IRS Form 8453-EMP Instructions

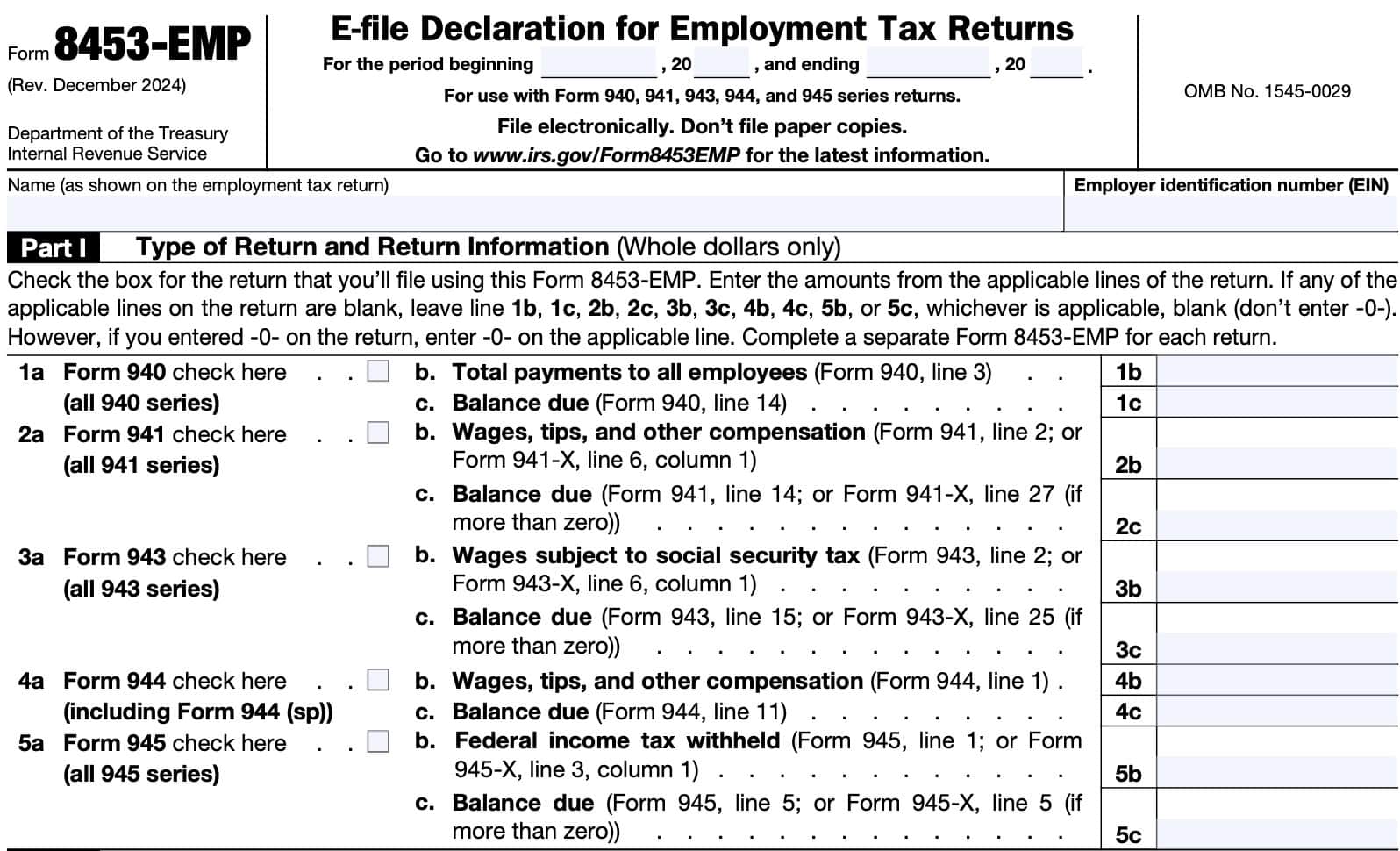

If you’re filing an employment tax return, you may see IRS Form 8453-EMP, E-file Declaration for Employment Tax Returns

This article will walk you through what you should know about this tax form, including:

- What is IRS Form 8453-EMP

- How to complete this form and when you should file it

- How to obtain a copy of this tax form

Let’s start with discussing how to complete IRS Form 8453-EMP.

