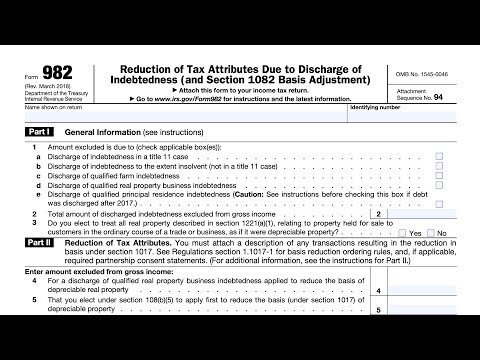

IRS Form 982 Instructions

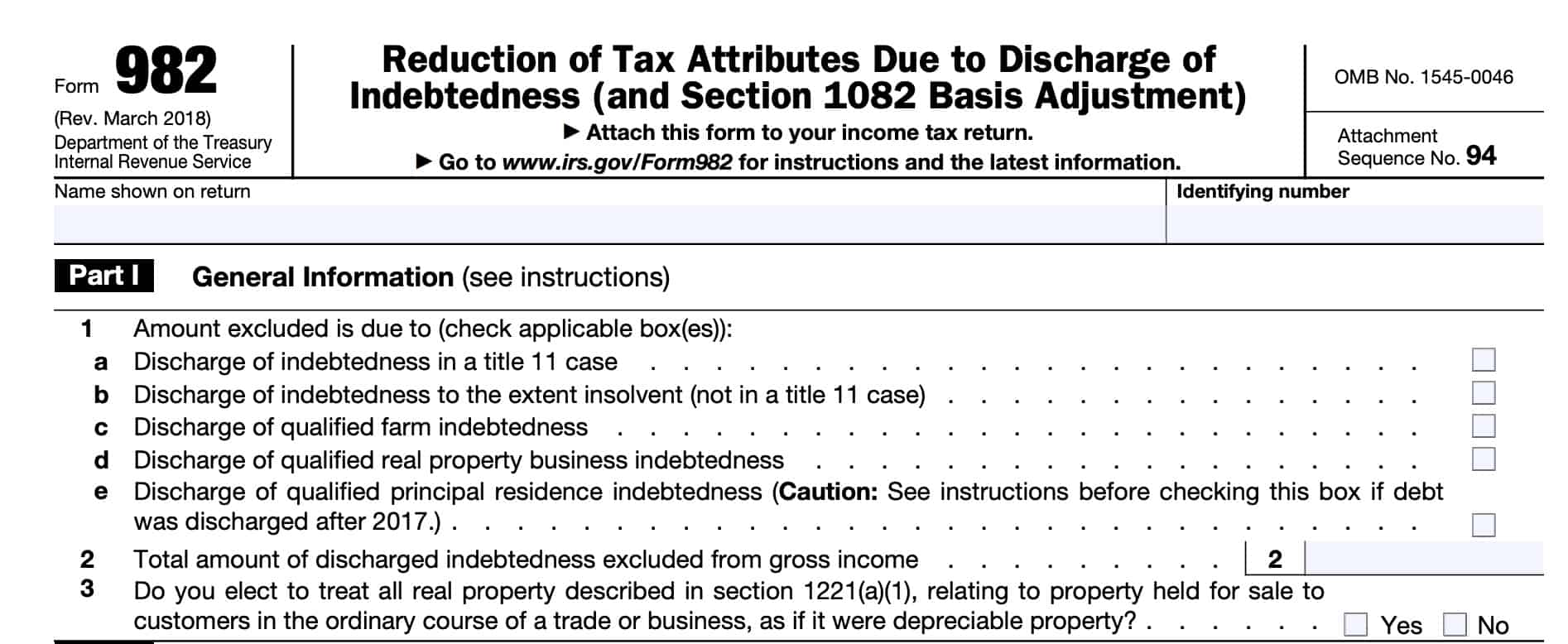

If you have discharged or forgiven debt, the Internal Revenue Service expects you to include that debt as taxable income. However, certain parts of the tax code allow for taxpayers to exclude certain forgiven, discharged, or canceled debts from income. In order to claim this, taxpayers must file IRS Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness (and Section 1082 Basis Adjustment).

