IRS Form 8453-TR Instructions

If you’re claiming a tentative refund on Form 1045 or Form 1139, you may see IRS Form 8453-TR, E-file Declaration or Authorization for Form 1045/1139

This article will walk you through what you should know about this tax form, including:

- What is IRS Form 8453-TR

- How to complete this form and when you should file it

- How to obtain a copy of this tax form

Let’s start with discussing how to complete IRS Form 8453-TR.

Contents

Table of contents

How do I complete IRS Form 8453-TR?

There are three parts to this one-page tax form:

- Part I: Application for Tentative Refund—Form and Information

- Part II: Declaration and Authorization of Taxpayer-Applicant

- Part III: Declaration of Electronic Return Originator (ERO) and Paid Preparer

However, let’s start at the very top of the form, in the taxpayer information fields above Part I.

Taxpayer information

In this section, you’ll enter basic information about the tax return.

Tax period

Enter the beginning date and the ending date of the tax period pertaining to your employment tax return.

Name

Enter the employer’s name in this field, as it appears on the tax return.

Employer identification number

Enter the employer identification number (EIN) of the estate or trust in this field. An employer identification number is a 9-digit tax identification number for tax entities who are not individual taxpayers.

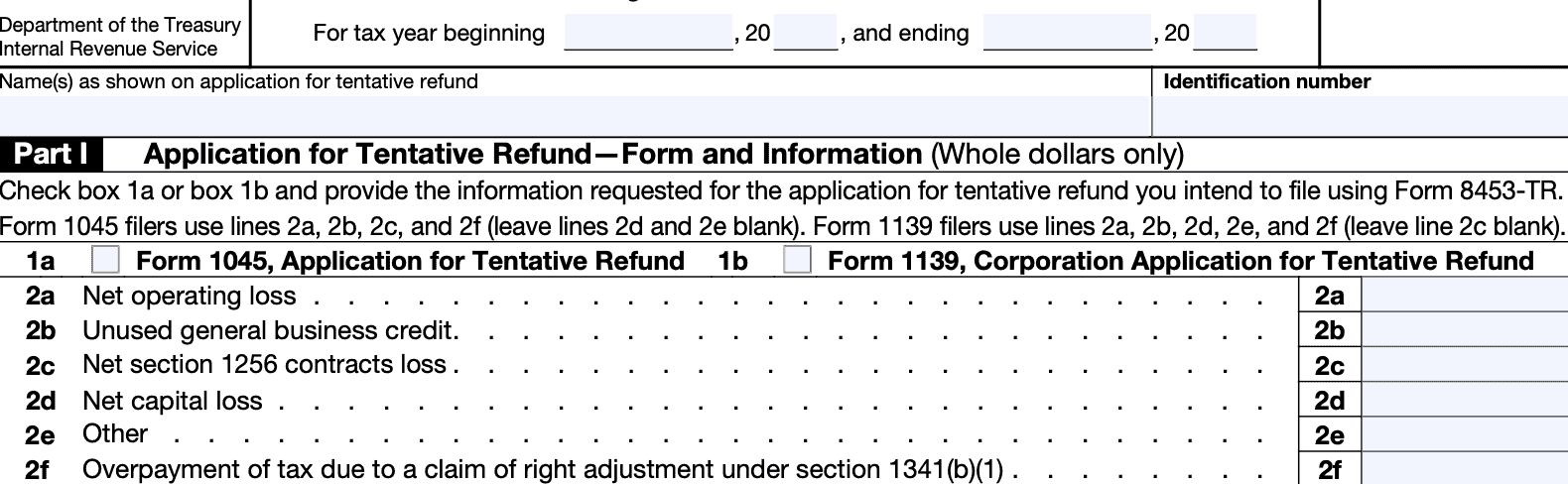

Part I: Application for Tentative Refund—Form and Information

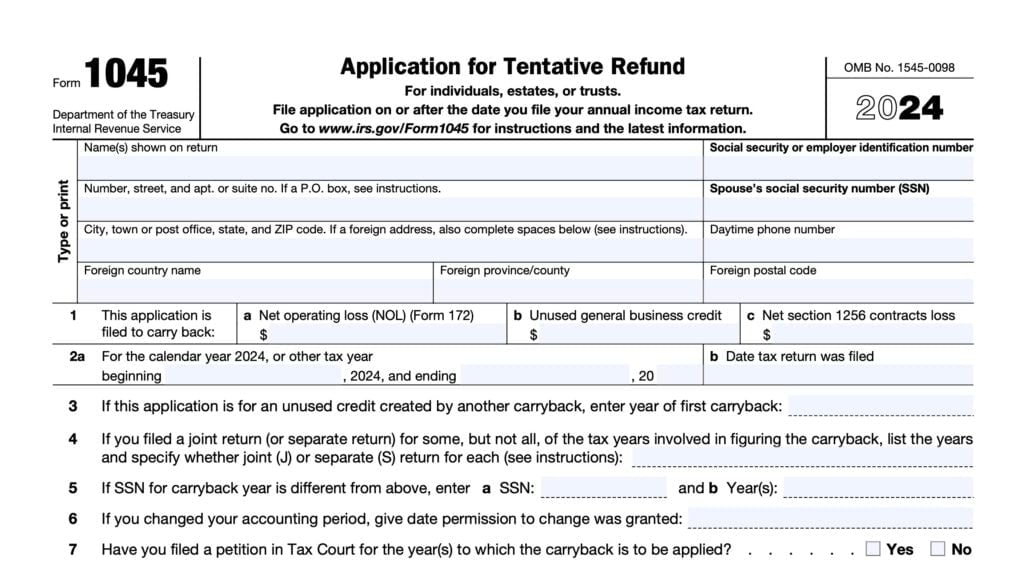

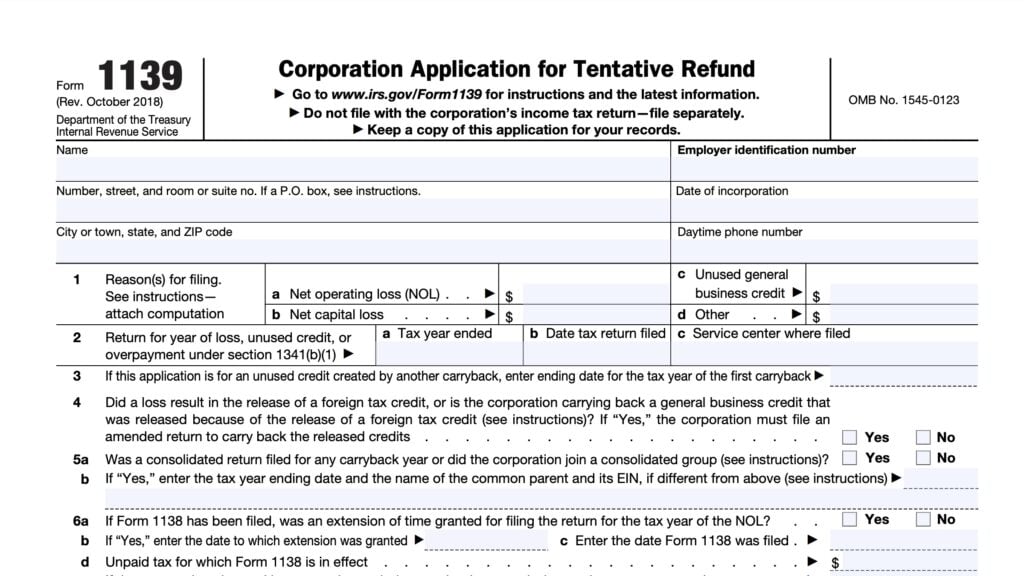

In Part I, we’ll enter certain information from either IRS Form 1045, Application for Tentative Refund, or IRS Form 1139, Corporation Application for Tentative Refund.

Line 1a: Form 1045

If you are filing Form 1045 as an individual taxpayer, check the box in Line 1a.

Line 1b: Form 1139

If you are filing Form 1139 as a corporate taxpayer, check the box in Line 1b.

