IRS Form 172 Instructions

Beginning with the 2024 tax year, the IRS created IRS Form 172 for individuals, estates, and trusts to report net operating losses, known as NOLs, on their tax returns. In this article, we’ll walk through everything you need to know about IRS Form 172, including:

- How to complete and file IRS Form 172

- How net operating losses work

- Other filing considerations

Let’s begin with a step by step overview of IRS Form 172.

Contents

Table of contents

How do I complete IRS Form 172?

There are two parts to this three-page tax form:

Before we start with Part I, let’s briefly go over the taxpayer information fields at the top of IRS Form 172.

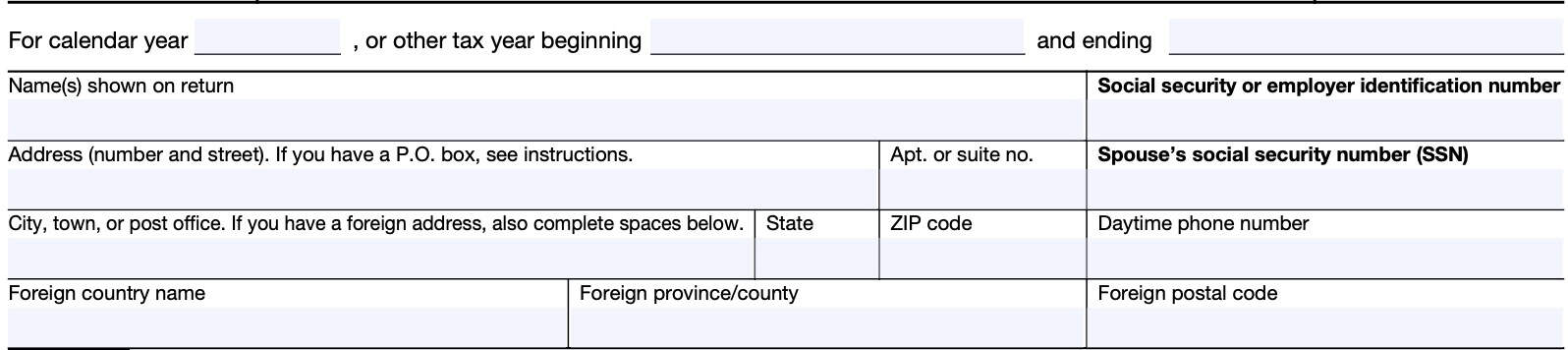

Taxpayer information

Your tax preparation software will likely auto-complete these fields based on what you’ve previously entered in your tax return. For better understanding, we’ll review each field so you know what is expected.

Calendar year or other tax year

For most taxpayers, this will be the calendar year of the tax return.

However, if you are a fiscal year taxpayer, this can be the ending date of any month other than December. For example, the federal government’s fiscal year begins on October 1 and ends the following year on September 30.

Name(s) on Tax Return

This should include the primary taxpayer’s information. This can be an individual, estate, or trust.

For a married couple filing a joint return, both spouses’ names should appear here.

Social Security or employer identification number

This field contains the Social Security number of the first taxpayer listed on the tax return. For estates and trusts, this field should contain the employer identification number (EIN) of that taxable entity.

Address

This field should contain the taxpayer’s address.

P.O box addresses

Enter your box number only if your post office doesn’t deliver mail to your home.

If you’ve recently relocated

If you’ve recently moved, you may consider updating the address listed in your tax records. You can do this by calling the IRS, filing your next tax return, or by filing one of the following change of address forms:

Spouse’s Social Security number

If filing a tax return as a married couple, enter the spouse’s SSN in this field.

City, town, or post office

This should include the name of the city, town, or post office.

State

This should reflect the state where you live or where the estate or trust is established.

ZIP code

This should include the 5-digit (or 9-digit) zip code.

Daytime telephone number

Provide a useful phone number in case the Internal Revenue Service needs additional information.

Foreign country address

If you reside in a foreign country, use this space to provide the address information.

Don’t enter any other information on that line, but also complete the spaces below that line. Don’t abbreviate the country name.

Follow the country’s practice for entering the postal code and the name of the province, county, or state.