Table of contents

How do I complete IRS Form 8453-EMP?

There are three parts to this one-page tax form:

- Part I: Type of Return and Return Information

- Part II: Declaration of Taxpayer

- Part III: Declaration of Electronic Return Originator (ERO) and Paid Preparer

However, let’s start at the very top of the form, in the taxpayer information fields above Part I.

Taxpayer information

In this section, you’ll enter basic information about the tax return.

Tax period

Enter the beginning date and the ending date of the tax period pertaining to your employment tax return.

Name

Enter the employer’s name in this field, as it appears on the tax return.

Employer identification number

Enter the employer identification number (EIN) of the estate or trust in this field. An employer identification number is a 9-digit tax identification number for tax entities who are not individuals.

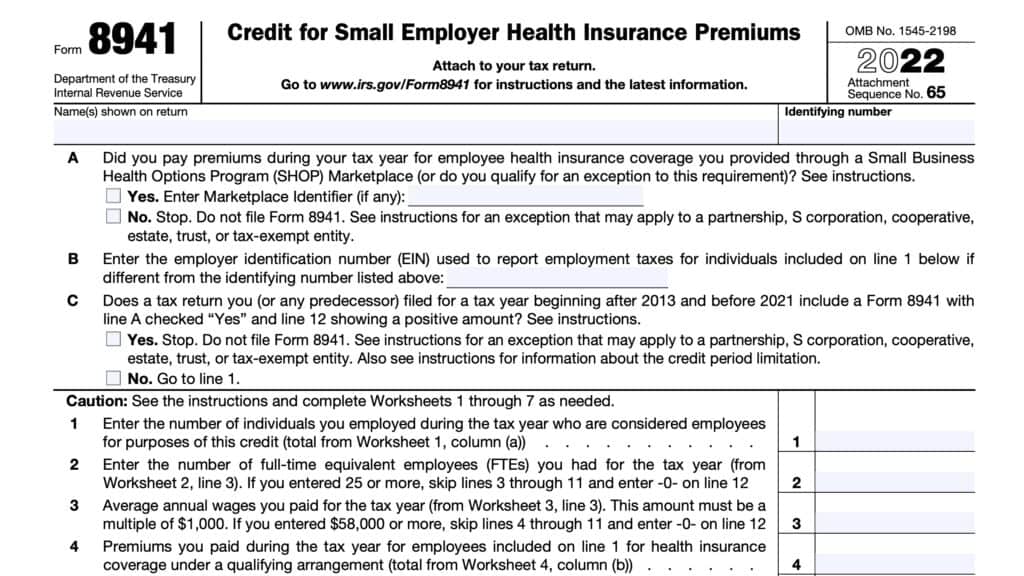

Part I: Type of Return and Return Information

In Part I, we’ll enter certain tax return information from the employment tax return. When completing IRS Form 8453-EMP, you will need to check one of the boxes, based on which e-filed return you are submitting:

- Line 1a: Form 940 series

- Line 2a: Form 941 series

- Line 3a: Form 943 series

- Line 4a: Form 944 series

- Line 5a: Form 945 series

Below is detailed guidance for the electronic return data that you should provide, depending on the type of electronically filed return you plan to submit.

If any of the applicable lines your federal tax return are blank, then leave the corresponding line on IRS Form 8453-EMP.

Line 1: Form 940

If you are completing IRS Form 940, Employer’s Annual Federal Unemployment (FUTA) Tax Return, check Box 1a.

Then complete Lines 1b and 1c as indicated below.

Line 1b: Total payments to all employees

Enter the total amount of payments made to all employees, from Line 3 of your Form 940.

Line 1c: Balance due

Enter the balance due from IRS Form 940, Line 14.

Line 2: Form 941

If you are completing either IRS Form 941, Employer’s Annual Federal Unemployment (FUTA) Tax Return, or IRS Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, check Box 2a.

Then complete Lines 2b and 2c as indicated below.