In this article, we’ll walk through the different types of forgiven debt you may exclude on your income tax return, and how to report it on Form 982. Let’s start by walking through Form 982 itself for a better understanding.

Table of contents

How do I complete IRS Form 982?

It is fairly unlikely that most taxpayers will use all parts of Form 982. In most cases, a taxpayer will use several lines to report one of the following:

- Discharge of qualified principal residence indebtedness

- Discharge of nonbusiness debt

- Discharge of all other debts

In this section, we’ll walk through the entire form, step by step. If you want specific guidance for a particular situation, we cover how to use Form 982 to report the discharge of your debt in the next section.

Part I: General information

In Part I, you’ll check the applicable box(es) and report the amount of discharged indebtedness that you intend to exclude from gross income.

Line 1a: Discharge of indebtedness in a title 11 case

Check this box if for discharged debts or debt cancellation related to a Chapter 11 bankruptcy case.

A Chapter 11 bankruptcy allows the taxpayer to reorganize their finances and restructure their debt with the intention of paying it off over time.

Line 1b: Discharge of indebtedness to the extent insolvent

Check the box if the discharge of indebtedness occurred while you were insolvent. In other words, your total liabilities exceeded your total assets at the time of discharge.

For example, if you owe $10,000 in credit card debt, but only have $7,000 in assets, the Internal Revenue Service would consider you to be insolvent. If the credit card company decides to forgive your credit card balance, then you would check the box in Line 1b and enter $3,000 of canceled debt (the difference between $10,000 and $7,000) on Line 2, below.

Line 1c: Discharge of qualified farm indebtedness

Check this box if your cancelled debt is qualified farm indebtedness, and if neither of the following apply:

- Chapter 11 bankruptcy

- Insolvency

Qualified farm indebtedness is the amount of debt that you incur directly in connection with the trade or business of farming. Additionally, at least half of your aggregate gross receipts for the 3 tax years preceding the tax year in which the discharge of such indebtedness occurs must be from the trade or business of farming.

Only a qualified person can discharge qualified farm indebtedness. The IRS considers a qualified person to be:

- An individual or organization actively in the business of banking or lending money

- Can be a federal, state, or local government entity

- Not any of the following:

- Related to the borrower

- Person who sold farm property to the borrower

- Anyone who receives a fee related to your investment in the property

Line 1d: Discharge of qualified real property business indebtedness

By checking the box on Line 1d, you will elect to apply the discharge of qualified real property business debt to reduce the basis of depreciable real property on Line 4, below. To do this, the debt discharge must not be related to Chapter 11 bankruptcy or insolvency.

The discharge only applies to qualified real property business indebtedness.

Qualified real property business indebtedness

This is indebtedness that:

- Is not qualified farm indebtedness

- Is incurred or assumed in connection with real property used in a trade or business

- Is secured by that real property, and

- That you have elected under this provision.

- This provision doesn’t apply to a corporation, unless it is an S corporation

Indebtedness incurred or assumed after 1992 isn’t qualified real property business indebtedness unless it is either:

- Debt incurred to refinance qualified real property business indebtedness incurred or assumed before 1993, or

- To the extent the amount of such debt doesn’t exceed the amount of debt being refinanced,

- Qualified acquisition indebtedness

Qualified acquisition indebtedness

This is:

- Debt incurred or assumed to acquire, construct, reconstruct, or substantially improve real property; and

- Debt resulting from the refinancing of qualified acquisition indebtedness

- To the extent the amount of such debt doesn’t exceed the amount of debt being refinanced.

You can’t exclude more than the excess of the outstanding principal amount of the debt (immediately before the discharge) over the net FMV (as of that time) of the property securing the debt reduced by the outstanding principal amount of other qualified real property business indebtedness secured by that property (as of that time).

