IRS Form 1116 Instructions

U.S. citizens who paid certain foreign taxes to either a foreign country or U.S. possession may be eligible to claim a foreign tax credit against their U.S. tax liability. The Internal Revenue Service has issued a separate form, IRS Form 1116, to help taxpayers calculate this foreign tax credit.

In this article, we’ll walk you through the foreign tax credit, specifically:

- What foreign taxes are eligible for the foreign tax credit

- When to (and when not to) use IRS Form 1116 to calculate tax credits on foreign source income

- How to complete IRS Form 1116 as part of your income tax return

Let’s start with step by step instructions on completing Form 1116.

Table of contents

How do I complete IRS Form 1116?

This tax form is fairly straightforward. There are two pages, broken down into 4 parts:

- Part I: Taxable Income or Loss from Sources Outside the United States

- Part II: Foreign Taxes Paid or Accrued

- Part III: Figuring the Credit

- Part IV: Summary of Credits from Separate Parts III

Let’s start with the form’s header.

Taxpayer information

Before we start with Part I, it’s important to note that you may need to file a separate Form 1116 for each of the following categories of income:

- Section 951A category income

- Also known as global intangible low-taxed income (GILTI)

- Included by U.S. shareholders of certain controlled foreign corporations (CFCs)

- Foreign branch category income

- Passive category income

- Includes passive income or specified passive category income from a domestic international sales corporation (DISC)

- General category income: Can include the following:

- Wages, salary, and overseas allowances of an individual as an employee

- Income earned in the active conduct of a trade or business

- Gains from the sale of inventory or depreciable property used in a trade or business

- Section 901(j) income

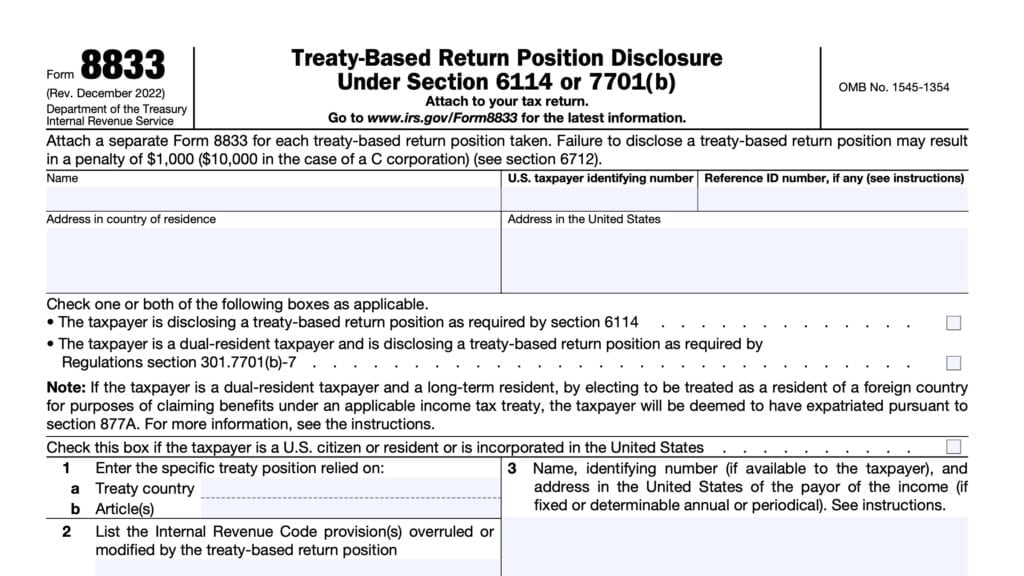

- Certain income re-sourced by treaty

- Lump-sum distributions

- May also require filing IRS Form 4972, Tax on Lump Sum Distributions

For each Form 1116, you’ll need to enter the following:

- Taxpayer name

- Identifying number, as shown on your tax return

- This can be a Social Security number, tax identification number or employer identification number (EIN) for estates and trusts

- Category of income

- Country of residence

Part I: Taxable Income or Loss from Sources Outside the United States

Line i: Enter the name of the foreign country or U.S. possession

If you only paid taxes to one country or U.S. possession, use column A in Part I, and Line A in Part II. For more than one country or U.S. possession (no more than 3), use a unique column (Part I) and corresponding row (Part II) for each country or possession.

Line 1: Gross income

For Line 1a: Include income in the category checked above Part I that is taxable by the United States and is from sources within the country entered on line i. You must include income even if it isn’t taxable by that foreign country.