Line 2b: wages, tips, and other compensation

Enter the wages, tips, and other compensation information from either:

- IRS Form 941, Line 2

- IRS Form 941-X, Line 6, Column 1

Line 2c: Balance due

Enter the balance due from either:

- IRS Form 941, Line 14

- IRS Form 941-X, Line 27 (if greater than zero)

Line 3: Form 943

If you are completing IRS Form 943, Employer’s Annual Federal Unemployment (FUTA) Tax Return or IRS Form 943-X, Adjusted Employer’s Annual Federal Tax Return for Agricultural Employees or Claim for Refund, check Box 3a.

Then complete Lines 3b and 3c as indicated below.

Line 3b: Wages subject to Social Security tax

Enter the total wages subject to Social Security tax from either:

- IRS Form 943, Line 2, or

- IRS Form 943-X, Line 6, Column 1

Line 3c: Balance due

In Line 3c, enter the balance due amount from either:

- IRS Form 943, Line 15, or

- IRS Form 943-X, Line 25 (if greater than zero)

Line 4: Form 944

If you are completing IRS Form 944, Employer’s Annual Federal Tax Return, check Box 4a.

Then complete Lines 4b and 4c as indicated below.

Line 4b: wages, tips, and other compensation

Enter the wages, tips, and other compensation information from Line 1 of IRS Form 944.

Line 4c: Balance due

If there is a balance due, then enter the balance due amount from Line 11.

Line 5: Form 945

If you are completing IRS Form 945, Annual Return of Withheld Federal Income Tax, or IRS Form 945-X, Adjusted Annual Return of Withheld Federal Income Tax or Claim for Refund, check Box 5a.

Then complete Lines 5b and 5c as indicated below.

Line 5b: Federal income tax withheld

Enter the total amount of federal income taxes withheld from either:

- IRS Form 945, Line 1, or

- IRS Form 945-X, Line 3, Column 1

Line 5c: Balance due

Enter the balance due from either:

- IRS Form 945, Line 5

- IRS Form 945-X, Line 5 (if greater than zero)

