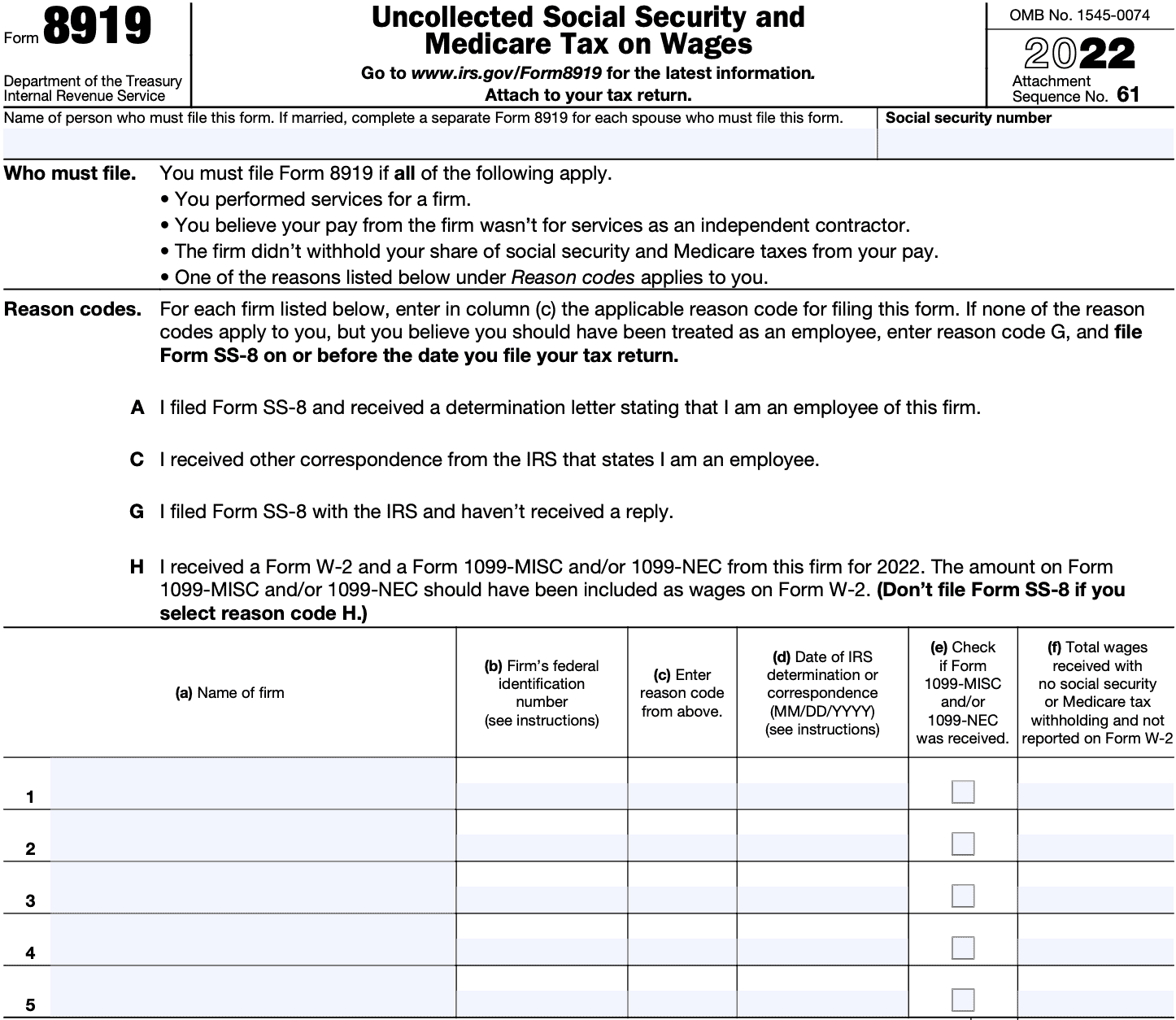

IRS Form 8919 Instructions

Business owners are usually responsible for collecting a worker’s Social Security and Medicare taxes, then remitting those taxes to the Internal Revenue Service. However, many businesses have started treating some employees like independent contractors, who must send those taxes to the IRS on their own. IRS Form 8919 exists to help misclassified workers calculate and report uncollected Social Security and Medicare tax.