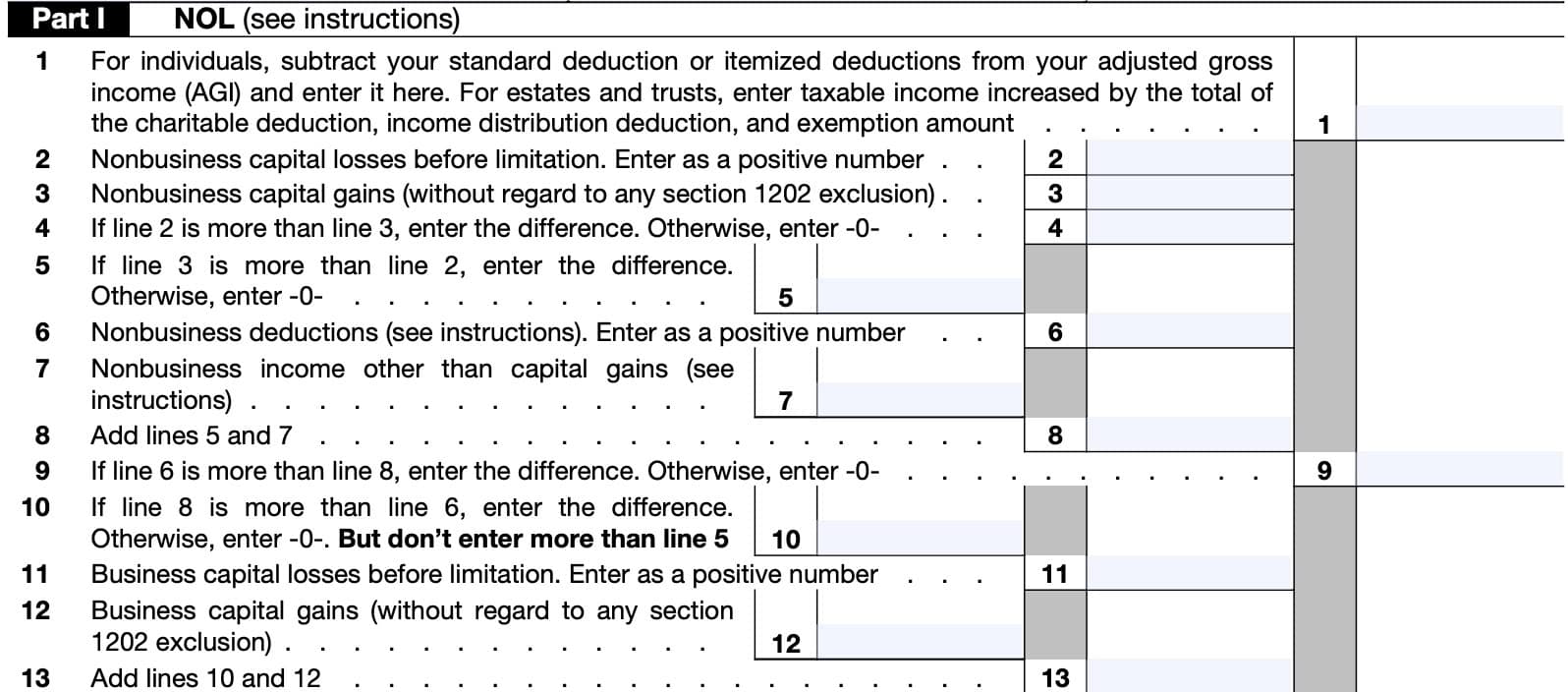

Part I: NOL

In this section, we’ll calculate the current year’s net operating loss, or NOL. Let’s begin with Line 1.

Line 1

Line 1 contains adjusted income or taxable income, depending on the taxpayer’s status.

Individuals

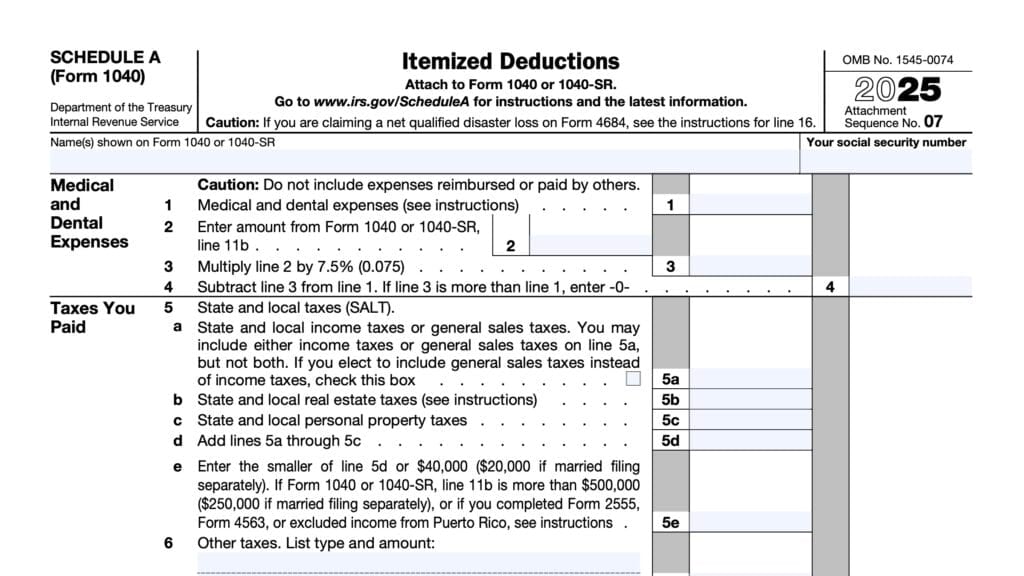

For an individual taxpayer’s return (filing IRS Form 1040), will enter their adjusted gross income (AGI), minus either the standard deduction or itemized deductions. If you itemized deductions on Schedule A of your tax return, use this figure. Otherwise, use the standard deduction that you are entitled to.

Estates and trusts

Estates and trusts will enter taxable income plus the following:

- Charitable deductions

- Income distribution deduction

- Exemption amount

Line 2: Nonbusiness capital losses before limitation

Enter any nonbusiness capital losses, before limits apply. However, don’t include on this line any Internal Revenue Code Section 1202 exclusion amounts. This refers to amounts that may be exempt, or partially exempt, from taxation due to the sale of certain small business stock.

Enter this figure as a positive number.

Line 3: nonbusiness capital gains

Enter any nonbusiness capital gains, either long-term capital gains or short term gains. Again, this does not include any excluded amounts under the meaning of Section 1202.

Line 4

Subtract Line 3 from Line 2, then enter the result. If this results in a negative number, enter ‘0.’

Line 5

Subtract Line 2 from Line 3, then enter the result. If this results in a negative number, enter ‘0.’

Note: You should have a figure for either Line 4, or Line 5, but not both (unless the figure is ‘0’ in both cases).

Line 6: Nonbusiness deductions

Enter as a positive number deductions that aren’t connected with a trade or business. These deductions may include:

- Health savings account deduction, calculated on IRS Form 8889

- Archer MSA deduction,

- Deductions for payments on behalf of a self-employed individual to a SEP, SIMPLE, or qualified plan,

- IRA deductions,

- Alimony paid,

- Most itemized deductions

- Except for casualty and theft losses resulting from a federally declared disaster and state

income tax on trade or business income, and

- Except for casualty and theft losses resulting from a federally declared disaster and state

- Standard deduction

Do not include business deductions.

Business deductions that you cannot include in Line 6

According to the Internal Revenue Service, below is a list of business deductions that you cannot include in Line 6:

- State income tax on income from your trade or business

- Including wages, salary, and unemployment compensation

- Moving expenses for members of the Armed Forces on active duty

- Reported on IRS Form 3903

- Educator expenses.

- The deduction for the deductible part of self-employed health insurance and the deduction for the deductible part of self-employment tax

- Rental losses

- Loss on the sale or exchange of business real estate or depreciable property

- Your share of a business loss from a partnership or an S corporation

- Ordinary loss on the sale or exchange of Section 1244 (small business) stock.

