Form SSA 632-BK Instructions

If you’ve received a notice of overpayment from the Social Security Administration, you may have also received instructions on how to reimburse the SSA for the Social Security overpayment.

If you are looking for a complete waiver of the overpayment amount, you’ll need to complete and submit Form SSA 632-BK, Request for Waiver of Overpayment Recovery for SSA consideration.

In this article, we’ll walk you everything you need to know about this Social Security form, including:

- How to complete Form SSA 632-BK

- Alternatives to filing Form SSA 632-BK

- Frequently asked questions

Let’s start by walking through this form.

Table of contents

How do I complete Form SSA 632-BK?

In this section, we’ll walk through each part of this Social Security form, step by step. Let’s begin with Section 1.

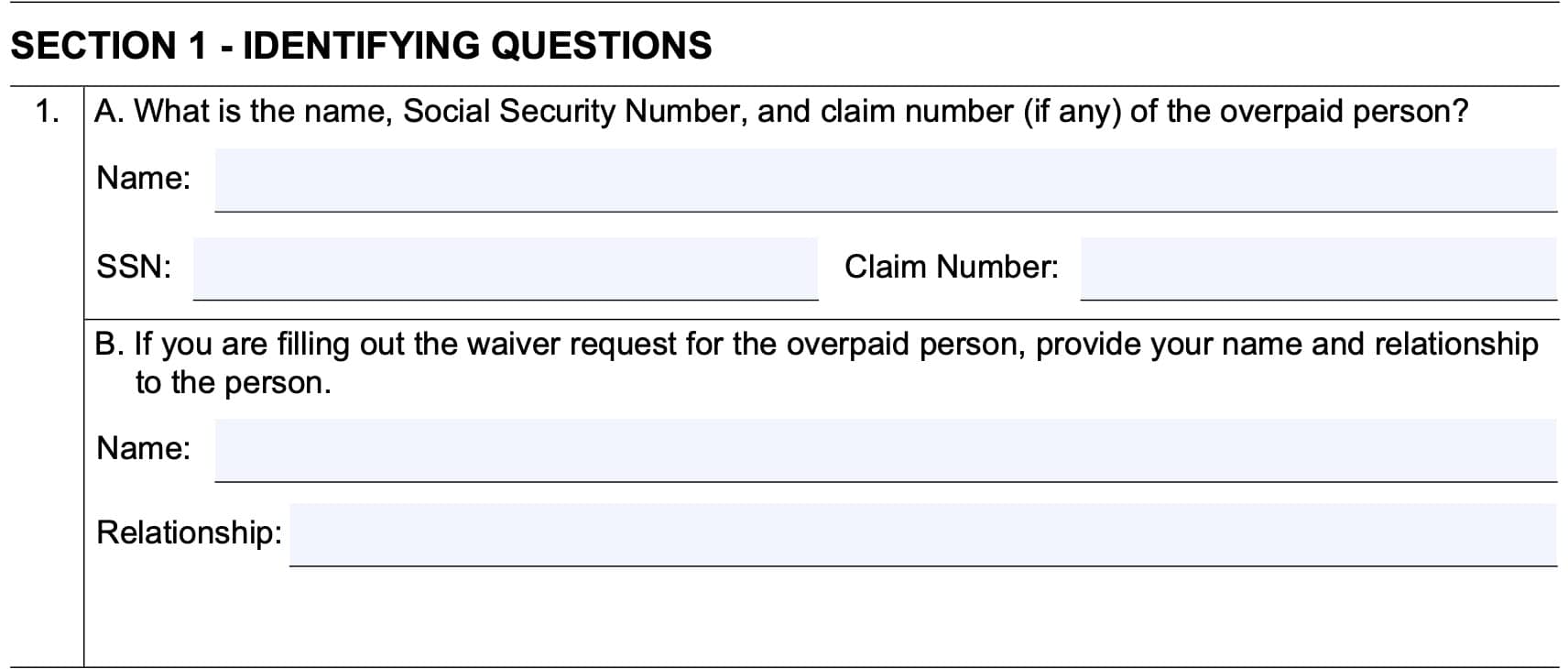

Section 1: Identifying Questions

Section 1 asks questions to ascertain the identity of the person filing the waiver request.

Question 1

This question is broken into two parts.

Question 1A

What is the name, Social Security Number, and claim number (if any) of the overpaid person?

In this section, enter your name, complete Social Security number, and claim number, if you have one. If you do not have a claim number, leave this field blank.

Question 1B

For individuals filling out the waiver request on behalf of the overpaid person, provide your name and relationship to the person.

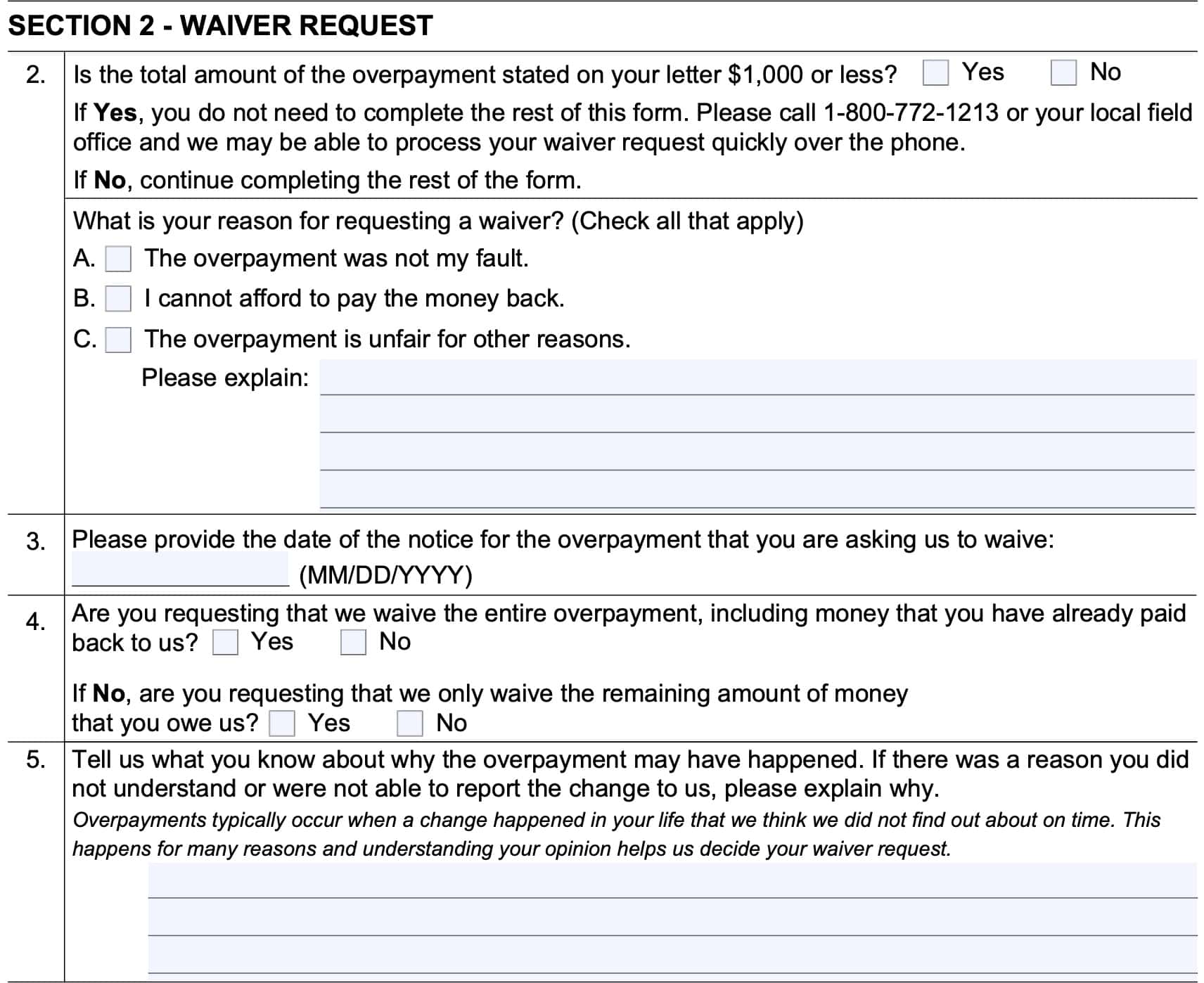

Section 2: Waiver request

In this section, you’ll be expected to answer questions about your involvement in the overpayment.

Question 2

This question is broken into several parts.

First, answer whether or not the overpayment stated on your letter is $1,000 or less. If so, you can stop completing Form SSA-632-BK. Instead, call the SSA to process your waiver request over the phone. You can do so by either of the following methods:

- Call your local Social Security office

- Call the toll-free number at: (800) 772-1213.

