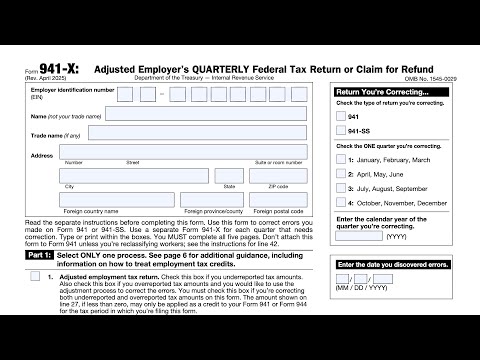

IRS Form 941-X Instructions

If you’re looking to amend a previously filed employer’s quarterly tax return, you may need to report those changes on IRS Form 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund.

In this article, we’ll walk through IRS Form 941-X, including:

- Step by step guidance on completing this tax form

- Filing considerations

- Frequently asked questions

Let’s begin with a walkthrough on completing IRS Form 941-X.

Table of contents

How do I complete IRS Form 941-X?

There are 5 parts to this tax form:

- Part 1: Select ONE process

- Part 2: Complete the certifications

- Part 3: Enter the corrections for this quarter

- Part 4: Explain your corrections for the quarter

- Part 5: Sign here

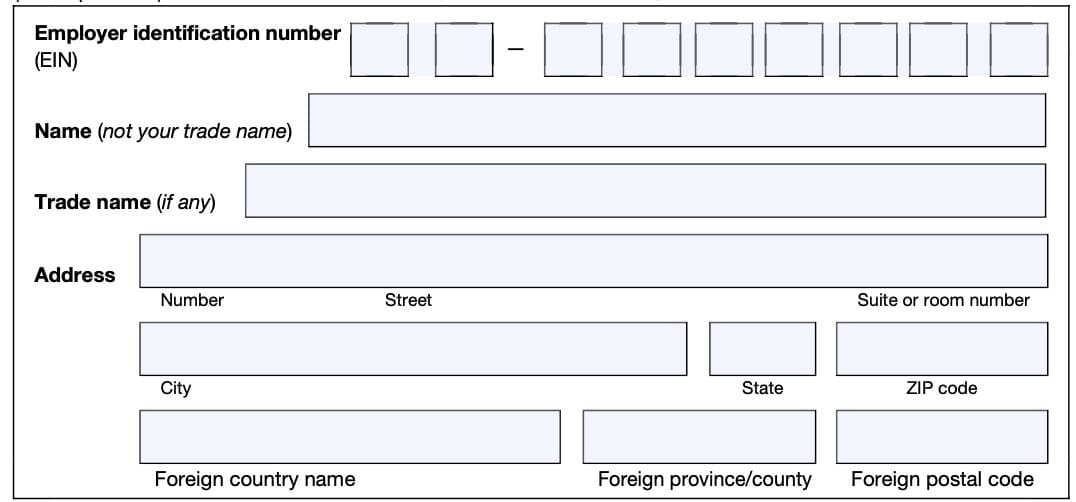

Before we start with Part 1, let’s take a look at the taxpayer fields at the top of the form, and the information fields about the type of return that you are amending.

Taxpayer information

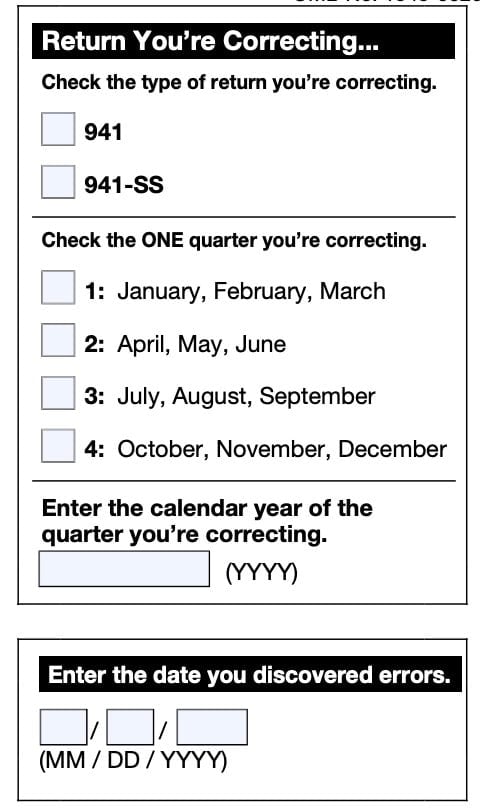

Type of return you’re correcting

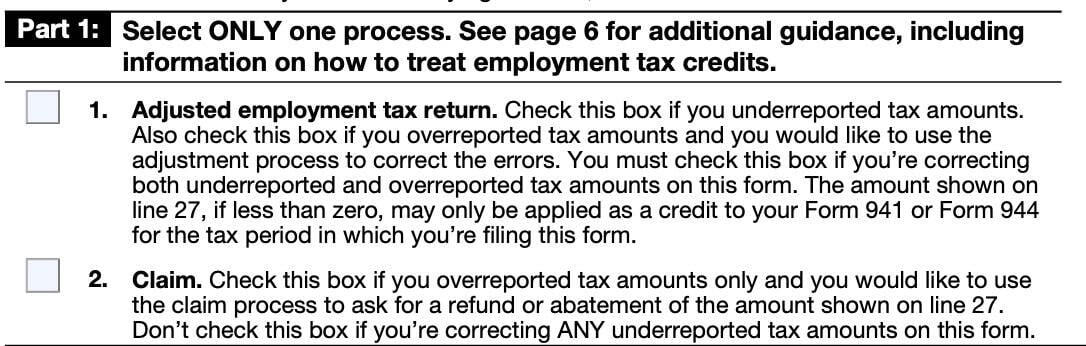

Part 1: Select ONE process

Check exactly one box. For more information about which process to select, see Processes Explained, later in this article.

Line 1: Adjusted employment tax return

Check this box if you underreported tax amounts. Also, check this box if you overreported tax amounts and you would like to use the adjustment process to correct the errors.

You must check this box if you’re correcting both underreported and overreported tax amounts on this form.

The amount shown on Line 27, if less than zero, may only be applied as a credit to your Form 941 or Form 944 for the tax period in which you’re filing this form.

Line 2: Claim

Check this box if you overreported tax amounts only and you would like to use the claim process to ask for a refund or abatement of the amount shown on Line 27.