In this article, we’ll walk through some key points about this tax form, including:

- When to use IRS Form 8919

- How to tell the difference between an employee and independent contractor for purposes of federal employment taxes

- How to calculate your share of uncollected Social Security and Medicare tax using Form 8919

Let’s start with some background information on the tax form itself.

Table of contents

- How do I complete IRS Form 8919?

- Video walkthrough

- Frequently asked questions

- What is the employee’s share of Social Security and Medicare taxes?

- What’s the difference between an employee and independent contractor?

- When should I NOT file IRS Form 8919?

- Where can I find IRS Form 8919?

- Related tax articles

- What do you think?

How do I complete IRS Form 8919?

This one-page form is relatively straightforward. Before we proceed to the form instructions, let’s take some time to go over the applicable reason codes.

Reason codes

There are 4 reason codes, which you may use when completing this form. These reason codes tell the IRS why you, as the taxpayer, are reporting income that you did not pay Social Security or Medicare taxes on.

- Reason Code A: I filed Form SS-8 and received a determination letter stating that I am an employee of this firm.

- Reason Code C: I received other correspondence from the IRS that states I am an employee.

- Reason Code G: I filed Form SS-8 with the IRS and haven’t received a reply.

- Reason Code H: I received a Form W-2 and a Form 1099-MISC and/or 1099-NEC from this firm for the tax year.

- The amount on Form 1099-MISC and/or 1099-NEC should have been included as wages on Form W-2.

- Don’t file Form SS-8 if you select reason code H.

Lines 1 through 5

For each firm that employed you during the tax year, document the following:

- Column (a): Name of firm

- Column (b): Firm’s federal identification number

- This can be a Social Security number (SSN) or employer identification number (EIN)

- If you received Form 1099 or W-2, use the ID number indicated

- If unknown, write ‘unknown’

- Column (c): Reason code

- Enter only one reason code for each company

- Column (d): Date of IRS determination or correspondence

- Only complete if you entered reason code ‘A’ or ‘C’

- Column (e): Check if you received Form 1099-MISC or Form 1099-NEC

- Column (f): Enter the total wages received with no withholding and no report on Form W-2

If there are more than 5 firms, then use additional sheets as necessary. However, only use 1 Form 8919 for Lines 6 through 13.