If your overpayment is greater than $1,000, then proceed to the next question: What is your reason for requesting a waiver. You may choose one or more of the following:

- Overpayment was not your fault

- You cannot afford to pay the money back

- Overpayment is unfair for other reasons

- Explain in more detail in the space provided

Question 3

Enter the date of the overpayment notice that you received. Use the following format: MM/DD/YYYY.

Question 4

Indicate whether or not you are requesting for the SSA to grant a waiver for the complete recovery of an overpayment. This includes money you may have already paid back to the SSA.

If you are not, then indicate whether you want the SSA to waive the amount of your overpayment that you still owe.

Question 5

In the space provided, provide a written explanation if you understand why the overpayment might have happened. If there is a reason that you did not understand reporting requirements or were unable to report the change to the SSA, indicate this as well.

You may use the Remarks section if you need more space to provide additional information. In the Remarks section, indicate the question number before providing your written answer.

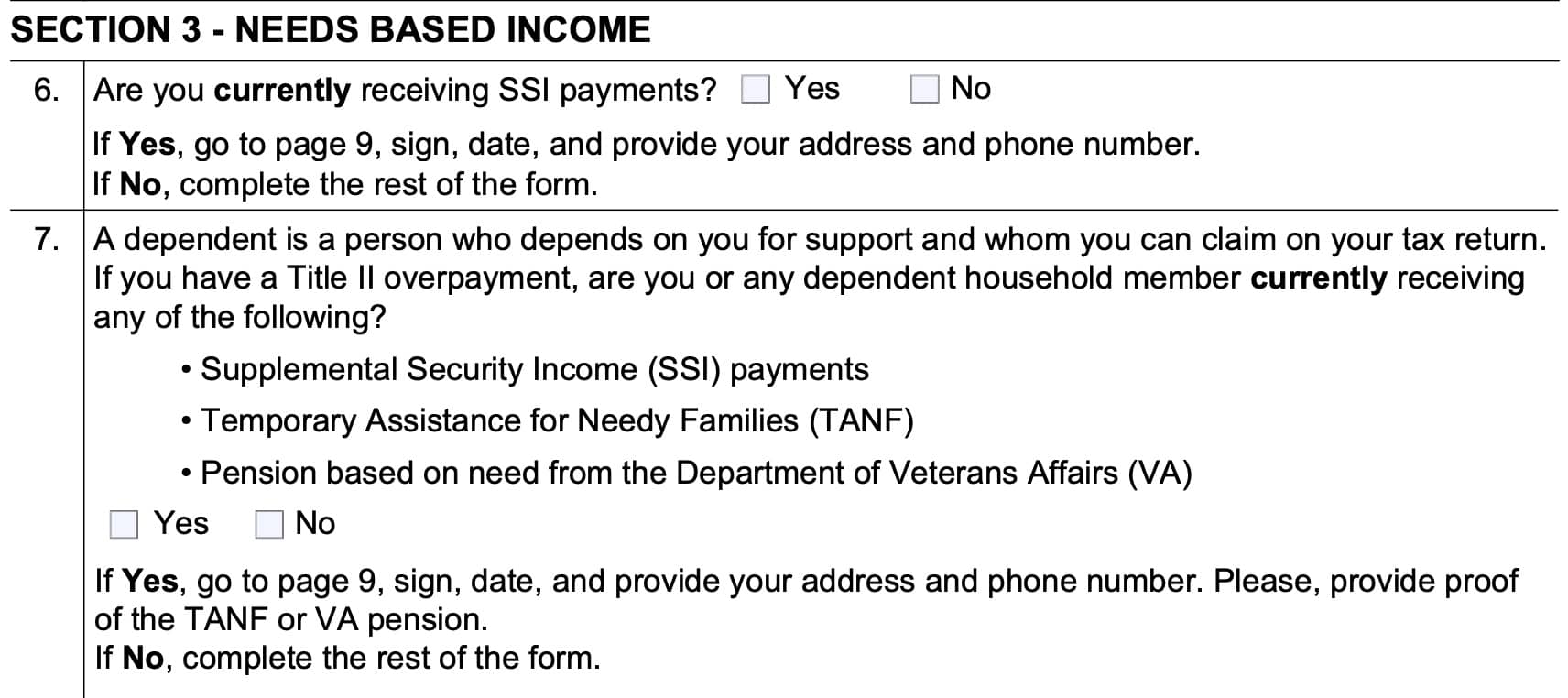

Section 3: Needs based income

In Section 3, you’ll answer questions about other needs-based programs administered by the federal government.

Question 6

Are you currently receiving SSI payments? If so, then you do not need to complete the rest of the form, even for SSI overpayments.

Simply proceed to the signature fields on page 9. From there, you’ll provide your address and phone number, then date and sign the form.

Otherwise, you must complete the rest of Form 632-BK.

Question 7

In Question 7, answer whether or not you are receiving any of the following benefits on your own behalf, or on behalf of a dependent household member:

- Supplemental Security Income (SSI) payments

- Temporary Assistance for Needy Families (TANF)

- Pension based on need from the Department of Veterans Affairs (VA)

Definition of a dependent

According to the SSA, a dependent is someone who depends on you for support, and whom you can claim on your federal income tax return. For divorced or unmarried parents living apart, the IRS generally only allows one parent to claim each child as a dependent for tax purposes.

If you do not know, the IRS provides an online tool that can help you determine whether you can claim a child or other person as a dependent on your tax return. Below is a link to the YouTube video we’ve created to help people walk through this tool.

If the answer is Yes, then go to the signature fields on page 9. From there, you’ll provide your address and phone number, then date and sign the form. You’ll also need to provide supporting documents that verify your TANF or VA pension.

Otherwise, proceed to Section 4, below.

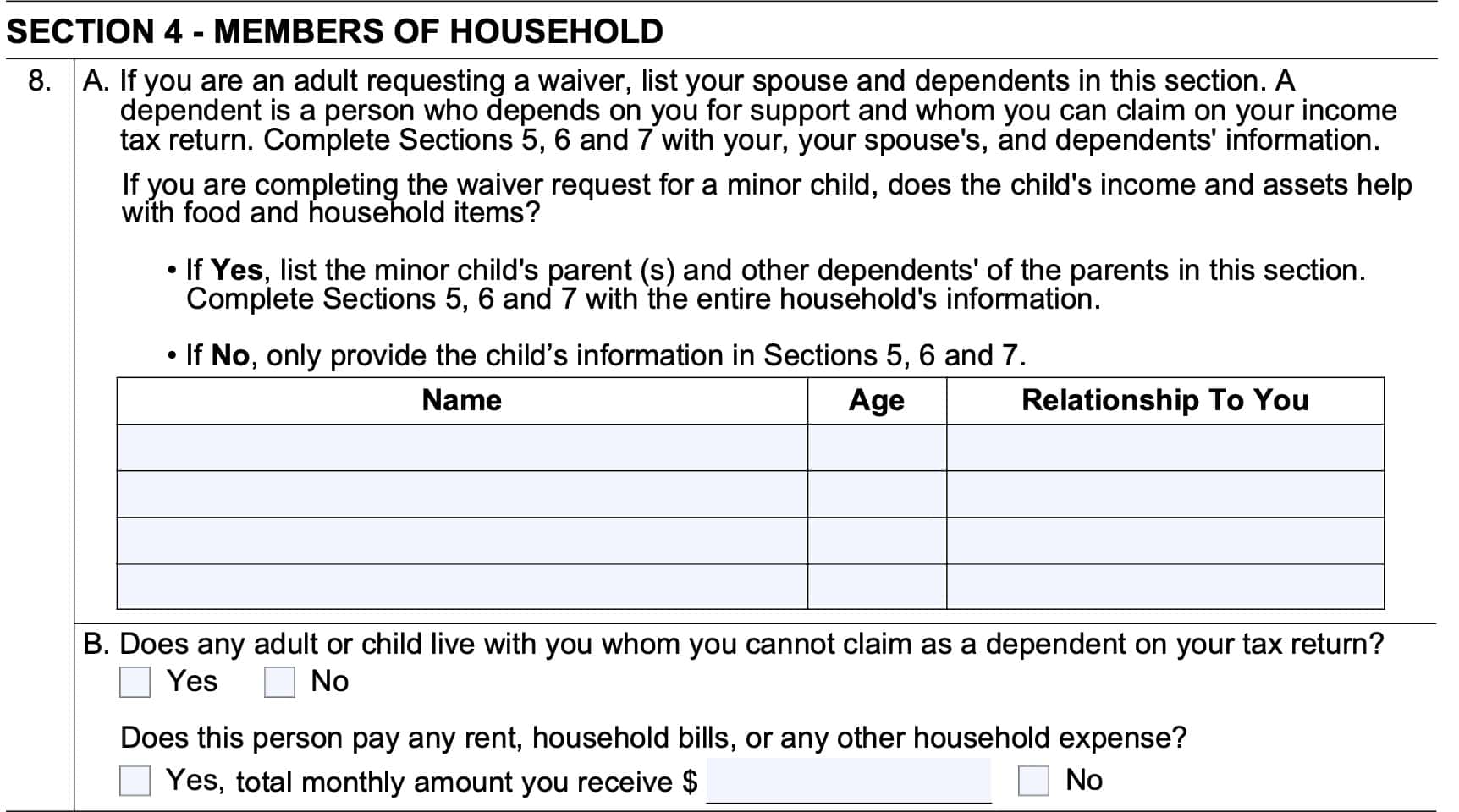

Section 4: Members of household

In this section, you’ll provide information about members of your household.