Line 2a: Net operating loss

Enter the net operating loss (NOL) from Line 1a of either Form 1045 or Form 1139.

Line 2b: Unused general business credit

Form 1045 filers should enter any unused general business credits from Line 1b of Form 1045.

If you are completing Form 1139, you will find this on Line 1c. Afterwards, skip Line 2c and move to Line 2d.

Line 2c: Net section 1256 contracts loss

Form 1045 filers should enter the Section 1256 Contracts Loss from Line 1c of Form 1045. Afterwards, skip Lines 2d and 2e.

Form 1139 filers can leave this field blank, and go to Line 2d.

Line 2d: Net capital loss

If you are filing Form 1045, skip this line and Line 2e, then proceed to Line 2f.

Form 1139 filers should enter the capital loss reported on Line 1b of Form 1139.

Line 2e: Other

Form 1139 filers should enter the other information from Line 1d of Form 1139.

Line 2f: Overpayment of Tax Due to a Claim of Right Adjustment Under Section 1341(b)(1)

Form 1139 filers should enter the other information from Line 29 of Form 1139. This represents the overpayment of tax due to a claim of right adjustment under Internal Revenue Code Section 1341(b)(1).

Form 1045 filers will find this information on Line 33.

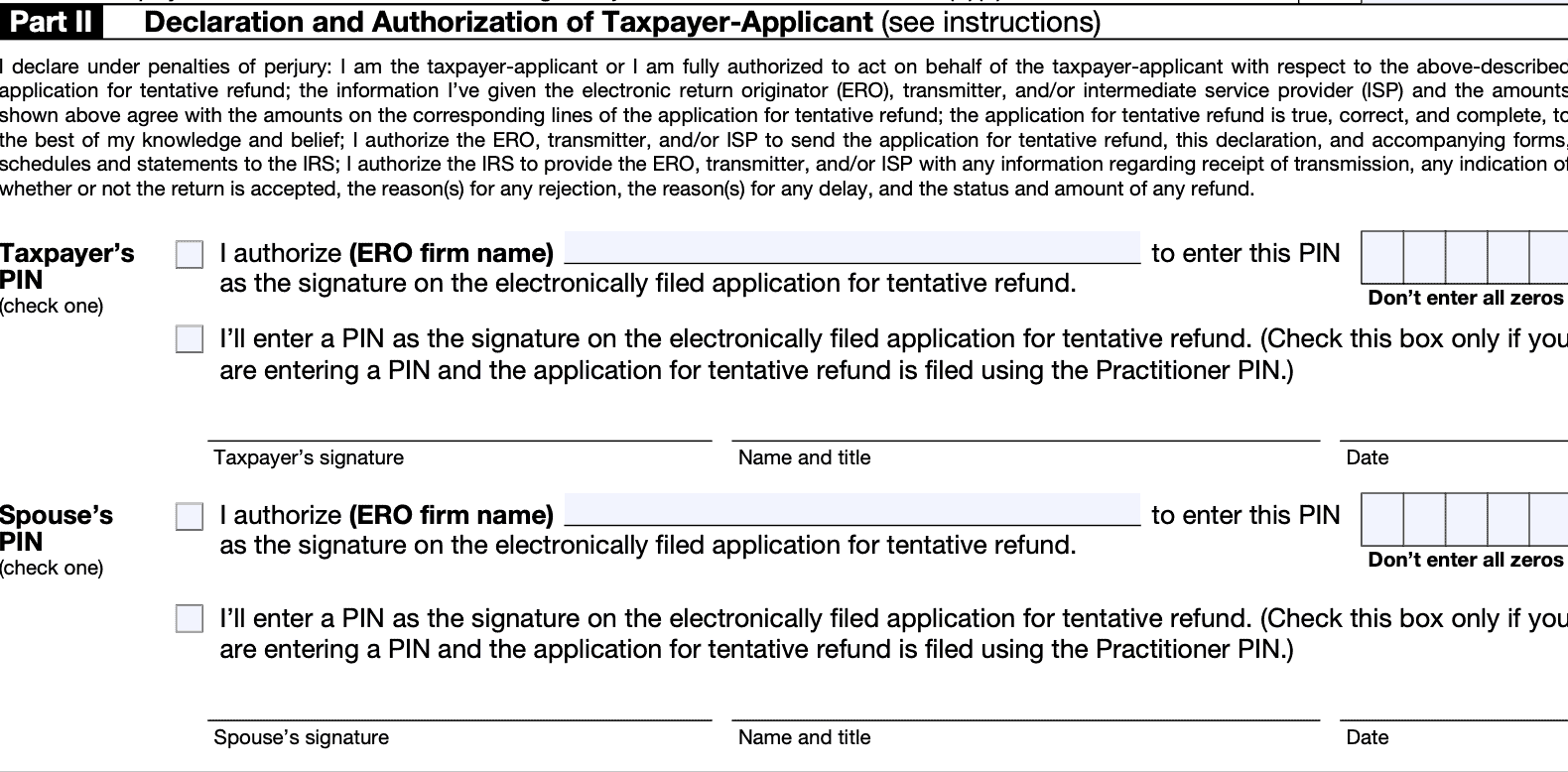

Part II: Declaration and Authorization of Taxpayer-Applicant

In Part II, the taxpayer will sign and date IRS Form 8453-TR in the space provided. If married, space is also provided for the taxpayer’s spouse.

An electronically transmitted application for tentative refund is not complete nor filed unless either:

- Form 8453-TR is signed by the taxpayer, scanned into a PDF file, and transmitted with the application for tentative refund; or

- The application for tentative refund is filed through an ERO and Form 8453-TR is used to select a PIN that is used to electronically sign the application for tentative refund.

The taxpayer’s signature allows the IRS to disclose to the ERO, transmitter, or ISP either:

- An acknowledgement that the IRS has accepted the electronically filed application for a tentative refund, and

- The reason(s) for any delay in processing the application for tentative refund.

In each field, select one option:

- I authorize the ERO to enter a 5-digit PIN that I enter on this form, or

- I will enter my own PIN as the signature on the electronically filed application

- Only check this box if you are entering a PIN and the application is filed using the Practitioner’s PIN.

What is the declaration?

In signing Part II, the taxpayer declares, under penalties of perjury, the following:

- He or she has an approved role within the company listed above

- The information provided to the electronic return originator (ERO), transmitter, and/or intermediate service provider (ISP), and the amounts entered in Part I agree with the corresponding amounts on the associated employment return

- The employment return is true, correct, and complete

- He or she has given permission to transmit the return to the Internal Revenue Service

- The Internal Revenue Service has permission to communicate receipt of this return and accompanying forms and schedules

