at the top field.

Taxpayer Information

At the top of the form, there are 5 entries:

- Submission identification number: This is the unique number assigned by the IRS for each tax return.

- Taxpayer’s name

- Taxpayer’s Social Security Number

- Spouse’s name

- Spouse’s Social Security Number

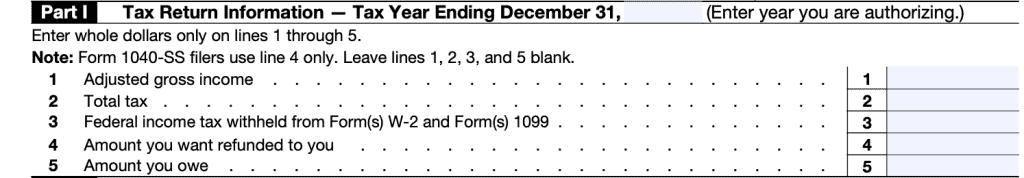

Part I-Tax Return Information

In Part I, your ERO will enter certain numbers from the current year tax return:

- Adjusted gross income (AGI)

- Total tax

- Federal income tax withheld

- Amount you want refunded

- Amount you owe

Since your ERO is using electronic filing, all of this information is automatically imported from the Form 1040 itself.

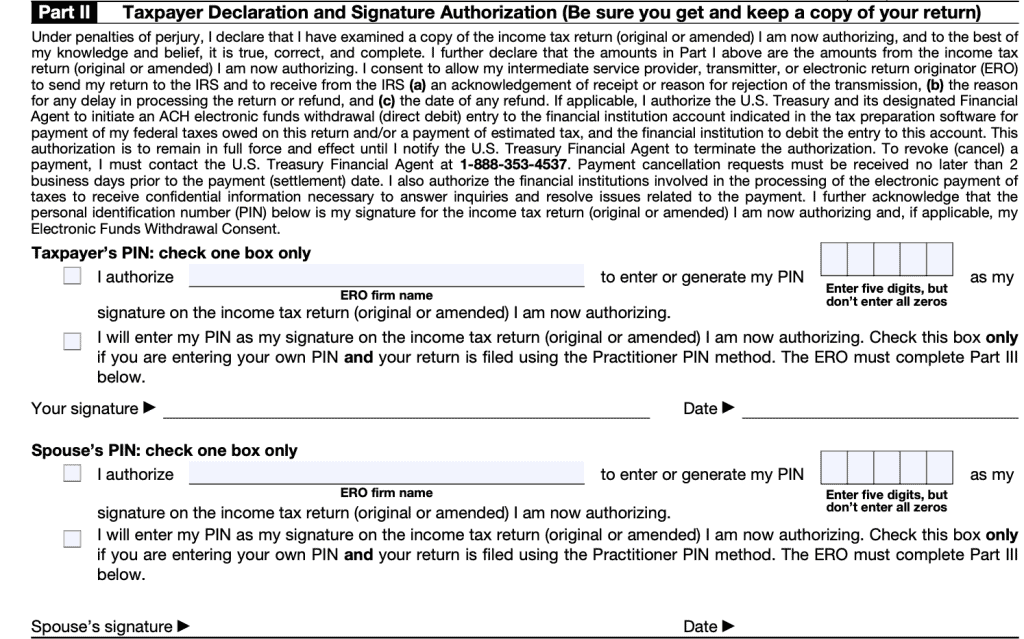

Part II-Taxpayer Declaration & Signature Authorization

After you’ve completed Part I, you’ll move onto Part II. This part contains two sections.

The first section simply states everything that the taxpayer acknowledges with their electronic signature, or with their personal identification number. Below is a summary of what the taxpayer acknowledges:

- The taxpayer has actually looked at a copy of the return. Furthermore, the taxpayer believes the reported information to be true to the best of their knowledge

- The taxpayer allows the ERO to send their electronic tax return to the IRS and to receive acknowledgement from the IRS that the completed return has been received

- The taxpayer authorizes the Treasury Department to initiate an electronic funds withdrawal from the taxpayer’s financial institution account

- That the five-digit PIN in Form 8879 is the taxpayer’s PIN and electronic signature for the authorized tax return

The second section requires the taxpayer (and spouse, if applicable) to check one of two boxes:

- First box authorizes the ERO to enter or generate a five-digit PIN on the taxpayer’s behalf. This serves as the taxpayer’s signature on the income tax return.