Don’t check this box if you’re correcting ANY underreported tax amounts on this form

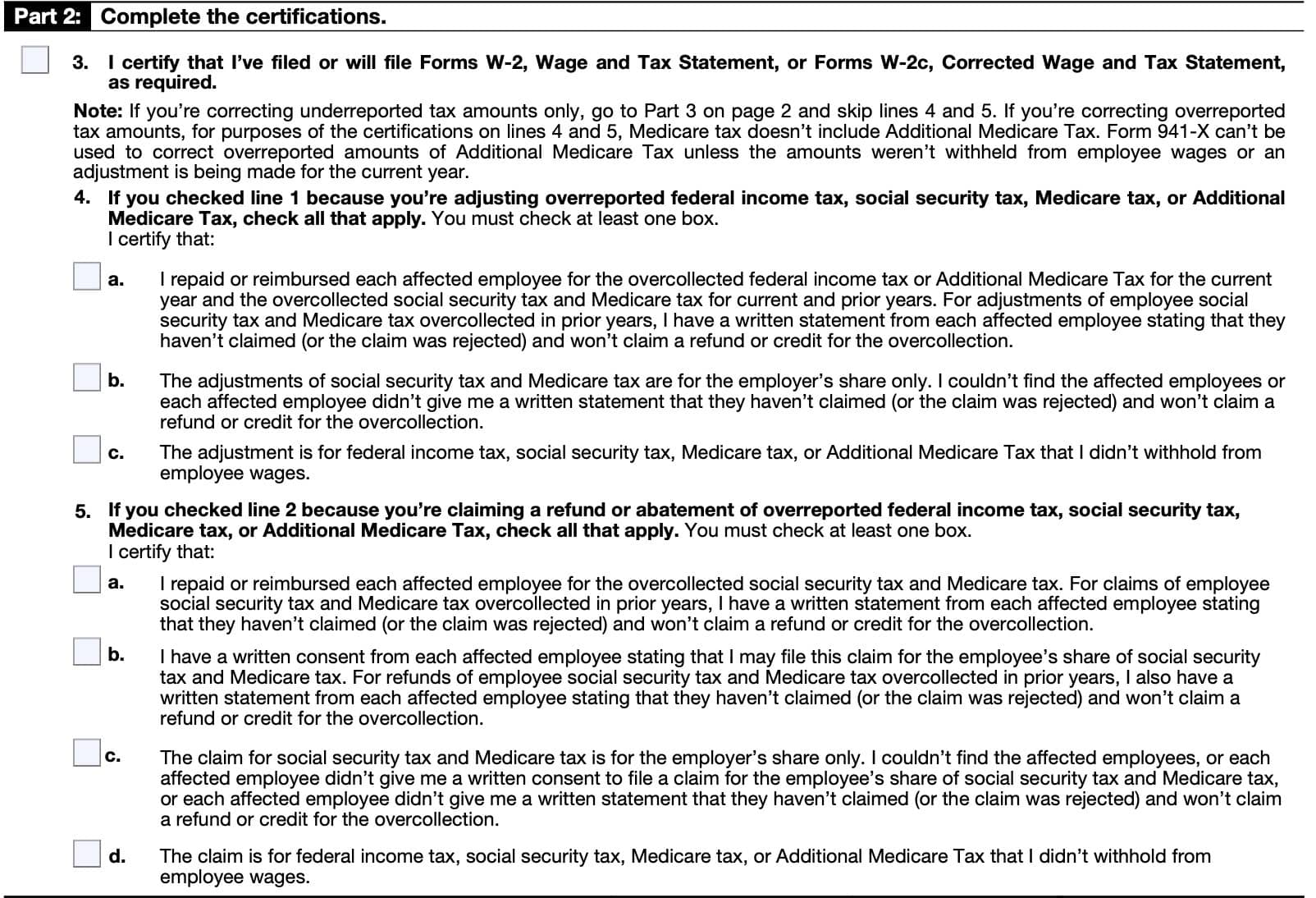

Part 2: Complete the certifications

You must complete all certifications that apply by checking the appropriate boxes in Part 2.

If all of your corrections relate to underreported tax amounts, complete Line 3 only. You may skip

Lines 4 and 5 and go to Part 3.

If your corrections relate to overreported tax amounts, other than corrections related to underreported employment tax credits, you have a duty to protect your employees’ rights to recover overpaid employee Social Security and Medicare taxes that you withheld.

The certifications on Lines 4 and 5 address the requirement to:

- Repay or reimburse your employees for the overcollection of employee Social Security and Medicare taxes, or

- Obtain consents from your employees to file a claim on their behalf.

Revenue Procedure 2017-28 contains additional guidance on the requirements for both a request for employee consent and for the employee consent itself.

Line 3

In Line 3, you’re certifying that you have filed, or will file the following tax forms as required:

- IRS Form W-2, Wage and Tax Statement

- IRS Form W-2c, Corrected Wage and Tax Statement

You must check the box on Line 3 to certify that you filed Forms W-2 or Forms W-2c even if your corrections on Form 941-X don’t change amounts shown on those forms.

Line 4

If you checked Line 1 because you’re adjusting overreported federal income tax, Social Security tax, Medicare tax, or Additional Medicare Tax, check all of the following lines that apply.

Line 4a

Check the box in Line 4a if the following applies:

I repaid or reimbursed each affected employee for the overcollected federal income tax or Additional Medicare Tax for the current year and the overcollected Social Security tax and Medicare tax for current and prior years.

For adjustments of employee Social Security tax and Medicare tax overcollected in prior tax years, I have a written statement from each affected employee stating that they haven’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

According to the IRS instructions, you don’t need to send these statements to the Internal Revenue Service. Instead, keep them for your records.

As a general rule, you should keep all employment tax records for at least 4 years. However, you should keep records related to the following for at least 6 years:

- Qualified sick leave wages and qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021, and

- Records related to qualified wages for the employee retention credit paid after June 30, 2021

Line 4b

Check the box in this line if the following applies:

The adjustments of Social Security tax and Medicare tax are for the employer’s share only. I couldn’t find the affected employees or each affected employee didn’t give me a written statement that they haven’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

Line 4c

Check the box in this line if the following applies:

The adjustment is for federal income tax, Social Security tax, Medicare tax, or Additional Medicare Tax that I didn’t withhold from employee wages.

Line 5

If you checked Line 2 because you’re claiming a refund or abatement of overreported federal income tax, Social Security tax, Medicare tax, or Additional Medicare Tax, check all that apply. You must check at least one box.

Line 5a

I repaid or reimbursed each affected employee for the overcollected Social Security tax and Medicare tax.

For claims of employee Social Security tax and Medicare tax overcollected in prior years, I have a written statement from each affected employee stating that they haven’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

Line 5b

I have a written consent from each affected employee stating that I may file this claim for the employee’s share of Social Security tax and Medicare tax.

For refunds of employee social security tax and Medicare tax overcollected in prior years, I also have a written statement from each affected employee stating that they haven’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

Line 5c

The claim for Social Security tax and Medicare tax is for the employer’s share only.

One of the following applies:

- I couldn’t find the affected employees, or

- Sach affected employee didn’t give me a written consent to file a claim for the employee’s share of Social Security tax and Medicare tax, or

- Each affected employee didn’t give me a written statement that they haven’t claimed (or the claim was rejected) and won’t claim a refund or credit for the overcollection.

Line 5d

The claim is for federal income tax, Social Security tax, Medicare tax, or Additional Medicare Tax that I didn’t withhold from employee wages.