- Ordinary loss on the sale or exchange of stock in a small business corporation or a small business investment company.

- If you itemize your deductions, casualty and theft losses resulting from a federally declared disaster (even if they involve nonbusiness property).

- Loss on the sale of accounts receivable (if you use an accrual method of accounting).

- Interest and litigation expenses on state and federal income taxes related to your business.

- Unrecovered investment in a pension or annuity claimed on a decedent’s final return.

- Payment by a federal employee to buy back sick leave used in an earlier year.

Line 7: Nonbusiness income other than capital gains

In Line 7, enter income that is not from a trade or business. Examples are ordinary dividends, annuities, and interest on investments. This includes:

- Your share of business income from a partnership or an S corporation

- Your taxable IRA distributions

- Pension benefits

- Social security benefits

- Annuity income

- Dividends

- Interest on investments

- Your share of nonbusiness income from a partnership or an S corporation.

Don’t enter business income on Line 7. This is income from a trade or business and includes the following:

- Salaries and wages

- Self-employment income

- Unemployment compensation

- Rental income

- Gain on the sale or exchange of business real property or depreciable property

Line 8

Add Line 5 and Line 7. Enter the total here.

Line 9

Subtract Line 8 from Line 6, then enter the difference in Line 9. If this results in a negative number, enter ‘0.’

Line 10

Subtract Line 6 from Line 8, then enter the difference in Line 10. If this results in a negative number, enter ‘0.’

Do not enter a number that exceeds the amount reported in Line 5.

Line 11: Business capital losses before limitation

If you have business capital losses, enter them in Line 11. These are losses without limitations that may be be applied at a later point.

Enter these capital losses as a positive number.

Line 12: Business capital gains

Enter business capital gains, without regard to Section 1202 exclusion, in Line 12.

Line 13

Add Line 10 and Line 12. Enter the total in Line 13.

Line 14

Subtract Line 13 from Line 11. If this results in a negative number, enter ‘0.’

Line 15

Add Line 4 and Line 14. Enter the result here.

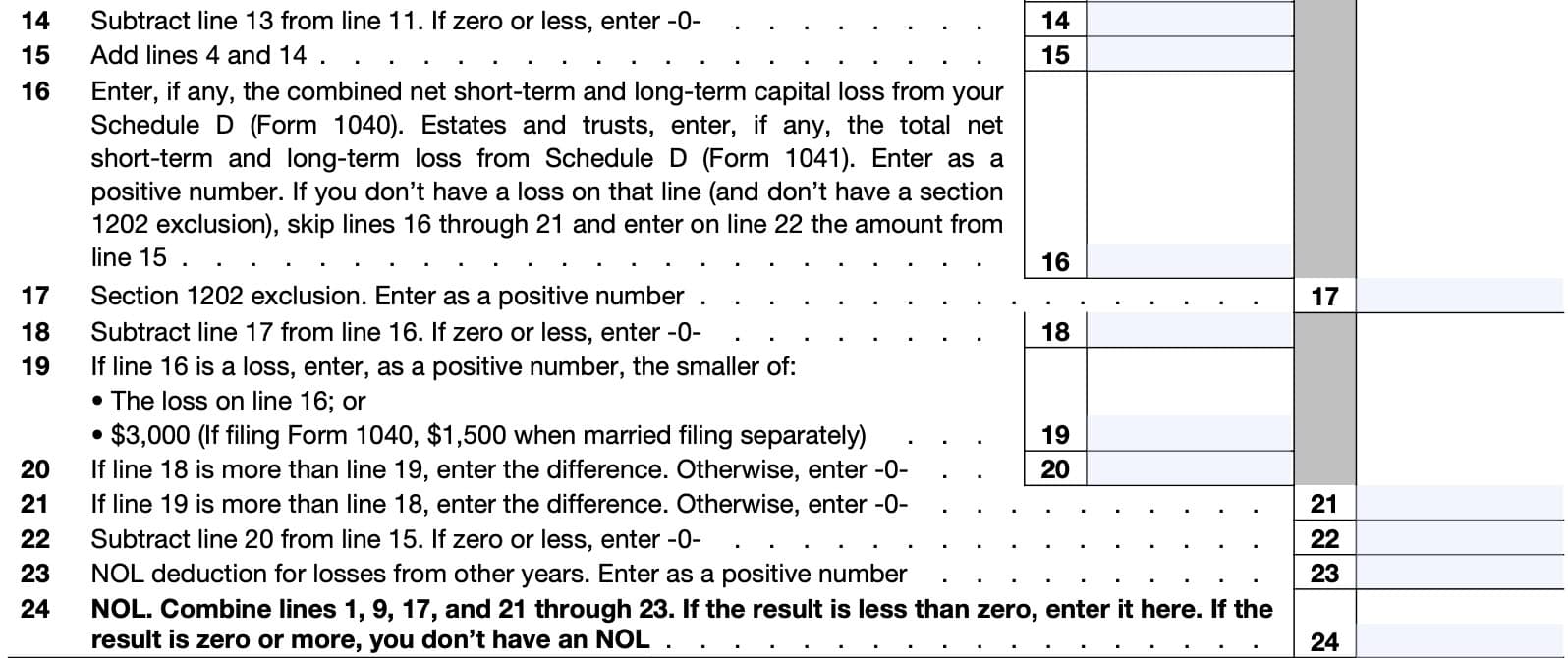

Line 16: Combined net short-term and long-term capital loss from Schedule D

If applicable, enter the combined net short-term and long-term capital loss from Schedule D of your Form 1040. Short-term losses are reported on Line 7, while long-term losses appear on Line 15 of Schedule D.

Enter this as a positive number. If you do not have a loss, and 1202 exclusions do not apply, then skip Lines 16 through 21. Enter the Line 15 amount on Line 22, below.

Estates and trusts

Enter the total net short-term and long-term loss from Schedule D from Form 1041.

Enter this as a positive number. If you do not have a loss, and 1202 exclusions do not apply, then skip Lines 16 through 21. Enter the Line 15 amount on Line 22, below.

Line 17: Section 1202 exclusion

Enter as a positive number on Line 17 any gain you excluded under section 1202 on the sale or exchange of qualified small business stock.

