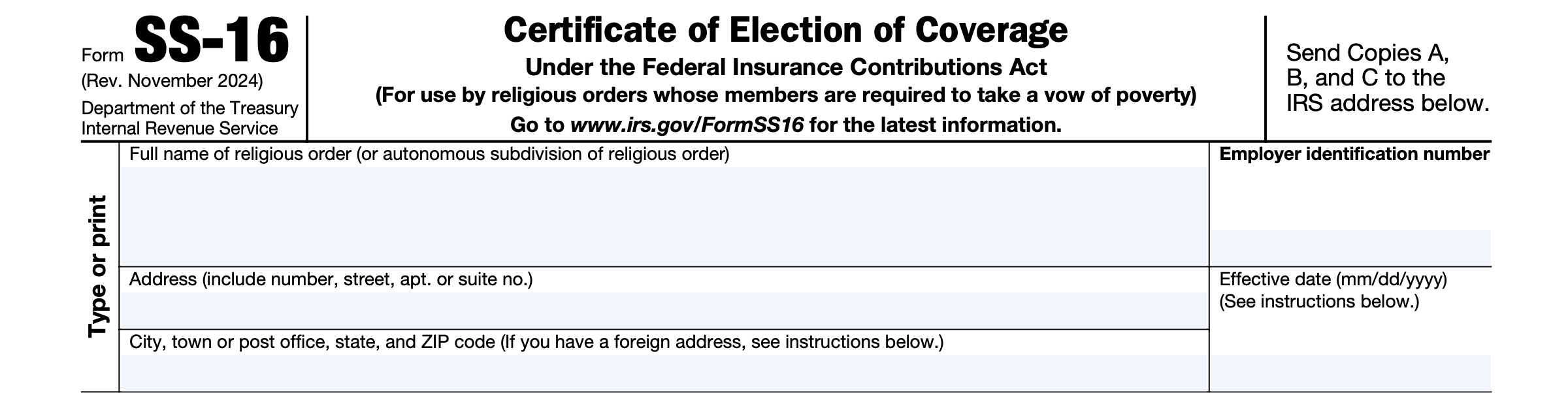

IRS Form SS-16 Instructions

Under the Internal Revenue Code, certain religious orders may be exempt from contributing to Social Security and Medicare. However, those orders may decide to start participating in those programs under the Federal Insurance Contributions Act (FICA) by filing IRS Form SS-16, Certificate of Election of Coverage Under the Federal Insurance Contributions Act.

In this article, we’ll walk through everything you need to know about IRS Form SS-16, including:

- How to complete and file Form SS-16

- Additional filing requirements

- Frequently asked questions

Let’s begin by taking a closer look at this tax form.

Table of contents

How do I complete IRS Form SS-16?

This one-page tax form is fairly straightforward. However, there are 4 identical copies of Form SS-16, and each copy goes to a different recipient:

- Copy A: To be retained by the Internal Revenue Service

- Copy B: To be forwarded to the Social Security Administration

- Copy C: To be returned to the taxpayer

- Copy D: Retain in your records

For your convenience, we’ve broken this down into two parts:

- Information about the religious order

- Signature section

Let’s take a closer look, starting at the top.

Information about the religious order

In this section, we will enter the necessary information about the religious order that is electing to participate in Medicare coverage for its members.

Enter the following information:

- Full name of the religious order

- Employer identification number

- Address, including city, state, and ZIP code

- Effective date of election

Foreign address

If your religious order has a foreign address, then enter the information in the following order:

- City

- Province or state

- Country

Follow the country’s practice for entering the postal code. Do not abbreviate the country name.

Effective date

This election becomes effective for the period that begins on the first day of one of the following:

- The calendar quarter in which the order files the certificate,

- The calendar quarter after the quarter in which the certificate is filed, or

- Any one of the 20 calendar quarters before the quarter in which the certificate is filed

Enter one of these dates in the space provided. If the effective date for your election is incorrect for your filing date, or if the date is missing, then the Internal Revenue Service will return Form SS-16 to you without processing it.