Identify the type of income on the dotted line next to Line 1a. Don’t include any earned income excluded under the foreign earned income exclusion on IRS Form 2555, Foreign Earned Income.

For Line 1b, you must check the box if all of the apply:

- The income on Line 1a is compensation for services you performed as an employee.

- Your total employee compensation from both U.S. and foreign sources was $250,000 or more.

- You used an alternative basis to determine the source of the compensation entered on Line 1a.

If you check the box in Line 1b, you must also include an accompanying statement with the following information:

- Your name and social security number

- The specific compensation income or the specific fringe benefit for which the alternative basis is used

- For each such item, the alternative basis of allocation of source used

- For each such item, a computation showing how the alternative allocation was computed

- A comparison of the dollar amount of the compensation sourced within and without the United States under both the alternative basis and the time or geographical basis for determining the source

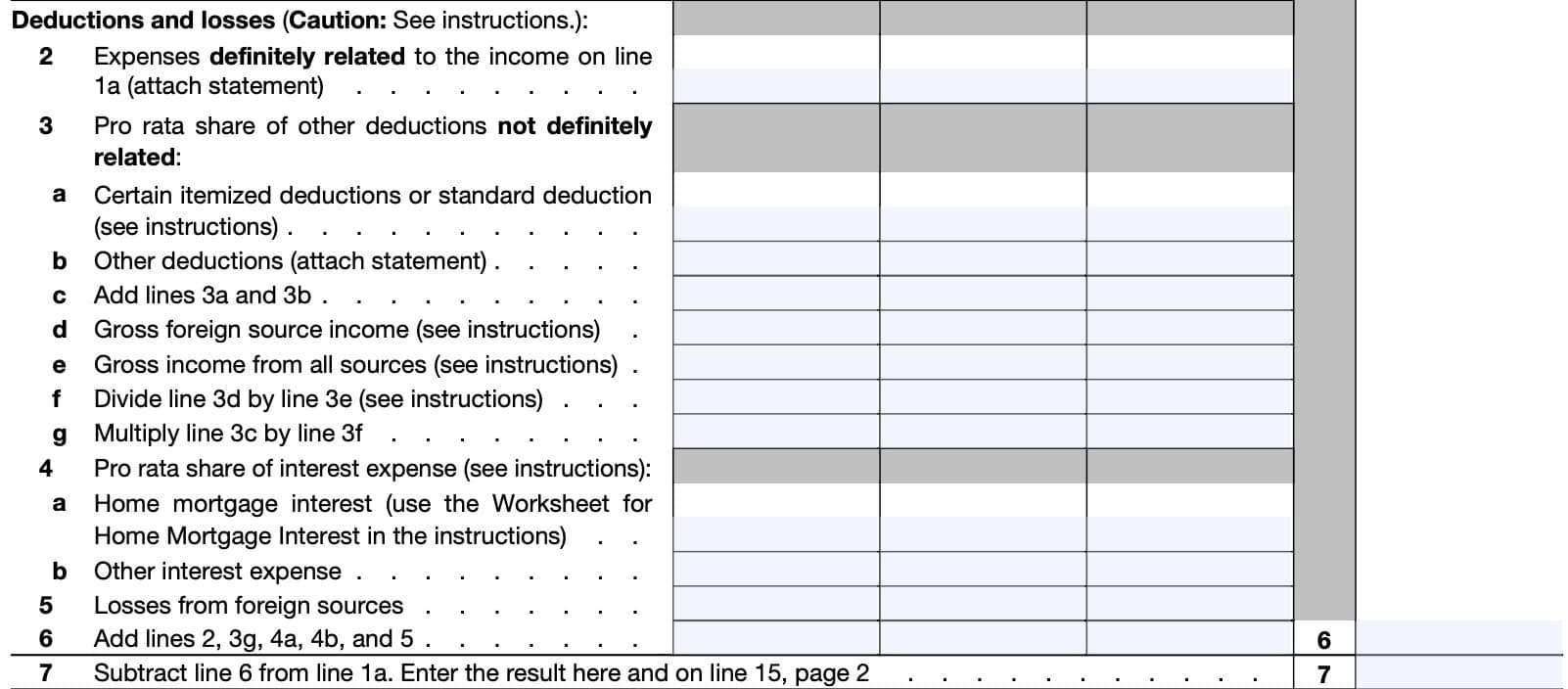

Line 2: Expenses definitely related to the income on Line 1a

For Lines 2 through 5, you must reduce your foreign earned income by either of the following:

- Any deductions that definitely relate to the foreign earned income stated in Line 1a

- A ratable share of any deductions that do not definitely relate to that income

In Line 2, list in each column the total of expenses definitely related to the income on Line 1a.