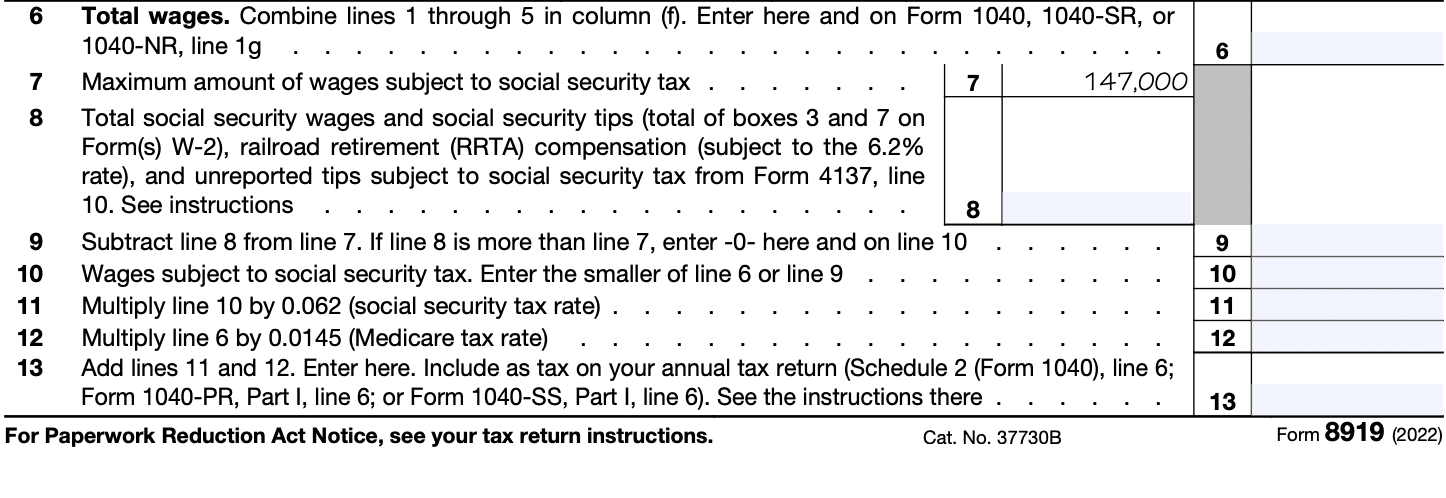

Line 6: Total wages

Add the total of all entries in Column (f) above, including any entries on additional sheets. Enter this total on Line 6 as well as on Line 1g of the tax form below that applies to your situation:

- Form 1040

- Form 1040-SR

- Form 1040-NR

Also enter this number on IRS Form 8959, Line 3, if you are required to calculate your additional Medicare tax.

Line 7: Maximum amount of wages subject to Social Security tax

This line should contain the current year’s maximum wages subject to Social Security taxes. In 2022, that number was $147,000. For tax year 2023, it has increased to $160,200.

Line 8: Total Social Security wages and tips

Enter your total Social Security wages and Social Security tips. This should equal:

- The total of boxes 3 and 7 on Form(s) W-2)

