IRS Schedule 1-A Instructions

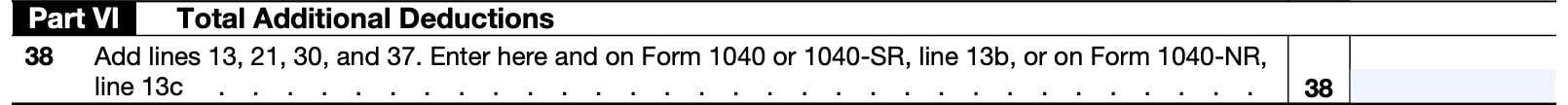

As a result of the One Big Beautiful Bill Act, the Internal Revenue Service created a new tax form to track the new deductions passed into law. This new form, known as IRS Schedule 1-A, Additional Deductions, will be used to help taxpayers calculate and report these tax deductions on their federal income tax return.

In this article, we’ll help you better understand everything you need to know about IRS Schedule 1-A, including:

- How to complete Schedule 1-A

- Types of deductions and tax breaks covered in Schedule 1-A

- Frequently asked questions and filing considerations

Let’s begin by going over this new tax form, step by step.

Table of contents

How do I complete IRS Schedule 1-A?

There are six parts to this two-page schedule:

- Part I: Modified Adjusted Gross Income (MAGI) Amount

- Part II: No Tax on Tips

- Part III: No Tax on Overtime

- Part IV: No Tax on Car Loan Interest

- Part V: Enhanced Deduction for Seniors

- Part VI: Total Additional Deductions

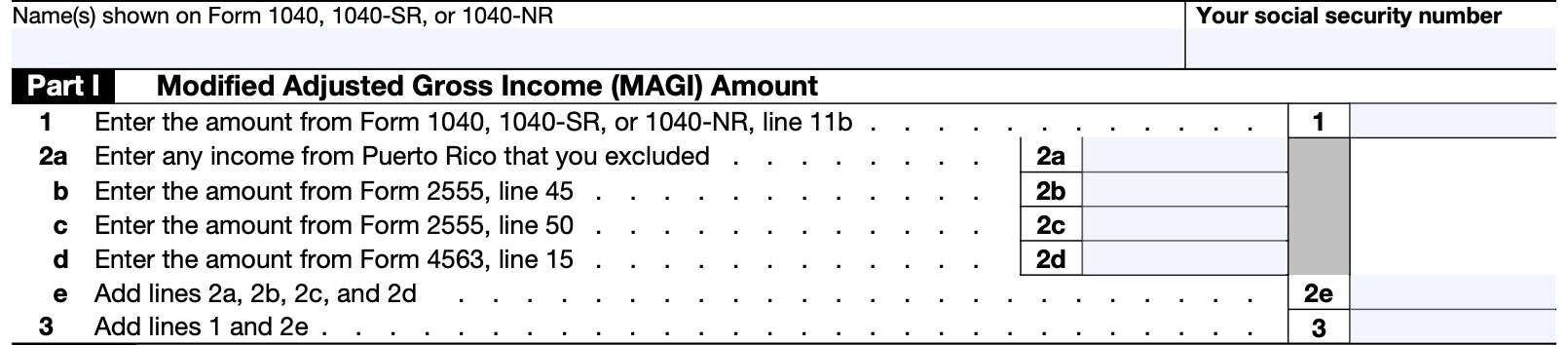

Part I: Modified Adjusted Gross Income (MAGI) Amount

In Part I, we will make adjustments to your adjusted gross income for purposes of determining the amount of the deductions that you may be able to claim on Schedule 1-A.

Let’s begin with your adjusted gross income from Line 11b of your income tax return.

Line 1

Enter the amount from your income tax return, on Line 11b. This is your adjusted gross income, and will be the starting point for calculating the modified adjusted gross income, or MAGI.

Line 2a: Excluded Puerto Rico Income

In this line, enter any income from Puerto Rico sources that you previously excluded from taxable income.

Line 2b: Foreign earned income exclusion

If you completed IRS Form 2555, Foreign Earned Income, then enter the amount from Line 45 here. This represents the foreign earned income exclusion.

If you did not complete IRS Form 2555, then go to Line 2d.

