IRS Form 7004 Instructions

If you need additional time to file certain business, estate, or trust tax returns, you may need to file IRS Form 7004 to request an automatic extension from the Internal Revenue Service.

In this article, we’ll break down IRS Form 7004, so that you understand:

- How to complete IRS Form 7004

- Which tax returns Form 7004 covers

- Different tax extension forms available if your return isn’t listed on Form 7004

- Frequently asked questions

Let’s take a closer look at the tax form itself.

Table of contents

How do I complete IRS Form 7004?

This one-page tax form is relatively straightforward. Let’s start at the top with the taxpayer information fields.

Taxpayer information

At the top of Form 7004, you’ll enter the following information:

- Name

- Address

- Identifying number

Taxpayer name

If your name has changed since you filed your tax return for the previous year, you should enter your name on IRS Form 7004 the same way you entered it on the prior year tax return.

If the name that appears on Form 7004 does not match IRS records, or if your identifying number is incorrect, the Internal Revenue Service will not grant your extension request.

Identifying number

Enter the applicable identifying number. For most taxpayers completing this form, that will be your employer identification number (EIN). However, you may also use your Social Security number (SSN) if that is the identifying number on your income tax returns.

If you do not have an EIN, you can apply for one by filing IRS Form SS-4, Application for Employer Identification Number.

If you do not have an SSN but are eligible for one, you can apply using Form SS-5, Application for Social Security Card.

Address

When entering your address, include the suite, room, or unit number after the address. If the U.S. Postal Service does not deliver mail to your street address, but you have a post office box, you may enter your P.O. box number in place of the street address.

Enter the city or town, state, and ZIP code. If you live overseas, use the overseas country’s practice for entering your postal code. Do not abbreviate the country name.

If you changed your address since filing your last income tax return, then you may need to complete one of the following change of address forms:

- IRS Form 8822, Change of Address,

- IRS Form 8822-B, Change of Address or Responsible Party-Business

Simply filing IRS Form 7004 with a new mailing address will not update your records.