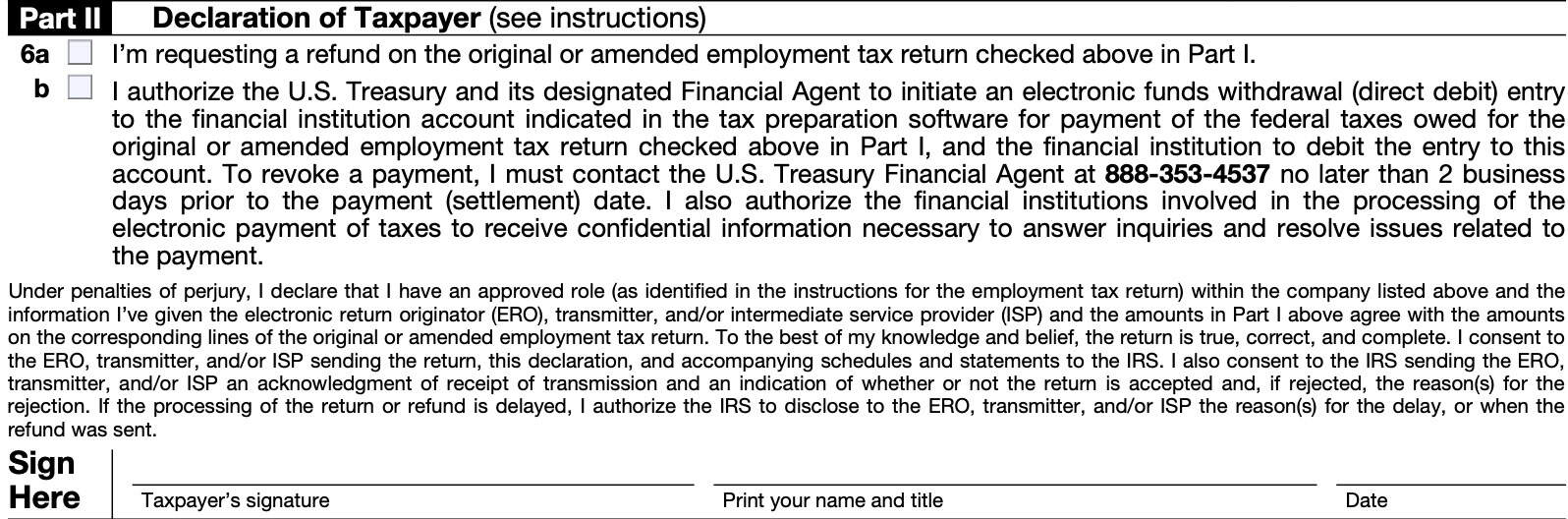

Part II: Declaration of Taxpayer

In Part II, the taxpayer will sign and date IRS Form 8453-EMP in the space provided. Prior to this, you can check the box for Line 6a, Line 6b, or both.

Line 6a

If you’re requesting a refund on the employment tax return that you checked in Part I, then check this box. This can be for an original tax return or amended return.

Line 6b

Check this box if you wish to authorize the United States Treasury Department to initiate a direct debit for employment taxes to the banking account indicated on your employment tax return.

do not check Box 6b

If you have a balance due reported in Part I, and do not check the box in Line 6b, the taxpayer must use the Electronic Federal Tax Payment System (EFTPS) to pay the tax.

check Box 6b

If the taxpayer checks box 6b, the taxpayer must ensure that the following information relating to the financial institution account is provided in the tax preparation software.

- Bank routing number and account number

- Type of account (checking or savings)

- Amount of tax payment to be debited

- Debit date (date the taxpayer wants the debit to occur)

- You must contact the U.S. Treasury 2 days in advance to revoke a pending tax payment

What is the declaration?

In signing Part II, the taxpayer declares, under penalties of perjury, the following:

- He or she has an approved role within the company listed above

- The information provided to the electronic return originator (ERO), transmitter, and/or intermediate service provider (ISP), and the amounts entered in Part I agree with the corresponding amounts on the associated employment return

- The employment return is true, correct, and complete

- He or she has given permission to transmit the return to the Internal Revenue Service

- The Internal Revenue Service has permission to communicate receipt of this return and accompanying forms and schedules

