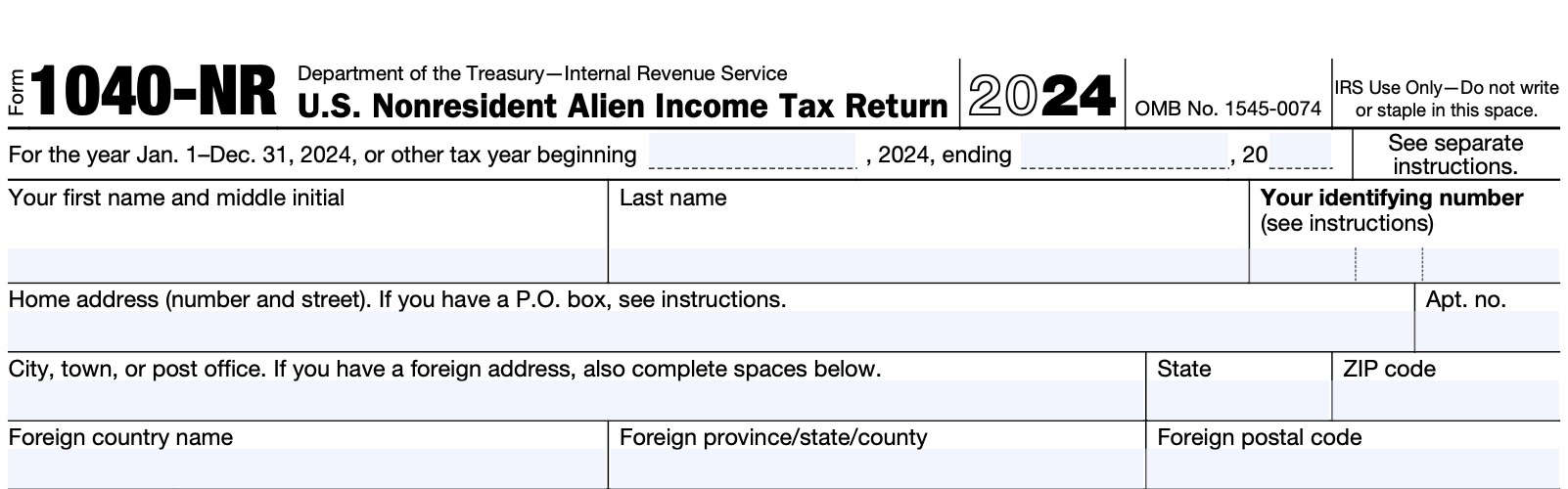

IRS Form 1040-NR Instructions

If you are a nonresident alien in the United States, you may still need to file an income tax return. To do this, you would complete IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

In this article, we’ll walk through everything you need to know about IRS Form 1040-NR, including:

- How to complete and file your annual income tax return using this special tax form

- Other tax forms and numbered schedules you may need to complete when filing your tax return

- Additional resources that may help you calculate your taxes

Let’s start by going through IRS Form 1040-NR, beginning at the top.

Contents

Table of contents

Are you tired of dreading tax season?

If you’re like most people, you push through the stress of filing, only to be hit with a bigger bill than expected—then put it all behind you until the same cycle repeats next year.

But what if you could change the game?

Tax planning puts you in control. It’s about being proactive, not reactive—taking small, smart steps throughout the year to reduce your tax burden, increase your savings, and keep more of your hard-earned money working for you.

Here’s what effective tax planning helps you do:

✅ Avoid the surprise of a high tax bill

✅ Understand how your income and decisions affect your taxes

✅ Strategically lower your tax liability over time

Ready to make smarter tax moves?

👉 Join my free weekly tax planning newsletter and get one actionable tip every week to help you reduce your taxes legally and effectively.

Start taking control—your future self will thank you.

How do I complete IRS Form 1040-NR?

This two-page tax form can be daunting. To make this easier, we’ve broken the form down into the following sections:

- Taxpayer information

- Filing status

- Digital assets

- Dependents

- Income effectively connected with U.S. trade or business

- Tax and credits

- Payments

- Refund

- Amount you owe

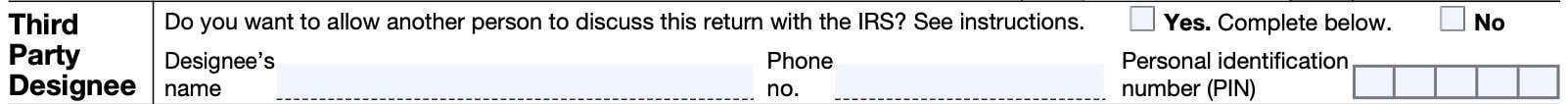

- Third party designee

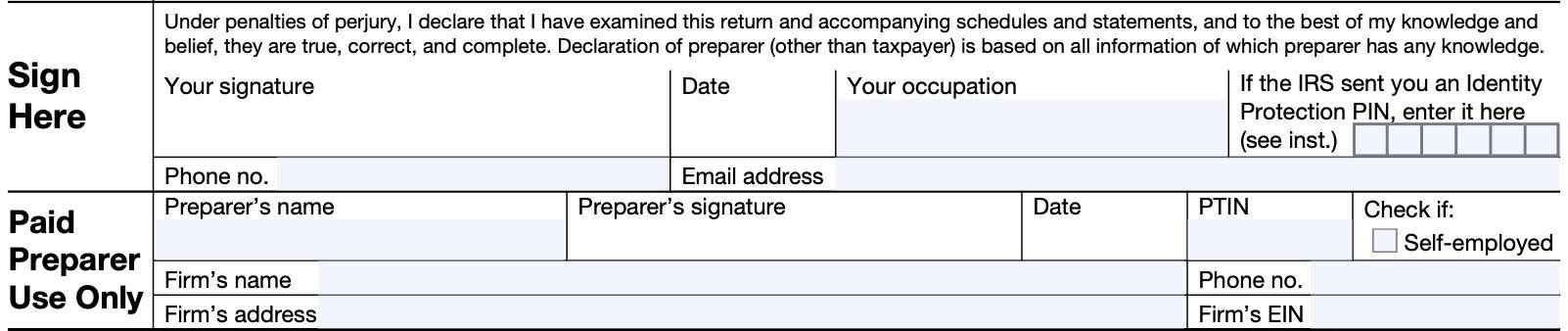

- Signature

To clarify, there are comprehensive form instructions located on the IRS website which cover IRS Form 1040. However, there are differences that pertain to the Form 1040-NR version, which we will focus on.

For reference to the original Form 1040 instructions, please refer to the IRS website.

We’ll go through this form, section by section. Let’s start at the very top with the taxpayer information fields.

Taxpayer information

In this section, you’ll enter some personal information. Most of the fields are straightforward, but there is additional information you may need to know.

But first, there is a line for taxpayers to complete their tax year. Most people use the calendar year (January 1 through December 31) for their federal tax return. However, if you are a fiscal year filer, you may enter the twelve-month period that is consistent with your tax year.

First name, middle initial, and last name

If you’ve recently changed your name, be sure to report your name change to the Social Security Administration.

You may do this by completing Form SS-5, Application for Social Security Card, and bringing your completed form to the local Social Security office, as well as proof of your name change (i.e. marriage certificate, divorce decree, etc.).

Spouse’s name

Enter your spouse’s name if you’re married and filing a joint tax return. If you filed a joint income tax return in prior taxable years, then be sure that your name and your spouse’s name appear in the same order as on the previous tax returns.

If you’re married filing separate returns, do not enter your spouse’s name here. Instead, enter your spouse’s name in the filing status fields.

Identifying number

Enter your Social Security number here, if you have one.

If you have an individual taxpayer identification number (ITIN), enter that number instead. For individuals with an ITIN who recently received an SSN, use your SSN, not your ITIN. The following additional guidance is for persons with special visa statuses.

