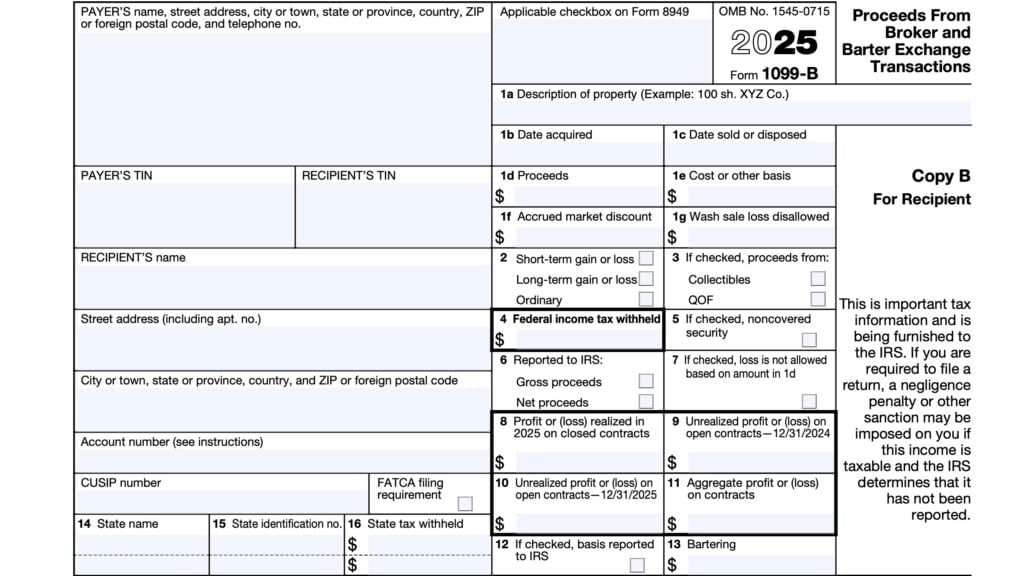

IRS Form 1099-DA Instructions

Starting in January 2025, the Treasury Department has issued final regulations with a new reporting requirement involving digital assets transactions. This resulted in the new IRS Form 1099-DA, Digital Asset Proceeds From Broker Transactions, which reports sales and exchanges of digital assets for tax purposes.

In this article, we’ll walk through everything you need to know about IRS Form 1099-DA, including:

- What you should expect to see in each box on this form

- How this tax information will impact your income tax return

- When you should expect your Form 1099-DA and what to do if you do not receive it on time

Let’s start by breaking down this new tax form, one step at a time.

Table of contents

IRS Form 1099-DA Instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the detailed information reported on their new 1099-DA form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 4 copies of the new Form 1099-DA. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy 1: State tax department