Line 2c: Foreign housing deduction

Enter the amount from IRS Form 2555, Line 50 here. This represents the foreign housing deduction.

Line 2d: Exclusion of Income for Bona Fide Residents

of American Samoa

If applicable, enter the amount from IRS Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa, Line 15.

Line 2e

Add Lines 2a, 2b, 2c, and 2d. Enter the total here.

Line 3

Add Lines 1 and 2e. This represents your total modified adjusted gross income (MAGI) for purposes of calculating additional deductions on IRS Schedule 1-A.

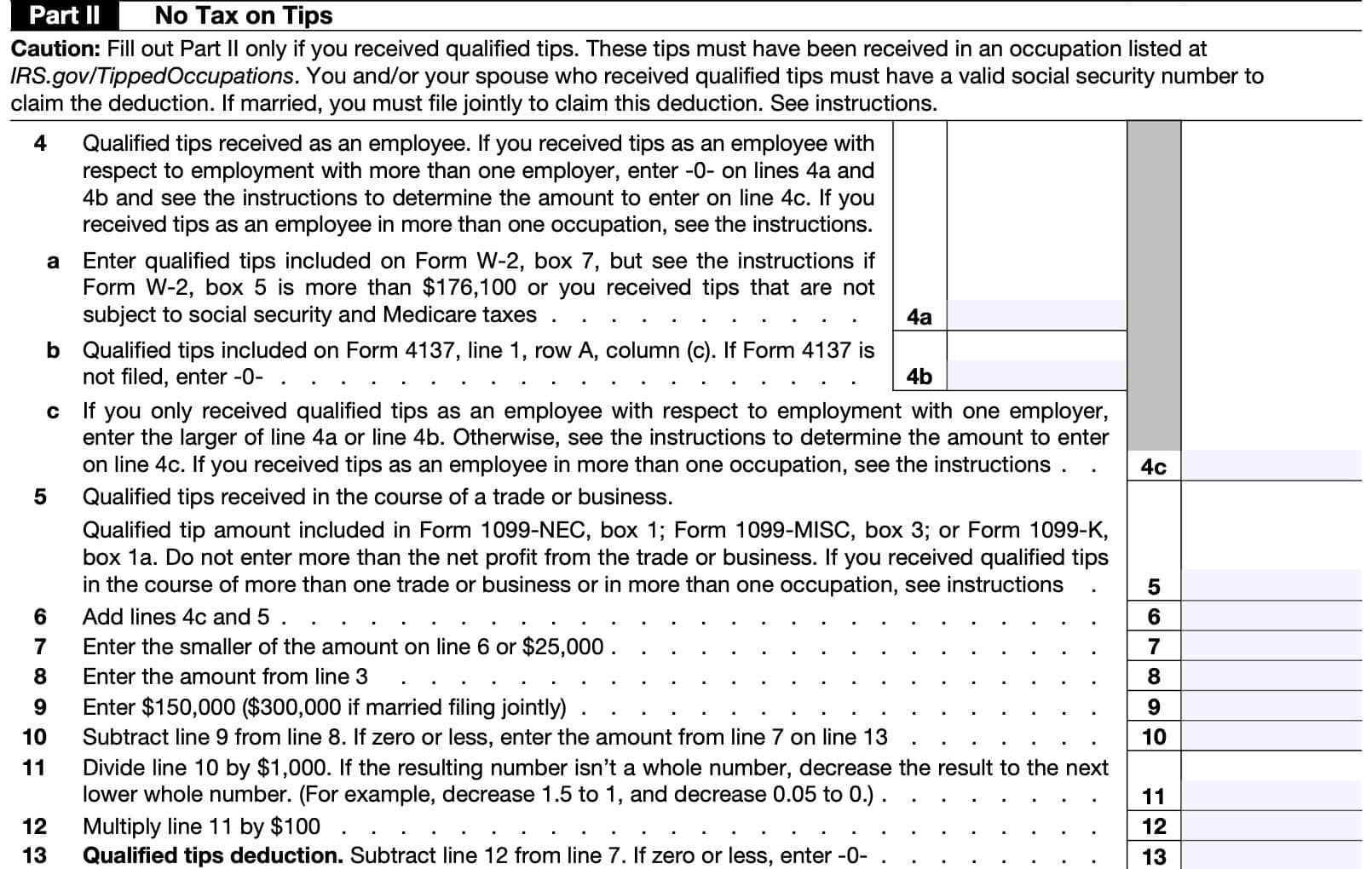

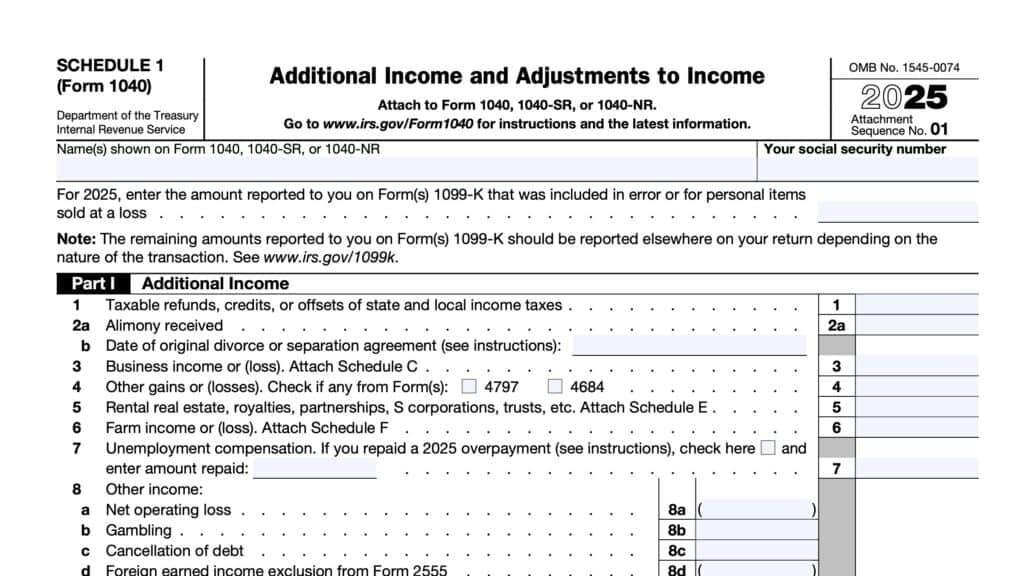

Part II: No Tax on Tips

Fill out Part II only if you received qualified tips. These tips must have been received in an occupation listed at IRS.gov/TippedOccupations.

You and/or your spouse who received qualified tips must have a valid Social Security Number to claim the deduction. If you are married, you must file jointly to claim this deduction.

Line 4: Qualified Tips as an employee

If you received tips as an employee with respect to employment with more than one employer, enter $0.00 on Lines 4a and 4b and see the instructions to determine the amount to enter on Line 4c.

If you received tips as an employee in more than one occupation, see the instructions.

Line 4a

Enter qualified tips included on Form W-2, Box 7. See the instructions if

