IRS Form 1040-SS Instructions

If you are not required to file a Form 1040 because you are a bona fide resident of a U.S. commonwealth or territory, you may have to file IRS Form 1040-SS, U.S. Self-Employment Tax Return, if you have self-employment income.

In this article, we will walk through everything you need to know about IRS Form 1040-SS, including:

- How to complete and file IRS Form 1040-SS

- Frequently asked questions

- When you must file

Let’s begin with step by step instructions on filing this tax return.

Table of contents

How do I complete IRS Form 1040-SS?

To make this walkthrough simpler, we’ve broken it down into the following sections:

- Taxpayer Information

- Part I: Total Tax and Credits

- Signatures

- Part II: Bona Fide Residents of Puerto Rico Claiming Additional Child Tax Credit

Let’s take a closer look at each section, starting with the taxpayer information fields at the top of page 1.

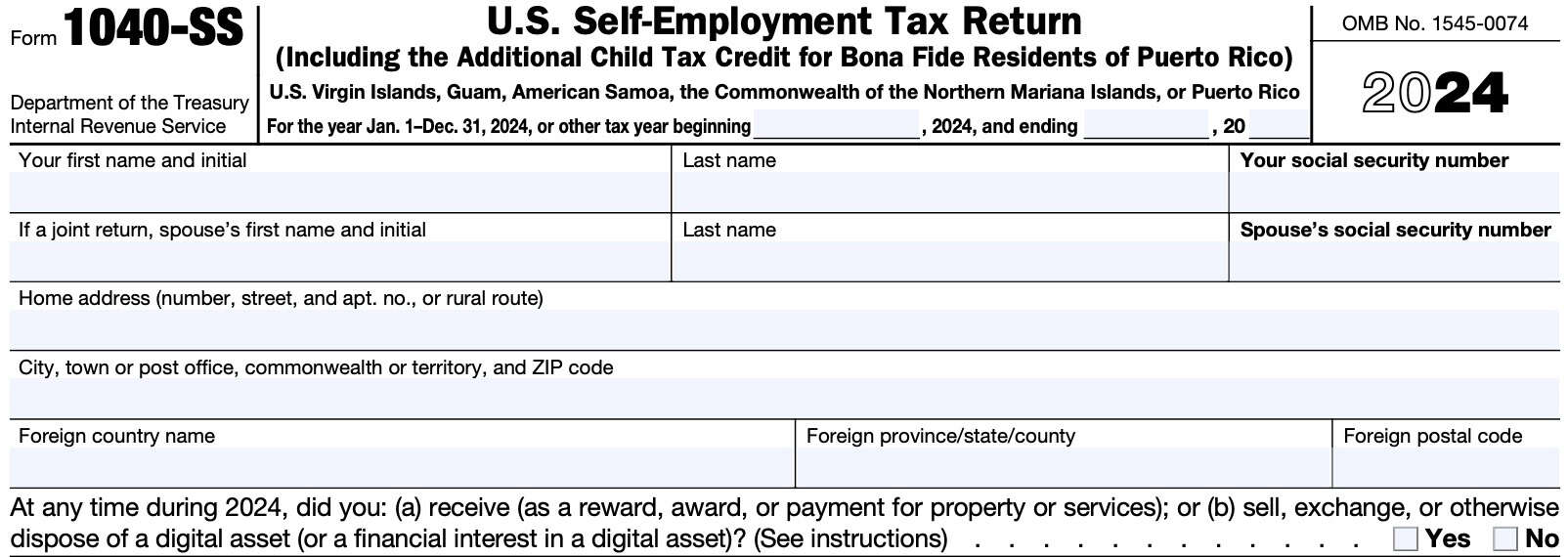

Taxpayer information

We’ll start with the taxpayer information fields at the top of IRS Form 1040-SS.

Fiscal year

If you are a calendar year taxpayer, you may proceed to the taxpayer name entries. If you are a fiscal year taxpayer, enter the beginning and ending dates of your fiscal year.

For example, the federal government’s fiscal year runs from October through September of the following year. If you operate on a similar fiscal year, you would enter:

- Beginning October

- Ending September

Taxpayer name

Enter the complete name of the primary taxpayer. Also, enter the primary taxpayer’s Social Security number (SSN) in the space provided.

Spouse name

If married, enter the complete name of the taxpayer’s spouse. Also, enter the spouse’s Social Security number (SSN) in the space provided.

Home address

Enter your home address, including city, state, and zip code.

Foreign country name

If you live in a foreign country, enter the complete name of the country, as well as the province, state, or county, and the foreign postal code.

Digital assets

Answer Yes or No:

At any time during the tax year, did you either:

- Receive a digital asset (or a financial interest in a digital asset) as a reward, award, or payment for services or property, or

- Sell, exchange, or dispose of a digital asset?

Digital assets

According to the Internal Revenue Service, digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or similar technology. This list includes:

- Non-fungible tokens (NFTs)

- Virtual currencies such as cryptocurrencies and stable coins

You do not need to answer Yes for simply:

- Holding a digital asset in a crytowallet

- Transferring a digital asset from one wallet or account you own to another wallet or account that you also own

- Purchasing digital assets using real currency

If you disposed of any digital asset and check Yes, you may need to file IRS Form 1040 instead of Form 1040-SS. For additional information, refer to IRS Publication 570, Tax Guide for Individuals With Income from U.S. Territories.