If you do not have an SSN or ITIN, and are not eligible for an SSN, you must apply for an ITIN by filing IRS Form W-7, Application for IRS Individual Taxpayer Identification Number.

Exception for students

When you bring your Form SS-5 to the local SSA office, if your visa status is that of an F-1 or M-1 student, you must also show your Form I-20, Certificate of Eligibility for Nonimmigrant Student Status.

Exception for exchange visitors

When you bring your Form SS-5 to the local SSA office, if you’re an J-1 or J-1 exchange visitor, you must also show your Form DS-2019, Certificate of Eligibility for Exchange Visitor Status.

Home address

Enter your home address here. If you plan to move after filing your federal income tax return, then you may need to report your move to the Internal Revenue Service by filing IRS Form 8822, Change of Address.

Foreign address

If you have a foreign address, enter the city name on the appropriate line. Don’t enter any additional information on that line. However, complete the spaces below it.

Do not abbreviate the country name. Follow the country’s practice for entering your postal code and the name of the province, county, or state.

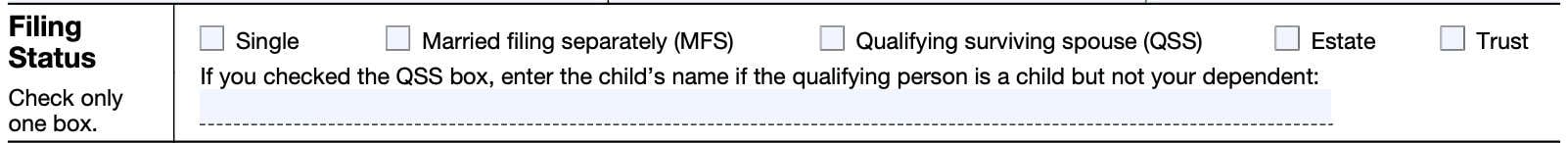

Filing status

Check one box as it pertains to your tax filing status:

- Single

- Married filing separately (MFS)

- Qualifying surviving spouse (QSS)

- Estate

- Trust

Below is additional information about each tax filing status. You must check only one box.

Single

Check the ‘Single’ box at the top of the tax form if any of the following was true as of the last day of the tax year:

- You were never married.

- You were legally separated according to your state law under a decree of divorce or separate maintenance.

- If, at the end of the year, your divorce wasn’t final (an interlocutory decree), you are considered married and can’t check the box.

- You were widowed before the first day of the tax year, and didn’t remarry before the end of the year.

- If you have a child, you may be able to use the qualifying surviving spouse filing status. See the instructions for Qualifying Surviving Spouse.

Married filing separately

Check this box if you are married, at the end of the tax year. Generally, if both spouses are nonresidents, then you can only file as a married couple filing separately. If you believe that one or both spouses could file as a United States citizen, then you should consider filing IRS Form 1040 instead of IRS Form 1040-NR.

Exception

Married persons who live apart: Some married nonresident aliens who have a child and who don’t live with their spouse can file as single.

You may check the Single filing status at the top of Form 1040-NR if you meet certain tests and you are either:

- A married resident of Canada or Mexico

- You are a married U.S. national,

- You’re a married resident of South Korea, or

- You’re a married student or business apprentice eligible for the benefits of Article 21(2) of the United States– India Income Tax Treaty

Exception tests

If any of the above apply to you, then you must meet the following tests to file as a single taxpayer:

- You lived apart from your spouse for the last 6 months of 2024.

- Temporary absences for special circumstances, such as for business, medical care, school, or military service, count as time lived in the home.

- You file a separate return from your spouse.

- You paid over half the cost of keeping up your home for 2024.

- Your home was the main home of your child, stepchild, or foster child for more than half of the calendar year.

- Temporary absences by you or the child for special circumstances, such as school, vacation, business, or medical care, count as time the child lived in the home.

- If the child was born or died in the tax year, you can still file as single as long as the home was that child’s main home for more than half of the part of the year the child was alive during the year.

- You could have claimed the child as a dependent or could claim the child except that the child’s other

parent claims the child as a dependent under the rules for children of divorced or separated parents.- Additional information is available on IRS Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent

Adopted child

An adopted child is always treated as your own child. An adopted child includes a child lawfully placed with you for legal adoption.

Foster child

A foster child is any child placed with you by an authorized placement agency or by judgment, decree, or other order of any court of competent jurisdiction.

Qualifying surviving spouse

Check the ‘Qualifying surviving spouse’ (QSS) box at the top of your return and use joint return tax rates for the tax year if all of the following apply:

- During the tax year, you were either:

- A resident of Canada, Mexico, or South Korea, or

- A student or business apprentice from India eligible for the benefits of Article 21(2) of the United States–India Income Tax Treaty

- You were a resident alien or U.S. citizen the year that your spouse passed away.

- This refers to your actual immigration status, not an election that some nonresident aliens can make to be taxed as U.S. residents

- Your spouse died in the preceding year or year before, and you didn’t remarry before the end of the tax year.

- Example: If your spouse passed away in 2022 or 2023, and you did not marry before the end of 2024, then you could claim QSS status for the 2024 tax year

- You have a child or stepchild (not a foster child) whom you can claim as a dependent or could claim as a dependent except that, for the tax year:

- The child had gross income of $4,400 or more

- The child filed a joint income tax return

- Someone else could claim you as a dependent on their tax return

- If the child isn’t your dependent, enter the child’s name in the entry space below the filing status checkboxes.

- The child lived in your home for the entire tax year

- You paid over 50% of the cost of your home’s upkeep

- You could have filed a joint tax return with your spouse the year that your spouse passed away, even if you didn’t do so

If your spouse passed away during the tax year, you cannot claim QSS status.

Estate

Your filing status is Estate if you are a personal representative filing an income tax return on behalf of a deceased individual who would have had to file a

Form 1040-NR.

Trust

Your filing status is Trust if you’re filing a tax return on behalf of a foreign trust that must pay U.S. tax on certain U.S.-sourced income or income effectively connected to a U.S. trade or business.

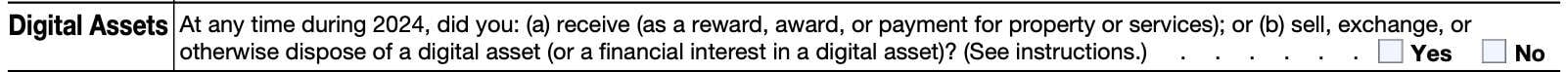

Digital assets

Digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or any similar technology.

For example, digital assets include non-fungible tokens (NFTs) and virtual currencies, such as cryptocurrencies and stablecoins. If a particular asset has the characteristics of a digital asset, it will be treated as a digital asset for federal income tax purposes.

During the tax year, did you either:

- Receive digital assets

- As a reward, award, or payment for property or services

- sell, exchange, or otherwise dispose of a digital asset

Answer Yes or No. If Yes, you may need to report your transaction as outlined below.

Disposing of a digital asset through a sale, trade, exchange, payment, or other transfer

If you sold or exchanged a digital asset that you held as a capital asset, check Yes and use IRS Form 8949 to report your capital gain or loss. Once calculated, you’ll report that gain or loss on Schedule D.

Receiving digital assets as compensation for services or for sale to customers in a trade or business

If you received digital assets as compensation, you would check Yes and report this income either as W-2 wages on Form 1040 or as inventory or services on Schedule C.

Ordinary income in connection with digital assets not reported elsewhere on your federal tax return

If you received ordinary income in connection with digital assets not reported anywhere else on your income tax return, you may need to report it as additional income on Schedule 1, Line 8v.

Disposing of a digital asset as a gift

If you gifted digital assets to another person, you may need to file IRS Form 709.