- Railroad retirement (RRTA) compensation subject to the 6.2% rate, and

- Unreported tips subject to Social Security tax from IRS Form 4137, Line 10

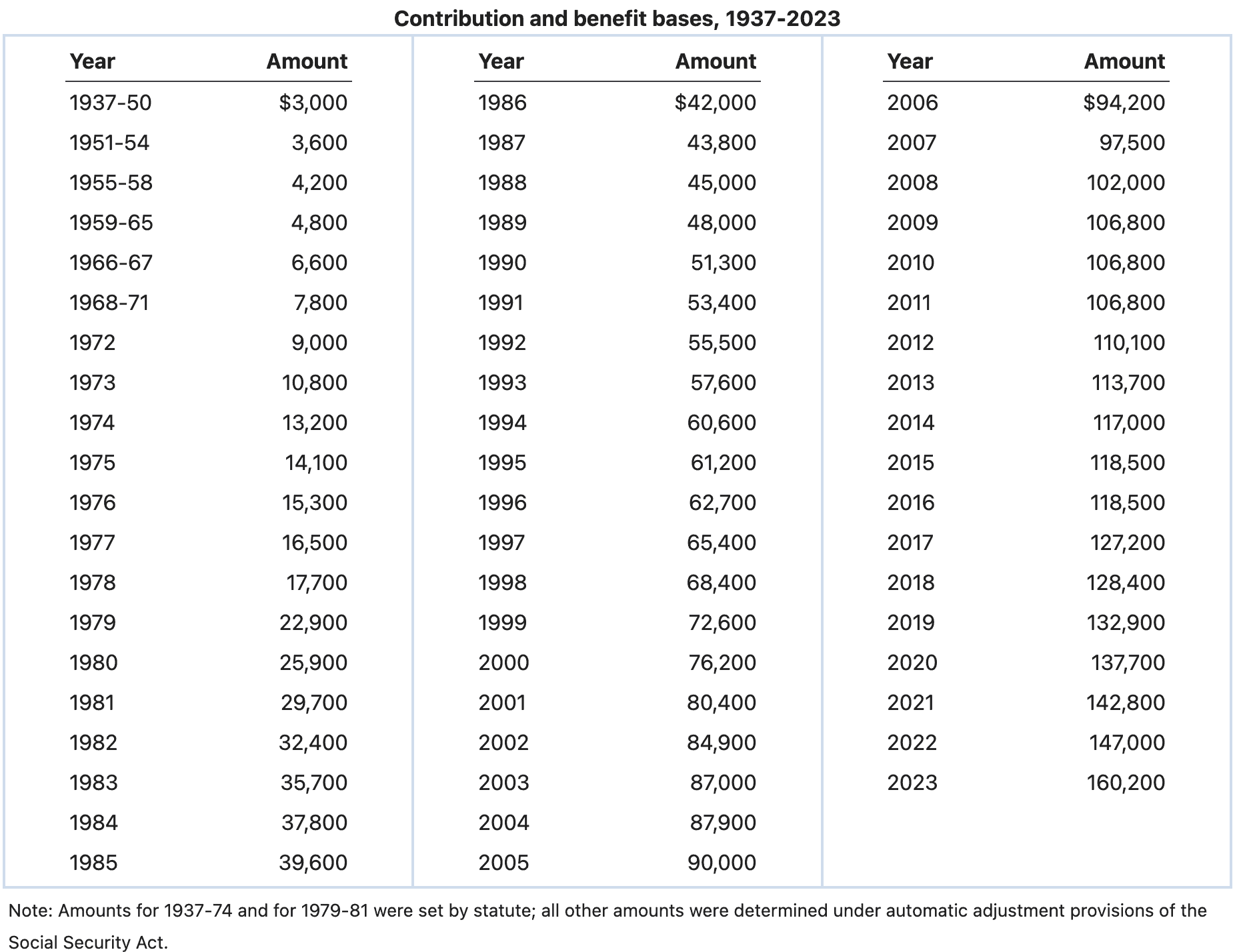

For RRTA compensation, do not include a number larger than the Social Security benefit base for the tax year. In tax year 2022, this would be $147,000. For 2023, this would be $160,200.

Line 9

Subtract Line 8 from Line 7. If Line 8 is greater than Line 7, enter ‘0’ here and on Line 10.

Line 10: Wages subject to Social Security tax

Enter the smaller of:

Line 11: Social Security taxes

Multiply Line 10 by 0.062, or 6.2%. This represents your total Social Security taxes.

Line 12: Medicare taxes

Multiply Line 6 by 0.0145, or 1.45%. This represents your total regular Medicare taxes.

Line 13: Total Social Security and Medicare taxes

Add Lines 11 and 12 and enter the answer on Line 13. Also enter this answer on one of the following as applicable:

- Form 1040: Schedule 2, Line 6

- Form 1040-PR: Part I, Line 6

- Form 1040-SS: Part I, Line 6

Video walkthrough

Watch this instructional video to learn how to properly report your Social Security and Medicare wages on IRS Form 8919.

Frequently asked questions

IRS Form 8919 is the tax form that taxpayers must file to figure and report their share of uncollected Social Security and Medicare taxes. Specifically, this happens to an employee who is treated like an independent contractor by their employer.

According to the IRS, you should file Form 8919 if you performed services for a firm, you believe your pay from the firm wasn’t for services as an independent contractor, but the firm didn’t withhold your share of Social Security and Medicare taxes from your pay, and one of the reason codes in the tax form applies to you.

What is the employee’s share of Social Security and Medicare taxes?

Internal Revenue Code Section 3101 states how much Social Security and Medicare taxes each employee must pay.

Social Security taxes

Section 3101 states that the Social Security tax rate is 6.2% of their Social Security earnings, up to a specific dollar limit. This limit is known as the contribution and benefit base, and is adjusted annually for inflation.

For 2023, this benefit base is $160,200. In other words, a worker’s share of Social Security tax is 6.2% of their Social Security wages up to $160,200 in 2023. Social Security is not withheld on compensation above this limit, nor do earnings above this amount appear on the worker’s Social Security record.

