IRS Form 6765 Instructions

The Internal Revenue Service allows companies of all sizes to claim tax credits for certain investments in their business. One significant opportunity is the tax credit for increasing research activities, also known as the R&D tax credit or research credit. Using IRS Form 6765 to claim this credit, taxpayers may reduce their federal income tax liability while investing in the future of their business.

In this article, we’ll walk through IRS Form 6765, including:

- How to complete & file IRS Form 6765

- Ways to obtain the maximum federal research credit

- Frequently asked questions about the research tax credit

Let’s start with a basic walkthrough of the form itself.

Table of contents

How do I complete IRS Form 6765?

There are seven sections to this tax form:

- Section A: Regular Credit

- Section B: Alternative Simplified Credit

- Section C: Current Year Credit

- Section D: Qualified Small Business Payroll Tax Election and Payroll Tax Credit

- Section E: Other Information

- Section F: Qualified Research Expenses Summary

- Section G: Business Component Information

If you are electing the alternative simplified credit or if you have previously elected the alternative method without revoking it, go directly to Section B of Form 6765. Otherwise, we will start with Section A.

But first, there are two questions at the very top of the form.

Top of form

Question A: Section 280C election

Are you electing the reduced credit under IRC Section 280C?

Making Section 280C election

If you are electing the reduced research credit, you must complete Form 6765 and clearly indicate your intent to make this election. This is true even if there is no R&D tax credit claim on the original return.

In order for the election to apply, the Form 6765 must be filed with your original timely filed (including extensions) return for the tax year. Once made, the election is irrevocable for that tax year.

Not making Section 280C election

For taxpayers who don’t elect the reduced credit, you must reduce your otherwise allowable deduction for qualified research expenses or basic research expenses by the amount of the credit on this line.

If the credit exceeds the amount allowed as a deduction for the tax year, you reduce the amount chargeable to capital account for the year for such expenses by the amount of the excess.

Attach a statement to your tax return that lists the deduction amounts or capitalized expenses that you reduced. Identify the lines of your return (schedule or forms for capitalized items) on which you reduced these items.

Question B

Are you a member of a controlled group or business under common control?

Controlled groups

For purposes of the reduced credit election, a member of a controlled group may make the election under Section 280C(c)(3).

However, only the common parent (within the meaning of Treasury Regulations Section 1.1502-77(a)(1)(i)) of a consolidated group may make the election on behalf of the members of a consolidated group.

If you are electing the reduced research credit, you must complete Form 6765 (even if no research credits are claimed on the original return).

In order for the election to apply, the Form 6765 must be filed with your original timely filed return (including extensions) for the tax year. This election cannot be made or changed on an amended return. Once made, the election is irrevocable for that tax year.

If you make an election to claim a portion of your research credit as a payroll tax credit, the amount elected is treated as a research credit for purposes of the reduced credit.

Members of controlled group and businesses under common control

If you are a member of a controlled group or business under common control, complete the required attachment. The attachment reports qualified research expenses (QREs) and additional information needed to compute each group member’s credit.

If you e-file your tax return, name this attachment Form6765ItemBGroupCredit.pdf. The required Item B attachment should include a heading for each line item including:

- Entity EIN

- Entity Name

- Common Parent or Designated Member

- Consolidated Member

- PBA Code

- Wages QREs

- Supplies QREs

- Rent/Lease Computers QREs

- Contract Research QREs

- Total QREs of Controlled Member

- Percentage of credit

- Portion of credit (if a section 280C election is made on Item A, record the reduced credit amount on this column)

- The last line needs to include the total QREs of the controlled group, and

- The total credit amount for the controlled group

Other questions you need to answer on the attachment include:

- Provide the number of controlled group members this year and provide the number of controlled group members in previous year.

- For the QREs claimed in the attachment, indicate if they are being claimed as one consolidated controlled group return, or filing separate returns.

Section A: Regular credit

Line 1: Certain amounts paid or incurred to energy consortia

Enter the amounts you paid or incurred to energy research consortia for energy research. This must be qualified research.

Generally, an energy research consortium is any organization:

- Described in Internal Revenue Code Section 501(c)(3)

- Exempt from taxation under IRC Section 501(a)

- Organized and operated primarily to conduct energy research

- Not a private foundation

IRC Section 41(f)(6) contains additional information.

Line 2: Basic research payments to qualified organizations

Enter the amounts the corporation paid in cash, under a written contract, for basic research to one of the following:

- Qualified university

- Scientific research organization

- Scientific tax-exempt organization, or

- Grant organization

This does not apply to S corporations, personal holding companies, and service organizations.

Line 3: Qualified organization base period amount

In Line 3, enter the qualified organization base period amount. This amount is based on minimum basic research amounts plus maintenance-of-effort amounts for the 3 preceding tax years.

Line 4

Subtract Line 3 from Line 2. Enter the result in Line 4.

If the result is zero or a negative number, enter ‘0.’

Line 5: Total qualified research expenses (QREs)

Enter the amount from Line 48, in Section F, below.

Controlled groups

If you are a member of a controlled group, enter the group total QREs even if you are filing a separate tax return. This amount must be computed and shown on the required group credit attachment.