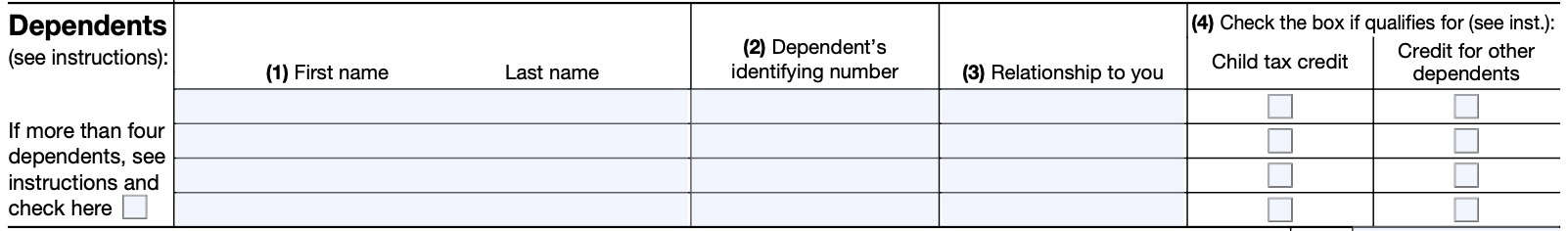

Dependents

Only U.S. nationals and residents of Canada and Mexico can claim a dependent on the same terms

as United States citizens.

Residents of South Korea and students or business apprentices from India who are eligible for the benefits of Article 21(2) of the United States–India Income Tax Treaty may claim dependents on the more limited terms described in chapter 5 of Pub. 519.

No other person filing a Form 1040-NR can claim a qualifying dependent.

For each dependent that you claim on your income tax return, enter the following information:

- First name

- Last name

- Social Security number

- Relationship to you

Also, check the appropriate box if your dependent is eligible for either the child tax credit or the credit for other dependents.

If you are claiming more than 4 dependents, then check the appropriate box and attach a separate statement containing the requested information.

Does my child or dependent qualify for the child tax credit or credit for other dependents?

If you are not sure whether your child or dependent qualifies for the child tax credit or the credit for other dependents, the IRS provides a 5-step test, outlined below.

Step 1: Do you have a qualifying child?

The IRS considers a qualifying child as a child who is your:

- Son or daughter

- Stepchild

- Foster child

- Brother or sister

- Stepbrother or stepsister

- Half brother or half sister

- Descendent of any of the relatives listed above

The child must also meet the following criteria:

- Under the age of 19 at the end of the tax year and is younger than you (or your spouse, if filing a joint tax return), and

- May be under the age of 24 if enrolled as a student

- May be any age if considered totally and permanently disabled

- Did not provide over 50% of his or her own support during the tax year, and

- Is not filing a joint income tax return for the tax year, and

- May file a joint return if the only reason is to claim a refund of taxes paid

- Lived with you for more than 50% of the tax year

- Exceptions exist for special circumstances, such as school, vacation, kidnapping, business, medical care, military service, or detention in a juvenile facility

If you have a child that meets this criteria, go to Step 2, below. Otherwise, go to Step 4, below.

Step 2: Is your qualifying child your dependent?

In Step 2, there are several questions.

1. Was the child a U.S. citizen, U.S. national, U.S. resident alien, or a resident of Canada or Mexico?

If so, go to the next question. If not, you cannot claim the child as a dependent.

2. Was the child married?

If not, go to the next question. If so, and he or she filed a joint return, you cannot claim that child as a dependent unless the joint return was filed solely to obtain a refund of income taxes or estimated taxes paid.

3. Could you, or your spouse if filing a joint return, be claimed as a dependent on someone else’s tax return?

If so, you cannot claim any dependents on your federal tax return. If not, go to Step 3.

Step 3: Does Your Qualifying Child Qualify You for the Child Tax Credit or Credit for Other Dependents?

In Step 3, you’ll determine whether your child qualifies for the child tax credit or the credit for other dependents.

1. Did the child have any of the following as of the date that you filed your tax return:

- SSN

- ITIN

- Adoption Taxpayer Identification Number (ATIN)

If so, go to the next question. If not, you cannot claim either tax credit for the child.

2. Was the child a U.S. citizen, U.S. national, or U.S. resident alien?

If ‘Yes,’ go to the next question. If not, you cannot claim either tax credit for the child.

3. Was the child under age 17 at the end of the tax year?

If so, go to the next question. If not, you cannot claim the child tax credit, but you may be able to claim the credit for other dependents. Check the ‘Credit for other dependents’ box in column (4) for this person.

4. Did this child have an SSN valid for employment issued before the due date of your tax return?

If so, you can claim the child tax credit. Check the ‘Child tax credit’ box in column (4) for this person.

If not, you cannot claim the child tax credit, but you may be able to claim the credit for other dependents. Check the ‘Credit for other dependents’ box in column (4) for this person.

Step 4: Is Your Qualifying Relative Your Dependent?

A qualifying relative is one of the following:

- Son, daughter, stepchild, foster child, or a descendant

- Brother, sister, half brother, half sister, or a son or daughter

- Father, mother, or an ancestor or sibling of either

- Stepbrother, stepsister, stepparent, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law

- Any other person (besides your spouse) who lived with you all year as a member of your household if your relationship didn’t violate local law

A qualifying relative must also meet the following criteria:

- Wasn’t a qualifying child as defined in Step 1

- Who had gross income of less than $4,400 in the tax year

- Exception exists for someone who is considered totally and permanently disabled

- Received over 50% of their support from you during the tax year

- Exceptions exist for kidnapping victims, children of divorced or separated parents, and multiple support agreements

Additional questions

If the person meets the above criteria, the IRS has additional questions:

1. Was your qualifying relative a U.S. citizen, U.S. national, U.S. resident alien, or a resident of Canada or Mexico?

If ‘Yes,’ go to the next question. If not, you cannot claim a tax credit.

2. Was your qualifying relative married?

If ‘No,’ go to the next question. If ‘Yes,’ go to the next question only if that person did not file a joint tax return, or if the only reason he or she filed a joint return was to receive a refund for taxes paid during the year.

3. Could you, or your spouse if filing a joint return, be claimed as a dependent on someone else’s tax return?

If so, you cannot claim any dependents on your federal tax return. If not, you can claim this person as a dependent. Complete columns (1) through (3) of the dependents field, then proceed to Step 5 to determine if your relative qualifies for the credit for other dependents.

Step 5: Does Your Qualifying Relative Qualify You for the Credit for Other Dependents?

1. Did the relative have any of the following as of the date that you filed your tax return:

- SSN

- ITIN

- Adoption Taxpayer Identification Number (ATIN)

If so, go to the next question. If not, you cannot claim a tax credit for this person.

2. Was your qualifying relative a U.S. citizen, U.S. national, or a U.S. resident alien?

If so, you can claim the credit for other dependents. Otherwise, you cannot.