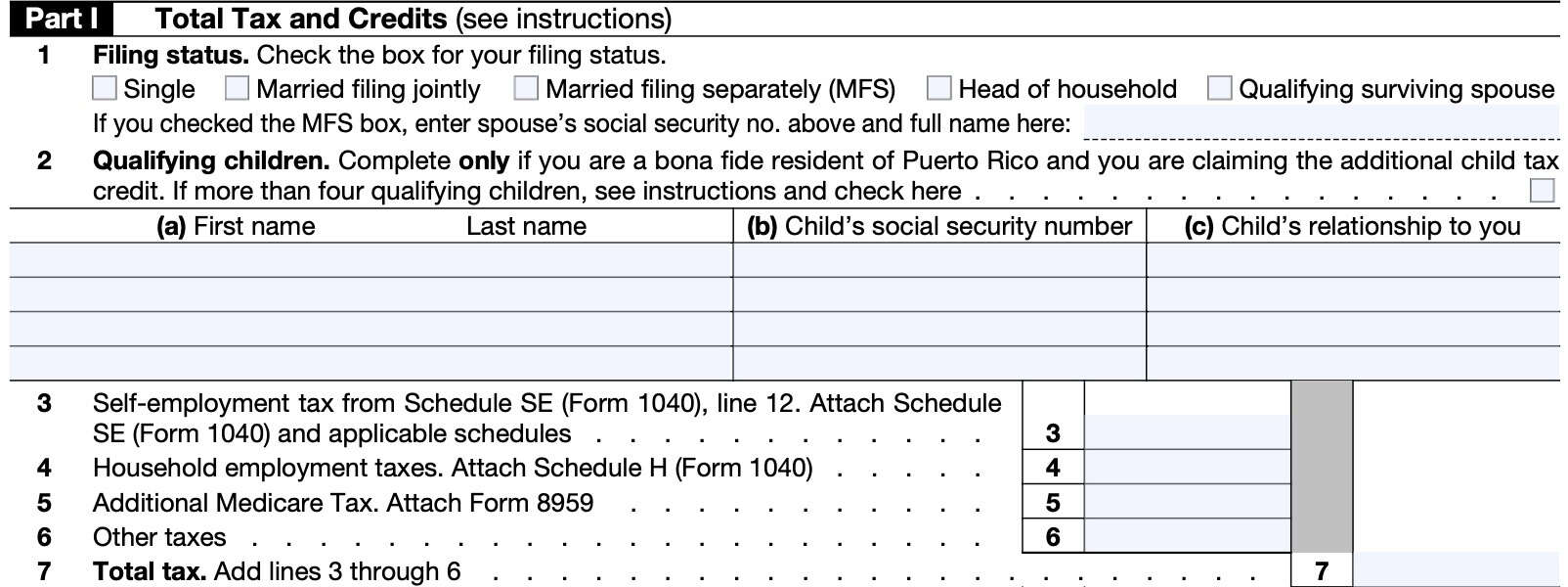

Part I: Total Tax and Credits

In Part I, we will calculate the total income tax and applicable tax credits. Let’s begin with the filing status in Line 1.

Line 1: Filing status

Check the applicable tax filing status. As a general rule, taxpayers who are not married should pay the same amount of tax under all filing statuses for which they qualify.

However, married taxpayers who owe additional Medicare tax on Line 5 may have a lower tax liability if they qualify for, and choose head of household instead of married filing separately. You may choose the status that you qualify for, which gives you the lowest tax liability.

Single

If you were unmarried or legally separated from your spouse according to state law under a divorce or separate maintenance decree at the end of the year, you may check the Single box.

Married filing jointly

You can select this status if:

- You were married at the end of the tax year, and

- You and your spouse both choose to file a joint tax return

You can also select this filing status if your spouse died during the tax year and you did not remarry.

If you file a joint tax return, and both spouses had self-employment income, then both spouses should complete and attach a separate Schedule SE, Part I and Part II (if necessary). Also, attach a separate Schedule C (Form 1040) or Schedule F (Form 1040), depending on the source of income.

If you file a joint tax return, both you and your spouse are considered equally responsible for the income tax and any interest or penalties due on the tax return. If one spouse doesn’t pay, the other may have to. Also, both spouses may be responsible for additional taxes that the IRS imposes.

Innocent spouse relief

However, you may qualify for innocent spouse relief from a tax liability on your joint return if:

- There is an understatement on the tax amount because your spouse omitted taxable income or claimed false tax deductions or credits

- You are divorced, separated, or no longer living with your spouse, or

- Given all of the facts and circumstances, the IRS determines that it would not be fair to hold you liable for the tax

To request innocent spouse relief, you may file IRS Form 8857.

Nonresident aliens and dual-status residents

Generally, a married couple cannot file a joint return if either spouse is a nonresident alien at any time during the taxable year. However, you and your spouse can choose to be treated as residents of the United States and file a joint return if one spouse was a nonresident alien and the other was a U.S. citizen or resident at the end of hte year.