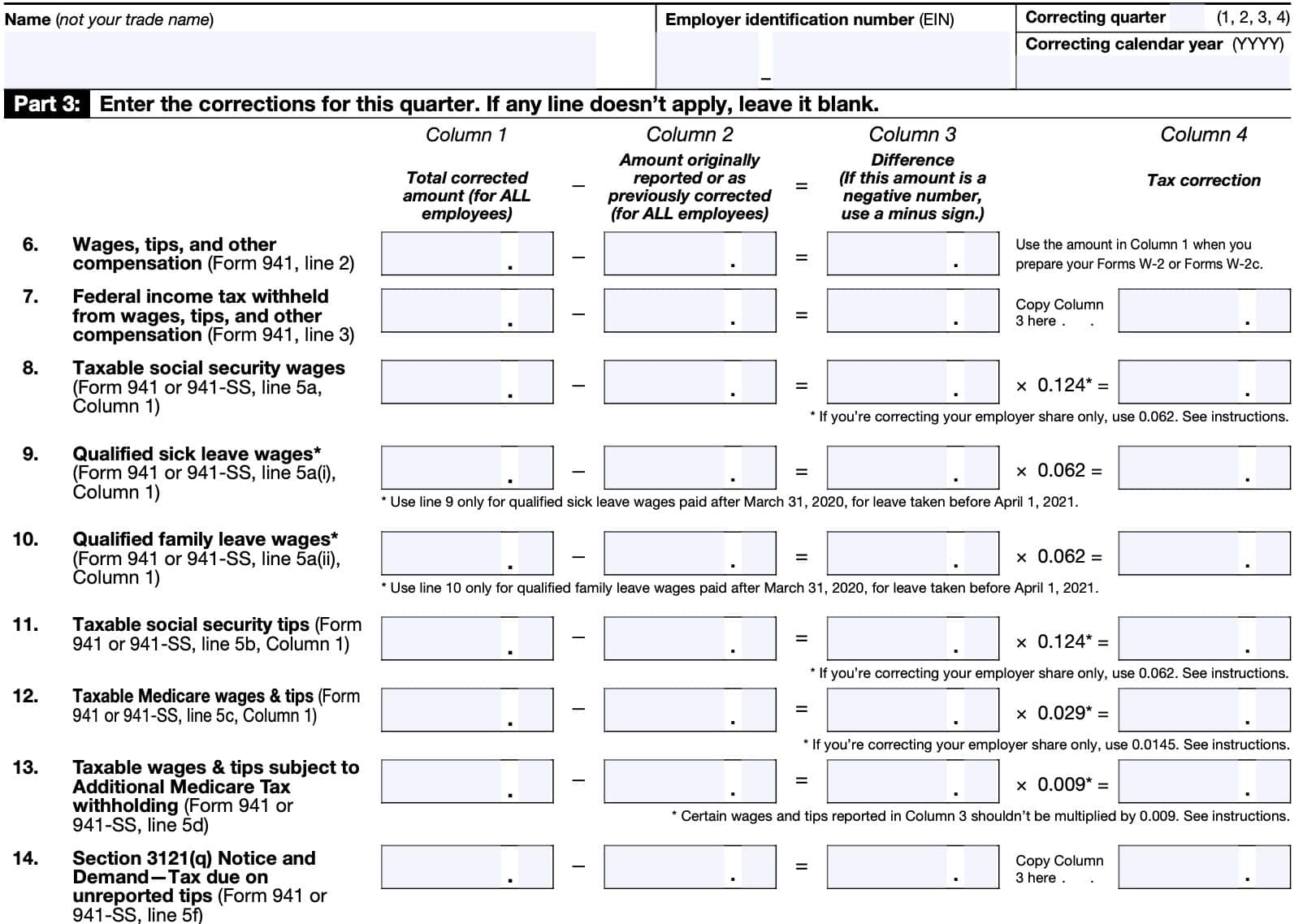

Part 3: Enter the corrections for this quarter

On Lines 6–13, columns 1 and 2, for each line you’re correcting, show amounts for all of your employees, not just for those employees whose amounts you’re correcting.

For clarification, below is a brief description of each of the 4 columns:

- Column 1: Total CORRECTED amount for all employees

- Column 2: Original reported amount for all employees

- Column 3: Difference between Column 1 and Column 2

- Negative numbers annotated with a minus sign

- Column 4: Tax correction

- Calculated by multiplying the Column 3 amount by the appropriate number on each line.

Let’s begin with Line 6. We will focus on what Columns 1 and 2 should contain, as well as the tax rate for each line.

Line 6: Wages, tips, and other compensation

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 2.

Enter the difference in Column 3. There is no Column 4 in Line 6.

Line 7: Federal income tax withheld from wages, tips, and other compensation

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 3.

Enter the difference in Column 3. Copy the Column 3 amount into Column 4.

Line 8: Taxable Social Security wages

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 5a, Column 1.

Enter the difference in Column 3. Multiply the difference by 12.4% (0.124) and enter the result in Column 4. If you’re correcting only the employer’s share, then use 6.2% (0.062).

Line 9: Qualified sick leave wages

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 5a(i), Column 1.

Enter the difference in Column 3. Multiply the difference by 6.2% (0.062) and enter the result in Column 4.

Line 10: Qualified family leave wages

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 5a(ii), Column 1.

Enter the difference in Column 3. Multiply the difference by 6.2% (0.062) and enter the result in Column 4.

Line 11: Taxable social security tips

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 5b, Column 1.

Enter the difference in Column 3. Multiply the difference by 12.4% (0.124) and enter the result in Column 4. If you’re correcting only the employer’s share, then use 6.2% (0.062).

Line 12: Taxable Medicare wages and tips

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 5c, Column 1.

Enter the difference in Column 3. Multiply the difference by 2.9% (0.029) and enter the result in Column 4. If you’re correcting only the employer’s share, then use 1.45% (0.0145).

Line 13: Taxable wages and tips subject to Additional Medicare Tax

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 5d.

Enter the difference in Column 3. Multiply the difference by 0.9% (0.009) and enter the result in Column 4.

Reporting prior years

If you are correcting a prior year return, you may correct only the taxable wages and tips subject to Additional Medicare Tax withholding that you reported on the original Form 941.

Don’t multiply the amount in Column 3 by 0.009 (0.9% tax rate). Leave Column 4 blank and explain the reasons for this correction on Line 43.

Line 14: Section 3121(q) Notice and Demand – Tax due on unreported tips

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 5f.

Enter the difference in Column 3. Copy the Column 3 amount into Column 4.