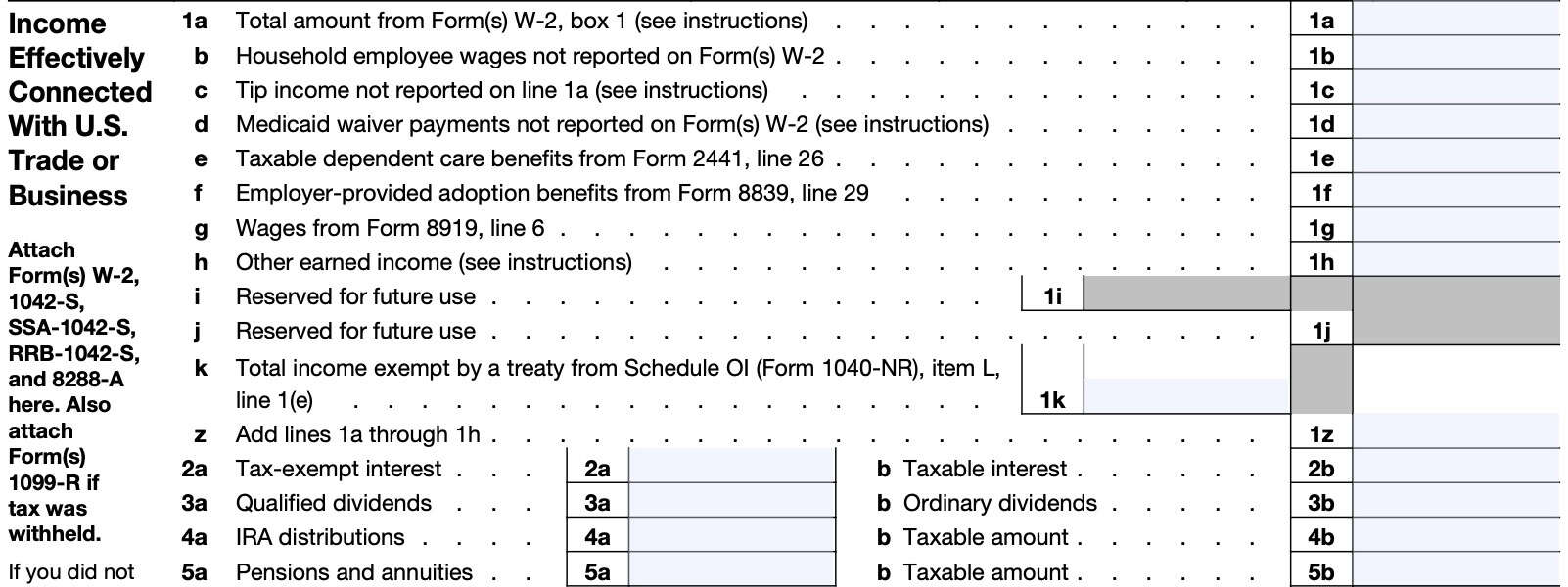

Income effectively connected with U.S. Trade or business

In this section, you’ll report income that is effectively connected with a U.S. trade or business in which you are engaged.

Under some circumstances, items of income from foreign sources are treated as effectively connected with a U.S. trade or business. Other items are reportable as effectively connected or not effectively connected with a U.S. trade or business, depending on how you elect to treat them.

You should plan to attach copies of the following tax forms to your annual income tax return when filing:

- IRS Form W-2, Wage and Tax Statement

- IRS Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding

- Form SSA-1042-S

- Form RRB-1042-S

- IRS Form 8288-A, Statement of Withholding on Certain Dispositions by Foreign Persons

- IRS Form 1099-R, Distributions from Pensions, Retirement Plans, etc

Let’s go through each line to cover additional details.

Line 1a: Total Amount From Form(s) W-2, Box 1

Enter on Line 1a of Form 1040-NR only the wages, salaries, tips, and other compensation reported in Box 1 of Form(s) W-2 effectively connected with a U.S. trade or business. Don’t include any income on Line 1a of Form 1040-NR that isn’t treated as effectively connected to a U.S. trade or business.

Note: If you received scholarship or fellowship grants that weren’t reported to you on Form W-2, you will now report these amounts on IRS Schedule 1, Line 8r.

Amounts exempt under a treaty

Wages, salaries, tips, and other compensation that you claim are exempt from U.S. tax under an income

tax treaty should not be reported on Line 1a. Instead, include these amounts on Line 1k and complete item L of Schedule OI (Form 1040-NR).

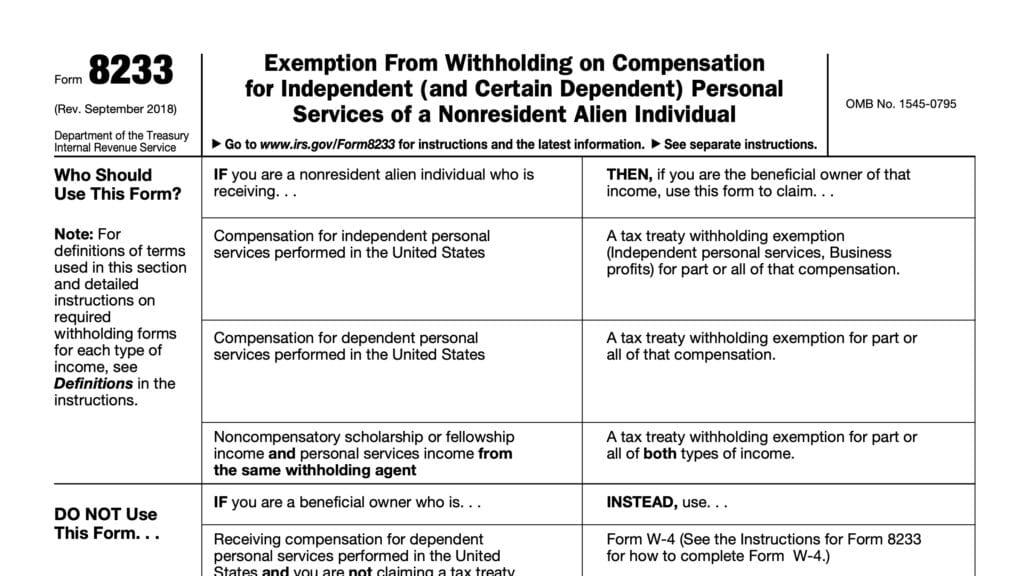

Generally, if you submitted a properly completed IRS Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual, to claim an exemption from withholding based on income tax treaties, your employer wouldn’t have withheld tax on the exempt amount. Instead, your employer would’ve reported the exempt amount on a Form 1042-S, not in Box 1 of Form W-2.

Line 1b: Household Employee Wages Not Reported on Form(s) W-2

Enter the total of your wages received as a household employee that was not reported on IRS Form(s) W-2.

An employer isn’t required to provide a Form W-2 to you if they paid you wages of less than $2,700 in 2024.

Line 1c: Tip income not reported on Line 1a

Enter the total of your tip income that was not reported on Form 1040, Line 1a.

This should include any tip income you didn’t report to your employer and any allocated tips shown in Box 8 on your Form(s) W-2 unless you can prove that your unreported tips are less than the amount in Box 8. Allocated tips aren’t included as income in Box 1.

Also include the value of any noncash tips you received, such as tickets, passes, or other items of value. Although you don’t report these noncash tips to your employer, you must report them on Line 1c.

You may owe Social Security and Medicare or railroad retirement (RRTA) tax on unreported tips, which you would report on IRS Schedule 2, Line 5.

Line 1d: Medicaid Waiver Payemnts Not Reported on Form(s) W-2

Enter your taxable Medicaid waiver payments that were not reported on Form(s) W-2.

Also enter the total of your taxable and nontaxable Medicaid waiver payments that were not reported

on Form(s) W-2, or not reported in Box 1 of Form(s) W-2, if you choose to include nontaxable payments in earned income for purposes of claiming a credit or other tax benefit.

Line 1e: Taxable dependent care benefits

Enter the total of your taxable dependent care benefits from IRS Form 2441, Child and Dependent Care Expenses, Line 26.

Dependent care benefits should be shown in box 10 of your Form(s) W-2. But first complete Form 2441 to see if you can exclude part or all of the benefits.

Line 1f: Employer-provided adoption benefits

Enter the total of your employer-provided adoption benefits from IRS Form 8839, Line 29. Employer-provided adoption benefits should be shown in Box 12 of your Form(s) W-2 with code T.

The IRS instructions for Form 8839 may contain additional details to help you determine if you can exclude part or all of the benefits from taxable income. You may also be able to exclude amounts if you adopted a child with special needs and the adoption became final in 2024.

Line 1g: Wages from IRS Form 8919, Line 6

Enter the total of your wages from IRS Form 8919, Uncollected Social Security & Medicare Taxes, Line 6.

Line 1h: Other earned income

The following types of income must be included in the total on Line 1h.

- Strike or lockout benefits (other than bona fide gifts).

- Excess elective deferrals.