Line 3: Pro rata share of other deductions not definitely related

Line 3a: You must list the total of the following itemized deductions as listed on Schedule A:

- Medical expenses (Line 4)

- General sales taxes (Line 5a)

- Real estate taxes for your home (Line 5b)

If you do not itemize, then list your standard deduction in Line 3a.

Line 3b: List other deductions that do not definitely related to a particular type of income.

Line 3c: Add Lines 3a and 3b. This represents your total allowable deductions.

Line 3d: Gross foreign source income

For each column, include the gross income from the country listed in that column. Include income that you excluded on Form 2555, but do not include other exempt income.

Line 3e: Gross income from all sources

This should be the same number across all columns. Include income that you excluded on Form 2555, but do not include other exempt income.

Line 3f

Divide Line 3d by Line 3e. Round off to the 4th decimal place.

For example, if your calculation results in 0.8756782, round this number to 0.8757.

Line 3g

Multiply Line 3c (total deductions) by Line 3f.

Line 4: Pro rata share of interest expense

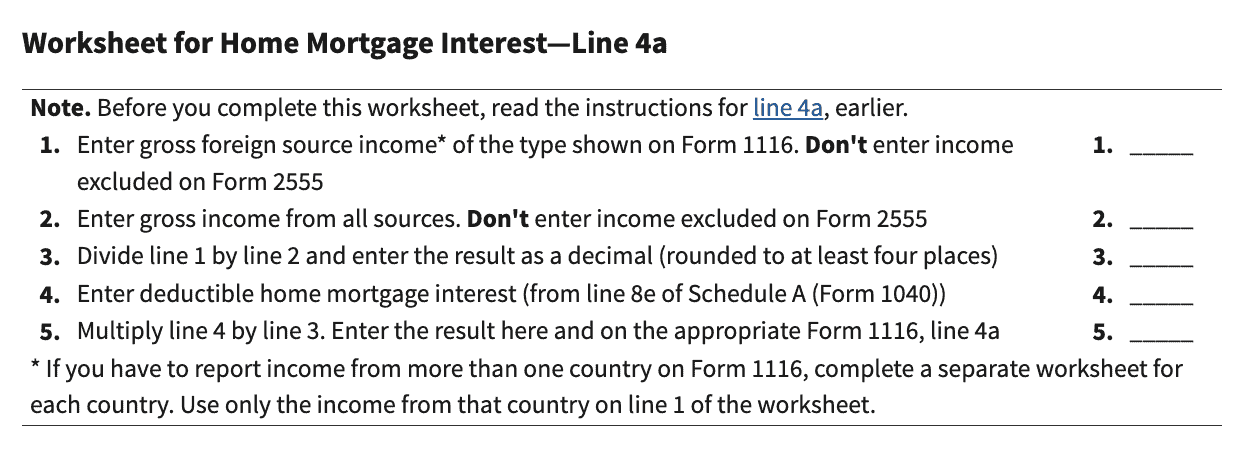

In Line 4a, you’ll need to use the home mortgage interest worksheet to calculate this number. If your gross foreign source income doesn’t exceed $5,000, you can allocate all of your interest expense to U.S. source income. This doesn’t include any income excluded on Form 2555.

For Line 4b, you must apportion each type of interest expense between U.S. source income and the respective foreign countries. You may include the following types of interest expenses:

- Investment interest

- Interest incurred in a trade or business, and

- Passive activity interest

Line 5: Losses from foreign sources

If you have foreign-source capital losses, you might need to make certain adjustments. See the IRS instructions for more detail.

Line 6

For each column, enter the total of the following lines:

Line 7

Subtract Line 6 from Line 1a. Enter the result on Line 7 and on Line 15.