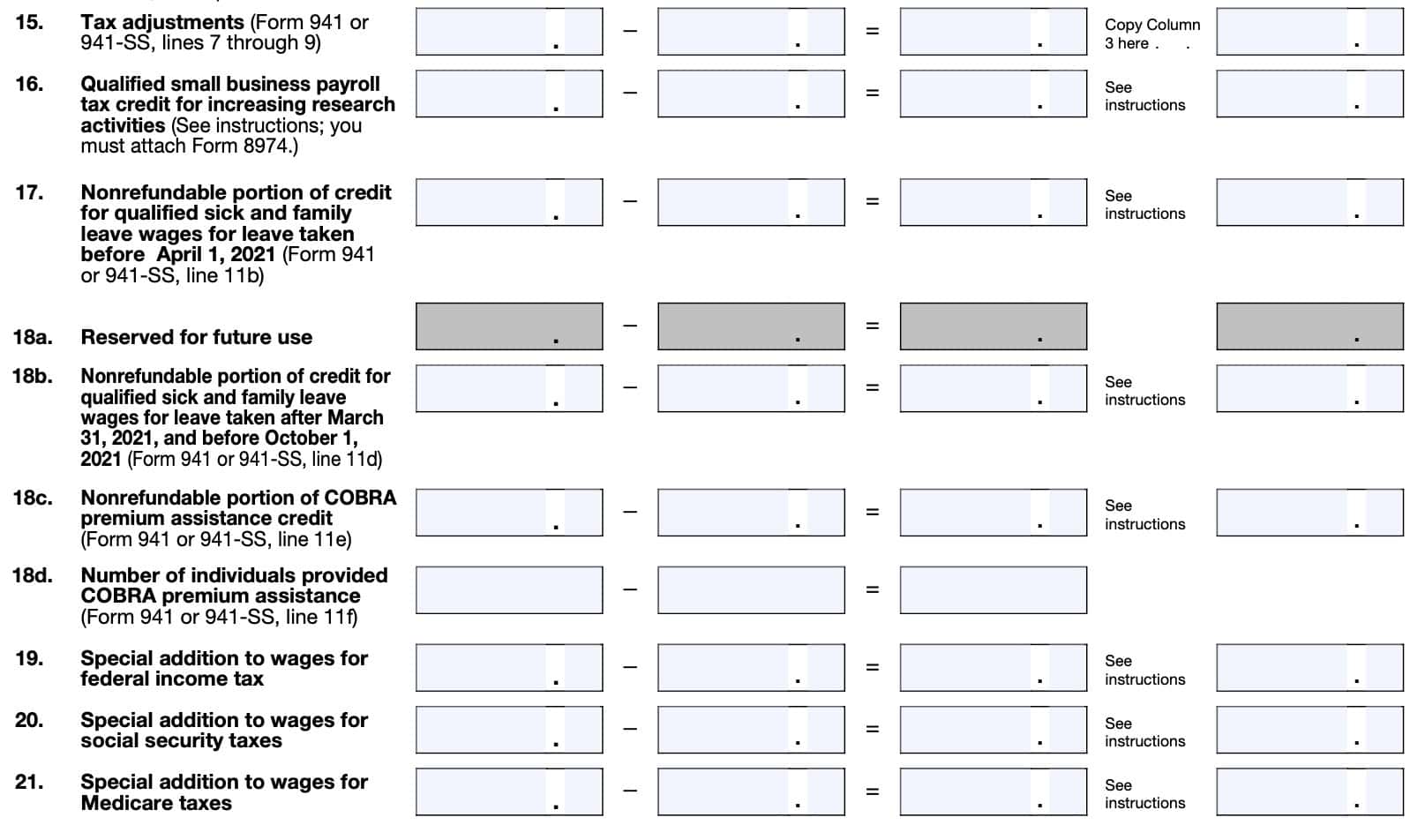

Line 15: Tax adjustments

Column 1: Tax adjustments for ALL employees

Column 2: Original amounts reported on IRS Form 941 or Form 941-SS, Lines 7 through 9.

Enter the difference in Column 3. Copy the Column 3 amount into Column 4.

Line 16: Qualified small business payroll tax credit for increasing research activities

The payroll tax credit election must be made on or before the due date of the originally filed income tax return (including extensions). Any election to take take a credit based on payroll taxes may be revoked only with the

IRS’ consent.

If you’re correcting the qualified small business payroll tax credit for increasing research activities that you reported on Form 941, Line 11a (Line 11 for quarters beginning after December 31, 2023), enter the total corrected amount in Column 1.

In Column 2, enter the amount you originally reported or as previously corrected. In Column 3, enter the difference between Columns 1 and 2. Copy the amount in column 3 to column 4.

You must attach a corrected copy of IRS Form 8974 and explain the reasons for this correction on Line 43, below.

Line 17: Nonrefundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 11b.

Enter the difference in Column 3. Copy the Column 3 amount into Column 4.

Line 18a: Reserved for future use

Line 18b: Nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before October 1, 2021

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 11d.

Enter the difference in Column 3. Copy the Column 3 amount into Column 4.

Line 18c: Nonrefundable portion of COBRA premium assistance credit

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 11e.

Enter the difference in Column 3. Copy the Column 3 amount into Column 4.

Line 18d: Number of individuals provided COBRA premium assistance

Column 1: Corrected wages, tips, and other compensation for ALL employees

Column 2: Original wages, tips, and other compensation for ALL employees, originally reported on IRS Form 941, Line 11f.

Enter the difference in Column 3. Copy the Column 3 amount into Column 4.

Line 19: Special addition to wages for federal income tax

For Lines 19 through 23: Internal Revenue Code Section 3509 provides special rates when workers are reclassified as employees in certain circumstances for employee shares of the following tax withholdings:

- Federal income tax

- Social Security tax

- Medicare tax

- Additional Medicare tax

The applicable rate depends on whether you filed required information returns. An employer can’t recover any tax paid under this provision from the employees. The full employer share of Social Security tax

and Medicare tax is due for all reclassifications.

Column 1: Corrected wages, tips, and other compensation for employees being reclassified

Column 2: Original wages, tips, and other compensation for employees being reclassified

Enter the difference in Column 3. Use the applicable percentage (depending on whether you filed information returns) to calculate the Column 4 amount.

If you filed required information returns

For federal income tax withholding, the Section 3509 rate is 1.5% of wages.

If you did not file required information returns

For federal income tax withholding, the rate is 3.0% of wages.

Line 20: Special addition to wages for Social Security taxes

Column 1: Corrected wages, tips, and other compensation for employees being reclassified

Column 2: Original wages, tips, and other compensation for employees being reclassified

Enter the difference in Column 3. Use the applicable percentage (depending on whether you filed information returns) to calculate the Column 4 amount.

If you filed required information returns

For federal income tax withholding, the Section 3509 rate is 1.5% of wages.

If you did not file required information returns

For federal income tax withholding, the rate is 3.0% of wages.

Line 21: Special addition to wages for Medicare taxes

Column 1: Corrected wages, tips, and other compensation for employees being reclassified

Column 2: Original wages, tips, and other compensation for employees being reclassified

Enter the difference in Column 3. Use the applicable percentage (depending on whether you filed information returns) to calculate the Column 4 amount.

If you filed required information returns

For federal income tax withholding, the Section 3509 rate is the employer rate (6.2%) plus 20% of the employer rate, or 7.44% of wages.

If you did not file required information returns

For employers who did not file required returns, the rate is the employer rate (6.2%) plus 40% of the employer rate, or 8.68% of wages.