- The amount deferred should be shown in Box 12 of your Form W-2, and the “Retirement plan” box in Box 13 should be checked.

Line 1i: Reserved for future use

Do not use this line.

Line 1j: Reserved for future use

Do not use this line.

Line 1k: Total income exempt by a treaty from Schedule OI

Report on Line 1k the total of all your income that is exempt from tax by an

income tax treaty. This include both effectively connected income and not effectively connected income.

Do not include this exempt income on any other line of Form 1040-NR. You must also complete item L of Schedule OI to report income that is exempt from U.S. tax.

Attach any IRS Form 1042-S you received for treaty-exempt income. If required, attach IRS Form 8833.

Line 1z

Add Lines 1a through 1h. Enter the result in Line 1z.

Line 2: Interest income

This line is broken down into two parts:

- Line 2a: Tax-exempt interest

- Line 2b: Taxable interest

Let’s take a closer look at each.

Line 2a: Tax-exempt interest

If you received any tax-exempt interest (including any tax-exempt original issue discount (OID)), such as from municipal bonds, each payer should send you a copy of IRS Form 1099-INT, Interest Income, or IRS Form 1099-OID, Original Issue Discount.

In general, your tax-exempt stated interest should be shown in Box 8 of Form 1099-INT or, for a tax-exempt OID bond, in Box 2 of Form 1099-OID, and your tax-exempt OID should be shown in Box 11 of Form 1099-OID. Enter the total on Line 2a.

Exceptions

The interest won’t be includible on Line 2a of Form 1040-NR unless it’s effectively connected with a trade or business. If the interest wasn’t effectively connected with a U.S. trade or business and was U.S. source, see Schedule NEC (Form 1040-NR), Line 2a, 2b, or 2c.

Do not include interest from a U.S. bank, savings and loan association, credit union, or similar institution (or from certain deposits with U.S. insurance companies) that is exempt from tax under a tax treaty or

under Internal Revenue Code Section 871(i) because the interest isn’t effectively connected with a U.S. trade or business.

Line 2b: Taxable interest

Each payer should send you a Form 1099-INT or Form 1099-OID. Enter your total taxable interest income on Line 2b. Be sure to include copies of tax forms associated with US-sourced income with your annual tax return.

But you must fill in and attach Schedule B if the total is over $1,500 or any of the other conditions listed at the beginning of the Schedule B instructions applies to you.

Line 3: Dividends

This line is broken down into two parts:

- Line 3a: Qualified dividends

- Line 3b: Ordinary dividends

Let’s take a closer look at each.

Line 3a: Qualified dividends

Enter your total qualified dividends on Line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on Line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in Box 1b of Form(s) 1099-DIV, Dividends and Distributions.

Only report qualified dividends effectively connected with a trade or business on IRS Form 1040-NR, Line 3a. If the qualified dividends weren’t effectively connected with a U.S. trade or business and were U.S. source, report them on Schedule NEC (Form 1040-NR), Line 1a, 1b, or 1c.

Line 3b: Ordinary dividends

Each payer should send you a Form 1099-DIV. Enter your total ordinary dividends on Line 3b. This amount should be shown in Box 1a of Form(s) 1099-DIV. You must fill in and attach Schedule B if the total is over $1,500 or you received, as a nominee, ordinary dividends that actually belong to someone else.

Only report ordinary dividends effectively connected with a trade or business on IRS Form 1040-NR, Line 3b. If the ordinary dividends weren’t effectively connected with a U.S. trade or business and were U.S. source, report them on Schedule NEC (Form 1040-NR), Line 1a, 1b, or 1c.

Line 4: IRA distributions

This line is broken down into two parts:

- Line 4a: IRA distributions

- Line 4b: Taxable portion

You should receive a copy of IRS Form 1099-R showing the total amount of any distribution from your IRA before income tax or other deductions were withheld. This amount should be shown in Box 1 of Form 1099-R.

Unless otherwise noted in the Line 4a and 4b instructions, an IRA includes the following:

- A traditional IRA (including a SEP IRA)

- Roth IRA

- SIMPLE IRA (can be either traditional or Roth)

Report the entire amount of your IRA distribution in Line 4a. In traditional IRAs, the taxable portion of your IRA distribution, reporta usually equals the IRA distribution, unless:

- You’ve previously made a nondeductible IRA contribution and reported it on IRS Form 8606.

- You’re making a tax-free rollover from an IRA to another IRA or qualified workplace retirement plan account

Line 5: Pensions and annuities

This line is broken down into two parts:

- Line 5a: Pension and annuities

- Line 5b: Taxable portion

Only report pensions and annuities effectively connected with a U.S. trade or business on Lines 5a and 5b. If the pensions and annuities weren’t effectively connected with a U.S. trade or business and were U.S. source, report them on Schedule NEC (Form 1040-NR), Line 7.

In addition to entering pension and annuity amounts from Box 1 of Form 1099-R, you may also enter pension and annuity amounts from Box 2 of Form 1042-S.

Attach Form 1042-S or 1099-R to Form 1040-NR if any federal income tax was withheld.

Your payments are fully taxable if:

- You didn’t contribute to the cost of your pension or annuity, or

- You got your entire cost back tax free before 2024.

Effectively Connected Pension Distributions

If you worked in the United States after December 31, 1986, the part of each pension distribution that is

attributable to the services you performed after 1986 is income that is effectively connected with a U.S. trade or business.

Fully taxable pension distributions

On Line 5b, include the total pension or annuity payments from Box 2 of Form(s) 1042-S, if any, with the total of payments from Box 1 of Form(s) 1099-R.

Partially taxable pension distributions

Enter the total pension or annuity payments (from Form 1099-R, Box 1) on Line 5a. If your Form 1099-R doesn’t show the taxable amount, you must use the General Rule explained in IRS Publication 939, General Rule for Pensions and Annuities, to figure the taxable part to enter on Line 5b.

Line 6: Reserved for future use

This line is reserved for future use. Do not use.

Line 7: Capital gain (or loss)

Only report effectively connected capital gains or losses connected with a trade or business on

IRS Form 1040-NR, Line 7. If the capital gains or losses weren’t effectively connected with a U.S. trade or business and were U.S. source, report them on Schedule NEC (Form 1040-NR), Line 16.

If you sold a capital asset, such as a stock or bond, you may need to complete and attach IRS Form 8949, Sales and Other Dispositions of Capital Assets, and Schedule D, Capital Gains and Losses.

However, you don’t have to file IRS Form 8949 or Schedule D if you aren’t deferring any capital gain by investing in a qualified opportunity fund and both of the following conditions apply:

- You have no capital losses and your only capital gains are capital gain distributions from Box 2a of Form 1099-DIV

- You do not have a Form 1099-DIV with amounts reported in any of the following boxes:

- Box 2b: Unrecaptured Section 1250 gain

- Box 2c: Section 1202 gain

- Box 2d: Collectibles (28%) gain

When you must file on Schedule D

You must file Schedule D but generally don’t have to file IRS Form

8949 if:

- The above exception doesn’t apply

- You aren’t deferring capital gains by investing in a qualified opportunity fund

- You aren’t terminating deferral from an investment in a qualified opportunity fund

- Your only capital gains and losses are one or more of the following:

- Capital gain distributions;

- A capital loss carryover from 2023;

- A gain from one of the following forms:

- A gain or loss from a partnership, S corporation, estate, or trust; or

- Gains and losses from transactions for which:

- You received a copy of IRS Form 1099-B (or substitute statement) that shows basis was reported to the IRS,

- The QOF box in Box 3 isn’t checked, and

- You don’t need to make any adjustments in column (g) of Form 8949 or enter any codes in column (f) of Form 8949.

Line 8: Additional income from Schedule 1, Line 10

Enter any additional income from Schedule 1, Additional Income and Adjustments to Income, Line 10.