- IRS Form W-2, Box 5 is more than $176,100, or

- You received tips that are not subject to Social Security and Medicare taxes

Line 4b

Enter any qualified tips included on IRS Form 4137, Line 1, Row A, Column (c). If Form 4137 is not filed, enter $0.00.

Line 4c

If you only received qualified tips as an employee with respect to employment with one employer, enter the larger of Line 4a or Line 4b.

Otherwise, see the instructions to determine the amount to enter on Line 4c. If you received tips as an employee in more than one occupation, see the instructions.

Line 5: Qualified Tips received in the course of a trade or business

Enter the qualified tip amount included in:

- IRS Form 1099-NEC, Box 1

- IRS Form 1099-MISC, Box 3, or

- IRS Form 1099-K, Box 1a

Do not enter more than the net profit from the trade or business. If you received qualified tips in the course of more than one trade or business or in more than one occupation, see the IRS instructions.

Line 6

Add Lines 4c and 5. Enter the result here.

Line 7

Enter the smaller of the following amounts:

- Line 6

- $25,000

Line 8

Enter the amount from Line 3 here.

Line 9

If you are married filing a joint tax return, enter $300,000. Otherwise, enter $150,000.

Line 10

Subtract Line 9 from Line 8. If the result is zero or less, then go to Line 13, and enter the Line 7 amount there.

