IRS Form 433-A Instructions

If you’re looking to pay down federal tax debts, you may be able to submit IRS Form 656, Offer In Compromise. This allows you to settle your outstanding tax liability for less than the actual amount that you owe. But to do this, IRS may also require you to complete IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, to provide detailed financial information.

This article will walk you through:

- What IRS Form 433-A is

- When you might need to complete IRS Form 433-A

- How to complete IRS Form 433-A

Let’s begin with step by step instructions on how to complete Form 433-A.

Table of contents

How do I complete IRS Form 433-A?

There are 10 sections to IRS Form 433-A:

- Section 1: Personal and Household Information

- Section 2: Employment Information for Wage Earners

- Section 3: Personal Asset Information (Domestic and Foreign)

- Section 4: Self-Employed Information

- Section 5: Business Asset Information (for Self-Employed) (Domestic and Foreign)

- Section 6: Business Income and Expense Information (for Self-Employed)

- Section 7: Monthly Household Income and Expense Information

- Section 8: Calculate Your Minimum Offer Amount

- Section 9: Other Information

- Section 10: Signatures

We’ll go over each section, one by one. Let’s begin with Section 1.

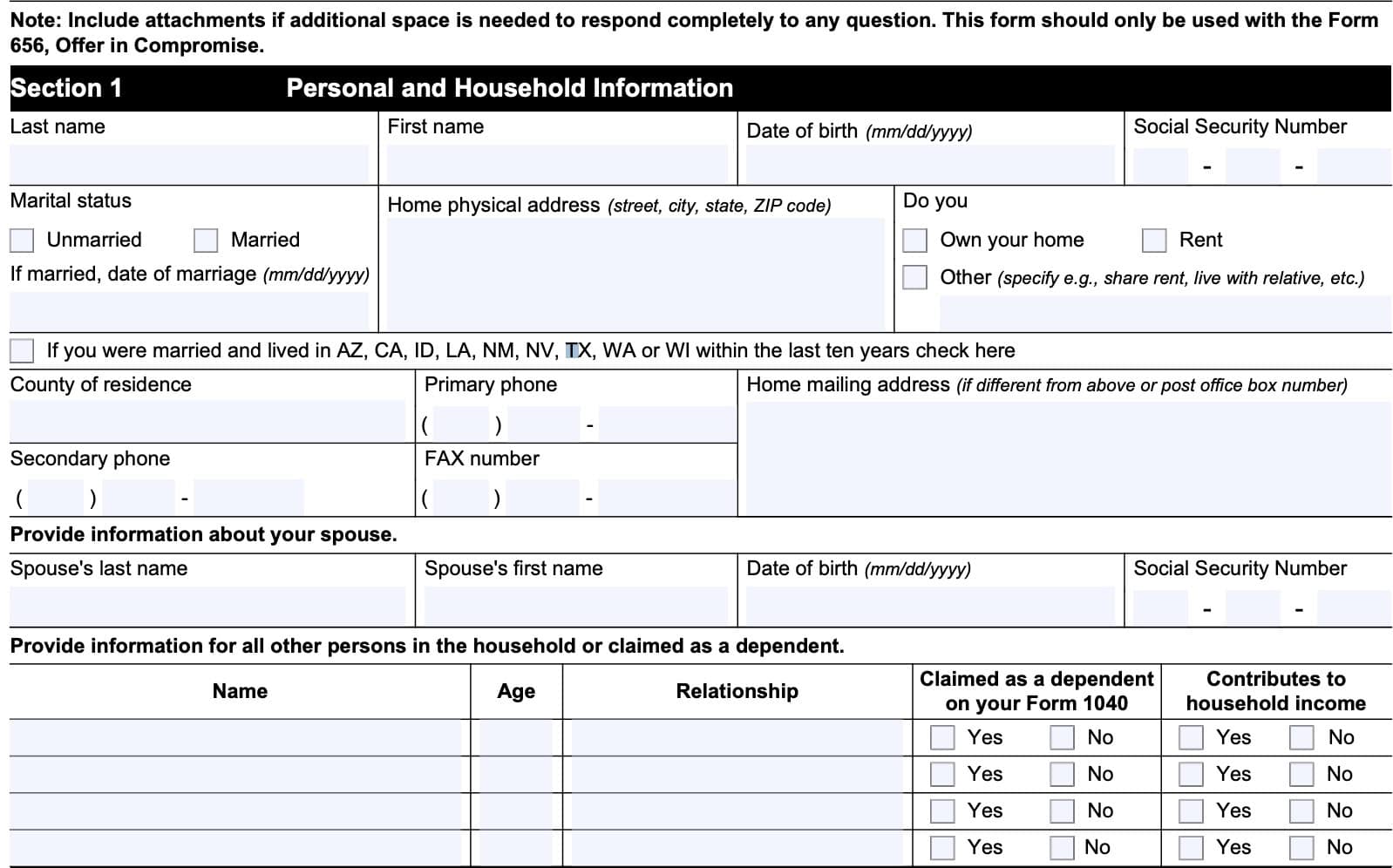

Section 1: Personal and Household Information

In this section, we’ll enter information about yourself and your household. You may attach additional sheets if you need more room.

Taxpayer information fields

Enter the following information:

- Last name

- First name

- Date of birth

- Social Security Number

- Marital status

- If married, enter the date of your marriage in the space provided

- Home physical address

- Own your home or rent

Community property states

If you were married and you lived in one of the following community property states in the previous ten years, check the box provided:

- Arizona

- California

- Idaho

- Louisiana

- New Mexico

- Nevada

- Texas

- Washington

- Wisconsin

Additional taxpayer information

Below this field, complete the following information:

- County of residence

- Primary and secondary phone number

- Fax number, if available

- Home mailing address, if different from the physical address listed above

Spouse information

If applicable, enter the following information about your spouse:

- Last name

- First name

- Birth date

- Social Security number

Household member information

Provide the following information for each member of your household as applicable:

- Name

- Age

- Relationship

- Whether you can claim the person as a dependent

- Whether this person contributes to household income

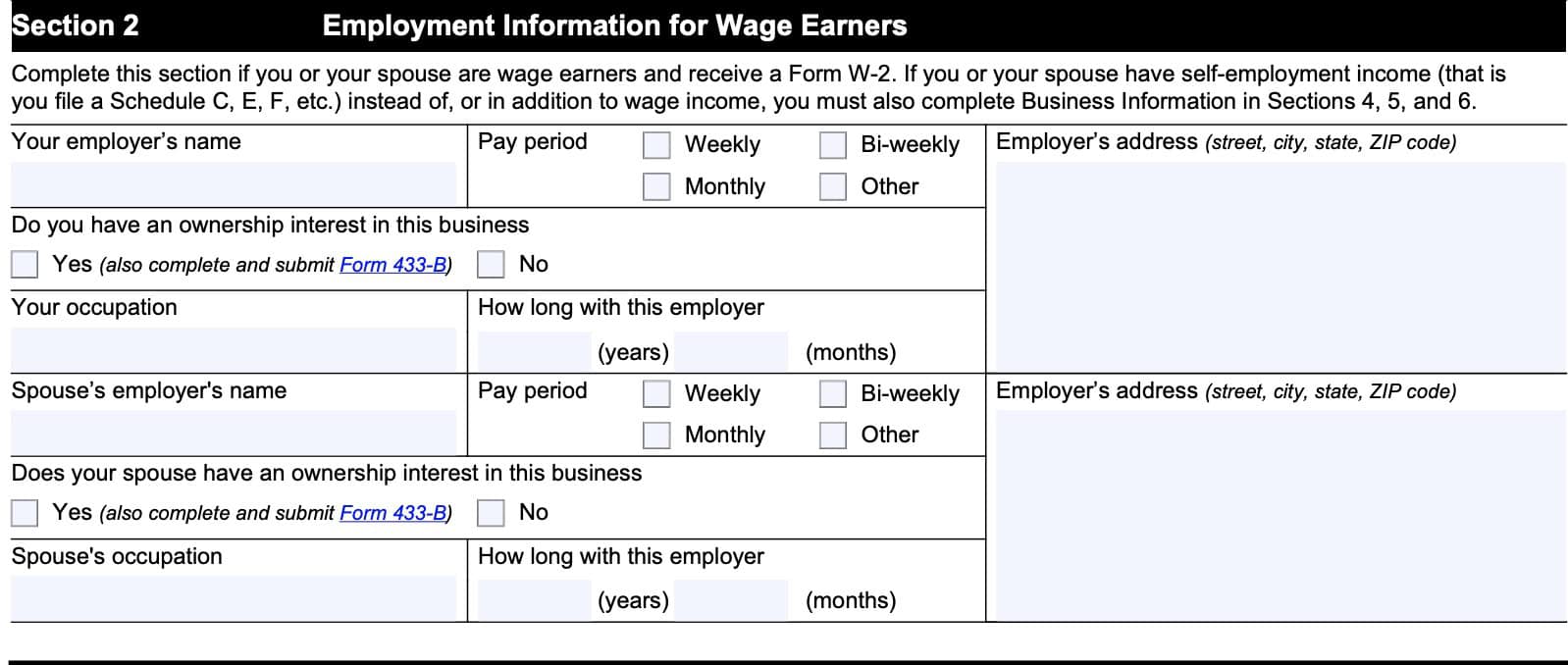

Section 2: Employment Information for Wage Earners

Only complete Section 2 if you or your spouse:

- Are wage earners, and

- Receive IRS Form W-2 to report wage income

If you or your spouse have self-employment income in addition to wage income, you must also complete the Business Information fields in Sections 4 through 6. If you only have self-employment income, you can skip directly to Section 3.

