IRS Form 8878 Instructions

If you’re requesting an extension on your income tax return, your tax return preparer may ask you to sign IRS Form 8878.

In this article, we’ll walk through this tax form, including:

- Step by step guidance on completing IRS Form 8878

- Why you may be asked to complete this form

- What your tax return preparer should be doing to protect your information

Let’s start by walking through this tax form, step by step.

Table of contents

How do I complete IRS Form 8878?

In general, taxpayers will only complete IRS Form 8878 if they’re working with a paid tax preparer. By using this form, the taxpayer enables one of two things to occur:

- Filing IRS Form 4868 using the Practitioner PIN method, or

- Electronic return originator (ERO) can enter or generate the taxpayer’s personal identification number on either:

If your tax professional asks you to complete Form 8878, it is to allow them to authorize him or her to sign and file one of your tax forms requesting an extension.

Let’s take a look at each section, starting at the top.

Taxpayer information

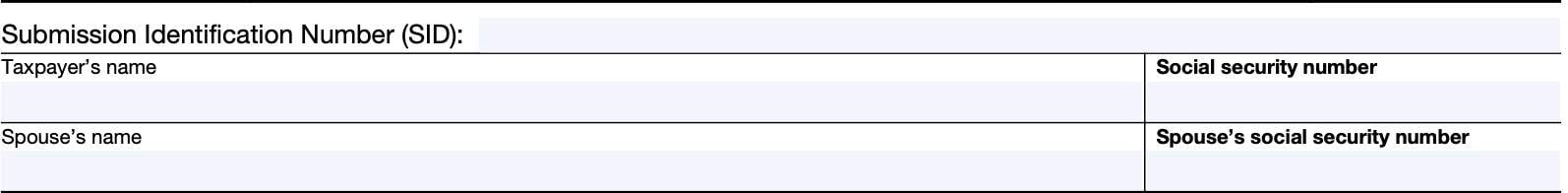

At the top of the tax form, you’ll see taxpayer information fields. Just above them, you’ll see Submission Identification Number (SID). Let’s take a closer look.

Submission identification number

This field will be completed by your tax preparer, which the IRS recognizes as the electronic return originator, or ERO.

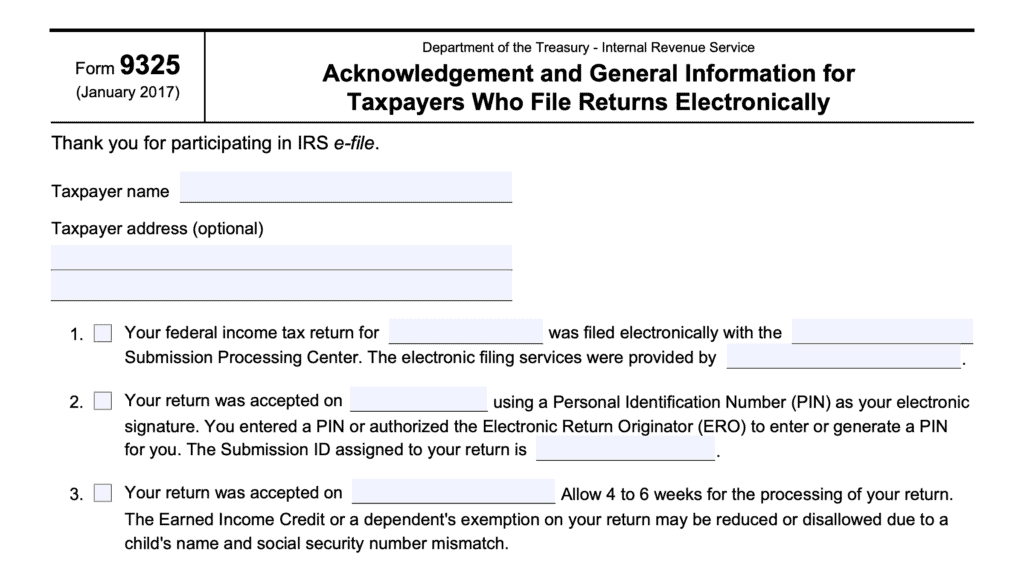

The Submission Identification Number (SID) is assigned to either your tax return extension form, or IRS Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically. The SID is a unique 20-digit number that is assigned to each individual tax return.