Line 6: Fixed base percentage

The fixed-base percentage depends on whether you are an existing company or a start-up company.

Start-up company

A start-up company is a taxpayer that had both gross receipts and qualified research expenses either:

- For the first time in a taxable year beginning after 1983, or

- For fewer than 3 tax years beginning after 1983 and before 1989.

Fixed-base percentage

The fixed-base percentage for a start-up company is figured as follows.

- For the first 5 tax years beginning after 1993 for which you have qualified research expenses, the percentage is 3%.

- For the 6th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 4th and 5th such tax years by the aggregate gross receipts for those tax years, then divide the result by 6.

- For the 7th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 5th and 6th such tax years by the aggregate gross receipts for those tax years, then divide the result by 3.

- For the 8th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 5th, 6th, and 7th such tax years by the aggregate gross receipts for those tax years, then divide the result by 2.

- For the 9th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 5th, 6th, 7th, and 8th such tax years by the aggregate gross receipts for those tax years, then divide the result by 1.5.

- For the 10th tax year beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for the 5th through 9th such tax years by the aggregate gross receipts for those tax years, then divide the result by 1.2.

- For the 11th and later tax years beginning after 1993 for which you have qualified research expenses, divide the aggregate qualified research expenses for any 5 of the 5th through 10th such tax years by the aggregate gross receipts for those tax years.

Existing company

An existing company is any company that is not a start-up company. The fixed-base percentage for an existing company is figured by dividing the aggregate qualified research expenses for the tax years beginning after 1983 and before 1989 by the aggregate gross receipts for those tax years.

Fixed-base percentage

The fixed-base percentage for all companies (existing and start-up) must be rounded to the nearest 1/100th of 1% (that is, four decimal places) and can’t exceed 16%.

In addition, when figuring your fixed-base percentage, you must reflect expenses for qualified research conducted in Puerto Rico or a U.S. possession for all prior tax years included in the computation.

If short tax years are involved, see Treasury Regulations Section 1.41-3(b).

Line 7: Average annual gross receipts

In Line 7, enter the average annual gross receipts for the 4 tax years preceding the tax year for which you are determining the credit. Reduce this amount by returns and allowances.

You may be required to annualize gross receipts for any short tax year. For a foreign corporation, include only gross receipts that are effectively connected with a trade or business in the United States (or in Puerto Rico or a U.S. possession, if applicable).

For a tax year that the credit ends, the average annual gross receipts for the 4 tax years preceding the termination tax year is prorated for the number of days that you applied the credit during the tax year.

Line 8

Multiply the average annual gross receipts (Line 7) by the fixed base percentage (Line 6). Enter the result in Line 8.

Line 9

Subtract the Line 8 amount from Line 5. If this results in zero or a negative number, enter ‘0.’

Line 10

Multiply Line 5 by 50%. Enter the result here.

Line 11

Enter the smaller of:

- Line 9

- Line 10

Line 12

Add the following lines:

Enter the total in Line 12.

Line 13

If you elect to reduce the credit under Section 280C, then multiply Line 12 by 15.8% (0.158).

If not, multiply Line 12 by 20% (0.20).

Members of a controlled group should enter your share of the credit. This amount must be computed and shown on the required group credit attachment.

If you don’t elect the reduced credit, and if the amount of the credit determined for the tax year exceeds the amount allowable as a deduction for such tax year for QREs or basic research expenses, reduce the amount chargeable to capital account for the tax year for such expenses by the amount of the excess.

Attach a statement to your tax return that lists the capitalized expenses that were reduced. Also, identify the schedule or forms for capitalized items on which the reductions were made.