Employer information

Enter the following with regards to your employment relationship:

- Employer’s name

- Pay schedule

- Weekly

- Bi-weekly

- Monthly

- Other

- Employer’s address

- Whether or not you have an ownership in the business

- If so, you may also need to complete IRS Form 433-B

- Your occupation

- How long you’ve been with the employer

Spouse’s employer information

If your spouse earns wage income, you’ll need to complete the same fields as well.

Section 3: Personal Asset Information (Domestic and Foreign)

Section 3 contains information about your personal assets. Before we begin, below is some additional information from the form instructions:

- Use current statements for each type of account

- The IRS may adjust your numbers based on your financial situation

- You can use additional space or include attachments if you need to

- Include assets located outside the United States

Section 3 is broken down into the following:

- Cash and investments

- Real property

- Vehicles

- Other valuables

Let’s take a closer look at each one, beginning with cash and investments.

Cash and investments

This part is broken down further into the following:

- Line 1: Banking accounts

- Line 2: Investment accounts

- Line 3: Retirement accounts

- Line 4: Cash value of life insurance policies

Feel free to skip any lines that do not apply to you.

Line 1: Banking accounts

List the following for each account or type of asset that you have:

- Type of asset (cash, checking/savings, money market, online, stored value card)

- Bank name and country location

- Account number

Enter this information for each of the following accounts:

- Line 1a: First account (or cash)

- Line 1b: Second account

- Line 1c: Total of any additional accounts

Add Lines 1a through 1c, then subtract $1,000. Enter this amount in Line 1.

Line 2: Investment accounts

For each investment account, enter the following information:

- Type of investments (stocks, bonds, other)

- Name of financial institution and country location

- Account number

- Current market value

- Use the space provided to multiply this amount by 0.8

- Loan balance (margin accounts)

Perform this calculation for Lines 2a and 2b, as necessary.

Digital assets

If you have digital assets, check the box marked Digital asset and enter the following:

- Description

- Number of units

- Location of digital asset

- Digital asset address (for self-hosted digital assets)

- U.S. dollar equivalent as of today’s date

Enter the total amount of digital assets in Line 2c.

If you have additional accounts, enter the total balances from those accounts (market value minus loan balances) in Line 2(d).

Add Lines 2a through 2d and enter the total in Line 2.

Line 3: Retirement accounts

For your retirement account(s), you will need to provide the following information:

- 401k, IRA, or other account (check the applicable box)

- Name and country location of financial institution

- Account number

Note: Towards the bottom of Line 3, you’ll see: “Your reduction from current market value may be greater than 20% due to potential consequences/withdrawal penalties. So why this note?

In the previous lines, the 20% reduction calculation helps the IRS’ calculation when using your Form 433-A to determine what you can afford to pay, based on your offer in compromise. However, for retirement accounts, the IRS may need to discount this amount by more than 20% because of the taxes and penalties that may be involved.

In other words, the IRS probably won’t force you to pull money from your retirement accounts, but they want to make sure that those account balances are accounted for when figuring out how much you can pay.

From a taxpayer’s perspective, having a smaller number is actually a good thing. Remember, the less money you have (or appear to have), the more likely the Internal Revenue Service is to accept lower payment amounts to avoid creating a financial hardship for you. Back to the instructions.

Line 3a

Enter the current market value of your investments in the applicable field. Multiply the full amount by 0.8, then enter the answer in the space provided. Finally, subtract any outstanding loan balances.

Enter this final amount in Line 3a.

Line 3b

In Line 3b, enter the total of any additional retirement accounts using the same formula as in Line 3a: (Current market value X 0.8) minus outstanding loan balances.

Be sure to include any attachments with the requested retirement account information.

Add Line 3a and Line 3b, and enter the total in Line 3.

Line 4: Cash value of life insurance policies

Enter the following information here:

- Name of your insurance company

- Policy number for your life insurance policy

Line 4a: Current cash value

In Line 4a, you’ll enter the following information in the lines provided:

- Current cash value of your life insurance policy

- Any outstanding loan balances on the policy

- Net cash value (cash value minus loan balances)

Note: Not all life insurance policies have a cash value. By their very nature, term life insurance policies (such as a 30-year term policy) generally have no cash value.

If your only life insurance coverage are term policies, skip this section.

Line 4b: Total cash value

If you have more than one life insurance policy with a cash value component, use a separate page to document the cash value and loan balances for each additional policy.

Use Line 4b to enter the total of the following as documented on the attachment:

- Current cash value of your life insurance policy

- Any outstanding loan balances on the policy

- Net cash value (cash value minus loan balances)

Real property

Real property consists of real estate that you or your spouse may own. This includes assets owned by your spouse if you live in a community property state.

Is the property for sale?

In this section, you’ll answer the question, “Is your real property currently for sale or do you anticipate selling your real property to fund the offer amount?” If Yes, then enter the listing price or anticipated listing price.

Line 5a

For each property that you own, you’ll enter the following information:

- Property description

- Indicate if this is a personal residence, rental property, vacant property, etc

- Purchase date

- Use MM/DD/YYYY format

- Amount of mortgage payment

- Date of final payment

- How the property is titled

- Location

- Include complete street address

- Lender information

- Current market value

- Multiply by 0.8 and enter the result in the space provided

- Loan balance

When you’ve finished the calculation, enter the result in the space provided for Line 5a. If there are no other real properties, proceed to the next section.

Line 5b

If necessary, repeat the steps you followed in Line 5a. Enter the result in the space provided in Line 5b.

Line 5c

This form only contains space for two properties. If you have additional properties, then enter the same information provided on Line 5a onto a separate sheet.

Enter the sum of all values into the space provided on Line 5c. Use the same formula used in Lines 5a and 5b, then total all sums together.

Enter on Line 5 the total of Lines 5a, 5b, and 5c.

Vehicles

Enter the required information for each vehicle that you own or lease, even if it’s located in a foreign country. There is sufficient space on this form for up to two vehicles.

If you need more space, use a separate sheet to list the required information, and use Line 6e below to report the value of these vehicles.

For each vehicle that you own, you’ll need to include the following information:

- Vehicle make and model (e.g. Ford F-150)

- Year of the vehicle

- Date of purchase

- Vehicle mileage

- License plate number

- Whether you lease or own the vehicle

- Name of creditor (if you have financing)

- Date of your final payment

- Monthly payment amount

- Current market value

- Also multiply this figure by 0.8 and enter the answer in the space provided

- Loan balance

Line 6a

For your first vehicle, enter the difference between the modified market value (market value X 0.8) and loan balance.

Line 6b

Subtract $3,450 from the amount on Line 6a. If this results in a negative number, enter ‘0.’

Line 6c

For your second vehicle, enter the difference between the modified market value (market value X 0.8) and loan balance.

Line 6d

Subtract $3,450 from the amount on Line 6c. If this results in a negative number, enter ‘0.’

Line 6e

Enter the total value of vehicles from the attachment. Use the formula provided for calculating vehicle value on Lines 6a and 6c.

Enter the total of the following lines on Line 6:

- Line 6b

- Line 6d

- Line 6e

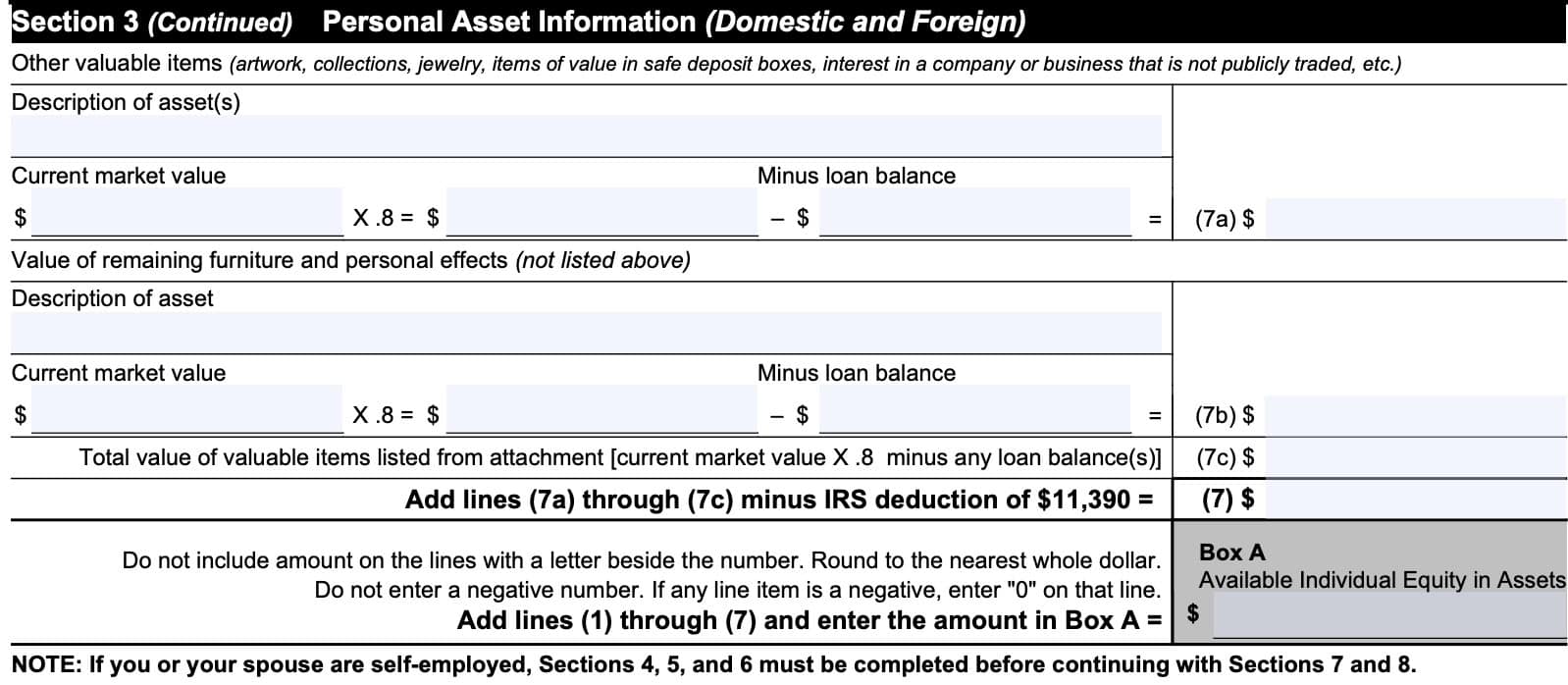

Other valuables

If you have other valuable items not previously listed, you’ll enter this information here. This could include any of the following:

- Artwork

- Collectibles or collections

- Jewelry

- Valuables

- Business interests

- Furniture & other personal effects

For each item, you’ll need to enter the following information:

- Asset description

- Current market value

- Also multiply this figure by 0.8 and enter the answer in the space provided

- Loan balance

If you have more than two items, then you’ll need to include a separate attachment with the requested information.

Line 7a

For your first valuable, enter the difference between the modified market value (market value X 0.8) and loan balance.

Line 7b

Enter the value of your furniture and personal effects not previously listed. You calculate this value in the same manner as previously described: (market value times 0.8) minus loan balance.

Line 7c

Enter the combined value on all items listed on a separate attachment.

Combine Line 7a, Line 7b, and Line 7c. Subtract $11,390 from this amount, and enter the total onto Line 7.

Box A: Available individual equity in assets

Add Lines 1 through 7, and enter the total in Box A. This is known as your Available Individual Equity in Assets, and will be used in Section 8, below.

Use the following guidelines:

- Do not include any amounts on lines with a letter beside the number (i.e. Line 7b)

- Round off to the nearest whole dollar

- Do not enter any negative figures

- Enter ‘0’ for any number that is negative

If either you or your spouse are self-employed, you must complete Sections 4 through 6, beginning with Section 4. Otherwise, you may be able to proceed directly to Section 7, below.

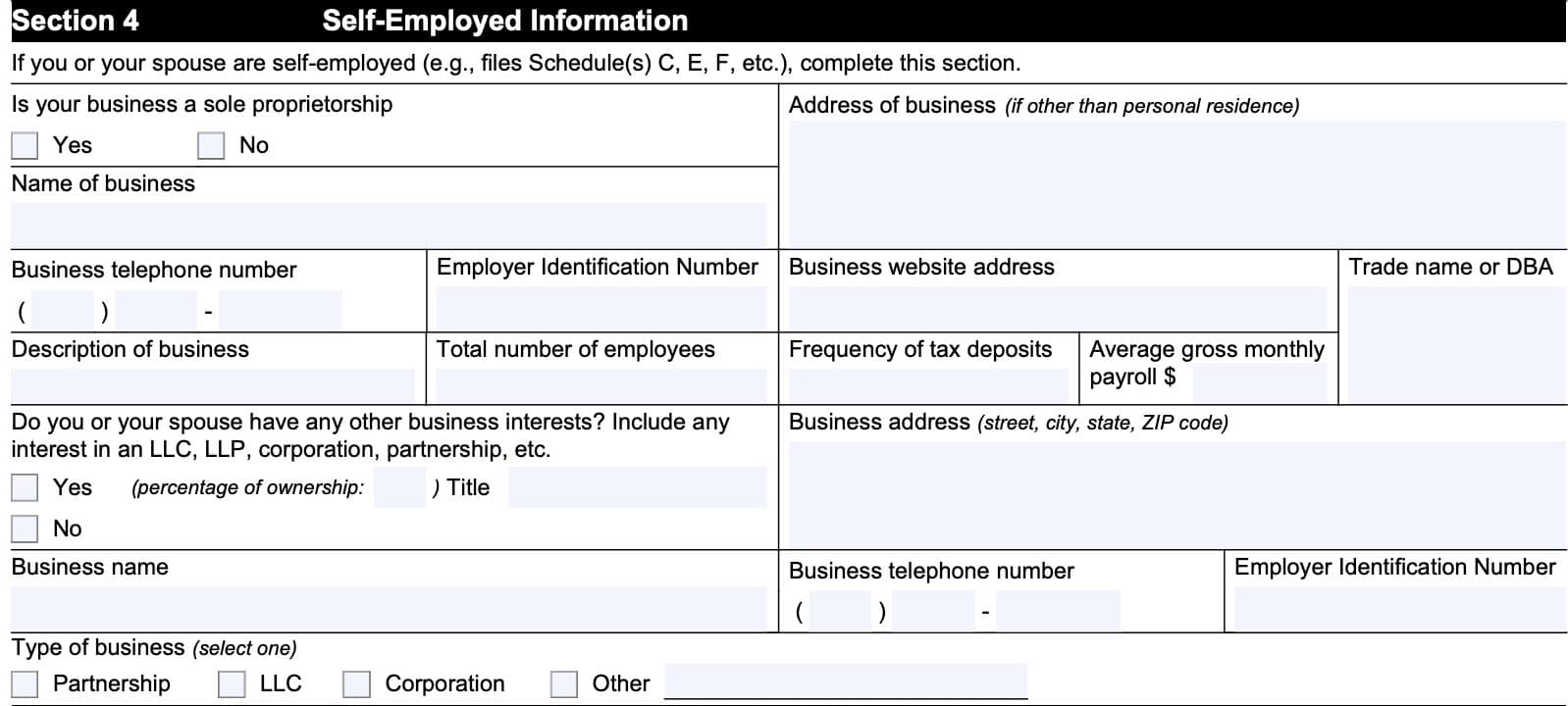

Section 4: Self-Employed Information

If either you or your spouse are self-employed, you’ll need to complete this section.

Who qualifies as self-employed?

According to the Internal Revenue Service, you are self-employed if any of the following apply to you:

- You are in business for yourself (including part-time or as a gig worker)

- You carry on a trade or business as a sole proprietor or independent contractor

- You are a member of a partnership that carries on a trade or business

Generally, self-employed individuals will file one (or more) of the following tax forms when filing their income tax return:

- Schedule C, Profit or Loss from Business

- Schedule E, Supplemental Income

- Schedule F, Profit or Loss from Farming

Self-employed individuals generating a profit will also file Schedule SE to report and pay self-employment taxes.

If this applies to you, then you’ll need to complete Section 4. Enter the following information:

- Sole proprietorship (default for taxpayers who don’t establish a tax entity such as an S corporation)

- Name and address of business, if not located with personal residence

- Business telephone number

- Employer identification number

- Website

- Trade name or DBA

- Description of business

- Total number of employees

- Frequency of tax deposits

- Average gross monthly payroll

- Ownership in other business interests

- If so, enter name, address, telephone number, EIN, and type of business entity

Once you’ve completed Section 4, move on to Section 5.