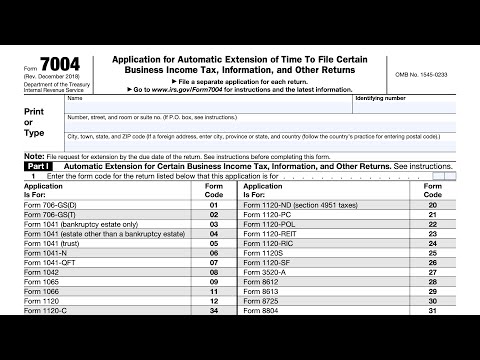

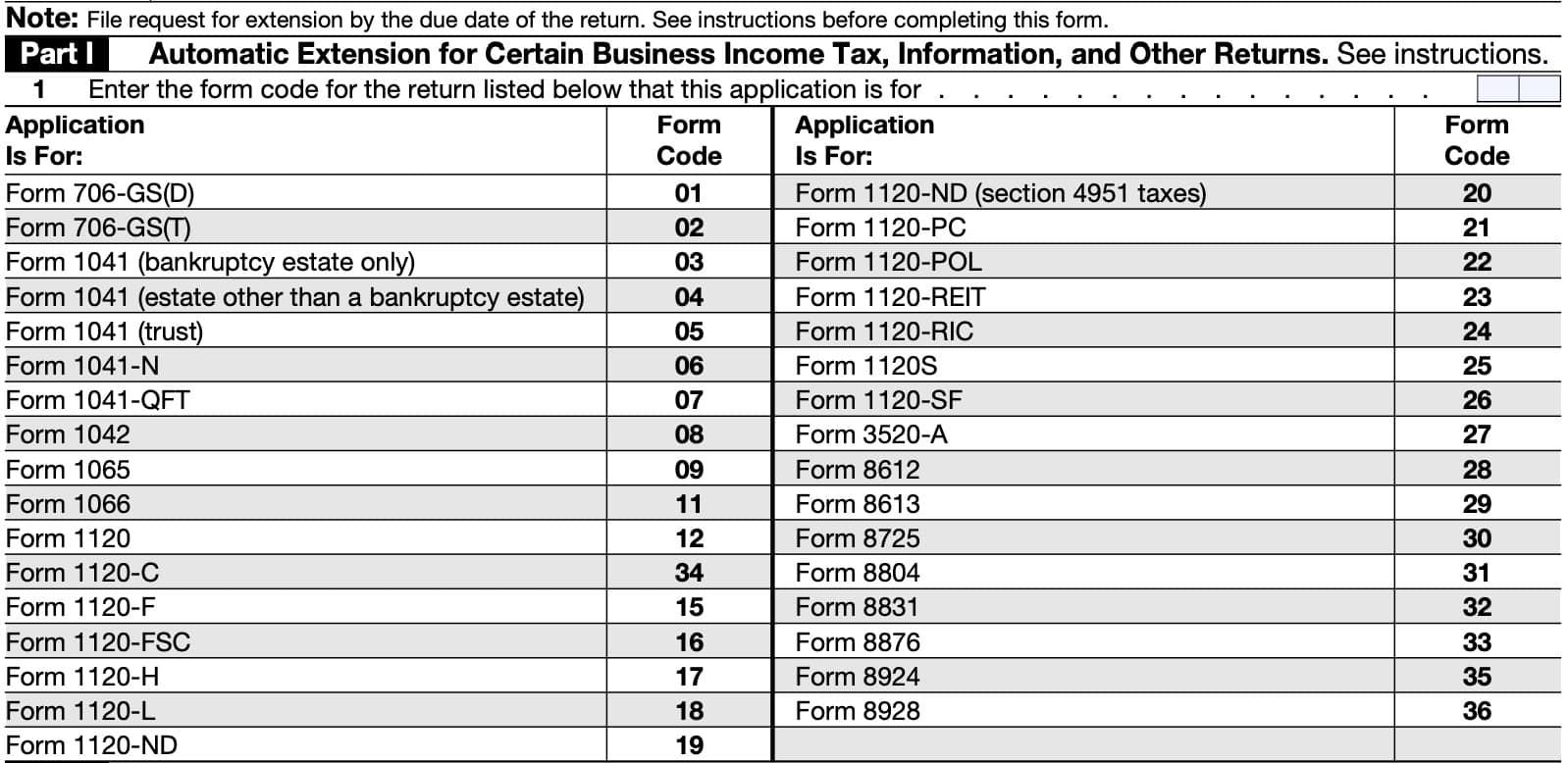

Part I: Automatic extension for certain business income tax, information, and other returns

In Part I, you’ll identify the form code for the tax return form that you need extra time for. There are a couple of notes from the business tax extension form instructions.

No blanket requests

The IRS will not accept a blanket request for multiple returns. You must file a separate Form 7004 for each return for which you are requesting an extension of time to file.

This extension will apply only to the specific return identified on Line 1. For consolidated group returns, see the instructions for Line 3, below.

Maximum extension period

As a general rule, the automatic extension of time refers to an automatic 6-month extension of time from the due date of the applicable tax return. However, there are exceptions for filers of IRS Form 1041 and for C corporations with a fiscal year ending on June 30.

Estates and trusts

An estate, other than a bankruptcy estate, or trust filing IRS Form 1041 are eligible for an automatic 5 1/2 month extension of time to file from the original due date.

C corporations with tax year ending June 30

C corporations with a tax year that ends on June 30 are eligible for an automatic 7-month extension of time to file their business tax return. If filing IRS Form 1120-POL, this extension is limited to a six-month extension.

There are other exceptions for the following, which are covered in Part II, below:

- Foreign corporations

- Certain domestic corporations

- Certain partnerships with books and records outside of the United States and Puerto Rico

Termination of extension period

At any time, the IRS may terminate the automatic extension at any time by mailing a notice of

termination to the entity or person that requested the extension at least 10 days before the termination date in the notice.

Line 1

Enter the form code for the tax return that you are filing Form 7004 for. Below is the list of each tax form, its form code, and a brief description.

If you already know which tax form you need a filing extension for, and its form code, you can skip to Part II, below.

IRS Form 706-GS(D)

IRS Form 706-GS(D), Generation-Skipping Transfer Tax Return for Distributions, is the tax form that a skip person distributee files in order to calculate and report the tax due on distributions from a trust that are subject to the generation-skipping transfer (GST) tax.

Use Form Code 01 to request a filing deadline extension for this form.

