IRS Form 8863 Instructions

In the United States, education credits can be one of the biggest tax benefits for many families. In this article, we’ll explore IRS Form 8863, Education Credits. Specifically, we’ll discuss:

- The types of educational credits this tax form covers

- What types of educational expenses qualify for these tax credits

- How to complete this form so you can lower your tax bill

Table of contents

Let’s start by discussing going through this tax form, step by step.

How do I complete IRS Form 8863?

This two-page tax form contains 3 parts:

- Part I: Refundable American Opportunity Credit

- Part II: Nonrefundable Education Credits

- Part III: Student and Educational Institution Information

Let’s take a look at each of these parts, one step at a time. Although we’ll proceed in order, taxpayers must complete Part III for each eligible student before completing Part I or Part II.

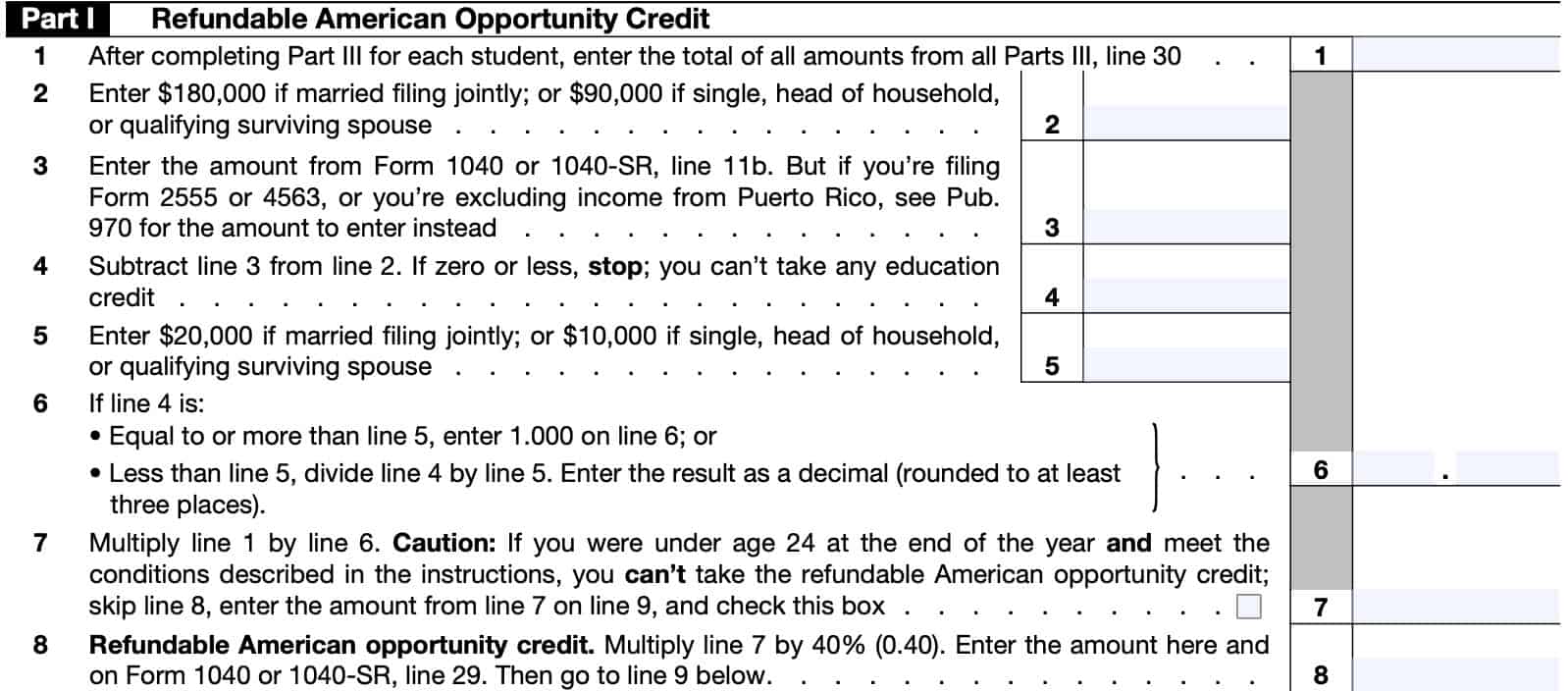

Part I: Refundable American Opportunity Credit

In Part I, we’ll calculate the refundable portion of the American Opportunity Tax Credit.