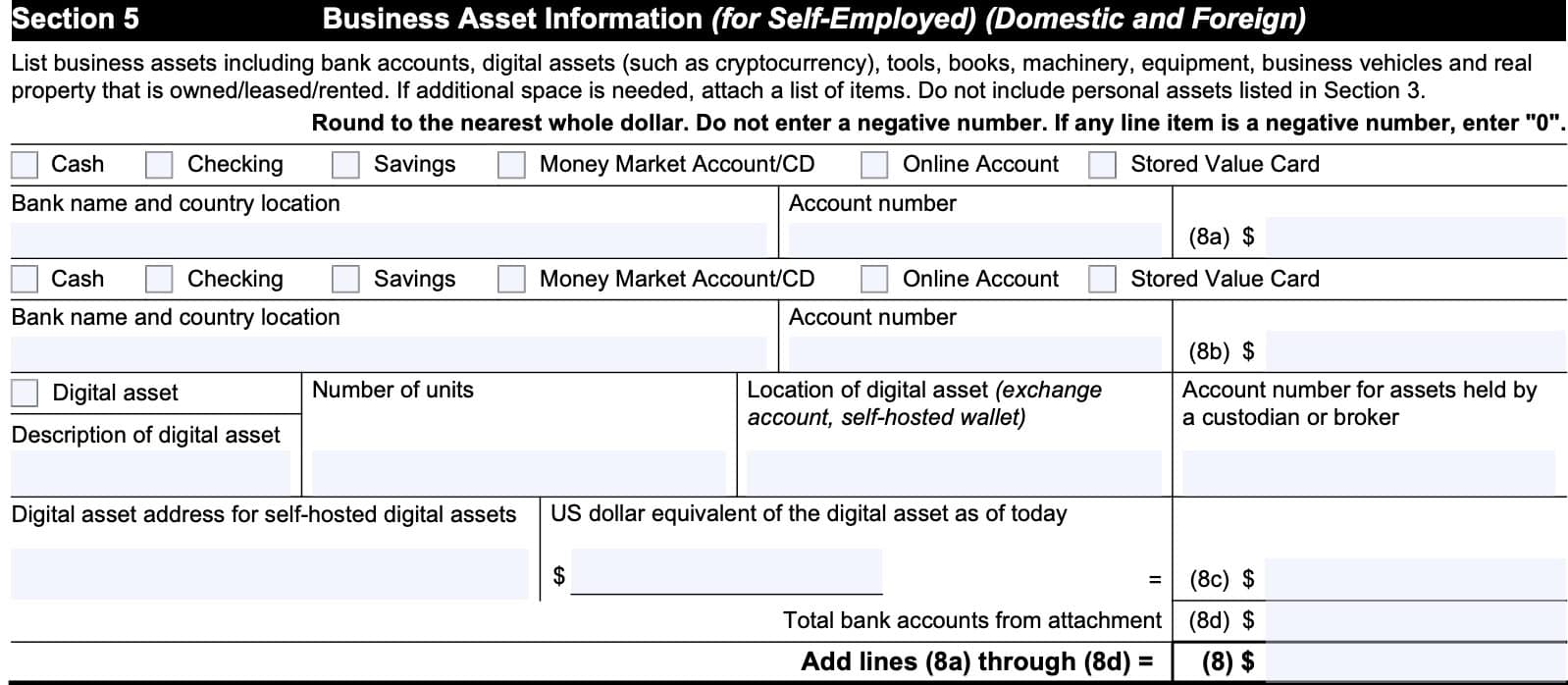

Section 5: Business Asset Information (for Self-Employed) (Domestic and Foreign)

In this section, you’ll list business assets as follows:

- Line 8: Financial and digital assets

- Line 9: Business non-financial assets

- Line 10: IRS deductions

- Line 11: Total value of all business assets

Let’s begin with Line 8.

Line 8

This line is broken down into several parts:

- Line 8a: Primary financial account information

- Line 8b: Secondary financial account information

- Line 8c: Digital assets

- Line 8d: Total bank accounts from separate attachment

Line 8a: Primary financial account information

For Line 8a, complete the following:

- Type of asset

- Bank name and country location

- Account number

Enter the total amount in the space provided for Line 8a.

Line 8b: Secondary financial account information

For Line 8b, complete the following, in a similar manner as Line 8a:

- Type of asset

- Bank name and country location

- Account number

Enter the total amount in the space provided for Line 8b.

Line 8c: Digital assets

Enter the following with regards to digital assets:

- Digital asset description

- Number of units

- Location of digital assets (exchange account, self-hosted cryptocurrency wallet)

- Account number (if held by a custodian or broker)

- Digital asset address (if self-hosted)

- U.S. dollar equivalent

Enter the total value in Line 8c where indicated.

Line 8d: Total bank accounts from separate attachment

For all other financial business assets, create a separate document with the information indicated in Lines 8a and Line 8b. Enter the total value of all assets where indicated in Line 8d.

Add Lines 8a through 8d and enter the total in Line 8. Do not use negative numbers in any line.

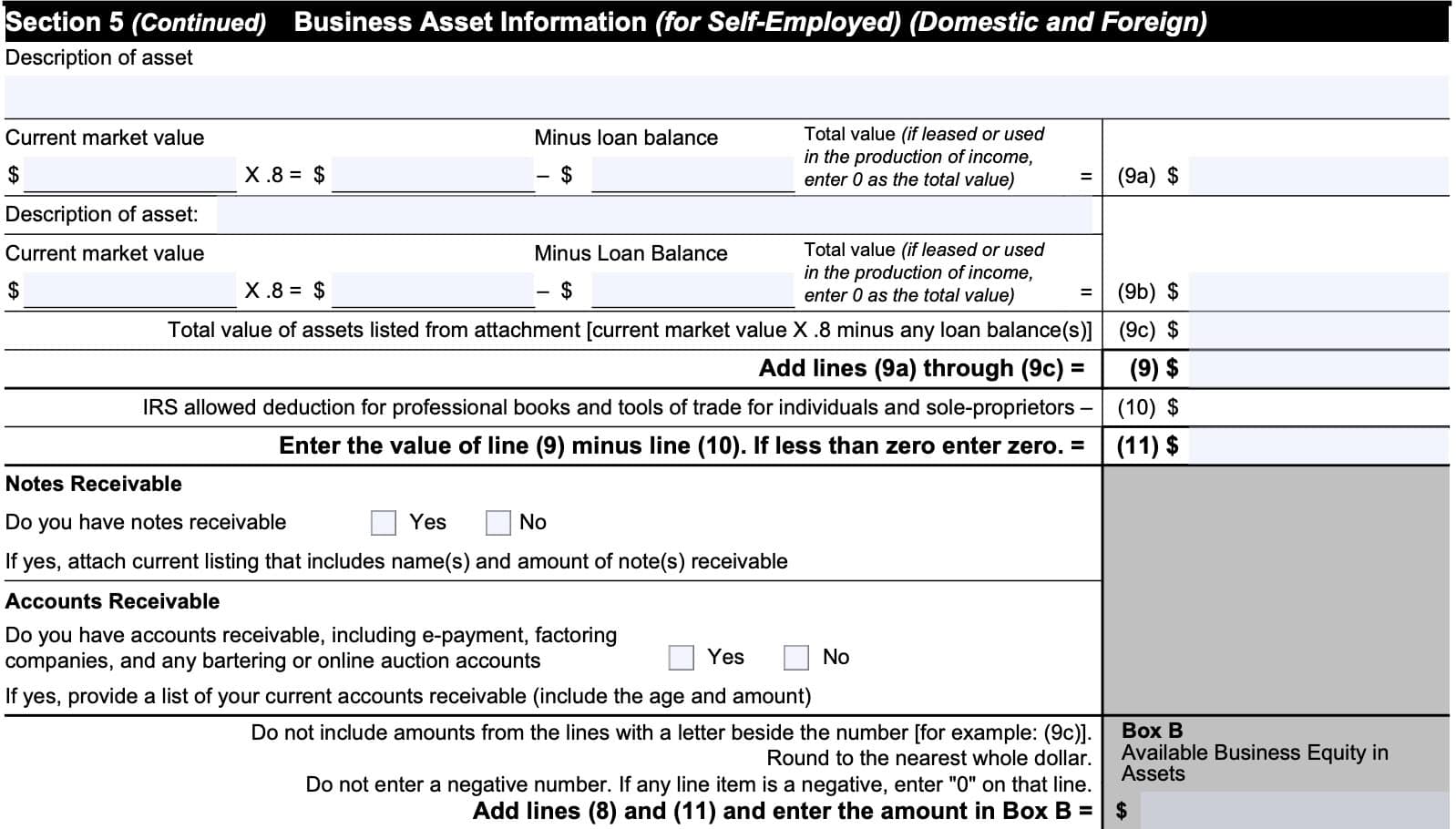

Line 9: Business assets

For other business assets, you’ll need to provide the following information:

- Asset description

- Current market value

- Also multiply this figure by 0.8 and enter the answer in the space provided

- Loan balance

Line 9a

Using the formula outlined above, enter the total value of the first business asset. If you lease this asset or if it is used in the production of income, enter ‘0’ as the total value.

Line 9b

Using the formula outlined above, enter the total value of the second business asset. If you lease this asset or if it is used in the production of income, enter ‘0’ as the total value.

Line 9c

If you have more than two business assets, you’ll need to create a separate document listing the calculated values of each business asset. Enter the total value of all business assets in the attachment in Line 9c.

Add Line 9a, Line 9b, and Line 9c. Enter the total in the space provided for Line 9.

Line 10

In Line 10, enter any IRS-allowed deduction for professional books and tools of trade for individuals and sole-proprietors.