Question 8

This is a two-part question.

Question 8A

If you are an adult requesting a waiver of overpayment of benefits, then list your spouse and any dependents in the space provided. Provide the following information for each person:

- Name

- Age

- Relationship to you

You’ll also need to complete the rest of Form SSA 632-BK with information for everyone in your household. This includes:

- Section 5: Assets – Things You Have and Own

- Section 6: Monthly Household Income

- Section 7: Monthly Household Expenses

If the overpaid individual is a child, and you are completing the waiver request on the child’s behalf, then you’ll need to determine whether the child’s income and assets help with purchasing food and household items for the family.

If the answer is Yes, then you’ll need to list the child’s parent or parents, as well as the rest of the parents’ dependents that live in the house. Complete the rest of the SSA form with the entire household’s information.

If the answer is No, then do not list any person here. Only provide the child’s information in Sections 5, 6, and 7.

Question 8B

Does any person, adult or child, live with you whom you cannot claim as a dependent on your income tax return?

If the answer is Yes, then indicate whether that person pays rent, household bills, or other household expenses. If they do pay on a regular basis, then enter the total amount of money you receive each month from that person or persons.

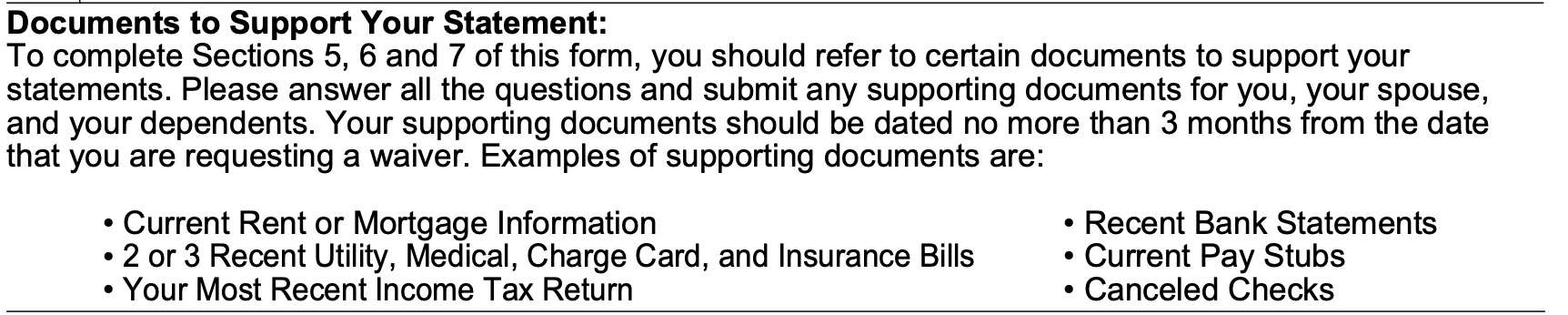

Supporting documents

Before we proceed to Section 5, we should take some time to discuss supporting documentation. These documents are required for answers to questions in Sections 5 through 7. Here are some guidelines.

Supporting documents should be recent.

In the Form SSA-632, it states that your supporting documentation should be no more than 3 months old, based on the date that you are completing the form.

Your answers should be supported by your documents.

If your answers contradict the facts reflected in your documents, this can complicate the approval process, or even result in your request being denied.

Since these are your answers and your documents, it is your responsibility to make sure they match.

When in doubt, pretend that you’re the person trying to process this paperwork. If someone handed this to you, and asked you to approve it or deny it based on a rulebook that the federal government made you follow, would you be able to approve it? If not, then keep working until the answer becomes ‘Yes.’

Examples of supporting documentation

The SSA provides examples of supporting documentation that they will accept. These examples include:

- Current rent or mortgage information

- This can include a copy of your lease or a recent mortgage statement

- 2 or 3 recent bills that you’ve paid or will pay

- Utility bills

- Medical bills

- Credit card bills

- Insurance bills

- Your most recent income tax return

- Recent bank statements

- Pay statements

- Canceled checks

With that understanding, let’s go to Section 5.

Section 5: Assets – Things you have and own

In Section 5, you’ll list assets that you have and own.

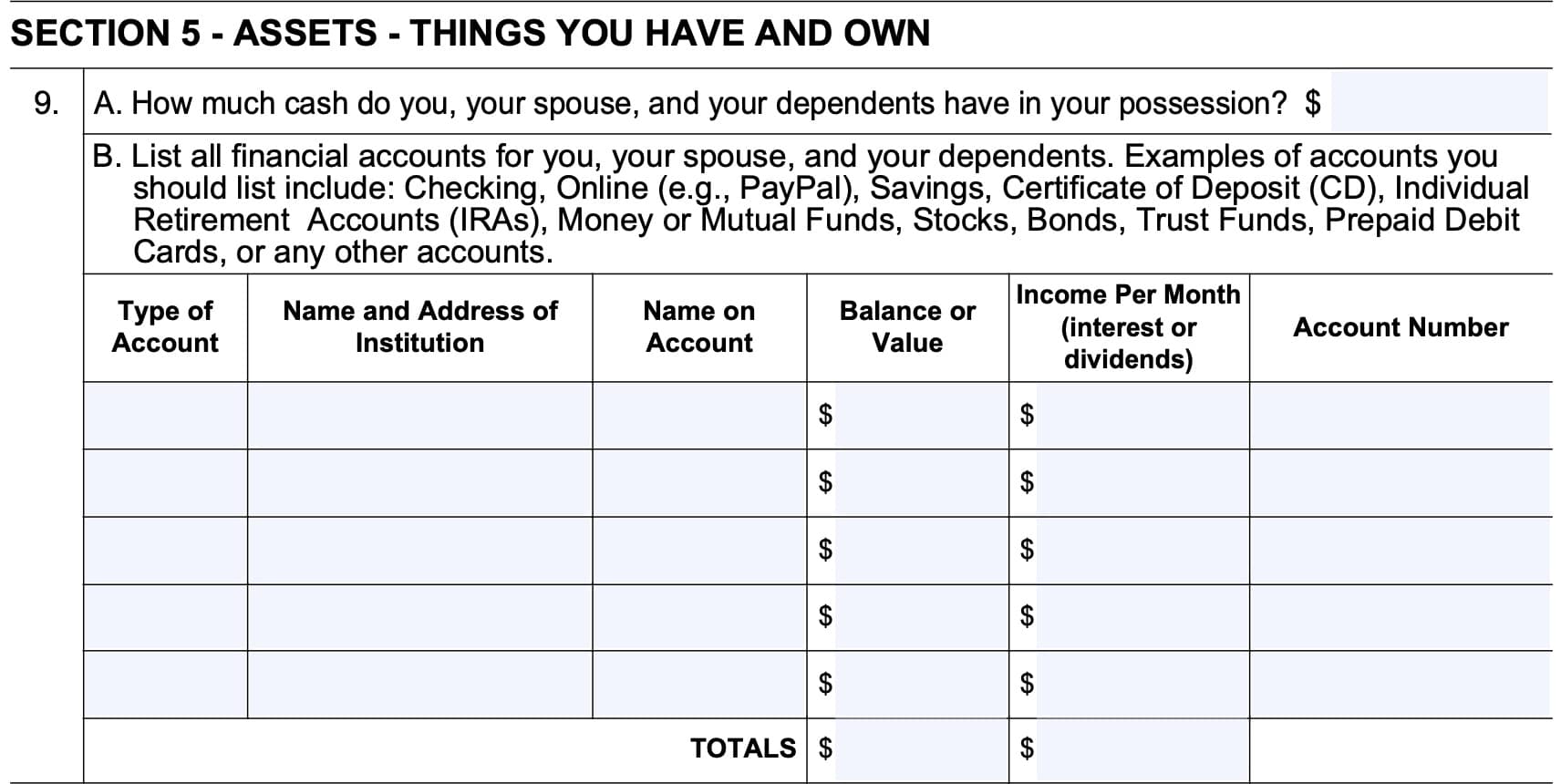

Question 9

This is a two-part question.

Question 9A

How much cash do you have in your possession This includes cash held by yourself, your spouse, or any of your dependents.

Enter the total dollar amount in the space provided.

Question 9B

In this section, you’ll need to list all financial accounts for yourself, your spouse, and your dependents.

For each account, provide the following information:

- Type of account

- Name and address of financial institution

- Name on account

- Account balance or value

- Monthly income (if your account generates interest income or income from dividends)

- Account number

At the bottom of the section, add the totals of your account balances and monthly income figures.