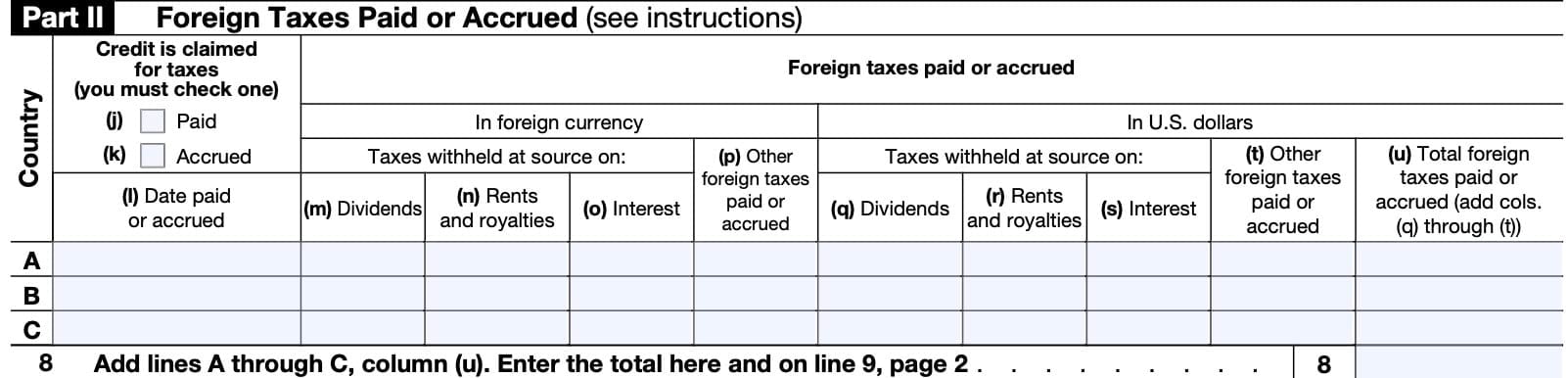

Part II: Foreign Taxes Paid or Accrued

Generally, you can claim the foreign tax credit for taxes paid (for cash basis taxpayers) or accrued (for accrual basis taxpayers). If you are a cash basis taxpayer, you may check the accrued box and take the credit for taxes accrued. However, you must make this selection in all future returns. This choice is not available on an amended return.

You must also enter the the amount of foreign taxes that relate to the category of income checked above Part I, in both

- The foreign currency denomination(s) and

- As converted into U.S. dollars

Add the total in Line 8, and enter this number on Line 9 as well.