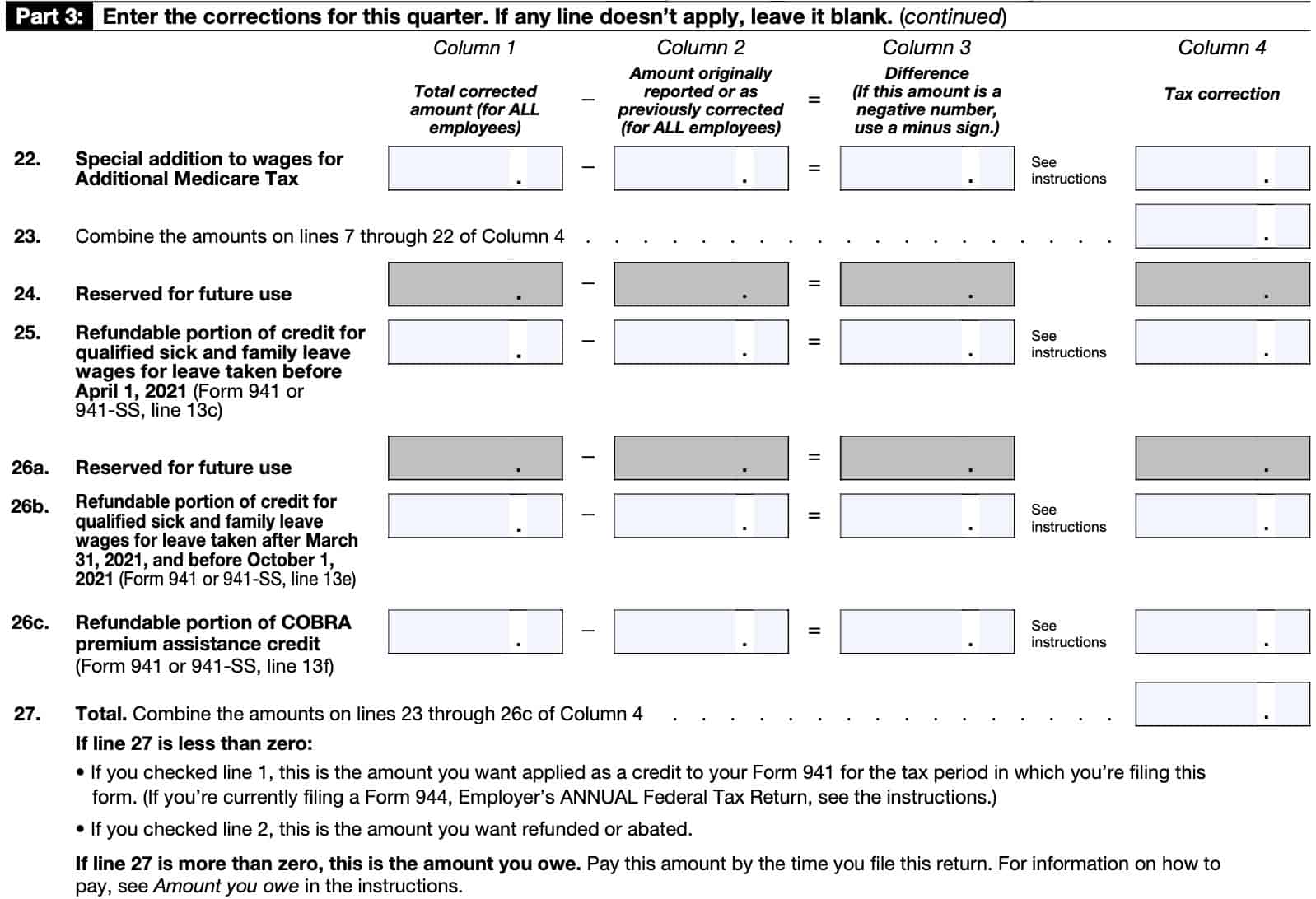

Line 22: Special addition to wages for Additional Medicare Tax

Column 1: Corrected wages, tips, and other compensation for employees being reclassified

Column 2: Original wages, tips, and other compensation for employees being reclassified

Enter the difference in Column 3. Use the applicable percentage (depending on whether you filed information returns) to calculate the Column 4 amount.

If you filed required information returns

For federal income tax withholding, the Section 3509 rate is 20% of the Additional Medicare Tax rate, or 0.18% of wages.

If you did not file required information returns

The rate is 40% of the Additional Medicare Tax rate, or 0.36% of wages for workers who are reclassified.

Line 23

Combine the Column 4 amounts for Lines 7 through 22. Enter the total in Column 4 of Line 23.

Line 24: reserved for future use

Do not complete this line.

Line 25: refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021

Generally, the period of limitations for correcting the refundable portion of credit for qualified sick and family leave wages paid in the second, third, and fourth quarters of 2020 expired on April 15, 2024, for most employers.

To complete these lines, you may need to complete Worksheet 1 in the form instructions.

Line 26a: reserved for future use

Do not enter anything here.

Line 26b: refundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before October 1, 2021

Generally, the period of limitations for correcting the refundable portion of credit for qualified sick

and family leave wages paid in the second and third quarters of 2021 expired on April 15, 2025, for most employers.

To properly show the amount as a credit or balance due item, enter a positive number in Column 3 as a negative number in Column 4 or a negative number in Column 3 as a positive number in Column 4.

Line 26c: refundable portion of COBRA premium assistance credit

Column 1: Corrected refundable portion of COBRA premium assistance credit

Column 2: Original refundable portion of COBRA premium assistance credit, reported on Form 941 or 941-SS, Line 31e.

To properly show the amount as a credit or balance due item, enter a positive number in Column 3 as a negative number in Column 4 or a negative number in Column 3 as a positive number in Column 4.

Line 27: Total

Combine the amounts on Lines 23 through 26c of Column 4.

If Line 27 is less than zero

- If you checked Line 1, this is the amount you want applied as a credit to your Form 941 for the tax period in which you’re filing this form.

- If you’re currently filing Form 944, Employer’s ANNUAL Federal Tax Return, see the instructions.

- If you checked Line 2, this is the amount you want refunded or abated.

If Line 27 is greater than zero

This is the amount that you owe. Pay this amount by the time you file this return.

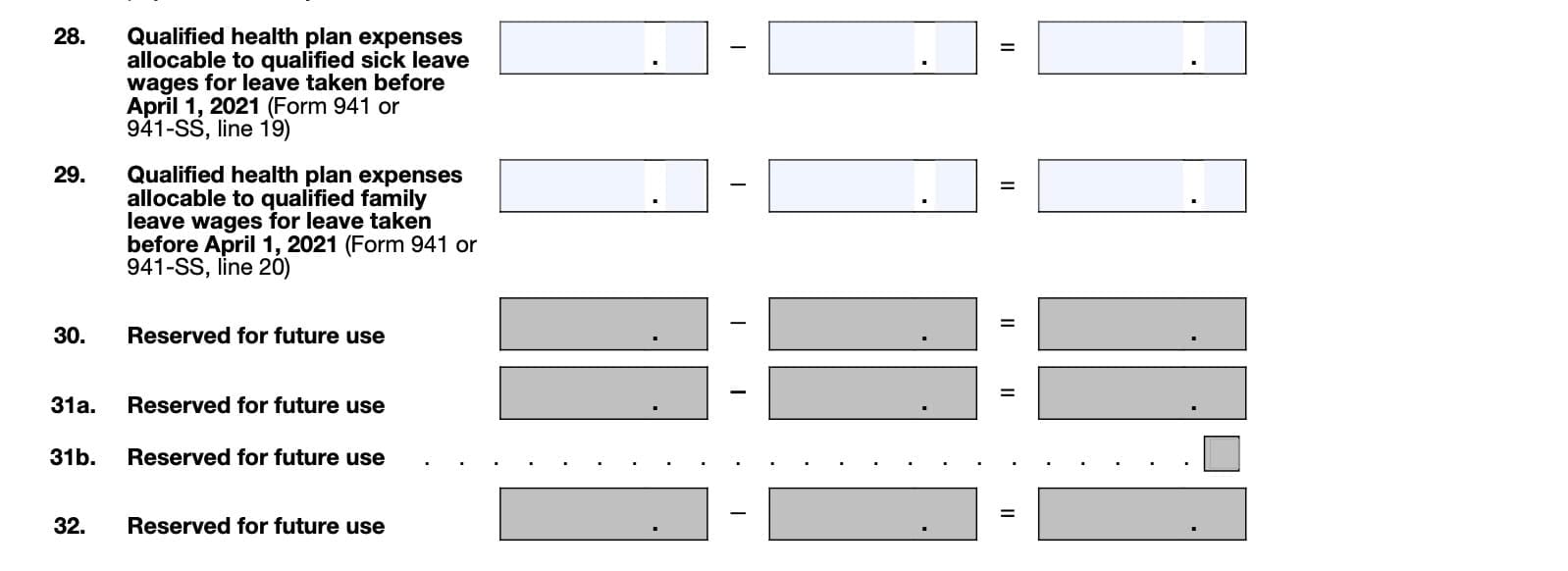

Line 28: Qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021

Column 1: Corrected qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021

Column 2: Original qualified health plan expenses allocable to qualified sick leave wages for leave taken before April 1, 2021, reported on Form 941 or 941-SS, Line 19.

