IRS Form 1040 Instructions

Most people must file IRS Form 1040, U.S. Individual Income Tax Return, to report taxable income, taxes paid, and to calculate any expected refunds or additional taxes owed.

In this article, we will break down IRS Form 1040 so that you can better understand:

- How to complete IRS Form 1040, step by step

- Additional forms and schedules you may need to complete as part of your tax return

- Filing considerations

Let’s start with a top-down overview of IRS Form 1040 itself.

Contents

Table of contents

How do I complete IRS Form 1040?

Most tax software companies have a specific process that leads taxpayers through the tax return filing. However, since the process is designed to make tax return preparation more user-friendly, the tax filing experience will appear much different than the IRS Form 1040 itself.

In this guide, we’ll break down each part of the Form 1040 into smaller pieces, to make it easier to understand. Keep in mind, this should be a guide for you to review your Form 1040, not necessarily a guide for your tax preparation software.

For your convenience, we’ve broken down this two-page tax form into the following sections as they appear on the tax return:

- Taxpayer Information

- Filing Status

- Digital Assets

- Dependents

- Income

- Tax and Credits

- Payments and Refundable Credits

- Refund

- Amount You Owe

- Signatures

Let’s begin at the top of IRS Form 1040.

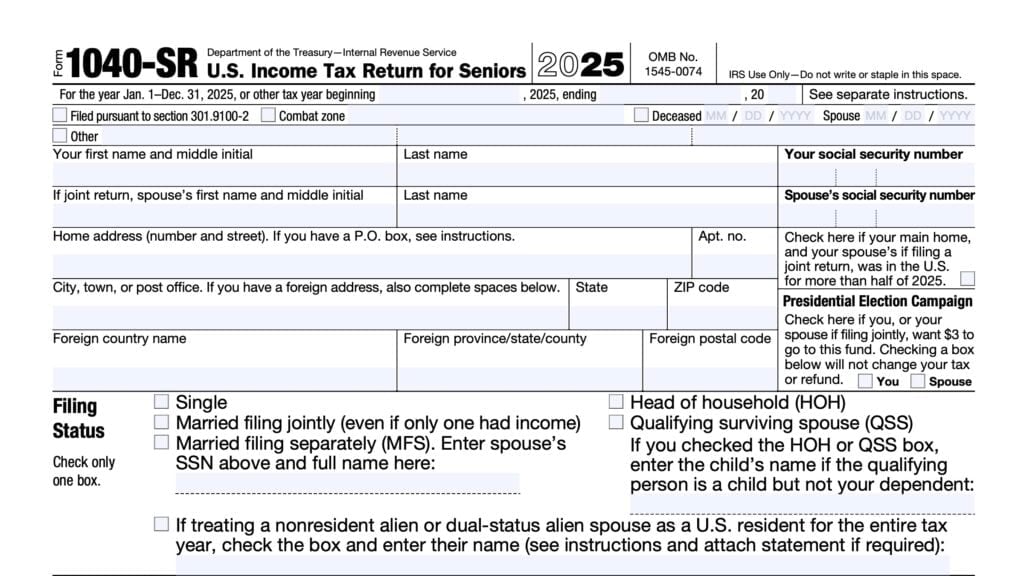

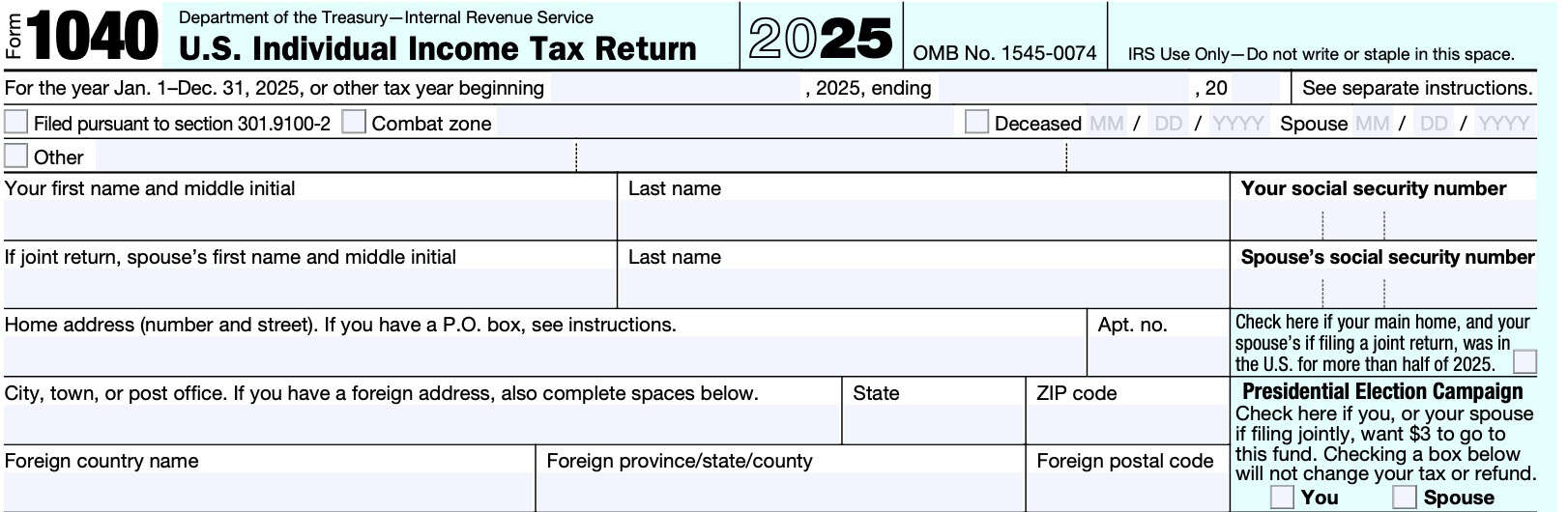

Taxpayer information

At the top of Page 1, you’ll see information fields that need to be completed as part of your tax return. Most of these fields contain your personal information, but there are a couple of lines that you’ll want to pay attention to.

We will cover each line in detail, beginning at the top, with the taxable year.

Tax year

If you are a calendar year taxpayer, you can leave this blank. A calendar year taxpayer’s tax year runs from January 1 through December 31 of the same calendar year.

If you are a fiscal year taxpayer, then enter the beginning and ending dates of your tax year. A fiscal year taxpayer’s tax year ends on the last day of any month except December. For example, the federal government has a fiscal year that runs from October 1 through September 30 of the following year.

Filed pursuant to Section 301.9100-2

Internal Revenue Code Section 301.9100-2 provides automatic extensions of time for making certain elections.

The IRS instructions contain zero guidance on this. If you are aware of a certain extension that may apply to your tax situation, check this box. Otherwise, you may leave it blank.

Combat zone

Members of the armed forces may check this box if applicable.

Combat zone defined by executive order

A combat zone is any area the President of the United States designates by Executive order as an area in which the U.S. Armed Forces are engaging or have engaged in combat. An area usually becomes a combat zone and ceases to be a combat zone on the dates the President designates by Executive order.

The following areas have been declared as combat zones by executive order:

- The Afghanistan area

- Executive order also includes Jordan, Pakistan, Djibouti, Yemen, Somalia, and Syria, in support of combat operations in Afghanistan

- The Kosovo area

- Executive order also includes Serbia, Montenegro, Albania, Kosovo, The Adriatic Sea, and the Ionian Sea (north of the 39th parallel)

- The Arabian Peninsula

- Executive order also includes the Persian Gulf, the Red Sea, the Gulf of Oman, the part of the Arabian Sea that is north of 10 degrees north latitude and west of 68 degrees east longitude, the Gulf of Aden, and the following land areas:

- Iraq

- Kuwait

- Saudi Arabia

- Oman

- Bahrain

- Qatar

- United Arab Emirates

- Executive order also includes the following areas in support of operations in the Arabian Peninsula

- Jordan

- Lebanon

- Turkey east of 33.51 degrees east longitude

- Israel (including Jerusalem and the Golan Heights, but excluding the West Bank and Gaza)

- The land area or adjacent littoral waters of the Cooperative Security Location of Manda Bay, Kenya

- Executive order also includes the Persian Gulf, the Red Sea, the Gulf of Oman, the part of the Arabian Sea that is north of 10 degrees north latitude and west of 68 degrees east longitude, the Gulf of Aden, and the following land areas:

- The Sinai Peninsula

Combat zone defined by federal law

The following areas have been designated by federal law as hazardous duty areas that are to be treated as combat zones:

- The Sinai Peninsula

- The former Yugoslavia, to include:

- Bosnia and Herzegovina

- Croatia

- Macedonia

Deceased

If you need to file a return for someone who died before filing a 2025 return, check the “Deceased” box at the top of IRS Form 1040 and enter the date of death.

Other

The IRS instructions provide zero guidance here. Only complete this field if you are completely sure of what you are doing.

Taxpayer name and Social Security number

In the spaces provided, enter the following information for the primary taxpayer:

- First name

- Middle initial

- Last name

- Social Security number

Spouse’s name and Social Security number

If married and filing a joint tax return, enter the following information for the primary taxpayer’s spouse:

- First name

- Middle initial

- Last name

- Social Security number

Address

Enter your complete mailing address in the space provided. If you have a post office box, only enter this information if the postal service does not deliver mail to your street address.

If you change your address after filing your tax return, you may update your records by filing IRS Form 8822, Change of Address.

However, if you are filing your federal tax return with a different address from last year’s tax return, you do not need to file the change of address form. The IRS will update your records with the address from your most recent income tax return.

Foreign address

If you have a foreign address, enter the city name on the appropriate line. Don’t enter any other information on that line, but do complete the spaces below that line:

- Country name

- Province, state, or county

- Postal code

Do not abbreviate the country name.