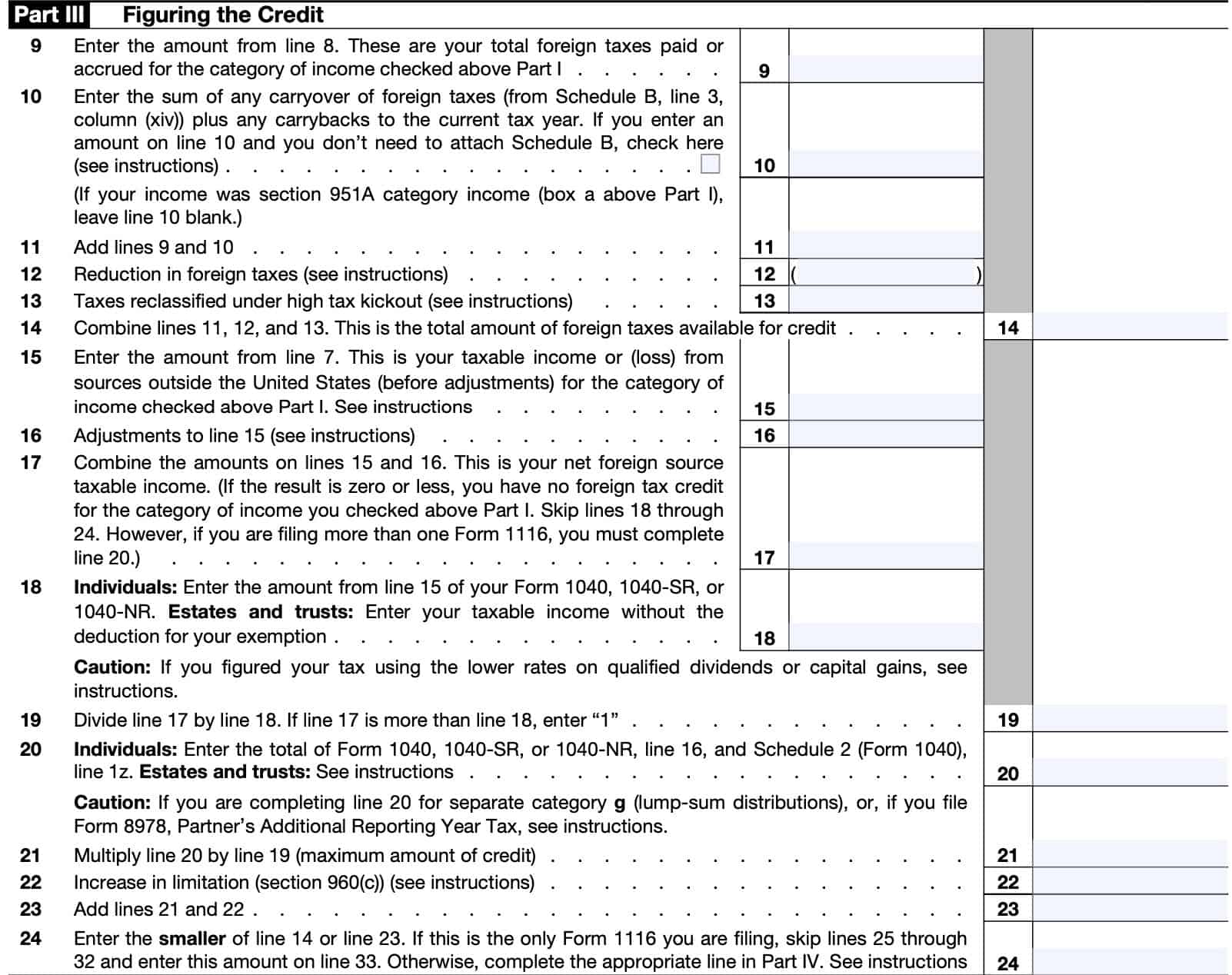

Part III: Figuring the Credit

Line 9

Carry over the amount from Line 8, in Part II above.

Line 10: Foreign tax carryover

Enter the amount of any foreign tax carryover, from Schedule B, Line 3, plus any carrybacks to the current tax year. You may need to attach Schedule B for any tax carryover from a prior year or if you generate a tax carryover in the current year. However, you do not need to attach Schedule B if you carryback a foreign tax from a future tax year.

Line 11

Add lines 9 and 10.

Line 12: Reduction in foreign taxes

In Line 12, you may have to reduce your foreign taxes paid by the following:

- Taxes excluded on Form 2555

- Taxable income from Puerto Rico that is exempt from U.S. taxes

- Income from American Samoa excluded on IRS Form 4563

- Taxes on combined foreign gas and oil income

- Taxes on foreign mineral income

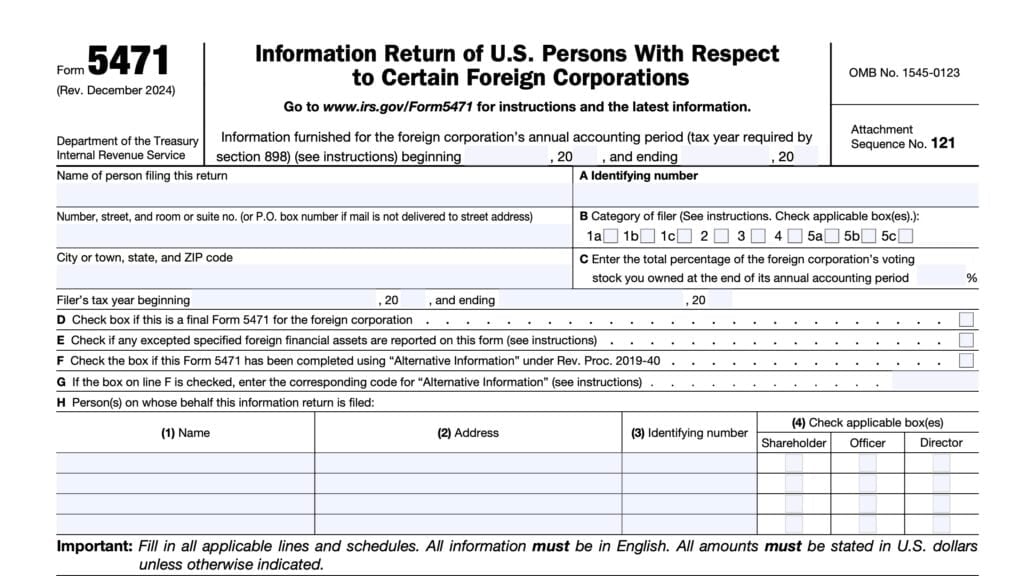

- Reduction for failure to file IRS Form 5471

- Reduction for failure to file IRS Form 8865

- Reduction due to international boycott operations

- Taxes related to a foreign tax credit splitting event

See the form instructions for more detail on these reductions.

Line 13: Taxes reclassified under high tax kickout

You must adjust the foreign taxes paid or accrued if they relate to passive income that is treated as other category income because it is high taxed.

For passive category income, enter as a negative number (in parentheses) the amount of your foreign taxes that relate to that income. For the other category income, enter as a positive number the amount of foreign taxes that relate to that income.