Line 9: Total effectively connected income

Add the following lines:

- Line 1z

- Line 2b

- Line 3b

- Line 4b

- Line 5b

- Line 7

- Line 8

This is your total effectively connected income.

Line 10: total adjustments to income

Enter the adjustments to income from Schedule 1, Line 26.

Line 11: Adjusted gross income

Subtract Line 10 from Line 9. The result is your adjusted gross income, or AGI.

Line 12: Itemized deductions

Enter the total itemized deductions, if any, from Line 8 of Schedule A (Form 1040-NR). Note: Schedule A for Form 1040-NR is a completely different form from Schedule A for IRS Form 1040. You cannot use Schedule A for the Form 1040 to complete Line 12 of Form 1040-NR.

Generally, non-resident aliens filing Form 1040-NR cannot claim a standard deduction.

United States-India Income Tax Treaty

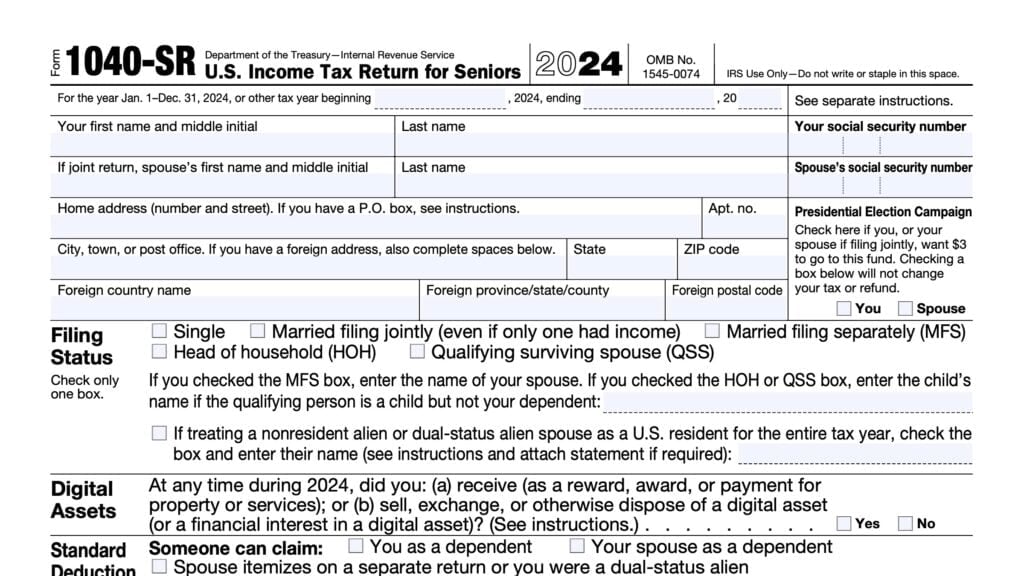

Students or business apprentices may be able to take the standard deduction on Form 1040-NR, Line 12, instead of their itemized deductions if they are eligible for benefits under Article 21(2) of the United States–India Income Tax Treaty. They will enter, on Form 1040-NR, Line 12, the standard deduction amount found for their filing status on Form 1040 or 1040-SR.

Line 13a: Qualified business income deduction

You must have income effectively connected with a U.S. trade or business to claim the qualified business income (QBI) deduction. You also must complete one of the following:

- IRS Form 8995, Qualified Business Income Deduction Simplified Computation

- IRS Form 8995-A, Qualified Business Income Deduction

Line 13b: Exemptions for estates and trusts only

A trust or estate can claim an exemption only to the extent of its income that is effectively connected with a U.S. trade or business.

Estates

If you’re completing this tax return on behalf of the estate of a deceased person, enter $600 on Line 13b.

Trusts

If you’re filing for a trust whose governing instrument requires it to distribute all of its income currently, enter $300 on Line 13b.

If you’re filing for a qualified disability trust (defined in Internal Revenue Code Section 642(b)(2)(C)(ii)), enter $5,000 on Line 13b.

If you’re filing for any other trust, enter $100 on Line 13b.

Line 13c

Add Line 13a and Line 13b. Enter the total here.

Line 14

Add Line 12 and Line 13c. Enter the total in Line 14.

Line 15: Taxable income

Subtract Line 14 from Line 11. Enter the total in Line 15. If zero or less, enter ‘0.’

This is considered your taxable income.

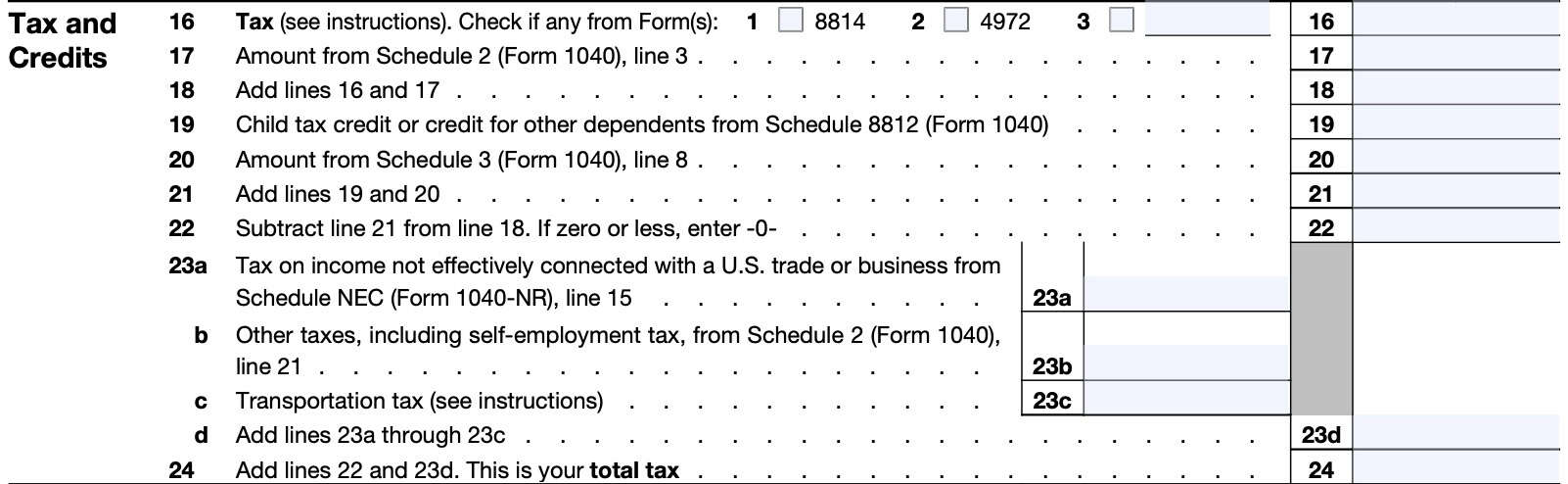

Tax and credits

In this section, we’ll calculate your tax liability, based upon the taxable income calculated in the first part of the tax form.

Line 16: Tax

Enter your overall tax liability from the following:

- Taxable income

- Must use either the tax tables or the tax computation worksheet in the Form 1040-NR instructions

- IRS Form 8814, Parents’ Election to Report Child’s Interest or Dividends

- IRS Form 4972, Lump-Sum Distributions

You may also need additional guidance from the form instructions if any of the other situations applies:

- You must calculate tax on unearned income on IRS Form 8615

- You must use the Schedule D tax worksheet

Form 1040-NR exceptions

If you’re filing for an estate or trust, you’ll need to use Tax Rate Schedule W, located in the Form 1040-NR instructions, to calculate your tax liability.

Do not use the Foreign Earned Income Tax Worksheet located in the Form 1040 instructions. You are not eligible for any tax benefits from IRS Form 2555, Foreign Earned Income.

The IRS will not calculate your tax for you.

You must file IRS Form 8615 for a child, regardless of the child’s citizenship status.

Line 17: Amount from Schedule 2, Line 3

Enter any amount from Line 3 on IRS Schedule 2, Additional Taxes.