- Copy B: For the payment recipient

- Copy 2: Filed with state income tax return

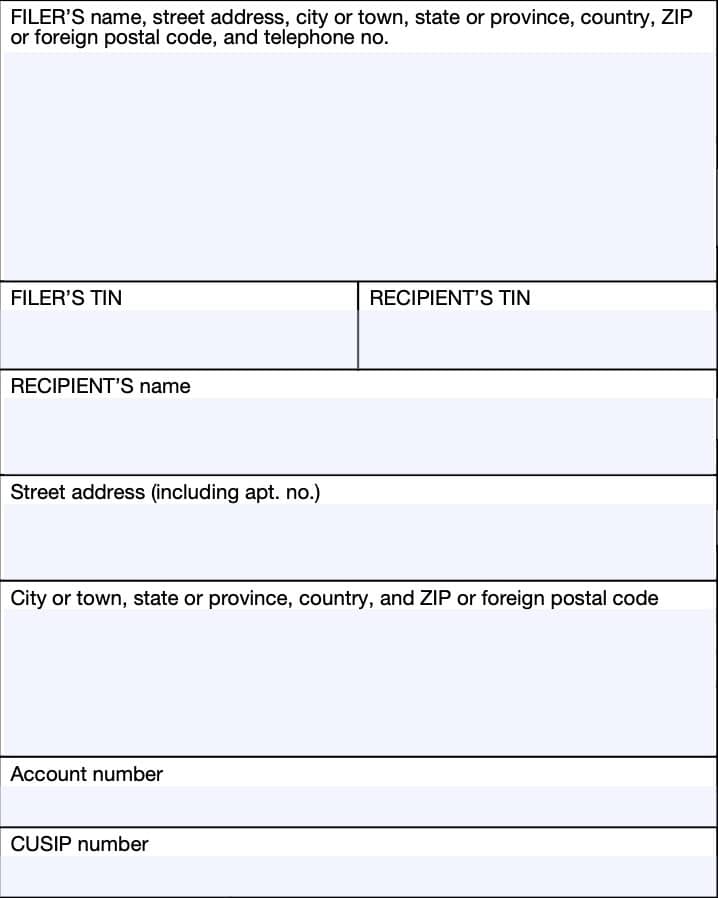

Taxpayer information

Let’s get into the form itself, starting with the information fields on the left side of the form.

Filer’s Name, Address, And Telephone Number

You should see the filer’s contact information, with complete business name, address, zip code, and telephone number in this field. The filer is the broker that is reporting the digital asset transactions and related tax information.

Filer’s TIN

This is the filer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The filer’s TIN should never be truncated.

Recipient’s TIN

As the recipient of IRS Form 1099-DA, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

Copy A, which the brokerage firms sends to the Internal Revenue Service, will not be truncated.

recipient’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the filer and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account number

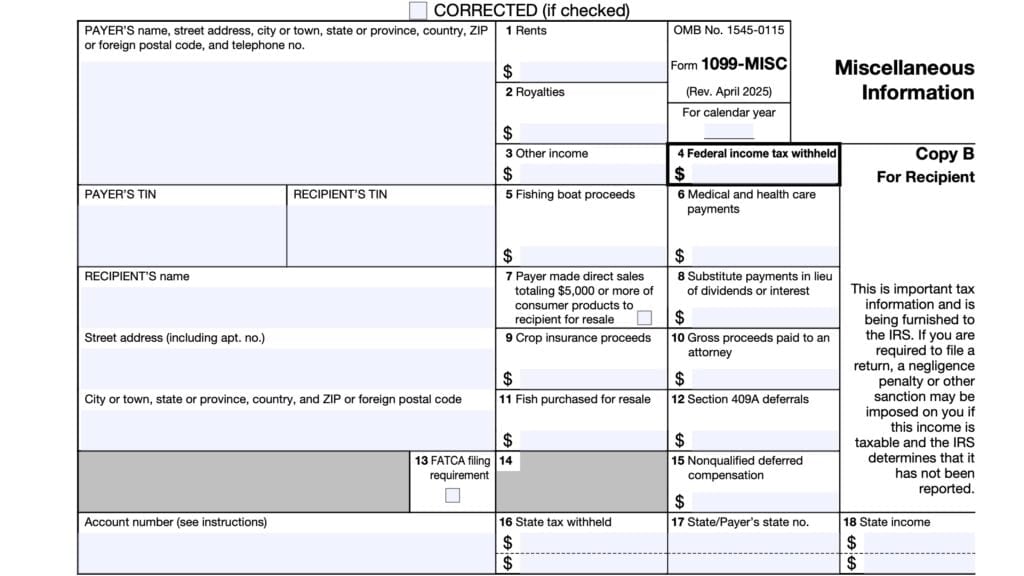

This field is present in many information returns, such as IRS Form 1099-NEC or IRS Form 1099-MISC.

Your lender have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

However, digital asset brokers must enter an account number if the financial institution has:

- Created multiple accounts for a recipient, and

- Is filing more than Form 1099-DA for that person

CUSIP number

This field shows the CUSIP (Committee on Uniform Security Identification Procedures) number or other applicable identifying number for certain securities.

Let’s take a closer look at the required information reported on the form itself.

Federal tax information

In this section, we’ll review the necessary information that you should expect to see reported on your Form 1099-DA.