Line 11

Divide Line 10 by $1,000. If the result is not a whole number, then decrease the result to the next lower whole number.

For example, decrease 1.5 to 1, and decrease 0.05 to 0.

Line 12

Multiply Line 11 by $100.

Line 13: Qualified tips deduction

Subtract Line 12 from Line 7. If the result is zero or a negative number, enter $0.00.

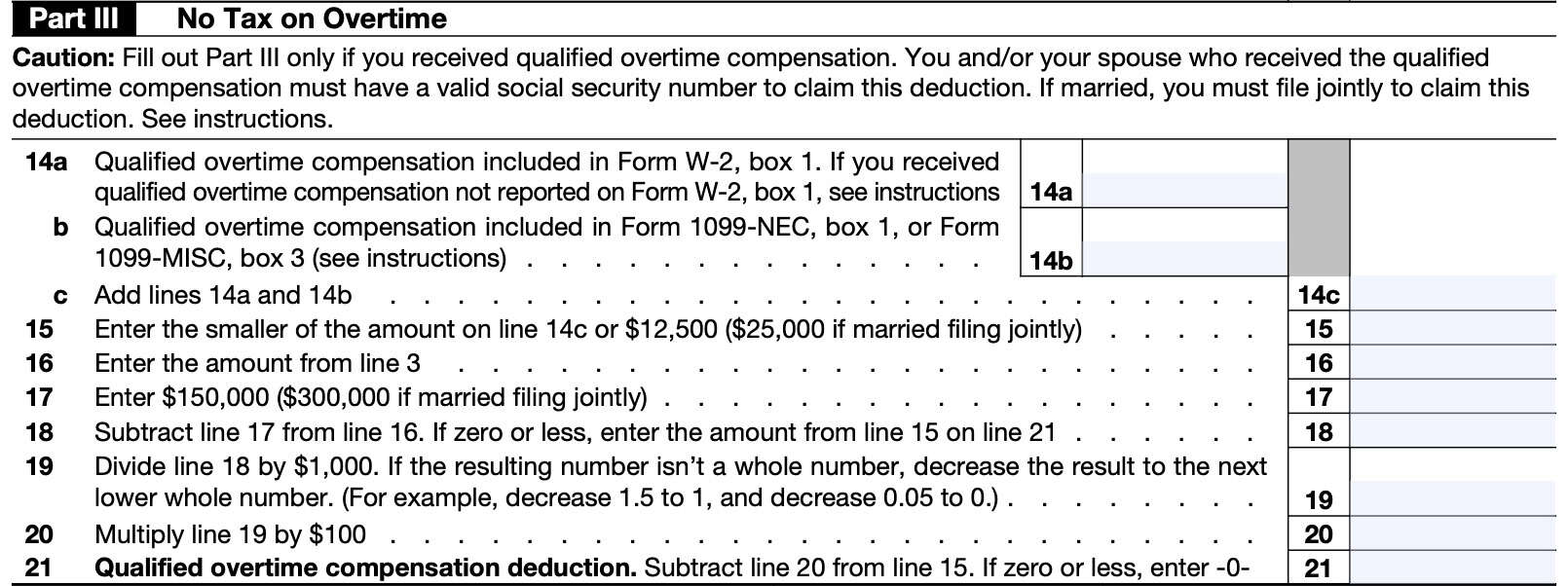

Part III: No Tax on Overtime

Fill out Part III only if you received qualified overtime compensation.

You and/or your spouse who received the qualified overtime compensation must have a valid Social Security number to claim this deduction. If married, you must file jointly to claim this deduction.

Line 14a: Qualified overtime compensation included in Form W-2, Box 1

Enter any qualified overtime compensation included in Form W-2, Box 1 here.

If you received qualified overtime compensation that was not reported on IRS Form W-2, Box 1, ten see the instructions.

Line 14b: Qualified overtime compensation included in Form 1099-NEC, Box 1 or Form 1099-MISC, Box 3

Enter any qualified overtime compensation that was included on Form 1099-NEC, Box 1, or Form 1099-MISC, Box 3.

Line 14c

Add Lines 14a and 14b. Enter the total in Line 14c.

Line 15

Enter the smaller of:

- Line 14c

- $12,500 (or $25,000 for married couples filing jointly)

Line 16

Enter the Line 3 amount here.