Refundable tax credits are tax credits that can result in a tax refund, even if the overall tax liability is already zero.

Line 1

Enter the total of all amounts from all Part III sections, Line 30. If you’re claiming the AOTC for 3 students, then you would do the following:

- Complete Part III three times (three separate forms)

- Combine the values

- Insert the total in Line 1

Line 2

Enter the dollar amount that applies to your tax filing situation:

- $180,000 for all married couples filing a joint return

- $90,000 for single, head of household, or qualifying widow(er) filers

Note: taxpayers who are married but filing separate returns are ineligible for the AOTC.

Line 3

Enter the amount from Line 11 of IRS Form 1040 or 1040-SR. This represents your adjusted gross income (AGI), as currently reported on your tax return.

If you’re filing Form 2555, Foreign Earned Income, or Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa or excluding income from Puerto Rico, see IRS Publication 970, Tax Benefits for Education for additional information.

Line 4

Subtract Line 3 from Line 2. If zero or less, you cannot take any education credit because your adjusted gross income is above the threshold.

Line 5

Enter the following dollar amounts as applicable:

- $20,000 for all married couples filing jointly

- $10,000 for single, head of household, or qualifying widow(er) filers

Line 6

If Line 4 is equal or more than Line 5, enter 1.000.

If Line 5 is greater than Line 4, then divide Line 4 by Line 5. Enter the result as a decimal rounded to at least 3 places.

Line 7

Multiply Line 1 by Line 6. Enter the result.

Taxpayers who cannot claim the American Opportunity Tax Credit

According to the form instructions, if you are below 24 years of age at the end of the tax year and meet one of the following criteria, you cannot take the AOTC if at least one of your parents was alive at the end of the tax year, and you’re not filing a joint tax return for the year.

- You were under the age of 18 at the end of the tax year

- You were age 18 at the end of the tax year and your earned income was less than 1/2 of your support

- You were older than 18 but younger than 24 at the end of the tax year, and a full-time student, and your earned income was less than 1/2 of your support

Line 8: Refundable American Opportunity Credit

Multiply Line 7 by 40%. Enter the amount here and on Line 29 of your Form 1040 or Form 1040-SR.