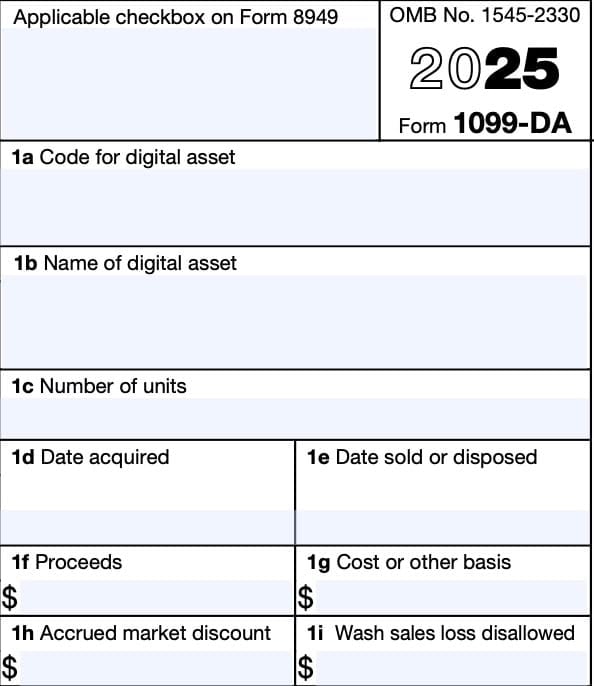

Applicable checkbox on Form 8949

Your brokerage firm will use this box to enter a one-letter code to help you properly report this transaction on either of the following forms (or both, if required):

- IRS Form 8949, Sales and Other Dispositions of Capital Assets

- Schedule D (Form 1040), Capital Gains and Losses

You should expect to see one of the following:

- Code G: This code indicates a short-term transaction for which the broker is reporting cost or other basis to the Internal Revenue Service

- Code H: Indicates a short-term transaction for which the broker is not reporting cost or other basis to the Internal Revenue Service

- Code J: This code indicates a long-term transaction for which the broker is reporting cost or other basis to the Internal Revenue Service

- Code K. This code indicates a long-term transaction for which the broker is not reporting cost or other basis to the Internal Revenue Service

- Code Y. Your broker will use this code to report a transaction if the brokerage firm cannot determine whether the recipient should check box H or box K on Form 8949 because the holding period is unknown.

Box 1a: Code for digital asset

This field should contain a nine-digit identification number issued by the Digital Token Identification

Foundation (DTIF). If the digital asset is not registered with DTIF, the IRS instructions will direct your broker to enter 999999999.

Box 1b: Name of digital asset

This field should contain the full name of the digital asset being reported.

If your broker entered a DTIF digital token identification in Box 1a, this box should contain the name that matches the DTIF registration.

Box 1c: Number of units

This field will contain the number of digital asset units sold, exchanged, or otherwise disposed of in the transaction to 18 decimal places.

Box 1d: Date acquired

This field should contain the acquisition date of the digital asset sold in MM/DD/YYYY format. For example, if the acquisition date is May 24, 2025, Box 1d should indicate: 05/24/2025.

Box 1d might be blank if either of the following conditions apply:

- You acquired the digital assets on multiple acquisition dates

- Your broker checks Box 9 and either:

- Does not know the acquisition date or

- Chooses to not complete Box 1d.

Box 1e: Date sold or disposed

Box 1e will contain the sale date or disposition date in MM/DD/YYYY format.

Box 1f: Proceeds

Box 1f will contain the gross proceeds from the sales of digital assets. Box 1f should reflect losses, such as such as one from a closing transaction on a written option or forward contract, as a negative amount and will appear in parentheses.

Total proceeds may include the following received in the exchange of digital assets:

- Value of services provided

- Cash

- Digital assets

- Other property received

The brokerage firm must reduce the proceeds by digital asset transaction costs. These include:

- Transaction fees

- Commissions

- Transfer taxes related to the sale

Options granted or acquired before 2014

For digital assets sales due to the exercise of an option granted or acquired in 2013 or in prior years, the broker may, but does not have to, take into account option premiums in determining gross proceeds.

Options granted or acquired after 2013

For digital assets sold because of the exercise of an option granted after 2013 or for the treatment of an

option granted or acquired after 2013, Treasury Regulations Section 1.6045-1(m) contains additional details.