Line 18

Subtract Line 17 from Line 16. If this results in a negative number, enter ‘0.’

Line 19

If Line 16 is a loss, then enter the smaller of the following as a positive number:

- The loss reported on Line 16

- $3,000

- If your filing status is married filing separate returns, enter $1,500

Line 20

If Line 18 exceeds Line 19, enter the difference. Otherwise, enter ‘0.’

Line 21

If Line 19 exceeds Line 18, enter the difference. Otherwise, enter ‘0.’

Line 22

Subtract Line 20 from Line 15. If this results in a negative number, enter ‘0.’

Line 23: NOL deduction for losses from other years

You cannot deduct any NOL carryovers or carrybacks from other tax years. Enter the entire amount of the net operating loss deduction for losses from other years.

Line 24: Net operating loss

Combine the following:

If the result is a negative number, you have a net operating loss. Enter this number in Line 24.

If the result is zero or more, then you do not have any net operating losses.

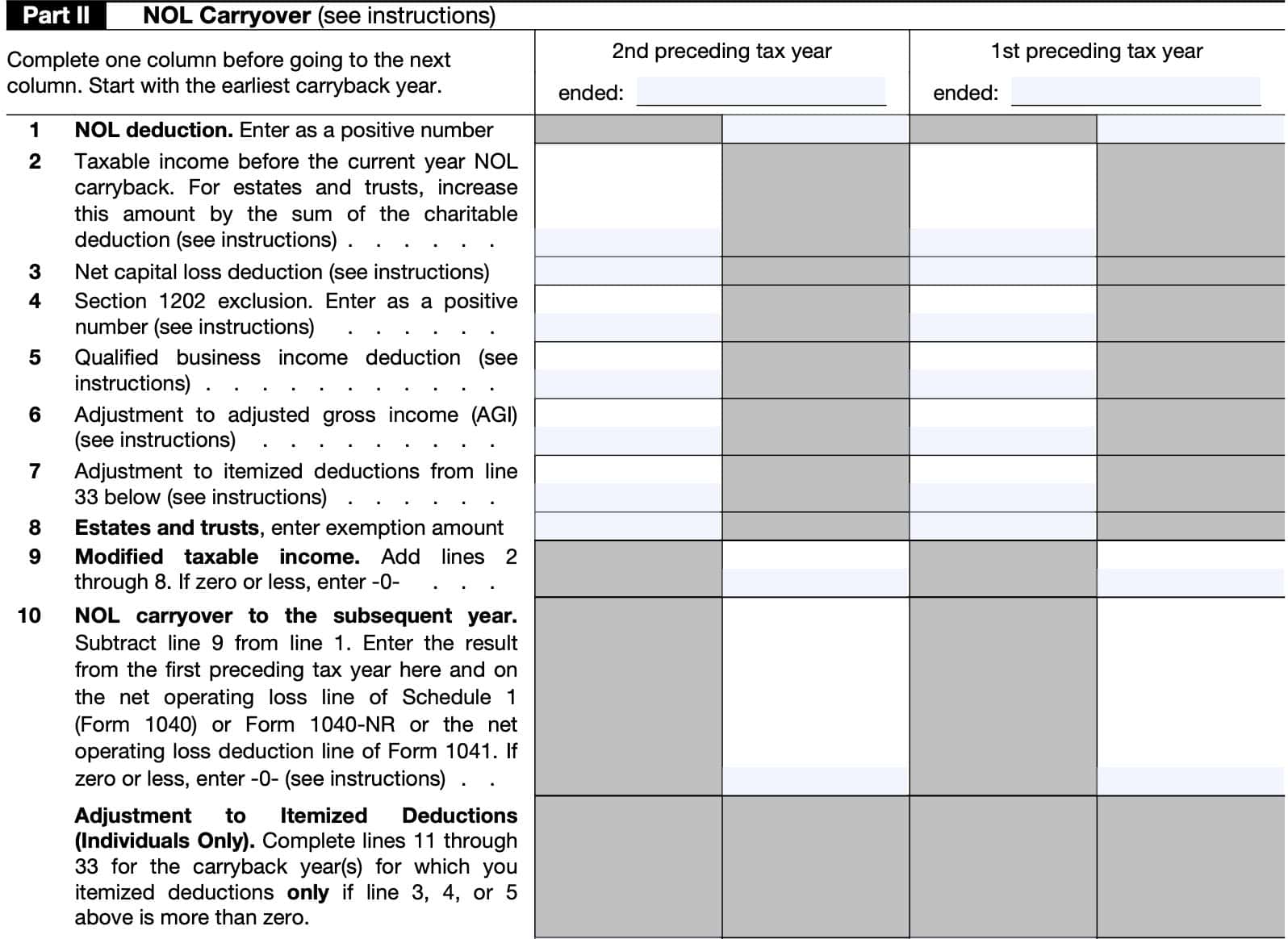

Part II: NOL Carryover

In Part II, we’ll calculate the amount of NOL deduction for each carryback year, and the amount to be carried forward to subsequent years, if the NOL is not fully absorbed.

If an NOL is more than the modified taxable income for the earliest such year to which it is carried, you must complete Part II to figure the amount of the NOL to be carried to the next tax year.

The amount of the carryback is the excess, if any, of the net operating loss carryback over the modified taxable income for that earlier year. Modified taxable income is the amount figured on Line 9 of Part II.

How to complete Part II

There are two columns:

- 2nd preceding taxable year of the loss, ended _______ (enter the appropriate date)

- 1st preceding tax year, ended _______ (enter the appropriate date)

When completing Part II, complete one column before going to the next column. Start with the earliest carryback year.

Line 1: NOL deduction

For the second preceding tax year, enter the amount of the current year farming loss carried back to the year.

For the first preceding tax year, enter on Line 1 the amount from Line 10 of Part II for the second such prior taxable year.

Line 2: Taxable income before the current year NOL carryback

Enter the taxable income before the current year NOL carryback.

Don’t take into account on this line any NOL carryback from the current year or later. However, do take into account NOLs that occurred in tax years before the current year and are otherwise allowable as carrybacks or carryforwards.