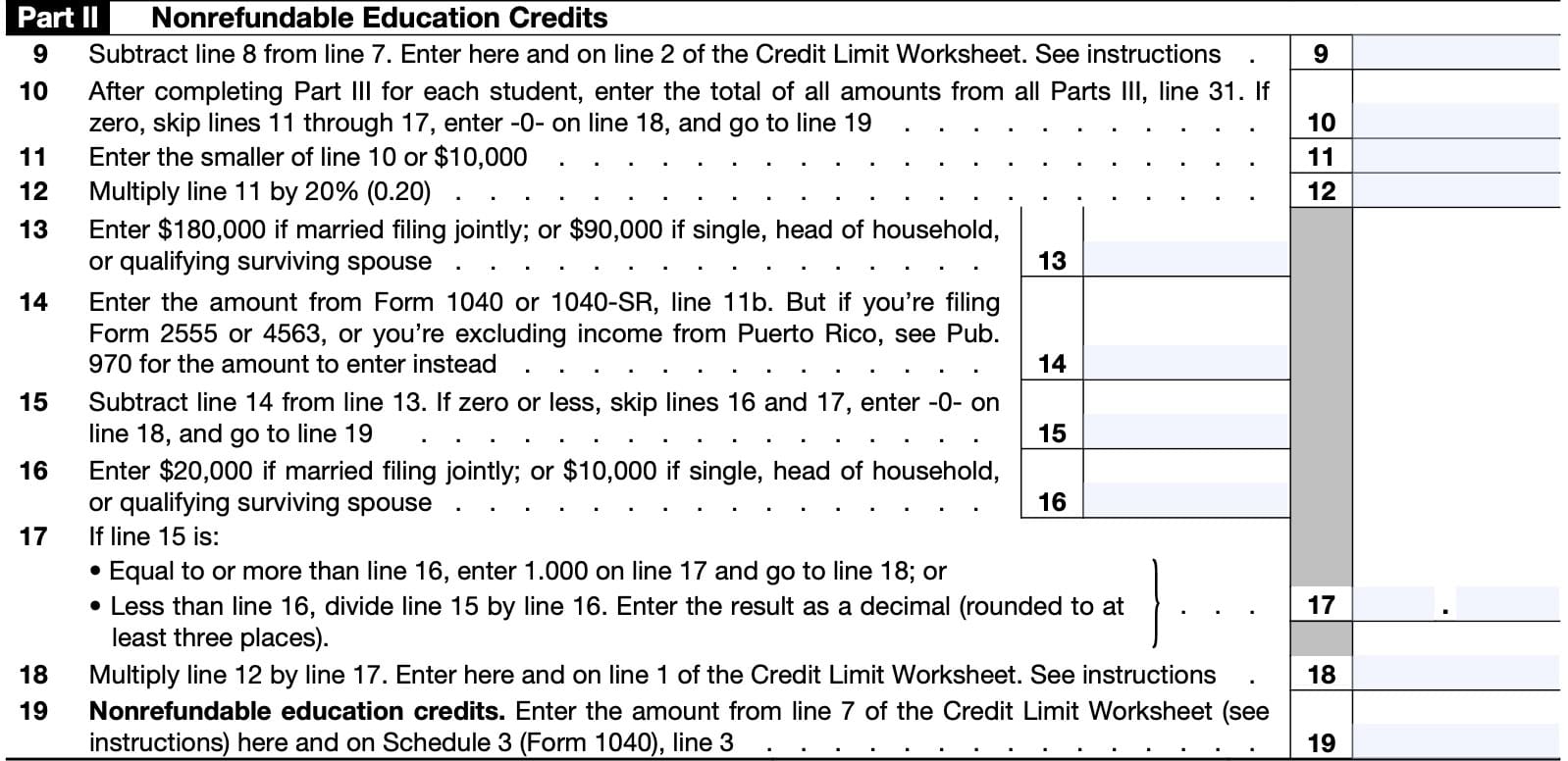

Part II: Nonrefundable Education Credits

In Part II, we’ll calculate the nonrefundable amount of education credits you can claim on IRS Form 8863. This includes both the American Opportunity Credit and the Lifetime Learning Credit.

Line 9

Subtract Line 8 From Line 7. Enter that number here and on the Credit Limit Worksheet contained in the form instructions. Below is a YouTube video that walks you through how to complete the credit limit worksheet.

Line 10

Enter the total of all amounts from all Parts III, Line 31.

If this amount equals zero, then do the following:

- Skip Lines 11 through 17

- Enter ‘0’ on Line 18

- Proceed to Line 19

Otherwise, go to Line 11.

Line 11

Enter the smaller of the number on Line 10 or $10,000. This is the ceiling for allowable qualified eduction credits.

Line 12

Multiply Line 11 by 20%. This total represents the possible nonrefundable education credits allowable.

Line 13

Enter the dollar amount that applies to your tax filing situation:

- $180,000 for all married couples filing jointly

- $90,000 for single, head of household, or qualifying widow(er) filers

Remember, taxpayers who are married but filing separate returns are ineligible for the Lifetime Learning Credit.

Line 14

Enter the amount from Line 11 of IRS Form 1040 or 1040-SR. This represents your adjusted gross income (AGI), as currently reported on your tax return.

If you’re filing Form 2555, Foreign Earned Income, or Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa or excluding income from Puerto Rico, see IRS Publication 970, Tax Benefits for Education for additional information.

Line 15

Subtract Line 14 from Line 13. If zero or less, do the following:

- Skip Lines 16 and 17

- Enter ‘0’ on Line 18

- Proceed to Line 19

Line 16

Enter the dollar amount that applies to your tax filing situation:

- $180,000 for all married couples filing jointly

- $90,000 for single, head of household, or qualifying widow(er) filers

Remember, taxpayers who are married but filing separate returns are ineligible for the Lifetime Learning Credit.

Line 17

If Line 15 is equal or more than Line 16, enter 1.000.

If Line 16 is greater than Line 15, then divide Line 15 by Line 16. Enter the result as a decimal rounded to at least 3 places.

Line 18

Multiply Line 12 by Line 17. Enter the result here and on Line 1 of the Credit Limit Worksheet.