IRS Form 706-GS(T)

IRS Form 706-GS(T), Generation Skipping Transfer Tax Return for Terminations, is the tax form that trustees use to figure and report the tax due from certain trust terminations that are subject to the generation-skipping transfer (GST) tax.

Use Form Code 02 to request a filing deadline extension for this form.

IRS Form 1041 (bankruptcy estate only)

IRS Form 1041, U.S. Income Tax Return for Estates and Trusts, is the U.S. income tax return that estates use to report income and tax liability.

In the case of a bankruptcy estate, use form Code 03 to request a filing deadline extension for this form.

IRS Form 1041 (estate other than bankruptcy estate)

For all estates, besides a bankruptcy estate, use Form Code 04 to request additional time to file your tax return.

IRS Form 1041 (trust)

For trusts filing IRS Form 1041, use Form Code 05 to request a filing deadline extension for this form.

IRS Form 1041-N

An Alaska Native Settlement Trust may file IRS Form 1041-N, U.S. Income Tax Return for Electing Alaska Native Settlement Trusts, to report its income, deductions, gains & losses, and to compute and pay any income tax.

Use Form Code 06 to request a filing deadline extension for this form.

IRS Form 1041-QFT

The trustee of a trust that has elected to be taxed as a qualified funeral trust (QFT), will file IRS Form 1041-QFT.

Use Form Code 07 to request a filing deadline extension for this form.

IRS Form 1042

Taxpayers who file IRS Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, use this form to report the following:

- Tax withheld under Internal Revenue Code Chapter 3 on certain income of foreign persons, including:

- Nonresident aliens

- Foreign partnerships

- Foreign corporations

- Foreign estates and

- Foreign trusts

- The tax withheld under Chapter 4 on withholdable payments.

- The tax withheld pursuant to IRC Section 5000C on specified federal procurement payments.

- Payments that are reported on IRS Form 1042-S under Chapters 3 or 4.

Use Form Code 08 to request a filing deadline extension for this form.

IRS Form 1065

Partnerships file IRS Form 1065, U.S. Return of Partnership Income, to report their income, gains, losses, deductions, credits, etc.

Use Form Code 09 to request a filing deadline extension for a partnership tax return.

IRS Form 1066

A taxable entity may file IRS Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return, to report the following items from a REMIC:

- Income,

- Deductions, and

- Gains and losses

Use Form Code 11 to request a filing deadline extension for this business income tax return.

IRS Form 1120

Domestic corporations will file IRS Form 1120, U.S. Corporation Income Tax Return, to:

- Report their income, gains, losses, deductions, credits.

- Figure their income tax liability.

Use Form Code 12 to request a filing deadline extension for this form.

IRS Form 1120-C

Corporations acting as a cooperative will file IRS Form 1120-C, U.S. Income Tax Return for Cooperative Associations to:

- Report taxable income,

- Report gains, losses, deductions, credits, and

- Calculate their income tax liability.

Use Form Code 34 to request a filing deadline extension for this form.

IRS Form 1120-F

Foreign companies will file IRS Form 1120-F, U.S. Income Tax Return of a Foreign Corporation, to report their income, gains, losses, deductions, credits, and to figure their U.S. income tax liability.

Use Form Code 15 to request a filing deadline extension for this form.

IRS Form 1120-FSC

Companies who elect for treatment as a foreign sales corporation (FSC) will file IRS Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation, to report:

- Income,

- Deductions, gains, losses, credits and

- Income tax liability

Use Form Code 16 to request a filing deadline extension for this form.

IRS Form 1120-H

A homeowner’s association may file IRS Form 1120-H, U.S. Income Tax Return for Homeowners Associations, to take advantage of certain tax benefits, which help the HOA to exclude exempt function income from its gross income.

Use Form Code 17 to request a filing deadline extension for this form.

IRS Form 1120-L

Life insurance companies file IRS Form 1120-L, U.S. Life Insurance Company Income Tax Return, to report income, gains, losses, deductions, credits, and to figure their income tax liability.

Use Form Code 18 to request a filing deadline extension for this form.

IRS Form 1120-ND

Nuclear decommissioning funds file IRS Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons, to report:

- Contributions received,

- Income earned,

- Administrative expenses of operating the fund,

- Tax on modified gross income, and

- Section 4951 initial taxes on self-dealing

Use Form Code 19 to request a filing deadline extension for this form.