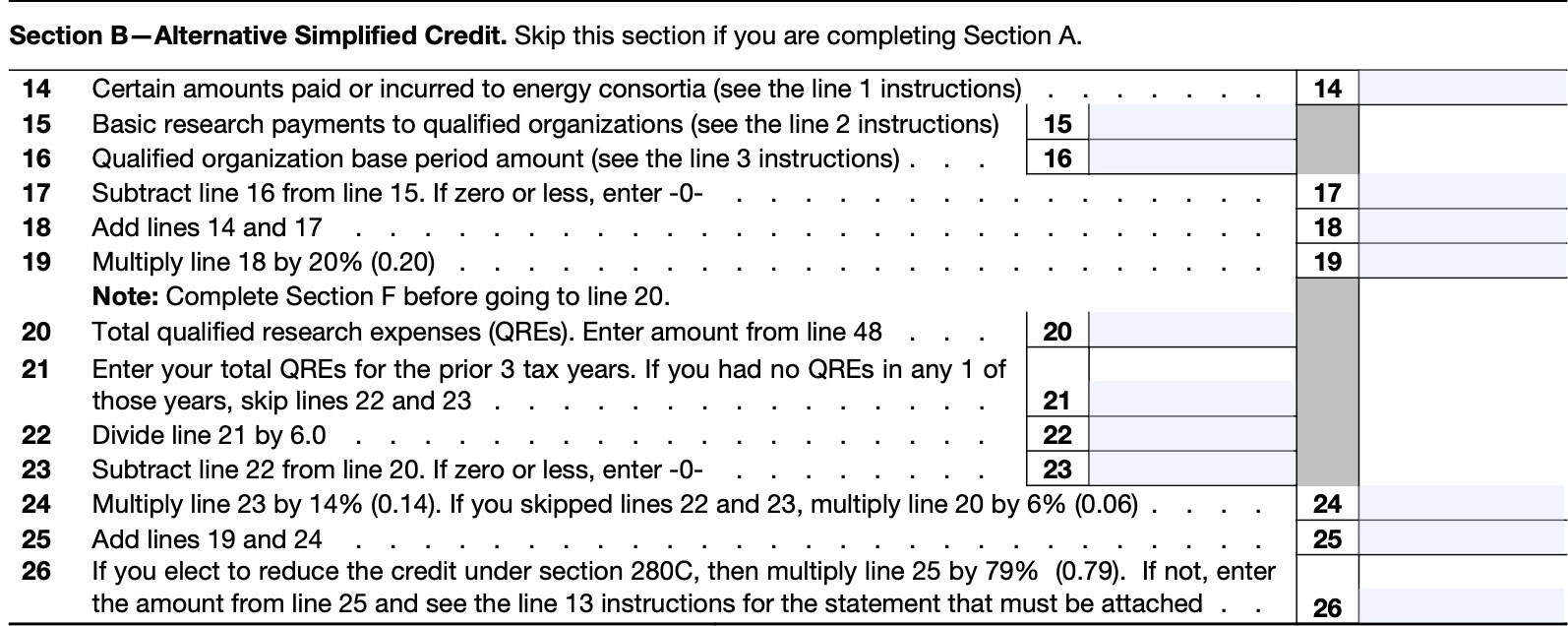

Section B: Alternative simplified credit

Complete Section B only if:

- You are electing the alternative simplified credit (ASC), or

- You previously elected the ASC and aren’t revoking the election on this return

You can only make an ASC election on an amended return for a tax year if you hadn’t previously claimed the research credit on an original return or amended return for that tax year.

The IRS will not grant an extension of time to make the ASC election.

Line 14: Certain amounts paid or incurred to energy consortia

Following the Line 1 instructions, enter the amounts you paid or incurred to energy research consortia for energy research. This must be qualified research.

Line 15: Basic research payments to qualified organizations

Following the Line 2 instructions, enter the amounts the corporation paid in cash, under a written contract, for basic research to one of the following:

- Qualified university

- Scientific research organization

- Scientific tax-exempt organization, or

- Grant organization

Line 16: Qualified organization base period amount

Using the Line 3 instructions, enter the qualified organization base period amount based on minimum basic research amounts plus maintenance-of-effort amounts for the 3 preceding tax years.

Line 17

Subtract Line 16 from Line 15. If this results in zero or a negative number, enter ‘0.’

Line 18

Add Line 14 and Line 17. Enter the result here.

Line 19

Multiply Line 18 by 20% (0.20). Enter the result in Line 19.

Note: You must complete Section F below before going to Line 20.

Line 20: Qualified research expenses

Enter the total of qualified research expenses (QREs) from Line 48 in this line.

Line 21

Enter your total QREs for the past 3 taxable years. If the credit terminates during the tax year, prorate the QREs for the prior 3 tax years for the number of days the credit applied during the tax year.

Controlled groups

If you are a member of a controlled group, enter the total amount of the group’s QREs for the prior 3 years.

If you had no QREs in any one of those three tax years, skip Lines 22 and 23. Proceed to Line 24, below.

Line 22

Divide Line 21 by 6.0. Enter the result in Line 22.

Line 23

Subtract Line 22 from Line 20. If this results in zero or a negative number, enter ‘0.’

Line 24

Multiply Line 23 by 14% (0.14).

If you skipped Line 22 and Line 23, then multiply Line 20 by 6% (0.06).

Enter wages for qualified services in Line 24.

Line 25

Add Line 19 and Line 24, then enter the total in Line 25.

Line 26

If you elected to reduce the credit under Section 280C, then multiply Line 25 by 79% (0.79). Members of a controlled group should enter your share of the credit. This amount must be computed and shown on the required group credit attachment.

If you did not reduce the credit under Section 280C, then enter the Line 25 amount here.

If you don’t elect the reduced credit, and if the amount of the credit determined for the tax year exceeds the amount allowable as a deduction for such tax year for QREs or basic research expenses, reduce the amount chargeable to capital account for the tax year for such expenses by the amount of the excess.

Attach a statement to your tax return that lists the capitalized expenses that were reduced. Also, identify the schedule or forms for capitalized items on which the reductions were made.

Section C: Current year credit

Line 27

In Line 27, enter the portion of the federal tax credit for employer differential wage payments, from IRS Form 8932, Line 2, that is attributable to wages used to calculate the tax credit on either Line 13 or Line 26.

In other words, business owners cannot use any wage payments for both the research and development tax credit and the tax credit for employer differential wage payments.

Line 28

Subtract Line 27 from either Line 13 or Line 26, as applicable. If the result is zero or a negative number, enter ‘0.’