Line 19: Nonrefundable education credits

Enter the amount from Line 7 of the Credit Limit Worksheet here and on IRS Schedule 3 (Form 1040), Line 3.

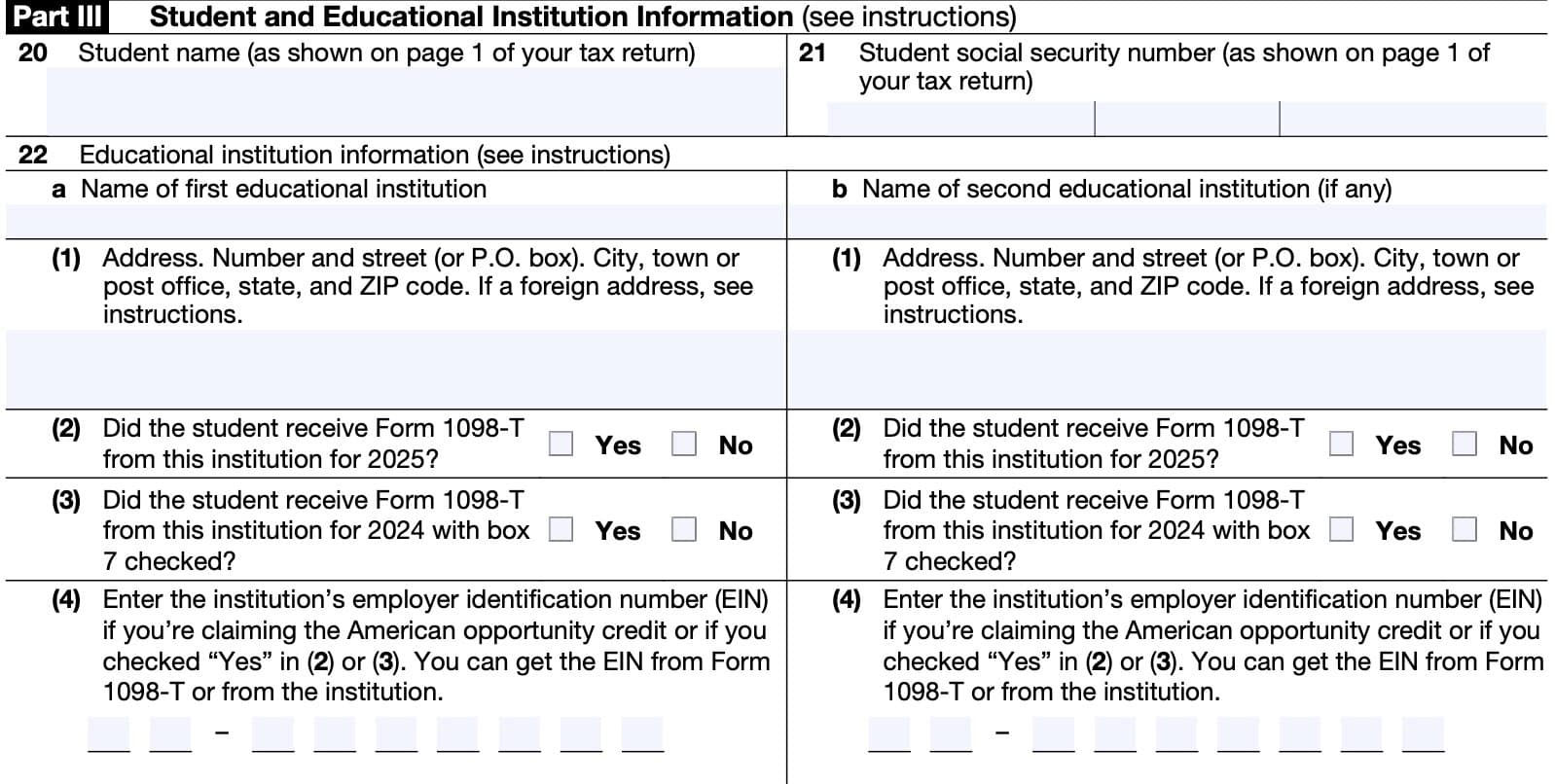

Part III: Student and Educational Institution Information

Before completing Part I or Part II, you must complete Part III for each eligible student for whom you are claiming either the American Opportunity Credit or Lifetime Learning Credit.