Use Form Code 20 to request a filing deadline extension for this form if it pertains to IRC Section 4951 taxes on self-dealing.

IRS Form 1120-PC

A property and casualty insurance company may file IRS Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of insurance companies, other than life insurance companies.

Use Form Code 21 to request a filing deadline extension for this form.

IRS Form 1120-POL

Political organizations may file IRS Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations, to report their political organization taxable income and income tax liability under IRC Section 527.

Use Form Code 22 to request a filing deadline extension for this form.

IRS Form 1120-REIT

Corporations, trusts and associations that elect treatment as a real estate investment trust (REIT) may file IRS Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts, to report:

- Income

- Gains, losses, deductions, credits, certain penalties and

- Income tax liability

Use Form Code 23 to request a filing deadline extension for this form.

IRS Form 1120-RIC

Regulated investment companies file IRS Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies, to report:

- Income

- Gains, losses, deductions, credits, certain penalties and

- Income tax liability

Use Form Code 24 to request a filing deadline extension for this form.

IRS Form 1120S

S corporations file IRS Form 1120-S, U.S. Income Tax Return for an S Corporation to report the income, gains, losses, deductions, credits, etc.

Use Form Code 25 to request a filing deadline extension for this form.

IRS Form 1120-SF

Section 468B designated and qualified settlement funds file IRS Form 1120-SF, U.S. Income Tax Return for Settlement Funds (Under IRC Section 468B) to report:

- Transfers received,

- Earned income

- Deductions claimed,

- Distributions made, and

- Income tax liability

Use Form Code 26 to request a filing deadline extension for this form.

IRS Form 3520-A

A foreign trust with a U.S. owner will file IRS Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner to report information about:

- The trust,

- U.S. beneficiaries, and

- any U.S. person who is treated as an owner of any portion of the foreign trust

Use Form Code 27 to request a filing deadline extension for this form.

IRS Form 8612

Real estate investment trusts (REITs) file IRS Form 8612, Return of Excise Tax on Undistributed Income of Real Estate Investment Trusts, to figure and pay the excise tax on undistributed income under IRC Section 4981.

Use Form Code 28 to request a filing deadline extension for this form.

IRS Form 8613

Regulated investment companies file IRS Form 8613, Return of Excise Tax on Undistributed Income of Regulated Investment Companies, to:

- Calculate and pay the excise tax on undistributed income under IRC Section 4982, and

- Make the Section 4982(e)(4) election.

Use Form Code 29 to request a filing deadline extension for this form.

IRS Form 8725

Taxpayers file IRS Form 8725, Excise Tax on Greenmail, to report and pay the 50% excise tax imposed under IRC Section 5881 on the gain or other income realized on the receipt of greenmail.

Use Form Code 30 to request a filing deadline extension for this form.

IRS Form 8804

Partnerships file IRS Form 8804, Annual Return for Partnership Withholding Tax (Section 1446), to:

- Report the total liability under IRC Section 1446 for the partnership’s tax year, and

- As a transmittal form for IRS Form 8805

Use Form Code 31 to request a filing deadline extension for this form.

IRS Form 8831

Taxpayers file IRS Form 8831, Excise Taxes on Excess Inclusions of REMIC Residual Interests, to report and pay:

- Excise tax on any transfer of a residual interest in a REMIC to a disqualified organization

- Amount due if the tax is waived

- Excise tax due on pass-through entities with interests held by disqualified organizations

Use Form Code 32 to request a filing deadline extension for this form.

IRS Form 8876

Taxpayers file IRS Form 8876, Excise Tax on Structured Settlement Factoring Transactions, to report and pay the 40% excise tax imposed under IRC Section 5891 on the factoring discount of a structured settlement factoring transaction.

Use Form Code 33 to request a filing deadline extension for this form.

IRS Form 8924

Taxpayers file IRS Form 8924, Excise Tax on Certain Transfers of Qualifying Geothermal or Mineral Interests, to report and pay the excise tax on certain transfers of qualifying geothermal or mineral interests.

Use Form Code 35 to request a filing deadline extension for this form.

IRS Form 8928

Group health plans or employers may file IRS Form 8928, Return of Certain Excise Taxes Under Chapter 43 of the Internal Revenue Code, to report the tax due on the following failures:

- A failure to provide a level of coverage of the costs of pediatric vaccines (as defined in section 2612 of the Public Health Services Act) that is not below the coverage provided as of May 1, 1993.