Line 29: Credit for increasing research activities from partnerships, S-corporations, estates, and trusts

In Line 29, enter total credit for increasing research activities from any of the following:

- Partnerships: Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc., Box 15 (code M);

- S-corporations: Schedule K-1 (Form 1120S), Shareholder’s Share of Income, Deductions, Credits, etc., Box 13 (code M); and

- Estates & trusts: Schedule K-1 (Form 1041), Beneficiary’s Share of Income, Deductions, Credits, etc., Box 13 (code I).

The following entities report the above credits on Line 9:

- Partnerships

- S corporations

- Estates

- Trusts

- All other filers figuring a separate credit in Section A or Section B, above

Any taxpayer not calculating a separate credit can report this as a general business credit on IRS Form 3800, Part III, as outlined below:

- Eligible small businesses: Report the credit on Line 4i. See the definition of “eligible small business” under Definitions, earlier. Also see Treatment of partners and S corporation shareholders, earlier.

- All other taxpayers: Report the credit on Line 1c.

Eligible small business

For the purpose of offsetting alternative minimum tax (AMT), an eligible small business is:

- A corporation whose stock isn’t publicly traded,

- A partnership, or

- A sole proprietorship.

Also, the average annual gross receipts of the corporation, partnership, or sole proprietorship for the 3-tax-year period preceding the tax year of the credit can’t exceed $50 million.

Gross receipts for any tax year must be reduced by returns and allowances made during the year. If your business wasn’t in existence for the entire 3-year period, base your average annual gross receipts on the period your business existed.

Also, if your business had a tax year of less than 12 months, your gross receipts must be annualized by multiplying the gross receipts for the short period by 12 and dividing the result by the number of months in the short period.

However, it is important not to confuse an eligible small business with a qualified small business, as outlined below.

Qualified small business

For the purpose of payroll tax election, a qualified small business is a corporation or partnership with:

- Gross receipts of less than $5 million for the tax year, and

- No gross receipts for any tax year before the 5-year period ending with the current tax return

Qualified small businesses may offset the employer portion of Social Security taxes by directing a specific amount of their research credit claim towards their payroll tax obligations. This tax credit is the smallest of:

- Current year research credit

- $500,000

- General business credit carryforward for the tax year

For more details, see the form instructions.

Line 30

Estates & trusts: Go directly to Line 31.

Partnerships and S corporations not electing the payroll tax credit: Stop here. Report this amount on Schedule K.

Partnerships and S corporations electing the payroll tax credit: Complete Section D, below. On Schedule K, report the amount on this line reduced by the amount on Line 36.

Eligible small businesses: Stop here. Report the credit on IRS Form 3800, Part III, Line 4i.

Filers other than eligible small businesses: Stop here. Report the credit on IRS Form 3800, Part III, Line 1c

Qualified small business filers, other than partnerships and S corporations, who elect the payroll tax credit, must complete IRS Form 3800 before completing Schedule D.

Line 31: Amount allocated to beneficiaries of the estate or trust

Estates & trusts must allocate the credit for increasing research activities on Line 30 between the estate or trust and the beneficiaries in the same proportion as taxable income was allocated. Enter the beneficiaries’ share on Line 31.

If the estate or trust is subject to the passive activity rules, include any credit for increasing research from passive activities disallowed for any prior year and carried forward to this year.

Complete Form 8582-CR, Passive Activity Credit Limitations, to determine the allowed credit that must be allocated between the estate or trust and the beneficiaries.

Line 32

Subtract Line 31 from Line 30.

For eligible small businesses, report the credit on IRS Form 3800, Part III, Line 4i. For filers other than eligible small businesses, report the credit on Form 3800, Part III, Line 1c.

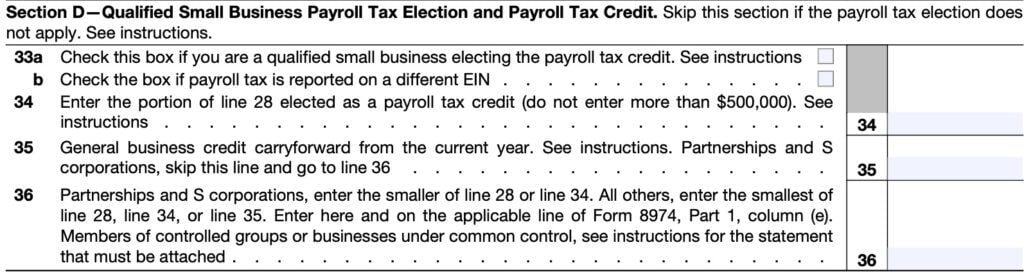

Section D: Qualified small business payroll tax election & payroll tax credit

Skip Section D if the payroll tax election does not apply. Before completing this section, you must complete Form 3800 if you are a qualified small business other than a partnership or an S corporation.

Line 33: Qualified small business electing the payroll tax credit

There are two boxes. Check the first box if you are a qualified small business choosing to claim part of your tax credit for qualified research activities as a payroll tax credit.

Do not confuse this with an eligible small business, as there are two different sets of criteria for each definition.

Check the second box if payroll taxes are reported on a different EIN.

Line 34

Enter the portion of Line 28 that you elect to be treated as a payroll tax credit. Do not enter more than $500,000.