Note: At the time of this writing, there appears to be no current guidance on what this deduction may look like. You may need to leave this line blank, and ask the IRS for guidance when you’ve completed other lines on this form.

Line 11

Subtract Line 10 from Line 9. Enter the result in Line 11, then answer the following questions by checking Yes or No.

- Do you have notes receivable?

- Do you have accounts receivable?

If you answer Yes to either question (or both), then provide a current listing that includes the following information:

- Name

- Amount of note(s) receivable or account(s) receivable

- If reporting accounts receivable, include the age of the receivables

Box B: Available business equity in assets

Using the following guidelines, subtract Line 11 from Line 8, and enter the difference:

- Do not include any amounts on lines with a letter beside the number (i.e. Line 7b)

- Round off to the nearest whole dollar

- Do not enter any negative figures

- Enter ‘0’ for any number that is negative

This is known as the Available Business Equity in Assets, and will be used in Section 8, below.

Section 6: Business Income and Expense Information (for Self-Employed)

Section 6 contains business income and expense information. Before proceeding, let’s highlight a couple of notes:

- If you provide a profit and loss (P&L) statement, you can simply enter the following:

- Line 17: Gross Income

- Line 29: Monthly expenses

- Do not complete Lines 12 through 16 or 18 through 28

- You can use amounts for your most recent Schedule C

- Submit a current P&L statement if there have been significant changes

Period covered

In the space provided, enter the beginning date and ending date of the period covered.

Note: The instructions indicate that taxpayers may average 6-12 months of income and expenses to arrive at average income and average expense amounts.

Business income

Unless attaching a P&L statement, enter business income items in the spaces provided. These should be monthly amounts, which you can average. Be sure to double-check that your average amounts represent the period reported above.

Enter your items of income as follows:

- Line (12): Gross receipts

- Line (13): Gross rental income

- Line (14): Interest income

- Line (15): Dividends

- Line (16): Other income

- Line (17): Total of Lines (12) through (16)

Line (17) represents your total business income.

Business expenses

Unless attaching a P&L statement, enter business income items in the spaces provided. These should be monthly amounts, which you can average. Be sure to double-check that your average amounts represent the period reported above. Also, be sure that you are using the same period for business expenses and business income.

Enter your expenses as follows:

- Line (18): Materials purchased (directly related to production)

- Line (19): Inventory purchased (for resale)

- Line (20): Gross wages and salaries

- Line (21): Rent

- Line (22): Supplies (can be consumed within 1 year and used to conduct business)

- Line (23): Utilities & telephones

- Line (24): Vehicle costs (gasoline, oil, maintenance)

- Line (25): Business insurance

- Line (26): Current business taxes

- Line (27): Secured debts (not including credit card debt)

- Line (28): Other business expenses

- Line (29): Add Lines (18) through (28)

Line (29) represents your total business expenses

Box C: Net business income

Subtract Line (29) from the total monthly business income reported in Line (17). This represents Net Business Income, which you will use in Section 8, later.

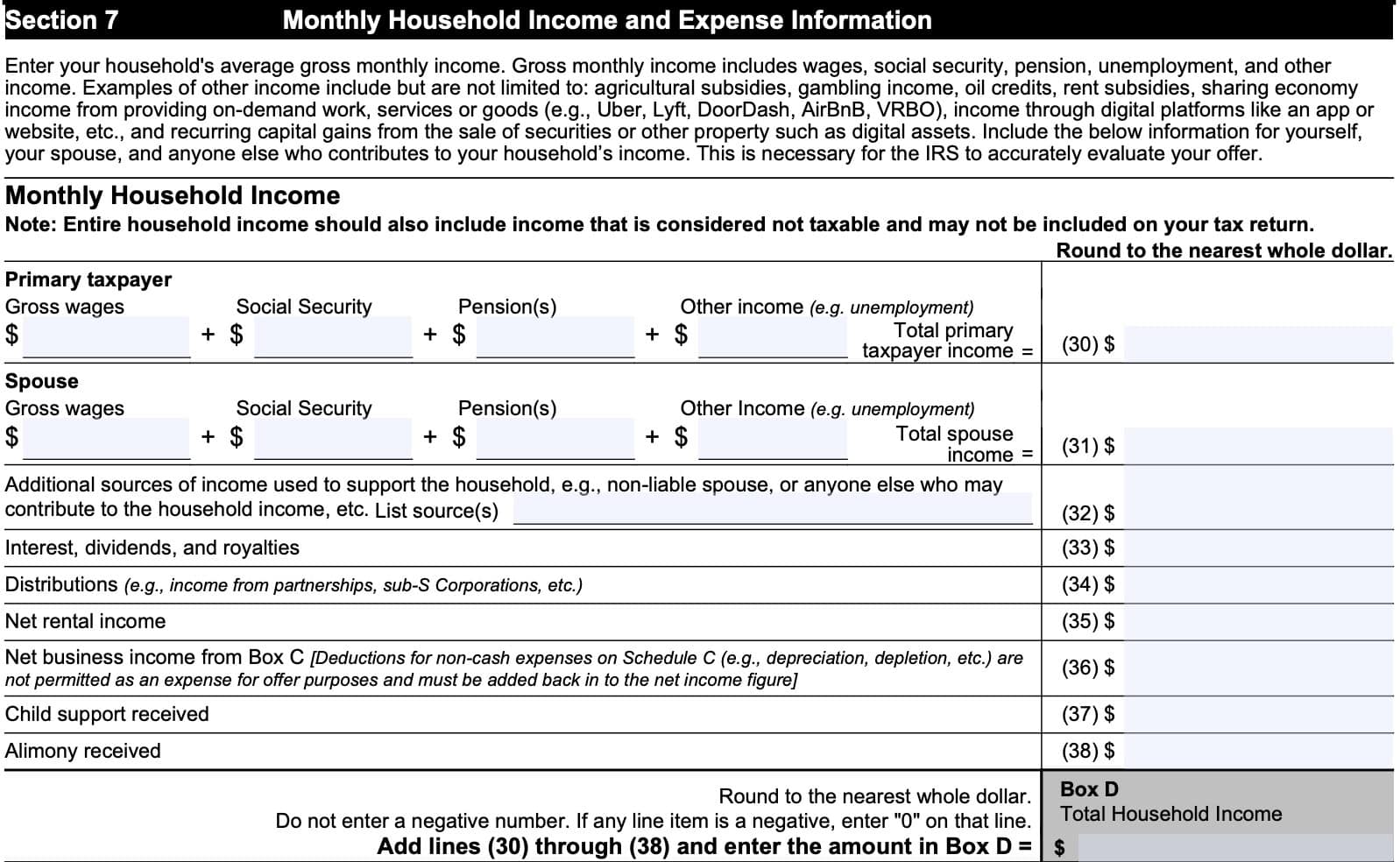

Section 7: Monthly Household Income and Expense Information

There are two parts to Section 7:

- Monthly Household Income

- Monthly Household Expenses

Let’s first look at the monthly household income figures.

Monthly household income

In this section, you’ll report your household’s average gross monthly income. According to the IRS, gross monthly income includes the following:

- Wage income

- Social Security

- Pension income

- Unemployment compensation

- Other income

- Includes, but not limited to agricultural subsidies, gambling income, oil credits, rent subsidies, sharing economy (or gig work) income, capital gains

You’ll need to include this information for yourself, your spouse, and any other household member that contributes to your household’s income.

Line 30: Primary taxpayer

For the primary taxpayer, enter the following information in the spaces provided (monthly amounts):

- Gross wages

- Social Security income

- Pension payments

- Other income

Add these figures together and enter the total in Line 30. This represents the primary taxpayer’s total monthly income.

Line 31: Spouse

For the spouse, enter the following information in the spaces provided (monthly amounts):

- Gross wages

- Social Security income

- Pension payments

- Other income

Add these figures together and enter the total in Line 31. This represents the spouse’s total income for the month.

Line 32: Additional sources of income used to support the household

List any additional sources of income used to support the household. This could come from anyone who might contribute to the household income.

List the sources in the space provided, then enter the total in Line 32.

Line 33: Interest, dividends, and royalties

Enter the total monthly amounts for all of the following types of payment:

- Interest

- Dividend income

- Royalty income

Line 34: Distributions

In Line 34, enter the total of any distribution income received by the household. This includes income from partnerships or S-corporations.

Line 35: Net rental income

In Line 35, enter the net rental income received by the household. This is gross monthly rents minus operating expenses.

Line 36: Net business income from Box C

In Line 36, enter the net business income previously reported in Box C. You’ll find this information in Section 6, above.

Line 37: Child support received

In Line 37, enter the total monthly payments for child support received by the household.

Line 38: Alimony received

Enter the total monthly alimony received by the household in Line 38. This is also known as spousal support.

Box D: Total Household Income

Add Lines 30 through 38 and enter the total in Box D. This represents Total Household Income.