Examples of financial accounts

The form lists the following as examples of financial accounts that the Social Security Administration expects you to report:

- Banking accounts, such as checking accounts, savings accounts, or money market accounts

- Third-party network accounts, such as Venmo, PayPal, etc.

- Investment accounts containing stocks, bonds, mutual funds, certificates of deposit and other investments

- Retirement accounts, including IRAs or Roth IRAs

- Trust funds that you manage

- Prepaid debit cards

After you’ve completed Question 9B, it’s time to move on to the next question.

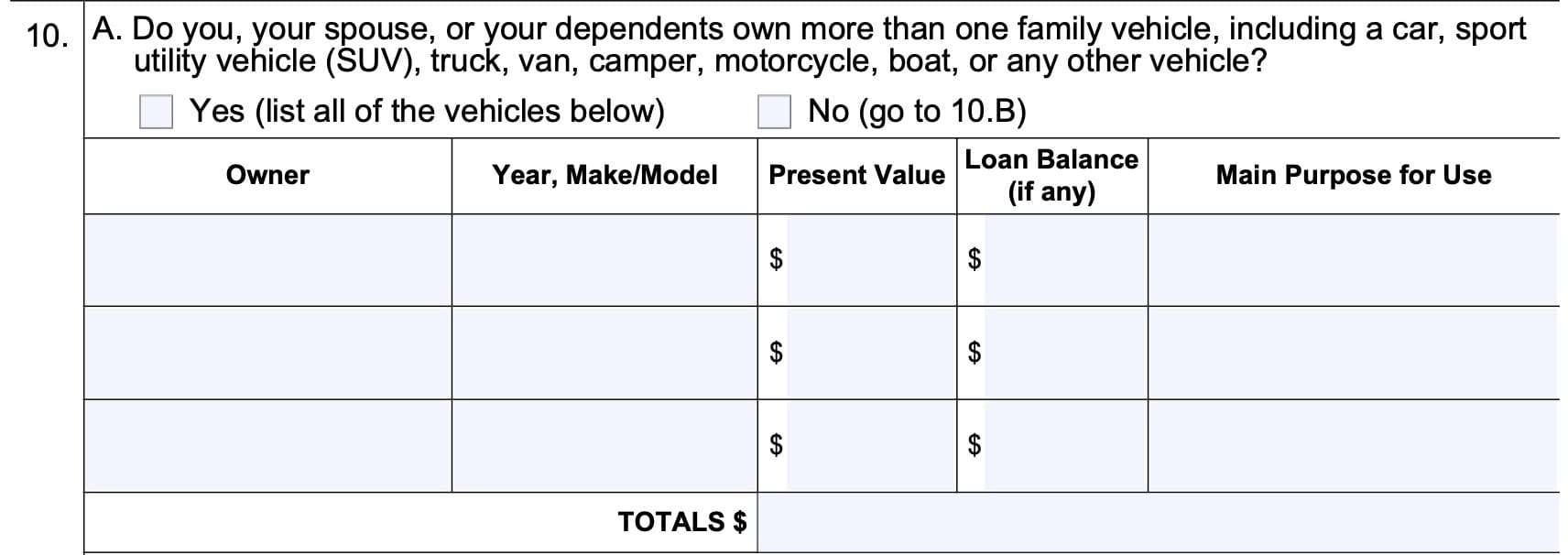

Question 10

Question 10 discusses assets that you or your dependents may own. These are not financial assets, but ‘hard assets’ that could be sold, if absolutely necessary.

This question contains 4 parts.

Question 10A

If you, your spouse, or your dependents own more than one family vehicle, then select Yes. Otherwise, select No and proceed to Question 10B.

If you answered Yes, list each additional vehicle in the space provided, and give the following information:

- Vehicle owner

- Year, make, and model of the vehicle

- Present value

- Loan balance, if applicable

- Main purpose for the vehicle

At the bottom, total the present values and loan balances, as applicable.

Family vehicles can include any of the following:

- Car

- Sport utility vehicle

- Truck

- Van or camper

- Motorcycle

- Boat

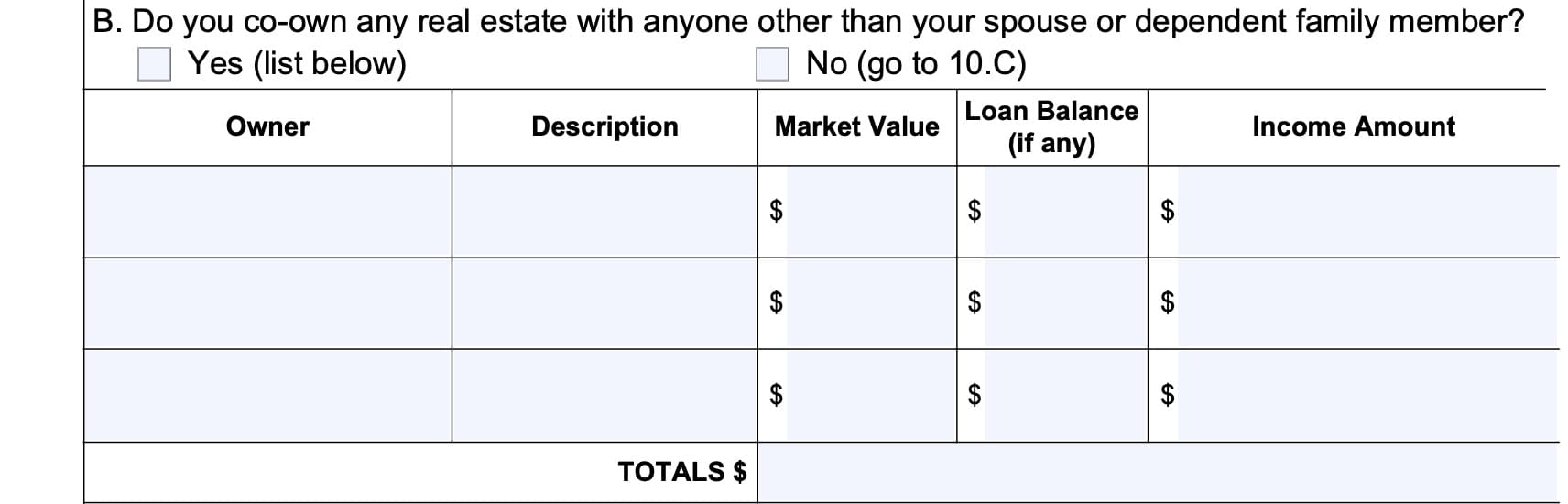

Question 10B

If you co-own real estate with anyone other than your spouse or a dependent, then select Yes. Otherwise, select No and proceed to Question 10C.

If you answered Yes, list each additional vehicle in the space provided, and give the following information:

- Property owner

- Property description

- Current market value

- Outstanding loan balance

- Income amount, if the property generates income

At the bottom, total the present market values, loan balances, and income amounts, as applicable.

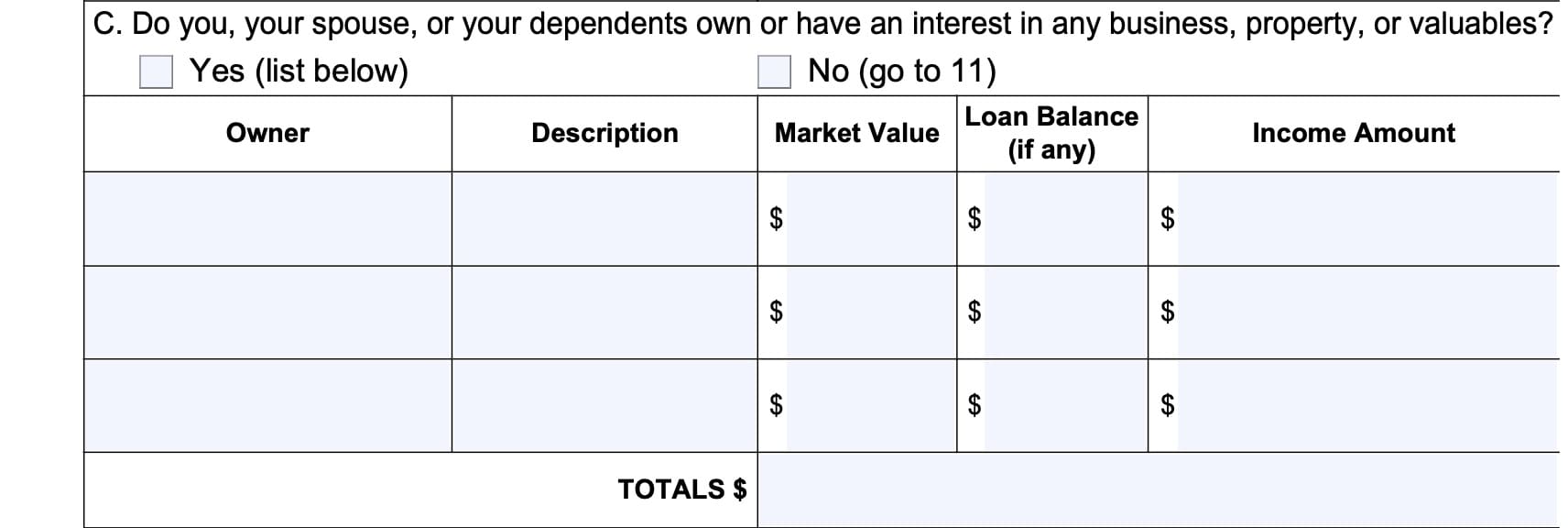

Question 10C

If you, your spouse, or your dependents own any business interests, business property, or valuables, then select Yes. Otherwise, select No.