Gross proceeds reduced by option premiums

If the broker reduced gross proceeds by option premiums, Net proceeds in Box 3a will be checked. Otherwise, check Gross proceeds will be checked in Box 3a.

Box 1g: Cost or other basis

Box 1g contains the adjusted basis of any digital asset sold unless:

- The digital asset is not a covered security and

- The broker checked Box 9 is checked and chose not to complete Box 1g

If the broker checked Box 9 and is not reporting cost basis, Box 1g will be blank. Box 1g will only contain a zero only if the digital asset sold actually had a cost basis of zero.

Box 1h: Accrued market discount

For digital assets that are covered securities and also debt instruments for federal income tax purposes, the amount of accrued market discount will be reflected in Box 1h.

Box 1i: Wash sales loss disallowed

Losses from wash sales of tokenized securities must be reported in accordance with Treasury Regulations Section 1.6045-1(c)(8)(i)(D)(1).

However, your custodial broker does not have to apply the wash sale rules if:

- You have made a valid and timely mark-to-market election under Section 475 and identified the account from which tokenized securities were sold as containing only securities subject to the election

- The purchased digital asset is transferred to another account before the wash sale,

- The purchased digital asset was purchased in another account and later transferred into the account from which the digital asset was sold, or

- The digital assets are treated as held in separate accounts

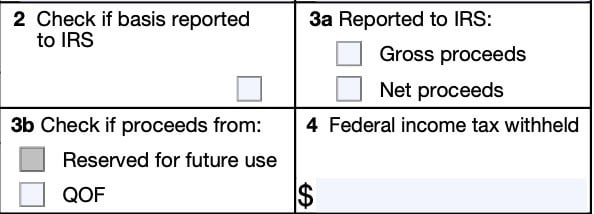

Box 2: Check if basis reported to IRS

If Box 2 is checked, then either your broker is:

- Not checking Box 9, or

- Checking Box 9 but reporting basis to the IRS in Box 1g anyway

Box 3a

Gross proceeds includes the entire amount of the proceeds from the sale of the digital asset. Net proceeds includes gross proceeds reduced by the amount of option premiums.

Box 3b

If the QOF box is checked, this means that you disposed of an interest in a qualified opportunity fund.

Box 4: Federal income tax withheld

You should see backup withholding amounts reported in Box 4. If you have not given your TIN to the payer, you may be subject to backup withholding rules on payments made on IRS Form 1099-B.

In this case, you may need to complete IRS Form W-9, Request for Taxpayer Identification Number and Certification. This will allow the payer to report the correct TIN to the Internal Revenue Service.

Foreign recipients may need to complete IRS Form W-8 instead.

You should include this amount on your Form 1040 or Form 1040-SR as tax withheld when filing your income tax return.

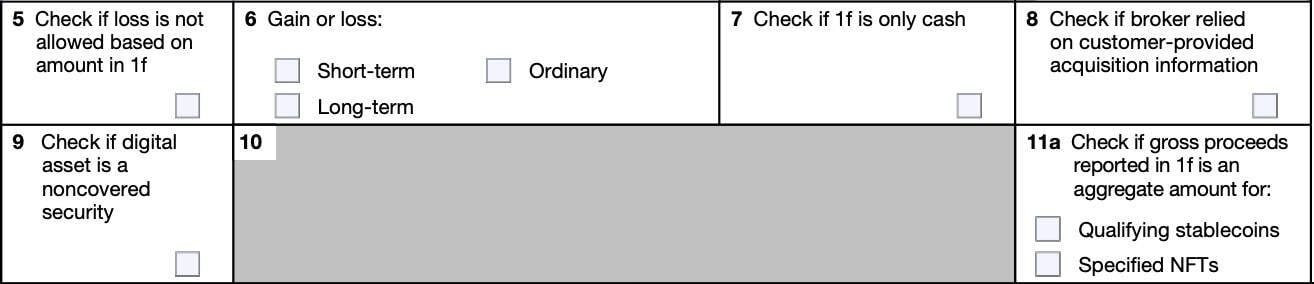

Box 5

If Box 5 is checked, you cannot take a loss on your tax return based on gross proceeds from a reportable significant change in control or capital structure that your broker reported in Box 1f. The broker should advise you of any losses on a separate statement.