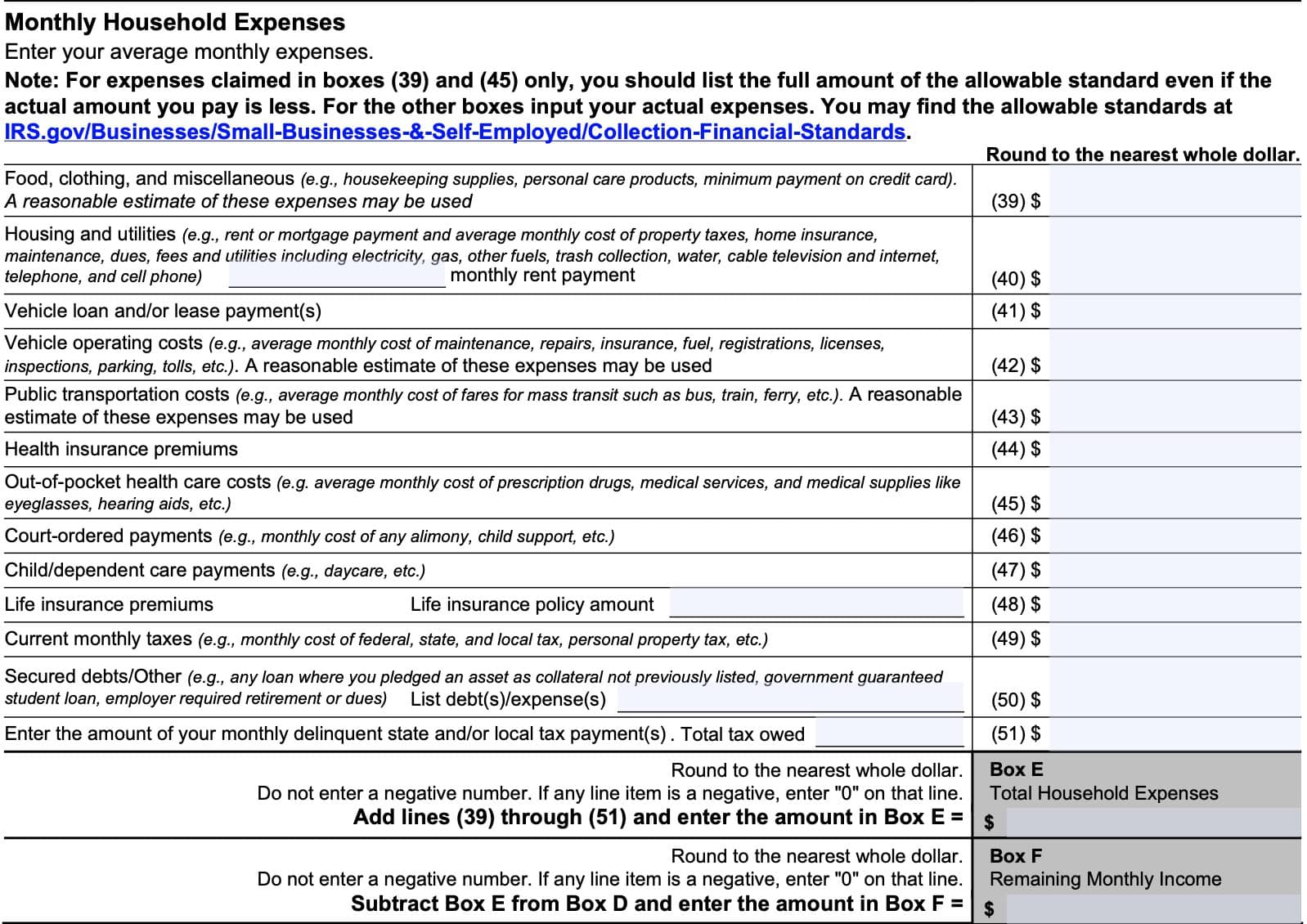

Monthly household expenses

After completing the monthly household income portion, we’ll report monthly household expenses as outlined below. For each line, enter the average monthly cost.

Line 39: Food, clothing, and Miscellaneous expenses

Enter a reasonable estimate of food, clothing, and other expenses, such as:

- Housekeeping supplies

- Personal care products

- Minimum credit card payments

Line 40: Housing and utilities

Enter the average monthly total for the following costs:

- Rent or mortgage payment

- If renting, enter the monthly rent payment in the space provided

- Property taxes

- Homeowner’s insurance policy

- Home maintenance

- Homeowner’s association or CDD dues

- Utilities, such as electricity, gas or fuel, trash, water, cable & internet, or telephone

Line 41: Vehicle loans or lease payments

On Line 41, enter the total monthly loan or lease payments for vehicles in your household.

Line 42: Vehicle operating costs

Enter the average monthly cost of the following vehicle-related operating costs:

- Maintenance and repairs

- Auto insurance

- Fuel

- Registrations, licenses, inspections

- Parking and tolls

Line 43: Public transportation

Enter a reasonable estimate of monthly public transportation costs.

Line 44: Health insurance

In Line 44, enter the average health insurance premiums.

Line 45: Out of pocket health care costs

Enter the average monthly out of pocket health care costs. These are health-related expenses not covered by your health insurance or a cafeteria plan.

Line 46: Court-ordered payments

Enter the total monthly cost of any court-ordered payments, such as alimony or child support.

Line 47: Child or dependent care payments

In Line 47, enter the monthly amount for child or dependent care. This could include day care or in-home care.

Line 48: Life insurance premiums

If you have a life insurance policy, enter the total policy amount in the space provided. In Line 48, enter the total monthly amount of your homeowner premiums.

Line 49: Current monthly taxes

Enter the current monthly amount of taxes not otherwise reported elsewhere. For example, if you reported property taxes in Line 40, do not include that amount here. However, this could include the monthly amounts of federal, state, or local income tax, personal property tax, or other taxes not previously reported.

Line 50: Secured loans or debts

For any loan where you’ve pledged an asset as collateral, but have not previously listed it, list the debt or expense in the space provided, and the monthly payment amount in Line 50.

This could include employer-required retirement payments, federally subsidized student loans, etc.

Line 51: Delinquent state or local tax payments

If you’re making payments on delinquent state or local tax, enter the monthly payment amount here.

Box E: Total Household Expenses

Add Lines 39 through 51 and enter the total in Box E. This represents total household expenses.

Box F: Remaining Monthly Income

Subtract Box E from Box D, calculated earlier in Section 7. Enter the difference in Box F.

This represents remaining monthly income, and will be used in Section 8, next.

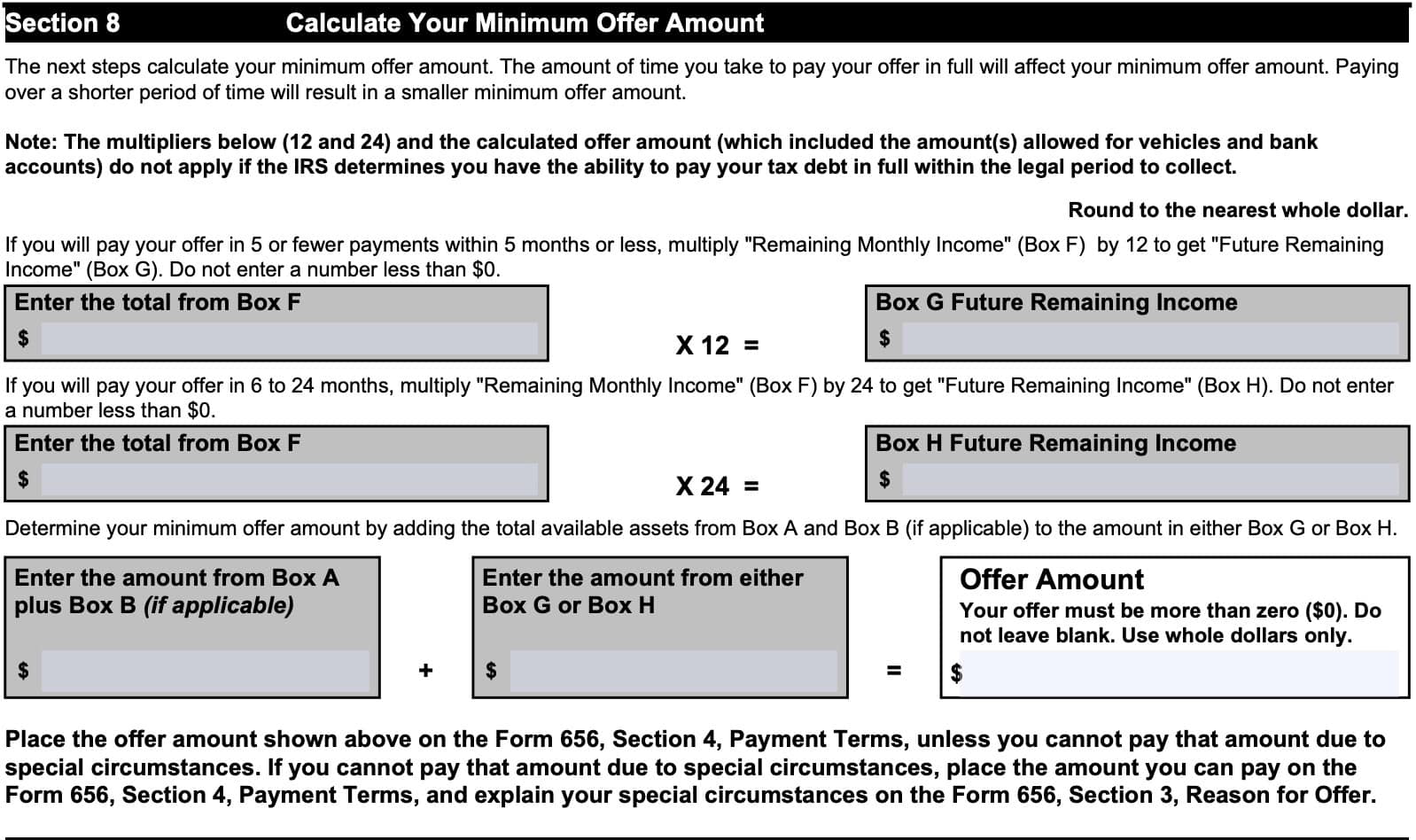

Section 8: Calculate Your Minimum Offer Amount

In Section 8, we’ll calculate your minimum offer amount.