You and your spouse can also choose to file as U.S. residents for the entire year if both of you are citizens or residents at the end of the year and either of you was a nonresident at the beginning of the year. However, you can make this choice for one year, and it does not apply to future years.

Married filing separately

Check this box if you were married at the end of the taxable year but file a separate return. Be sure to enter your spouse’s name and Social Security number or individual taxpayer identification number (ITIN) in the space provided. If your spouse is not required to have either, enter NRA next to their name in the entry space.

Generally, you will only owe the tax on your own income. However, you will usually pay more tax than if you use another filing status that you qualify for.

Head of household

A head of household is someone who is unmarried (or is considered unmarried) and provides a home for certain other persons.

You can check the “Head of household” box if, at the end of the tax year, you:

- Are unmarried (or considered to be unmarried)

- Claim a qualifying child for the additional child tax credit (ACTC), and

- Paid over half the costs of keeping up a home in which you lived with your qualifying child

Unmarried taxpayers

You are considered unmarried for this purpose if any of the following applies:

- You were legally separated according to your state law under a decree of divorce or separate maintenance at the end of the calendar year.

- But if, at the end of the year, your divorce wasn’t final (an interlocutory decree), you are considered married

- You are married but lived apart from your spouse for the last 6 months of the calendar year and you meet the other rules under Married persons who live apart

- You are married and your spouse was a nonresident alien at any time during the year and the election to treat the alien spouse as a resident alien is not made

Qualifying child

A child you claim for the ACTC is a qualifying child for this filing status. Your adopted child is always treated as your own child.

Qualifying surviving spouse

You can check this box if all of the following apply:

- Your spouse died in one of the two preceding tax years, and you did not remarry prior to the end of the taxable year

- You have a child or stepchild (not a foster child) whom you can claim as a dependent or could claim as a dependent except that, for the tax year:

- The child had gross income of $5,050 or more,

- The child filed a joint tax return, or

- You could be claimed as a dependent on someone else’s tax return.

- This child lived in your home for all of the tax year.

- If the child didn’t live with you for the required time, see Temporary absences in IRS Publication 501.

- You paid over half the cost of keeping up your home

- You could have filed a joint tax return with your spouse the year your spouse died, even if you didn’t actually do so

Line 2: Qualifying children

In this field, enter the following information for each child that you are claiming for the additional child tax credit (ACTC):

- First name and last name

- Social Security number

- Child’s relationship to you

Do not enter the information for a person who qualifies for the credit for other dependents (ODC). Instead, you will enter this information in Part II, Line 8, below.

Line 3: Self-employment tax from Schedule SE, Line 12

Complete this line only if you (or your spouse, filing a joint return) had net earnings exceeding the following amounts:

- Self-employment income: $400, or

- Church employee income: $108.28

If applicable, enter the amount of self-employment tax from IRS Schedule SE, Line 12. Attach a copy of Schedule SE (Form 1040) and any applicable schedules.

Line 4: Household employment taxes

If you had household employees, enter the household employment taxes in Line 4, and attach a copy of your completed Schedule H.

Household employment taxes

You may owe household employment taxes if either of the following applies:

- You paid any one household employee cash wages of $2,700 or greater in the taxable year, or

- You paid total cash wages of $1,000 or more in any calendar quarter for the current tax year and the prior tax year

Line 5: Additional Medicare tax

Enter any applicable additional Medicare tax. You can find additional Medicare tax information on IRS Form 8959, Part IV, Line 18.

Line 6: Other taxes

Enter the total of any additional taxes in Line 6. Examples of additional taxes include the following:

- Employee Social Security and Medicare tax on tips not reported to your employer

- Uncollected employee Social Security and Medicare tax on tips

- Uncollected employee Social Security and Medicare tax on group-term life insurance

- Uncollected employee Social Security and Medicare tax on wages

Let’s take a closer look at each.

Employee Social Security and Medicare tax on tips not reported to your employer

If you received cash and charge tips of $20 or more in a calendar month, and did not report all of those tips to your employer, you may need to complete IRS Form 4137, Taxes on Unreported Tip Income.

On the dotted line next to Line 6, enter “Tax on Tips,” and enter the amount from Form 4137, Line 13. Include this tax in the total for Line 6 and attach a copy of Form 4137 to your return.

Uncollected employee Social Security and Medicare tax on tips

If you did not have enough wages to cover the Social Security and Medicare tax due on tips that you reported to your employer, the amount of tax due should be identified with codes A and B on one of the following:

- IRS Form W-2AS

- IRS Form W-2CM

- IRS Form W-2GU

- IRS Form W-2VI

If you receive a Form 499R-2 or W-2PR, you should find this information in boxes 25 and 26.

On the dotted line next to Line 6, enter “Uncollected tax,” and enter the uncollected tax amount.

Uncollected employee Social Security and Medicare tax on group-term life insurance

If you had group-term life insurance through an employer, you may have to pay Social Security and Medicare taxes on part of the cost of life insurance.

The amount of federal taxes due should be identified with codes M and N in Box 12 of one of the following:

- IRS Form W-2AS

- IRS Form W-2CM

- IRS Form W-2GU

- IRS Form W-2VI

If you are a bona fide resident of Puerto Rico, you may need to contact your employer for this amount.