Check here if your main home was in the United States for more than half of 2025

If you want $3 to go to this fund, check the box. If you are filing a joint return, your spouse can also have $3 go to the fund.

If you check a box, your tax or refund won’t change.

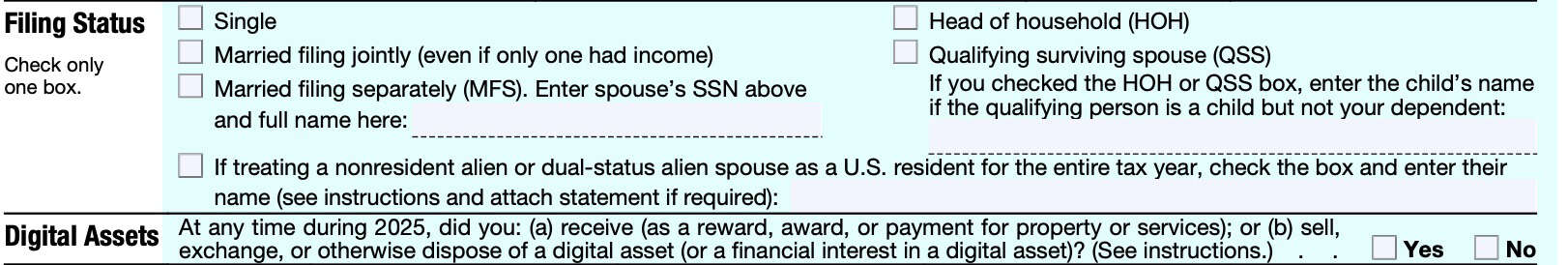

Filing status

ame amount of tax under all filing statuses for which they qualify.

However, married taxpayers who owe additional Medicare tax on Line 5 may have a lower tax liability if they qualify for, and choose head of household instead of married filing separately. You may choose the status that you qualify for, which gives you the lowest tax liability.

Single

If you were unmarried or legally separated from your spouse according to state law under a divorce or separate maintenance decree at the end of the year, you may check the Single box.

Married filing jointly

You can select this status if:

- You were married at the end of the tax year, and

- You and your spouse both choose to file a joint tax return

You can also select this filing status if your spouse died during the tax year and you did not remarry.

If you file a joint tax return, and both spouses had self-employment income, then both spouses should complete and attach a separate Schedule SE, Part I and Part II (if necessary). Also, attach a separate Schedule C (IRS Form 1040) or Schedule F (IRS Form 1040), depending on the source of income.

If you file a joint tax return, both you and your spouse are considered equally responsible for the income tax and any interest or penalties due on the tax return. If one spouse doesn’t pay, the other may have to. Also, both spouses may be responsible for additional taxes that the IRS imposes.

Innocent spouse relief

However, you may qualify for innocent spouse relief from a tax liability on your joint return if:

- There is an understatement on the tax amount because your spouse omitted taxable income or claimed false tax deductions or credits

- You are divorced, separated, or no longer living with your spouse, or

- Given all of the facts and circumstances, the IRS determines that it would not be fair to hold you liable for the tax

To request innocent spouse relief, you may file IRS Form 8857.

Married filing separately

Check this box if you were married at the end of the taxable year but file a separate return. Be sure to enter your spouse’s name and Social Security number or individual taxpayer identification number (ITIN) in the space provided. If your spouse is not required to have either, enter NRA next to their name in the entry space.

Generally, you will only owe the tax on your own income. However, you will usually pay more tax than if you use another filing status that you qualify for.

Head of household

A head of household is someone who is unmarried (or is considered unmarried) and provides a home for certain other persons.

You can check the “Head of household” box if, at the end of the tax year, you:

- Are unmarried (or considered to be unmarried)

- Claim a qualifying child for the additional child tax credit (ACTC), and

- Paid over half the costs of keeping up a home in which you lived with your qualifying child

Unmarried taxpayers

You are considered unmarried for this purpose if any of the following applies:

- You were legally separated according to your state law under a decree of divorce or separate maintenance at the end of the calendar year.

- But if, at the end of the year, your divorce wasn’t final (an interlocutory decree), you are considered married

- You are married but lived apart from your spouse for the last 6 months of the calendar year and you meet the other rules under Married persons who live apart

- You are married and your spouse was a nonresident alien at any time during the year and the election to treat the alien spouse as a resident alien is not made

Qualifying child

A child you claim for the ACTC is a qualifying child for this filing status. Your adopted child is always treated as your own child.

Qualifying surviving spouse

You can check this box if all of the following apply:

- Your spouse died in one of the two preceding tax years, and you did not remarry prior to the end of the taxable year

- You have a child or stepchild (not a foster child) whom you can claim as a dependent or could claim as a dependent except that, for the tax year:

- The child had gross income of $5,050 or more,

- The child filed a joint tax return, or

- You could be claimed as a dependent on someone else’s tax return.

- This child lived in your home for all of the tax year.

- If the child didn’t live with you for the required time, see Temporary absences in IRS Publication 501.

- You paid over half the cost of keeping up your home

- You could have filed a joint tax return with your spouse the year your spouse died, even if you didn’t actually do so

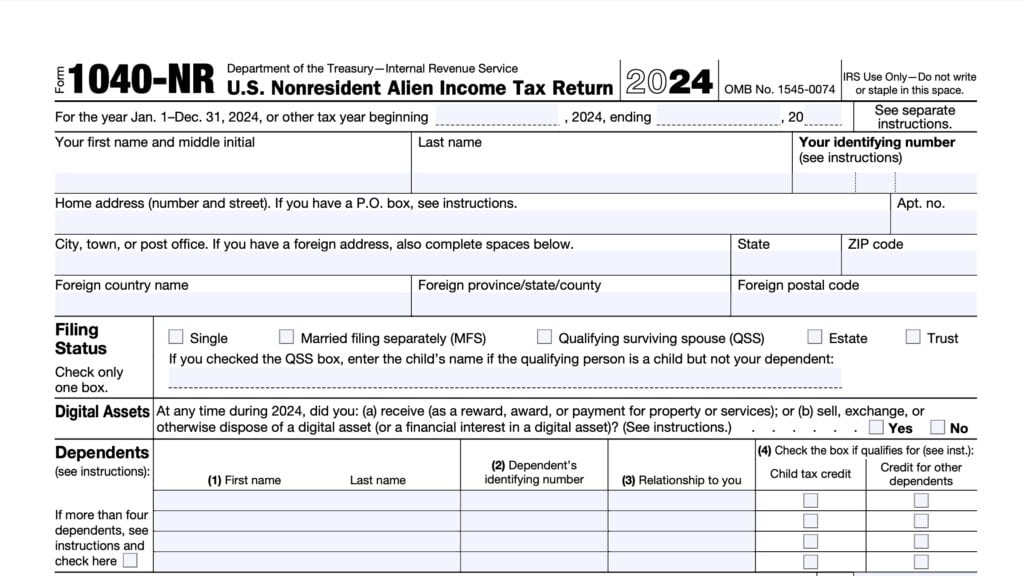

Digital assets

Check Yes if, at any time during the tax year, you did either of the following:

- Received digital assets as a reward, award, or payment for property or services

- Sold, exchanged, or disposed of either a digital asset or a financial interest in a digital asset

Otherwise, check No.

If you used a broker to sell a digital asset, your broker should send you a copy of IRS Form 1099-DA, Digital Asset Proceeds From Broker Transactions.

Even if you receive a Form 1099-DA, you must still answer this digital assets question.

Digital assets defined

Digital assets are any digital representations of value that are recorded on a cryptographically secured distributed ledger or any similar technology. For example, digital assets include non-fungible tokens (NFTs) and virtual currencies, such as cryptocurrencies and stablecoins.

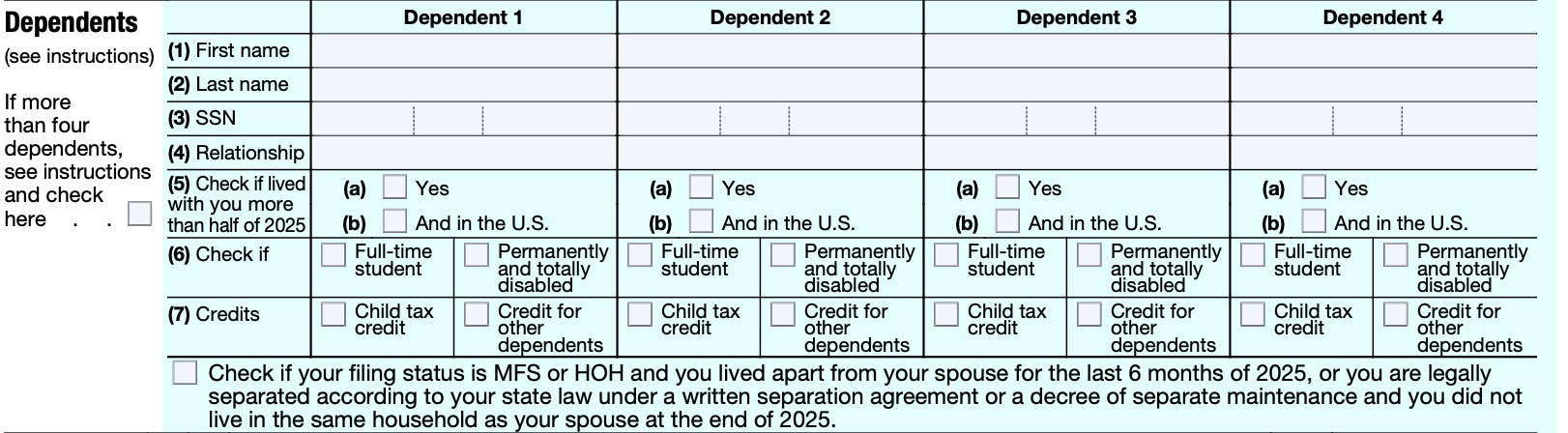

Dependents

Use the this section to list your dependents. You may list up to 4 dependents in this section.