Line 18

Add Line 16 and Line 17. Enter the total here.

Line 19: Child tax credit or credit for other dependents from Schedule 8812

Enter any tax credits you may have calculated for an eligible child or dependent using Schedule 8812, Credits for Qualifying Children and Other Dependents.

Line 20: Amount from Schedule 3, Line 8

Enter the total of all nonrefundable tax credits from Line 8 on Schedule 3, Additional Credits and Payments.

Line 21

Add Line 19 and Line 20. Enter the total here.

Line 22

Subtract Line 21 from the tax amount in Line 18. Enter the total on Line 22.

Line 23a: Tax on income not effectively connected with a U.S. trade or business from Schedule NEC

Enter the amount from Line 15 on Schedule NEC. This represents the amount of tax on income not effectively connected with a U.S. trade or business.

Line 23b: Other taxes, including self-employment tax, from Schedule 2, Line 21

Include other taxes that you calculated on Schedule 2, Line 21.

Line 23c: Transportation Tax

Nonresident alien individuals are subject to a 4% tax on U.S. source gross transportation income that isn’t effectively connected with a U.S. trade or business.

However, the term “U.S. source gross transportation income” doesn’t include any such income that is taxable in a territory of the United States under the provisions of the Internal Revenue Code as applied to that territory.

For purposes of this tax, transportation income will be treated as not effectively connected with the conduct of a trade or business in the United States unless:

- You had a fixed place of business in the United States involved in the earning of transportation income, and

- At least 90% of your U.S. source gross transportation income was attributable to regularly scheduled transportation. Or, in the case of income from the leasing of a vessel or aircraft, it was attributable to a fixed place of business in the United States.

Exemptions

You may be exempt from this tax because of a treaty or an exchange of notes between the United States and the country of which you’re a resident.

If the country of which you’re a resident doesn’t impose tax on the shipping or aircraft income of U.S. persons, you may also be exempt from this tax. If you’re exempt from the tax by treaty or exchange of notes, then do the following:

- Complete IRS Form 8833,Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b) and attach it to this return.

- Complete Item L of Schedule OI (Form 1040-NR) and include the amount on Line 1k

If you’re exempt from the transportation tax for any other reason, you must attach a statement to Form 1040-NR identifying your home country of residence and the law and provisions under which you claim exemption from the tax.

Line 23d

Add Lines 23a through 23c. Enter the total here.

Line 24: Total tax

Add Lines 22 and 23d. This represents your total tax liability.

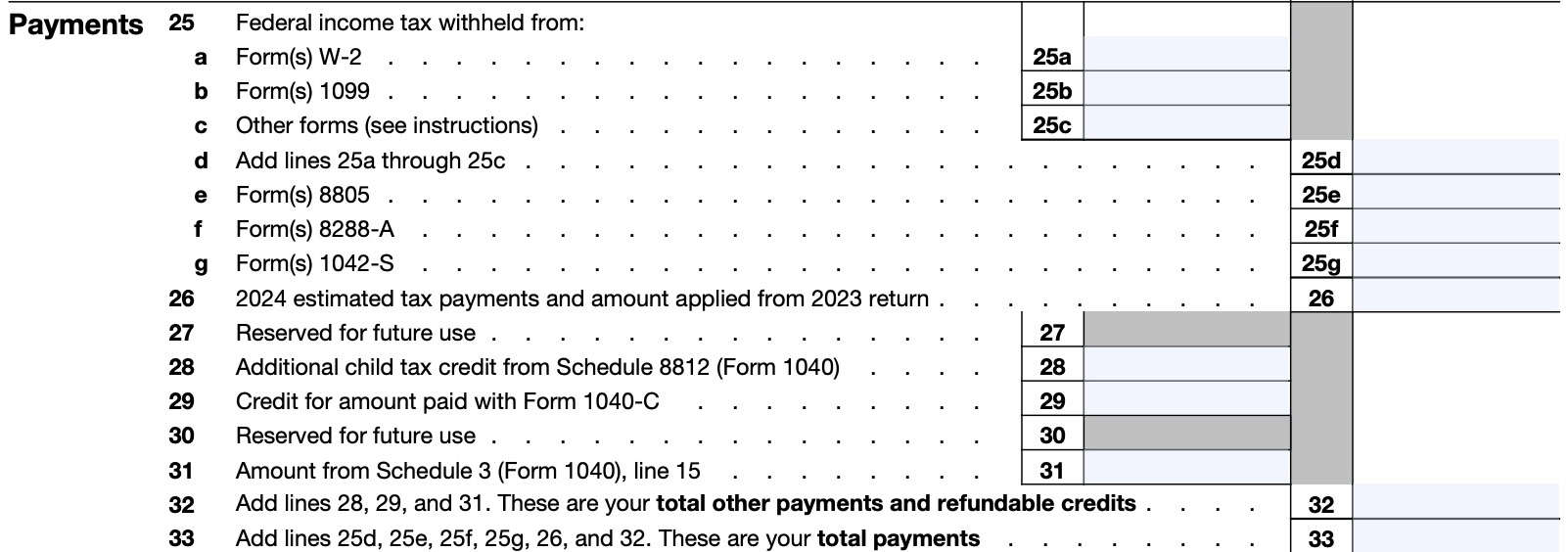

Payments

In this section, we’ll total the amount of taxes paid. This also includes any tax refund carried over from a previous year or tax credits from the current calendar year.

Line 25a: Form W-2

In this line, enter all taxes withheld on IRS Form W-2, Wage and Tax Statement. The amount withheld should be shown in Box 2 of Form W-2.

Line 25b: Form 1099

In this line, enter all taxes withheld on copies of Form 1099 you might have received. Withheld taxes should be shown in Box 4 of your 1099 form.

Form 1099 refers to any version of Form 1099, which comes in many versions. Some of the most common 1099 forms include:

- IRS Form 1099-DIV, Dividends and Distributions

- IRS Form 1099-INT, Interest Income

- IRS Form 1099-MISC, Miscellaneous Information

- IRS Form 1099-K, Payment Card and Third Party Network Transactions

- IRS Form 1099-NEC, Nonemployee Compensation

Line 25c: Other forms

Include taxes withheld on the following:

- IRS Form W-2G, Certain Gambling Winnings, Box 4

- IRS Form 8959, Additional Medicare Tax, Line 24

- Schedule K-1

Do not include any taxes withheld on any of the following:

- IRS Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding

- IRS Form 8805, Foreign Partner’s Information Statement of Section 1446 Withholding Tax

- IRS Form 8288-A, Statement of Withholding on Certain Dispositions by Foreign Persons

Those withheld taxes will be reported later in this form.

Line 25d

Add Lines 25a through 25c together. Enter the total here.

Line 25e: Form 8805

Enter on Line 25e any tax withheld by a partnership and shown on Form(s) 8805.

Line 25f: Form 8288-A

Enter on Line 25f any tax withheld under IRC Section 1445 (related to dispositions of U.S. real property interests) or under IRC Section 1446(f)(1) (related to dispositions of interests in partnerships engaged in the conduct of a trade or business in the United States) and shown on Form(s) 8288-A.

Line 25g: Form 1042-S

Enter on Line 25g the total amount shown as federal income tax withheldunder Chapter 3 or 4 on your Form(s) 1042-S.

The withholding credit should be shown in Box 10 of your Form(s) 1042-S.