- Second box states that the taxpayer will enter their own PIN, AND that the tax return is being filed using the Practitioner PIN method.

If the second box is checked, then the ERO must complete Part III below. This section also cautions the taxpayer to retain a copy of this form for their personal files.

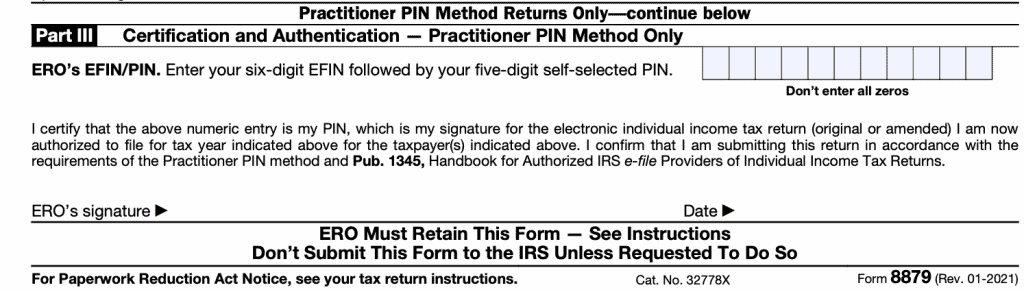

Part III-Certification & Authentication

If using the Practitioner PIN method, the ERO will complete Part III which contains:

- ERO’s EFIN/PIN: This 11-digit combination contains:

- The ERO’s six-digit electronic filing identification number (EFIN)

- The ERO’s five-digit PIN

- ERO signature

- Date

Additionally, there are some IRS instructions that each ERO must follow.

ERO Instructions

- Accurately complete the information in the form, based on the taxpayer’s return

- If authorized, enter or generate an electronic PIN on the taxpayer’s behalf

- Provide the taxpayer a copy of the completed Form 8879 with their completed return

- Properly maintain a copy of the form in their records

However, the taxpayer also has some responsibilities, as stated in the form.

Taxpayer responsibilities

According to the form instructions, each taxpayer must:

- Verify the accuracy of the income tax return being filed

- Either authorize the ERO to create a PIN or use their own PIN

- Sign and date the form

- Return the completed form to the ERO

Let’s take a look to some common taxpayer questions.

What is IRS Form 8879?

IRS Form 8879, IRS e-file Signature Authorization, is the declaration document that an electronic return originator (ERO) uses as proof that the taxpayer authorized electronic submission of a return. Specifically, the tax return preparer will use Form 8879 when:

- Using the Practitioner PIN method to file the electronic income tax return, OR

- The taxpayer authorizes the ERO to generate a PIN for the individual’s e-filed return

Video walkthrough

Frequently asked questions

The IRS instructs your ERO to accurately complete the return, enter the taxpayer’s PIN (if authorized), provide the taxpayer a copy of the form, and maintain a copy in their records.

The ERO keeps a copy of each accompanying Form 8879 in their files, along with each corresponding tax return.

The IRS does not require Form 8879 to accompany your federal income tax return. However, the IRS requires your ERO to maintain this form as proof of taxpayer authorization.

Furthermore, your ERO must maintain a Form 8879 for each tax year they submit your return.

A paid tax preparer or a tax preparation service must use the IRS e-file system if they anticipate “preparing and filing 11 or more Forms 1040 and/or 1041 during a calendar year,” unless there is an administrative exemption or approved hardship waiver.

An ERO is an electronic return originator. As defined by the Internal Revenue Service (IRS) website, an ERO is “the Authorized IRS e-file Provider who originates the electronic submission of a return to the IRS.” Generally speaking, your professional tax preparer serves as the ERO for your tax return.

Where can I get a copy of IRS Form 8879?

Your ERO will probably provide a copy of a completed form for your signature. However, you may also obtain a copy from the IRS website. For your convenience, the latest copy of this form is below.