If you answered No to Questions 10A, 10B, and 10C, then go to Question 11. Go to Question 10D, below if you answered Yes to either Question 10A or 10B.

If you answered Yes, list each item or group of items below, and give the following information:

- Owner

- Description

- Market value

- Loan balance, if applicable

- Income amount, if the item generates income

At the bottom, total the present market values, loan balances, and income amounts, as applicable.

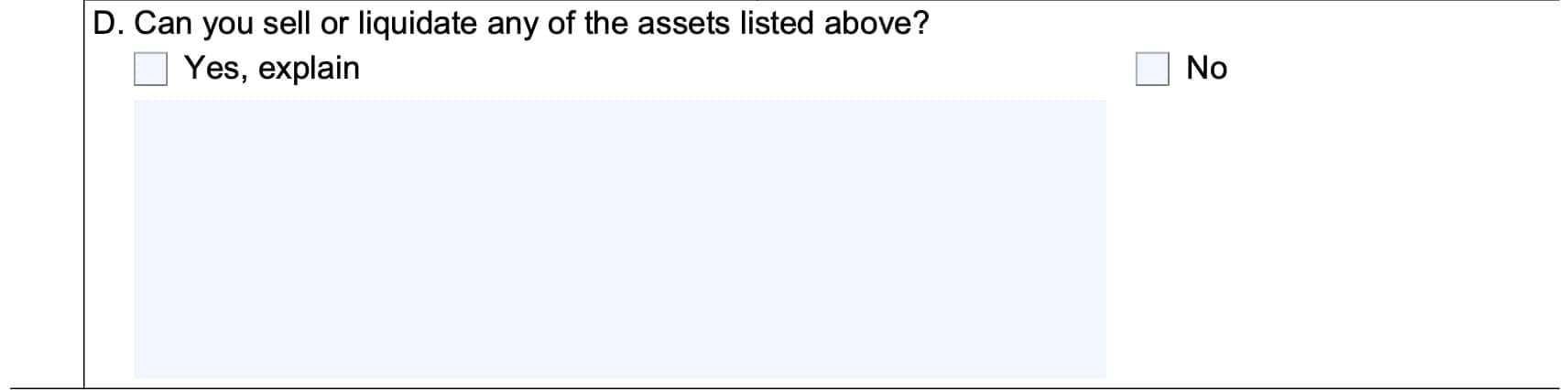

Question 10D

If you listed assets in Questions 10A, 10B, or 10B, and you can sell or liquidate any of them, then check Yes and provide additional detail. Otherwise, select No and proceed to Section 6, below.

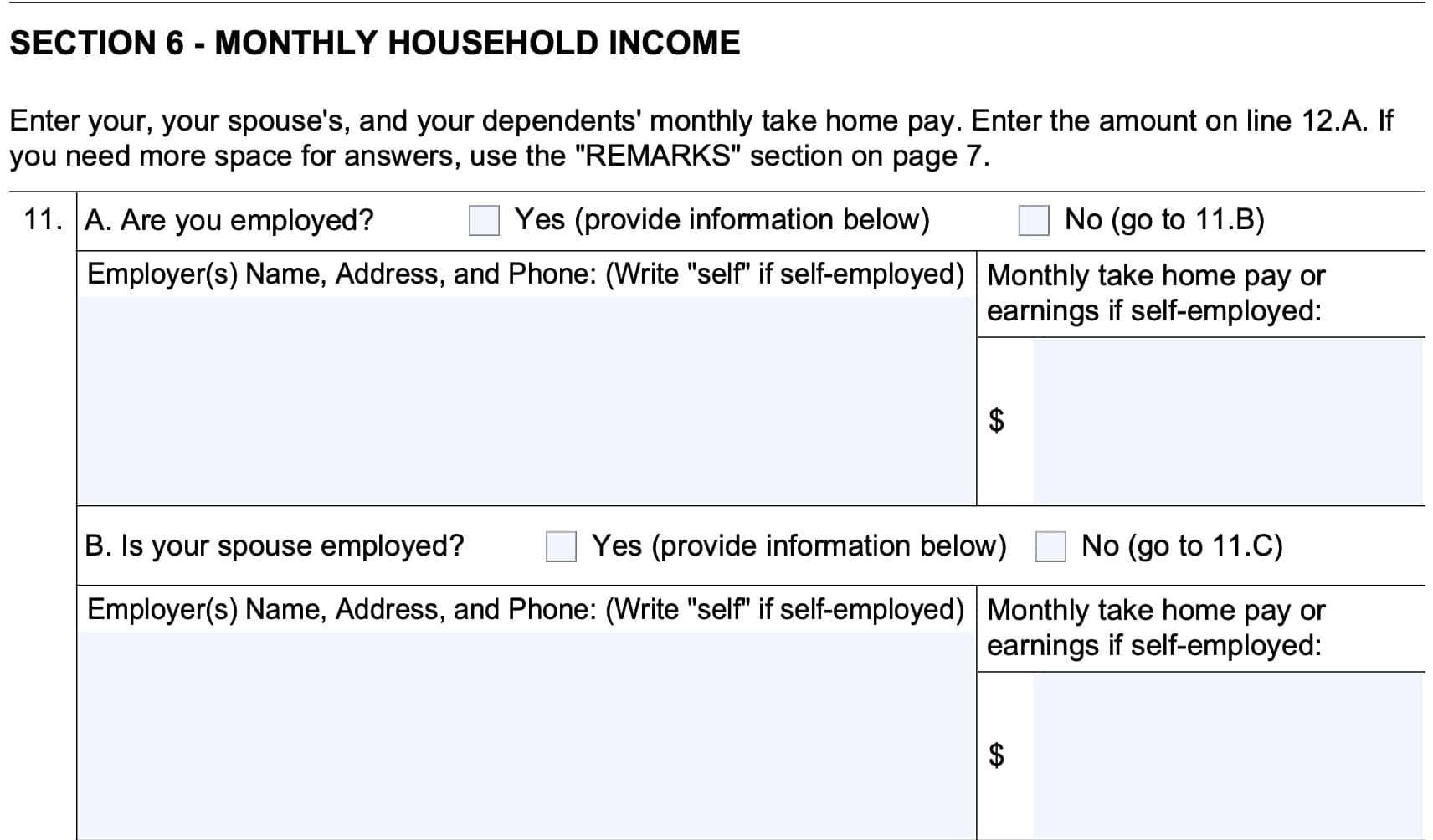

Section 6: Monthly household income

In Section 6, you’ll report information regarding monthly household income for yourself, your spouse, and your dependents.

If necessary, you can use the REMARKS section on Page 7 of this application to provide more detail. Be sure to list the question number at the beginning of each new remark.

Question 11

Question 11 asks about employment status for yourself and your family members. This is broken down into 3 parts.

Question 11A: Are you employed?

If you are employed (including self-employment), select Yes and provide the following information:

- Employer’s (or employers’ if there is more than one employer) name, address, and phone number

- Write ‘Self’ if you are self-employed

- Monthly take-home pay or earnings if you are self-employed

Otherwise, select No, then proceed to Question 11B.

Question 11B: Is your spouse employed?

If your spouse is employed, select Yes and provide the following information:

- Employer’s (or employers’ if there is more than one employer) name, address, and phone number

- Write ‘Self’ if your spouse is self-employed

- Monthly take-home pay or earnings if your spouse is self-employed

Otherwise, select No, then proceed to Question 11C.