Line 17

Enter $150,000 ($300,000 if married filing jointly).

Line 18

Subtract Line 17 from Line 16. If the result is zero or less, then enter the Line 15 amount onto Line 21.

Line 19

Divide Line 18 by $1,000. If the resulting number isn’t a whole number, decrease the result to the next lower whole number. For example, decrease 1.5 to 1, and decrease 0.05 to 0.

Line 20

Multiply Line 19 by $100.

Line 21: Qualified Overtime Compensation Deduction

Subtract Line 20 from Line 15. If the result is zero or less, enter $0.00. This represents your qualified overtime compensation deduction.

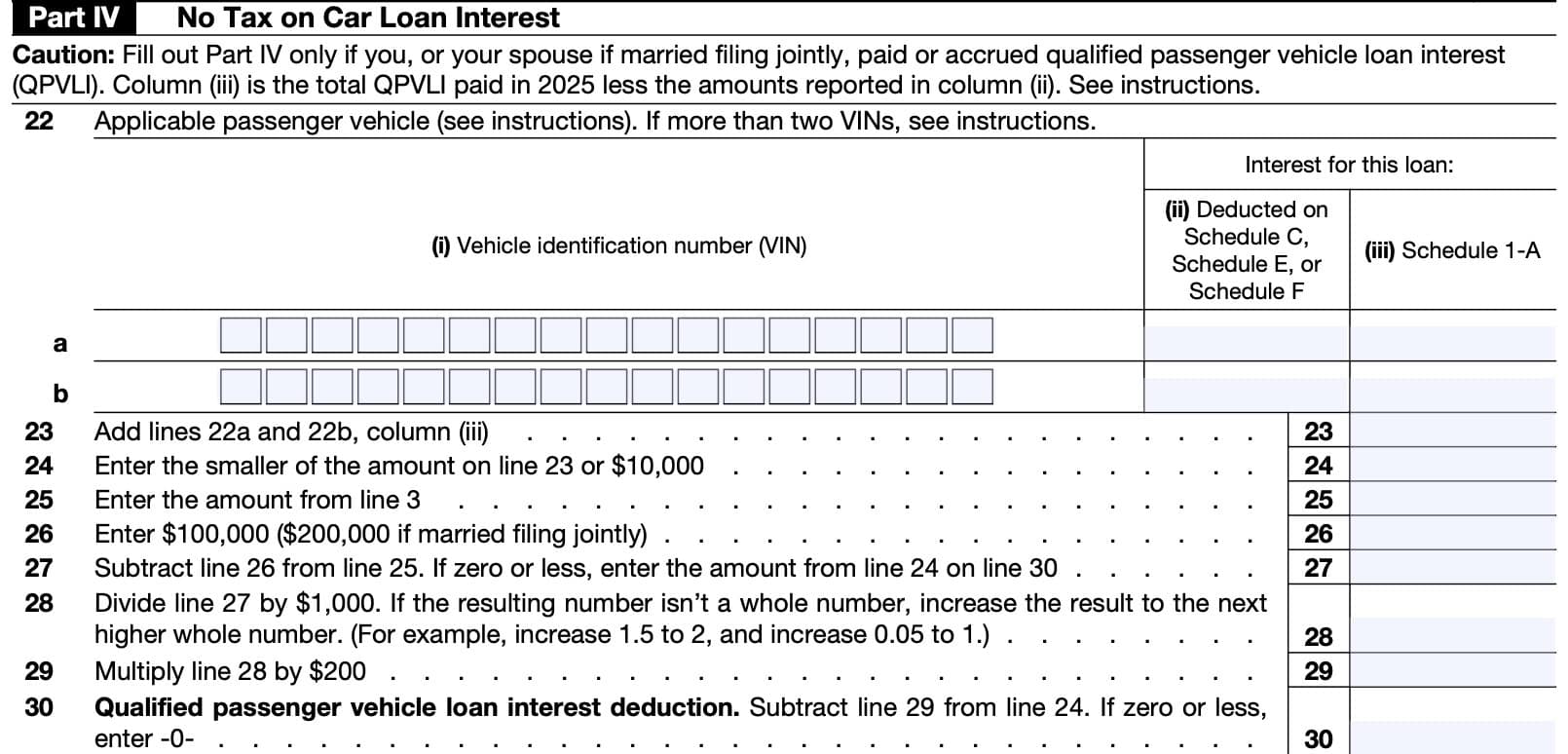

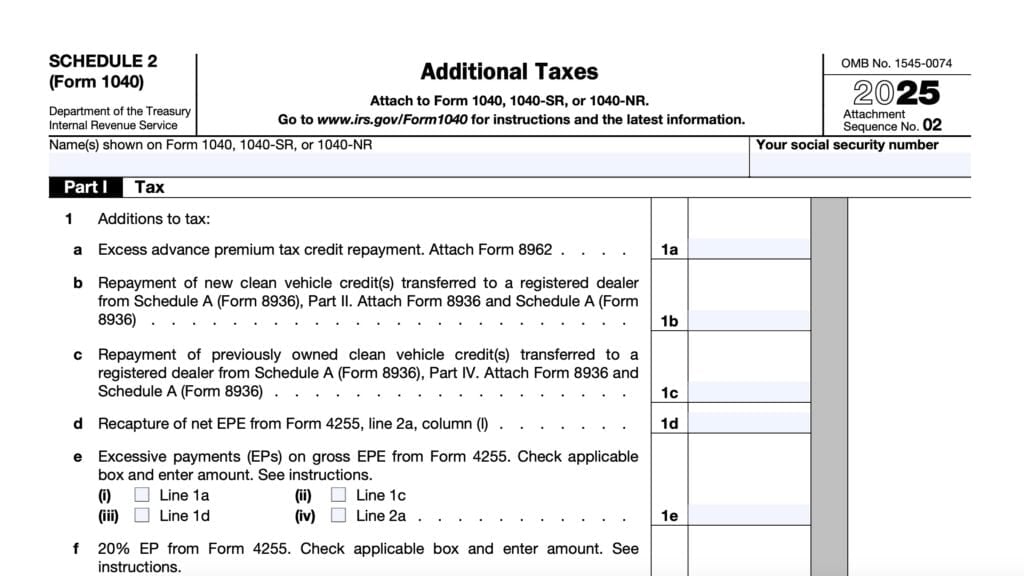

Part IV: No Tax on Car Loan Interest

Fill out Part IV only if you, or your spouse if married filing jointly, paid or accrued qualified passenger vehicle loan interest (QPVLI).

Column (iii) is the total QPVLI paid in the calendar year minus the amounts reported in column (ii).

Line 22: Applicable passenger vehicle

There is room for up to two vehicles in Line 22. If you have more than two vehicles, please refer to the instructions.

For each vehicle, enter the following information:

- Column (i): Vehicle identification number (VIN)

- Column (ii): Interest previously deducted on one of the following:

- Column (iii): Interest deducted on Schedule 1-A

Line 23

Add Lines 22a and 22b, Column (iii).

Line 24

Enter the smaller of the following:

- Line 23

- $10,000

Line 25

Enter the Line 3 amount here.

Line 26

Enter $100,000 ($200,000 for married couples filing a joint tax return).

Line 27

Subtract Line 26 from Line 25. If zero or less, enter the amount from Line 24 onto Line 30.

Line 28

Divide Line 27 by $1,000. If the resulting number isn’t a whole number, increase the result to the next higher whole number. For example, increase 1.5 to 2, and increase 0.05 to 1.

Line 29

Multiply Line 28 by $200, then enter the result here.

Line 30: Qualified passenger vehicle loan interest deduction

Subtract Line 29 from Line 24. If the result is zero or less, enter $0.00. This is your qualified passenger vehicle loan interest (QPVLI) deduction for the tax year.