Line 35: General business credit carryforward from the current year

If you are a partnership or S-corporation, go directly to Line 36.

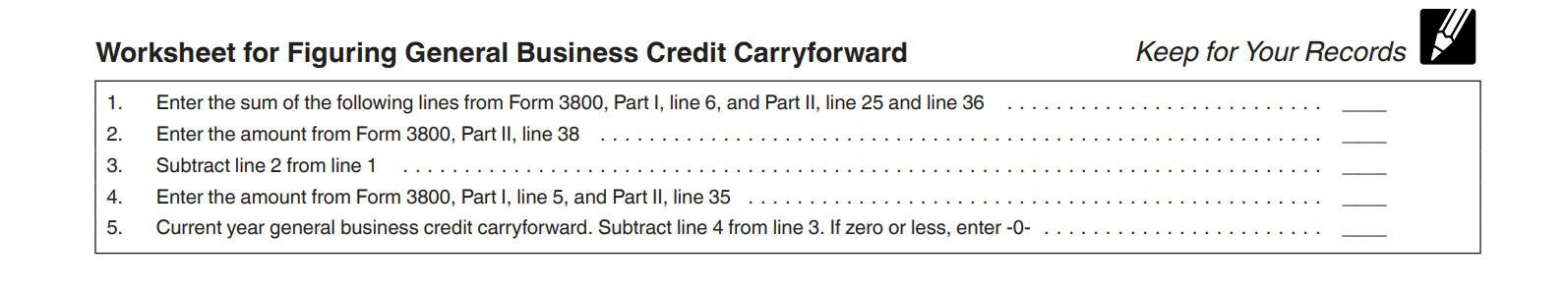

Otherwise, follow these steps as outlined in the worksheet for figuring the general business credit carryforward, contained in the form instructions.

Figuring the general business credit carryforward

- Enter the sum of the following lines from IRS Form 3800:

- Part I, Line 6

- Part II, Line 25

- Part II, Line 36

- Enter the amount from IRS Form 3800, Part II, Line 38

- Subtract Line 2 from Line 1

- Enter the amount from IRS Form 3800, Part I, Line 5, and Part II, Line 35

- Subtract Line 4 from Line 3. If zero or less, enter ‘0.’

The result in Step 5 represents the amount of general business credit carryforward for future tax years.

Line 36

Partnerships and S corporations, enter the smaller of:

All others, enter the smallest of:

- Line 28

- Line 34

- Line 35

Enter this number here and on the applicable line of IRS Form 8974, Part 1, column (e). This is the tax form for claiming the qualified small business payroll tax credit for increasing research activities.

Members of controlled groups or businesses under common control, see the form instructions for the statement that must be attached to IRS Form 6765.

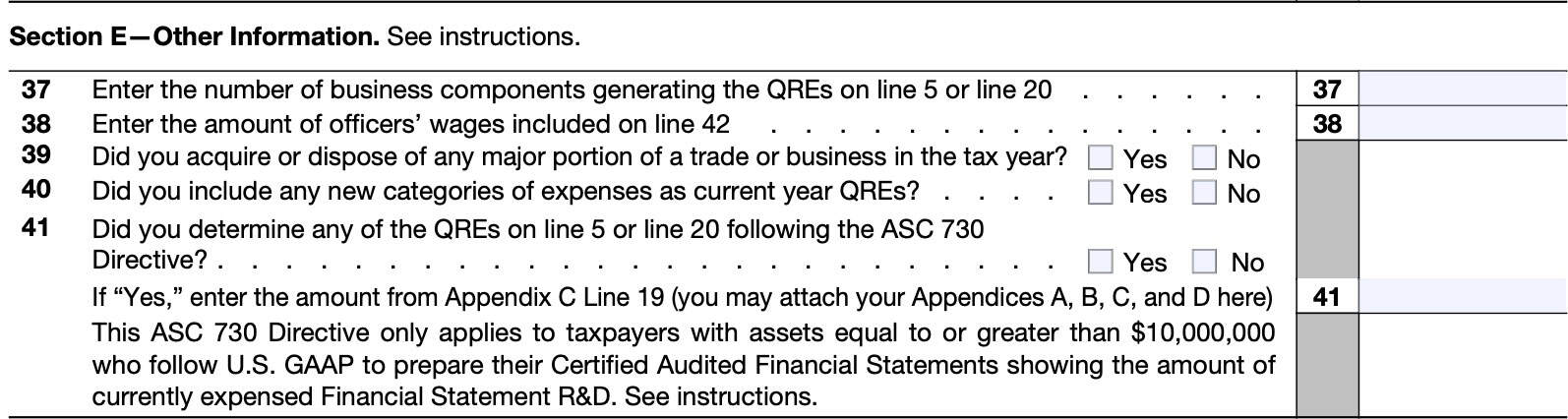

Section E: Other information

Complete this section to provide additional details or information about the total QREs reported in Section F.

Line 37

In Line 37, enter the number of business components generating QREs show on Line 48. This includes the total number of business components generating the QREs shown, not just the limited number of business components you may be reporting in Section G.

The four-part test must be applied separately to each business component.