For each dependent, you should list the following information:

- First name

- Last name

- Social Security number

- Relationship

- Whether the dependent lived with you more than half the year

- Yes

- Within the United States

- Whether dependent is:

- Full-time student

- Permanently and totally disabled

- Credits

- Child tax credit

- Credit for other dependents

Check the box at the bottom of the Dependents section if:

- If you were married filing separately or head of household, and you lived apart from your spouse for the last 6 months of the year, or

- You are legally separated under state law and you did not live in the same household at the end of the tax year

- Under a written separation agreement or decree of separate maintenance

If you have more than four dependents

If you have more than four dependents, check the applicable box to the side of the Dependents section, then attach a separate document containing the requested information for any additional dependents.

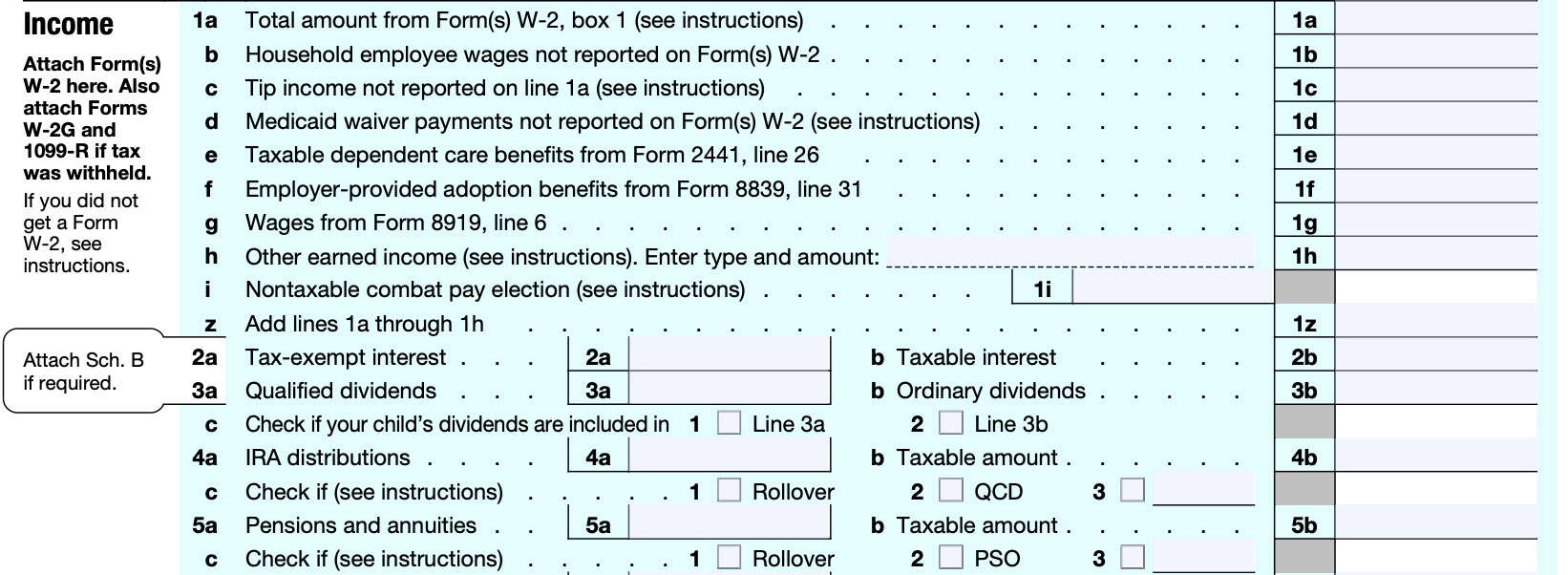

Income

In this section, we’ll report items of income, as they should appear on your federal tax return.

Line 1a: Total Amount From Form(s) W-2, Box 1

Enter the total amount of wages, tips, and other compensation from Form(s) W-2, Wage and Tax Statement, Box 1. If you are filing a joint tax return, include your spouse’s income from IRS Form W-2, Box 1.

Wages earned while an inmate

If you earned wages while you were an inmate in a penal institution, report these amounts on

IRS Schedule 1, Additional Income and Adjustments to Income, Line 8u. Do not report these wages directly on your Form 1040.

If you received pension or annuity income from a deferred compensation plan

If you received a pension or annuity from a nonqualified deferred compensation plan or a nongovernmental section 457 plan and it was reported in box 1 of your Form W-2,

do not include this amount here.

This amount is reported on Schedule 1, Line 8t.

Line 1b: Household Employee Wages Not Reported on Form(s) W-2

Enter the total of your wages received as a household employee that was not reported on Form(s) W-2.

An employer isn’t required to provide a Form W-2 to you if they paid you wages of less than $2,800 in 2025.

Line 1c: Tip income not reported on line 1a

Enter the total of your tip income that was not reported on Line 1a.

This should include any tip income you didn’t report to your employer and any allocated tips shown in Box 8 on your Form(s) W-2 unless you can prove that your unreported tips are less than the amount in Box 8.

Allocated tips aren’t included as income in Box 1.

You may owe social security and Medicare or railroad retirement (RRTA) tax on unreported tips. See the instructions for IRS Schedule 2, Additional Taxes, Line 5.

Line 1d: Medicaid Waiver Payments not reported on Form(s) W-2

Enter your taxable Medicaid waiver payments that were not reported on Form(s) W-2. Also enter the total of your taxable and nontaxable Medicaid waiver payments that

- Were not reported on Form(s) W-2, or

- Not reported in Box 1 of Form(s) W-2, if you choose to include nontaxable payments in earned income for purposes of claiming a credit or other tax benefit

If you and your spouse both received nontaxable Medicaid waiver payments during the year, you and your spouse can make different choices about including payments in earned income. You can find more information in the IRS instructions for Schedule 1, Line 8s.

Sole proprietors

If you are a sole proprietor in a business of providing home care services, see the Schedule C instructions for how to report these amounts.

If you do not have a separate trade or business of providing these services, enter your Medicaid waiver

payments reported on either Form 1099-MISC, Miscellaneous Income, or Form 1099-NEC, Nonemployee Compensation.

Nontaxable Medicaid waiver payments

Enter your nontaxable Medicaid waiver payments on Schedule 1, Line 8s.

Your nontaxable Medicaid waiver payments may have been reported to you on Form(s) W-2, box 12, with Code II.

If you received nontaxable Medicaid waiver payments, and Box 1 of your Form(s) W-2 is blank or has zeros, and you are choosing not to include nontaxable payments in earned income for purposes of claiming a credit, do not attach any of these Form(s) W-2 to your return.

Line 1e: Taxable dependent care benefits from Form 2441, line 26

Enter the total of your taxable dependent care benefits from IRS Form 2441, line 26.

Dependent care benefits should be shown in Box 10 of your Form(s) W-2. You should complete Form 2441 to see if you can exclude part or all of the benefits.

Line 1f: Employer-provided adoption benefits from Form 8839, line 31

Enter the total of your employer-provided adoption benefits from IRS Form 8839, Line 31. Employer-provided adoption benefits should be shown in Box 12 of your Form(s) W-2 with Code T.

You may first need to see the Form 8839 instructions to find out if you can exclude part or all of the adoption benefits. You may also be able to exclude amounts if you adopted a child with special needs and the adoption became final in 2025.

Line 1g: Wages from Form 8919, line 6

Enter the total of your wages from IRS Form 8919, Uncollected Social Security & Medicare Taxes, Line 6.

Line 1h: Other earned income

Enter any other earned income not previously reported. This may include the following:

- Strike or lockout benefits (other than bona fide gifts)

- Excess elective deferrals.

- Should be shown in Box 12 of your Form W-2, and the “Retirement plan” box in Box 13 should be

checked.

- Should be shown in Box 12 of your Form W-2, and the “Retirement plan” box in Box 13 should be

- Disability pensions shown on Form 1099-R if you haven’t reached the minimum retirement age set by your employer

- Corrective distributions from a retirement plan shown on Form 1099-R of excess elective deferrals and excess contributions (plus earnings)

- Do not report IRA distributions. Report these on Lines 4a and 4b, below.

Line 1i: Nontaxable combat pay election

If you elect to include your nontaxable combat pay in your earned income when figuring the earned income credit, enter the amount here.

Line 1z

Add Lines 1a through 1i. Enter the total here.

Line 2a: Tax-Exempt Interest

If you received any tax-exempt interest, such as from municipal bonds, each payer should send you one of the following:

In general, your tax-exempt stated interest should be shown in Box 8 of Form 1099-INT.

For a tax-exempt OID bond, you should see your tax-exempt stated interest in Box 2 of Form 1099-OID, and your tax-exempt OID should be shown in Box 11. Enter the total on Line 2a.

Line 2b: Taxable Interest

Enter your total taxable interest income on Line 2b. If the total amount of interest income that you received is over $1,500, you will need to complete IRS Schedule B, Interest and Ordinary Dividends.

You may also need to complete Schedule B if any of the following conditions apply:

- You received mortgage interest from a seller-financed mortgage and the buyer used the property as a personal residence.

- You have accrued interest from a bond.

- You are reporting original issue discount (OID) in an amount less than the amount shown on Form 1099-OID.

- You are reducing your interest income on a bond by the amount of amortizable bond premium.

- You are claiming the exclusion of interest from series EE or I U.S. savings bonds issued after 1989.

- You received interest or ordinary dividends as a nominee.