Your electronic return originator’s office must obey certain IRS records retention requirements to maintain this information for future reference.

Taxpayer’s name and Social Security number

At the top, just below the SID field, you’ll see space for the taxpayer name and Social Security number (SSN). For taxpayers with a filing status of married filing joint tax returns, you’ll need to enter your spouse’s name and SSN in the field as well.

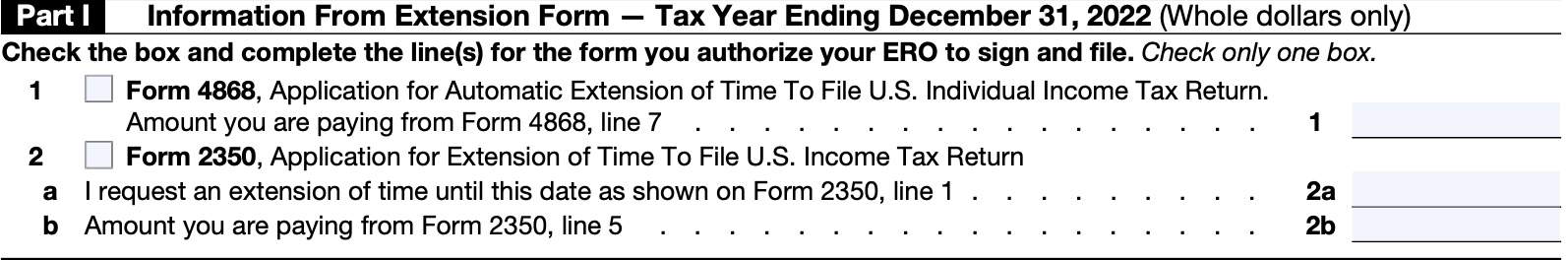

Part I: Information from Extension form

In Part I, you’ll check the appropriate box, depending on which tax extension form you are filing.

Line 1: Form 4868

You’ll check Box 1 if you are applying for the automatic six month extension of time from your original due date to October. You’ll also include the Line 7 amount indicating how much money, if any, you are paying with your tax return extension request.

Line 2: Form 2350

Taxpayers living abroad will file Form 2350 if they expect to qualify for one of the following:

- Foreign earned income exclusion

- Foreign housing exclusion

- Foreign housing deduction

If filing Form 2350, these taxpayers may also need an extension of time to meet one of the following tests:

- Bona fide residence test

- Physical presence test

If applicable, check the box here.

Line 2a

In Line 2a, enter the date for which you expect to meet the requirements for either test.

If you plan to qualify for bona fide residence test, you’ll enter the date which is 12 months and 30 days from the first day of your next full tax year. Use 12 months and 90 days if you plan to allocate moving expenses.

For taxpayers who plan to qualify under the physical presence test, you’ll enter the date that is 12 months and 30 days (90 days if allocating moving expenses) from your first full day in the foreign country.

Line 2b

In Line 2b, enter the amount that you’re paying with your tax return extension request. This amount is on Line 5 of Form 2350.