Line 38

Enter the total amount of officers’ wages included on Line 42, in Section G, if the amount shown on Line 42 as wages for qualified services includes wage amounts attributable to any officer of the reporting entity.

When corporate officers perform services for the corporation and receive or are entitled to receive payments, their compensation is generally considered wages. The fact that an officer is also a shareholder does not change this reporting requirement.

Line 39

Did you acquire or dispose of any major portion of a trade or business in the tax year? Check Yes or No.

Line 40

Did you include any new categories of expenses as current year QREs? Check Yes or No.

Line 41

Did you determine any of the QREs on Line 5 or Line 20 following the ASC 730 Directive? Check Yes or No.

If Yes, enter the amount from Appendix C Line 19. You may attach ASC 730 Directive Appendices A, B, C, and D to your return using the following file naming conventions:

- Form6765ASC730AppendixA.pdf

- Form6765ASC730AppendixB.pdf

- Form6765ASC730AppendixC.pdf

- Form6765ASC730AppendixD.pdf

This ASC 730 Directive only applies to taxpayers with assets equal to or greater than $10,000,000

who follow U.S. GAAP to prepare their Certified Audited Financial Statements showing the amount of

currently expensed Financial Statement R&D.

Section F

Before you begin Line 42, check Yes or No to the question at the top of Section F:

Are you required to complete Section G?

If you are required to complete Section G, the totals from Section G will be entered into the applicable lines of Section F and then you will complete Line 46, if applicable.

If you are not required to complete Section G, simply complete all applicable lines of Section F.

Section G is required unless:

- You are a qualified small business, as defined under Internal Revenue Code Section 41(h)(1) and (2), and you checked the box to claim a reduced payroll tax credit; or

- Your total QREs on Line 48 are equal to or less than $1.5 million, and

- Determined at the control group level

- Your gross receipts are equal to or less than $50 million of gross receipts

- As determined under Section 448(c)(3) (without regard to subparagraph (A) thereof), reporting a research credit on an original filed return.

Line 42: Total wages for qualified services for all business components

If you completed Section G, enter the total amount from all entries for Column 53.

Otherwise, enter your total in-house wages for qualified services for all business components. Do not include any wages used in figuring the work opportunity credit.

Group members filing separate tax returns, report only your qualified wages expense and not the combined group amount of qualified wages.

Line 43: Total costs of supplies for all business components

If you completed Section G, enter the total amount from Column 54.

Otherwise, enter your total supplies for all business components.

Line 44: rental or lease cost of computers for all business components

Enter the cost that you paid or incurred for the use of computers used in qualified research.

The computer must be located off your premises. You cannot be the operator or primary user of the computer.

Reduce this amount by the amount that you (or any member of a controlled group of corporations or businesses under common control) received or accrued for the right to use substantially identical property.

Line 45: applicable amount of contract research for all business components

Enter the total qualified contract expenses you paid or incurred for research, not including basic research. These amounts are subject to the following limitations.

- 100% of amounts you paid (or incurred) for qualified energy research performed by one of the following:

- An eligible small business

- A university, or

- A federal laboratory (see IRC Section 41(b)(3)(D) for definitions of those entities).

- Include payments made to the extent they are included as basic research payments on Line 2, not to exceed the base period amount on Line 3.

- 75% of amounts you paid (or incurred) for qualified research by a qualified research consortium

- 65% of amounts you paid (or incurred) for all other qualified research by any other person.

Line 46: Applicable amount of all basic research payments

Enter basic research payments from Line 2 to the extent such payments do not exceed the base period amount on Line 3.

Basic research expenses are subject to the following limitations.

- 100% of amounts you paid (or incurred) for qualified energy research performed by one of the following:

- An eligible small business

- A university, or

- A federal laboratory (see IRC Section 41(b)(3)(D) for definitions of those entities).

- Include payments made to the extent they are included as basic research payments on Line 2, not to exceed the base period amount on Line 3.

- 75% of amounts you paid (or incurred) for qualified research by a qualified research consortium

- 65% of amounts you paid (or incurred) for all other qualified research by any other person.

Line 47

Add Line 45 and Line 46. Enter the total here.

Line 48

Add the following lines:

- Line 42

- Line 43

- Line 44

- Line 47

Enter this amount on either Line 5 or Line 20, as appropriate.