- You had a financial interest in, or signature authority over, a financial account in a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust.

Line 3a: Qualified Dividends

Enter your total qualified dividends on Line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on Line 3b.

Qualified dividends defined

Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in Box 1b of Form 1099-DIV, Dividends and Distributions.

If you are including your child’s qualified dividends in the total here, check Box 1 on Line 3c, below.

Line 3b: Ordinary Dividends

Enter your total ordinary dividends on Line 3b. You should see this amount in Box 1a of Form(s)

1099-DIV.

If you are including your child’s ordinary dividends in the total on Line 3b, check Box 2 on Line 3c. For

more information, see the instructions for IRS Form 8814, Parent’s Election to Report Child’s Interest and Dividends.

Line 3c

Check the applicable box. If your child’s qualified dividends are included in Line 3a, check Box 1. If your child’s ordinary dividends are included in Line 3a, check Box 2.

Line 4: IRA Distributions

If the distribution from your IRA is fully taxable, enter the total distribution on Line 4b; don’t make an entry on Line 4a.

You should receive a Form 1099-R showing the total amount of any distribution from your IRA before income tax or other deductions were withheld. This amount should be shown in Box 1 of Form 1099-R.

Exception 1: Rollovers

Enter the total distribution on Line 4a if you rolled over part or all of the distribution from one:

- Roth IRA to another Roth IRA, or

- IRA (other than a Roth IRA) to a qualified plan or another IRA (other than a Roth IRA).

Also, check Box 1 on Line 4c. If the total distribution was rolled over, enter $0 on Line 4b. If the distribution was partially rolled over, then enter the part not rolled over on Line 4b unless Exception 2 applies. Generally, you must complete a rollover within 60 days after the day that you received the distribution.

Exception 2: IRS Form 8606

If any of the following apply, enter the total distribution on Line 4a, then see the instructions for IRS Form 8606, Nondeductible IRAs, to determine the Line 4b amount:

- You received a distribution from an IRA (other than a Roth IRA) and you made nondeductible contributions to any of your traditional IRAs for 2025 or an earlier year

- You received a distribution from a Roth IRA. But if either of the following applies, enter -0- on Line 4b

- Form 1099-R, Box 7, contains distribution code T and you made a contribution (including a conversion) to a Roth IRA for 2020 or an earlier year

- Form 1099-R, Box 7, contains distribution code Q

- You converted part or all of a traditional IRA or traditional SIMPLE IRA to a Roth IRA in 2025.

- You had a 2024 or 2025 IRA contribution returned to you, with the related earnings or less any loss, by the due date (including extensions) of your tax return for that year.

- You made excess contributions to your IRA for an earlier year and had them returned to you in 2025.

- You recharacterized part or all of a contribution to a Roth IRA as a contribution to a traditional IRA, or vice versa.

Exception 3: Qualified charitable distributions

If all or part of the distribution is a qualified charitable distribution (QCD), enter the total distribution on Line 4a. If the total amount distributed is a QCD, enter -0- on Line 4b. If only part of the distribution is a QCD, enter the part that is not a QCD on Line 4b unless Exception 2 applies to that part.

Check Box 2 on Line 4c.

Qualified charitable distributions

A QCD is a distribution made directly by the trustee of your IRA (other than an ongoing SEP or SIMPLE IRA) to an organization eligible to receive tax-deductible contributions (with certain exceptions).

You must have been at least age 70 1/2 when the distribution was made. Each taxpayer may not make more than $108,000 per year in QCD distributions.

Exception 4: Health savings account distributions

If all or part of the distribution is a health savings account (HSA) funding distribution (HFD), enter the total distribution on Line 4a. If the total amount distributed is an HFD and you elect to exclude it from income, enter $0 on Line 4b.

If only part of the distribution is an HFD and you elect to exclude that part from income, enter the part that isn’t an HFD on Line 4b unless Exception 2 applies to that part. Check Box 3 on Line 4c and enter “HFD” in the entry space next to Box 3.

HSA funding distributions

An HFD is a distribution made directly by the trustee of your IRA (other than an ongoing SEP or SIMPLE IRA) to your HSA. If eligible, you can generally elect to exclude an HFD from your income once in your lifetime. You can’t exclude more than the limit on HSA contributions or more than the amount that would otherwise be included in your income.

If your IRA includes nondeductible contributions, the HFD is first considered to be paid out of otherwise taxable income.

More than one distribution

More than one distribution. If you (or your spouse if filing jointly) received more than one IRS distribution, figure the taxable amount of each distribution and enter the total of the taxable amounts on Line 4b.

Enter the total amount of those distributions on Line 4a.

Line 5: Pensions and Annuities

You should receive a Form 1099-R showing the total amount of your pension and annuity payments before income tax or other deductions were withheld. This amount should be shown in Box 1 of Form 1099-R.

Don’t include the following payments on Lines 5a and 5b:

- Disability pensions received before you reach the minimum retirement age set by your employer.

- Corrective distributions of excess elective deferrals or other excess contributions to retirement plans.

- Including any earnings

Report these payments on Line 1h.

Fully taxable pensions and annuities

Your payments are fully taxable if:

- You did not contribute to the cost of your pension or annuity, or

- You received your entire investment back tax free before the taxable year

If your pension or annuity is fully taxable, enter the total pension or annuity payments (from Form(s)

1099-R, Box 1) on Line 5b. Don’t enter anything on Line 5a.

Fully taxable pensions and annuities also include military retirement pay shown on Form 1099-R.

Partially taxable pensions and annuities

Enter the total pension or annuity payments (from Form 1099-R, Box 1) on Line 5a. If your Form 1099-R doesn’t show the taxable amount, you must use the General Rule explained in IRS Publication 939 to figure the taxable part to enter on Line 5b.

You can also ask the Internal Revenue Service to calculate the taxable part of your pension or annuity for a $1,000 fee. If this is of interest to you, email me for more details and I’ll send you a quote.

Insurance premiums for retired public safety officers

If you are an eligible retired public safety officer (law enforcement officer, firefighter, chaplain, or member of a rescue squad or ambulance crew who is retired because of disability or because you reached normal retirement age), you can elect to exclude from income distributions made from your eligible retirement plan that are used to pay the premiums for coverage by an accident or health plan or a long-term care insurance contract.

The premiums can be for coverage for you, your spouse, or dependents.

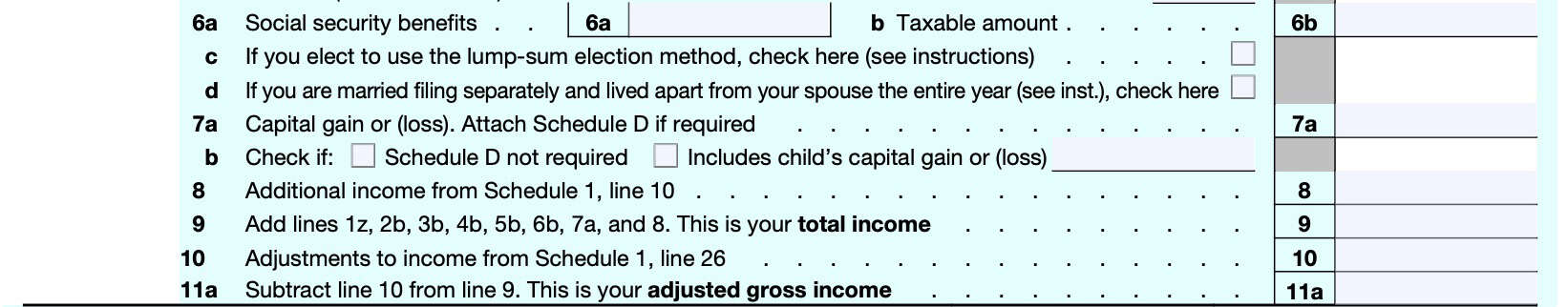

Line 6a: Social Security Benefits

You should receive a Form SSA-1099 showing in Box 3 the total social security benefits paid to you. Box 4 will show the amount of any benefits you repaid in 2025.

If you received railroad retirement benefits treated as Social Security, you should receive a Form RRB-1099.

Line 6b: Taxable amount

Use the Social Security Benefits Worksheet in the IRS instructions to see if any of your benefits are taxable.

However, do not use the Social Security Benefits Worksheet in the IRS instructions if any of the following applies.

- You repaid any benefits in 2025 and your total repayments (Box 4) were more than your total benefits for 2025 (Box 3). None of your benefits are taxable for 2025.

- You made contributions to a traditional IRA for 2025 and you or your spouse were covered by a retirement plan at work or through self-employment.

- Use the worksheets in IRS Publication 590-A to see if any of your Social Security benefits are taxable and to figure your IRA deduction

- If you excluded employer-provided adoption benefits or income from Puerto Rico

- You filed any of the following tax forms:

Line 6c: Lump sum election

Check this box if you elect to use the lump-sum election method for your benefits. If any of your benefits are taxable for 2025 and they include a lump-sum benefit payment that was for an earlier year, you may be able to reduce the taxable amount with the lump-sum election.

Line 6d: Married filing separately

If you are married filing separately and you lived apart from your spouse for all of 2025, check this box. If you don’t check the box here, you may get a math error notice from the IRS.

Line 7a: Capital gain or loss

If you sold a capital asset, such as a stock, bond, or digital asset, you must complete and attach:

However, there are two major exceptions.