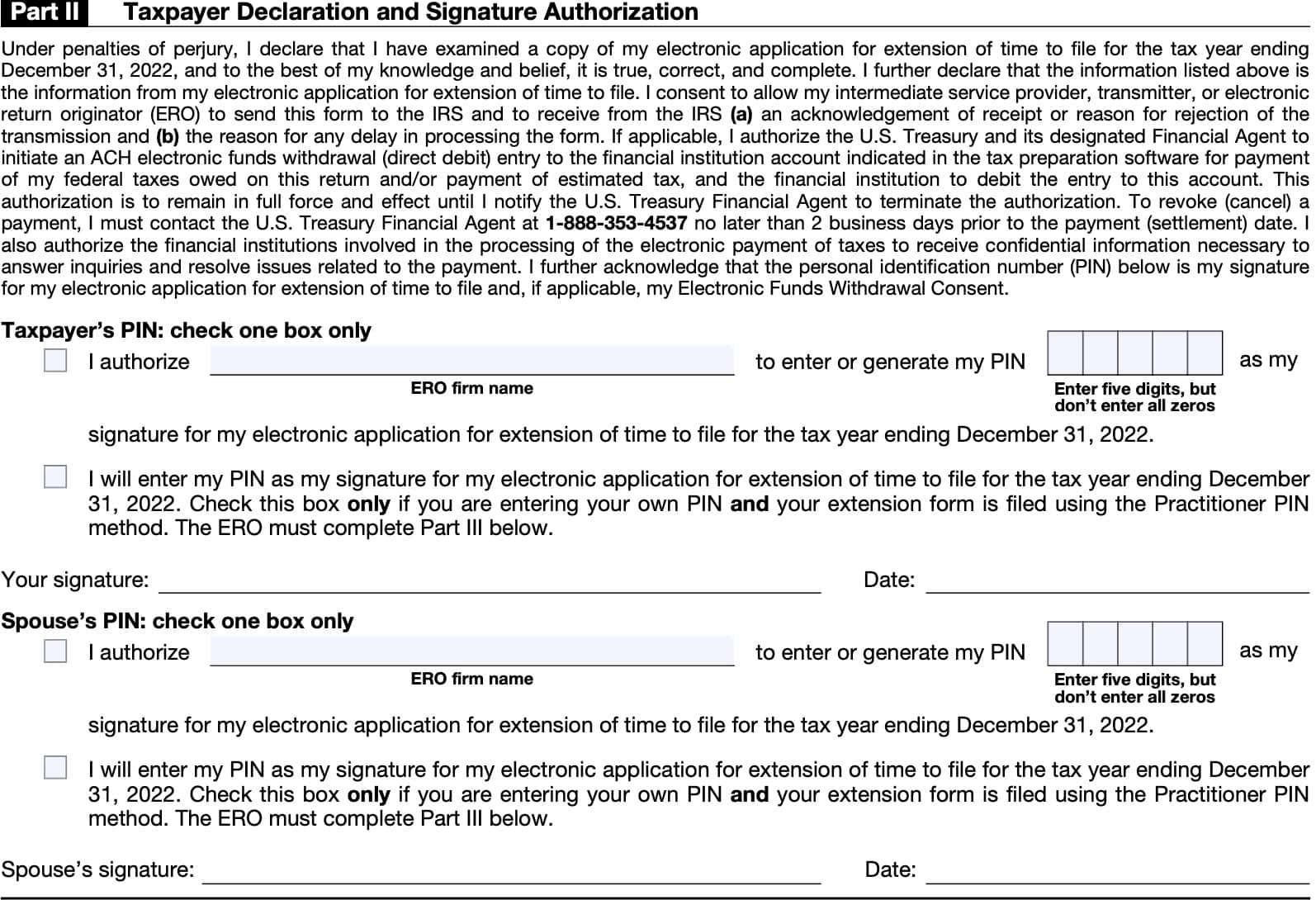

Part II: Taxpayer declaration and signature authorization

In Part II, you’ll simply check one of the options (for each spouse if married filing jointly). Let’s take a look at each option.

Option 1

If you check the first box, you authorize your tax return preparer to generate a taxpayer’s PIN on your behalf. This also allows your tax professional to use this PIN as your signature on this extension request.

Option 2

By selecting the second box, you’re stating that you will generate your own PINS for the e-filed return. You should only check this box if:

- You want to select your own taxpayer’s PIN and

- Your extension form is being filed using the Practitioner PIN method (Part III, below)

Below your selection, you’ll enter your own handwritten signature. However, the IRS does allow electronic signature methods, so your tax professional may use that, instead.

For married taxpayers, one spouse may choose to allow their ERO to generate the taxpayer’s PIN, and the other spouse may choose to enter their own PIN. However, one spouse may not enter the PIN of another spouse, if that spouse is absent.

Before we move on to Part III, let’s take a closer look at the fine print in Part II.