- The IRS has authorization to disclose the reason for any delay in processing

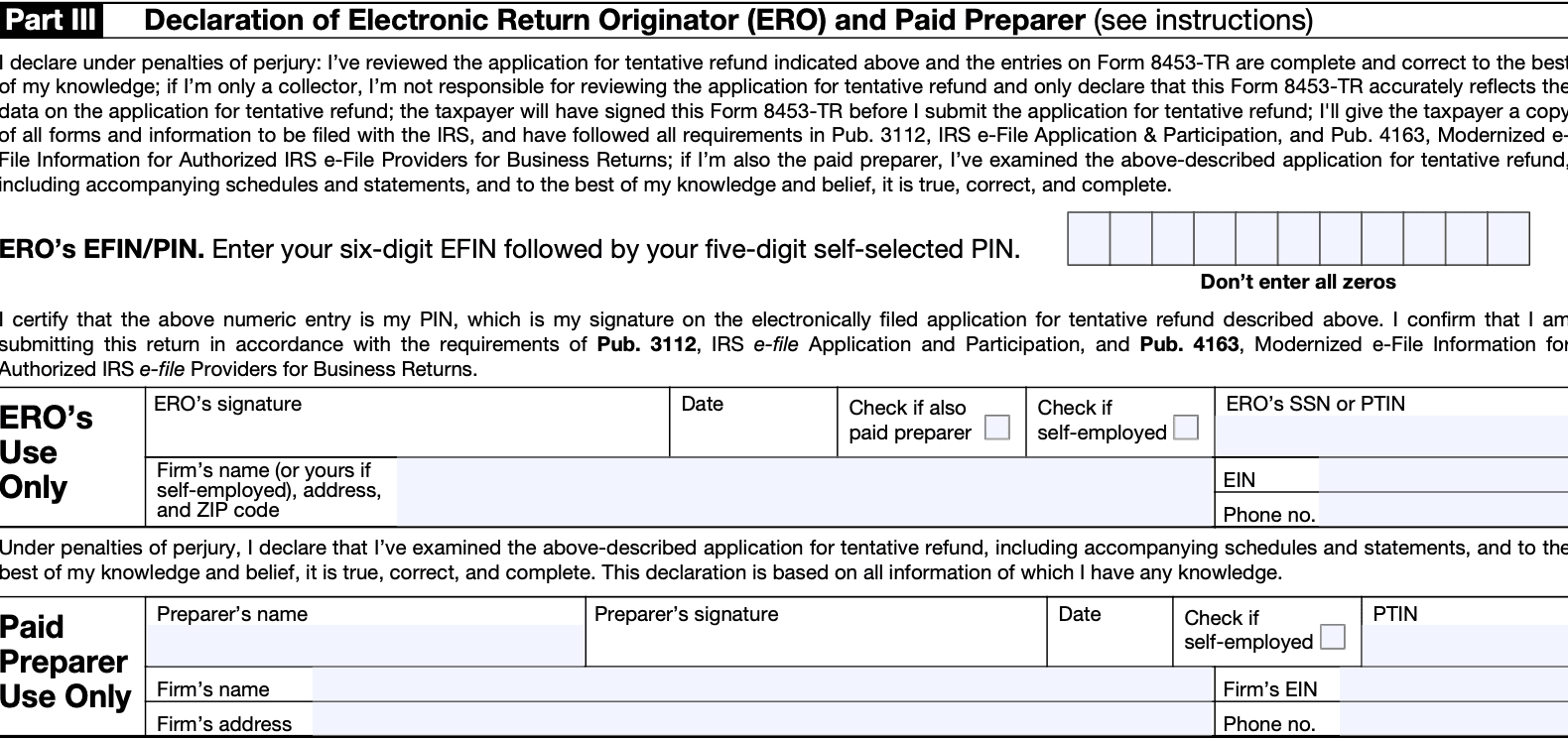

Part III: Declaration of Electronic Return Originator (ERO) and Paid Preparer

In Part III, the ERO and paid tax return preparer declare that the submitted information is complete and correct, under penalty of perjury.

Difference between the ERO and paid preparer

There is a difference between an electronic return originator (ERO) and a paid preparer.

Paid preparer

A paid tax return preparer is anyone who is paid to prepare the estate’s or trust’s tax return. A paid preparer must enter their preparer tax identification number (PTIN) in the paid preparer only portion of Part III.

To receive a PTIN, a paid preparer must complete and submit IRS Form W-12, IRS Paid Preparer Tax Identification Number Application and Renewal to the Internal Revenue Service.

Electronic return originator (ERO)

The ERO is one who deals directly with the fiduciary and either prepares tax returns or collects prepared tax returns, including Forms 8453-TR, for fiduciaries who wish to have the return of the estate or trust electronically filed. The ERO’s signature is required by the IRS.

However, the ERO is not responsible for reviewing the return. The ERO is only responsible for ensuring that the information on Form 8453-TR matches the information on the tax return itself. Additionally, the ERO will give the fiduciary a copy of all forms and information submitted to the IRS.

If also the paid preparer, then the ERO is responsible for reviewing the return. If there is a separate paid tax return preparer, he or she must sign below.

ERO’s use only:

In this section, the ERO will provide:

- Signature & date

- Check if also the paid preparer

- ERO does not need to complete the paid preparer use only section, below

- Check if self-employed

- Social Security number or preparer tax identification number (PTIN)

- Firm’s name or ERO’s name, if self-employed

- Employer identification number (EIN)

- Phone number

Paid preparer use only

In this section, the paid preparer will provide:

- Name

- Signature & date

- Check if self-employed

- PTIN

- Firm’s name

- Firm’s EIN

- Address

- Phone number

Video walkthrough

Are you using the correct Form 8453?