- A failure to satisfy continuation coverage requirements under IRC Section 4980B.

- A failure to meet portability, access, renewability, and market reform requirements under Sections 9801, 9802, 9803, 9811, 9812, 9813, and 9815.

- A failure to make comparable Archer MSA contributions under IRC Section 4980E.

- A failure to make comparable health savings account (HSA) contributions under IRC Section 4980G.

Use Form Code 36 to request a filing deadline extension for this form.

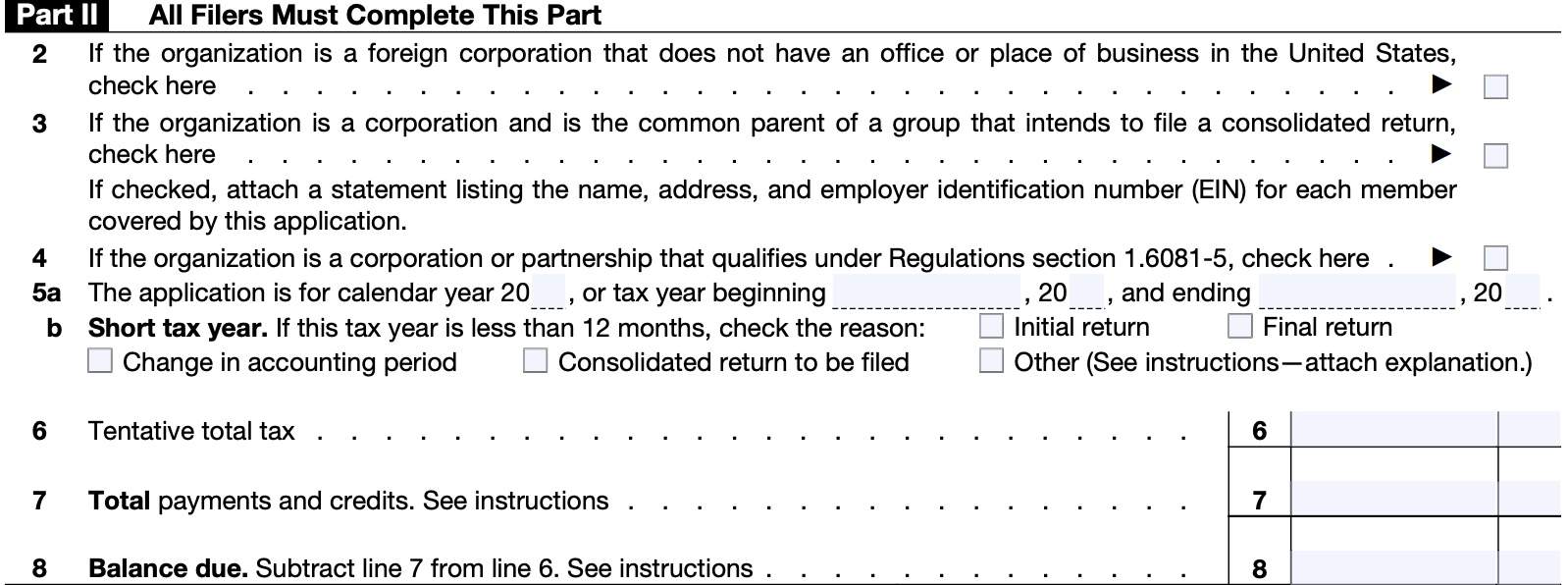

Part II: All filers must complete this part

All entities filing IRS Form 7004 must complete Part II. Let’s take a look at each line.

Line 2

Check the box on here if you are requesting an extension of time to file for a foreign corporation that does not have an office or place of business in the United States.

The foreign entity must file IRS Form 7004 by the due date of the return to request an extension. The due date for this type of tax return is the 15th day of the 6th month following the close of the tax year.

Line 3

If the organization is a corporation and the common parent of a group intending to file a consolidated return, check this box.

Only the common parent or agent of a consolidated group can request an extension of time to file the group’s consolidated return.

To do this, attach a list of all members of the consolidated group with the following additional information for each member of the group:

- Name

- Address

- Employer identification number

In general, all members of a consolidated group must use the same taxable year as the common parent corporation.