On the dotted line next to Line 6, enter “Uncollected tax,” and enter the uncollected tax amount.

Uncollected employee Social Security and Medicare tax on wages

If you’re an employee who received wages from an employer who did not withhold Social Security and Medicare tax from your wages, then you’ll need to complete IRS Form 8919, Uncollected Social Security & Medicare Taxes, to calculate your share of hte unreported tax.

On the dotted line next to Line 6, enter “Uncollected tax,” and enter the uncollected tax amount from Line 13 on Form 8919. Attach the completed Form 8919 to your tax return.

Line 7: total Tax

Add lines 3 through 6. This represents your total tax.

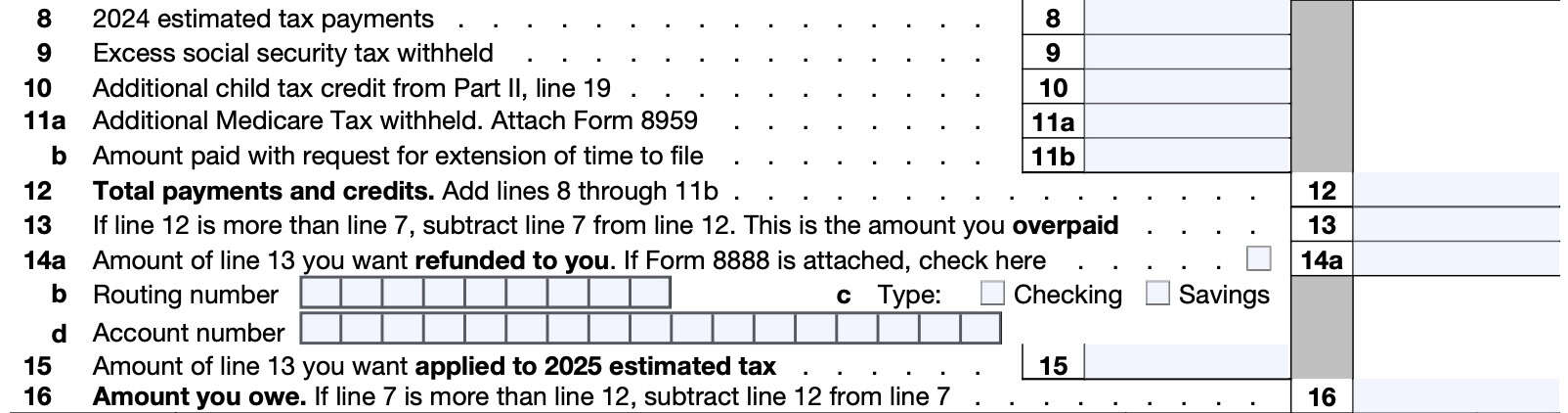

Line 8: Estimated tax payments

Enter any estimated federal income tax payments that you made for the tax year. This includes any overpayment from your previous year tax return that you applied to your current year estimated tax.

Married taxpayers changing filing statuses

If you or your spouse made separate estimated tax payments, but are now filing a joint return as a married couple, then you can add the amounts that you each made, and enter the total amount on Line 8.

If you previously made joint payments, and are now filing separate tax returns, you can divide the estimated tax amount any way you choose as long as you both agree. If you cannot agree, then you must divide the tax payments in proportion to each spouse’s individual tax as shown on your separate tax returns.

Line 9: Excess Social Security tax withheld

In Line 9, enter any excess Social Security tax withheld.

If you (or your spouse if filing a joint return) had more than one employer for the tax year, and the total wages exceed the Social Security wage base, you may have had too much Social Security taxes withheld.

For 2025, the Social Security wage base is $176,100, and the maximum Social Security tax is $10,918.20. In 2026, the Social Security wage base is $185,500, and the maximum Social Security tax is $11,439.00.

If multiple employers without Social Security tax in excess of the maximum tax amount, you may claim the excess in this line. If any single employer withheld more than the maximum tax, you must ask that employer to refund the excess amount to you. You cannot claim this on Form 1040-SS.

Calculate this amount separately for yourself and your spouse, if applicable.

Line 10: Additional Child Tax Credit from Part II, Line 19

Use Part II and its instructions for additional information on calculating and claiming any additional child tax credit (ACTC) that you may be able to claim.

Enter the amount from Part II, Line 19, here.

Line 11a: Additional Medicare Tax withheld

If you had Additional Medicare Tax withheld by your employer, enter the amount shown on your Form 8959, Additional Medicare Tax. Attach the completed Form 8959 with your income tax return.

Line 11b: Amount paid with request for extension to file

If you requested an automatic extension of time to file your Form 1040-SS by filing IRS Form 4868 or by making a tax payment, enter the amount of the payment or any amount that you paid with Form 4868.

If you paid estimated taxes with a credit card or debit card, do not include the convenience fee.

Line 12: Total payments and credits

Add lines 8 through 11b. Enter the total in Line 12.

This represents the total tax payments and credits that are applied to your tax liability.

Line 13: Amount of overpayment

If Line 12 is more than Line 7, then subtract Line 7 from Line 12 and enter the total here. This is the amount that you overpaid during the year.