Note: If your taxable income is shown as zero on your tax return (or as previously adjusted) for any carryback year, refigure it without limiting the result to zero. Then enter this amount on Line 2 as a

negative number.

Estates and trusts

Increase this amount by the sum of the charitable deduction, if applicable.

Line 3: Net capital loss deduction

For individuals: Enter as a positive number the net long-term capital loss, if any, shown (or as previously adjusted) on Schedule D (Form 1040).

For estates and trusts: Enter as a positive number the net long-term capital loss, if any, shown (or as previously adjusted) on Schedule D (Form 1041).

Line 4: Section 1202 exclusion

Enter any gain excluded under Internal Revenue Code Section 1202 on the sale or exchange of qualified small business stock, as a positive number.

Line 5: Qualified business income deduction

Enter as a positive number the amount of the following items claimed on your federal income tax return for years beginning after December 31, 2017:

- Qualified business income (QBI) deduction under IRC Section 199A(a), and

- Domestic production activities deduction allocated from specified agricultural or horticultural cooperatives under Section 199A(g)

These deductions are calculated on either of the following tax forms:

- IRS Form 8995, Qualified Business Deduction – Simplified Computation

- IRS Form 8995-A, Qualified Business Deduction

Line 6: Adjustment to adjusted gross income

If you entered an amount on either Line 3 or Line 4, you must refigure certain income and deductions based on adjusted gross income, or AGI. These recalculations include the following:

- The special allowance for passive activity losses from rental real estate activities

- Taxable social security benefits

- IRA deductions

- Excludable savings bond interest

- The exclusion of amounts received under an employer’s adoption assistance program

- The student loan interest deduction and

- The tuition and fees deduction

For purposes of figuring the adjustment to each of these items, your AGI is increased by the total of the amounts on Line 3 and Line 4. Don’t take into account any NOL carryback from the current year or later.

In most cases, figure the adjustment to each item of income or deduction in the order listed above and, when figuring the adjustment to each subsequent item, increase or decrease AGI by the total adjustments you figured for the previous items.

Social Security benefits and IRA contributions

However, a special rule applies if you received Social Security benefits and deducted IRA contributions. Use the worksheets in IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs), to refigure your taxable Social Security benefits and IRA deductions under the special rule.

Enter on the total adjustments made to the listed items on Line 6. Attach a computation showing how you figured the adjustments.

Line 7: Adjustment to itemized deductions from Line 33

Individuals: Skip this line if, for the applicable carryback year:

- You didn’t itemize deductions on Schedule A, or

- The amounts on Lines 3 through 5 are zero

Otherwise, complete Lines 11 through 33 below. Enter the Line 33 amount on Line 7.

Estates and trusts: Refigure the miscellaneous itemized deductions shown (or as previously adjusted) on Form 1041 for the carryback year, and any casualty and theft loss deduction of property not used in a trade or business or for income-producing purposes shown (or as previously adjusted) on IRS Form 4684,

Casualties and Thefts, by substituting MAGI (see below) for the AGI of the estate or trust.

Modified AGI for estates and trusts

For purposes of figuring miscellaneous itemized deductions subject to the 2% limit, figure MAGI by adding the following amounts to the AGI previously used to figure these deductions:

- The total of the amounts from Lines 3 through 6 of IRS Form 172, Part II.

- The exemption amount shown (or as previously adjusted) on Form 1041 for the carryback year.

- The income distribution deduction shown (or as previously adjusted) on Form 1041 for the carryback year.

For purposes of figuring casualty or theft losses, figure MAGI by adding the total of the amounts from Lines 3 through 6 of Part II, to the AGI previously used to figure these losses.

Line 8

For estates and trusts only: enter the exemption amount.

Line 9: Modified taxable income

Combine Lines 2 through 8. If zero or less, enter ‘0.’

Line 10: NOL carryover to the subsequent year

Generally, subtract Line 9 from Line 1. If zero or less, enter .’0.’

After completing all applicable columns, carry forward to the next year the amount, if any, on Line 10 of the column for the first preceding tax year.