Exception 1: Both Form 8949 and Schedule D are optional

You don’t have to file Form 8949 or Schedule D if you aren’t deferring any capital gain by investing in a qualified opportunity fund and both of the following conditions apply

- You have no capital losses, and your only capital gains are capital gain distributions from Form(s) 1099-DIV, Box 2a (or substitute statements); and

- None of the Form(s) 1099-DIV have an amount in any of the following:

- Box 2b: Unrecaptured Section 1250 gain

- Box 2c: Section 1202 gain, or

- Box 2d: Collectibles (28%) gain

Exception 2: Form 8949 is optional

You must file Schedule D but generally don’t have to file Form 8949 if:

- Exception 1 doesn’t apply

- You aren’t deferring any capital gain by investing in a qualified opportunity fund or terminating deferral from an investment in a qualified opportunity fund, and

- Your only capital gains and losses are:

- Capital gain distributions

- A capital loss carryover from the prior tax year

- A gain from:

- Gain or loss from:

- Gains and losses from transactions for which

- You received a Form 1099-B or Form 1099-DA showing that basis was reported to the IRS,

- The QOF box in Box 3 of Form 1099-B or Box 3b of Form 1099-DA isn’t checked, and

- You don’t need to make adjustments in Column (g) of Form 8949 or enter any codes in Column (f) of Form 8949

Line 7b

If Exception 1 applies, check the Schedule D not required Box.

If you are including your child’s capital gain or (loss) in the total on Line 7a, check the includes child’s capital gain or (loss) box. Then enter the amount from Form 8814, Line 10, in the entry space.

Line 8: Additional income from Schedule 1, Line 10

Line 9: Total income

Add the following lines:

Enter the total here. This represents your total income.

Line 10: Adjustments to income from Schedule 1, Line 26

Enter the total adjustments to income from IRS Schedule 1, Line 26.

Line 11a: Adjusted gross income

Subtract Line 10 from Line 9. This represents your adjusted gross income, or AGI.

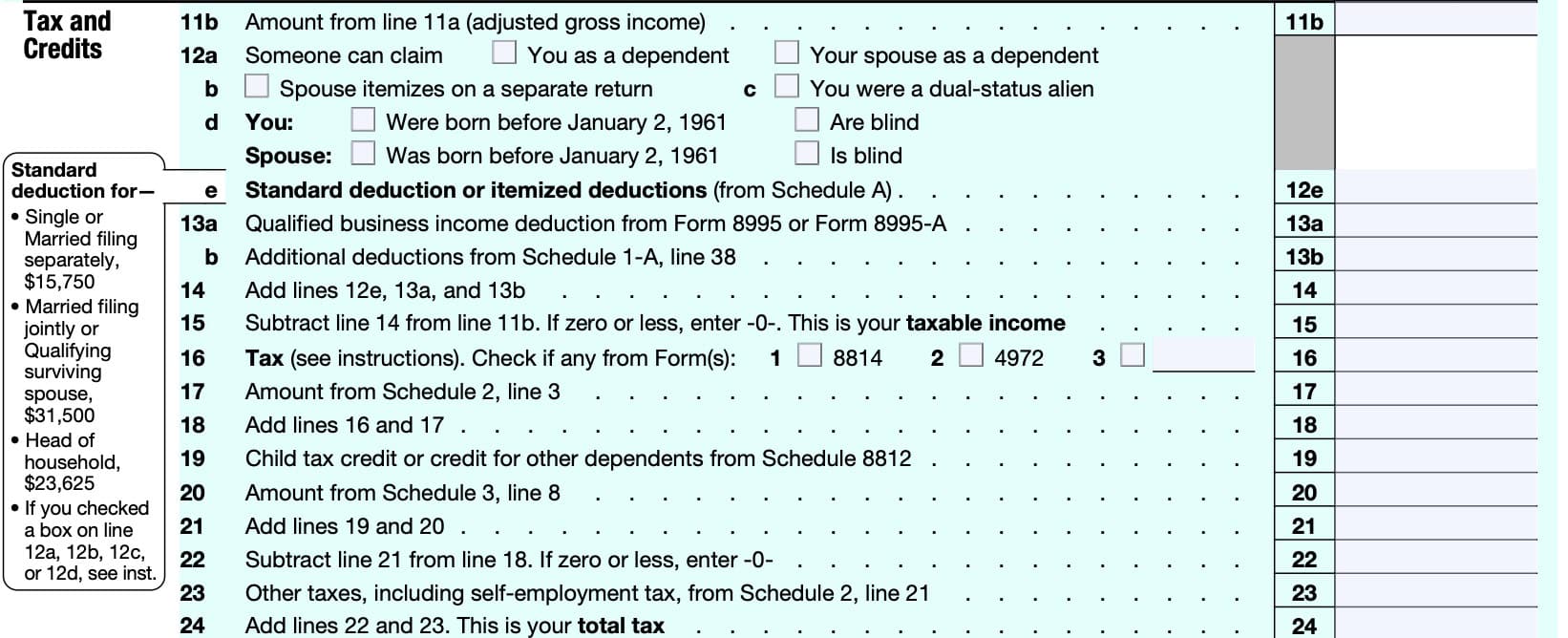

Tax and credits

Line 11b: Adjusted gross income

Carry down the AGI figure from Line 11a on the previous page.

Line 12

There are five boxes in this section. Let’s go over each of them in order.

Line 12a

Check the applicable box(es) if another taxpayer can claim either yourself or your spouse as a dependent on their tax return.

Married filing jointly

If you are married and filing a joint return, you can be claimed on someone else’s return if you file the joint return only to claim a refund of withheld income tax or estimated tax paid.

Line 12b

If your filing status is married filing separately and your spouse itemizes deductions on their return, check this box.

Line 12c

If you were a dual-status alien, check the box on Line 12c.

Don’t check the box if you were a dual-status alien and

- You file a joint return with your spouse who was a U.S. citizen or resident alien at the end of the year, and

- You and your spouse agree to be taxed on your combined worldwide income

Line 12d

If you or your spouse (if you are married and filing a joint return) were born before January 2, 1961, or were blind at the end of 2025, check the appropriate box(es) on Line 12d.

Don’t check any boxes for your spouse if your filing status is head of household.

Death of spouse during the tax year

If your spouse was born before January 2, 1961, but died in 2025 before reaching age 65, don’t check the box that says “Spouse was born before January 2, 1961.”

Blindness

If you weren’t totally blind as of December 31, 2025, you must get a statement certified by your eye doctor (ophthalmologist or optometrist) that:

- You can’t see better than 20/200 in your better eye with glasses or contact lenses, or

- Your field of vision is 20 degrees or less.

If your eye condition is not likely to improve beyond the above conditions, you can get a statement certified by your eye doctor to this effect instead. Maintain this statement for your tax records.

If you receive a notice or letter but you would prefer to have it in Braille-ready or large print, you can use

IRS Form 9000, Alternative Media Preference, to request notices in an alternative format. You may choose from Braille-ready, large print, audio, or electronic formats. To make this request, you can attach Form 9000 to your return or mail it separately.

Line 12e

You may choose either the standard deduction or itemized deductions from Schedule A. If you choose the standard deduction, you can see the list of deductions, based on filing status, on the left-hand side of the Form 1040. For 2025, the standard deductions are:

- Single or married filing separately: $15,750

- Married filing jointly or qualified surviving spouse: $31,500

- Head of household: $23,625

There are certain exceptions that may apply.

Exception 1: Dependent

If you checked a box on Line 12a, use the Standard Deduction Worksheet for Dependents to figure your standard deduction.

Someone claims you or your spouse as a dependent if they list your or your spouse’s name and SSN in the Dependents section of their return.

Exception 2: Spouse itemizes deductions on a separate return

If you checked the box on Line 12b, then your standard deduction is zero, even if you were

born before January 2, 1961, or are blind.

Exception 3: Dual status alien

If you checked the box on Line 12c, your standard deduction is zero, even if you were born before January 2, 1961, or are blind.

Exception 4: Born before January 2, 1961, or blind

If you checked any box on Line 12d, figure your standard deduction by using the Standard Deduction Chart for People Who Were Born Before January 2, 1961, or Were Blind if you are filing Form 1040.

You can also use the chart on the last page of IRS Form 1040-SR, Tax Return for Seniors.

Exception 5: Net qualified disaster loss

If you had a net qualified disaster loss and you elect to increase your standard deduction by the amount of your net qualified disaster loss, use Schedule A to figure your standard deduction.

Qualified disaster loss refers to losses arising from certain disasters occurring in 2016 and subsequent years.

Line 13a: Qualified business income deduction

Enter your qualified business income (QBI) deduction from IRS Form 8995, Qualified Business Income Deduction, Simplified Calculation, or IRS Form 8995-A, Qualified Business Income Deduction, as applicable.

When you can use IRS Form 8995

You can use the simplified calculation on IRS Form 8995 if the following conditions apply:

- You have qualified business income, qualified REIT dividends, or qualified PTP income (loss);

- Your 2025 taxable income before the QBI deduction is less than or equal to $197,300, and

- $394,600 for married taxpayers filing jointly

- You are not a patron in a specified agricultural or horticultural cooperative

Otherwise, you must use IRS Form 8995-A.

Line 13b: Additional deductions

Enter the amount from IRS Schedule 1-A, Line 38, if you are eligible to claim a tax deduction for any of the following:

- No tax on tips

- No tax on overtime

- No tax on car loan interest

- Enhanced deduction for seniors

Line 14

Add the following:

Enter the total in Line 14.

Line 15: Taxable income

Subtract Line 14 from Line 11b. This represents your taxable income.

Line 16: Tax

Include the total of the following taxes, which we’ll cover in more detail:

- Tax on your taxable income

- Tax from IRS Form(s) 8814 related to your election to report your child’s interest or dividends

- Tax from IRS Form 4972 related to lump-sum distributions

- Tax with respect to a Section 962 election

- Recapture of an education credit

- Taxes from IRS form 8621, Line 16e

- Tax from IRS Form 8978, Line 14

- Triggering event under IRC Section 965(i)

Tax on your taxable income

We’ll spend most of our time in this section, since there are a lot of parts to calculating your tax. Too difficult? The IRS can help with that.