Use additional copies of Page 2 on this form as required.

Line 20: Student name

As shown on Page 1 of the tax return.

Line 21: Student Social Security number

As shown on Page 1 of the tax return.

Line 22: Educational institution information

If one or more of the following is applicable, see the form instructions for more details.

- The student attended more than one higher educational institution during the year

- The student’s educational institution has a foreign address

Otherwise, enter the following:

- Name of educational institution

- Institution’s address, including city, state, and zip code

- Whether or not the student received IRS Form 1098-T from the institution

- Whether or not Box 7 was checked on IRS Form 1098-T

- Institution’s employer identification number

Line 7 indicates whether or not an amount was paid for the following tax year.

The Institution’s EIN is required for taxpayers claiming the American Opportunity Credit, and should be on the Form 1098-T. If you did not receive Form 1098-T from the institution, you may need to contact the institution directly to obtain the EIN.

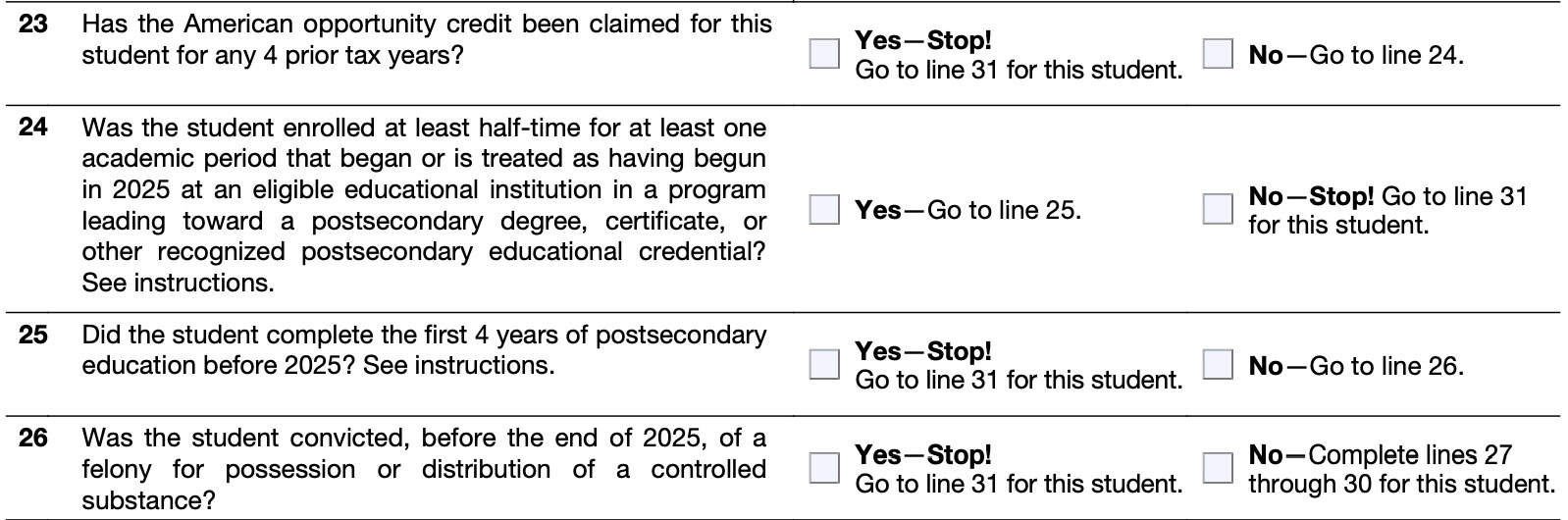

Line 23: Was the Hope Scholarship Credit or AOTC claimed for this student for any 4 tax years?

If not, go to Line 24. If so, go to Line 31. The student is ineligible for the AOTC.

Line 24: Was the student enrolled at least half-time for at least one academic period in the tax year?

Must meet the AOTC requirements outlined above. Otherwise, go to Line 31. The student is ineligible for the AOTC.

Line 25: Did the student complete the first 4 years of postsecondary education before the tax year?

If so, go directly to Line 31.

Line 26: Was the student previously convicted of a felony drug offense?

If so, go directly to Line 31.