Line 14: Total foreign taxes available for credit

Add Lines 11, 12, and 13. This represents the total amount of foreign taxes for which you may calculate the tax credit on IRS Form 1116.

Line 15

Enter the amount from Line 7, above. If the amount on Line 15 is zero or a negative number, you probably do not have a tax credit for the category of income checked above Part I in this form.

Line 16: Adjustments to Line 15

You must enter the following adjustments to the number that you entered on Line 15, above:

- Adjustment for disallowed business loss under IRC Section 461(l)

- Allocation of foreign losses

- Allocation of U.S. losses

- Recapture of prior year overall foreign loss accounts

- Recapture of separate limitation loss accounts

- Recapture of overall domestic loss accounts

If any of these adjustments apply to your tax situation, see the form instructions for more details.

Line 17: Net foreign source taxable income

Combine Lines 15 and 16. This represents your net foreign source taxable income.

If this number is zero or negative, you do not have a foreign tax credit. Skip Lines 18 through 24, unless you are completing more than one Form 1116. In that case, you must complete Line 20.

Line 18

If you have qualified dividends or capital gains, you may be required to make adjustments to those qualified dividends and gains before you take those amounts into account on Line 18.

Otherwise, for individuals, enter the amount from Line 15 of your Form 1040, 1040-SR, or 1040-NR. Estates and trusts will enter taxable income without the deduction for exemption.

Line 19

Divide Line 17 by Line 18. If the answer is more than 1, enter ‘1.’

Line 20

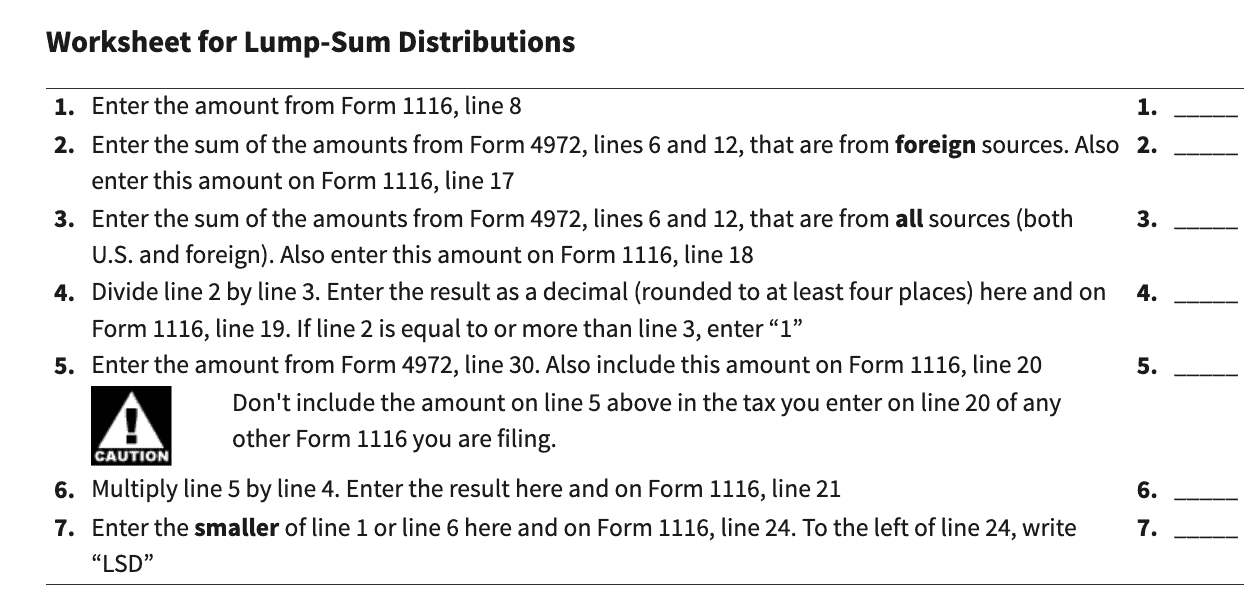

If completing Line 20 for lump sum distributions, enter the amount from Line 5 of the lump sum distribution worksheet, below.

Individuals

Individuals will enter the total of Form 1040, 1040-SR, or 1040-NR, Line 16, and Schedule 2 (Form 1040), Part I, Line 2, minus any tax included on Line 16 from Form 4972.

Estates and trusts

- Form 1041 filers: Enter the amount from Form 1041, Schedule G, Line 1a.

- Form 990-T filers: Enter the total of Form 990-T, Part II, Lines 2, 3, 4, and 6.

- Don’t include any taxes listed in Section 26(b) that are included in Part II, Line 4.