If Line 12 is less than Line 7, then skip Lines 14 and 15 and proceed directly to Line 16.

If the Line 13 amount is less than $1, then the IRS will only send a refund if you submit a written request.

Line 14: Amount to be refunded to you

If you want your overpayment to be refunded to you via direct deposit, then complete Lines 14a through 14d.

Line 14a: Amount you want refunded

Enter the dollar amount of the tax refund. If you’ve attached IRS Form 8888 to receive the refund into two or more separate accounts, check the box provided.

Line 14b: Account routing number

Enter your bank or financial institution’s routing number in Line 14b. This should be a nine-digit number that is unique to your bank or financial institution.

Line 14c: Account type

Check the appropriate box to indicate whether this bank account is a checking account or savings account.

Line 14d: Account number

Enter your account number in this field.

Line 15: Amount you want applied to next year’s estimated tax

If you would prefer to apply any of your tax refund to the next year’s estimated tax, then enter that amount in Line 15.

Line 16: Amount you owe

If Line 7 is more than Line 12, then subtract Line 12 from Line 7 and enter the difference here. This represents the amount of your outstanding tax liability that you owe the Internal Revenue Service.

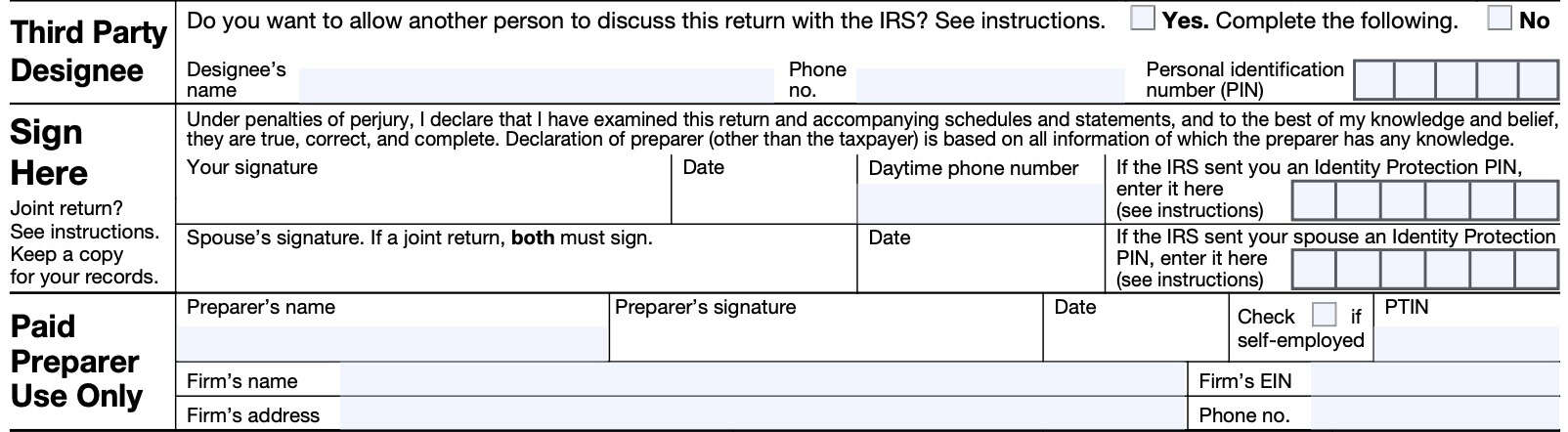

Signatures

This area of the income tax return contains various signatures and taxpayer information. Let’s take a closer look at each area.

Third party designee

If you would like to authorize a third party to discuss your tax return with the IRS, then you can check the Yes box in the third-party designee area. Enter the designee’s name, phone number, and a 5-digit personal identification number (PIN) that the designee can use to identify themselves when speaking with the IRS.

You may allow your tax return preparer, friend, family member, or other person to be your third-party designee. By assigning a designee, you are allowing the designee to do the following:

- Give the IRS any information that is missing from your return;

- Call the IRS for information about the processing of your return or the status of your refund or payment(s);

- Receive copies of notices or transcripts related to your return, upon request; and

- Respond to certain IRS notices about math errors, offsets, and return preparation.

However, this does not authorize the designee to:

- Receive tax refunds on your behalf

- Obligate you to any additional tax liability, or

- Represent you before the IRS

The authorization will automatically end no later than the due date (without regard to extensions) for filing your following year tax return.

Taxpayer signature

Form 1040-SS isn’t considered a valid return unless you sign it in accordance with the requirements in the IRS instructions.

If you are filing a joint return, your spouse must also sign. If your spouse can’t sign the return, see

IRS Publication 501. Be sure to date your return.

If you have someone prepare your return, you are still responsible for the accuracy of the return.

If your return is signed by a representative for you, you must have a power of attorney attached that specifically authorizes the representative to sign your return. To do this, you can use IRS Form 2848, Power of Attorney and Declaration of Representative.

Identity Protection PIN

If you received an Identity Protection PIN (IP PIN) from the IRS, enter it in the IP PIN spaces provided next to your daytime phone number.

You must correctly enter all six numbers of your IP PIN. If you didn’t receive an IP PIN, leave these spaces blank.