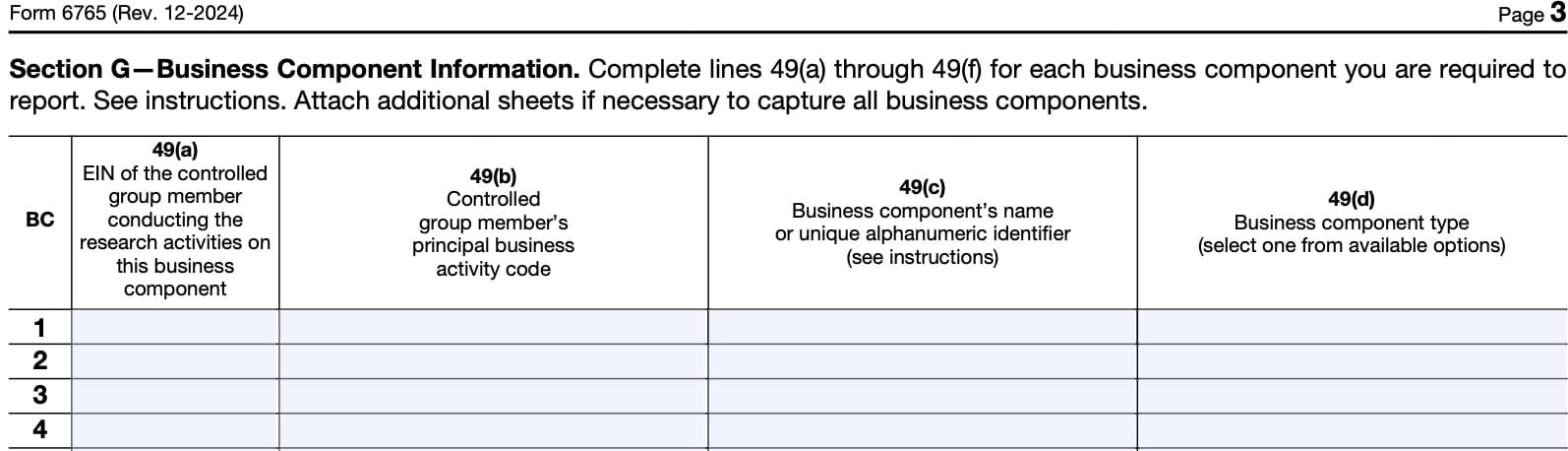

Section G

If you are required to complete Section G, the totals from Section G will be entered into the applicable lines of Section F and then you will complete Line 46, if applicable. If you are not required to complete Section G, simply complete all applicable lines of Section F.

You can list up to 15 business units in Section G. If you do not e-file, and you have more than 15 business units, you can use additional sheets to provide more information.

Column 49(a)

In Column 49(a), enter the EIN of the controlled group member conducting research activities on this business component.

Column 49(b)

Enter the principal business activity (PBA) code that best describes the activities of the entity listed in Column 49(a). You can find a list of PBA codes in the instructions for IRS Form 1120.

Column 49(c)

Enter the business component’s name or unique alphanumeric identifier. This field should be populated with an identifier that is consistent with how you maintain the books and records that substantiate the qualified research activities and associated QREs.

Column 49(d)

Enter the appropriate business component type for each business component. Select from the following

options only:

- Product

- Process

- All others

- Includes computer software, technique, formula, or invention

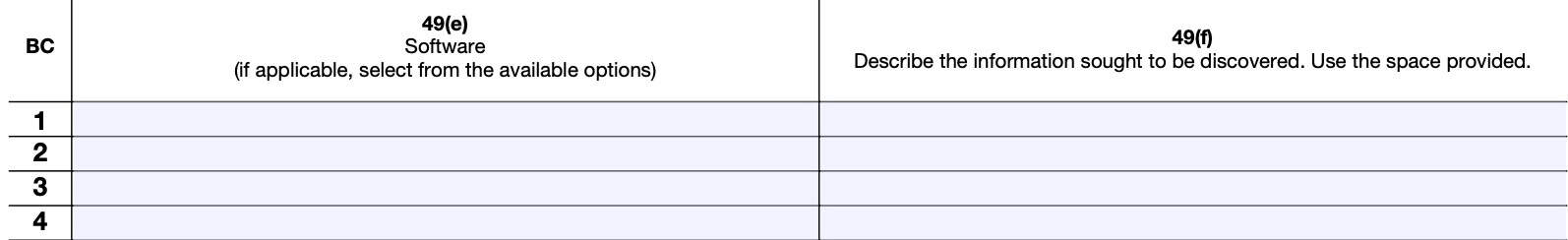

Column 49(e)

If the business component is software, enter in this column the software type by selecting from the following options only:

- A. IUS—internal use software

- B. DFS—dual function software

- C. Non-IUS

- D. Excepted from IUS treatment

Column 49(f)

Currently, Column 49(f) is required if you are claiming a refund or credit on an amended return that includes a Section 41 credit for increasing research activities that either:

- Was not reported on your original filed return or

- Is increased from the amount reported on your original return.

It is not required for timely filed original returns including extensions.