- Form 1040-NR filers: Enter the amount from Form 1040-NR, Line 16, minus any tax included on Line 16 of Form 1040-NR from Form 4972.

You may need to adjust this amount by any amount that you report on IRS Form 8978, Partner’s Additional Reporting Year Tax.

Line 21

Multiply Line 19 by Line 20. This represents the maximum amount of tax credit available.

Line 22

Enter the amount of any increase to your limitation as determined under the excess limitation rules of IRC Section 960(c).

Line 23

Add Lines 21 and 22.

Line 24

Enter the smaller of:

If this is the only Form 1116 that you plan to file, you may enter this number on Line 33, in Part IV. When there are multiple Forms 1116, enter this number in the respective line in Part IV.

If Line 23 is smaller than Line 14, Publication 514 may contain more information about carryback or carryforward provisions.

Part IV: Summary of Credits from Separate Parts III

In Part IV, you only need to complete Lines 25 through 31 if there is more than 1 Form 1116 that you are completing. In this case, you’ll enter the total from each Form 1116 into its respective row.

Line 32

If necessary, add Lines 25 through 31.

Line 33

Enter the smaller of:

Usually, Line 32 will exceed Line 20 only if you have U.S. capital gains or qualified dividends that are subject to the capital gain rate differential.

Line 34: Reduction of credit for international boycott operations

If applicable, see the instructions for Line 12. You’ll calculate the tax credit by the international boycott factor, and enter that adjustment in Line 34.

Line 35

Subtract Line 34 from Line 33. This represents your foreign tax credit.

Enter the total here and on one of the following:

- Form 1040: Schedule 3, Line 1

- Form 1041: Schedule G, Line 2a

- Form 990-T, Part III, Line 1a

What is the foreign tax credit?

IRS Publication 514, Foreign Tax Credit for Individuals, discusses the credit or itemized deduction you may be able to take if you paid or accrued foreign taxes to one or more foreign countries on foreign source income and you are subject to U.S. tax on that same income.

The foreign tax credit exists to help taxpayers avoid double taxation, or the double tax burden of having to pay both U.S. and foreign income tax on the same source of income. But there are a couple of ways to use foreign taxes paid to reduce your total taxable income:

- Taking a foreign tax credit

- Taking a tax deduction on foreign taxes paid

Tax credit or tax deduction?

There is an option to choose either a foreign tax credit or a foreign tax deduction. Taken as a deduction, foreign income taxes reduce your U.S. taxable income. Taken as a credit, foreign income taxes reduce your U.S. tax liability.

Generally speaking, you can only take a credit or a deduction, but not both. Because of this, it’s usually prudent to calculate your tax liability under both scenarios, then apply the one that results in a lower tax bill.

Since this article focuses on the foreign tax credit, we’ll cover that more extensively than the tax deduction.

What foreign income taxes are eligible for a foreign tax credit?

A wide variety of qualified foreign taxes are eligible for the tax credit. There are 4 general criteria that a foreign tax must meet in order for the taxpayer to qualify:

- The tax must be imposed on you. In order words, it cannot be optional, and you cannot shift the tax responsibility onto someone else.

- You must have paid or accrued the tax. In limited cases, you may claim a credit if you paid the tax through a holding.

- For example, if you own shares of a mutual fund that invests in foreign holdings, and the mutual fund company paid foreign taxes, you may be eligible for the tax credit if the company chooses to distribute the credit to shareholders

- The tax must be the legal tax liability. You cannot claim a tax credit for taxes paid which eventually result in a tax refund.

- It must be an income tax, or a tax imposed in lieu of an income tax. In most cases, only income, war profits, or excess profits qualify.

However, there are a lot of taxes that are ineligible for this credit.

Which foreign income taxes are ineligible for a tax credit?

The following taxes are ineligible for a foreign tax credit:

- Taxes on excluded income

- Taxes for which you can only take an itemized deduction,

- Taxes on foreign mineral income,

- Taxes from international boycott operations,

- A portion of taxes on combined foreign oil

- and gas income,

- Taxes of U.S. persons controlling foreign corporations and partnerships who fail to file required information returns,

- Taxes related to a foreign tax splitting event, and

- Foreign taxes disallowed under IRC Section 965(g) and Regulations section 1.965-5.

Do I need to file IRS Form 1116 to claim a credit for foreign taxes?