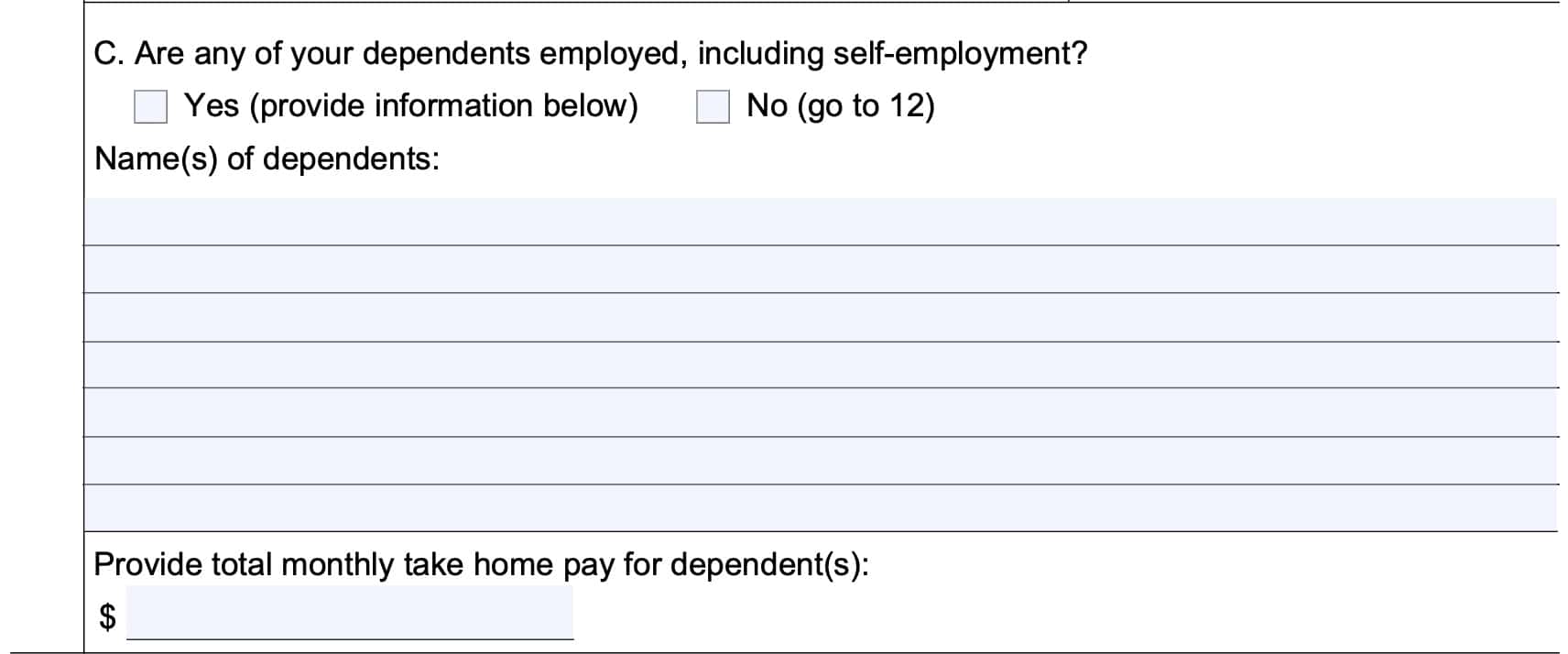

Question 11C: Are any of your dependents employed?

If any of your dependents are employed, select Yes and provide the name(s) of dependents that are employed, including self-employment. Enter the total monthly take home pay for your dependents at the bottom of Question 11C.

Otherwise, select No, then proceed to Question 12.

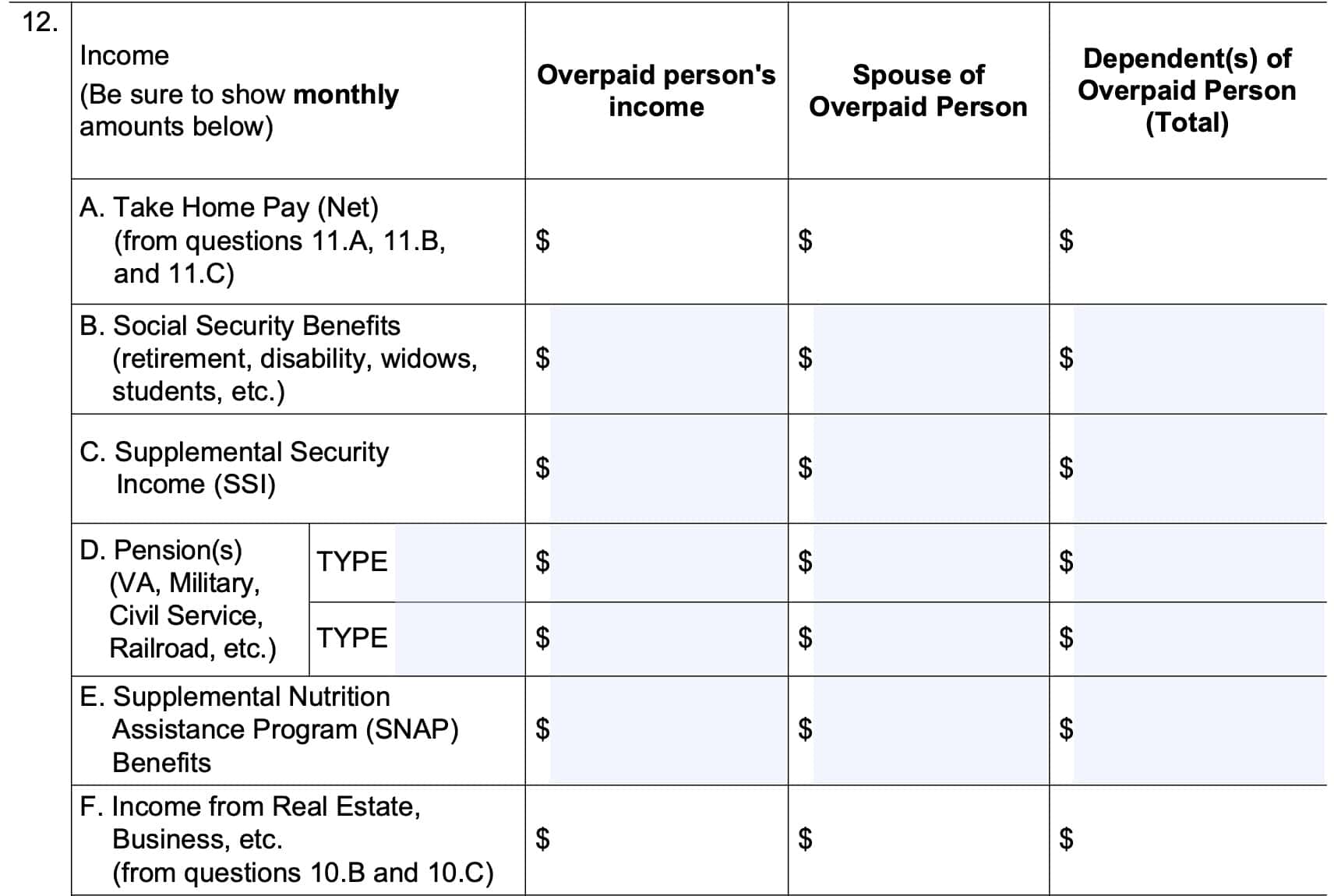

Question 12

In this section, you’ll enter monthly income amounts from all sources. For your benefit, the SSA has listed the most common income sources as outlined below:

- A: Take Home Pay (From Question 11, above)

- B: Total Social Security benefits

- Includes retirement, disability, and survivor benefits

- C: Supplemental Security Income (SSI)

- D: Pension income

- Can include VA, military, government service, or railroad pension

- E: Supplemental Nutrition Assistance Program (SNAP) benefits

- F: Real estate or business income (from Question 10B and Question 10C, above)