The IRS can calculate your tax bill…in most cases

Most taxpayers can request that the IRS calculate your tax liability for you, as long as you have filed your annual income tax return by the tax deadline. However, the IRS cannot calculate your tax if any of the following apply:

- You want your refund via direct deposit into a checking or savings account

- You want to apply any part of your refund to next year’s estimated tax

- You had income from sources other than wages, salaries, tips, interest, dividends, Social Security, unemployment, IRA distributions, pensions, or annuities

- Your taxable income is $100,000 or more

- You file any of these forms:

- IRS Form 2555, Foreign Earned Income

- IRS Form 4137, Social Security and Medicare Tax on Unreported Tip Income

- IRS Form 4970, Tax on Accumulation Distribution of Trusts

- IRS Form 4972, Tax on Lump-Sum Distributions

- IRS Form 6198, At-Risk Limitations

- IRS Form 6251, Alternative Minimum Tax—Individuals

- IRS Form 8606, Nondeductible IRAs

- IRS Form 8615, Tax for Certain Children Who Have Unearned Income

- IRS Form 8814, Parents’ Election To Report Child’s Interest and Dividends

- IRS Form 8839, Qualified Adoption Expenses

- IRS Form 8853, Archer MSAs and Long-Term Care Insurance Contracts

- IRS Form 8889, Health Savings Accounts (HSAs)

- IRS Form 8919, Uncollected Social Security and Medicare Tax on Wages

Tax table or tax computation worksheet

If your taxable income is less than $100,000, you must use the Tax Table, located in the IRS instructions, to figure your tax. Be sure you use the correct column.

If your taxable income is $100,000 or more, use the Tax Computation Worksheet right after the Tax Table in the IRS instructions.

However, don’t use the Tax Table or Tax Computation Worksheet to figure your tax if any of the following applies:

- IRS Form 8615

- Schedule D Tax worksheet

- Qualified dividends and capital gain tax worksheet

- Schedule J

- Foreign earned income tax worksheet

IRS Form 8615

You must generally use IRS Form 8615 to figure the tax on your unearned income over $2,700 if you are under age 18, and in certain situations if you are older.

You must file Form 8615 if you meet all of the following conditions:

- You had more than $2,700 of unearned income

- Including taxable interest, ordinary dividends, or capital gains (including capital gain distributions).

- You are required to file a tax return

- You were either:

a. Under age 18 at the end of 2025,

b. Age 18 at the end of 2025 and didn’t have earned income that was more than half of your support, or

c. A full-time student at least age 19 but under age 24 at the end of 2025 and didn’t have earned income that was more than half of your support. - At least one of your parents was alive at the end of 2025.

- You don’t file a joint return in 2025.

A child born on January 1, 2008, is considered to be age 18 at the end of 2025; a child born on January 1, 2007, is considered to be age 19 at the end of 2025; and a child born on January 1, 2002, is considered to be age 24 at the end of 2025.

Schedule D Tax worksheet

Use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040 or 1040-SR, Line 16, if:

- You have to file Schedule D, Line 18 or 19 of Schedule D is more than zero, and Lines 15 and 16 of Schedule D are gains; or

- You have to file IRS Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D.

However, if you are filing IRS Form 2555, you must use the Foreign Earned Income Tax Worksheet instead.

Qualified Dividends and Capital Gain Tax worksheet

Use the Qualified Dividends and Capital Gain Tax Worksheet, to figure your tax if you don’t have to use the Schedule D Tax Worksheet and if any of the following applies.

- You reported qualified dividends on Form 1040 or 1040-SR, Line 3a.

- You don’t have to file Schedule D and you reported capital gain distributions on Form 1040 or 1040-SR, Line 7a.

- You are filing Schedule D, and Schedule D, Lines 15 and 16, are both more than zero.

But if you are filing Form 2555, you must use the Foreign Earned Income Tax Worksheet instead.

Schedule J

If you had income from farming or fishing, your tax may be less if you choose to figure it using income averaging on Schedule J.

Foreign Earned Income Tax Worksheet

If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on IRS Form 2555, you must figure your tax using the Foreign Earned Income Tax Worksheet.

Tax from IRS Form(s) 8814 Related to Your Election to Report Your Child’s Interest or Dividends

Check the appropriate box in Line 16.

Tax from IRS Form 4972 related to lump-sum distributions

Check the appropriate box in Line 16.

Tax with respect to a Section 962 election

This relates to an election made by a domestic shareholder of a controlled foreign corporation to be taxed at corporate rates reduced by the amount of any foreign tax credits claimed on IRS Form 1118. Internal Revenue Code Section 962 contains additional details.

Enter the amount and “962” in the space next to that box. Attach a statement showing how you figured the tax.

Recapture of an education credit

You may owe this tax if you claimed an education credit in an earlier year, and the student received either of the following during the current year:

- Tax-free educational assistance

- Refund of qualified expenses

Check Box 3. Enter the amount and “ECR” in the space next to the box.

Taxes from IRS form 8621, Line 16e

Any tax from Form 8621, Line 16e, relating to a Section 1291 fund.

Check Box 3. Enter the amount and “1291TAX” in the space next to the box.

Tax from IRS Form 8978, Line 14

Tax from IRS Form 8978, Line 14, relating to partner’s audit liability under IRC Section 6226.

Check Box 3. Enter the amount and “Form 8978” in the space next to the box.

If the amount on Form 8978, Line 14, is negative, see the instructions for Schedule 3, Line 6l.

Triggering event under IRC Section 965(i)

If you had a triggering event under IRC Section 965(i) during the year and did not enter into a transfer agreement, check Box 3. Enter the amount of the triggered deferred net 965 liability and “965INC” on the line next to Box 3.

Line 17: Amount from Schedule 2, Line 3

Enter the amount from IRS Schedule 2, Line 3. This contains additional taxes, such as:

- Excess advance premium tax credit from IRS Form 8962

- Repayment of new clean vehicle credit(s) on IRS Form 8936

- Recapture of net EPE from IRS Form 4255

- Alternative minimum tax from IRS Form 6251

Line 18

Add Line 16 and Line 17. Enter the total here.

Line 19: Child tax credit or credit for other dependents from Schedule 8812

If you are eligible for either the child tax credit or the credit for other dependents (ODC), as calculated on Schedule 8812, then enter the amount of that nonrefundable credit in Line 19.

To claim the refundable additional child tax credit, go to Line 28.

Line 20: Amount from Schedule 3, Line 8

Enter the total amount of nonrefundable credits from Schedule 3, Line 8. Nonrefundable tax credits can reduce your tax liability, dollar for dollar. However, if your tax bill is already zero, then a nonrefundable credit cannot generate a tax refund.

Line 21

Add Line 19 and Line 20. Enter the total here.

Line 22

Subtract Line 21 from Line 18. Enter the result here.

If the result is zero or a negative number, then enter $0.

Line 23: Other taxes from Schedule 2, Line 21

Enter any other taxes from Schedule 2, Line 21. This includes many other common taxes, such as:

- Self-employment tax, calculated on Schedule SE

- Uncollected Social Security and Medicare Tax on Wages, from IRS Form 8919

- Additional taxes on IRAs and other tax-favored accounts, from IRS Form 5329

- Additional Medicare tax from IRS Form 8959

- Net investment income tax from IRS Form 8960

For a complete list of additional taxes, see IRS Schedule 2.

Line 24: Total tax

Add Line 22 and Line 23. This represents your total tax liability.

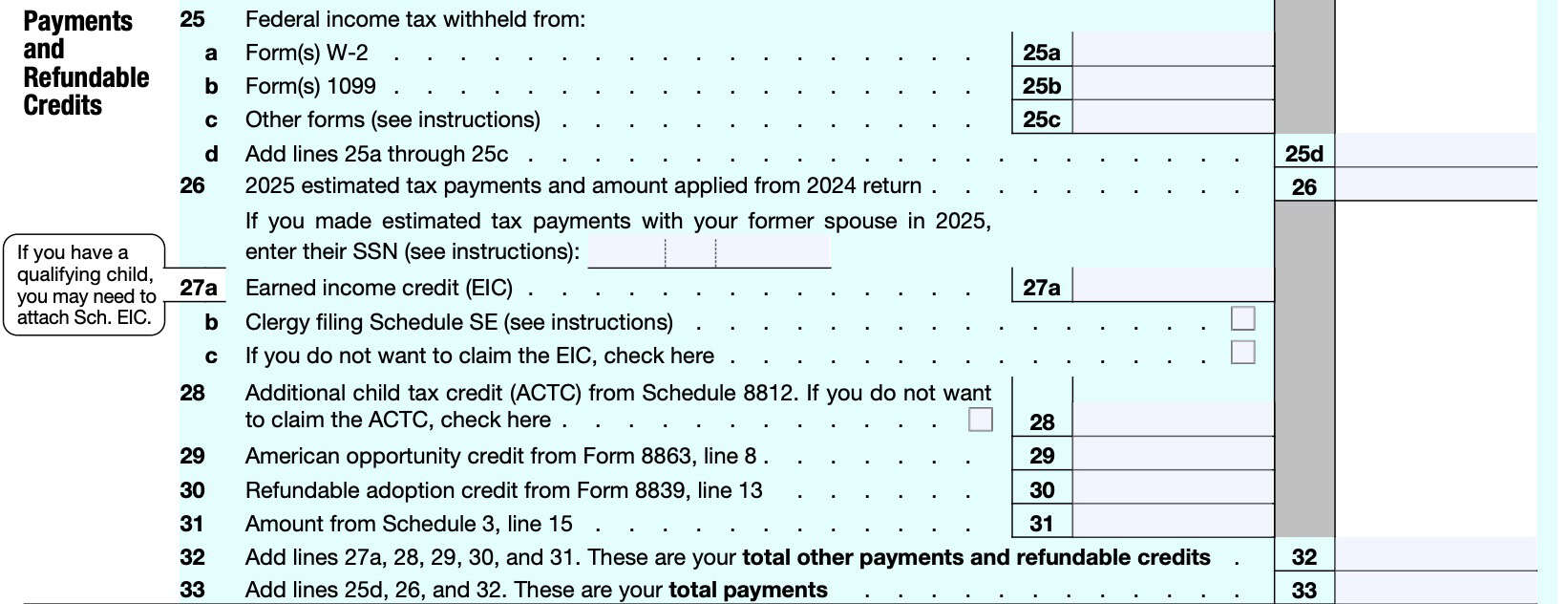

Payments and refundable credits

In this section, we’ll go over tax payments and refundable credits.