Line 29: Qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021

Column 1: Corrected qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021

Column 2: Original qualified health plan expenses allocable to qualified family leave wages for leave taken before April 1, 2021, reported on Form 941 or 941-SS, Line 20.

Line 30: Reserved for future use

Do not enter anything on this line.

Line 31a: Reserved for future use

Do not enter anything on this line.

Line 31b: Reserved for future use

Do not enter anything on this line.

Line 32: Reserved for future use

Do not enter anything on this line.

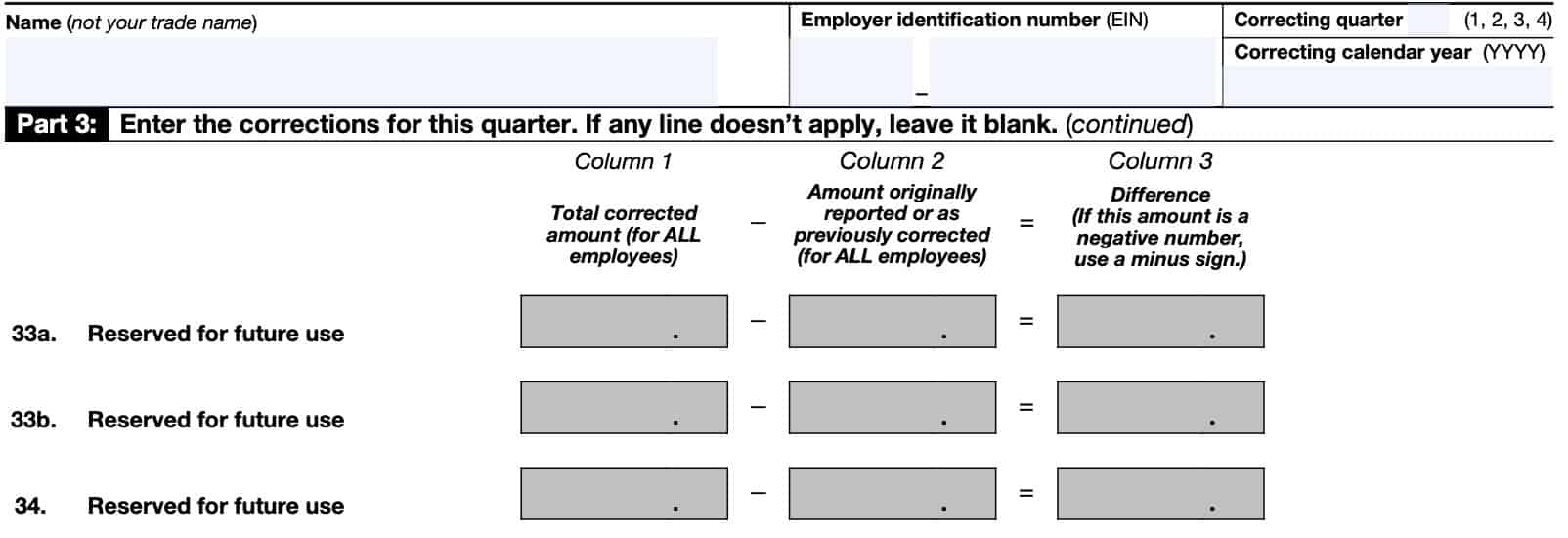

Line 33a: Reserved for future use

Do not enter anything on this line.

Line 33b: Reserved for future use

Do not enter anything on this line.

Line 34: Reserved for future use

Do not enter anything on this line.

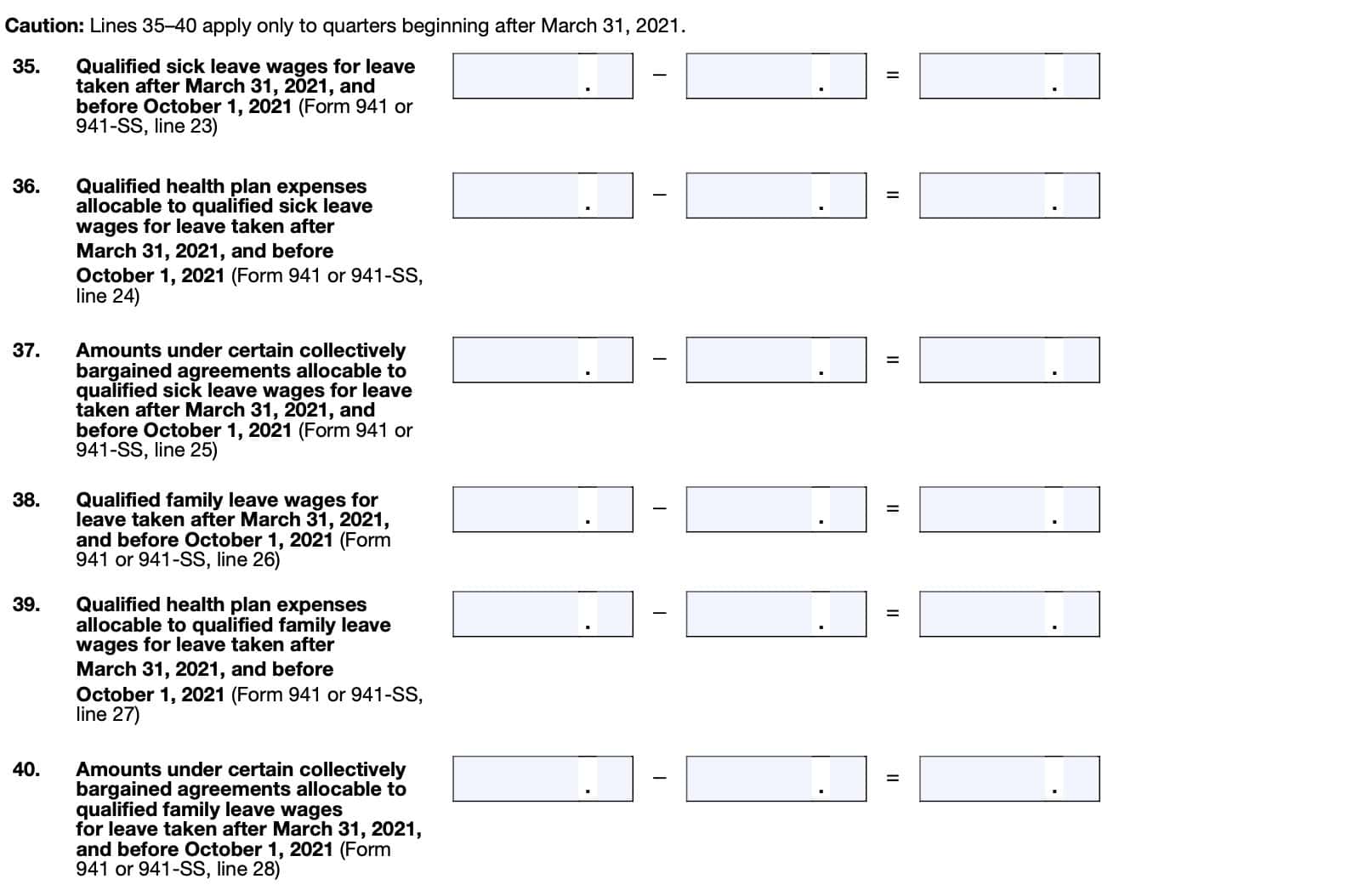

Lines 35 through 40 pertain only to quarters beginning after March 31, 2021.