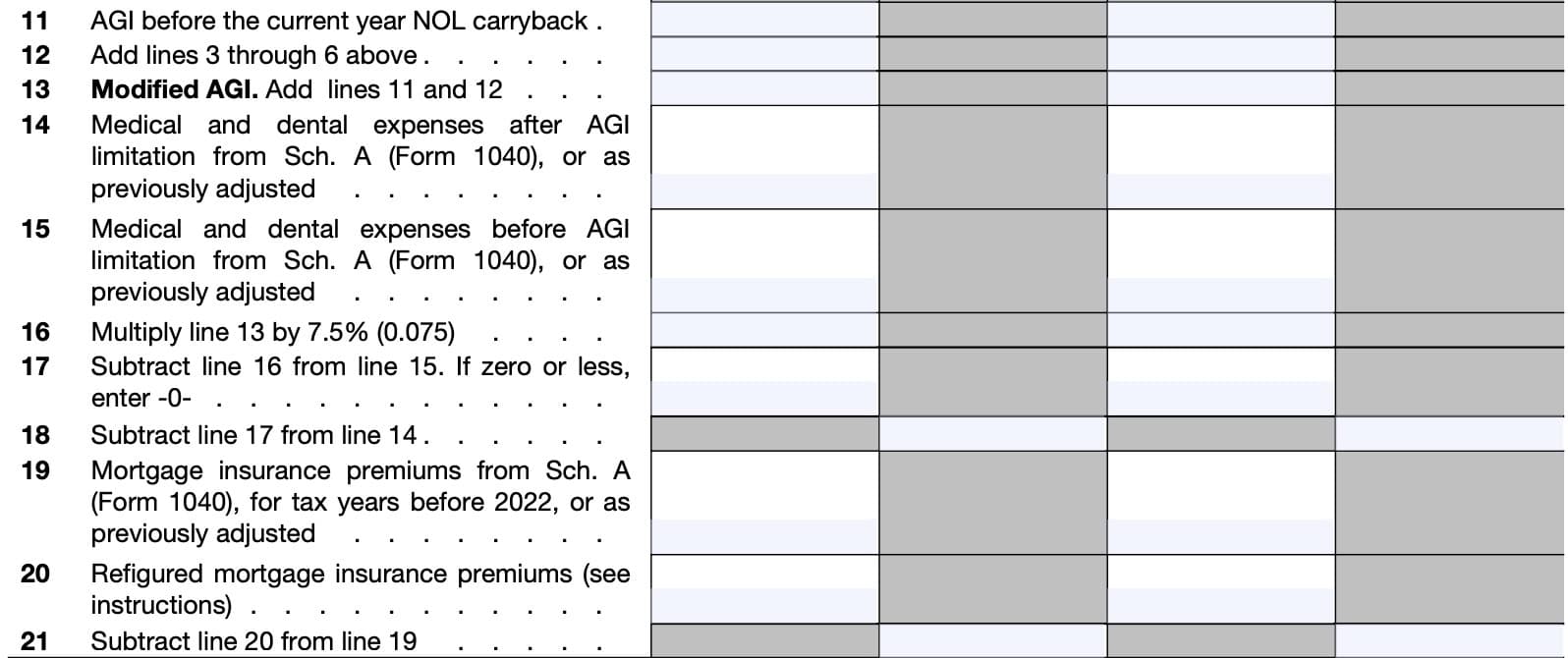

Line 11: AGI before the current year NOL carryback

Enter the AGI before the current year NOL carryback is applied.

Line 12

Add Lines 3 through 6 above. Enter the result in the respective column on Line 12.

Line 13: Modified AGI

Add Line 11 and Line 12. This is the modified AGI.

Line 14: Medical and dental expenses after AGI limitation from Schedule A

Enter any medical and dental expenses remaining after applying the AGI limitation from Schedule A (Form 1040).

Line 15: Medical and dental expenses before AGI limitation from Schedule A

Enter any medical and dental expenses remaining before applying the AGI limitation from Schedule A (Form 1040).

Line 16

Multiply Line 13 by 7.5% (0.075).

Line 17

Subtract Line 16 from Line 15, then enter the result. If the result is a negative number, enter ‘0.’

Line 18

Subtract Line 17 from Line 14. Enter the result.

Line 19: Mortgage insurance premiums from Schedule A

For tax years prior to 2022, enter the amount of any mortgage insurance premiums from Schedule A.

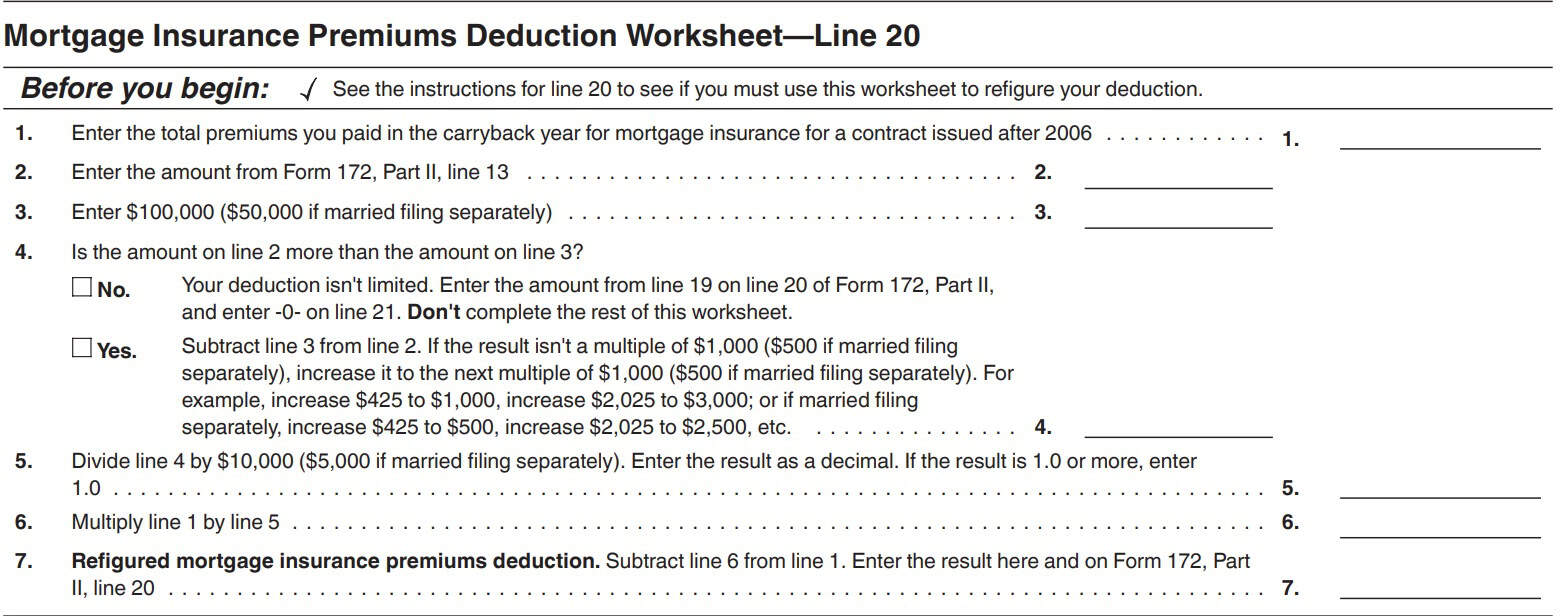

Line 20: Refigured mortgage insurance premiums

Mortgage insurance premiums that are paid or accrued before 2022 may be deducted like qualified residence interest.

For years prior to 2022, is your MAGI from Line 13 more than $100,000 ($50,000 if married filing separately)?

If yes, your tax deduction is limited. You must recalculate the deduction using the Mortgage Premiums Deduction Worksheet, located in the form instructions.

If no, your deduction is not limited. Enter the Line 19 amount here, then enter ‘0’ on Line 21, below.

Line 21

Subtract Line 20 from Line 19. Enter the result in Line 21.