Unlike nonrefundable credits, a refundable tax credit can generate a refund, even if you have zero tax liability for the year.

Line 25: Federal income tax withheld

This line contains federal income taxes withheld from various tax forms. We’ll cover each in more detail.

Line 25a: Form(s) W-2

Add the amounts shown as federal income tax withheld on your Form(s) W-2. Enter the total on Line 25a.

The amount withheld should be shown in Box 2 of Form W-2. Attach your Form(s) W-2 to your return.

Line 25b: Form(s) 1099

Include any federal income tax withheld on your Form(s) 1099. The amount withheld depends on the type of 1099 form issued:

- Social Security benefits: Form SSA-1099, Box 6

- Railroad retirement benefits: Form RRB-1099, Box 10

- Other 1099 forms where taxes are withheld: Box 4

- IRS Form 1099-B, Proceeds From Broker and Barter Exchange Transactions

- IRS Form 1099-DA, Digital Asset Proceeds From Broker Transactions

- IRS Form 1099-DIV, Dividends and Distributions

- IRS Form 1099-G, Certain Government Payments

- IRS Form 1099-INT, Interest Income

- IRS Form 1099-K, Payment Card and Third Party Network Transactions

- IRS Form 1099-MISC, Miscellaneous Income

- IRS Form 1099-NEC, Nonemployee Income

- IRS Form 1099-OID, Original Issue Discount

- IRS Form 1099-PATR, Taxable Distributions Received From Cooperatives

- IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Line 25c: Other forms

Include any taxes withheld on other forms, including:

- IRS Form W-2G, Certain Gambling Winnings, Box 4

- IRS Form 8959, Additional Medicare Tax, Line 24

- Schedule K-1 (from either Form 1041, Form 1065, or Form 1120-S)

- Taxes withheld that is shown on:

- IRS Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding

- IRS Form 8805, Foreign Partner’s Information Statement of Section 1446 Withholding Tax, or

- IRS Form 8288-A, Statement of Withholding on for Certain Dispositions by Foreign Persons

Line 25d

Add Lines 25a, 25b, and 25c. Enter the total here.

Line 26: 2025 Estimated tax payments and amount applied from 2024 return

Enter the amount of any estimated tax payments that you made throughout the year.

Also, enter any amounts that were carried over from your previous year’s tax return.

Line 27

There are several entries here. Let’s go over them individually.

Line 27a: Earned Income Credit

If you claim the earned income credit, then you can enter that amount in Line 27a.

Line 27b: Clergy filing Schedule SE

Check this box if you are

- A minister, member of a religious order who has not taken a vow of poverty, or a Christian Science practitioner, and

- Filing Schedule SE and the amount on Line 2 of that schedule includes an amount that was also reported on Line 1z, above.

Also, determine the amount that was reported on Line 1z and on Schedule SE, Part I, Line 2. Subtract the Schedule SE, Line 2 amount from the Line 1z amount. Use this amount in the Earned Income Credit worksheet to determine your EIC eligibility.

Line 27c

Check the box on Line 27c if you do not want to claim the earned income credit or if you have been instructed to check the box in the instructions for Line 27a.

Line 28: Additional child tax credit from Schedule 8812

Enter any additional child tax credit (ACTC) from Schedule 8812. If you do not want to claim the ACTC, then check the box.

Claiming a tax credit after disallowance

If any of the following tax credits were denied or reduced for any reason other than a math or clerical error, you must file IRS Form 8862, Information to Claim Certain Credits After Disallowance, to claim the additional child tax credit:

- Child tax credit

- Additional child tax credit

- Credit for other dependents

Attach a completed Form 8862 to your 2025 return to claim the credit for 2025.

Line 29: American opportunity credit

If you meet the requirements to claim an education credit, then enter any amount from IRS Form 8863, Education Credits, Line 8. This represents the American Opportunity Tax Credit, also known as AOTC or AOC.

You may be able to increase an education credit and reduce your total tax or generate a larger refund if the student chooses to include all or part of a Pell grant or certain other scholarships or fellowships in income.

If you previously had the AOTC denied for any reason other than a math or clerical error, you must file IRS Form 8862, Information to Claim Certain Credits After Disallowance, to claim it.

Line 30: Refundable adoption credit

If you are eligible to claim the refundable portion of the adoption credit, enter the amount from IRS Form 8839, Line 13. You may also be eligible to claim a nonrefundable adoption credit on Schedule 3, Line 6c.

Line 31: Amount from Schedule 3, Line 15

Enter the amount from Schedule 3, Line 15, here in this line.

Line 32: Total other payments and refundable credits

Add Lines 27a, 28, 29, 30, and 31. This represents your total other payments and refundable credits.

Line 33: Total payments

Add Lines 25d, 26, and 32. This is your total tax payments.

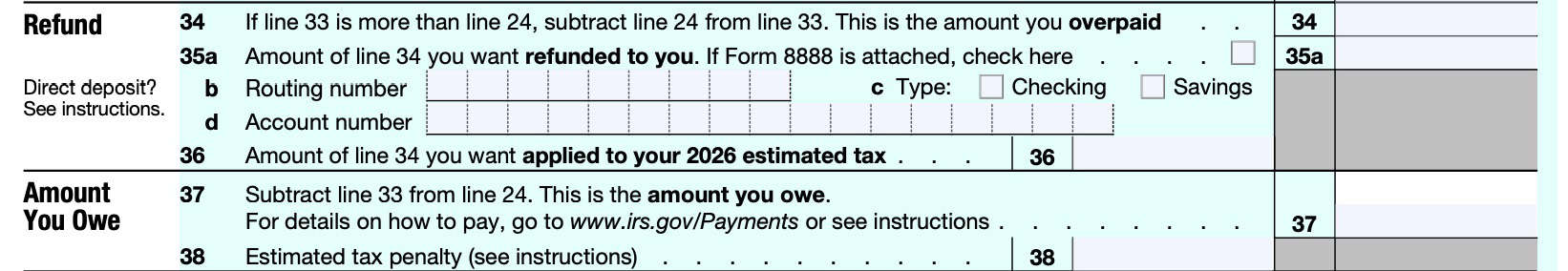

Refund

If Line 33 is greater than Line 24, then you have overpaid your taxes and are due a federal tax refund. Please proceed to Line 34, below.

If Line 24 is more than Line 33, this means that you still owe taxes to the federal government. Go to Line 37, below.

Line 34

Subtract Line 24 from Line 33, and enter the result here. This is the amount you overpaid.

In Lines 35 and 36, you’ll decide how much of this tax overpayment you’d like to receive as a refund, and how much you’d like to carry forward to next year’s estimated taxes.

Tax refund offset

All or part of the tax overpayment on Line 34 may be used to offset outstanding debts, specifically past-due:

- Federal tax

- State income tax

- State unemployment compensation debt

- Child support

- Spousal support (alimony)

- Certain nontax debts, like student loans

This is known as a tax refund offset.

Offsets for federal taxes are made by the IRS. All other offsets are made by the Treasury Department’s Bureau of the Fiscal Service.

For federal tax offsets, you will receive a notice from the IRS. For all other offsets, you will receive a notice from the Fiscal Service.

To find out if you may have an offset or if you have any questions about it, contact the agency to which you owe the debt.

Injured spouse

If you file a joint return and your spouse hasn’t paid past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or a federal nontax debt, such as a student loan, part or all of the overpayment on line 34 may be used (offset) to pay the past-due amount.

But your part of the overpayment may be refunded to you if certain conditions apply and you complete IRS Form 8379, Injured Spouse Allocation.

Line 35

If you want a refund, complete this line.

Line 35a: Amount of overpayment you want refunded to you

Enter the amount of the tax overpayment you wish to receive as a tax refund in Line 35a.

If you would like to split this refund into multiple accounts, you can do this by completing and attaching IRS Form 8888, Allocation of Refund, to your Form 1040. Also, check the applicable box.

Line 35b: Routing number

Enter the financial institution’s nine-digit routing number in the space provided.

Line 35c: Account type

Check the correct box to indicate whether the bank account is a checking account or savings account.

Line 35d: Account number

Enter the account number associated with your desired account. Be sure that the account number corresponds to the account type indicated in Line 35c.

Line 36: Estimated tax

Enter the amount of your tax overpayment that you would like to apply to next year’s taxes.

Amount you owe

Line 37

If Line 24 is greater than Line 33, then subtract Line 33 from Line 24. This represents your outstanding tax liability, or the amount that you owe.

Line 38: Estimated tax penalty

You may owe an estimated tax penalty if:

- Line 37 is at least $1,000 and it is more than 10% of the tax shown on your return, or

- You didn’t pay enough estimated tax by any of the due dates. This is true even if you are due a tax refund.

If you choose to figure the penalty yourself, use IRS Form 2210, Underpayment of Tax, or IRS Form 2210-F, Underpayment of Tax by Fishermen and Farmers, to calculate the estimated tax penalty.