Line 35: Qualified sick leave wages for leave taken after march 31, 2021, and before October 1, 2021

Column 1: Corrected sick leave wages for leave taken after March 31, 2021, and before October 1, 2021

Column 2: Original sick leave wages for leave taken after March 31, 2021, and before October 1, 2021, reported on Form 941 or 941-SS, Line 23.

Generally, the period of limitations for correcting qualified sick leave wages paid in the second and

third quarters of 2021 expired on April 15, 2025, for most employers.

Line 36: Qualified health plan expenses allocable to qualified sick leave wages for leave taken after march 31, 2021, and before October 1, 2021

Column 1: Corrected qualified health plan expenses allocable to qualified sick leave wages for leave taken before after March 31, 2021, and before October 1, 2021

Column 2: Original qualified health plan expenses allocable to qualified sick leave wages for leave taken before after March 31, 2021, and before October 1, 2021, reported on Form 941 or 941-SS, Line 24.

Generally, the period of limitations for correcting qualified health plan expenses allocable to qualified sick leave wages paid in the second and third quarters of 2021 expired on April 15, 2025, for most eligible employers.

Line 37: Amounts under certain collectively bargained agreements allocable to qualified sick leave wages for leave taken after march 31, 2021, and before October 1, 2021

Column 1: Corrected amounts under certain collectively bargained agreements allocable to qualified sick leave wages for leave taken after March 31, 2021, and before October 1, 2021

Column 2: Original amounts under certain collectively bargained agreements allocable to qualified sick leave wages for leave taken after March 31, 2021, and before October 1, 2021, reported on Form 941 or 941-SS, Line 25.

Line 38: Qualified family leave wages for leave taken after march 31, 2021, and before October 1, 2021

Column 1: Corrected qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021

Column 2: Original qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021, reported on Form 941 or 941-SS, Line 26.

Line 39: Qualified health plan expenses allocable to qualified family leave wages for leave taken after march 31, 2021, and before October 1, 2021

Column 1: Corrected qualified health plan expenses allocable to qualified family leave wages for leave taken before after March 31, 2021, and before October 1, 2021

Column 2: Original qualified health plan expenses allocable to qualified family leave wages for leave taken before after March 31, 2021, and before October 1, 2021, reported on Form 941 or 941-SS, Line 27.

Line 40: Amounts under certain collectively bargained agreements allocable to qualified family leave wages for leave taken after march 31, 2021, and before October 1, 2021

Column 1: Corrected amounts under certain collectively bargained agreements allocable to qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021

Column 2: Original amounts under certain collectively bargained agreements allocable to qualified family leave wages for leave taken after March 31, 2021, and before October 1, 2021, reported on Form 941 or 941-SS, Line 28.

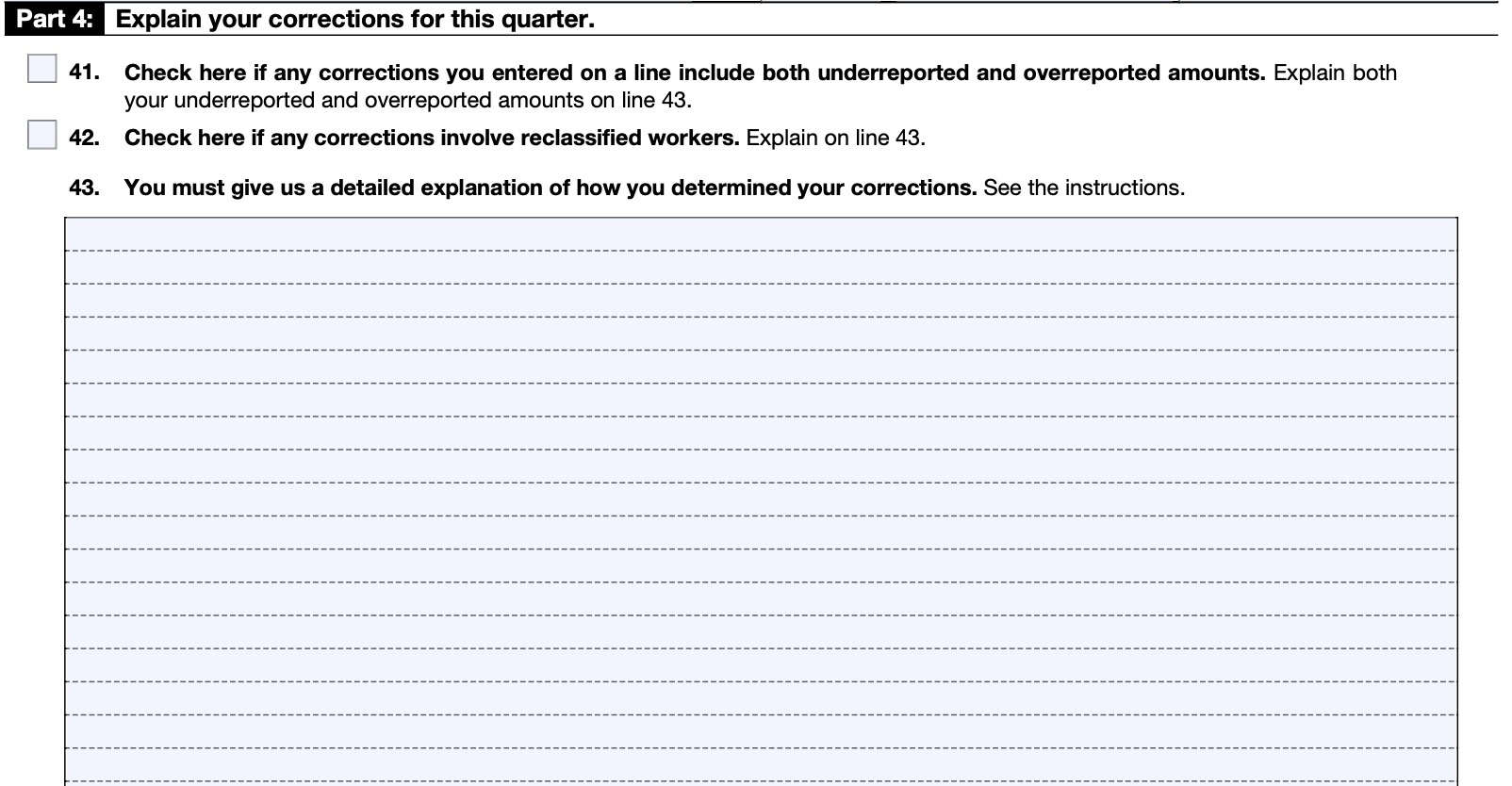

Part 4: Explain your corrections for the quarter

In Part 4, we’ll provide explanations for any corrections you made in the tax quarter.