Paid preparer use only

Generally, anyone you pay to prepare your return must sign it and include their Preparer Tax Identification Number (PTIN) in the space provided.

The preparer must give you a copy of the return for your records. Someone who prepares your return but doesn’t charge you shouldn’t sign your return.

If your paid preparer is self-employed, then the paid preparer should check the “self-employed” checkbox.

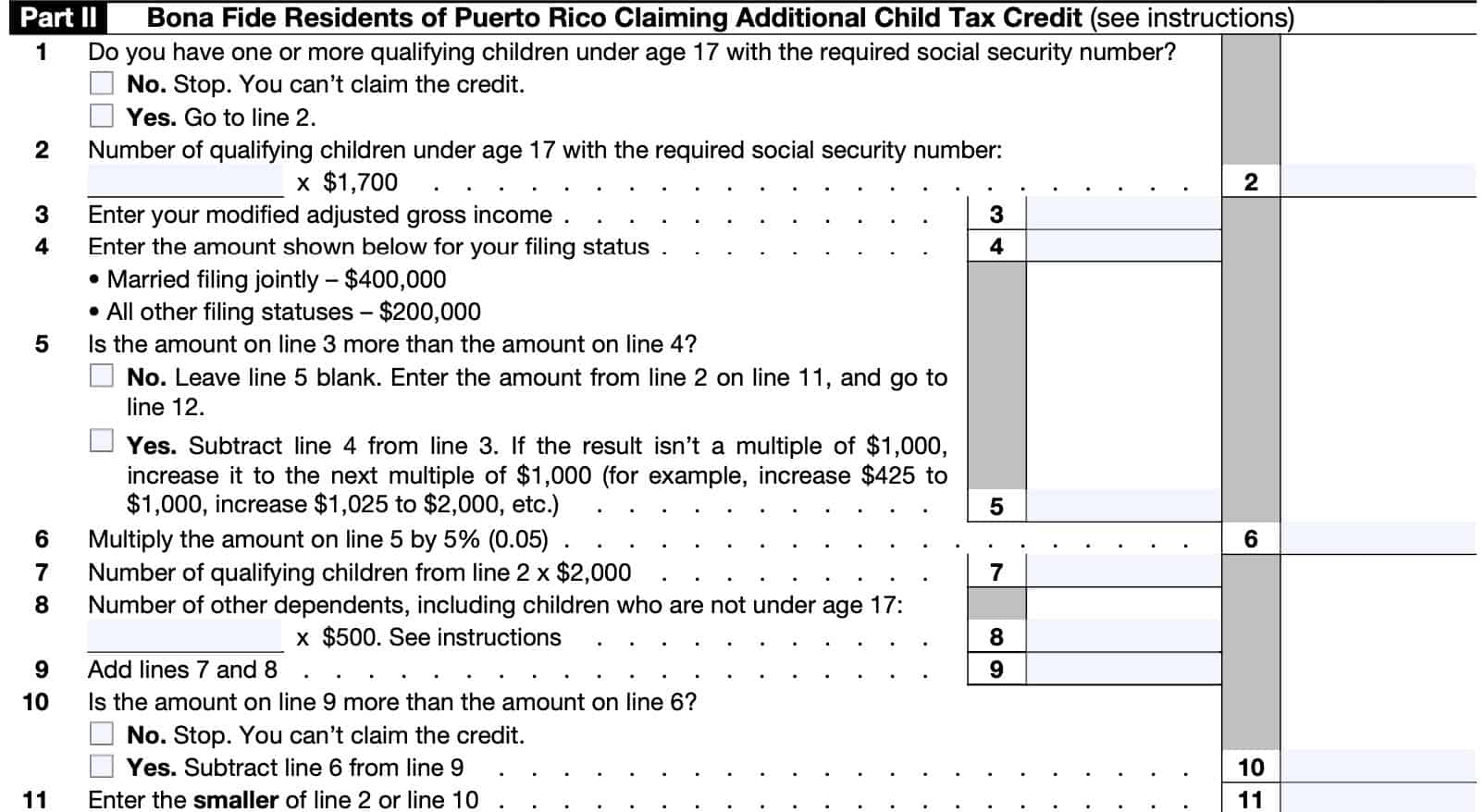

Part II: Bona Fide Residents of Puerto Rico Claiming Additional Child Tax Credit

The additional child tax credit (ACTC) is available to bona fide residents of Puerto Rico with one or more qualifying children.

Generally, you were a bona fide resident of Puerto Rico if, during the tax year, you:

- Met the presence test,

- Did not have a tax home outside of Puerto Rico, and

- Did not have a closer connection to the United States or to a foreign country than you have to Puerto Rico.

Previously denied credits

If you had a child tax credit or additional child tax credit previously denied for any reason other than a math or a clerical error, you will have to attach a copy of IRS Form 8862, Information to Claim Certain Credits After Disallowance, to your income tax return.

Line 1: Do you have Qualifying children?

Answer Yes or No. If the answer is No, then you cannot claim the additional child credit. If you answered Yes, proceed to Line 2.

Qualifying child

Each qualifying child you use for the ACTC must have a Social Security number (SSN) assigned by the Social Security Administration (SSA). If you have a qualifying child who does not have the required SSN, you cannot use the child to claim the ACTC on either your original or an amended tax return for the given year.