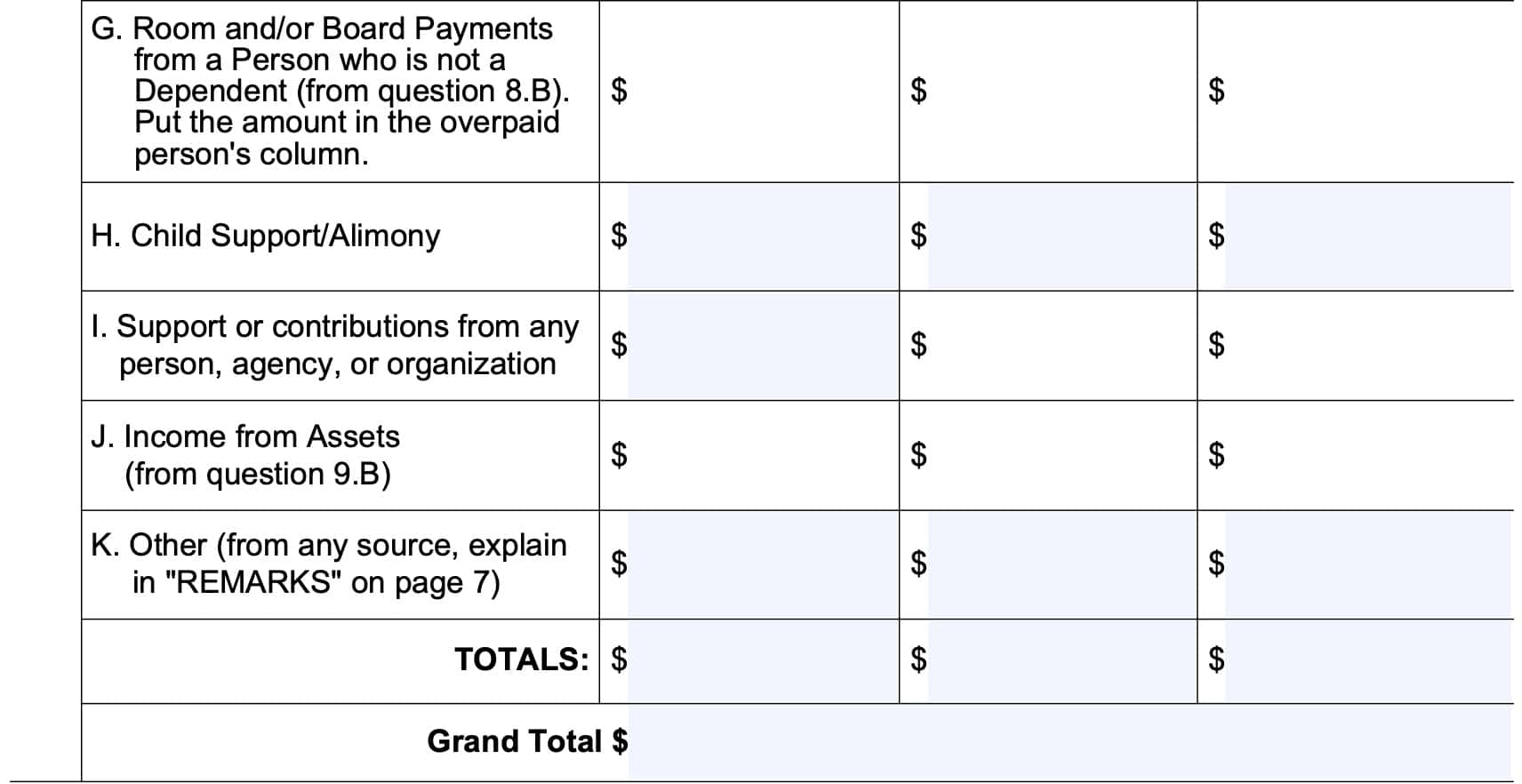

- G. Room and board payments from a non-dependent (from Question 8B)

- Enter this amount in the first column

- H. Child support or alimony

- I. Support or contributions from other persons or agencies

- J. Income from assets (from Question 9B)

- K. Income from other sources

- Explain in the REMARKS section provided

There are 3 columns for your entries:

- Overpaid person’s income

- Spouse of overpaid person

- Dependent(s) of overpaid person (total income)

At the bottom, total each column. Afterwards, add the column totals to calculate the grand total, which you will enter below the column totals.

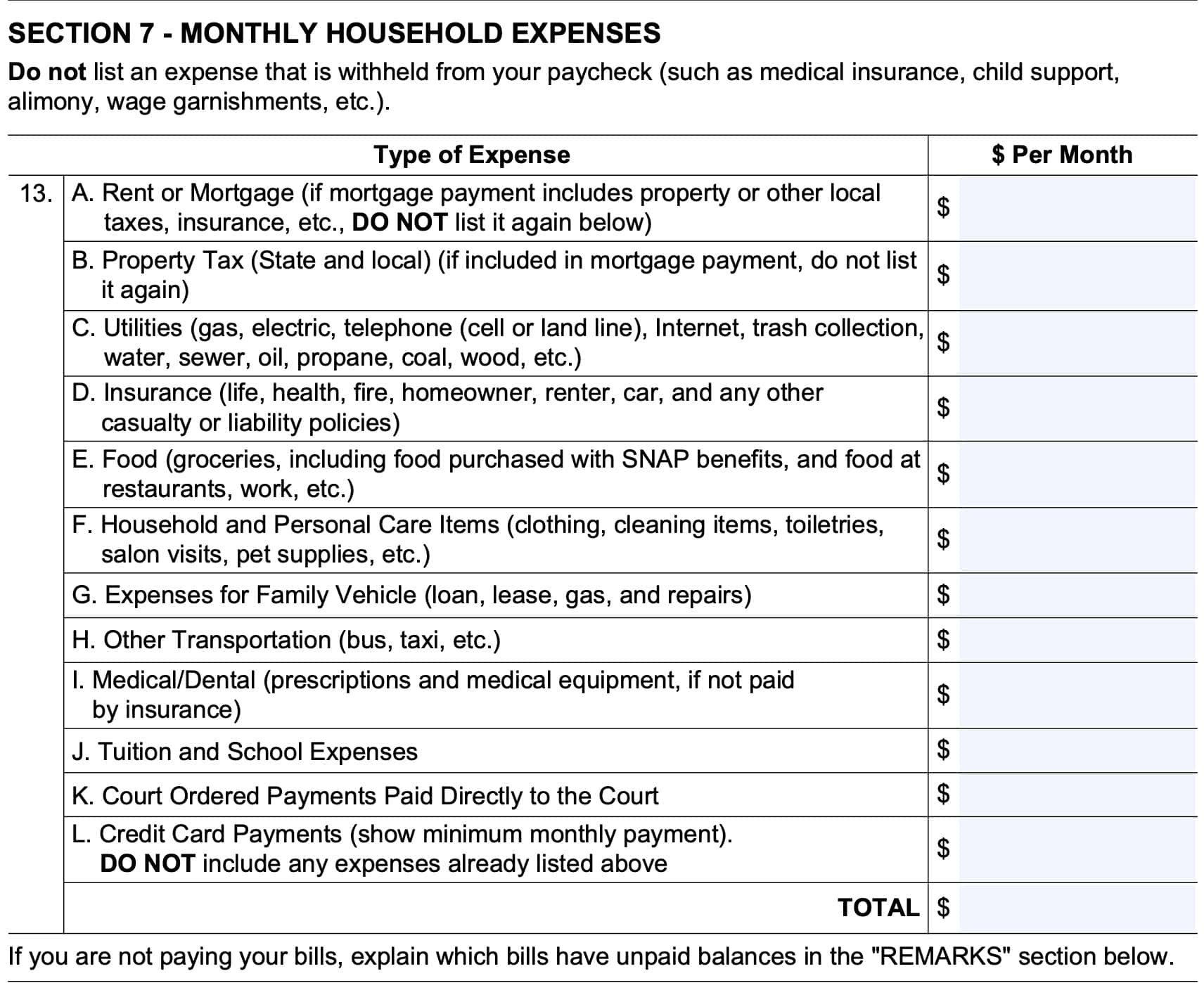

Section 7: Monthly household expenses

In this section, you’ll report on your monthly expenses. However, do not list expenses that are already withheld from your paycheck or pension payments. These expenses are accounted for when listing your take-home amounts.

Question 13

In this section, you’ll enter monthly expenses for the categories outlined below.

- A: Rent/Mortgage payments

- B: Property tax

- If property tax is part of your mortgage payment, do not report it again here

- C: Utilities

- D: Insurance

- If property insurance is part of your mortgage payment, don’t list it here

- E: Food

- F: Household and personal care items

- G: Family vehicle expenses

- If car insurance was listed above, do not include it here

- H: Other transportation costs

- I: Out of pocket medical expenses

- J: Tuition and school-related expenses

- K: Court-ordered payments paid directly to the court

- L: Credit card payments (minimum monthly payment)

- Do not include previously listed expenses

For bills that you are not paying, use the REMARKS section to indicate which bills have unpaid balances.