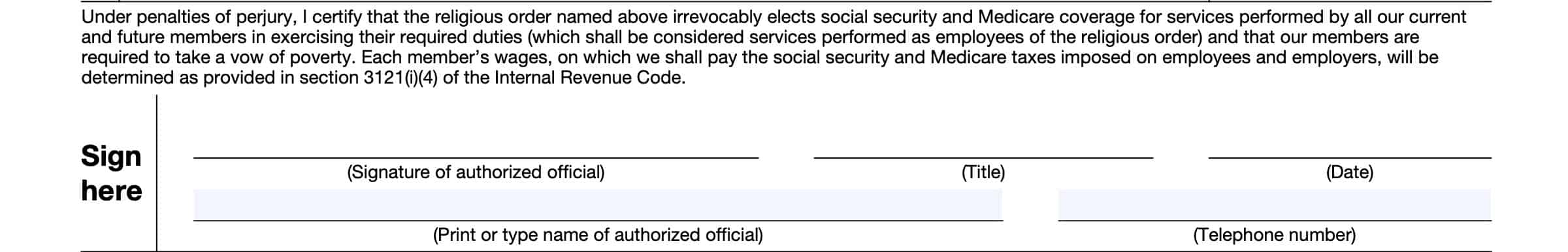

Signature section

The signature section contains the sworn statement, under penalties of perjury, that:

- The named religious order irrevocably elects Social Security and Medicare coverage for services performed by all future and current members in exercising their required duties

- Considered services performed as employees of the religious order

- All members must take a vow of poverty

- Each member’s wages are determined as provided in Internal Revenue Code Section 3121(i)(4)

This section should contain the following information:

- Signature of authorized official

- Authorized official’s title

- Date of signature

- Printed or typed name

- Contact telephone number

Filing considerations

There are several things to keep in mind about Form SS-16.

Purpose of Form

A religious order (or autonomous subdivision of a religious order) whose members must take a vow of poverty may file Form SS-16 to certify that it elects Social Security and Medicare coverage under IRC Section 3121(r) for services its members perform in exercising their required duties.

This form consists of four pages.

Copies A and C each contain the same general information and instructions for filing IRS Form SS-16.

Copies B and D each contain the same instructions specific to this election for filing the following tax forms:

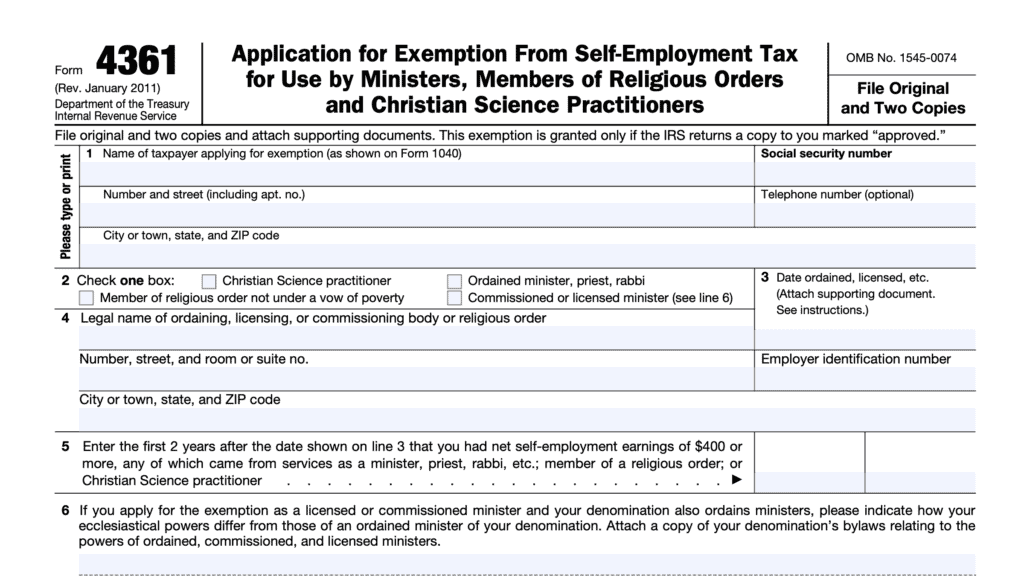

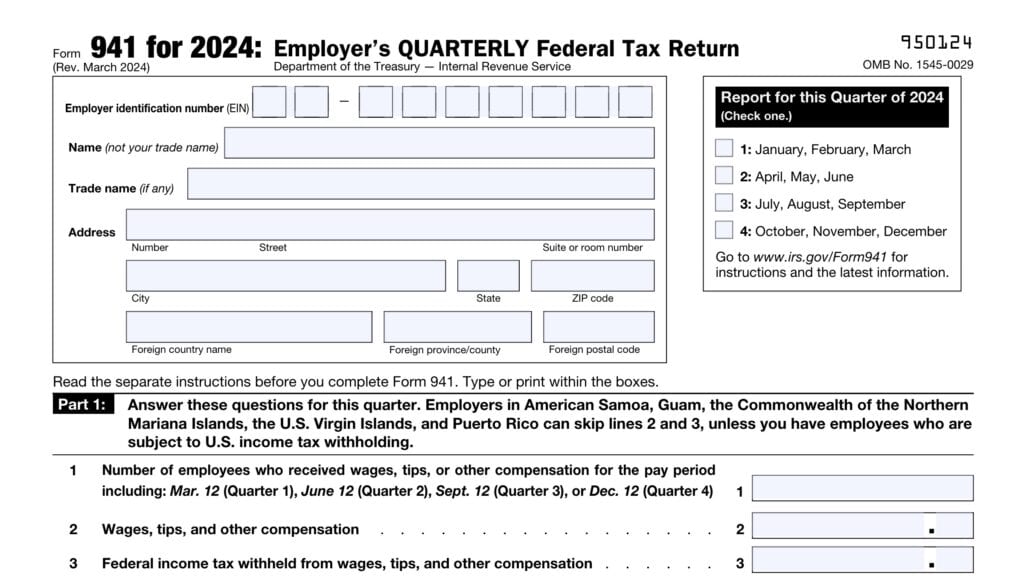

- IRS Form 941, Employer’s QUARTERLY Federal Tax Return, and

- IRS Form 941-X, Adjusted Employer’s QUARTERLY Federal Tax Return or Claim for Refund

How to file IRS Form SS-16

File this tax form by sending completed copies A, B, and C to the IRS at the following address:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0005

Effect of Election

This certificate is irrevocable and applies to all current and future members of the order.

All services a member performs in exercising required duties are considered performed as an employee of the order. The order must pay the Social Security and Medicare taxes imposed on employees and employers on the wages, as defined later, of each active member.

Report these taxes on Form 941 or 941-X, as appropriate.

Retroactive Coverage

When Social Security and Medicare coverage is made retroactive to a quarter before the quarter in which the certificate is filed, coverage applies only to services performed during the retroactive period by persons who were active members when the services were performed and who are alive on the first day of the quarter the certificate is filed.

Paying taxes for retroactive coverage

When the order elects retroactive coverage to cover one or more calendar quarters before the filing quarter, the religious order must report and pay the total employer and employee Social Security and Medicare taxes for these quarters.

File Form 941 or 941-X, as appropriate, for each quarter.

Definitions

Member of religious order

For purposes of this certificate, a member of a religious order is an individual who

- Is subject to a vow of poverty as a member of the religious order

- Performs the services usually required of an active member, and

- Is not considered retired because of age or disability

Wages for member’s services

For purposes of this certificate, wages subject to Social Security and Medicare taxes generally include

all pay given to a member for services performed. The term wages also includes the fair market value of board, lodging, clothes, and other benefits that a member receives in return for services from the religious order or from any person or organization under an agreement with that order or subdivision.

If the fair market value of items provided is less than $100 per month, then that amount is not included as wages

Video walkthrough

Frequently asked questions

IRS Form SS-16 is the tax form that a religious order may file with the IRS to certify that it elects Social Security and Medicare coverage for services its members perform in exercising their required duties.

Certain religious orders, whose members must take a vow of poverty, may file IRS Form SS-16 to elect Social Security coverage for members who were previously exempt.

Yes. Religious orders who file Form SS-16 must file employment tax returns and pay employment taxes. If choosing a retroactive election, the order may need to file adjusted employment tax returns and pay the additional employment tax on behalf of its members.

Where can I find IRS Form SS-16?

You can find updated versions of tax forms on the IRS website. For your convenience, we’ve included the latest version of Form SS-16 here in this article.