The amount excluded is further limited to the aggregate adjusted basis of depreciable real property you held immediately before the discharge. You must include excess debt in income on your income tax return.

By checking this box, you intend to apply the discharge of qualified real property business indebtedness to reduce the basis of depreciable real property on Line 4.

Line 1e: Discharge of qualified principal residence indebtedness

Check this box if the discharge of debt was:

- For a qualified principal residence debt discharged before 2026

- Based on an arrangement or agreement that both parties reached before 2026

Line 1e does not apply to debts discharged due to Chapter 11 bankruptcy or insolvency. For more guidance, see Qualified Principal Residence Indebtedness, below.

Line 2: Total amount of discharged debt excluded from gross income

In Line 2, enter the total amount excluded from your gross income due to discharge of indebtedness under Internal Revenue Code Section 108.

If you checked any box on Lines 1b through 1e, don’t enter more than the limit explained in the instructions for those lines.

If you checked Line 1e, this amount won’t necessarily equal the total basis reduction on Line 10b (which is required only if you continue to own the residence after the discharge).

Line 3

Under IRC Section 1017(b)(3)(E), you may elect to treat all real property held primarily for sale to customers in the ordinary course of a trade or business as if it were depreciable property. This doesn’t apply to qualified real property business indebtedness.

To make this election, check ‘Yes.’ Otherwise, check ‘No.’