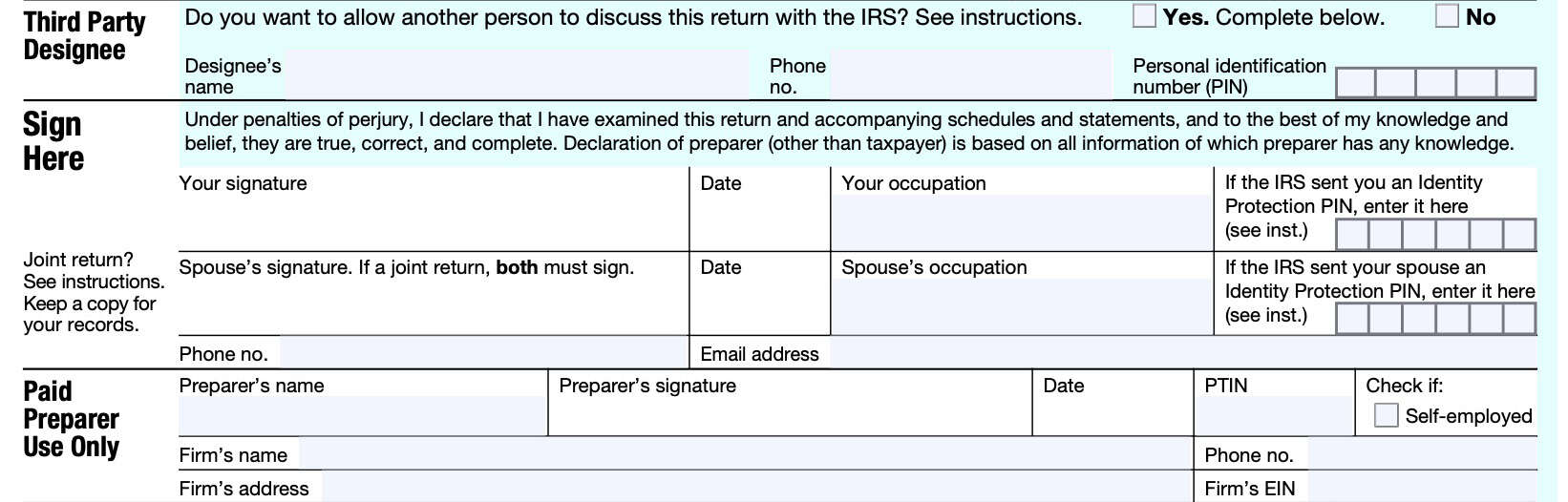

Signatures

In this area, we’ll go over the different signature areas, and what they mean. Let’s start with the third party designee field below.

Third party designee

You can allow a third party to discuss your filed tax return with the IRS. This could be someone like your tax preparer, a friend or family member.

To make this selection, you can:

- Check the Yes box in the ‘Third Party Designee’ area of your tax return

- Enter the following information for the designee:

- Name

- Telephone number

- Any five digit code used as a personal identification number (PIN)

If you check Yes, then you (and your spouse on a joint return) authorize the IRS to call the designee to answer questions that may come up while the IRS processes your return.

You also authorize the designee to:

- Give the IRS any information that is missing from your return;

- Call the IRS for information about the processing of your return or the status of your refund or payment(s);

- Receive copies of notices or transcripts related to your return, upon request; and

- Respond to certain IRS notices about math errors, offsets, and return preparation.

However, you are not authorizing the designee to:

- Receive your tax refund check

- Obligate you to anything, including additional tax liability, or

- Represent you before the IRS

You can authorize additional powers by completing and signing IRS Form 2848, Power of Attorney and Declaration of Representative.

This authorization automatically expires by the due date of your following year’s tax return.

Sign here

Form 1040 or 1040-SR isn’t considered a valid return unless you sign it in accordance with the requirements in these instructions. If you are filing a joint return, your spouse must also sign.

Also, enter your occupation, as well as your spouse’s occupation, in the fields provided.

Identity protection PIN

If you have been the victim of identity theft, or if the IRS has flagged your record, you may be enrolled in the Identity Protection PIN (IP PIN) program.

If you participate in the IP PIN program, you must enter your six-digit PIN number on your tax return to file electronically. If you do not, the IRS will reject your electronic tax return.

New IP PINs are generated every year. They will generally be sent out by mid-January 2026. You can use your current IP PIN on your 2025 return as well as any prior-year returns you file in 2026.

Paid preparer use only

If you have a paid tax return preparer, then he or she will complete this field.

Generally, anyone you pay to prepare your return must sign it and include their Preparer Tax Identification Number (PTIN) in the space provided. The preparer must give you a copy of the return for your records.

Someone who prepares your return but doesn’t charge you shouldn’t sign your return.

If your paid preparer is self-employed, then they should check the “self-employed” checkbox.

Filing considerations

There are many filing considerations when it comes to your IRS Form 1040 tax return. We’ve selected the most common ones to include in this article, but you can refer to the IRS Form 1040 instructions on the IRS website for any questions or topics you don’t see included here.

Filing requirements

The first filing consideration is whether or not you actually have to file a tax return for the year. The answer to this is not very straightforward, but there are some guidelines that might help:

- Income-based requirements

- Requirements for children and dependents

- Situational requirements

Income-based requirements

For most taxpayers, the decision on whether or not to file will be based on a combination of age, income, and filing status. As a general rule, if your adjusted gross income (AGI) is less than the standard deduction, then you do not have to file.

The form instructions contain a user-friendly chart to help taxpayers make this determination. For your convenience, we’ve included a copy below.

| IF your filing status is . . . | AND at the end of 2025 you were | THEN file a return if your gross income was at least |

| Single | under 65 age 65 or older | $15,750 $17,750 |

| Married filing jointly | under 65 (both spouses) age 65 or older (one spouse) age 65 or older (both spouses) | $31,500 $33,100 $34,700 |

| Married filing separately | any age | $5 |

| Head of household | under 65 age 65 or older | $23,625 $25,625 |

| Qualifying surviving spouse | under 65 age 65 or older | $31,500 $33,100 |

Requirements for children and dependents

If your parent, or another taxpayer, can claim you as a dependent, then you should use the following guidance to see if you must file a return.

Single taxpayers-Under Age 65 and not blind

Unless you are age 65 or older, or are legally blind, then you must file a tax return if any of the following apply:

- Your unearned income was over $1,350.

- Your earned income was over $15,750.

- Your gross income was more than the larger of:

- $1,350, or

- Your earned income (up to $15,300) plus $450

Single taxpayers-Age 65 or older and/or blind

If you are age 65 or older, or are legally blind, then you must file a tax return under any of the following conditions:

- Your unearned income was over $3,350

- $5,350 if 65 or older and blind

- Your earned income was over $17,750.

- $19,750 if 65 or older and blind

- Your gross income was more than the larger of:

- $3,350, ($5,350 if 65 or older and blind) or

- Your earned income (up to $15,300) plus $2,450 ($4,450 if 65 or older and blind)

Married taxpayers-Under Age 65 and not blind

Unless you are age 65 or older, or are legally blind, then you must file a tax return if any of the following apply:

- Your unearned income was over $1,350

- Your earned income was over $15,750

- Your gross income was at least $5 and your spouse files a separate return while itemizing deductions

- Your gross income was more than the larger of:

- $1,350, or

- Your earned income (up to $15,300) plus $450

Married taxpayers-Age 65 or older and/or blind

If you are age 65 or older, or are legally blind, then you must file a tax return under any of the following conditions:

- Your unearned income was over $2,950

- $4,550 if 65 or older and blind

- Your earned income was over $17,350.

- $18,950 if 65 or older and blind

- Your gross income was at least $5 and your spouse files a separate return while itemizing deductions

- Your gross income was more than the larger of:

- $2,950, ($4,550 if 65 or older and blind) or

- Your earned income (up to $15,300) plus $2,050 ($3,650 if 65 or older and blind)

Situational Requirements

Finally, regardless of the income requirements, you must file an income tax return if any of the following conditions apply:

- You owe any special taxes, including any of the following:

- Alternative minimum tax

- Additional tax on a qualified plan, including an individual retirement arrangement (IRA), or other tax-favored account

- Household employment taxes

- Social security and Medicare tax on tips you didn’t report to your employer or on wages you received from an employer who didn’t withhold these taxes

- Uncollected social security and Medicare or RRTA tax on tips you reported to your employer or on group-term life insurance and additional taxes on health savings accounts.

- Recapture taxes

- You or your spouse received distributions from any of the following:

- Health savings accounts

- Archer MSA

- Medicare Advantage MSA

- You had net self-employment earnings of at least $400

- You had wages of $108.28 or more from a church or qualified church-controlled organization that is exempt from Social Security and Medicare tax

- Advance payments of the premium tax credit were made for you or a family member enrolled in Marketplace coverage

- Should be annotated on IRS Form(s) 1095-A, Health Insurance Marketplace Statement

- You are subject to IRC Section 965 reporting requirements

- You purchased a new or used clean vehicle form a registered dealer and reduced your purchase price by transferring the tax credit to the dealer

Frequently asked questions

Taxpayers must generally file IRS Form 1040 no later than April 15 of the year following the end of the tax year. If April 15 falls on a holiday or weekend, then the due date is extended to the next business day.

You may be subject to interest and penalties, which are calculated based upon the outstanding tax liability. You may be able to file for an automatic six-month extension to file your tax return. However, you are still liable for outstanding taxes, and may still incur penalties and interest.

Where can I find IRS Form 1040?

You can find IRS Form 1040, as well as additional forms, on the Internal Revenue Service website. For your convenience, we’ve enclosed the latest version here, in this article.