According to the IRS website, there are 14 different versions of IRS Form 8453, including IRS Form 8453-TR. Below is a brief summary of each of the 13 other IRS forms, and what each form does.

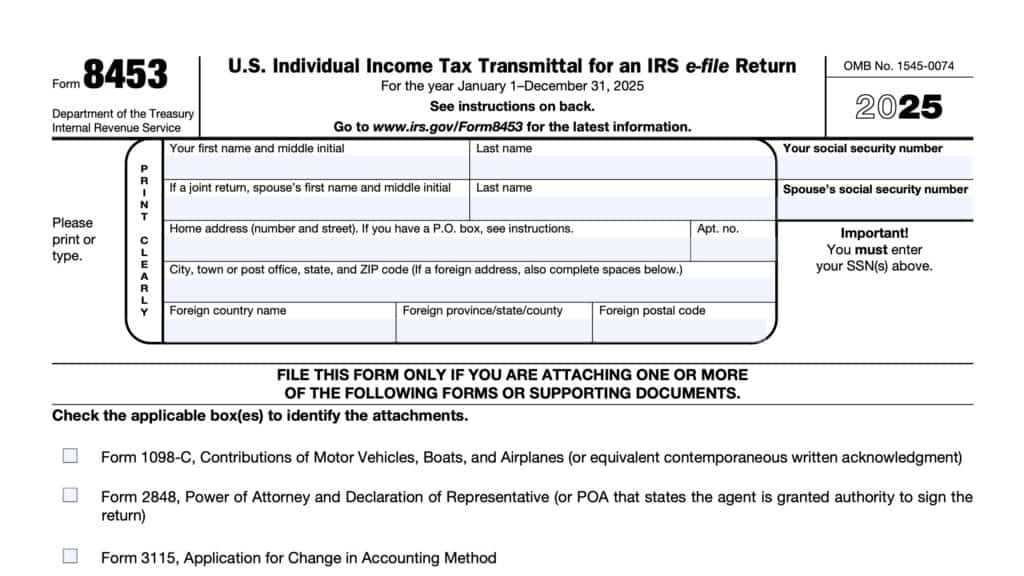

IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return

Individual taxpayers use IRS Form 8453 to send required paper forms or supporting documentation that cannot be submitted to the Internal Revenue Service via electronic means.

IRS Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return (Spanish)

Spanish version of the individual income tax transmittal tax form described above.

IRS Form 8453-CORP, U.S. Corporation Income Tax Declaration for an IRS e-file Return

U.S. corporations use IRS Form 8453-CORP to:

- Authenticate an electronic Form 1120, U.S. Corporation Income Tax Return

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO)

- Provide the corporation’s consent to directly deposit any refund into a bank account and/or authorize a direct debit for payment of federal taxes owed

IRS Form 8453-EG, E-file Declaration for Forms 709, 709-NA, 706, 706-A, 706-GS(D), 706-GS(T), 706-NA, and 706-QDT

Taxpayers use IRS Form 8453-EG to:

- Authenticate an electronic Form 709 and Form 709-NA;

- Authorize the ERO, if any, to transmit via a third-party transmitter;

- Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if you are filing online (not using an ERO); and

- Provide the taxpayer’s consent to authorize an electronic funds withdrawal for payment of federal taxes owed.