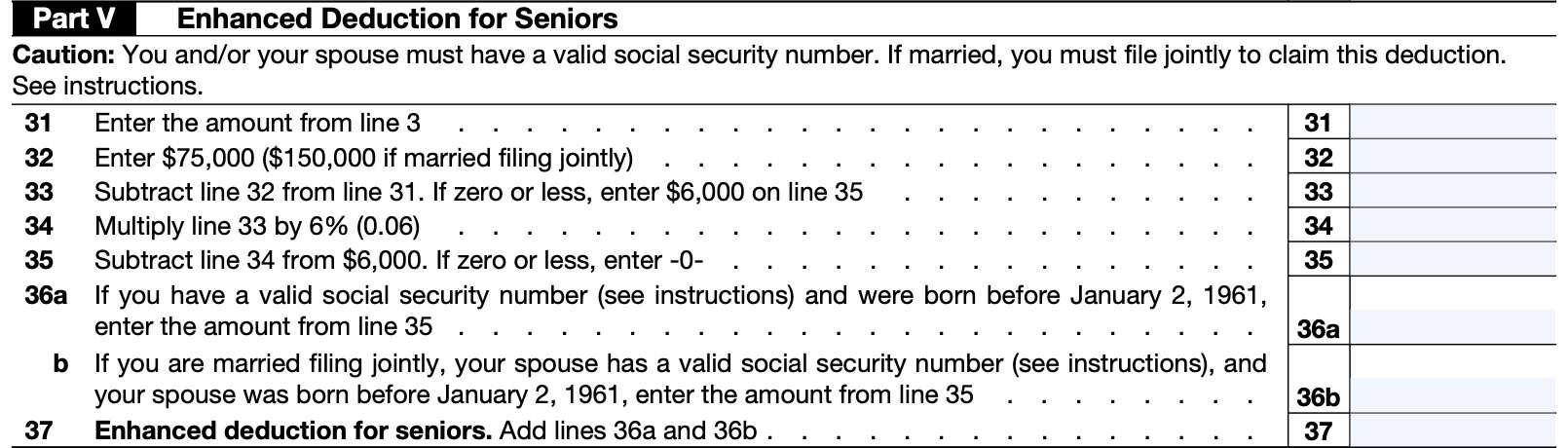

Part V: Enhanced Deduction for Seniors

You and/or your spouse must have a valid Social Security number. If married, you must file jointly to claim this tax deduction.

Line 31

Enter the Line 3 amount here.

Line 32

Enter $75,000 ($250,000 for married couples filing a joint tax return).

Line 33

Subtract Line 32 from Line 31. If zero or less, enter $6,000 on Line 35.

Line 34

Multiply Line 33 by 6% (0.06), then enter the result here.

Line 35

Subtract Line 34 from $6,000. If the result is zero or less, then enter $0.00.

Line 36a

If you have a valid Social Security number (see instructions) and were born before January 2, 1961, enter the amount from Line 35 here.

Line 36b

If you are married filing jointly, your spouse has a valid Social Security number (see instructions), and your spouse was born before January 2, 1961, enter the amount from Line 35.

Line 37: Enhanced deduction for seniors

Add Line 36a and Line 36b. Enter the total here. This represents the calculation of the enhanced deduction for senior citizens.

Part VI: Total Additional Deductions

Line 38

Add the following:

Enter the total here and on Form 1040 or 1040-SR, Line 13b, or on Form 1040-NR,

Line 13c.

Filing considerations

Below are some considerations about the new Schedule 1-A.

Qualified tips

In Part II, Schedule 1-A discusses the tax deduction to eliminate taxes on qualified tips. In the Form 1040 instructions, the IRS provides a detailed explanation on qualified tips.

According to the IRS, qualified tips are tips that you received from customers or, as an employee, through a tip-sharing arrangement in an occupation that customarily and regularly received tips on or before December 31, 2024.

Qualified tips are tips that are:

- Cash tips,

- Paid voluntarily,

- Not the subject of negotiation, and

- Determined by the customer or payor.

The IRS website contains a list of occupations that customarily and regularly received tips on or before December 31, 2024.

Video walkthrough

Watch this video for step by step guidance on completing Schedule 1-A to lower your tax bill.

Frequently asked questions

Taxpayers file IRS Schedule 1-A with their federal income tax return to claim certain additional deductions announced as part of the One Big Beautiful Bill Act. These deductions include No Tax on Tips, No Tax on Overtime, No Tax on Car Loan Interest, and Enhanced Deductions for Seniors.

Any taxpayer who qualifies for a tax deduction on overtime or tip income, who paid car interest on a qualifying vehicle, or seniors claiming the enhanced deduction should file IRS Schedule 1-A with their income tax return.