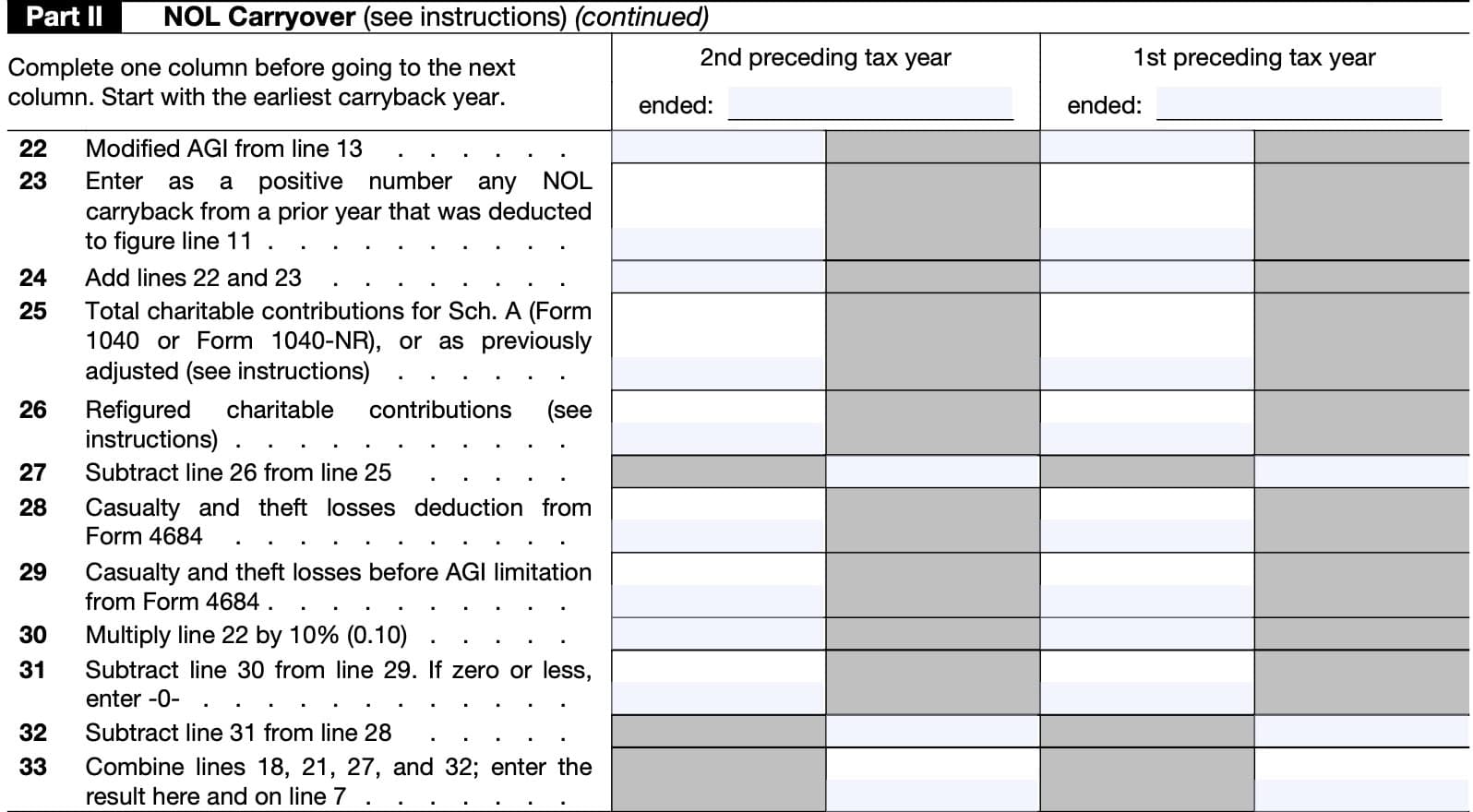

Line 22: Modified AGI from Line 13

Enter the modified AGI figure from Line 13, above.

Line 23

Enter any NOL carryback from prior taxable years that was deducted to calculate AGI on Line 11. Enter this amount as a positive number.

Line 24

Add Line 22 and Line 23. Enter the total in Line 24.

Line 25: Total charitable contributions for Schedule A

Enter your total gifts to charity reported on Schedule A, or as previously adjusted.

Line 26: Refigured charitable contributions

Refigure your charitable contributions using Line 24 as your AGI unless, for any preceding taxable year:

- You entered an amount other than zero on Line 23; and

- You had any items of income or deductions based on AGI, which are listed in the instructions for Line 6 of Part II.

These items of income or deductions include the following:

- The special allowance for passive activity losses from rental real estate activities

- Taxable social security benefits

- IRA deductions

- Excludable savings bond interest

- The exclusion of amounts received under an employer’s adoption assistance program

- The student loan interest deduction, and

- The tuition and fees deduction

Recalculated charitable contributions

If you cannot use the Line 24 amount as your AGI, then you must follow these steps to recalculate your charitable contributions

- Figure the adjustment to each item of income or deduction in the same manner as explained in the instructions for Line 6 of Part II, except:

- Don’t take into account any NOL carryback when figuring AGI.

- Attach a computation showing how you figured the adjustments.

- Add the following lines from Part II to the total adjustments you figured above:

Use this result as your AGI figure to recalculate charitable contributions.

For NOL carryover purposes, you must reduce any charitable contributions carryover to the extent that the net operating loss carryover on Line 10 is increased by any adjustment to charitable contributions.

Line 27

Subtract Line 26 from Line 25. Enter the result here.

Line 28: Casualty and theft loss Deduction

Enter the casualty and theft loss deduction as reported on IRS Form 4684.

Line 29: Casualty and theft losses before AGI limitation

Enter any casualty and theft losses reported on IRS Form 4684, before AGI limitations, if applicable.

Line 30

Multiply Line 22 by 10% (0.10). Enter the result here.

Line 31

Subtract Line 30 from Line 29, then enter the result here. If the result is zero or less, enter ‘0.’

Line 32

Subtract Line 31 from Line 28. Enter the result here.

Line 33

Add the following lines:

Enter the result here and on Line 7.

Filing considerations

The IRS instructions contain additional details about NOLs, which we’ll cover here.

How To Figure an NOL

If your deductions for the year are more than your income for the year, you may have a net operating loss, or NOL.