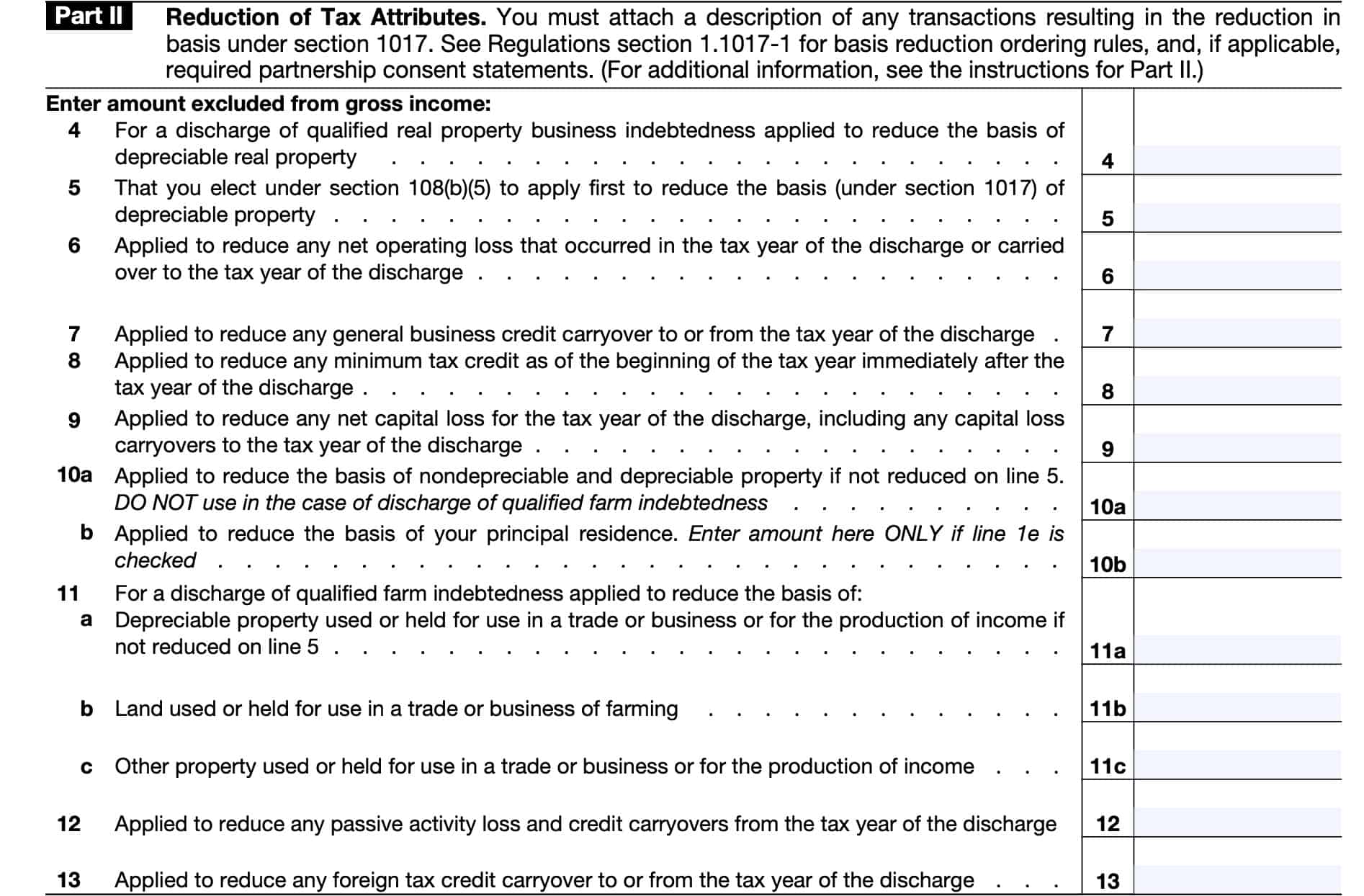

Part II: Reduction of tax attributes

In Part II, you will enter the amount excluded from gross income that is applied to allowable basis reductions or credit reductions, based on ordering rules, as defined under IRC Section 1017 and Treasury Regulations Section 1.1017-1.

Line 4

In Line 4, enter the amount excluded from gross income for the discharge of qualified real property business indebtedness that will reduce the basis of depreciable real property. Use this if you checked the box in Line 1d, above.

Line 5

If you checked the box in Line 1a, Line 1b, or Line 1c above, you may complete Line 5, to apply all or a part of the debt discharge amount to first reduce the basis of depreciable property. This includes property you elected to treat as depreciable property on Line 3.

Any remaining excluded income amounts will be applied to Lines 6 through 13 (except for Line 10b, below), in descending order. If you don’t elect any amount under Line 5, then apply the entire amount to Lines 6 through 13, in order.

Line 6

Use Line 6 to reduce any net operating loss (NOL) that either:

- Occurred in the tax year of the debt cancellation

- Was carried over to the tax year of the discharge

Line 7

In Line 7, enter the amount that will reduce any general business credit carryover to or from the tax year of discharge. You may find business credit carryovers on Form 3800.

Line 8

In Line 8, enter the amount applied to reduce any minimum tax credit as of the beginning of the tax year immediately after the tax year of discharge.

Line 9

Amounts entered in Line 9 will reduce any net capital loss for the year of the discharge. This includes capital loss carryovers to the tax year of discharge.

Line 10

For Line 10a, the entered amount will reduce the basis of nondepreciable and depreciable property if not reduced on Line 5, above. Do not use this in the case of discharge of qualified farm indebtedness.

In Line 10b, this amount will reduce the basis of your qualified principal residence. Only enter an amount here if you checked the box in Line 1e. If you checked Line 1e and you continue to own the residence after discharge, enter the smaller of:

- That part of Line 2 attributable to the exclusion of qualified principal residence indebtedness, or

- The basis of your main home

Line 11

Line 11 is used to reduce the basis in the case of qualified farm indebtedness. Entered amounts will reduce basis of property as follows:

- Line 11a: Depreciable property used or held for use in a trade or business, or for production of income if not already reduced in Line 5, above

- Line 11b: Land used or held for use in a trade or the business of farming

- Line 11c: Other property used or held for use in a trade or business, or for producing income

Line 12

Amounts entered into Line 12 will reduce any passive activity loss and credit carryovers from the tax year of discharge.