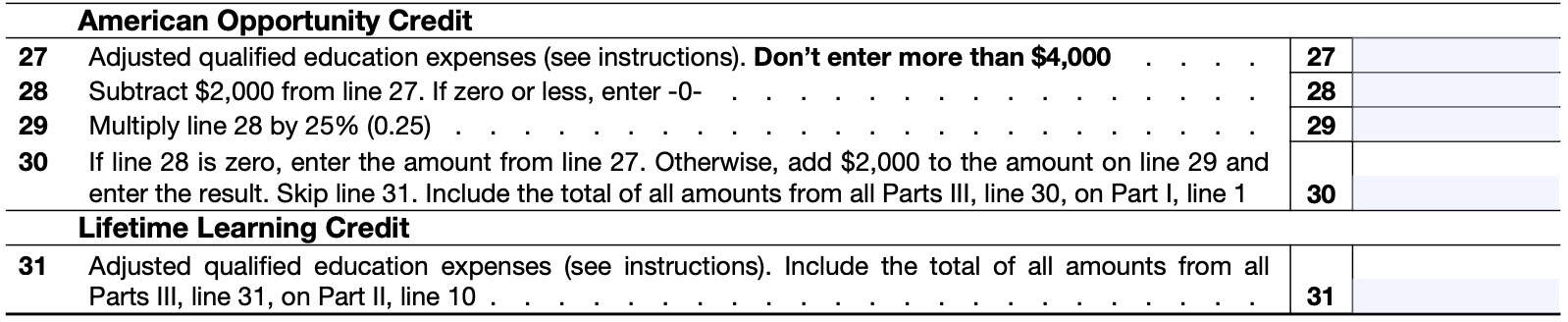

Lines 27 through 30

Lines 27 through 30 are for purposes of determining the American Opportunity Credit. If any answer in Lines 23 through 26 above directed you to Line 31, it is because the student is ineligible for the AOTC.

Line 27: Adjusted qualified education expenses

Do not enter more than $4,000. If you cannot determine the adjusted amount, you may need to use the worksheet contained in the form instructions.

Line 28

Subtract $2,000 from Line 27.

Line 29

Multiply Line 28 by 25%.

Line 30

If Line 28 is zero, enter the amount from Line 27. Otherwise, add $2,000 to the amount on Line 29 and enter the result.

Skip Line 31. Include the total of all amounts from all Parts III, Line 30, on Part I, Line 1.

Line 31: Lifetime Learning Credit

Enter the adjusted qualification education expenses (same as Line 27). However, you will only enter this number on either Line 27 or Line 31, not both.

Include the total of all amounts from all Parts III, Line 30, on Part II, Line 1.

What is the American Opportunity Tax Credit?

According to the Internal Revenue Service website, the American Opportunity Tax Credit (AOTC) is a refundable tax credit for qualified education expenses paid on behalf of an eligible student during the first four years of higher education.

Since the AOTC is a refundable credit, you can receive a portion of the credit as a tax refund, even if the tax credit brings your tax liability down to zero.

How much is the American Opportunity Credit?

Each person can receive a maximum annual credit of $2,500. This amounts to up to $10,000 in educational tax credits over four years.

The credit amounts to:

- 100% of the first $2,000 in qualified education expenses paid, per eligible student

- 25% of the next $2,000 in qualified education expenses paid

If the credit brings the taxpayer’s tax liability down to zero, then the IRS will refund 40% of the remaining education tax credit, up to $1,000. Per year.

Who can claim the American Opportunity Tax Credit?

According to IRS Publication 970, Tax Benefits for Education, a taxpayer can generally claim the AOTC if they meet all three of the following requirements:

- Taxpayer pays qualified education expenses for higher education

- Taxpayer pays education expenses for an eligible student

- The eligible student is either:

- The taxpayer

- Taxpayer’s spouse

- Dependent that the taxpayer claims on their federal income tax return

To meet the criteria for eligible student, the following conditions must be true:

- The student must not have completed the first 4 years of postsecondary education as determined by the eligible educational institution

- No one must have claimed the AOTC for the student on their federal tax return for any 4 tax years prior to the current tax year

- For at least one academic period during the tax year, the student must have carried at least 50% of the normal workload for their course of study. The student must be enrolled in a course of study that leads to a degree, certificate, or other recognized education credential.

- The student must not have a conviction for a felony drug offense.