However, there are special rules that limit what you can deduct when figuring an NOL. In general, the following items are not allowed when figuring an NOL:

- Capital losses in excess of capital gains

- The Section 1202 exclusion of the gain from the sale or exchange of qualified small business stock

- Nonbusiness deductions in excess of nonbusiness income

- The NOL deduction

- The Section 199A deduction for qualified business income

When To Use an NOL

If you have an NOL for a tax year ending after 2020, only the farming loss portion, if any, can be carried back. However, there is an exception that might apply.

Exception to the No Carryback Rule

Farming losses, defined next, qualify for a 2-year carryback period. Only the farming loss portion of an NOL can be carried back 2 years.

There is an 80% limitation, which applies as a general rule. This limitation does not apply to a carryback period before 2021.

Farming business

A farming business is a trade or business involving cultivation of land or the raising or harvesting of any agricultural or horticultural commodity. A farming business can include operating a nursery or sod farm or raising or harvesting most ornamental trees or trees bearing fruit, nuts, or other crops.

The raising, shearing, feeding, caring for, training, and management of animals is also considered a farming business.

A farming business does not include contract harvesting of an agricultural or horticultural commodity grown or raised by someone else. It also does not include a business in which you merely buy or sell plants or animals grown or raised entirely by someone else.

Farming loss

A farming loss is the smaller of:

- The amount of such loss that would be the NOL for the tax year if only income and deductions from farming businesses (as defined in IRC Section 263A(e)(4)) were taken into account, or

- The NOL for the tax year.

Waiving the Carryback Period

If you wish to waive the entire carryback period, then attach a statement to your original return filed by the due date (including extensions of time) for the NOL year.

This statement must show that you are choosing to waive the carryback period under IRC Section 172(b).

If you filed your original return on time but did not file the statement with it, you can make this choice on an amended return filed within 6 months of the due date of the return (excluding extensions).

Attach a statement to your amended return, and write “Filed pursuant to Section 301.9100-2” at the

top of the statement.

Once you choose to waive the carryback period, it is generally irrevocable. Such election must be made by the due date of the return, including extensions. If you do not file this statement on time, you cannot waive the carryback period.

How to Carry an NOL Back or Forward

You choose to carry back a farming loss. However, you must first carry the farming loss to the earliest year in the 2-year carryback period. If the farming loss is not used up, you can carry the rest to the next earliest carryback year, and then on to carryover years after such loss year, and so on.

If you waive the carryback period or do not use up all of the farming loss in the carryback period, you will have an NOL that can be carried forward indefinitely until used up. This NOL will be equal to the sum of what remains of the farming loss, plus any nonfarm NOL, plus any excess business loss for the NOL year.

Start by carrying the NOL to the first taxable year after the NOL year.

If you do not use it up, carry the unused part to the next year. Continue to carry any unused part of the NOL forward until the NOL is used up.

Nonfarming businesses

For nonfarming businesses, since you can’t carry the NOL to an earlier year, your NOL deduction for tax years beginning after December 31, 2020, cannot exceed the sum of:

- The NOLs carried to the year from tax years beginning before January 1, 2018; plus

- The lesser of:

a. The NOLs carried to the year from tax years beginning after December 31, 2017, or

b. 80% of the excess (if any) of taxable income computed without regard to deductions for NOLs, or Qualified Business Income (QBI), or Section 250 deductions, over the NOLs carried to the year from tax years beginning before January 1, 2018.

Only NOLs arising after 2017 and carried forward to a year after 2020 are subject to the 80% of taxable income limit. The total amount of any NOL deduction for 2021 or thereafter that is attributable to NOLs from tax years after 2017 can’t exceed 80% of taxable income without regard to the NOL deduction or Sections 199A or 250.

Video walkthrough

Frequently asked questions

IRS Form 172, Net Operating Losses, is the tax form that individuals, estates, and trusts can use to calculate and report net operating losses against taxable income. NOLs can be carried forward indefinitely.

In general, a net operating loss (NOL) cannot exceed 80% of the excess (if any) of taxable income

computed without regard to deductions for NOLs, Qualified Business Income (QBI), or Section 250 deductions, over the NOLs carried to the year from tax years beginning before January 1, 2018.

Where can I find IRS Form 172?

You can find the latest versions of IRS forms, such as IRS Form 172, on the Internal Revenue Service website. For your convenience, we’ve enclosed the most recent version of IRS Form 172 as a PDF file in this article.

On the final K-1 form (2024) from my mom’s estate are listed 11D $5000, 11E & 11F $25,000. (11A has $30; other boxes are blank.) Before considering the K-1, I have no taxable income for 2024. How do I file my 1040 return so that I preserve the NOL carryover to future years? In particular, do I need to file form 172 in my 2024 tax return? Or do I only need to file form 172 in future years to use my NOL deduction?

If you have an NOL in the current year, then you should file IRS Form 172 so that you can carry it over to future tax years.

Watched the YouTube Video, but had some problems leaving comments there so thought I would ask here.

For 2023 I had a big NOL due to bad debt expense. Trying to carry forward to offset small income in 2024.

Having trouble determining which years should go where on 172.

I know the NOL amount from my 2023 return but it looks like this form is used to determine the NOL for 1040 line 8a.

Should the amounts for Part 1 then be from my 2023 return that created the NOL?

Then use Part II to show the carry forward to 1040 line 8a on my 2024 return?

Also my Part II that I downloaded starts with line 1, not line 22 as in your YouTube video.

Thanks,

Mark

You should be able to enter any amounts from prior years on Line 23 (Part I). I believe you would report your 2023 NOL on Schedule 1, Line 8a: If you carry forward your NOL to a tax year after the NOL year, list your NOL deduction as a negative figure on Schedule 1 (Form 1040) for the year to which the NOL is carried.

Your form 172 instructions do NOT say which IRS address to mail it too!

That’s correct, because this is not a standalone tax return that is filed by itself. Generally, this is used to either track net operating losses from one tax year to the next, or it’s used in conjunction with another tax form, such as IRS Form 1045 (to claim a tentative refund), or Form 1040-X (amended tax returns).

The IRS instructions do not give any guidance on how to file this form by itself.