Line 13

Line 13 amounts will reduce foreign tax credit carryover amounts from the tax year of discharge.

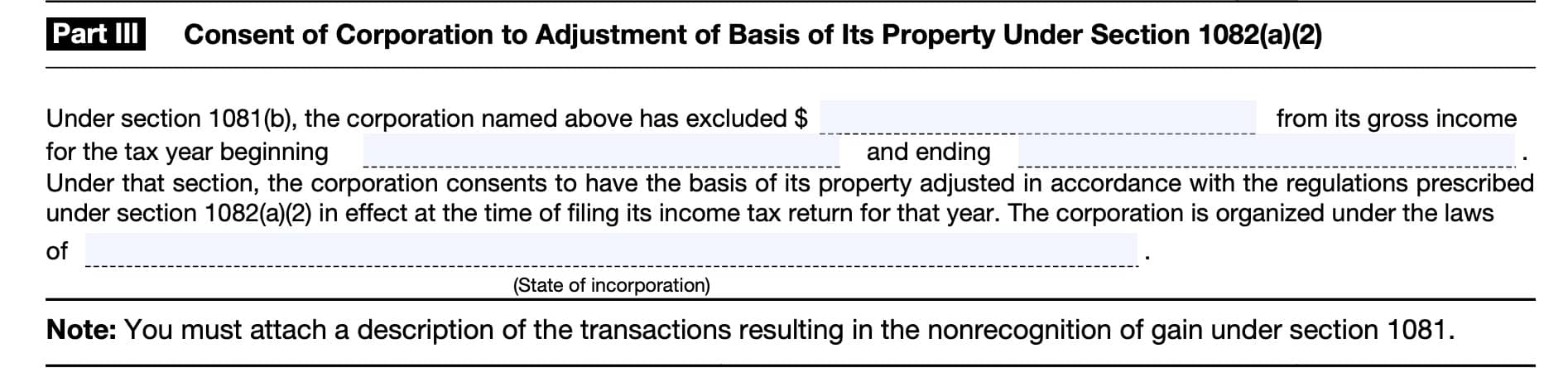

Part III: Consent of corporation

Unless otherwise stated, the corporation, by filing this form, agrees to apply the general rule for adjusting the basis of property (as described in Treasury Regulations Section 1.1082-3(b)). Taxpayers must request any deviations from this general rule in writing and wait for approval by the IRS Commissioner.

In Part III, enter the exclusion amount, tax year beginning and end dates, and the state of incorporation for your company.

How to use Form 982 to report discharged debt

In this section, we’ll walk through how to use this form to report discharged debts, depending on the type of debt being discharge. Let’s start with the discharge of indebtedness related to your primary residence.

Qualified principal residence indebtedness

Before using this form to report the cancellation of your mortgage debt, you’ll need to ensure that your debt is qualified for tax exclusion. This requires us to discuss a few definitions.

What is a principal residence?

Your principal residence is your primary residence, or the place where you live most of the time.

What is qualified principal residence indebtedness?

This is a mortgage you took out to buy, build, or substantially improve your main home. Your primary residence must also secure this mortgage.

If the amount of your original mortgage is more than the cost of your main home plus the cost of any substantial improvements, only the debt that is not more than the cost of your main home plus improvements is qualified principal residence indebtedness. In other words, if you borrowed extra money to pay off a credit card bill or start an emergency savings account, those amounts are not qualified principal residence indebtedness.

Any debt secured by your main home that you use to refinance qualified principal residence indebtedness is treated as qualified principal residence indebtedness, but only up to the amount of the old mortgage principal just before the refinancing. However, if you incurred additional debt to substantially improve your main home, that additional debt is qualified principal residence indebtedness.

How much of my qualified principal residence indebtedness can I exclude?

For mortgages that originated after 2020, and are discharged before 2026, you may exclude up to $750,000 of qualified indebtedness. For married taxpayers filing separate tax returns, this limit is $375,000.