Line 41: check here if any corrections you entered on a line include both underreported and overreported amounts

Check this box if you made any corrections on a line that include both underreported and overreported amounts. Specifically, the following lines:

- Lines 7 through 17

- Lines 18b through 22

- Line 25

- Line 26b

- Line 26c

- Line 28

- Line 29

- Lines 35 through 40

If this box is checked, provide a written explanation on Line 43, below.

Line 42: Check here if any corrections involve reclassified workers

Check the box if you reclassified any workers to be independent contractors or nonemployees. Also check this box if the IRS (or you) determined that workers you treated as independent contractors or nonemployees should be classified as employees.

If this box is checked, provide a written explanation on Line 43, below.

Line 43: Detailed explanation

Use Line 43 to provide a detailed explanation if you checked the box on Line 41 or Line 42.

Provide the following information in your explanation for each correction.

- Form 941-X line number(s) affected.

- Date you discovered the error.

- Difference (amount of the error).

- Cause of the error.

You may report the information in paragraph form.

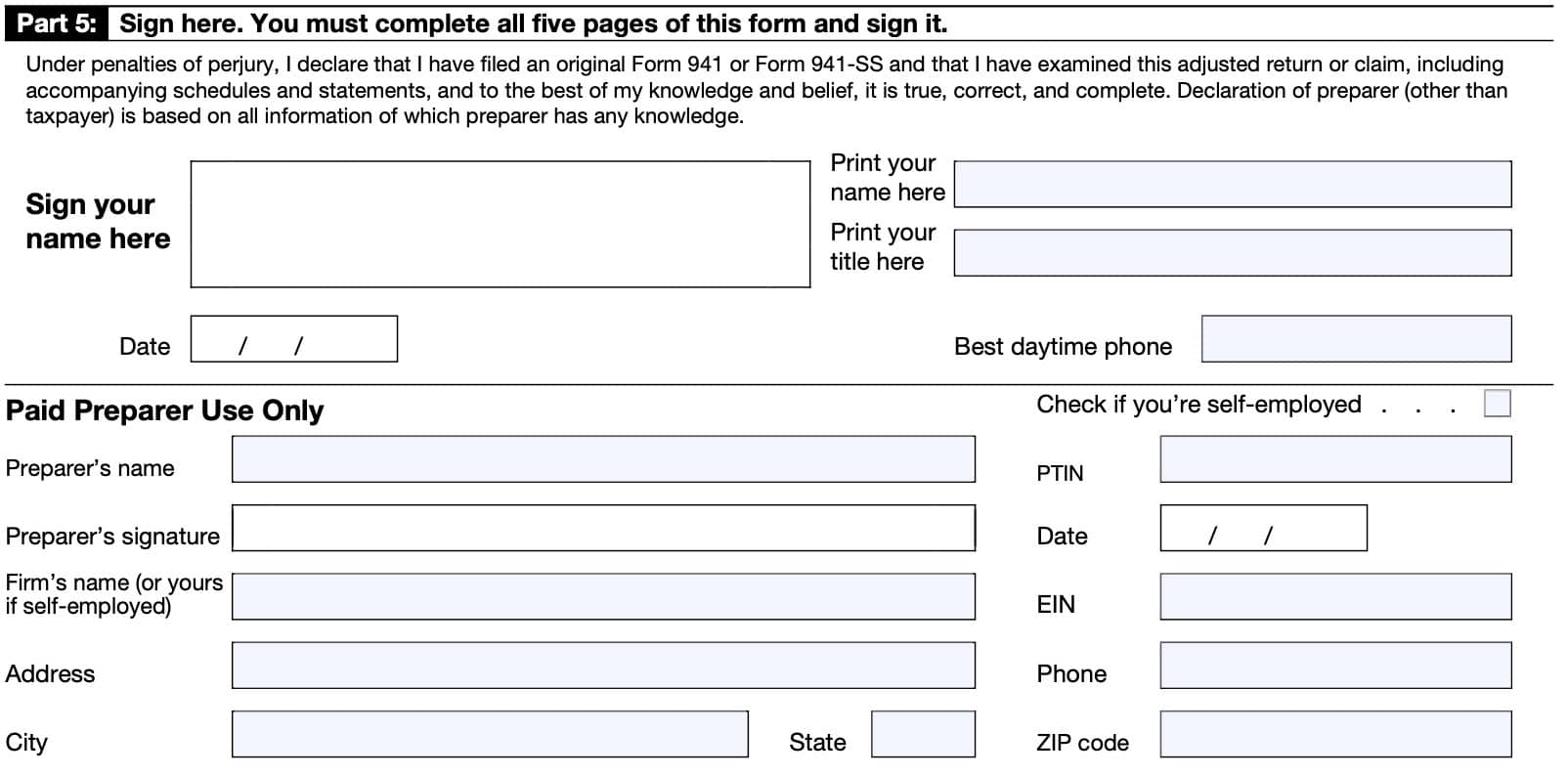

Part 5: Sign here

Provide your sworn signature in Part 5. As a reminder, you must complete all five pages of IRS Form 941-X, then sign the completed form. Also, print your name and business title in the space provided.

If you have a paid tax return preparer, then he or she will complete the space below. Be sure that the following fields are completed:

- Tax return preparer’s name & signature

- Firm’s name and address

- Preparer Tax Identification Number (PTIN)

- Date

- Employer identification number (EIN)

Filing considerations

Below are some filing considerations regarding IRS Form 941-X.

How do I file?

The Internal Revenue Service encourages taxpayers to file IRS Form 941-X. However, below is a list of mailing addresses based upon where your business is located.

| If you’re in | Then send the tax return to this address |

| Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Cincinnati, OH 45999-0005 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

| No legal residence or principal place of business in any state | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

| Special filing address for exempt organizations; federal, state, and local governmental entities; and Indian tribal governmental entities, regardless of location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0005 |

How long you have to file IRS Form 941-X?

Generally, you may correct overreported taxes on a previously filed Form 941 if you file Form 941-X within the later of the following dates:

- 3 years of the date Form 941 was filed or

- 2 years from the date you paid the tax reported on Form 941

Period of limitations

For purposes of the period of limitations, Forms 941 for a calendar year are considered filed on April 15 of the succeeding calendar year if filed before that date.

Example

For example, you filed your 2023 fourth quarter Form 941 on January 25, 2024, and made your tax payments on time. The IRS will treat the quarterly tax return as if it were filed on April 15.

On January 29, 2027, you discover that you overreported social security and Medicare wages on that form by $350. To correct the error, you must file Form 941-X by April 15, 2027, which is the end of the period of limitations for Form 941, and use the claims process.

Video walkthrough

Watch this informative video to walk through IRS Form 941-X, step by step.

Frequently asked questions

No. You must use a separate Form 941-X for each Form 941 that you’re correcting. For example, if you found errors on your Forms 941 for the third and fourth quarters of 2024, file two separate Form 941-X copies, one for each quarter.

IRS Form 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund, is the tax form that employers use to amend, or adjust a previously filed quarterly tax return.

Where can I find IRS Form 941-X?

You may find copies of tax forms like IRS Form 941-X on the IRS website. For your convenience, we’ve included the most current revision of Form 941-X here in our article.