The fine print

By completing this form, you consent to the following:

- Electronic transmission of this form to the IRS

- IRS personnel may send an electronic acknowledgement, reason for rejection, or reason for delay

- Electronic funds withdrawal for the payment of your estimated tax payments

- Your PIN serves as an electronic record of your tax return filing

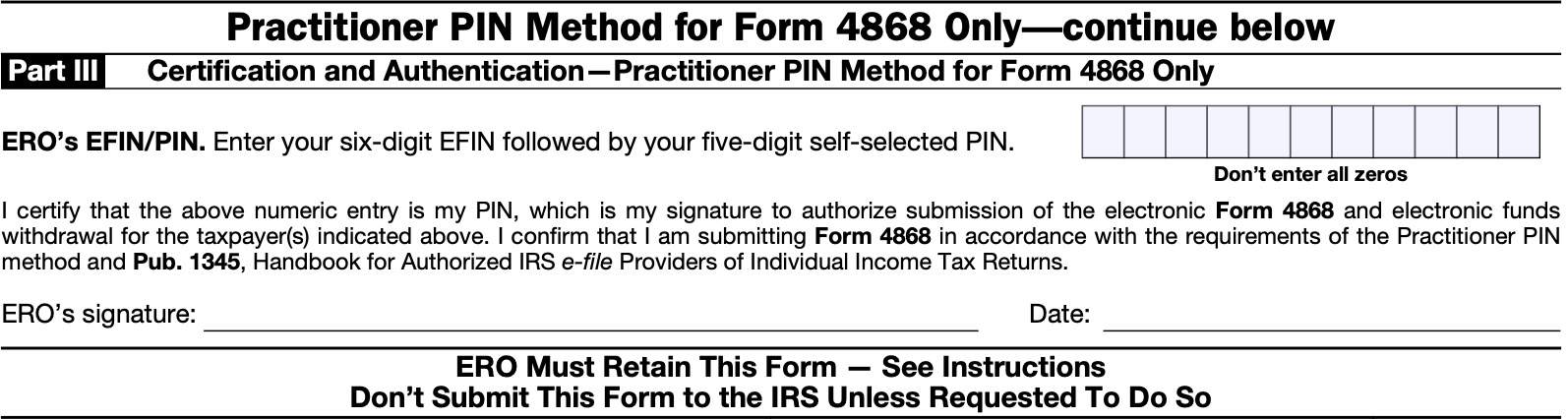

Part III: Certification and Authentication-Practitioner PIN Method for Form 4868 Only

You won’t need to complete Part III, but your tax preparer will. You’ll see the space for the ERO’s PIN, as well as their dated signature.

What are the requirements for my tax return preparer?

The IRS has certain requirements for tax professionals when it comes to IRS Form 8878.

Maintain the completed form in tax records

Your tax return preparer should not send Form 8878 to the IRS unless specifically requested. Otherwise, they will retain the completed form for up to 3 years from the later of:

- Tax return due date

- Tax return filing date

Provide each taxpayer their own copy

You should expect to receive your own copy of the signed Form 8878, upon request. If there are corrections, you can expect to receive the corrected version.

However, you should ask your tax return preparer.

Use your taxpayer’s PIN as authorized

Your ERO can only enter your PIN into the electronic signature pad, or to authorize digital signatures, if you’ve given specific authorization on Form 8878. Otherwise, you must be able to do this yourself.

Use specified methods for electronic funds withdrawal

If you are making a payment by electronic funds withdrawal for Form 4868, and your ERO is not using the Practitioner PIN method, then your ERO must enter your date of birth and either of the following from your prior year return:

- Adjusted gross income (AGI)

- PIN

The IRS uses this information to authenticate a taxpayer.

Use proper signature methods

An ERO can sign the form using one of the following:

- Rubber stamp

- Mechanical device, such as a signature pen

- Computer software program that offers esignature packages

Video walkthrough

Learn more about IRS Form 8878 in our video tutorial!

Frequently asked questions

Individual taxpayers do not need to maintain these files. However, tax preparers are required to keep copies of each completed Form 8878 and other esignature documents on behalf of a taxpayer for whom they submitted an e-filed return.

The Internal Revenue Service allows taxpayers who file IRS Form 8878 to use an e-signature to sign and electronically submit these forms to their Electronic Return Originator (ERO).

Where can I find IRS Form 8878?

As with most tax forms, you can find IRS Form 8878 on the IRS website. For your convenience, we’ve enclosed the latest version in this article.