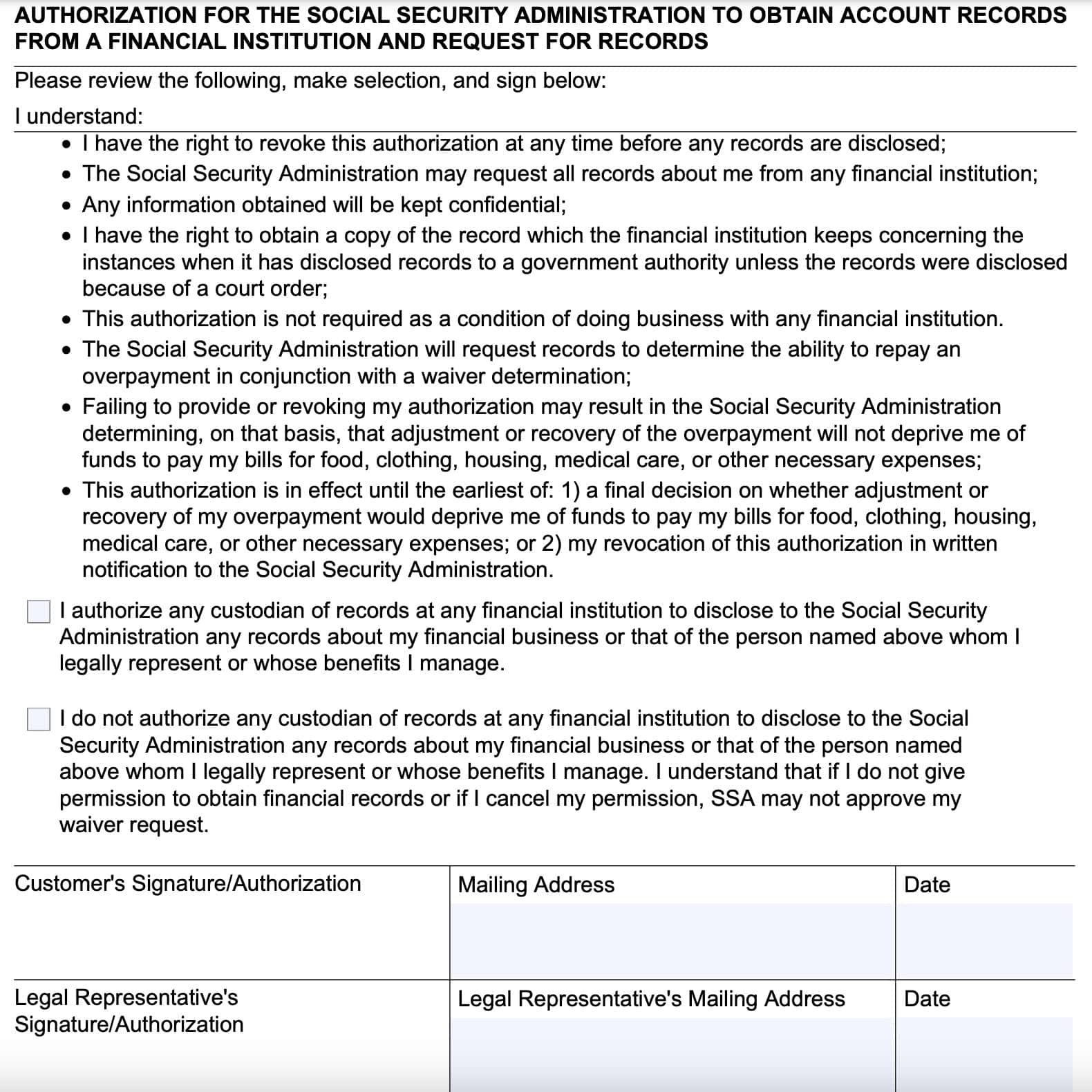

Authorization

To complete Form SSA-632-BK, you’ll need to sign this section to authorize your financial institutions to release pertinent information to the Social Security Administration. This is the same authorization request outlined in Form SSA-4641.

If you do not sign this release form, the SSA may not approve your waiver request.

By signing this portion of the form, you are either authorizing or not authorizing your financial institution(s) to disclose financial records to the SSA. If you’ve authorized a legal representative on your own, or if you’ve appointed a representative by filing Form SSA 1696, then that person can sign on your behalf.

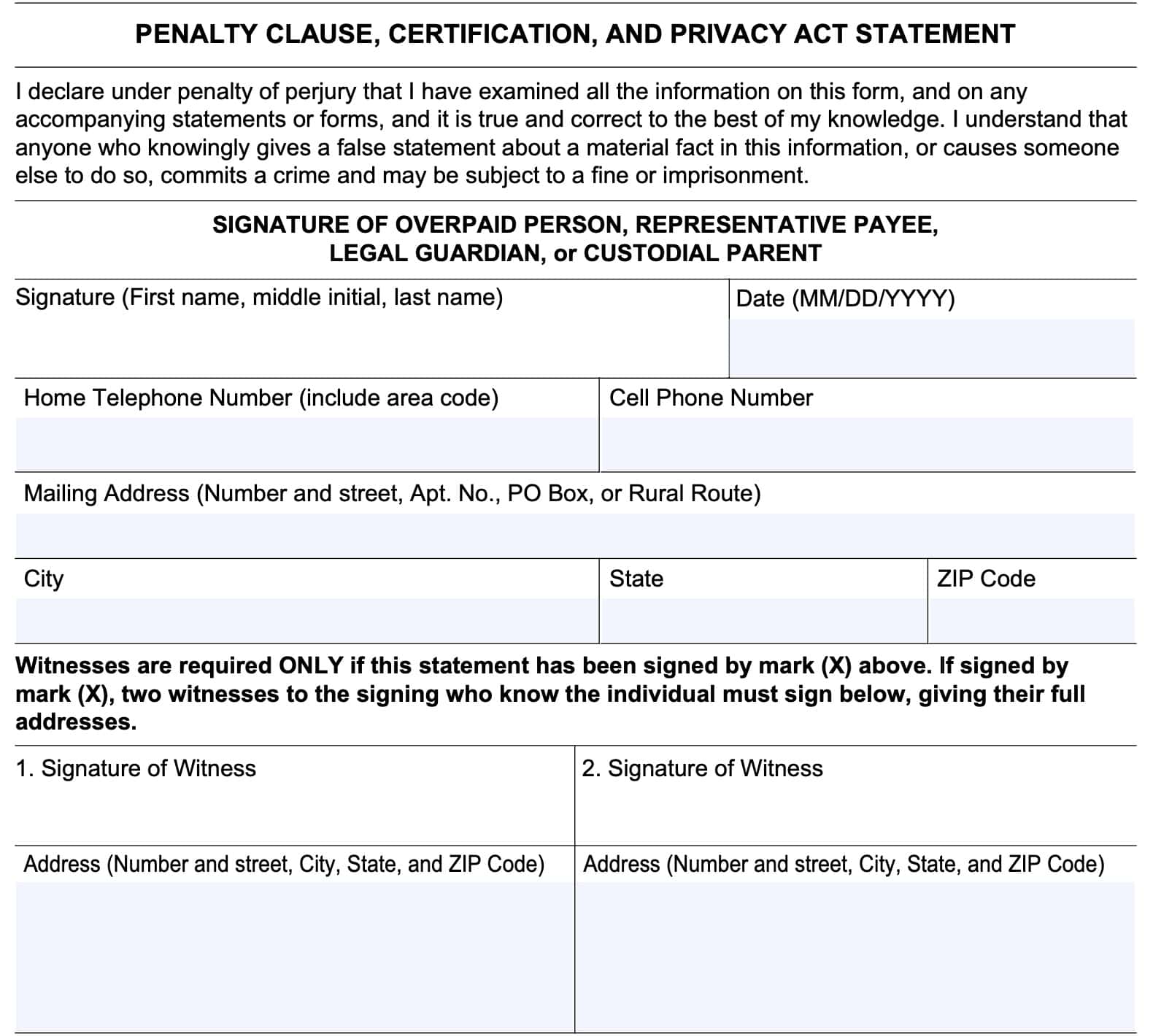

Penalty Clause, Certification, and Privacy Act Statement

As with other SSA forms, there is a penalty clause.

Basically, you’re making the good faith representation, under penalty of perjury, that all financial and personal information you’re providing is true and accurate to the best of your knowledge. If you knowingly give a false statement, you may be subject to criminal charges.

As with the financial disclosure form, your legal representative can sign this form on your behalf. If you appointed another person as a representative payee on Form SSA-11, your representative can sign on your behalf.

When to request a waiver using Form SSA-632

According to the SSA, you should complete Form SSA-632 BK if you think that you are not at fault for the overpayment, and

- You cannot afford to repay the money

- You think the overpayment is unfair for another reason

When not to complete Form SSA 632

The SSA also states certain conditions where you should not complete this form.

If your overpayment is $1,000 or less

If your overpayment is $1,000 or less, then call your local SSA office or the toll-free number at: (800) 772-1213. The SSA may be able to resolve your request over the phone.

If you think the SSA made a mistake or if you disagree with the overpayment

In this situation, you should file Form SSA-561, Request for Reconsideration, instead of Form SSA-632-BK.

If you are requesting a hearing

For a case that you’d like to present to an administrative law judge, you should complete HA-501-U5, Request for Hearing by Administrative Law Judge.

If you want to change the repayment rate, but intend to repay the total amount

In this situation, you should file Form SSA-634, Request for Change in Overpayment Recovery Rate. This allows you to fully repay your overpayment, but on terms that allow you to fulfill your other financial obligations.

You have been convicted of fraud relating to this overpayment

According to the SSA website, if you have a fraud conviction related to this overpayment, then you are not eligible for a waiver of recovery of this overpayment.

Video walkthrough

Watch this instructional video to learn more about requesting a waiver of Social Security overpayments using Form SSA-632-BK.

Frequently asked questions about Form SSA-632-BK

Here are some frequently asked questions about completing the Form SSA 632-BK.

If you are receiving Social Security benefits, the SSA may garnish the entire check until your overpayment has been paid in full. For SSI payments, the SSA may withhold up to 10% of the maximum federal SSI benefits each month.

The SSA will not start withholding income from your benefits until 60 days after you’ve received your notice of overpayment. If you’ve submitted a waiver or have requested an appeal, the SSA will withhold collection efforts until a decision has been made.

Where can I find a copy of Form SSA-632-BK?

You may obtain a copy of the form at your local SSA office, through the SSA website, or by downloading the attached form below.