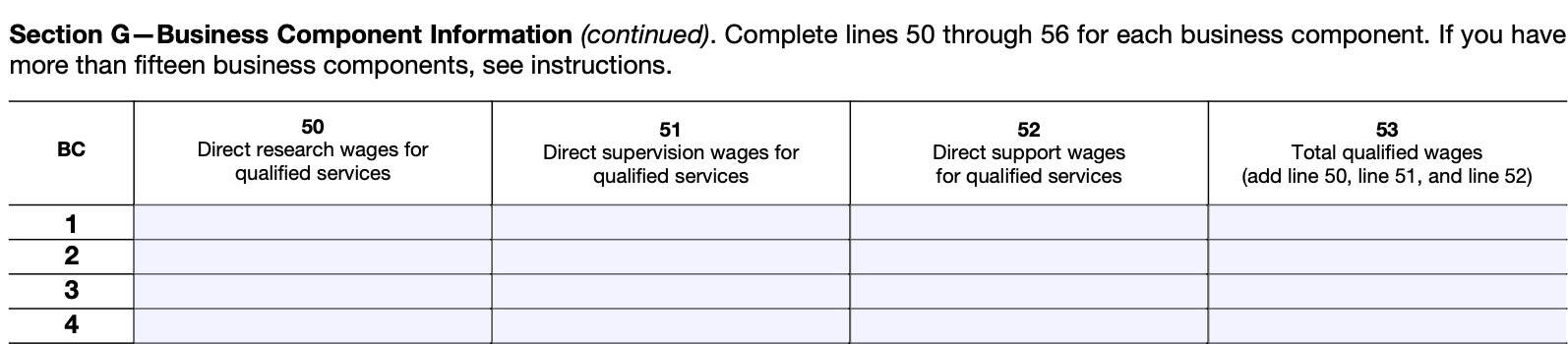

Column 50

Enter the total amount of in-house wages incurred by persons engaged in the actual conduct of qualified research activities (as in the case of a scientist conducting laboratory experiments) for each of the 80%/Top 50 and the aggregate business components.

Column 51

Enter the total amount of in-house wage QREs incurred by persons engaged in direct supervision of qualified research activities for each 80%/Top 50 and the aggregate business components.

The term direct supervision means immediate supervision (first-line management) of qualified research (as in the case of a research scientist who directly supervises laboratory experiments, but who may not actually perform experiments).

Direct supervision does not include supervision by a higher-level manager to whom first-line managers report, even if that manager is a qualified research scientist.

Column 52

Enter the total amount of in-house wage QREs incurred by persons engaged in direct support of qualified research activities for each 80%/Top 50 and the aggregate business components.

Direct support of research activities does not include general administrative services, or other services only indirectly of benefit to research activities.

Column 53

Add the total of Columns 50, 51, and 52 for each business component. Enter the total in Column 53. Show the total qualified wages and report this amount on Section F, Line 42.

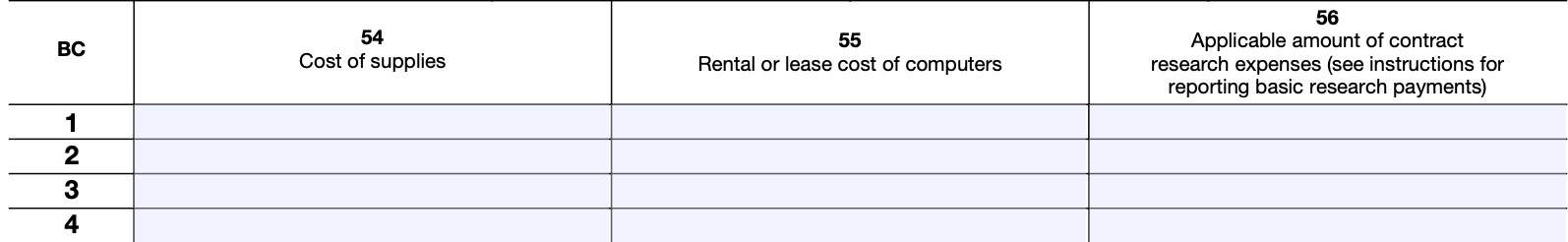

Column 54

Enter the total cost of supplies used in the conduct of qualified research for each business component. Show the total of the cost of supplies used for qualified services and report this amount on Section F, Line 43.

Column 55

Enter the total amount you paid or incurred for the rental or lease of computers in the conduct of qualified research for each business component. Show the total of rental or lease cost of computers used for qualified services and report this amount on Section F, Line 44.

Column 56

Enter the total applicable amount of contract research expenses for qualified services for each business component.

Enter the total qualified contract expenses you paid or incurred for research, not including basic research. These amounts are subject to the following limitations.

- 100% of amounts you paid (or incurred) for qualified energy research performed by one of the following:

- An eligible small business

- A university, or

- A federal laboratory (see IRC Section 41(b)(3)(D) for definitions of those entities).

- Include payments made to the extent they are included as basic research payments on Line 2, not to exceed the base period amount on Line 3.

- 75% of amounts you paid (or incurred) for qualified research by a qualified research consortium

- 65% of amounts you paid (or incurred) for all other qualified research by any other person.

Show the total of contract research expenses used for qualified services and report this amount on Section F, Line 45.

Video walkthrough

Watch this instructional video to learn more about how to claim the maximum credit for research and development activities using IRS Form 6765.

Frequently asked questions

This credit, also known as the federal research credit or research tax credit, allows entities who invest in research and development activities to offset their income tax liability based on the amount of their research investments.

According to the Internal Revenue Code, qualified research means research for which expenses may be treated as Section 174 expenses. This research must be undertaken for discovering information that is technological in nature, and its application must be intended for use in developing a new or improved business component of the taxpayer.

Eligible taxpayers file IRS Form 6765 to figure and claim the federal tax credit for increasing research activities, to elect a reduced tax credit under IRC Section 280C, and to elect to claim a certain amount of the credit as a payroll tax offset against the employer portion of payroll taxes.

Where can I find IRS Form 6765?

You can find this tax form on the IRS website. For your convenience, we’ve attached the latest version of this form here.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!