- The IRS has authorization to disclose the reason for any delay in processing

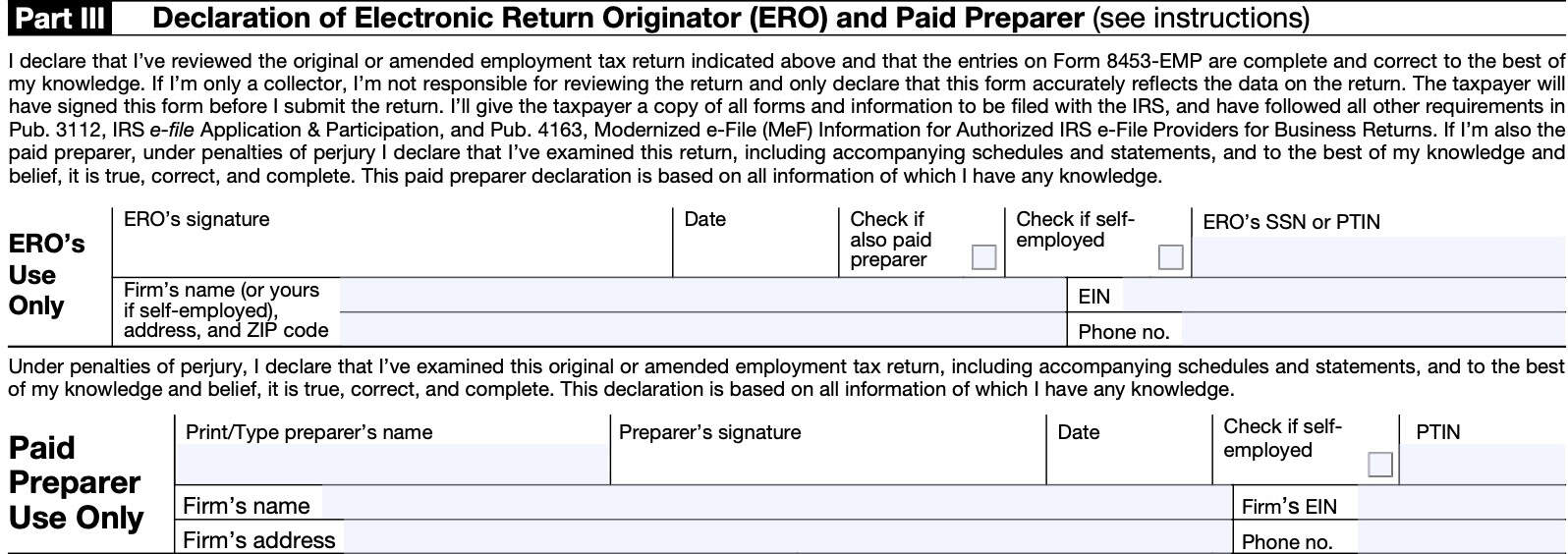

Part III: Declaration of Electronic Return Originator (ERO) and Paid Preparer

In Part III, the ERO and paid tax return preparer declare that the submitted information is complete and correct, under penalty of perjury.

Difference between the ERO and paid preparer

There is a difference between an electronic return originator (ERO) and a paid preparer.

Paid preparer

A paid tax return preparer is anyone who is paid to prepare the estate’s or trust’s tax return. A paid preparer must enter their preparer tax identification number (PTIN) in the paid preparer only portion of Part III.

To receive a PTIN, a paid preparer must complete and submit IRS Form W-12, IRS Paid Preparer Tax Identification Number Application and Renewal to the Internal Revenue Service.

Electronic return originator (ERO)

The ERO is one who deals directly with the fiduciary and either prepares tax returns or collects prepared tax returns, including Forms 8453-PE, for fiduciaries who wish to have the return of the estate or trust electronically filed. The ERO’s signature is required by the IRS.

However, the ERO is not responsible for reviewing the return. The ERO is only responsible for ensuring that the information on Form 8453-PE matches the information on the tax return itself. Additionally, the ERO will give the fiduciary a copy of all forms and information submitted to the IRS.

If also the paid preparer, then the ERO is responsible for reviewing the return. If there is a separate paid tax return preparer, he or she must sign below.

ERO’s use only:

In this section, the ERO will provide:

- Signature & date

- Check if also the paid preparer

- ERO does not need to complete the paid preparer use only section, below

- Check if self-employed

- Social Security number or preparer tax identification number (PTIN)

- Firm’s name or ERO’s name, if self-employed

- Employer identification number (EIN)

- Phone number

Paid preparer use only

In this section, the paid preparer will provide:

- Name

- Signature & date

- Check if self-employed

- PTIN

- Firm’s name

- Firm’s EIN

- Address

- Phone number

Video walkthrough

Are you using the correct Form 8453?

According to the IRS website, there are 12 different versions of IRS Form 8453, including IRS Form 8453-EMP. Below is a brief summary of each of the 11 other IRS forms, and what each form does.

IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return

Taxpayers use IRS Form 8453 to send required paper forms or supporting documentation that cannot be submitted to the Internal Revenue Service via electronic means.

IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return (Spanish)

Spanish version of the individual income tax transmittal tax form described above.

IRS Form 8453-CORP, U.S. Corporation Income Tax Declaration for an IRS e-file Return

U.S. corporations use IRS Form 8453-CORP to:

- Authenticate an electronic Form 1120, U.S. Corporation Income Tax Return

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO)

- Provide the corporation’s consent to directly deposit any refund into a bank account and/or authorize a direct debit for payment of federal taxes owed

IRS Form 8453-EG, E-file Declaration for Forms 709 and 709-NA

Taxpayers use IRS Form 8453-EG to:

- Authenticate the electronic versions of gift tax returns:

- Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return

- Form 709-NA, United States Gift (and Generation-Skipping Transfer) Tax Return

- of Nonresident Not a Citizen of the United States

- Authorize the electronic filer to transmit via a third-party transmitter; and

- Authorize an electronic funds withdrawal for payment of federal taxes owed.