According to the instructions, the amount of time you take to pay your offer in full will impact your minimum offer amount. If you pay over a shorter period of time, you should have a smaller minimum offer amount.

Before you begin, you will need the following figures, previously calculated:

- Box A: Available Individual Equity in Assets, calculated in Section 3

- Box B: Available Business Equity in Assets, calculated in Section 5

- Box F: Remaining Monthly Income, calculated in Section 7

You’ll use these figures to determine your offer amount. But first, you must calculate future remaining income, as indicated by either Box G or Box H. To determine which box to calculate, first determine the period of time you wish to make your payments:

- Box G: 5 or fewer payments occurring within 5 months or less (less than 6 months)

- Box H: 6 to 24 months

Box G: Future Remaining income

If you choose to pay your tax amount within 6 months, you can use this formula to calculate your future remaining income amount:

Box F amount X 12 = Box G.

For example, if your Box F amount is $1,000, then you would multiply $1,000 by 12, and enter $12,000 in Box G. This is the amount that you would carry use when calculating minimum offer amount (see Determine Your Minimum Offer Amount, below).

Box H: Future Remaining Income

If you choose to pay your tax liability over a 6 – 24 month timeframe, use this formula to calculate your future remaining income amount:

Box F amount X 24 = Box H.

Using the previous example, multiply your $1,000 by 24, and enter $24,000 in Box H. This is the amount that you would carry use when calculating minimum offer amount (see Determine Your Minimum Offer Amount, below).

Determine your minimum offer amount

There are several steps here:

- Add Box A and Box B amounts. Enter the total in the first box provided.

- Enter the amount from either Box G or Box H in the second box.

- Add the amounts in the two boxes and enter the total in the third box. This is your offer amount.

Your offer amount must be more than $0, and cannot be left blank. Use whole dollar amounts only.

Completing your Form 656

When completing your Offer in Compromise, or Form 656, you’ll enter the offer amount in Section 4, Payment Terms, unless you cannot pay that amount due to special circumstances.

If you cannot pay the offer amount, then enter the following information on Form 656:

- Section 3, Reason for Offer: Explain your special circumstances preventing you from paying the full offer amount

- Section 4, Payment Terms: Enter the amount that you can pay

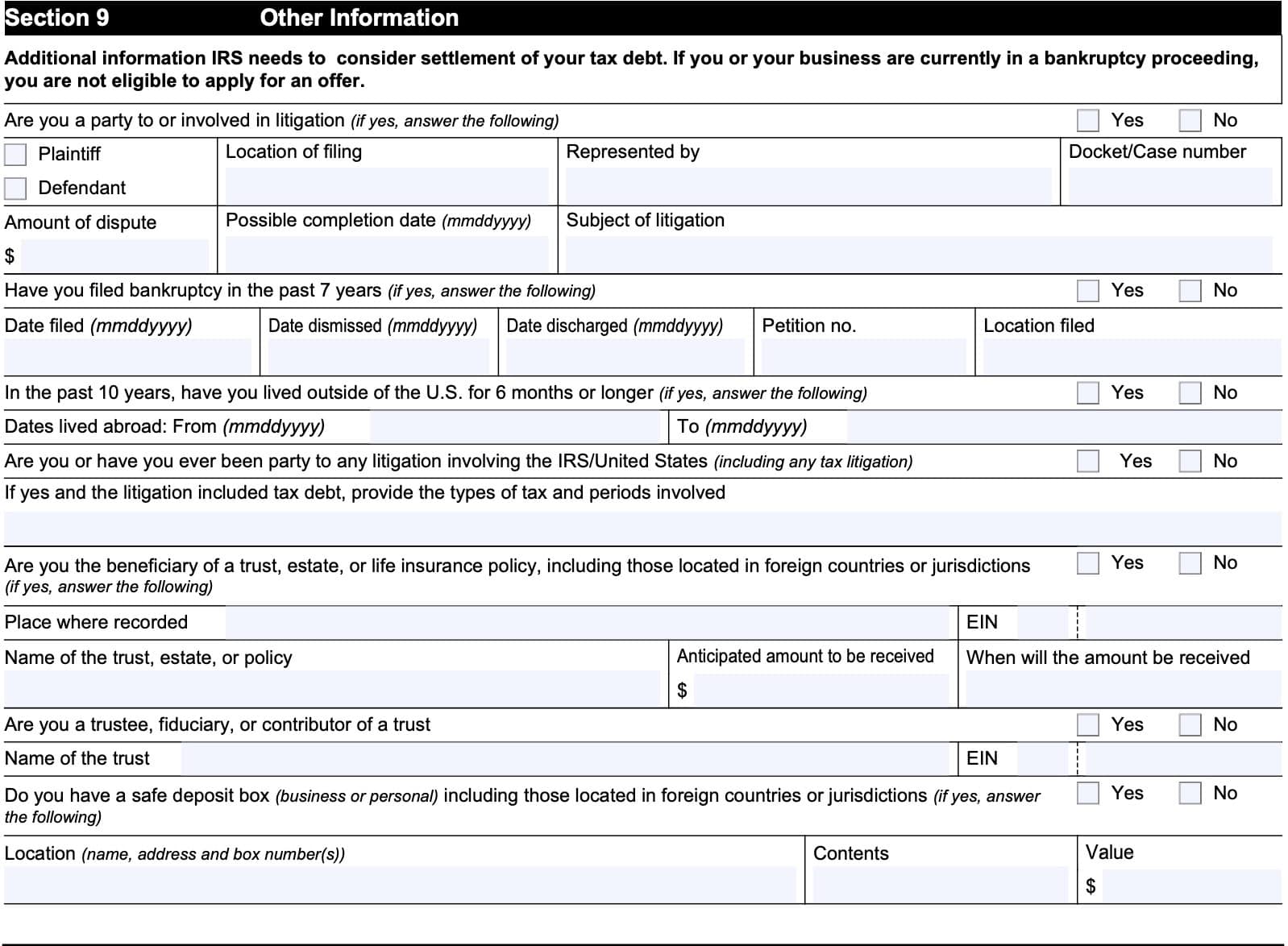

Section 9: Other Information

Section 9 contains additional information that the Internal Revenue Service needs in order to consider settlement of your tax debt. Note: If you or your business are in the middle of bankruptcy proceedings, then you are not eligible to make an offer in compromise.

We’ll go through a series of Yes/No questions. If a question does not apply to you, select No and move to the next question.

Are you a party to or involved in litigation?

If you are involved in litigation, enter the following information:

- Plaintiff or defendant (check one box)

- Location of filing

- Representative’s name

- Case or docket number

- Disputed amount

- Estimated completion date

- Subject of litigation

Have you filed bankruptcy in the past 7 years?

If applicable, enter the following:

- Date of bankruptcy filing

- Date the bankruptcy was dismissed

- Date of discharge

- Petition number

- Location filed

In the past 10 years, have you lived outside of the United States for 6 months or longer?

If this applies, enter the dates that you lived abroad in the spaces provided.

Are you or have you ever been party to any litigation involving the IRS or the United States government?

If the answer is yes, and the litigation involves tax debt, then provide the types of tax, and the tax period or periods involved.

Are you the beneficiary of a trust, estate, or life insurance policy, including those located in foreign countries or jurisdictions?

If so, then enter the following:

- Place where the trust or estate documents are recorded

- Employer identification number (EIN), if applicable

- Name of the trust, estate, or policy

- Anticipated amount to be received

- When will the amount be received?

Are you a trustee, fiduciary or contributor of a trust?

If applicable, enter the trust’s name and EIN where indicated.

Do you have a safe deposit box, including those located in foreign countries or jurisdictions?