However, if a particular member of a consolidated group must file a separate income tax return for a short period and seeks an extension of time to file the return, that member must file a separate IRS Form 7004 for that period.

Line 4

Check the box on Line 4 if the following applies.

Certain foreign and domestic corporations and certain partnerships already qualify for an automatic extension of time to file and pay under Treasury Regulations Section 1.6081-5.

These entities do not need to file IRS Form 7004 to take this automatic extension. However, they and must file (or request an additional extension of time to file) and pay any balance due by the 15th day of the 6th month following the close of the tax year.

This includes the following entities:

- Partnerships that keep their books and records outside the United States and Puerto Rico,

- A foreign corporation that maintains an office or place of business in the United States,

- A domestic corporation that transacts its business and keeps its books and records of account outside the United States and Puerto Rico, or

- A domestic corporation whose principal income is from sources within the possessions of the United States.

Line 5a

Enter either the following:

- Calendar year

- Beginning date and ending date of your fiscal year

If the tax year is less than 12 months, go to Line 5b, below. Otherwise, go to Line 6.

Line 5b: Short tax year

Select one of the following, if your requesting a filing extension for a short tax year:

- Initial return

- Final return

- Change in accounting period

- Consolidated return to be filed

- Other

If you check the box for “Change in accounting period,” the entity must have applied for approval to change its tax year unless it meets certain conditions.

For more information, refer to IRS Form 1128, and IRS Publication 538, Accounting Periods and

Methods.

Line 6: Tentative total tax

In Line 6, enter the total tax, including any nonrefundable credits, the entity expects to owe for the tax year.

To estimate the amount of tentative tax, refer to the specific instructions for the applicable return. If you expect this amount to be zero, enter ‘0.’

Line 7: Total payments and credits

Enter the total payments and refundable credits.

For more information, see the instructions for the applicable return.

Line 8: Balance due

Subtract Line 7 from Line 6, then enter the result. This represents the amount of tax that you owe.

Tax payment deadline

IRS Form 7004 is not a tax payment extension, and does not extend the time to pay tax.

If the entity is a corporation or affiliated group of corporations filing a consolidated return, the corporation must remit the amount of the unpaid tax liability shown on Line 8 on or before the due date of the return.

My tax form is not listed on IRS Form 7004. What do I do?

The IRS has different tax extension forms available, depending on the tax return or situation. Here is a list of some of the more common versions:

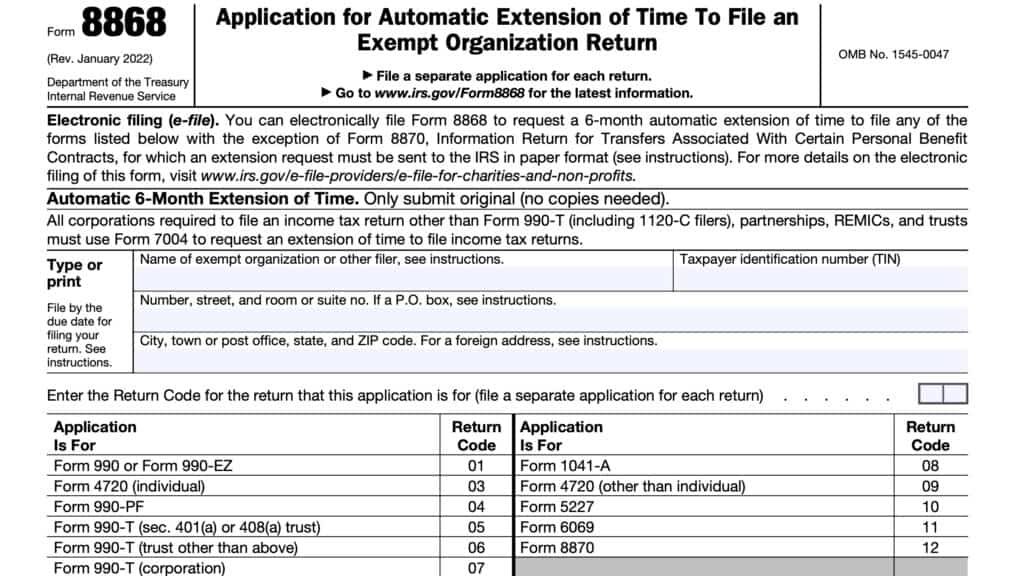

- IRS Form 8868, Application for Automatic Extension of Time to File an Exempt Organization Return