Box 6: Gain or loss

The short-term and long-term boxes pertain to short-term gain or loss and long-term gain or loss.

If your broker checked the Ordinary gain or loss box, then special rules may apply to the sale of your digital asset.

Box 7

If this box is checked, that means the amount reported in Box 1f reflects that you only received cash as part of the digital assets transaction.

Box 8

If this box is checked, this indicates that you provided acquisition information to your broker and

they relied on this specific information to determine which digital asset was sold, exchanged, or disposed of.

Box 9: Noncovered Security

If Box 9 contains a check, the digital asset sold was a noncovered security. As a result, the following boxes may be blank:

Box 10: Reserved for future use

There should be nothing in Box 10.

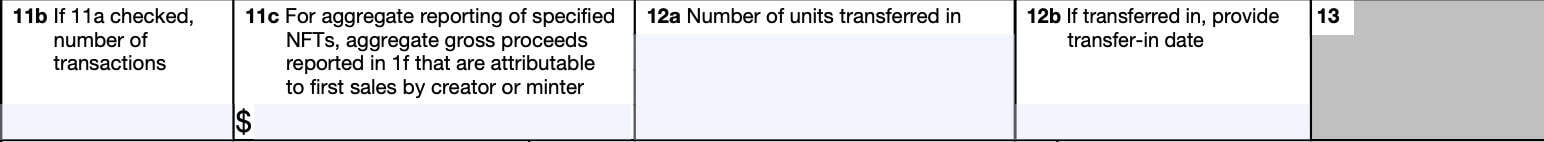

Box 11a

If checked, the digital assets sold were qualifying stablecoins or specified non-fungible tokens (NFTs). The information reported in Box 1f represents the aggregate gross proceeds from those stablecoin or NFT sales for the current year.

Box 11b will indicate the number of broker transactions that occurred during the tax year if a check appears in Box 11a.

Box 11b

If the brokerage firm checked Box 11a, then Box 11b will contain the number of property transactions involved. Otherwise, Box 11b will be blank.

Box 11c

Box 11c contains the gross proceeds from the first sale of any specified NFTs you created or minted.

Box 12a: Number of units transferred in

Box 12a shows the number of digital asset units transferred into an account at the broker.

Box 12b

Box 12b shows the transfer-in date for the number of units reported in Box 12a, in MM/DD/YYYY format.

This box may be blank if you transferred the digital assets on a variety of dates.

Box 13

For future use.

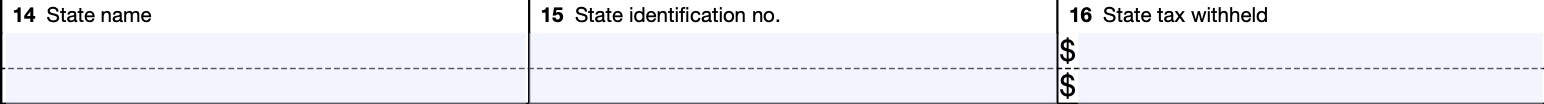

State tax information

Box 14 through Box 16 contain state income tax information. If you live in a state without an income tax, these fields may be left blank.

Box 14: State

If you live in a state without income tax, you may not see any information in Boxes 14 through 16. However, Boxes 14 through 16 may contain relevant taxable income information for up to 2 different states.

If applicable, Box 14 will contain the abbreviated name of the applicable state(s).

Box 15: State identification number

If your financial institution has a specific state tax identification number, that TIN will appear in Box 15.

Box 16: State tax withheld

Box 16 contains any state income tax withheld on income items reported on Form 1099-DA.

Video walkthrough

Frequently asked questions

The IRS requires financial institutions to issue Form 1099-DA by January 31 of the year following the tax year they issued dividends. These reporting requirements only apply when a brokerage firm must report digital asset dispositions to you and the IRS.