If you have a safe deposit box, then enter the following:

- Location, including name, address, and box number

- List of contents in the box

- Approximate value of contents

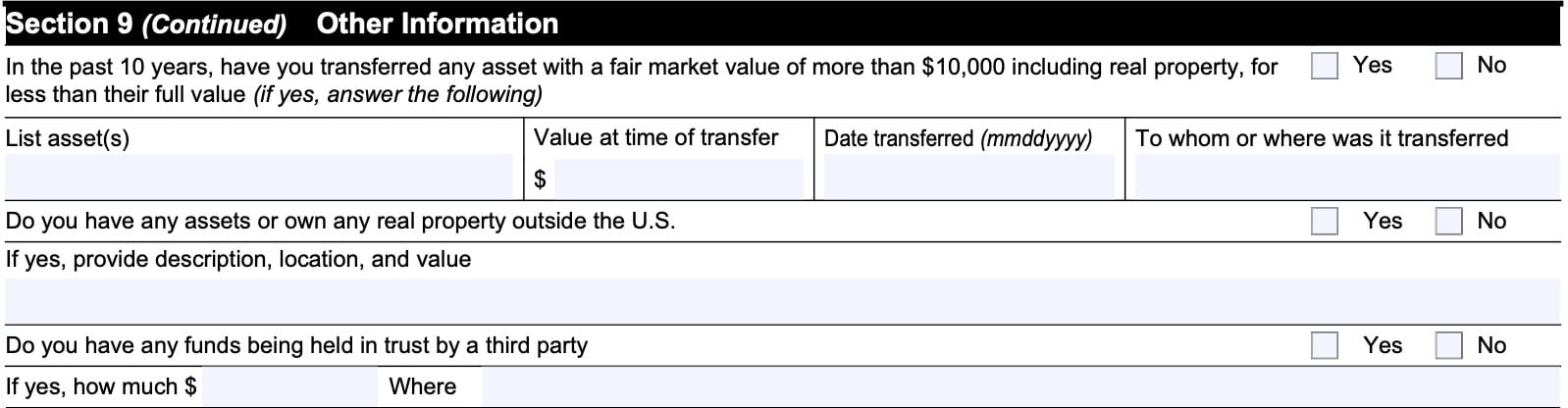

In the past 10 years, have you transferred any asset with a fair market value of more than $10,000 including real property, for less than full value?

If the answer is Yes, then provide the following:

- Asset(s) transferred

- Value at the time of transfer

- Date of transfer

- Recipient

Do you have any assets or own real property outside the United States?

If you have assets or real property outside the United States, provide a description, location, and approximate value.

Do you have any funds being held in trust by a third party?

If so, indicate how much is being held on your behalf, and where the funds are being held.

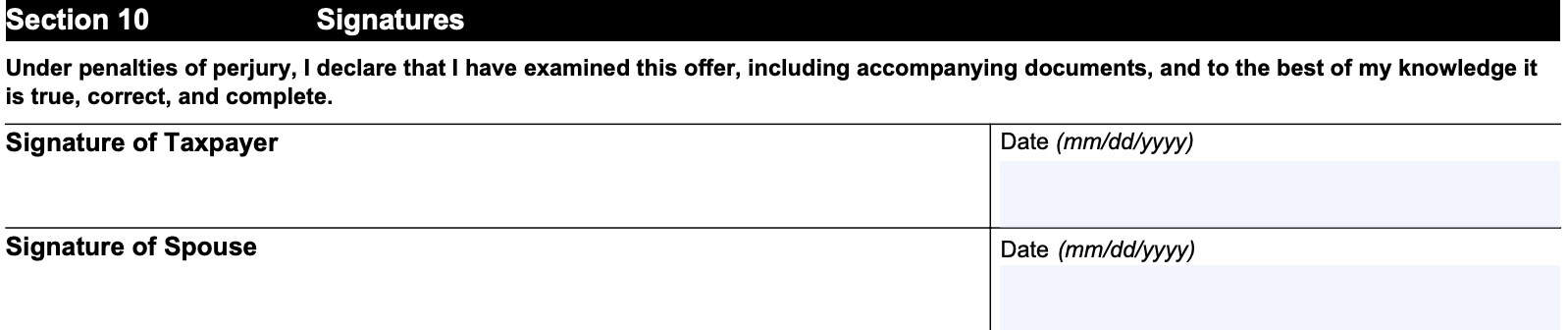

Section 10: Signatures

In the spaces provided, sign and date the form. In signing, you are declaring, under penalty of perjury, that:

- You’ve examined the offer, including the accompanying documents

- It is true, correct, and complete to the best of your knowledge

After signing, you’ll need to attach the applicable attachments as indicated below.

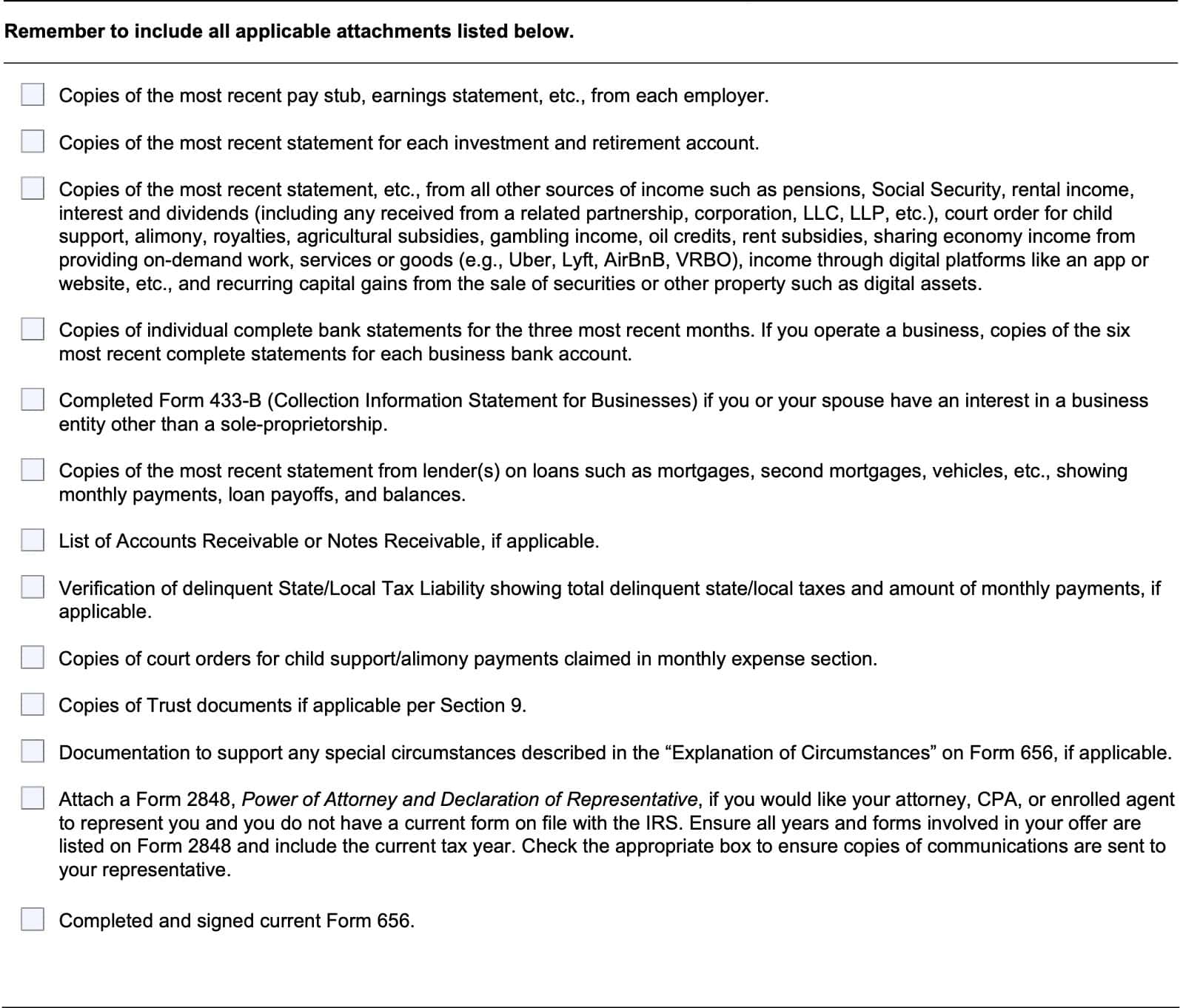

Applicable attachments

As indicated in the form, this is the list of applicable attachments. Be sure to include copies of requested documents. Keep original versions of important documents, such as court orders and trust documents, in your records.

If attaching a copy of IRS Form 2848, Power of Attorney and Declaration of Representative, you should ensure that all years and forms involved in your offer are included on the Form 2848 and that your current tax year is included. Check the correct box to ensure that your representative(s) receive copies of IRS communications.

Video walkthrough

Frequently asked questions

You should complete IRS Form 433-A as part of your Offer in Compromise. Follow the instructions in your Offer in Compromise package.

IRS Form 433-A provides the Internal Revenue Service with necessary information to determine how a wage earner or self-employed individual can satisfy an outstanding tax liability.

Where can I find IRS Form 433-A?

You can find IRS Form 433-A on the Internal Revenue Service website. For convenience, we’ve included the most recent version of this tax form in this article as a PDF file.