In limited situations, you may be able to claim a foreign tax credit without having to file Form 1116, and without foreign tax credit limitation. However, you must meet the following criteria:

- All of your foreign source gross income was “passive category income.” For this purpose, passive income also includes:

- Income subject to the special rule for high-taxed income, and

- Certain export financing interest income

- All the income and any foreign taxes paid on it were reported to you on a qualified payee statement in the current tax year:

- Form 1099-DIV

- Form 1099-INT

- Schedule K-1 (Form 1041)

- Schedule K-3 (Form 1065)

- Schedule K-3 (Form 1120-S), or

- Similar substitute statements

- Your total creditable foreign taxes aren’t more than $300

- $600 for married taxpayers filing a joint return in the current year

Also, if you are calculating a tax credit for taxes paid to the U.S. Virgin Islands, you’ll need to file Form 8689, Allocation of Individual Income Tax to the U.S. Virgin Islands, not Form 1116.

Video walkthrough

Watch this instructional video to learn more about how to complete Form 1116.

Are you tired of dreading tax season?

If you’re like most people, you push through the stress of filing, only to be hit with a bigger bill than expected—then put it all behind you until the same cycle repeats next year.

But what if you could change the game?

Tax planning puts you in control. It’s about being proactive, not reactive—taking small, smart steps throughout the year to reduce your tax burden, increase your savings, and keep more of your hard-earned money working for you.

Here’s what effective tax planning helps you do:

✅ Avoid the surprise of a high tax bill

✅ Understand how your income and decisions affect your taxes

✅ Strategically lower your tax liability over time

Ready to make smarter tax moves?

👉 Join my free weekly tax planning newsletter and get one actionable tip every week to help you reduce your taxes legally and effectively.

Start taking control—your future self will thank you.

Frequently asked questions

You may claim a maximum of $300 ($600) for taxpayers filing a joint return without having to file IRS Form 1116.

Not always. You may be able to elect to not file as long as your foreign income is considered passive category income, all foreign income was reported on a payee statement, and your foreign tax credit does not exceed $300 ($600 for married taxpayers filing jointly).

You may be eligible to take a tax deduction to lower taxable income, or a tax credit to lower your tax liability. However, you cannot take both a deduction and credit.

U.S. citizens, resident aliens, and nonresident aliens may be able to take a foreign tax credit if they paid foreign income tax and are subject to U.S. tax on foreign source income.

Where can I find IRS Form 1116?

Like other tax forms, you may find IRS Form 1116 on the IRS website. For your convenience, we’ve included the most recent version for download at the end of this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!

We have 2k of foreign left from last year. How can we claim whole amount in 2022 taxes? ty for your help.

Shaila,

I’m assuming that you’re asking about foreign taxes that you paid, but that you did not take a credit on, or a deduction for.

According to the form instructions, you would need to apply the excess to the earliest year that you can take it. In the case of foreign taxes paid, that would be 1 tax year prior (as a carryback), or up to 10 years forward (carryforward). Then the next earliest year, then the next, etc.

In either case, you’ll simply file Form 1116 for the tax year in which the taxes paid applies, to accompany that year’s tax return. In the case of a carryback, you probably will need to file an amended tax return. Enter the amount of the credit in Part III, Line 10.

Because there are very specific rules about the characterization of foreign taxes paid, I would highly suggest you have your accountant or tax preparer prepare your tax return for you. This will help ensure that the foreign taxes paid are properly documented, and that the tax credit is properly calculated and credited to your tax situation.

Hi,

In Form 1116,line 3a- ‘ certain ‘ itemised deductions: if State income tax to be included or excluded. It is not mentioned either in your article nor in ‘ IRS instruction for 1116’

Thanks & regards

That is correct. The form instructions specify exactly which itemized deductions to include in Line 3a, and the corresponding lines where you would find those deductions on Schedule A. Specifically, Lines 3a and 3b are intended to remove deductions that are not otherwise included on Line 2, and are not related to your U.S. income.

Since state income tax is directly related to your income, I would not expect that to be included on Line 3a or 3b.

Thank you for putting this presentation together. Though, as the other commentators have noted there are a bunch of intricacies on several lines. I have several questions, but I’ll ask one this time. Line 18 amount is either Line 15 from Form 1040 or a reduced amount based on the worksheets you’ve included (from IRS Instructions for Form 1116) in your presentation. What are the determining factors in using these worksheets versus using Line 15 from 1040?

The differentiating factor is whether you’re reporting qualified dividends or capital gains. In this case, you may need to use the worksheet to make adjustments to those figures before you can make an entry on Line 18.

From the form instructions: If you have qualified dividends or capital gains, you may be required to make adjustments to those qualified dividends and gains before you take those amounts into account on Line 18.