Who cannot claim the American Opportunity Tax Credit?

In general, the following people cannot claim the AOTC:

- Taxpayers whose filing status is married filing separately

- People who are claimed as a dependent on another taxpayer’s tax return. For example, a student cannot claim the AOTC if the student is listed as a dependent on their parents’ tax return

- Taxpayers with a modified adjusted gross income (MAGI) of:

- $90,000 or more for single taxpayers

- $180,000 for married couples filing jointly

- Either the taxpayer or the taxpayer’s spouse was a nonresident alien for any part of the current year, and did not choose to be treated as a resident alien for tax purposes

- Taxpayers without a Social Security number or individual taxpayer identification number (ITIN) by the due date of the tax return.

Below is a flow chart from IRS Publication 970 that outlines how you might determine whether you’re eligible for the AOTC.

What is the Lifetime Learning Credit?

The Lifetime Learning Credit is another education credit for students or taxpayers whose dependents are students.

How much is the Lifetime Learning Credit?

The Lifetime Learning tax credit represents 20% of a student’s eligible expenses for higher education, up to $10,000 per year. This means that the taxpayer can use the Lifetime Learning Credit to reduce their total tax bill by up to $2,000 per year.

Unlike the AOTC, there is no limit on the number of years a taxpayer may use the Lifetime Learning Credit. However, the Lifetime Learning Credit is a nonrefundable tax credit, so it cannot lower taxable income below zero.

The Lifetime Learning Credit gives a smaller tax benefit than the AOTC, but may be good for taxpayers in the following situations:

- Taxpayers who have already used their 4 years of AOTC eligibility

- Taxpayers who may otherwise be ineligible for AOTC because of a felony drug conviction

- Students who do not meet the enrollment criteria (at least half time coursework) the AOTC requires

Who can claim the Lifetime Learning Credit?

Generally speaking, a taxpayer may claim the Lifetime Learning credit if they are paying qualified education expenses for an eligible student that they can claim as themselves, a spouse, or a dependent student on their income tax return.

Who cannot claim the Lifetime Learning Credit?

Generally speaking, a taxpayer cannot claim the Lifetime Learning Credit if:

- Their filing status is married, filing separately

- Their MAGI is above:

- $90,000 for single taxpayers

- $180,000 for a married couple filing a joint tax return

- They are claimed as a dependent on another taxpayer’s return

- Either the taxpayer or the taxpayer’s spouse was a nonresident alien for any part of the current year, and did not choose to be treated as a resident alien for tax purposes

- They claimed the AOTC for the same tax year

Please notice that the major difference between the AOTC and the Lifetime Learning Credit is that students convicted of a felony drug conviction may still be eligible for the Lifetime Learning Credit.

In order to qualify for either the American Opportunity Credit or the Lifetime Learning Tax Credit, a student must have qualified education expenses.

What are qualified education expenses?

Generally speaking, qualified education expenses are the amounts paid in the given tax year for tuition and fees required for the student’s enrollment or attendance at an eligible postsecondary educational institution. The form of payment (cash, check, credit card, student loans) is immaterial.

Books, supplies and equipment

For course-related books, supplies, and equipment, only certain expenses qualify. Each tax credit has slightly different criteria for eligible expenses in this category.

American Opportunity Tax Credit

Qualified education expenses include amounts paid for tuition, fees, and course materials. This include books, supplies, and equipment needed for a course of study.

Unlike the Lifetime Learning credit, it does not matter whether or not the materials are purchased from the educational institution as a condition of enrollment or attendance.

Lifetime learning credit

Qualified education expenses include amounts paid for books, supplies, and equipment only if required to be paid to the institution as a condition of enrollment or attendance.

Fees

Qualified education expenses can also include nonacademic fees only if the institution requires that fee as a condition of enrollment or attendance.

Examples might include:

- Student activity fees,

- Athletic fees,

- Other expenses unrelated to the academic course of instruction,

However, fees for personal expenses (described below) are never qualified education expenses.

Ineligible expenses

Qualified education expenses don’t include amounts paid for the following.

Personal expenses

This includes:

- Room and board or dormitory expenses

- Insurance

- Medical expenses (including student health fees)

- Transportation

- Other similar personal, living, or family expenses

Other expenses

Any course or other education involving sports, games, or hobbies, or any noncredit course, unless such course or other education is part of the student’s degree program. For purposes of the Lifetime Learning Credit, an expense may be eligible if that expense helps the student acquire or improve job skills.