Where can I find IRS Schedule 1-A?

You can find tax forms like Schedule 1-A on the IRS website. For your convenience, we’ve included the most recent version of this schedule right here, in our article.

Am I the only one in the country which says the form will give wrong results for the senior deduction if followed precisely?

This did not copy well on the available window, but may print properly.

Only this part of the form is relevant to my challenge.

Part I Modified Adjusted Gross Income (MAGI) Amount

1 Enter the amount from Form 1040, 1040-SR or 1040-NR, line 11b 75000

2a Enter any income from Puerto Rico that you excluded 0 <

b Enter the amount from Form 2555, line 45 0 <

c Enter the amount from Form 2555, line 50 0 <

c Enter the amount from Form 4563, line 15 0 <

e Add Lines 2a, 2b, 2c, and 2d 0

3 Add Lines 1 and 2e 75000

Part II No Tax on Tips

13 Qualified tips deduction. Subtract line 12 from line 7. If zero or less, enter -0- 0

Part III No Tax on Overtime

21 Qualified overtime compensation deduction. Subtract line 20 from line 15. If zero or less, enter -0- 0

Part IV No Tax on Car Loan Interest

30 Qualified car loan interest deduction. Subtract line 29 from line 24. If zero or less, enter -0- 0

Part V Enhanced Deduction for Seniors

31 Enter the amount from line 3 75000

32 Enter $75,000 ($150,000 if married filing jointly) 150000 Married filing jointly

33 Subtract line 32 from line 31. If zero or less, enter 6,000 on line 35 -75000 Line 31 – line 32

34 Multiply line 33 by 6% (0.06) -4500 Line 33 X 0.06

35 Subtract line 34 from $6,000. If zero or less, enter -0- 10500 6000 – line 34

36a If you have a valid social security number (see instructions) and were born before

enter the amount from line 35 10500 Line 35 for me

b If you are married filing jointly, your spouse had a valid social security number (see instructions) and

were born before enter the amount from line 35 10500 Line 35 for Janice

37 Enhanced deduction for seniors. Add Lines 36a, and 36b

Part VI Total Additional Deductions

38 Add Lines 13, 21, 30, and 37. Enter here and on Form 1040 or 1040—R, line 13b, or on Form 1040-NR,

line 13c 21000

Why do you think that this will give the wrong results? The senior deduction is a $6,000 per person deduction with a phaseout that begins at $75,000 MAGI ($150,000 for married couples filing jointly).

Specifically, from the Public Law 119-21 text: In the case of any taxpayer for any taxable year, the $6,000 amount in clause

(i) shall be reduced (but not below zero) by 6 percent of so much of the taxpayer’s modified adjusted gross income as exceeds $75,000 ($150,000 in the case of a joint return).

I agree…the deduction for Married Filed Jointly should be $12K MINUS $0.06 for every dollar your MAGI is over $150K (?). That is the benefit of filing as MFJ…you have, roughly double the Single rate in the Tax Brackets so the benefit of the Senior Deduction should not be penalized. The form must have been designed by some lower-level civil servant!

OBBAOTPREMIUM /OBBAQUAL TIP ARE ON BOX 14 OF MY W-2 so how would i report it

Please advise

For 2025, you would report this as income, but then also take the deduction on Schedule 1-A. This would effectively cancel out this item of income on your tax return.

line 14A . box 1 on w2 states wages,tips,other comp. does not break it down. my final check from 12/31/25 does show ytd ot. do i use that number or how do/can i claim?

For 2026 through 2028, W-2 forms should break out qualified overtime. For 2025, the IRS has stated that you can use several ways of keeping track of your qualified overtime. If you have this on your final pay statement, then you should be able to use it.

Where do you enter tax free interest on Schedule 1-A added to your AGI to calculate MAGI ?

You don’t enter tax-free interest on Schedule 1-A to calculate MAGI. You would use Part I, which includes adding back in certain excluded items of foreign income.

MAGI for Schedule 1-A is calculated differently from MAGI for IRMAA purposes, where you would add AGI (Line 11 or 11a, depending on which Form 1040 you use) to tax-exempt interest (Line 2a) to arrive at MAGI. Tax-free interest does not factor into MAGI for Schedule 1-A purposes.