IRS Form 8453-EMP, Employment Tax Declaration for an IRS e-file Return

Taxpayers use IRS Form 8453-EMP to:

- Authenticate an electronic Form 940, 940-PR, 941, 941-PR,

- 941-SS, 943, 943-PR, 944, or 945,

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if filing online without using an ERO, and

- Provide taxpayer’s consent to authorize an electronic funds transfer for payment of federal taxes owed

IRS Form 8453-EX, Excise Tax Declaration for an IRS e-file Return

Taxpayers use IRS Form 8453-EX to:

- Authenticate electronic versions of the following forms:

- IRS Form 720

- IRS Form 2290

- IRS Form 8849

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online without an ERO

- Provide taxpayer’s consent for electronic funds withdrawal to pay taxes owed

IRS Form 8453-FE, Estate/Trust Declaration for IRS e-file Return

Taxpayers use IRS Form 8453-FE to:

- Authenticate the electronic Form 1041, U.S. Income Tax Return for Estates and Trusts;

- Authorize the electronic filer to transmit via a third-party transmitter; and

- Authorize an electronic funds withdrawal for payment of federal taxes owed.

IRS Form 8453-PE, U.S. Partnership Declaration for an IRS e-file Return

Partnerships use IRS Form 8453-PE to:

- Authenticate an electronic Form 1065, U.S. Return of Partnership Income, as part of return or administrative adjustment request (AAR)

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO).

IRS Form 8453-R Declaration and Signature for Electronic Filing of Form 8963

Taxpayers use IRS Form 8453-R to authenticate the electronic filing of Forms 8963, Report of Health Insurance Provider Information.

IRS Form 8453-S, U.S. S Corporation Income Tax Declaration for an IRS e-file Return

Prior to tax year 2022, U.S. S-corporations used this tax form to:

- Authenticate an electronic Form 1120-S, U.S. Income Tax Return for an S-Corporation

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the ISP to transmit via a third-party transmitter if filing online (not using an ERO)

- Provide the corporation’s consent to directly deposit any refund into a bank account and/or authorize a direct debit for payment of federal taxes owed

IRS Form 8453-TE, Tax Exempt Entity Declaration and Signature for Electronic Filing

Tax-exempt entities use this tax form to:

- Authenticate one of the following tax forms:

- IRS Form 990, Return of Organization Exempt From Income Tax

- IRS Form 990-EZ, Short Form Return of Organization Exempt From Income Tax

- IRS Form 990-PF, Return of Private Foundation

- IRS form 990-T, Exempt Organization Business Income Tax Return

- IRS Form 1120-POL, U.S. Income Tax Return for Certain Political Organizations

- IRS Form 4720, Return of Certain Taxes Under Chapters 41 and 42 of the Internal Revenue Code

- IRS Form 8868, Application for Automatic Extension of Time To File an Exempt Organization Return

- IRS form 5227, Split-Interest Trust Information Return

- IRS Form 5330, Return of Excise Taxes Related to Employee Benefit Plans, and

- IRS Form 8038-CP, Return for Credit Payments to Issuers of Qualified Bonds

- Authorize the ERO, if any, to transmit via a third-party transmitter

- Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if filing online without using an ERO

- Authorize an electronic funds withdrawal as the payment method for federal taxes owed as determined by one of the following:

- IRS Form 990-PF

- IRS Form 990-T

- IRS Form 1120-POL

- IRS Form 4720

- IRS Form 5330

- IRS Form 8868

IRS Form 8453-WH, Electronic Filing Declaration for Form 1042

Taxpayers use IRS Form 8453-WH to:

- Authenticate an electronic Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons;

- Provide consent to authorize an electronic funds withdrawal for tax payments of the balance due on IRS Form 1042

- Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if you are filing online (not using an ERO); and

- Authorize the ERO, if any, to transmit via a third-party transmitter

IRS Form 8453-X Political Organization Declaration for Electronic Filing of Notice of Section 527 Status

After electronically submitting IRS Form 8871, Political Organization Notice of Section 527 Status, an authorized official must sign, date, and send this send IRS Form 8453-X to the Internal Revenue Service. This allows the political organization to:

- File an amended or final Form 8871, or

- To electronically file Form 8872, Political Organization Report of Contributions and Expenditures.

Frequently asked questions

Taxpayers use IRS Form 8453-TR, E-file Declaration or Authorization for Form 1045/1139, to accompany electronically filed tentative refund claims, when filed by an intermediate service provider (ISP) or electronic return originator (ERO). Taxpayers also use this form to authorize electronic funds transfer for tax payments or refunds.