The required SSN is one that is valid for employment and is issued before the due date of your federal income tax return (including extensions).

Qualifying child criteria

A qualifying child for purposes of the ACTC is a child who meets all of the following requirements:

- Is your son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them (i.e., your grandchild, niece, or nephew).

- An eligible foster child is any child placed with you by an authorized placement agency or by a judgment, decree, or other order of any court of competent jurisdiction.

- Your adopted child is always treated as your own child. A child lawfully placed for legal adoption is treated the same as an adopted child.

- Was under age 17 at the end of the calendar year.

- Was younger than you (or your spouse, if filing jointly) or was permanently and totally disabled

- Didn’t provide over half of their own support for the taxable year.

- Lived with you for more than half of the year.

- If the child didn’t live with you for the required time, see Residency Test in IRS Publication 501

- Isn’t filing a joint tax return for the tax year or is filing a joint tax return only to claim a refund of estimated or withheld taxes.

- Was a citizen of the United States, U.S. national, or a U.S. resident alien.

Line 2: Number of qualifying children

Enter the number of qualifying children from Part I, Line 2. Multiply this number by $1,700 and enter the total in Line 2.

Line 3: Modified Adjusted gross income

For purposes of figuring the ACTC, you must report all of your income. This includes income derived from sources within Puerto Rico that is excluded from U.S. tax because you were a bona fide resident of Puerto Rico.

Modified adjusted gross income calculation

Your modified adjusted gross income (AGI) includes items such as:

- Wages

- Interest income

- Dividends

- Unemployment compensation

- Alimony received (from divorce agreements entered into on or before December 31, 2018)

- Taxable pensions and annuities

Also include any of the following as applicable

- Profit or loss from Schedule C, Line 31

- Profit or loss from Schedule F, Line 34

- Taxable Social Security benefits

Taxable Social Security benefits

Use Worksheet 1 in IRS Publication 915, Social Security and Equivalent Railroad Retirement Benefits, to see if any of your benefits are taxable.

Check out this video for a walk through on the Social Security benefits calculation.

Line 4

Enter the appropriate amount based upon your filing status:

- Married filing jointly: $400,000

- All other tax filing statuses: $200,000

The ACTC may be limited if your income derived from sources within Puerto Rico exceeds the amounts shown on Line 4.

Line 5

Is the Line 3 amount more than the amount on Line 4?

If the answer is No, then do the following:

If the answer is Yes, then subtract Line 4 from Line 3. If the result is not a multiple of $1,000, then increase it to the next multiple of $1,000. For example, you would increase $425 to $1,000.

Enter this amount in Line 5.

Line 6

Multiply the Line 5 amount by 5% (0.05). Enter the result here.

Line 7: Number of qualifying children from Line 2

Multiply the number of qualifying children from Line 2 by $2,000. Enter the result here.

Line 8: Number of other dependents

Enter the number of other dependents who meet additional criteria (defined next), including children who

are 17 or older, and multiply by $500.

If you include dependents on Line 8, you must attach a statement to your Form 1040-SS, which provides the following information for each person who is a qualifying person for purposes of the credit for other dependents:

- First and last name

- Tax identification number

- SSN

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Relationship to the person(s) filing Form 1040-SS

Qualifying person for the credit for other dependents (ODC)

A qualifying person for purposes of the credit for other dependents is a person who:

- Qualifies as a dependent for purposes of being claimed as a dependent on a U.S. federal tax return

- Cannot be reported on Part I, Line 2, and Part II, Lines 2 and 7, of Form 1040-SS

- Was a U.S. citizen, U.S. national, or U.S. resident alien

Line 9

Add Line 7 and Line 8. Enter the total here.

Line 10

Is the Line 9 amount greater than the Line 6 amount?

If the answer is No, then stop here. You cannot claim this tax credit. If Yes, then subtract Line 6 from Line 9, and enter the answer here.

Line 11

Enter the smaller of:

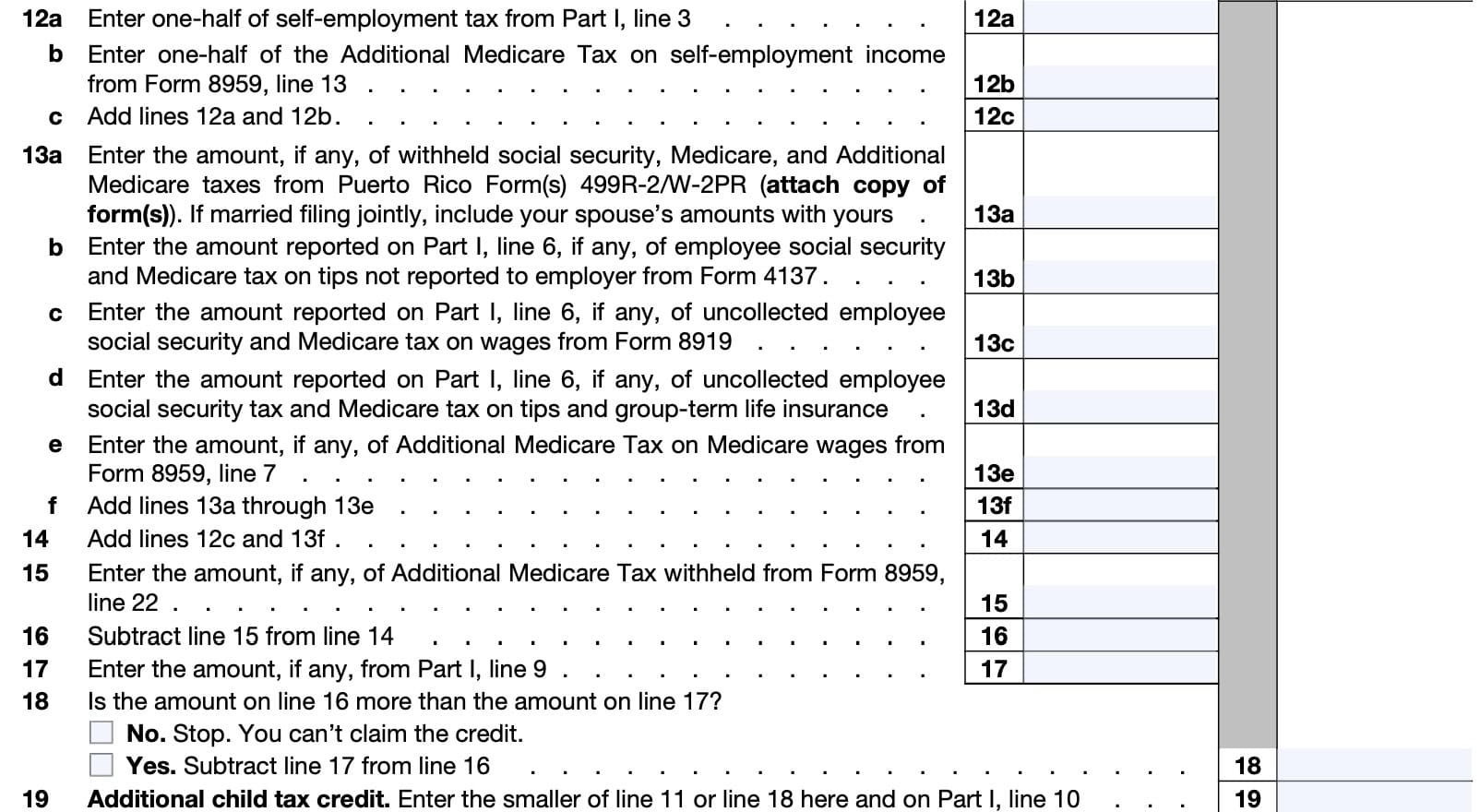

Line 12

There are three parts to this line.

Line 12a

Enter one-half of the self-employment tax from Part I, Line 3.

Line 12b

Enter one-half of the additional Medicare Tax on self-employment income. You can find this on IRS Form 8959, Line 13.

Line 12c

Add Lines 12a and 12b, then enter the total here.

Line 13

There are six parts to Line 13.

Line 13a

Enter the amount, if any, of withheld Social Security, Medicare, and Additional Medicare taxes from Puerto Rico Form(s) 499R-2/W-2PR. Attach a copy of the forms.

If you are a married couple filing a joint return, include your spouse’s amounts as well as yours.

Line 13b

Enter the amount reported on Part I, Line 6, of employee Social Security and Medicare tax on tips not previously reported to your employer from IRS Form 4137.

Line 13c

Enter the amount reported on Part I, Line 6, of uncollected employee Social Security and Medicare tax on wages from IRS Form 8919.

Line 13d

Enter the amount reported on Part I, Line 6, of uncollected employee Social Security and Medicare tax on tips and group-term life insurance.

Line 13e

If applicable, enter any Additional Medicare Tax on Medicare wages. You can find this on IRS Form 8959, line 7.

Line 13f

Add Lines 13a through 13e. Enter the total in Line 13f.

Line 14

Add Line 12c and Line 13f. Enter the total here.

Line 15

If applicable, enter any Additional Medicare Tax withheld, from IRS Form 8959, Line 22.

Line 16

Subtract the Line 15 amount from Line 14. Enter the result here.

Line 17

Enter the amount from Part I, Line 9, if applicable.

Line 18

Is the Line 16 amount more than the amount in Line 17? If the answer is No, then you cannot claim the additional child tax credit. If Yes, then subtract Line 17 from Line 16 and enter the result here.

Line 19: Additional child tax credit

Enter the smaller of:

Enter this amount here, and in Part I, Line 10.

Video walkthrough

Frequently asked questions

This form is for residents of the U.S. Virgin Islands (USVI), Guam, American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), and Puerto Rico who are not required to file a U.S. income tax return but who have self-employment income or are eligible to claim certain tax credits.

You must file Form 1040-SS if you had self-employment income of $400 or more, are not required to file a Form 1040 tax return, and if you are a bona fide resident of Guam, American Samoa, U.S. Virgin Islands, the CNMI, or Puerto Rico.

Where can I find IRS Form 1040-SS?

You can find IRS Form 1040-SS on the IRS website. For your convenience, we’ve enclosed the latest version of the form here in this article.