Specific form instructions

If your mortgage debt meets the above criteria, and it was discharged before 2026, then check Line 1e. If part or all of your debt is not eligible for discharge under this rule, you may have to see if it will qualify for exclusion under other nonbusiness debt or any other debt, outlined below.

On Line 2, include the amount of discharged qualified principal residence indebtedness that you are excluding from gross income, up to the maximum allowable limit. Any amount in excess of the excluded amount may be considered taxable income. IRS Publication 523, Selling Your Home, may provide more details based on your situation.

If you continue to own your residence after the debt is discharged, on Line 10b, you’ll need to enter the smaller of:

- Amount of qualified principal residence indebtedness on Line 2

- Basis of your principal residence

- Generally, this is your cost plus improvements

Note: If your debt discharge is in a Title 11 bankruptcy case, you cannot check Box 1e. You must check either Box 1a and look to qualify under nonbusiness debt procedures or check Box 1b and follow insolvency rules.

Other nonbusiness debt

Follow these instructions if you don’t have any of the tax attributes listed in Part II, other than a basis in nondepreciable property, such as land.

If you do have any of the tax attributes listed in Part II, then you must follow the instructions for any other debt, outlined below.

Specific form instructions

If this discharge was made as part of a Title 11 bankruptcy case, check the box on Line 1a. If the discharge occurred when you were insolvent, check the box on Line 1b.

On Line 2, include the amount of discharged nonbusiness debt that is excluded from gross income. If you were insolvent, don’t include more than the excess of your liabilities over the fair market value of your assets.

On Line 10a, include the smallest of the following:

- The basis of your nondepreciable property

- The amount of the nonbusiness debt included on Line 2, or

- The excess of the aggregate bases of the property and the amount of money you held immediately after the discharge over your aggregate liabilities immediately after the discharge.

Any other debt

For all other debt that you cannot exclude under primary residence or other nonbusiness debt rules, you must follow these guidelines.

Specific form instructions

Use Part I to indicate:

- Why any amount received from the discharge of indebtedness should be excluded from gross income, and

- The amount excluded from gross income

Use Part II to report your reduction of tax attributes. Unless you check the box on Line 1d for qualified real property business indebtedness, or elect to reduce the basis of depreciable property on Line 5, you must report the reduction of tax attributes in the following order:

- Any net operating loss (NOL) for the tax year of the discharge

- Includes any NOL carryover to the tax year

- Dollar for dollar reduction

- Any general business credit carryover to or from the tax year of discharge

- 331/3 cent reduction for each dollar

- Found on IRS Form 3800

- Any minimum tax credit as of the tax year immediately after the year of discharge

- 331/3 cent reduction for each dollar

- Net capital losses for the tax year of discharge

- Includes capital loss carryovers to the tax year

- Dollar for dollar reduction

- Basis of property

- Dollar for dollar reduction

- Passive activity loss carryovers (dollar for dollar), or credits (331/3 cent reduction for each dollar) from the tax year of discharge

- Foreign tax credit carryover to or from the tax year of discharge

- 331/3 cent reduction for each dollar

Use Part III to exclude from gross income under Internal Revenue Code Section 1081(b) any amounts of income attributable to the transfer of property described in that section.

Video walkthrough

Watch this informative video to learn more about excluding discharged debt from taxable income on Form 982.

Frequently asked questions

A taxpayer is insolvent when his or her total liabilities exceed his or her total assets. Under the insolvency exclusion, the taxpayer may exclude any forgiven debt from gross income to the extent of his or her insolvency. Any remaining debt may be forgiven under another income exclusion listed in Form 982.

Taxpayers must file IRS Form 982 with their federal income tax return in for the tax year in which the debt was discharged.

How can I find IRS Form 982?

Like other tax forms, you may find Form 982 on the IRS website. For your convenience, we’ve enclosed the most recent version of this form in this article.