Expense reporting

You may receive Form 1098-T Tuition Statement from the institution reporting payments received in the tax year in Box 1. However, the amount in box 1 of IRS Form 1098-T may be different from the amount you paid (or are treated as having paid).

In completing Form 8863, use only the amounts you actually paid (plus any amounts you’re treated as having paid) in the tax year. This may be reduced by adjustments to qualified education expenses, as outlined below.

If you or the student takes a tax deduction for the cost of higher education, such as on Schedule C (Form 1040), you cannot use those same expenses in your qualified education expenses when figuring your education credits.

Prepaid Expenses

Qualified education expenses paid in the tax year for an academic period that begins in the first 3 months of the following tax year can be used in figuring an education credit for the current tax year only.

For example, if you pay $2,000 in December 2025 for qualified tuition for the 2026 winter quarter that begins in January 2026, you can use that $2,000 in figuring an education credit for 2025 only (if you meet all the other eligibility requirements).

Adjustments to qualified education expenses

A taxpayer may need to adjust their qualified education expenses if they received financial assistance in paying these expenses during the tax year. The IRS Form 8863 instructions cite the following examples:

- Tax-free educational assistance

- Coordination with Pell grants or other scholarship or fellowship grants

- Tax-free educational assistance treated as a refund

- Tax refunds for credits applied to previous years

- Tax credit recapture

For more details on each of these, please see the form instructions. As a general rule, you cannot claim a tax credit for a cost that you incurred, but eventually received financial assistance for.

Video walkthrough

Watch this instructional video to learn how to claim education tax credits using IRS Form 8863.

Are you tired of dreading tax season?

If you’re like most people, you push through the stress of filing, only to be hit with a bigger bill than expected—then put it all behind you until the same cycle repeats next year.

But what if you could change the game?

Tax planning puts you in control. It’s about being proactive, not reactive—taking small, smart steps throughout the year to reduce your tax burden, increase your savings, and keep more of your hard-earned money working for you.

Here’s what effective tax planning helps you do:

✅ Avoid the surprise of a high tax bill

✅ Understand how your income and decisions affect your taxes

✅ Strategically lower your tax liability over time

Ready to make smarter tax moves?

👉 Join my free weekly tax planning newsletter and get one actionable tip every week to help you reduce your taxes legally and effectively.

Start taking control—your future self will thank you.

Frequently asked questions

IRS Form 8863, Education Credits, is the tax form that a taxpayer may use to take a tax credit for qualified education expenses they incurred during the year. This includes the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit.

For the American Opportunity Credit, the taxpayer must have been enrolled at least half-time during the year, not completed the first 4 years of postsecondary education, not claimed the credit in 4 previous tax years, and have never received a drug-related felony. For the lifetime learning credit, a taxpayer may take a credit of up to 20% of qualified expenses, subject to income limits.

If a student has received tax-free educational assistance, then the taxpayer must adjust qualified education expenses downward. Qualified education expenses not offset by tax-free assistance are considered to be adjusted qualified education expenses.

Where can I find a copy of IRS Form 8863?

You may download a PDF version of this form from the IRS website or by downloading the file below.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!

I like the way on your videos you dive in-but do the simple way and explain if you had this do that!

My question we have to do the college credit but can we also take the $500.00 child credit over 18 but sill at home?

Thank you this very helpful!

If you independently qualify to claim either the AOTC or the LLC for your college student, as well as the credit for other dependents, I don’t see anything in the IRS guidance that says you cannot take both. I would make doubly sure that you independently meet the criteria for each tax credit.

What do you enter on line 2 of the 8863 when married filing single? Is it a 0 or how do you know the instructions say nothing about married filing single. Yes, I know you cant take the credit, but is this where the form entry would rule out the credit by the $0 entry?

Thanks

John

If you’re talking about married filing separately (MFS), the actual tax code prevents MFS filers from claiming a tax credit. As a result, there is not space in Line 2 for any entry by MFS filers. The form was probably designed with the intention that MFS filers do not complete IRS Form 8863.

Here is a link to the tax code reference: https://www.law.cornell.edu/uscode/text/26/25A