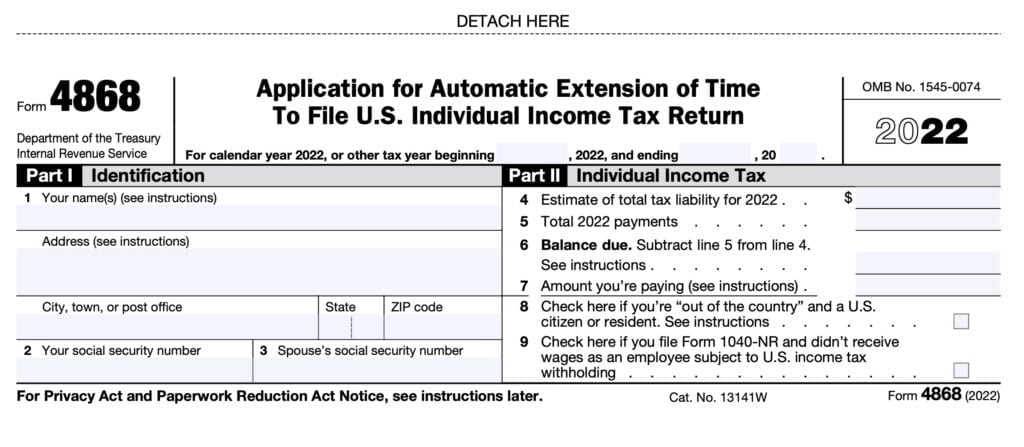

- IRS Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

- IRS Form 4768, Application of Extension to File a Return for Estate & GSTT

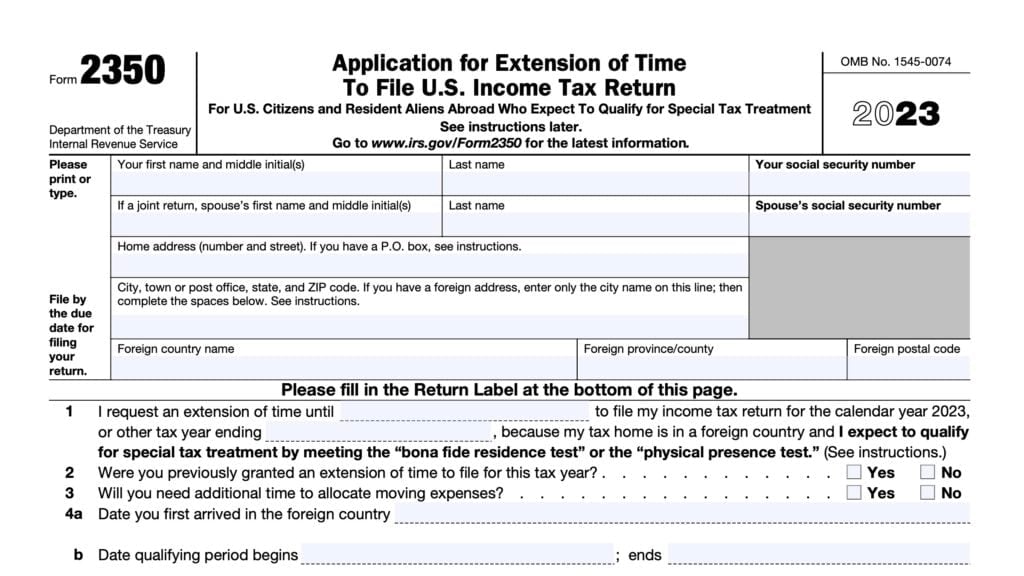

- IRS Form 2350, Application for Extension of Time To File U.S. Income Tax Return For U.S. Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment

Video walkthrough

Frequently asked questions

No. Tax-exempt organizations file IRS Form 8868 to request an automatic extension of time to file an exempt organization return.

The IRS expects all filers to pay estimated taxes due on the original due date of their tax return. A failure to pay penalty of .5% will accrue each month or part of a month on the unpaid balance unless the taxpayer can show reasonable cause. Interest accrues on the unpaid balance as well.