Line 26: Estimated tax payments and amount applied from prior year return

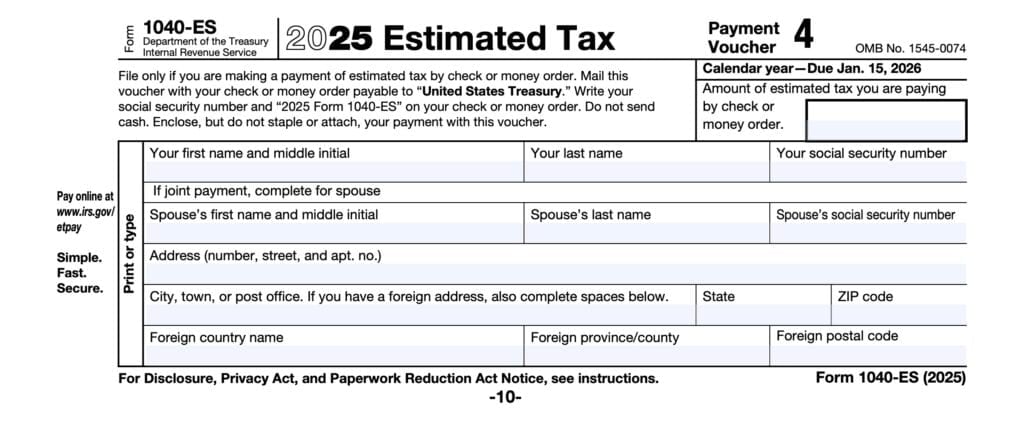

Enter any estimated federal income tax payments you made for 2024. Include any overpayment that you applied to your 2024 estimated tax from your 2023 return or an amended tax return (on IRS Form 1040-X).

Line 27: Reserved for future use

Do not enter anything here. On Form 1040, this line is reserved for the earned income tax credit (EITC), which is only available to American citizens. If you file Form 1040-NR, you are not eligilbe for this tax credit.

Line 28: Additional child tax credit from Schedule 8812

Enter any additional child tax credit (ACTC) from Schedule 8812, Child Tax Credit and Credit for Other Dependents.

Who can claim the additional child tax credit?

To claim the additional child tax credit in full, you must be a U.S. national or a resident of Canada or Mexico.

Residents of South Korea and India can claim the credits to the extent described in IRS Publication 519.

No other persons filing Form 1040-NR can claim the additional child tax credit even if they otherwise meet the criteria for taking those credits.

Line 29

Enter any amounts that you may have paid when filing IRS Form 1040-C, U.S. Departing Alien Income Tax Return.

Don’t follow the instructions in Line 29—American Opportunity Credit, in the Instructions for Form 1040. The American opportunity credit can’t be claimed by persons filing Form 1040-NR.

Line 30: reserved for future use

Do not enter anything here.

Line 31: Refundable credits

Enter any other tax payments or refundable tax credits from Schedule 3, Line 15.

Line 32

Add the following:

- Line 28: Additional child tax credit

- Line 29: IRS Form 1040-C

- Line 31: Refundable credits

This represents your total tax payments and refundable tax credits.

Line 33

Add the following:

- Line 25d, Federal taxes withheld from W-2, 1099, and other tax forms

- Line 25e, Form(s) 8805

- Line 25f, Form(s) 8288-A

- Line 26, 2024 estimated tax payments and amount applied from 2023 return

- Line 32, Total payments

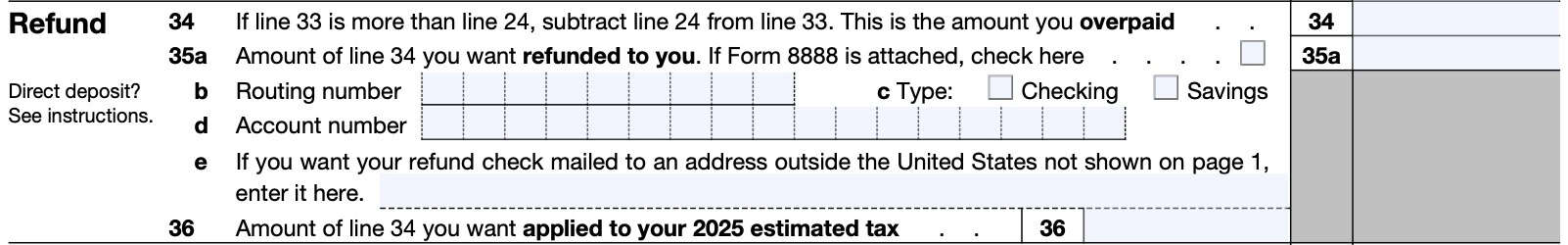

Refund

Line 34

If Line 33 is more than Line 24, subtract Line 24 from Line 33. This is the amount you overpaid, which will result in a tax refund.

Line 35a: Amount of line 34 you want refunded to you

Enter the amount of your tax refund that you want refunded to you, instead of applied on your future tax return.

If you’ve attached IRS Form 8888, which allows you to split your refund into multiple bank accounts or purchase U.S. Treasury bonds with your refund, then check the applicable box.

Line 35b: Routing number

Enter your nine-digit routing number. You can find this on your checks (left-hand side on the bottom), account statements, online account, or on your mobile app.

Line 35c: Type of banking account

Check the box that applies:

- Checking account

- Savings account

Line 35d: Account number

Enter the account number associated with your banking account. Be sure to enter the account number that matches the type of banking account you selected in Line 35d.

Line 35e

If you want your refund check to be mailed to an address outside the United States but not shown on the first page of the tax return, then enter that address here.

Line 36: Amount of refund you want applied to your 2025 estimated tax

Enter the amount of your tax refund you want applied to your estimated tax for next year. Lines 35a and 36 should add up to the total refund outlined in Line 34.

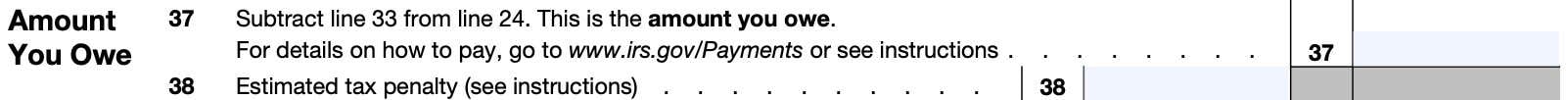

Amount you owe

Line 37

If Line 24 is greater than Line 33, then subtract Line 33 from Line 24. This is the amount of your remaining tax liability, or how much you still owe the IRS.

Line 38

You may owe an estimated tax penalty if:

- You did not pay enough estimated taxes by any of the due dates, or

- Even if you receive a tax refund

- Line 37 is at least:

- $1,000, and

- More than 10% of the tax shown on your tax return

Third party designee

Do you want to allow another person to discuss this tax return with the IRS?

If you want to allow your preparer, a friend, a family member, or any other person you choose to discuss your 2024 tax return with the IRS, check the Yes box in the “Third Party Designee” area of your return.

Also enter the designee’s name, phone number, and any five digits the designee chooses as their personal identification number (PIN).

If you check the Yes box, you, and your spouse if filing a joint return, are authorizing the IRS to call the designee to answer any questions that may arise during the processing of your return.

You are also authorizing the designee to:

- Give the IRS any information that is missing from your return;

- Call the IRS for information about the processing of your return or the status of your refund or payment(s);

- Receive copies of notices or transcripts related to your return, upon request; and

- Respond to certain IRS notices about math errors, offsets, and return preparation.

You aren’t authorizing the designee to receive any refund check, bind you to anything (including any additional tax liability), or otherwise represent you before the IRS.

Signature

Sign and date in the space provided. If the Internal Revenue Service provided you with an identity protection PIN, then enter that six-digit number in the space provided.

Video walkthrough

Frequently asked questions

Nonresidents of the United States must file IRS Form 1040-NR if they meet certain conditions outlined in the IRS instructions. Examples include a nonresident alien engaged in a trade or business in the United States during 2024, nonresidents receiving U.S. source income, or nonresidents subject to special taxes.

No. Taxpayers with a Social Security card should complete IRS Form 1040 to report their taxes to the Internal Revenue Service. IRS Form 1040-NR is for nonresident aliens.

Where can I find IRS Form 1040-NR?

You can find tax forms on the IRS website. For your convenience, we’ve included the latest version of IRS Form 1040-NR here.