For reference, the Social Security Administration maintains a historical list of Social Security benefit base limits. The most current version is included below.

Medicare tax

On the other hand, there is no contribution limit on the employee’s share of Medicare tax. IRC Section 3101 states that Medicare is taxed at the following rates:

- 1.45% on all Medicare wages

- Additional Medicare tax of 0.9% on wages above the following thresholds, depending on tax filing status:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- Single, head of household, qualifying surviving spouse: $200,000

Now we know how much an employee’s Social Security and Medicare income tax withholding should look like. Let’s turn to the next question: How to tell when you’re an employee and when you’re considered to be self-employed.

Employer’s share

Employers must match the employee’s share of Social Security and Medicare taxes. In other words, for each employee, the employer must pay an additional amount of each. This includes:

- 6.2% of the Social Security wages, up to the base limit

- 1.45% of all Medicare wages

However, employers are not responsible for any additional Medicare tax payments. Additional Medicare taxes are solely the taxpayer’s responsibility.

Self-employed individuals

For self-employed individuals, this means that they have to pay the employee’s share AND employer’s share for Social Security and Medicare taxes. This looks like:

- 12.4% of Social Security wages, up to the base limit

- 2.9% of total wages

- Plus the additional Medicare tax, if applicable

The employer’s share of Social Security and Medicare taxes is the primary reason many businesses may improperly classify someone as a contractor when they might actually be an employee.

What’s the difference between an employee and independent contractor?

Generally speaking, the difference between an employee and a contractor is how much control the business owner has over that person’s actions during the work period. A contractor usually is responsible for delivering results, but might maintain the flexibility to control how to deliver those results. The company reports the contractor’s earnings on IRS Form 1099-MISC.

Conversely, an employee may (or may not) have as much control as a contractor. And an employer may exert more control over certain job aspects that are unrelated to performance. An employer will report their employee’s earnings and income tax withholding on IRS Form W-2.

According to the IRS, there are three variables that can help indicate the level of control and independence a worker might have. In turn, these variables can help determine whether someone is an employee or independent contractor:

- Behavioral

- Financial

- Type of relationship

The IRS website goes on to say that no single factor or variable will determine a person’s status as an employee or self-employed individual. Which begs the question: “How can you tell?”

How can I tell if I am an employee or independent contractor?

It is incumbent upon business owners to apply the proper worker classification to their employees, whether it be an employee of the firm or a contract employee.

For people who feel as though they might be a misclassified worker, the IRS can help. Either the worker or the business can file IRS Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding.

By filing this form, the filer can expect the IRS to issue a determination letter. However, the IRS website states that it can take up to 6 months for the IRS to make a determination.

When should I NOT file IRS Form 8919?

The form instructions indicate several situations where you should not file Form 8919 to report Medicare and Social Security wages and taxes.

For services performed as an independent contractor

If you performed services in a role as an independent contractor, then you should complete Schedule C to report your income on your individual income tax return. Also, you should file Schedule SE to determine your self-employment taxes related to your net earnings, or net profit.

To calculate Social Security and Medicare tax on unreported tips

You should use IRS Form 4137, Social Security & Medicare Tax on Unreported Tip Income, to perform this calculation on cash tips you received, but did not report to your employer. This includes any allocated tips that may have appeared on your Form W-2.

To receive a determination letter regarding your employment status

File IRS Form SS-8 to request an IRS determination on your status as employee or independent contractor. If you use reason code ‘G’ in filing your Form 8919, you must also file Form SS-8 on or before the date that you file Form 8919.

To calculate your additional Medicare tax

Instead, use IRS Form 8959, Additional Medicare Tax, to calculate Medicare tax on net income above the additional Medicare Tax threshold.

Where can I find IRS Form 8919?

Like most tax forms, you can find IRS Form 8919 on the IRS website. For your convenience, we’ve included the most recent version at the bottom of this article.

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!