IRS Form 8453-EX, Excise Tax Declaration for an IRS e-file Return

Taxpayers use IRS Form 8453-EX to:

- Authenticate electronic versions of the following forms:

- IRS Form 720

- IRS Form 2290

- IRS Form 8849

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online without an ERO

- Provide taxpayer’s consent for electronic funds withdrawal to pay taxes owed

IRS Form 8453-FE, Estate/Trust Declaration for IRS e-file Return

Taxpayers use IRS Form 8453-FE to:

- Authenticate the electronic Form 1041, U.S. Income Tax Return for Estates and Trusts;

- Authorize the electronic filer to transmit via a third-party transmitter; and

- Authorize an electronic funds withdrawal for payment of federal taxes owed.

IRS Form 8453-PE, U.S. Partnership Declaration for an IRS e-file Return

Partnerships use this tax form to:

- Authenticate an electronic Form 1065, U.S. Return of Partnership Income, as part of return or administrative adjustment request (AAR)

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO).

IRS Form 8453-R Declaration and Signature for Electronic Filing of Form 8963

Taxpayers use IRS Form 8453-R to authenticate the electronic filing of Form 8963, Report of Health Insurance Provider Information.

IRS Form 8453-S, U.S. S Corporation Income Tax Declaration for an IRS e-file Return

U.S. S-corporations use this tax form to:

- Authenticate an electronic Form 1120-S, U.S. Income Tax Return for an S-Corporation

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO)

- Provide the corporation’s consent to directly deposit any refund into a bank account and/or authorize a direct debit for payment of federal taxes owed

IRS Form 8453-TE, Tax Exempt Entity Declaration and Signature for Electronic Filing

Tax-exempt entities use this tax form to:

- Authenticate one of the following tax forms:

- IRS Form 990, Return of Organization Exempt From Income Tax

- IRS Form 990-EZ, Short Form Return of Organization Exempt From Income Tax

- IRS Form 990-PF, Return of Private Foundation

- IRS form 990-T, Exempt Organization Business Income Tax Return

- IRS Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations

- IRS Form 4720, Return of Certain Taxes Under Chapters 41 and 42 of the Internal Revenue Code

- IRS Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return

- IRS form 5227, Split-Interest Trust Information Return

- IRS Form 5330, Return of Excise Taxes Related to Employee Benefit Plans, and

- IRS Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if filing online without using an ERO

- Authorize an electronic funds withdrawal as the payment method for federal taxes owed as determined by one of the following:

- IRS Form 990-PF

- IRS Form 990-T

- IRS Form 1120-POL

- IRS Form 4720

- IRS Form 5330

- IRS Form 8868

IRS Form 8453-WH, Electronic Filing Declaration for Form 1042

Taxpayers use IRS Form 8453-WH to:

- Authenticate an electronic Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons;

- Provide consent to authorize an electronic funds withdrawal for payment of the balance due on IRS Form 1042

- Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if you are filing online (not using an ERO); and

- Authorize the ERO, if any, to transmit via a third-party transmitter

IRS Form 8453-X Political Organization Declaration for Electronic Filing of Notice of Section 527 Status

After electronically submitting IRS Form 8871, Political Organization Notice of Section 527 Status, an authorized official must sign, date, and send this form to the Internal Revenue Service. This allows the political organization to:

- File an amended or final Form 8871, or

- To electronically file Form 8872, Political Organization Report of Contributions and Expenditures.

Frequently asked questions

Taxpayers use IRS Form 8453-EMP to accompany electronically filed employment tax returns, when filed by an intermediate service provider (ISP) or electronic return originator (ERO). Taxpayers also use this form to authorize electronic funds transfer for tax payments or refunds.

IRS Form 8453-EMP is used to submit an electronic employment tax return through an intermediate service provider (ISP) without using an electronic return originator (ERO). IRS Form 8879-EMP allows the ERO to sign the return with an identity protection PIN number (IP PIN). An ERO may use either form.

Where can I find IRS Form 8453-EMP?

You can find tax forms like IRS Form 8453-EMP on the Internal Revenue Service website. For your convenience, we’ve enclosed the latest version of IRS Form 8453-EMP in this article as a PDF file.